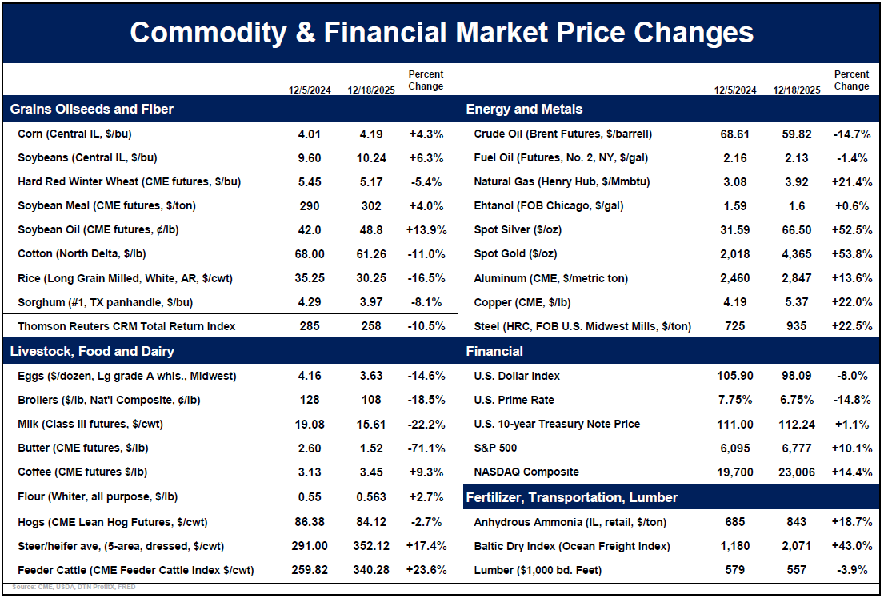

2025 is ending with mixed results. The livestock industry flourished, particularly in the beef sector. Profits were a record high for many producers. The pork industry fared well, as did poultry, and even dairy did well when you factor in the value received from selling newborn calves.

Corn and soybean producers, who had good risk management strategies, did well — just not as well as the previous two years. On the other hand, some grain producers had a very challenging year. Some due to poor risk management, and some due, particularly in the south, to production issues that have carried over for three or four years. Cotton and rice producers never had a good price to sell at period.

As we look forward to 2026, price volatility is going to remain very high and financial stress will continue for some producers while others have significant opportunities. It’s going to be a wild year. Here are some of our thoughts on five key areas:

1. Consolidation. The last three years have already seen witness to major consolidation in the farm equipment industry and in some sectors of agribusiness. The ag chemical industry has consolidated as well as the fertilizer industry over the last few years. Those consolidations are nearing an end but are not quite there yet.

The large consolidation over the next year will occur with row crop producers. The separation in income for grain producers from the top 10% to the bottom 30% is dramatic. With the advent of artificial intelligence (AI) along with satellite positioning and other technological improvements, the size of row crop farms will increase significantly over the next five years. There are some predicting that 50% of the farmers within five years will no longer be operating. We think that is an exaggeration. Consolidation will vary substantially within various geographic locations. For example, in states such as Illinois, Iowa and Nebraska, where there are vast fields that are flat and not separated by major hills or valleys, expansion will be easier and more abundant.

Producers will find ways to team up with neighbors where fields lay adjacent to take advantage of larger equipment and artificial intelligence. While prices of this new equipment may seem prohibitive now, by combining producers’ resources, equipment costs will be spread over more acres. We would not be at all surprised to see a cutback of 30% of today’s number of row crop producers over the next 10 years.

2. Corn and soybean prices will stabilize. The bear markets in corn and soybean prices are nearly over, if not completely over. That does not mean that prices are going into a bull market, but that a bottoming process is going to start. The conflict with China will continue. They’ve already switched the majority of their soybean purchases to Brazil. That is more than tariff related. China has been building infrastructure in Brazil to move soybeans from Mato Grosso to ports 1,100 miles south for the last several years. This should be of very little surprise to producers. That trend cannot be reversed.

Strong corn exports over the last couple of months are a good indication that other countries buy more U.S. corn when prices are low. That is going to add support to corn prices over the coming year. Supplies, however, are very large and acreage will likely not decrease this coming spring. Producers will have to adapt to making profits on corn prices in the mid to high $4.00 range, possibly moving above $5.00 on a weather scare this spring or summer. Opportunities to make profits in corn and soybeans are going to happen. But the profits are not going to be anywhere near what producers were experiencing in 2021 and 2022.

3. Cattle and hog prices. Beef cattle prices have been in a bull market since 2020 as the market has rallied from $90 a hundredweight to $240. We had a shortage of $90 beef, we will not have a shortage of $240 beef. The market will retrace. The highs are in and profit margins are going to be squeezed in this coming year. Buying 600-pound steers at $5.00 per pound will result in some negative feeding margins over the next few months. Granted there is a huge shortage of cattle, but consumer resistance will start to set in this coming year. A recession is likely (see point 4). Hog prices are also going to come under pressure. Profit margins are going to drift lower. Overall, producers should still continue to do well. The huge consolidation has occurred over the last 10 years where many producers are now integrated with packing facilities, will keep most producers profitable throughout 2026.

4. The economy and stock market. Over the last three years, tremendous wealth has been created in the stock market. Much of the public is unaware of that. Stock prices have become overheated due to AI and AI stock concentration is a real concern. Residential real estate prices have already softened. In states like Florida, where hurricanes have resulted in a sharp increase in insurance rates which is driving out many potential buyers. After many people were fleeing to Florida during and after the pandemic, over the last three years, more people are leaving Florida rather than arriving. Residential real estate prices are already down 20-25% in areas hit hard by hurricanes. That is going to have a trickle-down effect and, particularly if the stock market weakens as we expect it will, more downside risk in prices will materialize.

In the stock market specifically, while we can’t pinpoint the exact time, before the end of the first half of 2026, we anticipate stock prices will make a major peak. It’s possible the bull market may already be over, but we believe that one more leg up is likely. That will then be followed by a two-to-three-year bear market in stock prices. A recession will be underway.

5. Land prices, cash rents and interest rates. Farmland prices are going to stay steady to stronger. Land prices are influenced by many variables other than the price of corn, soybeans and wheat. Cash is pouring in from 1031 Exchanges as new plants are being built for AI data centers as well as solar farms increasing all over the U.S. In most states, 80% of the farmland is still being purchased by farmers. While some farmers are obviously struggling, there is still old farm wealth and wealth coming in from livestock operations. In the last month, most states have seen some record prices on farmland auctions.

As farms expand in size, those who continue farming are not going to want to lose land. Those expanding are going to bid up cash rents. Cash rents will stay flat. In the south, very little land is cash rented. Almost all rents are still sharecrop rents.

Interest rates may drop slightly, but nothing dramatic. One-half point lower? Not much more. The biggest winner in lower rates is the government.

Opportunities

Volatility creates opportunities and thus there should be no lack of opportunities this coming year. Unfortunately, many will retire, as the average age of farmers has continued to rise and with the changes taking place, many producers are going to find this year as an opportune time for retirement. This creates tremendous opportunities for the younger generation. But as happened in the late 1980s and early 1990s, risk management becomes even more important in volatile market times like this.

We at Brock Associates wish everyone a Merry Christmas and a prosperous New Year!

Sidebar: Christmas Break

The calendar provides some calm for the ag markets and producers over the next couple of weeks, but there will still be plenty activity over the next month.

USDA is set to release rates for specific crops next week as part of its “bridge” aid package, and Congress is already talking about another aid package (see page 5). And Jan. 12 will be one of the more important report days of the year, as USDA releases quarterly stocks as well as final estimates for the 2025 crop. At that point, we will also have a good sense of whether Brazil will harvest a very large soybean crop, and attention will then start turning to 2026 planting prospects. In the meantime, we hope you have a peaceful and joyful Christmas.