Corn and soybean futures drifted lower under U.S. harvest pressure in early trade with crude oil price weakness also a negative factor. Soybean futures also continued to feel pressure from China’s absence from the U.S. market. Wheat futures held firm overnight amid a lack of fresh fundamental news, but turned lower late in early trade under renewed pressure from corn market weakness. Cotton futures are marginally higher in limited early trade.

Corn futures were mostly 1 to 2 1/4 cents lower at the end of early trading, with soybean futures mostly 4 1/4 to 5 cents lower, while wheat futures mostly ranged from 1/4 cent higher to 1 cent lower. Cotton futures mostly range from 6 to 10 points lower.

Looking at other markets, U.S. crude oil futures are $1.61 to $1.82 lower under pressure from the reopening of exports from Iran’s Kurdistan region and expectations for OPEC-Plus members to agree on another production hike when they meet next weekend.

The dollar index is moderately lower under pressure from potential for a U.S. govt. shutdown starting on Wednesday if Congress does not approve a stopgap spending bill. Most-active Dec. gold futures are $43.60 higher after surging to another all-time high of $3,860.60 on concerns about a possible govt. shutdown.

Based on index futures trade, U.S. stock indexes are set to open moderately higher as investors don’t appear worried by potential for a govt. shutdown as such shutdowns have not generally had long-term negative effects on the U.S. economy. There are also doubts Democrats will actually allow the govt. to shut down with President Trump threatening to use a shutdown to permanently fire large numbers of govt. workers.

Investors this morning will be watching data on pending home sales, with the U.S. pending home sales index for August expected to come in unchanged from July. Comments from Fed officials will also likely draw significant interest.

Soybean futures traded very narrow ranges of 4 1/4 cents or less overnight, but ended early trading on their session lows. May through July 2026 futures fell through nearby chart support at their Friday lows. Nearby Nov. beans now have nearby chart resistance at $10.13 3/4, with more important resistance at last week’s high of $10.20 1/4, and key nearby support at $10.05.

Corn futures traded ranges of 3 cents or less overnight, but fell to 4-session lows and finished nearly on those lows. Dec. corn futures have traded as low as $4.19 and a breakout below last week’s low at $4.18 1/4 could spur added selling. The market’s 40-day moving avg. is at $4.14. Dec. has nearby chart resistance at $4.22 1/4-$4.24.

Corn and soybean futures may remain cautious today ahead of USDA’s Crop Progress report, Tuesday’s quarterly Grain Stocks report and a potential govt. shutdown. Rising harvest pressure will remain a negative market factor along with the lack of any Chinese buying of U.S. soybeans. Corn futures may continue to be underpinned by strong export demand and ideas USDA’s U.S. corn yield forecast will shrink further.

USDA this morning announced that exporters have sold 135,660 MT of U.S. corn to Mexico for 2025-26 delivery and 110,668 MT of corn to unknown destinations, also for 2025-26.

This afternoon’s USDA Crop Progress report may peg U.S. corn crop conditions at 65% good/ex. as of Sunday, down from 66% a week earlier, with harvest progress at about 19%-20%, up from 11% a week earlier. Soybean harvest progress may come in at about 18%-19% as of Sunday, up from 9% a week earlier, with the soybean crop condition rating likely to slip further to 60% good/ex. from 61% previously.

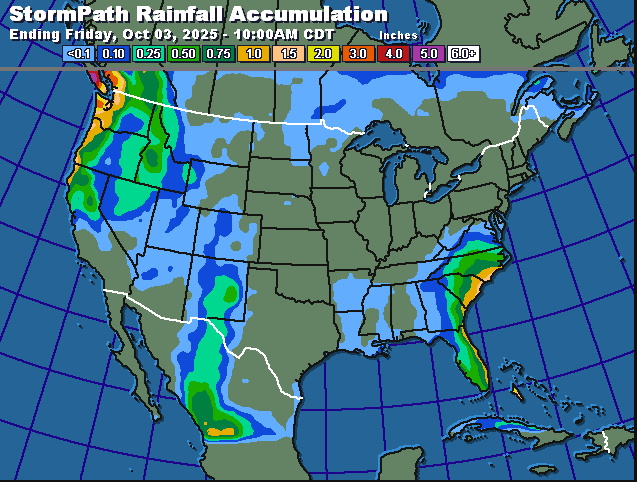

Clear weekend weather across the Midwest allowed increasing harvest activity. U.S. weather this week will be quite dry in the Midwest, Delta and southern Plains, which should allow good harvest progress. Rain is expected next weekend in the northeastern U.S. Plains and southeastern Canada’s Prairies followed by another storm system in some of the same region during mid-week next week, World Weather Inc. says.

Brazilian producers had planted 3.2% of their expected 2025-26 soybean area as of last Thursday, Brazilian analyst AgRural estimated on Monday. Progress was up 0.9% from a week earlier and 2.0% a year earlier. Planting of 2025-26 first-crop corn was 32% complete in Brazil’s center-south region as of Thursday, AgRural estimated.

Brazil’s center-west and center-south crop areas will be dry biased over the next 10 days, raising concern over early season soybean and first-season corn planting and emergence.

Argentina received rain during the weekend, maintaining a very good moisture profile for its wheat and barley crop. The moisture will support corn and sunseed planting.

Wheat futures continue to struggle to find any upward momentum with supplies in major exporting countries ample to meet world demand. Favorable U.S. HRW wheat planting conditions remain a negative market factor along with a general lack of weather issues in other major growing areas, although continued dryness in southern Russia bears watching as winter wheat seeding is lagging there.

USDA this afternoon may peg U.S. winter wheat planting progress at about 36-38%, up from 20% a week earlier, but behind last year’s pace of 40%.

The Black Sea export price for 12.5% protein Russian wheat rose for a second week in a row last week on increased demand from buyers and a stronger Russian ruble, Moscow based analysts said. Export shipments also accelerated last week. IKAR put the price for November delivery at $230 per MT on a free-on-board basis, up $2 from a week earlier, while SovEcon put the price at $230-$232 per MT FOB vs. $228-$229 a week earlier.

Southeastern Europe is expecting rain this week that should bring some relief to persistent dryness in the lower Danube River Basin. Central and western Ukraine will also get some important rain this week while only southernmost parts of Russia’s Southern region gets rain. Russia’s eastern New Lands will receive rain this week may slow wheat harvesting there and raise some concern over crop quality.

Livestock futures may open mostly higher with lean hog futures likely to be boosted by technically-driven buying, a continued reaction to last Thursday’s bullish-looking USDA report and firm cash hog/wholesale pork prices. Live cattle and feeder cattle futures may be boosted by a firm Friday close, although weakening cash fed cattle trade will be a negative market factor along with sharply negative packer operating margins. Feeder cattle futures should be supported by their discounts to cash.