USDA made a couple of notable changes to its world corn supply/demand balance sheet for 2024/25 and although changes to the world soybean and wheat balance sheets were minimal, this seems like a good time to review the world supply/demand fundamentals.

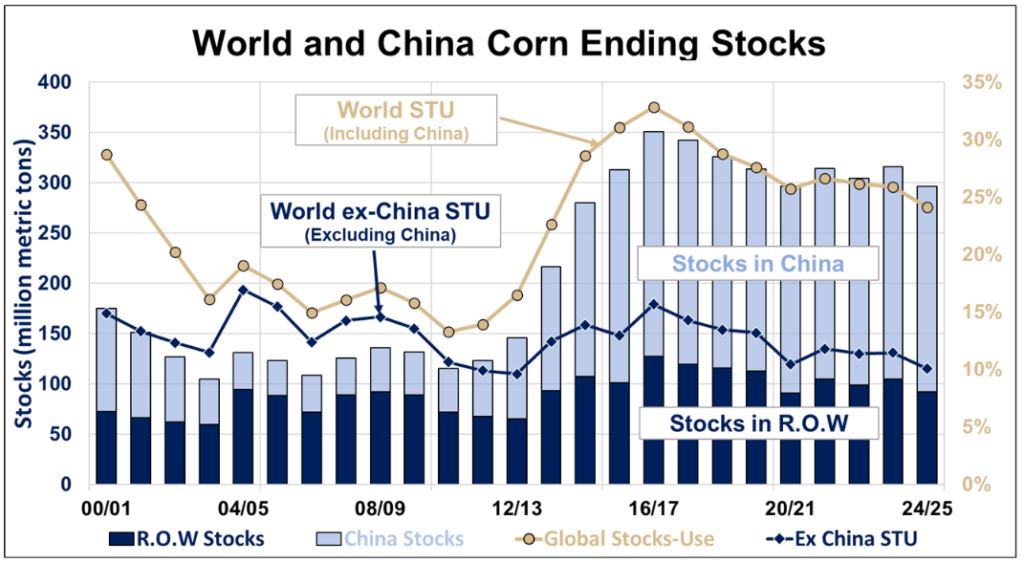

Based on USDA’s latest estimates, corn supplies in the world outside of China are getting tight. USDA on Tuesday hiked its forecast for 2024/25 world corn use by 8.18 million metric tons (MMT) or 0.7% to a record high and increased its forecast for world corn export trade by 3.21 MMT or 1.7%, while trimming projected world ending stocks by 7.70 MMT or 2.5%. Probably more importantly, ending stocks for the world outside of China were lowered by 5.69 MMT or 5.8%. Both total world ending stocks and ending stocks for the world minus China are now expected to slip to four-year lows. The expected ending stocks/use ratio for the world minus China is just 10.1%, down from 11.5% last year and the tightest since 2012/13 when it fell to 9.6% after drought slashed U.S. production. A big difference now is that unlike then, the supply shortfall is not in the U.S. and buyers are turning to the U.S. to meet needs. Ending stocks in major exporters other than the U.S. are expected to fall nearly 47% from last year to just 7.99 MMT.

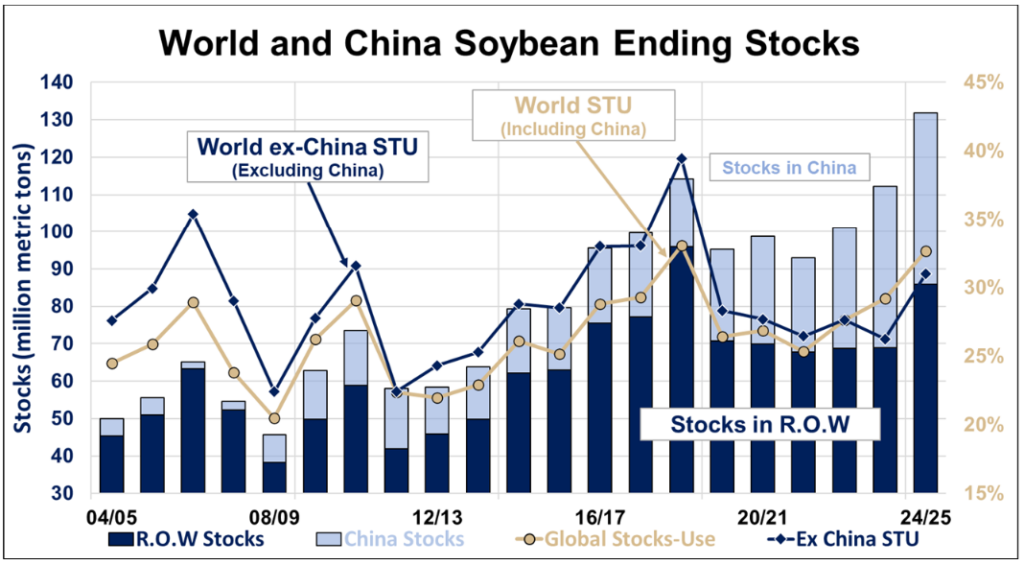

USDA raised its world soybean ending stocks forecast for 2024/25 marginally on Tuesday to 131.87 MMT, up 17.6% from last year, which would be a record high and quite burdensome looking. Stocks rose despite a small increase of 1.36 MMT in projected world use and a marginal cut in the old-crop carry-in, as USDA raised world production by 1.74 MMT, hiking Argentina’s projected crop by 1.0 MMT. USDA projects the full world soybean ending stocks/use ratio at 32. +7%, up from 29.0% last year and the second highest on record behind 2018/19’s 33.0%. China is estimated to have built up its soybean stocks significantly over the past six years from just 18.4 MMT to 43.3 MMT. The projected stocks/use ratio for the world minus China is 31.0%, still high, but only the sixth highest on record.

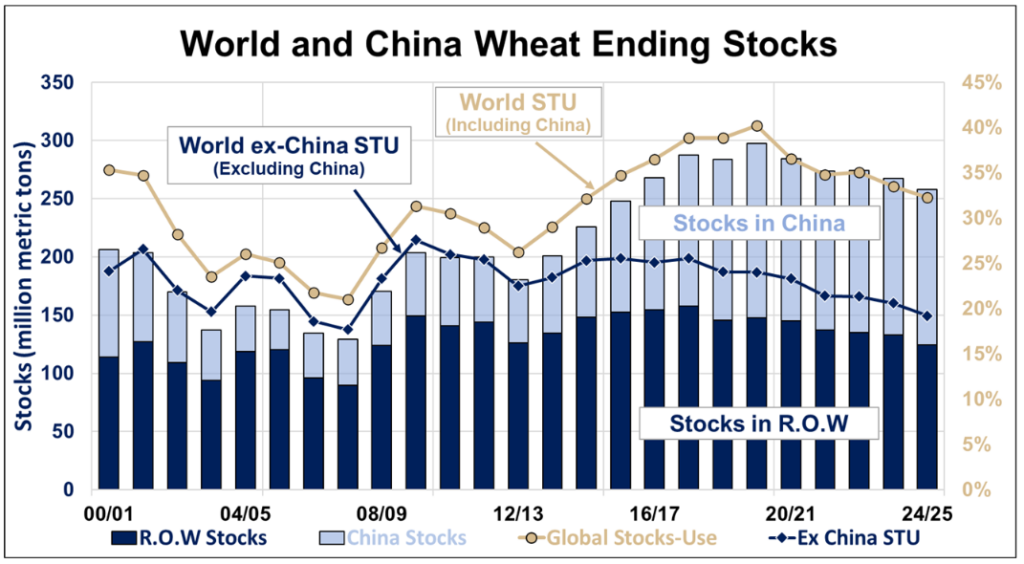

World wheat supply/demand numbers, like the corn numbers remain deceptive because of huge Chinese stocks. USDA raised its 2024/25 world wheat carryout forecast marginally on Tuesday to 257.88 MMT despite cutting production by 1.78 MMT as it raised the old-crop carry-in and cut projected use by nearly 1.0 MMT. USDA projects a world wheat ending stocks/use ratio of 32.0%, the lowest since 2014/15, but still comfortable looking. However, an estimated 51.8% of world wheat stocks are in China where the market can’t access them. The projected wheat carryout for the world minus China is just 124.4 MMT, which equates to an ending stocks/use ratio of just 19.2%, the tightest since 2007/08.