This was a very emotional week. For the first three days, grain and financial markets were down sharply. The reaction amongst most people was “what just happened?” Then by Thursday and Friday, markets rallied back sharply. Every market in the world was volatile. Gold prices were all over the board. The value of the U.S. dollar was as well. The Dow Jones sold off sharply but then came ripping back on Friday.

Why did the sky suddenly start to fall? In the financial markets, a big reason was the threat that the U.S. government was going to shut down and government employees were not going to get paid. Going into midday on Friday, there are still hopes Congress and Senate are going to come to a temporary solution so that the government doesn’t shut down.

In addition, the Federal Reserve on Wednesday lowered the base lending rate by one quarter of a point. This was the third cut in a row, all together shaving a full percentage point off the federal funds rate since September. This is significant. But then the chairman of the Fed followed with guidance that indicated only two rate cuts in the year ahead, less than many have been hoping for.

Corn and Soybean Prices Were Very Volatile

This had to be one of the more emotional weeks in the grain markets we have all lived through in the past several months. The selloff earlier in the week convinced the vast majority of farmers and traders that the market was going to plunge. It did temporarily. It is hard to argue with new contract lows as large as the supplies are worldwide in corn, and particularly soybeans. This is the kind of market that if we have to make decisions, make them small so that no one gets hurt badly. The corn market received bullish news last week, with the December Supply/Demand report indicating a 200-million-bushel cut in carryout, which we stated in last week’s Brock Report was a “game changer”. Some other influences were coming from:

• The Brazilian Real hit a record low versus the U.S. Dollar this week. (See page 3) That makes Brazil’s soybeans much less expensive in the world market than ours.

• Brazil’s soybean acres are projected to be up 2.6% from last year, and weather has been very good there.

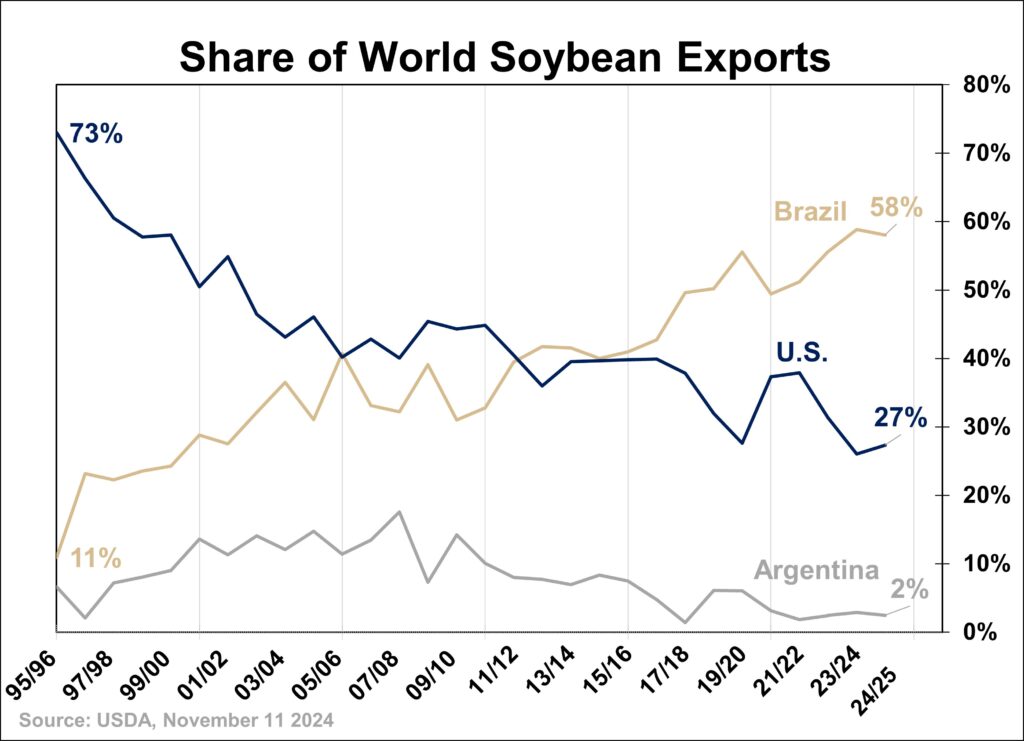

• Brazil now has 58% of the world’s soybean exports compared to the U.S. at only 28%. (See page 2)

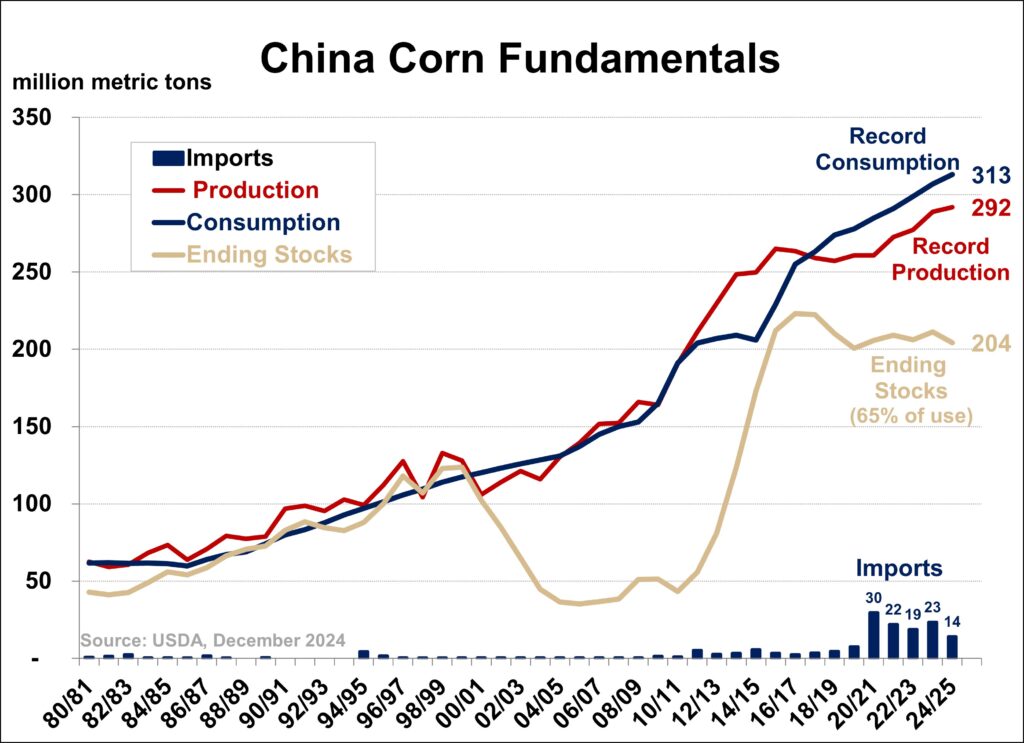

• U.S. corn exports to China are the lowest in four years.

• The Chinese corn stocks-to-usage ratio is at 68% (see chart below).

• The world’s stocks-to-usage ratio is at 25.7% in corn.

• Take China out of the picture and the world’s stocks-to-usage ratio in corn can arguably be viewed as bullish at 11%. It is the lowest since the 1996/97 marketing year. (Page 3 last week discusses the supply/demand picture with and without China for corn, beans and wheat).

The price moves, as stated earlier, in the first of the week were alarming to everyone, including us. Tuesday and Wednesday soybeans broke major support levels that we had been watching and discussing for the better part of two months. We frankly didn’t love the idea of making sales here, but with a technical breakout to the downside, a record world carryout, just barely shy of a record world ending stocks-to-use ratio, and soybeans trading near $10, a defensive sale was more than warranted.

The following day beans plunged 25 cents, but after Thursday and Friday’s rebound, we had to accept the fact that this appears to be a bear trap. When a bear trap occurs, there is nothing wrong with making some decisions on selling —just make sure they’re small. We knew it was possible when we put the position on, but a drastic selloff was also possible.

Markets bottom on bearish news. The difficult factor this week was making a sale early in the week and then having to admit on Friday it was wrong.

Corn Marketing Strategy

We made absolutely no decisions in the corn market this week. Coming into this week, our recommendations had producers 70% sold on old-crop for strict cash marketers and nothing on the new. Hedgers were 60% sold on old and nothing on the new.

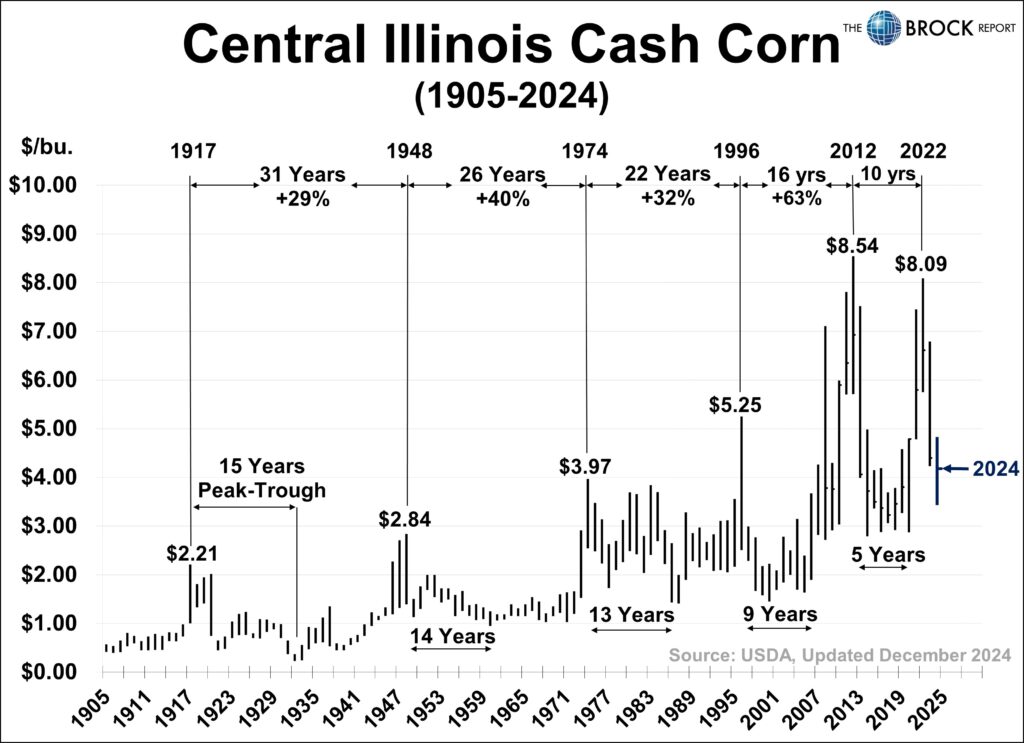

It’s hard to fathom what the bullish news is going to be, but with the carryover now back to a 10% stocks-to-usage ratio, the market has some room to play with. No longer is the U.S. corn supply extremely burdensome. It’s big, but manageable. With anticipated increased planted acreage this spring, there well could be a lid on prices advances. But the crop is not in the ground yet.

For the new-crop corn we have not priced a single bushel yet. That is fairly unusual for us at this point in the year. But prices are cheap, and odds favor waiting.

Soybean Strategy

Coming into the week, strict cash marketers were 50% sold on old and nothing on the new. We pushed old-crop sales by 10% to 60%. Hedgers were 30% contracted which we pushed another 10%. Doesn’t look like that was the best idea to do at the time but hindsight is 20/20. Futures broke a support area we had been watching for weeks and it warranted a small defensive sale.

We also hedged short 20% of the old-crop soybeans in March futures. We exited on Friday with a loss of just a few cents. We exited long March meal for livestock feeders but reestablished that position on Friday. When you make a mistake in the market, admit it quickly and reverse it. Fortunately, the positions were small and the losses were very small.

The good news is that, as of right now, both the corn and soybean markets appear to have bottoms. It’s not an indication of a major bull market that is starting. It’s just confirmation that the bear market is over. Be patient and wait at this point.