We apologize for the lateness of closing comments, which is due to a power outage at the Brock office in Milwaukee.

CORN COMMENTS

NO NEW RECOMMENDATIONS

The corn market’s collapse continued today with futures plunging another 6 1/2 to 11 1/2 cents under pressure from anxieties over new U.S. tariffs scheduled to take effect on Tuesday, month-end position evening and technically-driven selling. Expectations for large 2025 corn plantings also remained a negative market factor. May futures fell 11 1/4 cents to $4.69 3/4 and July futures fell 11 cents to $4.75 3/4, while Dec. futures fell 6 3/4 cents to $4.55.

The corn futures charts continue to look terrible. For the week, most-active May futures plunged 35 1/2 cents and posted their lowest weekly close in 8 weeks, putting our 5-week Friday close rule short the market. May also broke the short-term uptrend line off the fall low on the weekly most-active corn futures continuation chart. Nearby chart support for May is now near $4.60, while a 50% retracement of the October-February rally on the weekly continuation chart would take the market down to $4.50. Dec. futures posted their lowest close since Jan. 16 and closed below their 40-day moving avg. for the first time since Dec. 19. Nearby support for Dec. is at $4.53 and at $4.45.

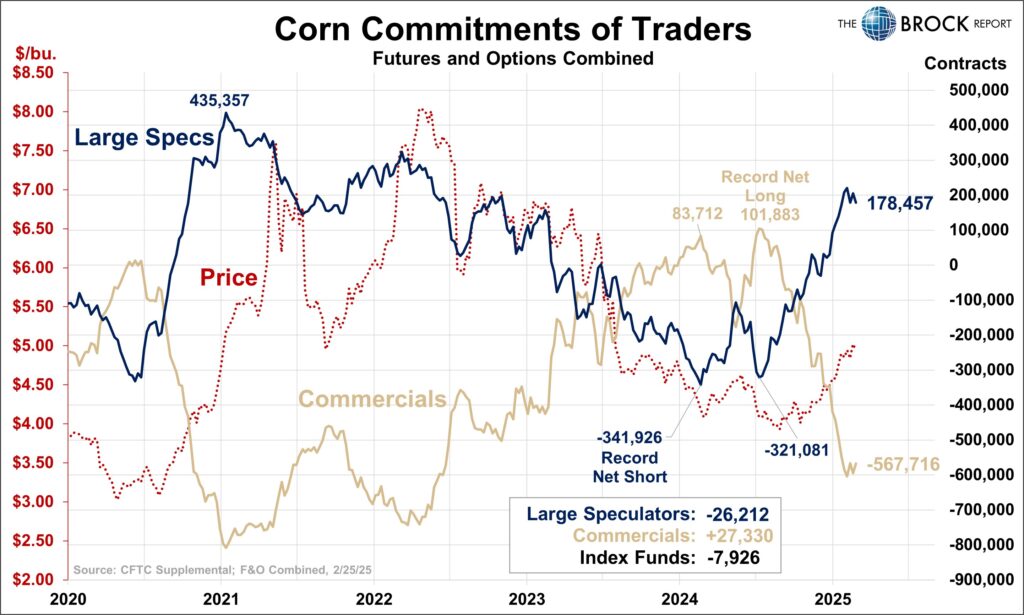

CFTC Supplemental Commitments of Traders report shows large speculators (non-commercials) were net sellers of more than 26,000 contracts of corn futures/options during the week ended Tuesday, cutting their net long position to about 178,000 contracts. Large specs liquidated nearly 21,000 long positions, but far more significant long liquidation likely took place over the past 3 sessions. Commercial traders exited both long and short position on the week as options on Mar. futures expired, and were net buyers of about 27,000 contracts, leaving them net short about 568,000 contracts.

This week’s spread action was very negative looking with the old-crop Mar-July spread widening out and the old-crop/new-crop spread collapsing. May futures this week went from 16 1/4 cents premium to the Dec. to 1 1/2 cents discount despite the large new-crop acreage forecasts.

Corn futures are now oversold on short-term technical indicators, but we doubt this sell-off is done, although that could change if the Trump administration forges a last minute deal over the weekend allowing Canada and Mexico to avoid U.S. import tariffs.

Improved prospects for Brazil’s safrinha-crop corn production are a negative fundamental factor. Planting of the safrinha crop in the largest production state of Mato Grosso is winding down on schedule and upcoming rains should be beneficial for newly-planted fields. Mato Grosso planting is 84.95% complete, ahead of the 5-yr. avg. of 84.02% and not far behind last year’s fast pace of 90.05%, according to the state agricultural institute IMEA.

Central Illinois processor spot corn basis bids are steady, ranging from 28 under to 8 under Mar. futures, according to USDA. CIF basis bids for delivery of corn to the U.S. Gulf steady to weaker vs. Thursday afternoon. The bid for March delivery is steady at 75 over Mar. futures, while the bid for April delivery is 3 cents weaker at 60 over May futures and the bid for May delivery is also at 60 over. The FOB offering price for first-half of Mar. shipment of U.S. corn from the Gulf was 8 cents weaker today at 87 over Mar. futures.

SOYBEAN COMMENTS

ADVICE REMINDER: Hedgers should have sold May 2025 soybean futures on 10% of 2024 production today, taking them to 20% hedged on last year’s crop and should also have sold Nov. 2025 soybean futures on 10% of expected 2025 production.

Soybean futures slid 10 1/4 to 12 1/4 cents under pressure from tariff anxiety, continued weakness in grain futures and technically-driven selling. Sharp losses in soyoil futures also weighed on soybean prices. Brazil’s big harvest and improved crop conditions in Argentina remained bearish market factors. Futures found limited support from prospects for lower U.S. soybean plantings this spring. May soybean futures fell 11 1/2 cents to $10.25 3/4, while July soybeans fell 12 cents to $10.40 and Nov. soybeans fell 12 1/4 cents to $10.29 1/2. May soyoil futures fell 116 points to 44.51 cents, while May soymeal futures were steady at $307.50.

Soybean futures ended the week on a solidly bearish note, showing clear follow-through to Thursday’s bearish outside trading days. Old-crop contracts posted their lowest closes since Jan. 10. Nearby May futures posted a decline of 31 1/2 cents for the week and now have no significant chart support above $9.96-$10.00. Nearby resistance for May beans is now at $10.45 3/4-$10.50. Nov. futures posted their lowest close since Jan. 17. Nov. now has nearby support at $10.18-$10.20, but odds seem good that it will at least test the $10.00 area on this down move.

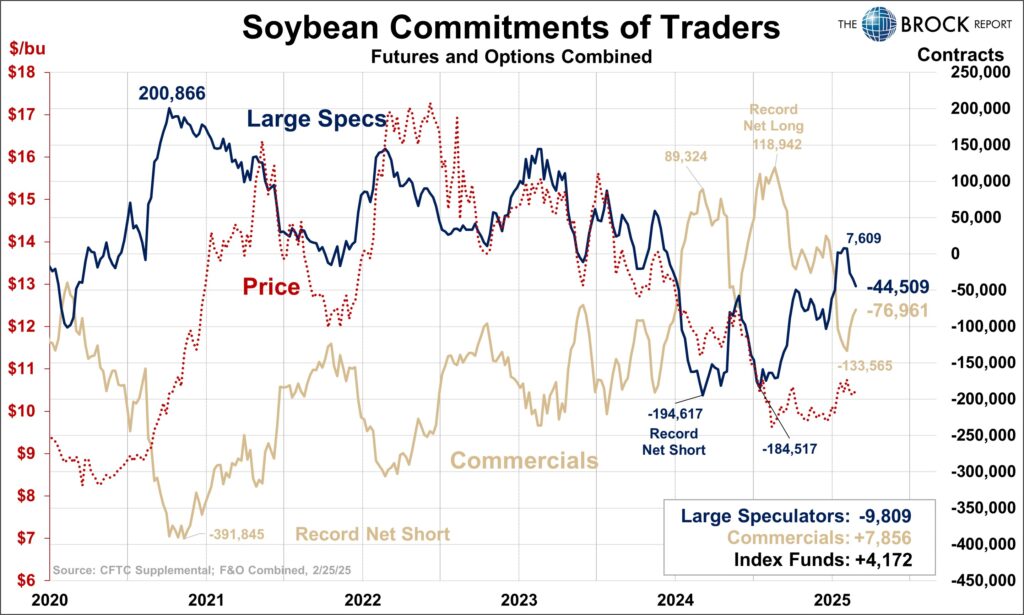

CFTC Supplemental data shows large speculators were net sellers of nearly 10,000 contracts of soybean futures/options during the week ended Tuesday, expanding their net short position in the market to about 44,000 contracts at Tuesday’s close. Commercial traders, meanwhile, were net buyers of about 8,000 contracts, trimming their net short position to about 77,000 contracts.

We are not as bearish on soybean prices right now as we are on corn prices, in large part due to U.S. acreage prospects, although that could change to some extent if corn prices continue to collapse going into planting. The 2025 soybean/corn price ratio (Nov soybeans/Dec. corn) did rebound this week, but only slightly to 2.26. Of course, as in the corn market, a shift in the tariff situation over the weekend could potentially boost soybean futures next week.

The soybean harvest in Brazil’s top producing state of Mato Grosso is heading into the home stretch. IMEA estimates the Mato Grosso soybean harvest is 82.3% complete, slightly behind last year’s pace of 84.66%, but ahead of the 5-yr. avg. of 82.30%.

Central Illinois processor spot soybean basis bids range from 15 cents under Mar. futures to 5 cents over May futures, according to USDA. CIF basis bids for delivery of soybeans to the U.S. Gulf are steady to a bit stronger vs. Thursday afternoon. The CIF basis bid for March delivery is 1 cent stronger at 86 over, while the bid for April delivery is 1 cent stronger at 67 over May futures and the bid for May delivery is at 66 over.

WHEAT COMMENTS

NO NEW RECOMMENDATIONS

Wheat futures ended lower, sinking to one-month lows amid technical selling with pressure from a stronger U.S. dollar and concerns about tariffs. Chicago wheat was down 7 to 10 cents amid bear-spreading, with March settling at $5.37, May at $5.55 ¾ and December settling at $6.04 ½. Kansas City wheat was down 9 to 13 cents, settling at $5.58 ¼ in the March, $5.73 in the May, and $6.20 ¼ in the December. Minneapolis wheat was down 5 to 7 cents, settling at $5.82 ¼ in the March, $5.97 ¾ in the May and $6.41 in the December.

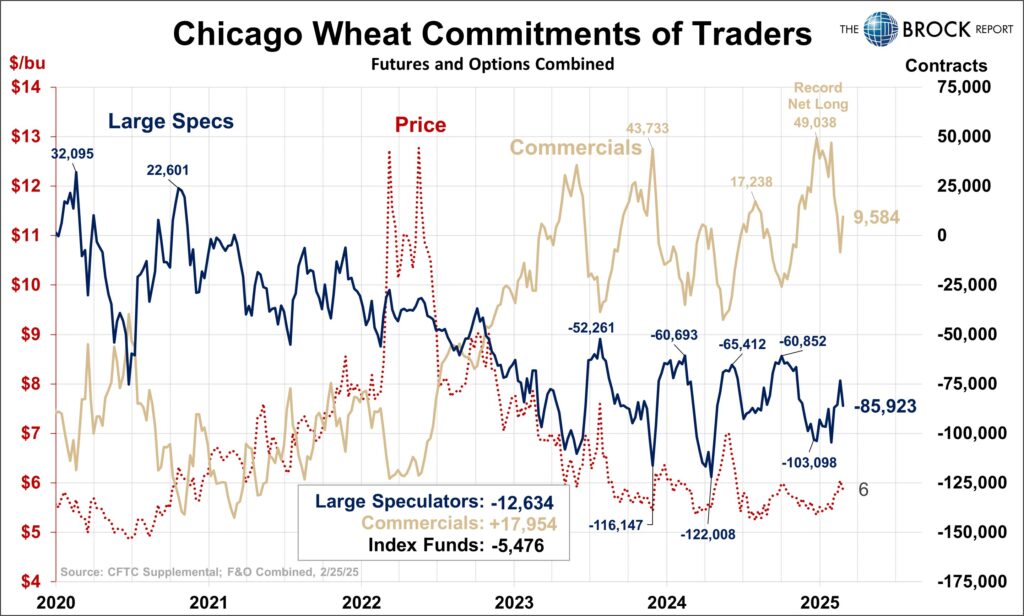

For the week, the most-active May contracts in all three classes lost 48 to 50 cents on the week. Large speculators were net short 85,923 contracts of Chicago wheat as of Tuesday, an increase of 12,635 from the prior week.

It’s hard to discern to what extent news about the war between Russia and Ukraine is affecting the wheat market, but it is of interest given the two countries’ roles as key producers and exporters, and the disruption to wheat shipments early in the war. Today Trump, J.D. Vance and Zelensky held a public and very contentious discussion in the White House, which ultimately resulted in Zelensky leaving without signing a deal as planned.

CME Inc this morning reported delivery notices for 466 contracts have been posted against Mar. SRW wheat futures, with notices for 314 contracts posted against Mar. HRW wheat futures.

Warming in the central and southern U.S. Plains, Delta and southeastern states is reducing winter crop hardiness against cold temperatures and some crops in the south will slowly break out of dormancy next week. The central and southern U.S. Plains will be drier than usual over the next ten days, despite some light precipitation in a part of the region. West and South Texas will remain very dry for the next ten days.

COTTON AND RICE COMMENTS

COTTON HEDGE REMINDER: Today we recommended selling May 2025 cotton futures at the market against 10% of 2024 production.

Cotton futures fell apart today, making new contract lows and a five-year low on a front-month basis. Speculative selling was driven by technical weakness, a firm dollar and lackluster demand. March cotton settled down 1.32 cents to 63.88. May cotton lost 1.35 cents to 65.25, after trading a range of 65.18 to 66.66. December cotton fell 79 points to 67.88.

Thursday’s annual Ag Outlook Forum projections put 2025 U.S. cotton plantings at 10.0 million acres, down 1.2 million from 2024, but on par with the average of trade expectations. The National Cotton Council earlier this month projected 9.6 million, and we expect actual plantings will come in below USDA’s estimate. This latest slide in prices reaffirms that expectation. The mood among many producers is not good and acreage is being switched to corn across the South as well as in Texas.

Negative factors for the cotton market include worries about the U.S. economy, competition from Brazil, and a lack of buying by China. Weekly cotton net export sales Thursday were unimpressive at 166,900 bales, down 35% from the four-week average. Shipments totaled 267,500 bales.

Rice futures ended mostly lower, and also made new lows. March settled up ½ cent to $13.28 1/2, after making a new 3 ½-year low. May rice settled down 11 ½ cents to $13.50 ½, after trading a range of $13.36 ½ to $13.64. September rice settled down 13 cents to $13.67.

LIVESTOCK COMMENTS

NO NEW RECOMMENDATIONS

Live cattle futures ended sharply lower, pressured by concerns about the economy and soft cash markets. February settled down $1.675 to $197.725, April was down $3.475 to $192.65, and June lost $3.55 to $188.775. Various contracts tumbled to fresh two-month lows. The afternoon Boxed Beef report showed Choice up 65 cents and Select down 8 cents.

Plains cash cattle trade picked up today but still appeared to be light for the week. USDA this afternoon reported light/moderate trade in Kansas at $197, and in Nebraska at $198. Texas had light trade at $197. Last week’s trade was at $199-200. The average beef packer operating margin is estimated by HedgersEdge at minus $167.50 per head, down from minus $157.35 on Thursday.

Feeder cattle futures also fell. March feeders lost $1.475 to $274.975, April feeders were down $2.55 to $273.00, and May lost $2.85 to $271.125. The CME Feeder Cattle Index for Wednesday was up 91 cents to $279.64.

Lean hog futures were down sharply, with pressure from worries about pork exports to Mexico. April lean hogs lost 70 cents to $83.675, June dropped $2.575 to $95.025, and August lost $2.775 to $95.90. Various contracts fell to their lowest level since last fall. The afternoon pork carcass cutout value, which surged yesterday, was down $2.54 today.

The national avg. negotiated cash carcass value this afternoon was up 53 cents. The lagging CME cash lean hog index is 10 cents lower at $89.39 but is expected to rise 5 cents on Monday. Today’s slaughter is expected to run 485,000 head, with the Saturday slaughter seen at 94,000, down from 128,000 last week and 113,000 last year.

BROCK MARKET POSITIONS:

CORN: Cash-only Marketers: 2024 CROP: 85% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25).

2025 CROP: 15% sold on hedge-to-arrive contracts (2-5-25, 2-24-2025).

Hedgers: 2024 CROP: 75% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25); short May corn on 10% (2-24-2025).

2025 CROP: 15% sold on hedge-to-arrive contracts (2-5-25, 2-24-2025); long 1 Dec. 2025 put and short 2 Dec. 2025 calls on 10% (2-24-2025)

SOYBEANS: Cash-only marketers: 2024 CROP: 85% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25).

2025 CROP: 10% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25).

Hedgers: 2024 CROP: 60% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25), short May 2025 soybean futures on 20% (2-12-25, 2-28-25).

2025 CROP: 10% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25), short Nov. 2025 futures on 10% (2-28-25).

SRW WHEAT: Cash-only Marketers: 2024 CROP: 100% sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 40% sold on hedge-to-arrive contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25).

Hedgers: 2024 CROP:100% cash sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24)

2025 CROP: 30% sold on hedge-to-arrive contracts (5-30-24, 10-15-24, 2-24-25); Short July futures on 20% of 2024 production.

HRW WHEAT: Cash-only Marketers: 2024 CROP: 100% sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 40% sold on hedge-to-arrive contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 5-30-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 30% sold on hedge-to-arrive contracts (5-30-24, 10-15-24, 2-24-25). Short July futures on 10% (2-24-2025)

LEAN HOGS: Short April 2025 lean hog futures on 50% of 2nd qtr. marketings (2-19-25); short Aug. 2025 lean hog futures on 50% of 3rd qtr. marketings (2-21-25)

LIVE CATTLE: Long $195 put options against June 2025 live cattle futures on 100% of 2nd qtr. marketings (1-29-25); long $190 put options against Aug. 2025 live cattle futures on 50% of 3rd qtr. marketings (1-29-25).

FEEDER CATTLE: Sellers are long 1 $270 put/short 1 $300 call option against May 2025 feeder cattle futures on 100% of 2nd qtr. marketings (1-29-25) and short Aug. feeder cattle futures against 50% of 3rd qtr. marketings (2-6-25). Feeder buyers remain aside futures.

MILK: Short Jan. 2025 Class III milk futures on 25% of 1st qtr. sales (9-5-24). We have recorded futures positions for track record purposes. Milk producers were advised to make either cash or futures sales, based on their preference.

FEED BUYERS: SOYMEAL: 50% of 1st qtr. soymeal needs bought in the cash market (1-14-25); long Mar. soymeal futures on 50% of 1st qtr. needs (12-20-24); long May 2025 soymeal futures on 25% of 2nd quarter (11-27-2024).

COTTON: Cash-only Marketers: 2023 CROP:100% sold (5-19-23, 7-19-23, 7-25-23, 8-3-23, 8-30-23, 11-1-23, 1-19-24, 2-1-24, 2-9-24, 2-12-24); 2024 CROP: 45% forward contracted (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24). 2025 CROP: No sales recommended.

Hedgers: 2023 CROP: 100% cash sold (5-19-23, 7-19-23, 7-25-23, 8-30-23, 1-19-24, 2-1-24, 2-9-24, 2-12-24, 2-28-24, 3-5-24, 3-14-2024). 2024 CROP: 35% cash forward contracted (2-12-24, 2-27-24, 4-3-24, 6-27-24), aside futures: No sales or hedge positions recommended.

RICE: 2023 CROP:100% cash forward contracted (4-25-23, 5-30-23, 7-20-23, 7-31-23, 8-7-23, 11-22-23, 12-5-23, 1-4-24, 2-13-24, 3-25-24). 2024 CROP:80% forward contracted (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25).