Grain and soybean futures mostly slightly higher at the end of a very quiet early trading session during which they showed limited movement amid a lack of fresh fundamental news. Corn and soybean futures have been underpinned by improved weekly export sales. Wheat futures have been boosted by renewed concerns about dry conditions in parts of the U.S. HRW wheat belt and fresh demand in the world market. Weakness in the value of the dollar remains a supportive market factor, although the dollar index is slightly stronger this morning. Cotton futures have pushed slightly higher on support from improved export sales

Corn futures are mostly 1/4 cent lower to 3/4 of a cent higher at the end of early trading, with soybean futures mostly 3/4 of a cent to 4 1/4 cents higher, while wheat futures mostly range from 3 3/4 to 7 1/2 cents higher. Cotton futures range from 40 to 64 points higher.

Looking at other markets, U.S. crude oil futures are 93 to 99 cents higher on support from new U.S. sanctions targeting Iran’s exports. However, gains have been limited by demand worries caused by escalating trade tensions.

The dollar index is slightly higher after the European Central Bank cut interest rates further, but is trading inside its Wednesday range and just above last Friday’s 3-yr. low. Most-active June gold futures are now $6.90 lower after reaching another new all-time high of $3,371.90 overnight.

Based on stock index futures trade, U.S. stock indexes are set to open mixed with S&P 500 index e-mini futures trading about 0.4% higher, while Dow Jones Industrial avg. futures are about 1.2% lower as investors continue to react to Wednesday’s warning from Fed Chairman Jerome Powell about the potential economic impact of U.S. tariffs. President Trump has again lambasted Powell on social media for not cutting interest rates, saying on his Truth Social account that “Powell’s termination cannot come fast enough!”

U.S. weekly unemployment claims came in at 215,000, compared with trade expectations that averaged 225,000 and the previous week’s revised 224,000. U.S. housing starts for March came in at 1.324 mil. down 11.4% from February vs. trade expectations that averaged -6,1%.

Corn futures overnight traded narrow ranges of 3 cents or less inside of their Wednesday ranges and finished early trade near their session lows amid concerns about the health of the general economy. Soybean futures traded ranges of 8 1/4 cents or less overnight. Nov. soybeans pushed to an 11-session high, but could not push past key nearby chart resistance at heir April 1 high of $10.39 3/4 and fell back to finish early trade at x.x.

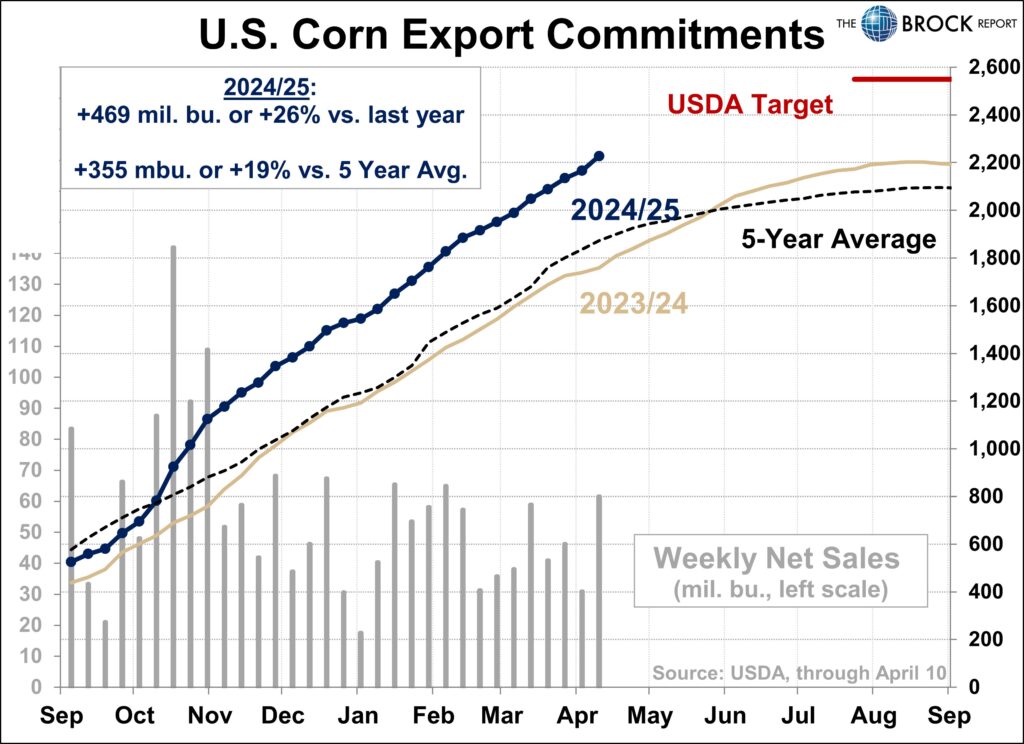

Net U.S. corn export sales for the week ended April 10 came in at 61.9 mil. bu., near the high end of trade expectations that ran 28.5-71.0 mil. bu. and well above the previous week’s sales of 40.2 mil. bushels. The sales data looks supportive for corn futures. Weekly shipments of 74 mil. bu. up from the previous week’s 66.9 mil. also look supportive for prices.

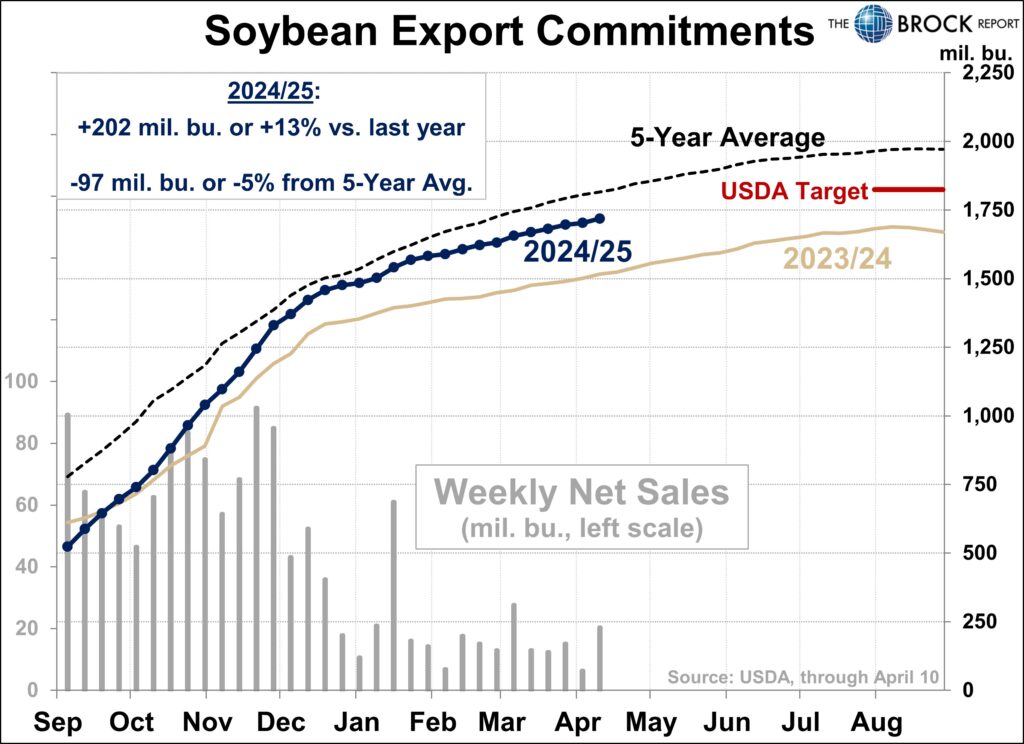

Net weekly U.S. soybean export sales came in at 27.1 mil. bu., including 20.4 mil. for 2024-25 delivery, compared with trade expectations that ran 5.5-33.0 mil. bu. and the previous week’s low sales of just 6.3 mil. bushels. The sales data should be supportive for soybean prices. Weekly export shipments of 26.5 mil. bu. were down slightly from 28.1 mil. a week earlier.

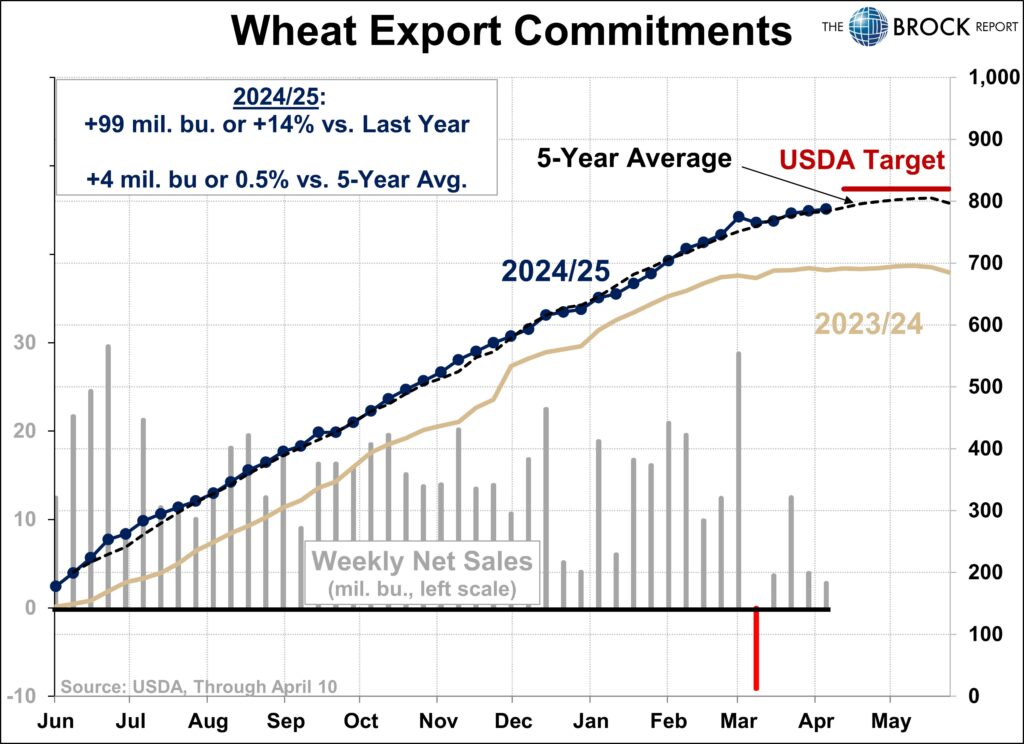

Net weekly U.S. wheat export sales came in at 12.9 mil. bu., including 2.8 mil. for 2024-25 delivery and 10.1 mil. for 2025-26, compared with trade estimates that ran from minus 3.5 mil. bu. to 20.0 mil. bushels. The sales data looks neutral for wheat prices. Weekly export shipments of 17.8 mil. bu. were up from 12.5 mil. a week earlier.

The U.S. Corn Belt is still expected to turn wet over the next two weeks. Weather will be wettest from eastern Kansas through central Missouri to Illinois, Indiana and a part of northern Ohio during the next 10 days. The region will experience frequent waves of rain that will delay spring fieldwork. Some of the rain will be great enough to saturate the soil and induce local flooding. However, flooding will continue to recede along the lower Ohio and the flood crest on the Mississippi River will continue to advance southward through the mid-Delta region and eventually the lower Delta by early next week.

China will pay no attention if the U.S. continues to play the “tariff numbers game”, China’s foreign ministry said on Thursday, after the White House outlined how China faces tariffs of up to 245% due to its retaliatory actions. In a fact sheet released on Tuesday, the White House said China’s total duties include the latest reciprocal tariff of 125%, a 20% tariff to address the fentanyl crisis, and tariffs of between 7.5% and 100% on specific goods to address unfair trade practices.

Wheat futures pushed to 3-session highs overnight and ended early trade near those highs, with HRW wheat futures strongest amid U.S. crop concerns. July SRW wheat futures traded as high as $5.65 1/2 and now have nearby chart support at $5.61 1/2. July HRW wheat futures traded as high as $5.80 1/4 overnight and have nearby support at $5.73 1/4.

U.S. HRW wheat areas in the high Plains will receive insignificant rain through Monday and into Tuesday. Some improving opportunity for “some” rain will evolve in the high Plains region from the middle part of next week into the end of this month. The moisture should help improve wheat development and improve spring planting conditions. Waves of heavy rain are still being advertised from Oklahoma into central Kansas and impacting a few neighboring areas where notable improvements in soil moisture and long-term crop development potential is likely.

In export news, Algeria’s OAIC is believed to have bought between 600,000 and 630,000 MT of optional-origin milling wheat in its latest import tender, which closed on Wednesday. Traders initially expected the wheat purchased to be mainly sourced from the Black Sea region, especially Ukraine, Romania and Bulgaria. Purchases of French wheat were not reported. Meanwhile, Tunisia has received offers in its tender for 75,000 MT of milling wheat, but no purchase has yet been reported.

Moscow-based analyst SovEcon has raised its estimate for Russia’s total 2025 wheat production by 1.1 MMT to 79.7 MMT. SovEcon now sees Russian winter wheat production at 52.2 MT, up from a previous estimate of 50.7 MMT. Another Moscow-based analyst, IKAR has forecast 2025 total wheat production at 82.5 MMT.

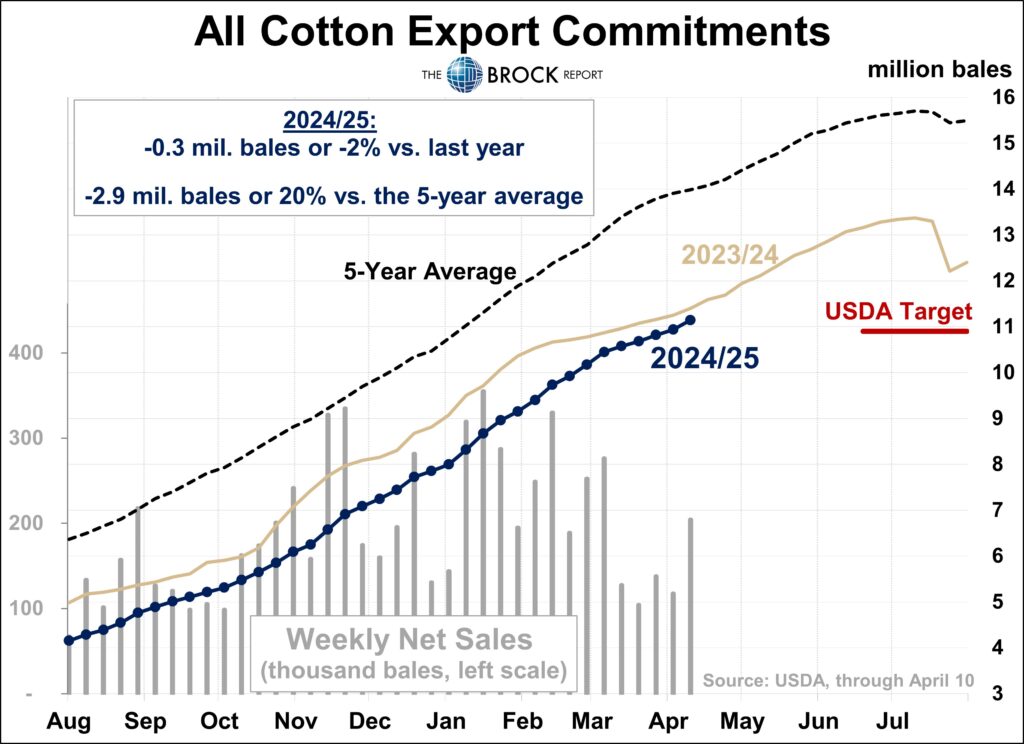

Weekly U.S. cotton export sales were up 76% from the previous week and 88% from the 4-week average. Net U.S. cotton export sales for the week ended April 10 ran 202,000 running bales for 2024-25 delivery and 65,900 bales for 2025-26 delivery.

Livestock futures may start out mostly higher for a fourth straight session on support from technically-driven buying but pre-holiday profit taking may weigh on prices. Lean hog futures are likely to feel fundamental pressure from lower weekly pork export sales of 20,500 MT. Live cattle futures may feel pressure from position evening ahead of this afternoon’s USDA report, a continues lack of Plains cash trade this week and Thursday’s declines of 85 cents to $1.90 in beef cutout values.