CORN COMMENTS

NO NEW RECOMMENDATIONS

Corn futures rebounded to post gains ranging from 4 to 6 3/4 cents, finishing near their session highs, on support from a weaker dollar, technically-driven buying and concerns about severe weather in parts of the Corn Belt. There are worries some acreage in the southern Corn Belt and the Delta will not be planted due to flooding. Gains were capped by overall favorable U.S. planting progress and crop emergence. July futures rose 4 cents to $4.47 1/2, while Sep. futures rose 6 3/4 cents to $4.28 1/4 and Dec. futures rose 6 1/4 cents to $4.41 3/4.

Today’s close was technically positive, although nearby July corn futures traded inside of their Friday price range and still have nearby chart resistance at $4.51 1/2, with nearby support at $4.42 3/4. A Dec. push past $4.51 1/2 would leave the next resistance at $4.58 3/4. Dec. futures pushed past their Friday high after holding nearby support and posted their highest close in 5 sessions. Dec. now has nearby resistance at $4.43 3/4, with resistance from last week’s high at $4.49 3/4.

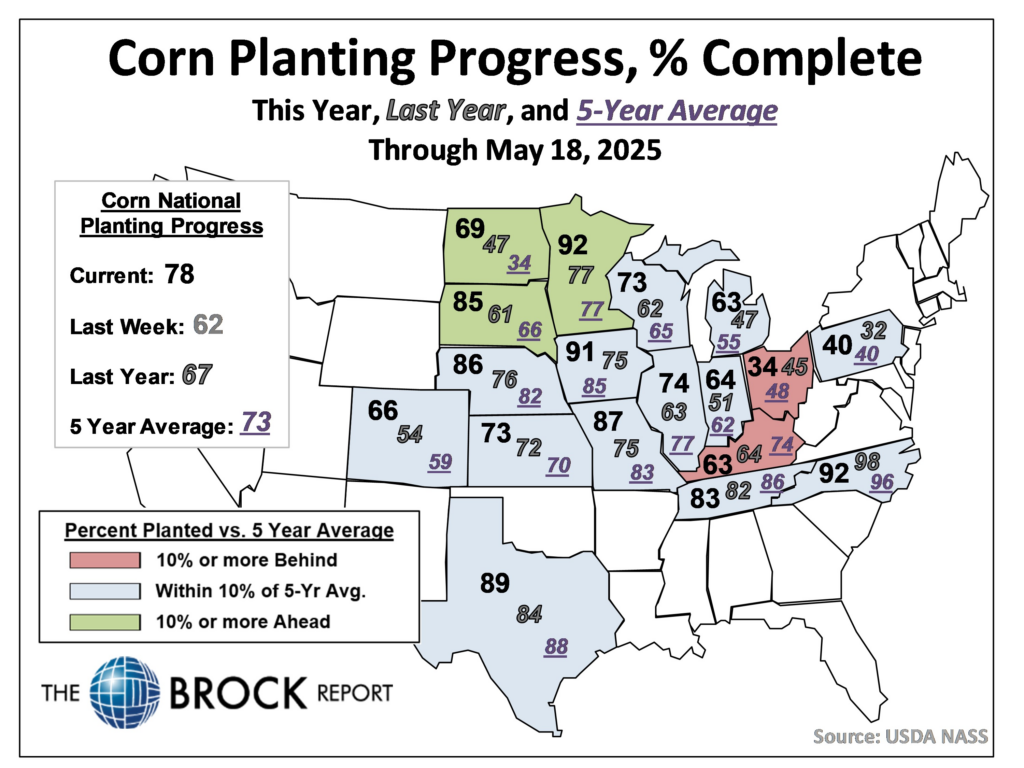

USDA this afternoon pegged U.S. corn planting progress at 78% as of Sunday, on par with the avg. of trade expectations, 11 points ahead of a year earlier and 5 points ahead of the 5-yr. average. USDA estimated that 50% of the crop had emerged vs. 38% a year earlier and the 5-yr. avg. of 40%.

Looking at the top growing states, Iowa planting progress was at 91% vs. a 5-yr. avg. of 85%, while Illinois progress was at 74% vs. an avg. pace of 77%. Minnesota progress was at 92% vs. an avg. of 77%, while Nebraska progress was at 86% vs. an avg of 82% and Indiana progress was at 64% vs. an avg. of 62%. The only trouble spot appears to be Ohio, where progress was only at 34% vs. a 5-yr. avg. of 48%.

USDA next week will offer its first U.S. corn condition rating of the season. The crop is off to a good start in the Delta, with Mississippi conditions rated 78% good/ex., Arkansas conditions rated 68% good/ex and Louisiana conditions rated 89% good/excellent.

Strong to severe thunderstorms are quite likely producing hail, damaging wind and tornadoes from the eastern Great Plains into the central Midwest. The storms will shift farther to the east Tuesday. A similar situation occurred during the weekend producing serious damage to property in the lower Midwest Friday and in the central Plains on Sunday.

Over the next 48 hours, rainfall is forecast to be anywhere between 0.75 to 3.20 inches from eastern Kansas and Oklahoma eastward into Missouri, Iowa, and northwestern Arkansas with locally heavier totals likely, World Weather Inc. says. Slightly lighter amounts between 0.50 and 2.00 inches are expected in the eastern Midwest southward. If these amounts verify, it could present a risk of flooding in some locations that are impacted by the heavier storm cells.

USDA this morning pegged U.S. corn export inspections for the week ended May 15 at 67.7 mil. bu., up from 51.2 mil. a week earlier and 48.7 mil. a year earlier. Export inspections for the marketing year to date totaled 1.793 bil. bu., up 29.2% from a year earlier.

Central Illinois processor spot corn basis bids are steady, ranging from 15 cents under July futures to 10 over, according to USDA. CIF basis bids for delivery of corn to the U.S. Gulf are stronger vs. Friday afternoon. The bid for May delivery is 3 cents stronger at 68 over July futures, while the bid for June delivery is also 3 cents stronger at 68 over and the bid for July delivery is 2 cents stronger at 66 over.

SOYBEAN COMMENTS

NO NEW RECOMMENDATIONS

Soybean futures managed to eke out small gains ranging from 3/4 of a cent to 3 cents in choppy, range-bound trading, finding support from a weak dollar, strength in soyoil futures and reports of crop losses due to flooding in Argentina. Gains were capped by the strong U.S. planting and crop emergence and dwindling export demand for U.S. soybeans. July soybeans rose 3/4 of a cent to $10.50 3/4, while Aug. soybeans rose 1 1/2 cents to $10.48 and Nov. soybeans rose 1 1/2 cents to $10.37. July soyoil rose 51 points to 49.44 cents, while July soymeal futures fell 80 cents to $291.10.

This was a very dull day in the soybean market that changed little from a technical standpoint. Futures traded narrow ranges of 9 3/4 cents as traders awaited fresh fundamental news. It is somewhat encouraging that July soybeans failed to find fresh selling interest when they fell to a 6-session low of $10.45 3/4 overnight, but the market found no upward momentum either and has nearby chart resistance at $10.56-$10.59 3/4. Nov. soybeans traded well inside of their Friday range and finished near midrange for the day, with nearby support at $10.30 3/4-$10.32 1/2 and nearby resistance at $10.40 1/4-$10.43.

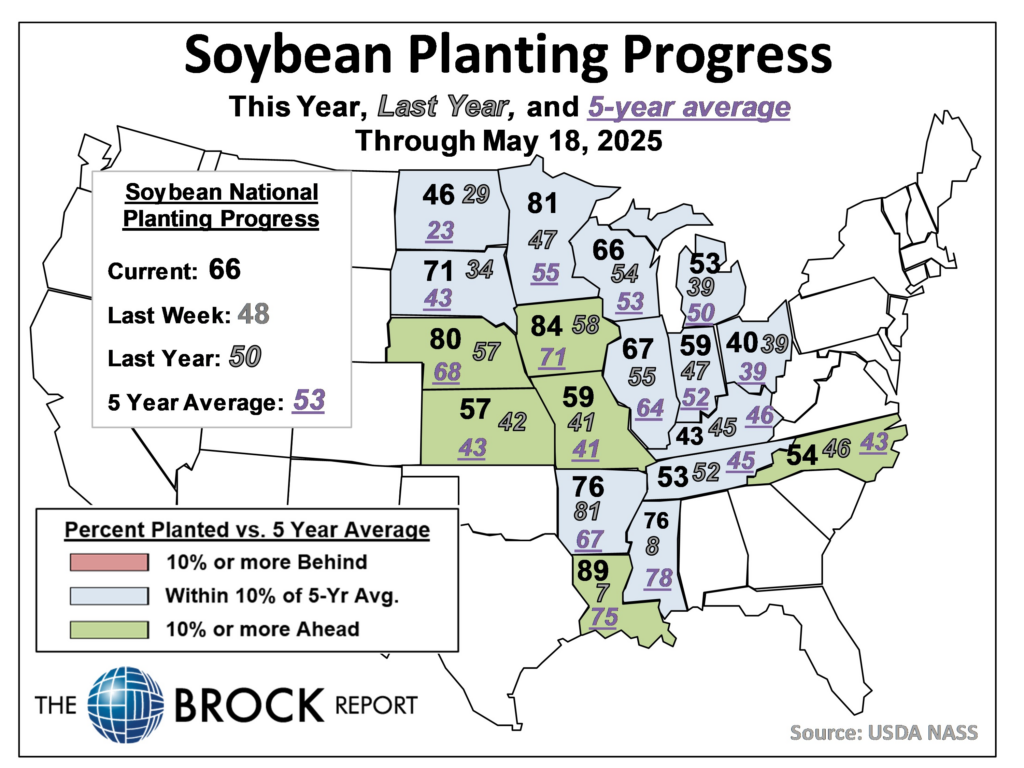

USDA this afternoon pegged U.S. soybean planting progress at 66% as of Sunday, up from 48% a week earlier and 2 points ahead of the avg. of trade expectations. Progress was also 16 points ahead of a year earlier and 13 points ahead of the 5-yr. average. USDA estimated that 34% of the soybean crop was emerged, up from 25% a year earlier and the 5-yr. avg. of 23%.

Looking at the top growing states, Iowa planting progress was at 84% vs. a 5-yr. avg. of 71%, while Illinois progress was at 67% vs. an avg. pace of 64%. Minnesota progress was at 81% vs. an avg. of 55%, while Nebraska progress was at 80% vs. an avg of 68% and Indiana progress was at 59% vs. an avg. of 52%. Of the 18 states included by USDA in its nationwide planting progress estimate, progress lagged the 5-yr. avg. only in Kentucky and Mississippi.

The Buenos Aires Grains Exchange said today that heavy rains in recent days could cause “significant losses” in northwestern Buenos Aires province, where 730,000 hectares (about 1.803 mil. acres) of soybeans have yet to be harvested. Rainfall of up to 15.75 inches was reported in some areas between Thursday and Saturday, causing widespread flooding. The area had been previously hit by heavy rains earlier in the harvest season and some fields are said to be completely underwater.

USDA pegged weekly U.S. soybean export inspections for the week ended May 15 at a marketing year low of 8.0 mil. bu., down from 16.2 mil. a week earlier, but up from 7.1 mil. a year earlier. For the marketing year to date, export inspections of nearly 1.622 bil. bu. were 11.1% above a year earlier.

Central Illinois processor spot soybean basis bids are 1 cent weaker to steady, ranging from 3 cents under July futures to 25 over, according to USDA. CIF basis bids for delivery of soybeans to the U.S. Gulf are steady to stronger vs. Friday afternoon. The CIF basis bid for May delivery is 1 cent stronger at 63 over July futures, with the bid for June delivery steady at 66 over, while the bid for July delivery is 1 cent stronger at 67 over.

WHEAT COMMENTS

NO NEW RECOMMENDATIONS

Wheat futures ended higher amid technical buying and short-covering as the market continued to rebound from contract lows set last week. Chicago wheat was up 3 to 4 cents, settling at $5.29 in the July, $5.43 in the September and $5.64 ½ in the December. Kansas City hard red winter wheat was up 5 to 6 cents, settling at $5.22 ¾ in the July, $5.36 ½ in the September and $5.58 ½ in the December. Spring wheat gained 10 to 12 cents, settling at $5.85 ½ in the July, $5.98 ¾ in the September and $6.17 ¼ in the December.

Today’s action adds to expectations that this market has established a bottom, although wheat has had a way of defying such predictions. Basis the July contract, Chicago rose to its highest level in 11 days today while spring wheat made a one-week high.

Today’s Crop Progress report showed winter wheat conditions not as good as expected, at 52% good/excellent, down two points from last week. Traders were on average expecting the rating to hold steady. There were a couple of significant drops: In Texas the rating fell 10 points to 32% good/excellent, and in Colorado it fell 10 points to 46%. But the rating in Idaho jumped 8 points to 70% good/excellent, and in top producer Kansas the rating increased by one point to 49%. The national poor/very poor rating held steady at 18 percent.

The spring wheat crop was 82% planted as of Sunday, USDA said today, up from 66% last week and the five-year average of 65%. Traders were on average expecting planting to be 80% done. All states are either essentially done, or well ahead of their average pace.

Weekly wheat export inspections of 423,785 metric tons were up from 405,170 the prior week, and within trade guesses of 300,000 to 500,000 metric tons. For the marketing year to date, inspections are up 15.7%, in line with the 16.0% increase in exports that USDA is projecting. Last week’s strong export sales total has fed hope that U.S. wheat prices have fallen enough to make us competitive in global markets.

In other news, Saudi Arabia bought 621,000 metric tons of wheat in a tender for arrival in August to October, Reuters reported. Origins offered were the European Union, Black Sea region, North America, South America and Australia with the sellers having the option of selecting the origin supplied.

Traders told Reuters they expected the wheat in the purchase to be mainly sourced from the Black Sea region including Russia, Romania and Bulgaria. The purchase was smaller than the 655,000 tons sought in the tender.

COTTON AND RICE COMMENTS

NO NEW RECOMMENDATIONS

Cotton futures ended higher, gaining 60 to 75 points. July settled at 65.64, after trading a range of 64.88 to 66.05. December cotton was up 67 points to 68.34. A weaker U.S. dollar helped set a positive tone for the ag complex today, and futures may also have some underpinning from concern about crops in the South.

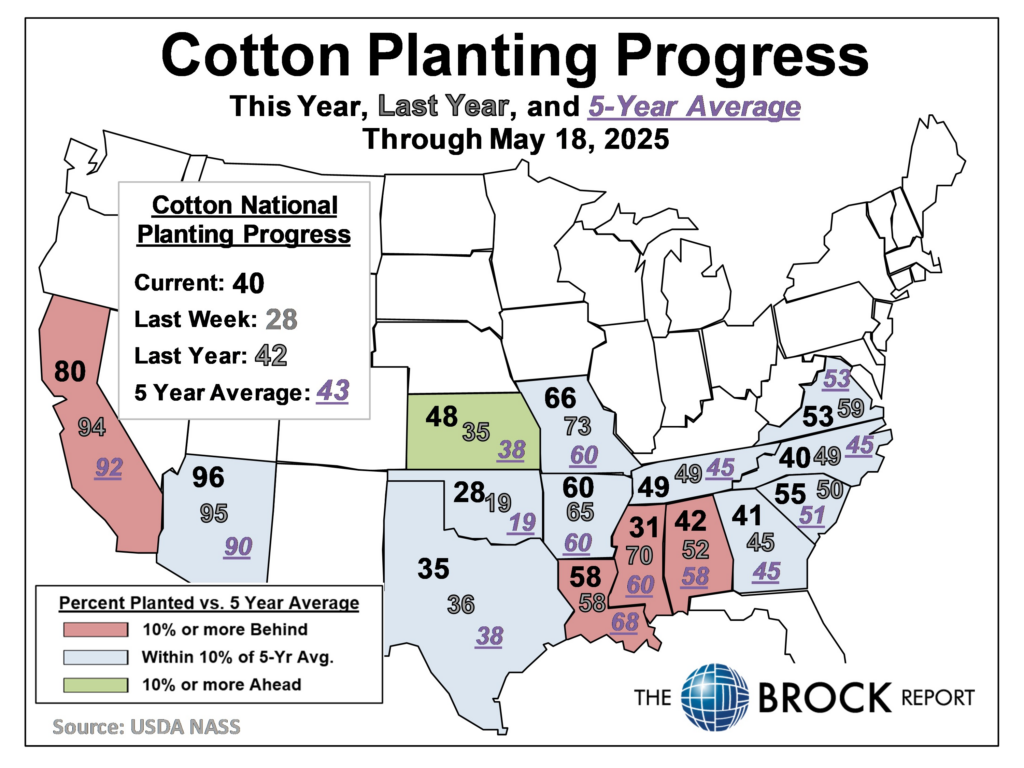

Today’s USDA Crop Progress report showed 40% of the crop planted, up from 28% last week but down slightly from the five-year average of 43%. Wet weather across the South has been an ongoing problem. Alabama was 42% planted as of Sunday, versus the five-year average of 58%; Georgia was 41% planted versus the average of 45%; Louisiana was 58% planted versus the average of 68%; and Mississippi was just 31% planted versus the average of 60%. With prices being what they are, farmers in the South may not need much encouragement to scrap their planting intentions if they are running late. On the other hand, recent rains in West Texas have improved the crop outlook there. USDA said the crop was 35% planted, up from 27% the prior week and near the five-year average of 38%.

Rice futures ended lower, losing 7 to 12 cents, with old crop showing the most weakness. July settled at $12.69 after trading a range of $12.65 ½ to $12.89. September rice settled at 10 cents to $12.94. While bear-spreading was a feature, which is not a good sign for the market, at the same time the relative strength in new crop could be attributed at least in part to concerns about the crop in the Mid-South in what has been a very wet spring.

Planting is nearly done, at 87%, USDA said. That is up from 80% last week and in line with the five-year average. Arkansas is 91% planted, up from the average of 87%. There is some concern about heavy rains this spring and the impact on crops, but the Arkansas crop is still rated 74% good/excellent.

LIVESTOCK COMMENTS

NO NEW RECOMMENDATIONS

Live cattle futures ended higher, underpinned by the market’s continued significant discount to the cash market. June live cattle settled up 75 cents to $212.975, August live cattle was up $1.175 to $207.925, and October was up $1.10 to $205.075. The afternoon Boxed Beef report showed Choice up $2.32 and Select up $1.72.

Beef packer margins remain deep in the red, at an average of minus $167.95 per head according to HedgersEdge, compared to minus $178.45 last week. Nearby futures months are still more than $5 off the contract highs set last Wednesday, and the market posted big bearish reversals that day, which fed ideas that the market has made a major top. But it is too soon to say that it is THE top. Futures remain at a large discount to cash.

Last week’s Plains cash cattle trade occurred mostly at $220 in Kansas and Texas, and at $229 in Nebraska on a live basis, and $358 dressed. Cash markets today were quiet, with offers in the southern Plains starting at $220, and at $229-30 in the Corn Belt.

Feeder cattle futures settled narrowly mixed. May feeders closed down $1.175 to $295.675, August was down 13 cents to $297.475, and September was up 5 cents to $296.325. The CME Feeder Cattle Index for Thursday was down $1.38 to $300.79.

Lean hog futures were mixed. June settled down $1.075 to $99.25, and August was down 53 cents to $103.10, but deferred contracts ended up slightly including the October, which settled up 25 cents to $87.15. The afternoon pork carcass cutout value was up 97 cents.

The national average cash carcass value surged $4.41 this afternoon, to $92.51, USDA said. The CME Lean Hog Index was at $91.26 on Thursday, and is expected to climb 20 cents for Friday. Pork packer margins are better but not great at $3.80 per head, up from minus 90 cents on Friday and minus $2.95 a week ago.

BROCK MARKET POSITIONS:

CORN: Cash-only Marketers: 2024 CROP: 85% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25).

2025 CROP: 15% sold on hedge-to-arrive contracts (2-5-25, 2-24-2025).

Hedgers: 2024 CROP: 80% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 4-15-2025); short July 2025 corn futures on 10% (5-8-25).

2025 CROP: 15% sold on hedge-to-arrive contracts (2-5-25, 2-24-2025); long 1 Dec. 2025 $4.70 put option, short 2 Dec. 2025 $5.40 calls, short 1 Dec. $4.20 put option on 10% (2-24-2025, 4-7-25); aside futures.

SOYBEANS: Cash-only marketers: 2024 CROP: 85% sold (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25)

2025 CROP: 10% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25).

Hedgers: 2024 CROP: 75% cash sold (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25, 4-15-25, 4-29-25), aside futures.

2025 CROP: 10% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25); aside futures.

SRW WHEAT: Cash-only Marketers: 2024 CROP: 100% sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 40% sold on hedge-to-arrive contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25).

Hedgers: 2024 CROP:100% cash sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24)

2025 CROP: 30% sold on hedge-to-arrive contracts (5-30-24, 10-15-24, 2-24-25); Aside futures.

HRW WHEAT: Cash-only Marketers: 2024 CROP: 100% sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 40% sold on hedge-to-arrive contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 5-30-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 30% sold on hedge-to-arrive contracts (5-30-24, 10-15-24, 2-24-25). Aside futures.

LEAN HOGS: Aside futures.

LIVE CATTLE: Long $195 put options against June 2025 live cattle futures on 100% of 2nd qtr. marketings (1-29-25); long $190 put options against Aug. 2025 live cattle futures on 50% of 3rd qtr. marketings (1-29-25); Short June futures on 25% of 2nd qtr. marketings( 3-25-2024), short Aug. 2025 live cattle futures on 50% of 3rd qtr. marketings (5-15-25).

FEEDER CATTLE: Sellers: Long May $270 put options, short May $300 call options against 50% of 2nd qtr. marketings; short Aug. 2025 feeder cattle futures against 50% of 3rd qtr. marketings (5-15-25); short Oct. 2025 feeder futures against 50% of 4th qtr. marketings (5-15-25. Feeder buyers remain aside futures.

MILK: Aside futures. 50% of 2nd qtr. production contracted in the cash market (5-9-25).

FEED BUYERS: CORN: 100% of 2nd qtr. needs bought in the cash market (5-6-25) 25% of 3rd qtr. needs bought in the cash market (5-6-25). SOYMEAL: 50% of 2nd qtr. needs bought in the cash market, long July soymeal futures on 50% (3-5-25); 25% of 3rd qtr. needs bought in the cash market, long July soymeal futures on 50% (3-5-25).

COTTON: Cash-only Marketers: 2024 CROP:75% sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24, 3-13-25, 3-18-2025, 4-28-25). 2025 CROP: No sales recommended.

Hedgers: 2024 CROP: 65% cash sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 3-13-25, 3-18-25, 4-28-25), aside futures: 2025 CROP: No cash sales recommended. Short Dec. 2025 futures on 20% (4-28,5-8)

RICE: 2024 CROP:90% forward contracted (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25. 4-29-25). 2025 CROP: No sales recommended.

NOTE: Along with the potential for profit, there is always a risk of losing money when trading futures and options contracts.

Copyright 2025 by Richard A. Brock & Associates, Inc.

Any unauthorized redistribution or reproduction of this commentary is strictly forbidden.