The U.S. corn export outlook remains bright. In its monthly Supply/Demand report earlier this month, USDA raised its forecast for 2024/25 U.S. corn exports by another 50 million bushels to 2.600 billion and projected exports would rise further to 2.675 billion in the upcoming 2025/26 marketing year, just short of the 2021/22 record of 2.722 billion, with low prices driving an increase in world export trade.

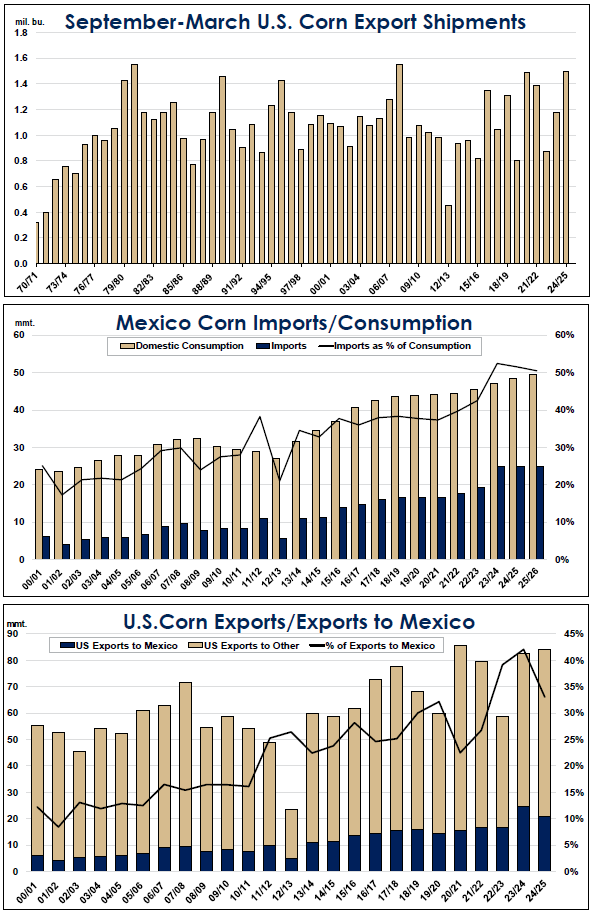

USDA may still be underestimating old-crop corn exports. As of May 15, export sales for 2024/25 delivery had reached 2.491 billion bushels and needed to average just 7.0 million per week over the remainder of the marketing year to reach USDA’s forecast. Sales over the past four weeks have averaged more than 54.5 million bushels per year, running 68% higher than the same period last year. Actual U.S. corn export shipment for the first seven months of the marketing year were slightly higher than in the record export year of 2021/22 and were the third highest on record behind 2008 and 1981.

One big reason that U.S. corn exports are booming is a recent surge in demand from top U.S. export customer Mexico., which usually sources more than 90% of its imports from here. Mexico’s annual corn imports jumped by about 50% between 2019/20 and 2023/24 and are expected to rise a bit further to 25.0 million metric tons (MMT), about 984 million bushels, this year. USA expects Mexico’s imports to hold steady in 2025/26. Mexico’s domestic corn consumption has risen 12 straight years and is expected to rise again in 2025/26. Consumption has roughly doubled since 2000/01 and Mexico went from importing 25% of its corn needs in 2000/01 to importing more than 52% in 2023/24.

Back-to-back years of drought have contributed to the recent jump in imports, as Mexico’s domestic production this year hit an 11-year low. But even if domestic production recovers in 2025/26, Mexico’s imports should remain high as President Claudia Sheinbaum has ended efforts to reduce imports of genetically-modified yellow feed corn from the U.S. and has ordered her administration to concentrate on boosting domestic production of white corn used for human consumption.

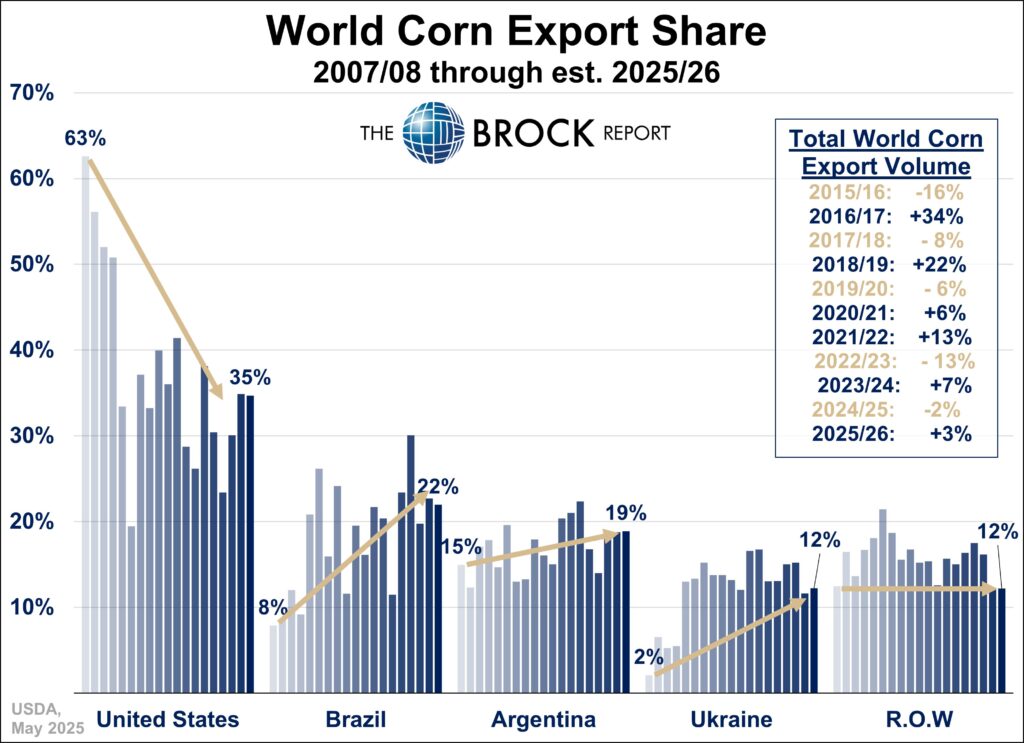

The U.S., in recent years, did become heavily dependent on Mexico as a corn buyer, with U.S. exports to Mexico making up 42.1% of total U.S. exports in 2023/24, up from just 22.5% in 2020/21, but exports to Mexico are currently on pace to make up only about 33% of total U.S. exports for 2024/25. As can be seen on our online weekly TBR corn summary, U.S. corn shipments to countries other than the traditional top export markets have surged sharply this year. Meanwhile, while the U.S. share of the world corn market has been trending sharply lower for years, the market share has rebounded from a recent low of 23% in 2022/23 to nearly 35% this year and is expected to hold about steady in 2025/26.