Live cattle futures ended this short trading week mostly steady-to-slightly lower in choppy price action. Futures came under significant pressure on Tuesday morning from speculative profit taking on long positions in the wake of a neutral USDA Cattle-on-Feed report. However, futures were again underpinned by their significant discounts to firm Plains cash markets, with strong wholesale beef prices adding support.

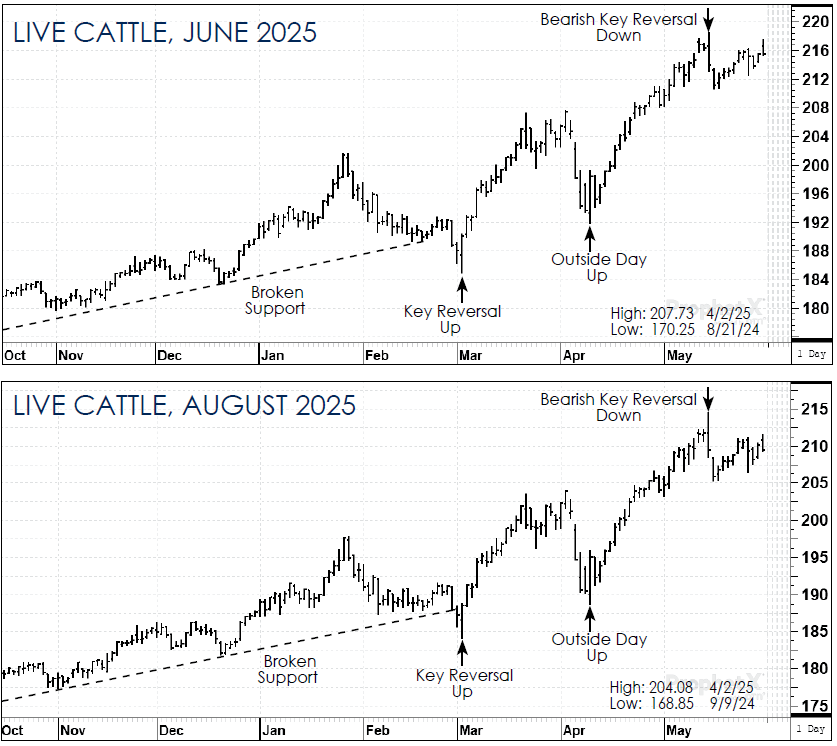

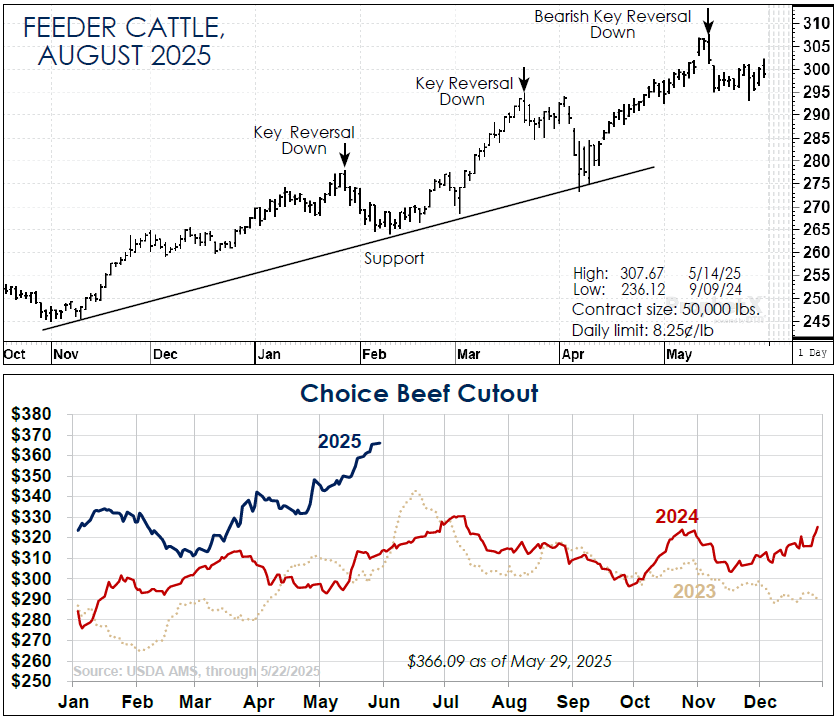

From a technical standpoint, both live cattle and feeder cattle futures look like markets that have put in major tops as large bearish reversals charted two weeks ago remain intact. However, those tops have not yet been strongly confirmed and, unless Plains cash markets show weakness soon, bulls may again take over leadership in the futures. June and Aug. live cattle futures, and most feeder cattle contracts, charted bearish outside trading weeks, but all finished above midrange for the week, so it’s hard to put much stock in those signals. Aug. live cattle will likely have to close below Monday’s low of $206.38 to put real fear into market longs.

Plains cash trade was strong again this week with feedlots maintaining the upper hand. Moderately active live cattle trade on Thursday in Kansas took place at mostly $222, $1-$3 higher than last week, with a few sales up to $230. Thursday live trade in Nebraska was at $234-$235, $4-$5 higher than last week with dressed carcass trade at $365-$370, $3-$5 higher. The choice beef cutout value rose another $5.12 in the week ended Thursday to $366.09. While last Friday’s USDA report was neutral relative to trade expectations, the May 1 feedlot inventory was the smallest in five years, underscoring tightening cattle supplies.

Hedgers’ Strategy: Live cattle hedgers sold Dec. live cattle futures on Monday against 50% of Q4 marketings and remain short June live cattle on 25% of Q2 and Aug. futures on 50% of Q3. They remain long $195 put options on June live cattle against 100% of Q2 marketings and $190 Aug. puts on 50% of Q3. Feeder cattle sellers are short Aug. and Oct. feeder cattle on 50% of Q3 and 50% of Q4 marketings.