NO NEW RECOMMENDATIONS

Grain and soybean futures came under pressure in early trading from expectations for this afternoon’s USDA Crop Progress report to indicate improved U.S. crop conditions. Wheat futures also felt pressure from a larger Russian crop forecast. However, soybean futures were underpinned by hopes for positive news on trade with China as market participants awaited the outcome of U.S.-China trade talks being held in London. Cotton futures edged lower in cautious early action as traders also awaited news out of the London talks.

Corn futures are mostly 2 3/4 to 6 cents lower at the end of early trading, with soybean futures mostly 1/4 cent lower to 1/4 cent higher, while wheat futures mostly range from 5 1/2 cents to 10 1/4 cents lower. Cotton futures mostly range from 14 points lower to 3 points higher.

Looking at other markets, U.S. crude oil futures are 33 to 34 cents higher on support from technically-driven buying/short covering and hopes for U.S.-China trade progress. The dollar index has is slightly weaker in cautious, rangebound action as traders await news out of the London talks. Most-active Aug. gold futures are $12.40 lower with investors looking to add risk to their portfolios.

Based on index futures trade, U.S. stock indexes are set to open slightly higher, continuing the Friday rally driven by better-than-expected U.S. employment data. Asian stock indexes rose slightly in Monday trade, while major European indexes are lower in afternoon trade.

There are no significant U.S. economic reports due out today, so investors will be focusing strictly on news out of the U.S-China trade talks. U.S. Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer are meeting China’s Vice Premier He Lifeng, Beijing’s lead trade negotiator.

Corn futures ended early trade near their session lows with nearby July futures falling back to $4.39 3/4 after failing to push through nearby chart resistance at $4.46. Dec. futures felt the most pressure amid very favorable U.S. crop weather, falling through nearby chart support and finishing early trade at $4.43 1/4. Dec. now has nearby resistance at $4.50-$4.50 1/2.

Soybean futures have traded narrow ranges of 8 1/4 cents so far. Futures came under pressure overnight from favorable crop weather, but rebounded on support from U.S.-China trade optimism. July soybeans traded to an 8-session high of $10.61 3/4 before backing off, while Nov. soybeans reached a 7-session high of $10.40 1/4 before pulling back.

We would expect this afternoon’s USDA report to show the U.S. corn conditions improved last week from the previous level of 69% good/excellent, while soybean conditions also rose versus the initial 2025 rating of 67% good/excellent. The good/ex. ratings for both crops will likely be at least 1-2 percentage points higher.

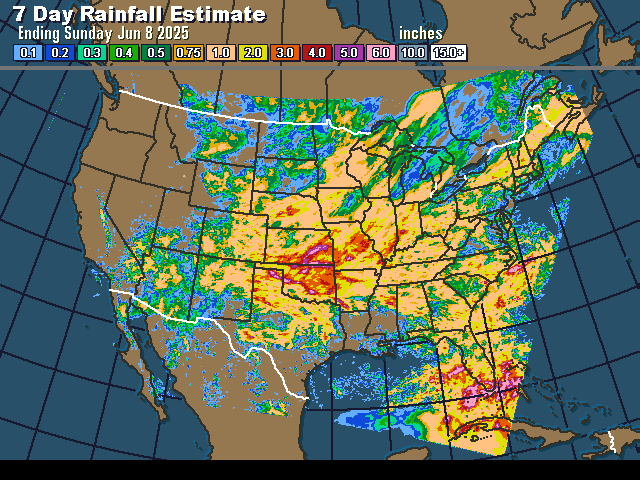

Most top U.S. corn and soybean producing states enjoyed warmer temperatures and sufficient rainfall last week, with the exception of the Dakotas, where rains were light and spotty.

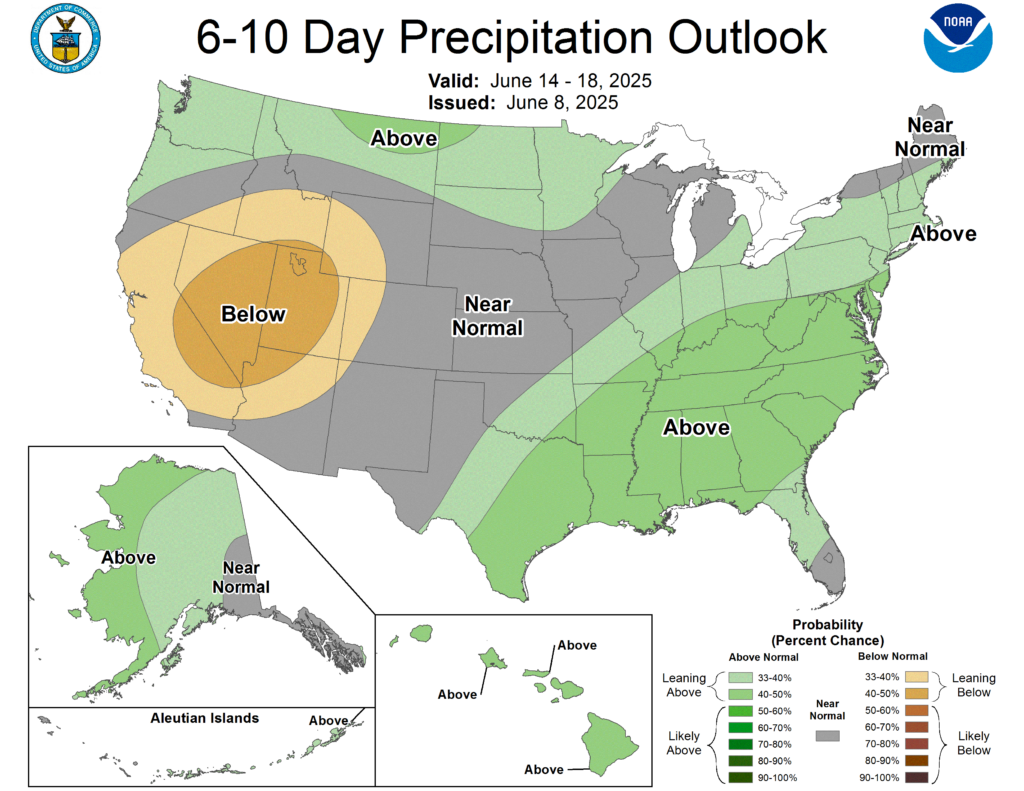

U.S. weather will be plenty wet in key crop areas during the next ten days to two weeks, World Weather Inc. says. The NWS 6- to 10-day outlook for Jun 14-18 favors above-normal temperatures across most of the Corn Belt along with near-normal to above-normal precipitation.

Brazil’s Safrinha corn conditions are much better than expected in production areas from Mato Grosso do Sul into Parana, Sao Paulo and neighboring Paraguay. Yields will be better than expected in these areas. Additional rain is forthcoming. Mato Grosso and Goias safrinha crops have not seen much of the rain that has occurred farther to the south. Late-planted corn and some cotton may be stressed and facing some yield reduction.

The safrinha corn harvest in Brazil’s center-south region reached 1.9% complete as of last Thursday, up just 0.6 percentage points from a week earlier and down from year-earlier progress of 10%, according to Brazilian consultant AgRural, which said the harvest pace is the slowest since 2021.

S. Korean buyer KFA reportedly bought 65,000 MT of corn in a private deal late last week for September arrival. The corn is expected to be sourced from S. America.

China’s May soybean imports hit a record high of 13.92 MMT, according to Chinese customs data released on Monday. May imports were more than double April imports as shipment delayed by slow customs clearance rates arrived. May imports were up 36.2% from a year earlier. January-May imports of 37.11 MMT were 0.7% below a year earlier, according to customs data.

Wheat futures accelerated lower into the close of early trading, ending near their session lows. Futures are threatening to chart bearish reversals. July SRW wheat futures hit a 7-week high of $5.57 3/4 overnight before ending early trade at $5.44 1/2. Friday’s low is now support at $5.40 1/4. July HRW wheat traded to a 6-week-plus high of $5.51, but ended early trade at $5.39 1/4 with support from Friday’s low at $5.35 3/4.

Mounting U.S. winter wheat harvest and a larger Russian wheat crop estimate all appear to be weighing on wheat futures. The wheat market seems to be largely ignoring continued high tensions between Russia and Ukraine. Futures are under pressure despite reports that Russia overnight launched its largest drone attack against Ukraine of the 3-year-plus war.

This afternoon’s USDA report may show further improvement in U.S. spring wheat conditions. Wet weather in the southern Plains may remain somewhat of a supportive factor for wheat prices. Northern Texas and southern Oklahoma were hit by severe thunderstorms on Sunday and more rains is expected there thru midweek.

Moscow-based consultant SovEcon has raised its forecast for Russia’s 2025 wheat crop by 1.8 MMT to 82.8 MMT, citing good weather in Russia’s Southern Region. Sovecon’s crop forecast is now in line with USDA’s May forecast of 83.0 MMT.

Livestock futures may start out mostly higher on further support from technically-driven buying and strong cash market fundamentals. Friday’s jump of $3.39 in the composite pork cutout value will be supportive for lean hog futures. Live cattle futures should continue to find support from their discounts to very strong Plains cash live cattle markets, although speculative profit taking could occur with cash markets set to be quiet today. Feeder cattle should find support from a further rise of $1.30 in the CME cash feeder cattle index to $306.16.