CORN COMMENTS

NO NEW RECOMMENDATIONS

Corn futures slid 7 1/4 to 9 1/2 cents under renewed pressure from mostly favorable crop weather and sharp declines in crude oil, soybean and wheat prices. A stronger dollar also weighed on futures, although the dollar weakened significantly after midday. July corn futures fell 9 1/2 cents to $4.19 1/4, while Sep. futures fell 8 cents to $4.17 1/2 and Dec. futures fell 7 1/2 cents to $4.33 3/4.

The theme song for the corn market right now has to be “I don’t like Mondays”, the Boomtown Rats’ 1979 new wave classic. The last good Monday the market had was Memorial Day when futures were closed. Nearby July corn futures have fallen 4 consecutive Mondays, posting losses of 9 or more cents each of the past 3 Mondays. After hitting a new contract low today, July futures appear headed for long-term support at $3.90-$4.00 as the July delivery period approaches.

More importantly, Dec. corn posted its lowest close today since Dec. 18, breaking below significant support near $4.34. The market has nearby support at $4.31-$4.33, with its contract low nearby at $4.28, but a close below $4.28 would likely send Dec. toward the $4.00 area as well. Dec. will have to close back above $4.50 to improve its chart picture.

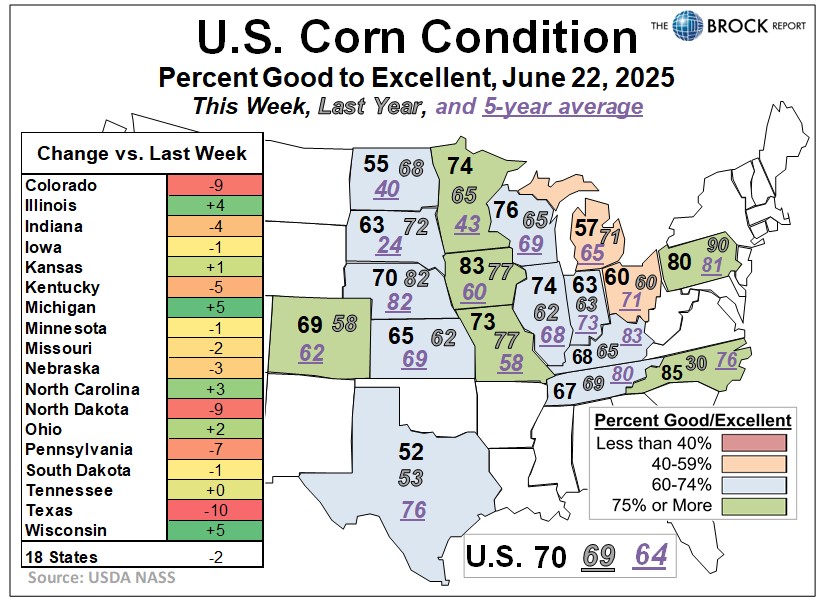

USDA this afternoon pegged U.S. corn conditions at 70% good/excellent as of Sunday, down from 72% a week earlier 2 percentage points below the avg. of trade estimates as extreme weekend heat likely impacted the crop. This should offer some support for corn futures; however, the U.S. rating was still up from 69% good/ex. at the same point last year. Looking at the top producing states, the good/ex. rating was down 1 point to 83% for the Iowa crop, but was up 4 points in Illinois to 74%. The good/ex. rating was 74% for the Minnesota crop, down 1 point and was 70% for the Nebraska crop, down 3 points, with the Indiana crop rated 63% good/ex., down 4 points.

The market focus on weather should only be increasing with the crop nearing its key growing period, but there is little change in the near-term weather outlook. Needed rains are forecast from eastern Nebraska through Iowa and southern Minnesota and much of Wisconsin within the next 5 days. Meanwhile, the NWS 6- to 10-day outlook again favors warm, wet conditions. The 8- to 14 day outlook for July 1-7 looks milder, favoring near-normal temperatures and precipitation across much of the Midwest, with above-normal temps and precip. still expected in the northwest Corn Belt.

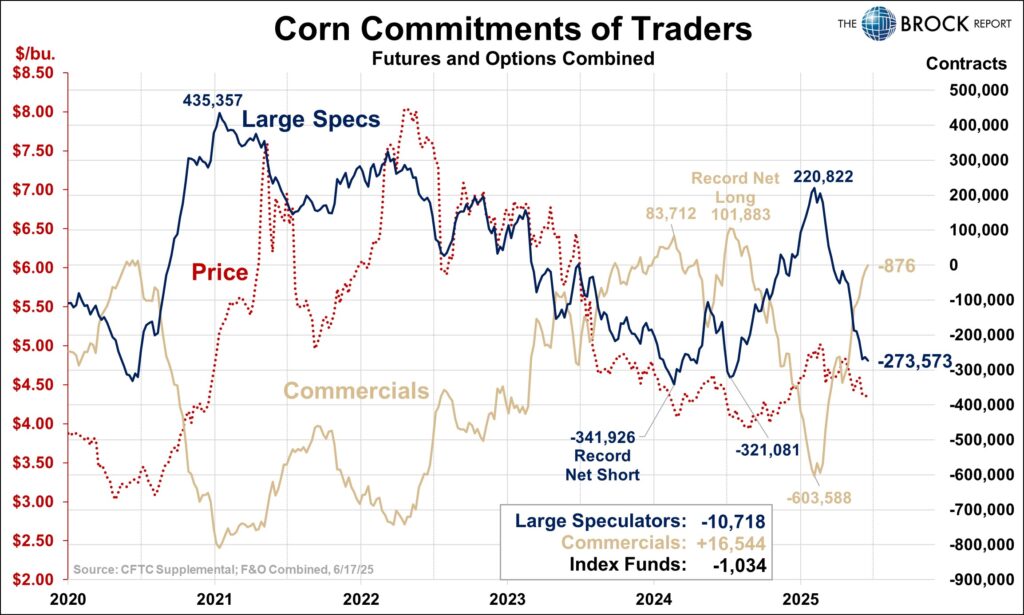

The latest CFTC Supplemental Commitments of Traders report shows large speculators (non-commercials) were net sellers of about 10,700 contracts of futures/options during the week ended last Tuesday and still held a large net short position of nearly 260,000 contracts as of Tuesday’s close. This indicates continued strong potential for a sharp short-covering rally at some point.

Outside influences should remain a wild card for the corn market. Crude oil futures posted massive bearish reversals off of 5-month highs today as Iran did not target the flow of oil out of the Middle East as retaliation for this weekend’s U.S. bombing of its nuclear sites. Iran did launch a missile attack on a U.S. base in Qatar but no casualties were reported. Meanwhile, the U.S. dollar index also posted a large bearish reversal off of a 3-week high in the wake of dovish comments by Fed officials. Two fed officials said the favored and interest rate cut at the July FOMC meeting. Investors will be focused on interest rates again on Tuesday, with Fed Chair Jerome Powell due to testify before Congress.

Central Illinois processor spot corn basis bids are steady, ranging from 3 cents under July futures to 8 over, according to USDA. CIF basis bids for delivery of corn to the U.S. Gulf are steady to slightly stronger vs. Friday afternoon. The bid for June delivery is steady at 67 over July futures, with the bid for July delivery 1 cent stronger at 68 over, with the bid for August delivery steady at 69 over Sep. futures.

SOYBEAN COMMENTS

ADVICE REMINDER: Both hedgers and cash-only marketers should have gone to 100% sold on 2024 production today. Both cash marketers and hedgers should also have sold another 10% of expected 2025 production. This takes everyone to 20% sold on this year’s expected crop.

Hedgers should also have sold July 2026 futures against 10% of expected 2026 crop.

Soybean futures slid 9 1/4 to 14 cents under pressure from favorable U.S. crop weather, the sharp slide in crude oil futures and the grain futures sell-off. Technically-driven selling helped extend losses. July soybeans fell 9 1/4 cents to $10.58 3/4, while Aug. soybeans fell 9 1/2 cents to $10.62 and Nov. soybeans fell 14 cents to $10.46 3/4. July soyoil futures fell 123 points to 53.24 cents, while July soymeal futures fell $1.70 to $282.40.

Today’s sell-off was set up by Friday’s bearish reversals, which left futures weakened technically. July soybeans today posted their lowest close in 6 sessions, although they did hold at their 10- and 40-day outlook. The next level of support on the July chart is at $10.38 1/2-$10.40 3/4. Nov. soybeans also posted their lowest close in 6 sessions and now have nearby chart support at $10.44 with moving avg. support at $10.38-$10.40. Short-term trend-line support for Nov. is at $10.32 1/2.

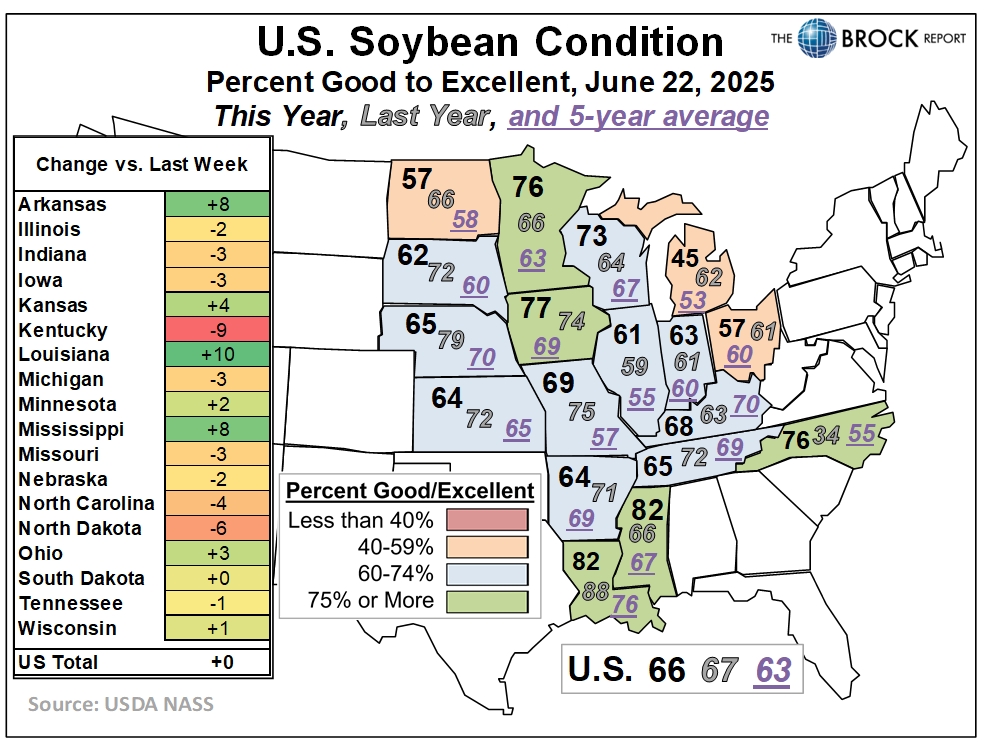

USDA this afternoon pegged U.S. soybean conditions at 66% good/excellent, unchanged from a week earlier, 1 percentage point below the avg. of trade expectations and 1 point below a year earlier. USDA estimated planting progress at 96% and estimated 90% of the crop was emerged, up from 84% a week earlier and on par with the 5-yr. average. Some 8% of the crop was said to be blooming, up 1% from the avg. pace.

Looking at top producing states, the good/ex. rating for the Iowa crop was down 3 points to 76% good/excellent and was down 2 points for the Illinois crop to 61%. The good/ex. rating rose 2 points in Minnesota to 76% but fell 2 points in Nebraska to 65% and was down 3 points in Indiana to 63%.

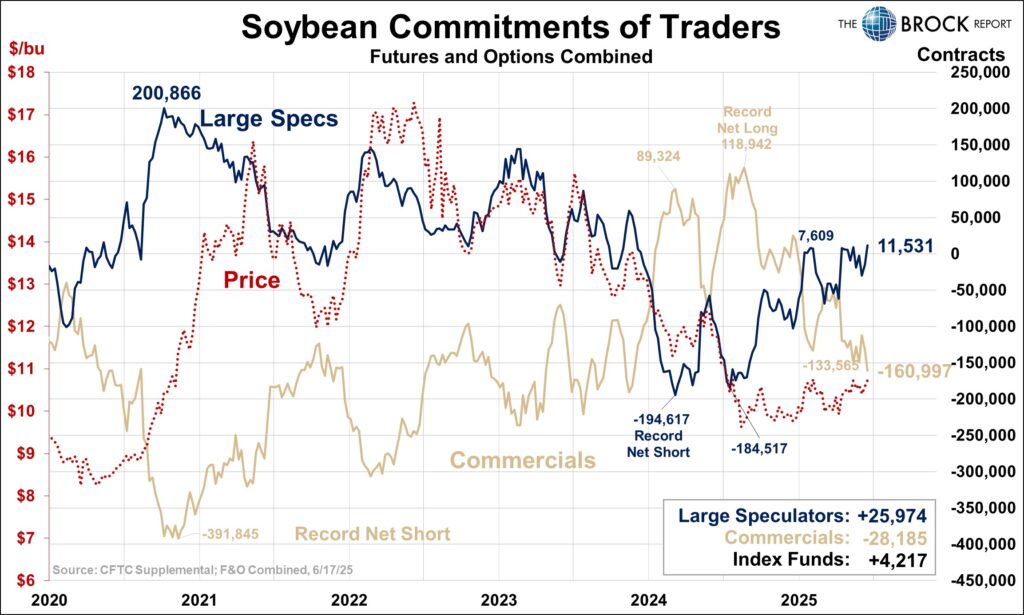

The latest CFTC Supplemental report shows large speculators were active buyers of about 26,000 contracts of soybean futures/options during the week ended last Tuesday and were net long more than 11,000 contracts at Tuesday’s close. Meanwhile commercial traders were net sellers of about 28,000 contracts on the week, expanding their net short position to about 111,000 contracts.

Central Illinois processor spot soybean basis bids now range from 33 cents under Nov. futures to 15 under Aug. futures compared with Friday’s range of 40 cents under to 5 under July futures, according to USDA. CIF basis bids for delivery of soybeans to the U.S. Gulf are steady to higher vs. Wednesday afternoon. The CIF basis bid for June delivery is at 58 cents over July futures, with the bid for July delivery steady at 73 over, while the bid for August delivery is 2 cents stronger at 78 over Aug. futures.

WHEAT COMMENTS

WHEAT HEDGE REMINDER: Today we recommended selling Sep. 2025 wheat futures against 20% of expected 2025 production to exit the current long position.

Wheat futures ended lower, with pressure from the U.S. harvest, a larger forecast for Russian production and the apparent sentiment that the risk of a broad war in the Middle East is declining. Chicago wheat was down 10 to 15 cents, settling at $5.53 ½ in the July, $5.69 ¾ in the September and $5.93 ¼ in the December. Kansas City wheat was down 13 to 14 cents, settling at $5.51 in the July, $5.65 ¾ in the September and $5.89 ½ in the December. Minneapolis wehat was down 9 to 12 cents, settling at $6.26 ¾ in the July, $6.45 ¼ in the September and $6.64 ½ in the December.

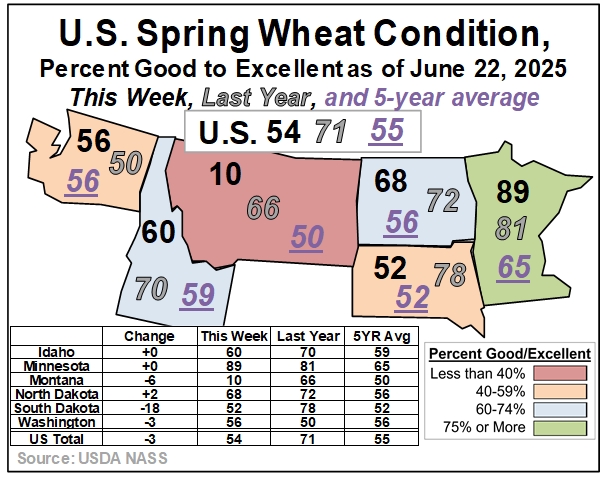

Today’s Crop Progress report showed a decline in the spring wheat good/excellent rating to 54%, down three points from last week. The drop is driven by a drop of 6 points in Montana to 10% good/excellent, while Washington was down 3 points to 56% and South Dakota’s rating plunged 18 points to 52%. But North Dakota’s rating improved by two points to 68% good/excellent, while Minnesota was steady at 89% good/excellent. Some rains in recent days in the northern Plains added to the pressure on the market today.

The winter wheat harvest is 19% done as of Sunday per USDA, up from 10% the prior week but down from the five-year average of 28%. Illinois was just 17% done versus the average of 40%, while Missouri was 29% done versus the average of 51% and Kansas was 20% done compared to the average of 31%. And Oklahoma is just 35% done, up from 30% the prior week but down from the five-year average of 73%.

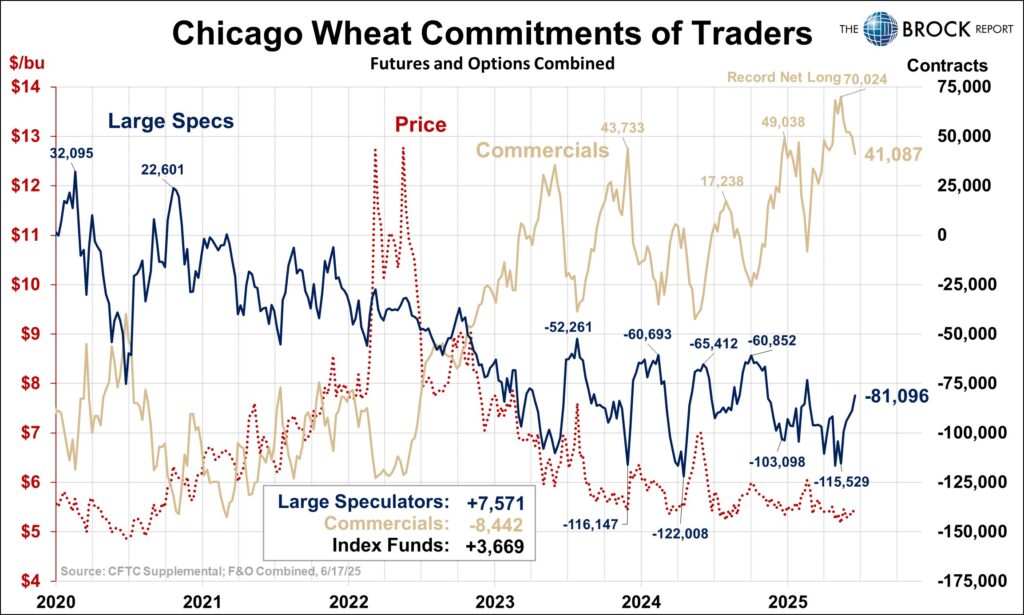

The CFTC released last week’s Commitment of Traders report today, due to last week’s holiday. It showed large speculators trimming their net short by 7,571 contracts in the week ended Tuesday, leaving them net short 81,096 in Chicago wheat futures.

The European Union’s crop observation agency MARS has raised its forecast for the EU avg. soft wheat yield slightly to 6.05 MT per hectare from a previous estimate of 6.04 MT, based on good crop conditions in southern Europe but noted dry conditions in northern areas of the bloc threaten yields there. The yield is now expected to be 5% above the 5-yr. average.

USDA this morning reported U.S. wheat export inspections for the week ended June 19 totaled 9.4 mil. bu., down from 14.3 mil. a week earlier and 12.7 mil. a year earlier. Inspections for the new marketing year to date totaled 31.0 mil. bu., down 7.7 mil. from a year earlier.

COTTON AND RICE COMMENTS

NO NEW RECOMMENDATIONS

Cotton futures were mostly higher. Nearby July settled down 8 points to 63.96, after trading a range of 63.64 to 64.83. But other contracts were higher including most-active December, which settled up 71 points to 67.41, after trading a range of 66.27 to 67.75. The market wasn’t helped by the weakness in crude oil, which fell even as Iran was launching missiles at U.S. military facilities in Qatar.

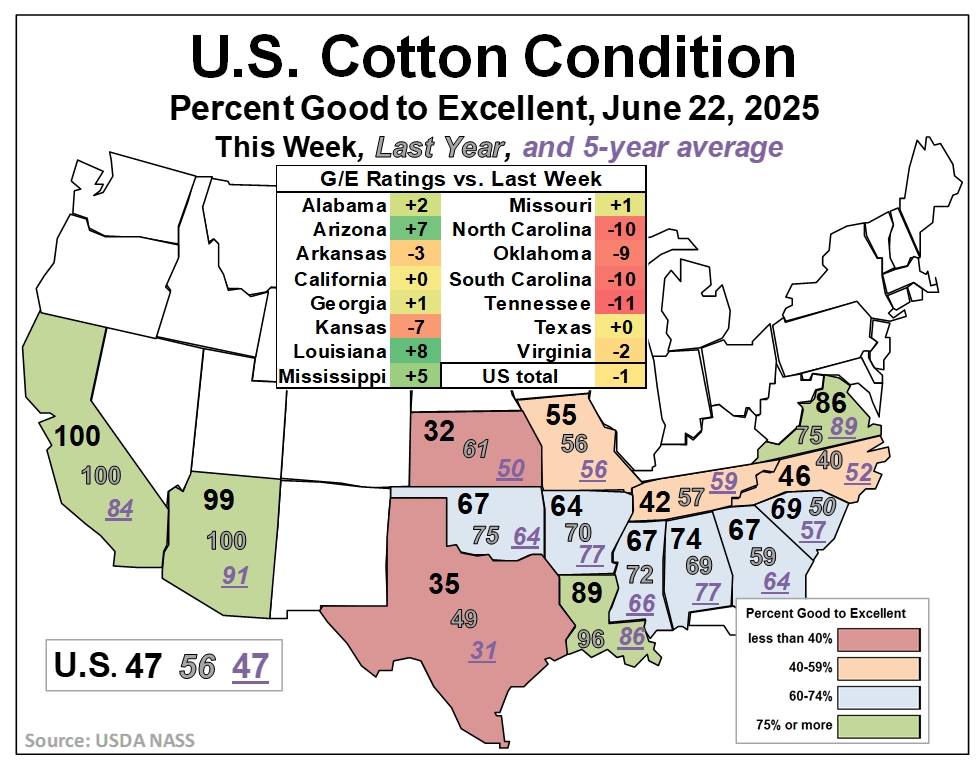

USDA reported the cotton crop was 47% good/excellent as of Sunday, down a point from last week and from 56% in the same week a year ago. The Texas rating held steady at 35% good/excellent, while the Georgia rating improved one point to 67%. Plantings were 92% done as of Sunday, up from 85% the prior week and near the average of 95%. Texas is 91% planted. West Texas into the Panhandle is actually drought-free following ample recent rains.

CFTC reported that large speculators cut their net short position in cotton futures by 3,453 contracts in the week ended June 17, leaving them net short 64,482 contracts.

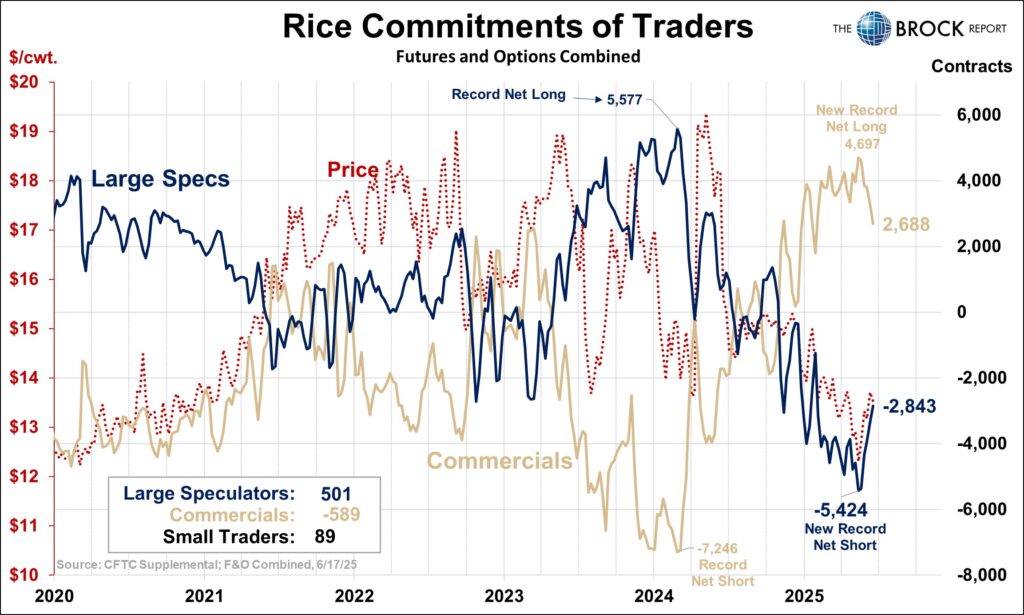

Rice futures ended lower. July rice settled down 12 cents to $13.39 ½, while September fell 7 cents to $13.65 ½ after trading a range of $13.63 ½ to $13.80. November rice was down 6 cents to $13.84.

USDA reported the rice crop was 78% good/excellent as of Sunday, up from 74% last week, though down from 83% at the same time a year ago. Mississippi was 76% good/excellent, while Arkansas was 71% good/excellent, up six points from the prior week.

LIVESTOCK COMMENTS

NO NEW RECOMMENDATIONS

Lean hog futures ended higher, and making new highs in most contracts with support from firm pork prices and strong cash hog fundamentals. August hogs settled up 68 cents to $113.45. While it could not quite take out last week’s contract high, other contracts did, including the October, which settled up 85 cents to $96.875, and the December, which gained 75 cents to $87.375. The afternoon pork carcass cutout value was up 64 cents.

USDA this afternoon reported the national negotiated cash carcass value down $1.11 to $109.35. The lagging CME cash lean hog index is at $108.08 and is expected to rise another $1.47 on Tuesday. Today’s hog slaughter is expected to run 477,000 head, down 1,000 from last week, but up 13,000 vs. last year. Last week’s estimated slaughter of 2.365 mil. head was down 1.9% from a year earlier.

Live cattle futures ended modestly lower amid long liquidation and technical pressure. June live cattle was down 73 cents to $222.30, August was down 45 cents to $209.375, and October was down 25 cents to $207.10. The afternoon Boxed Beef report showed Choice down 28 cents but Select up $6.15.

As is normal for a Monday, Plains direct cash cattle markets are quiet with no packer bids or feedlot asking prices established. We would not expect active trade to develop before Wednesday afternoon at the earliest. Last week’s Nebraska negotiated trade totaled 19,162 head, with live cattle sales at mostly $236 and dressed carcass trade at mostly $376. Weekly negotiated sales in Kansas were light at just 5,158 head, down from 8,759 a week earlier and 10,997 a year earlier. Kansas negotiated sales were at $228-$234, mostly $228-$230, down from the previous week’s $235 trade. The avg. packer operating margin is estimated by HedgersEdge at minus $38.40 per head, down from minus $20.90 on Friday.

Feeder cattle futures ended slightly higher, supported by the selloff in the grains complex. August feeders were up 35 cents to $302.80, September feeders were up 40 cents to $302.625, and October was up 50 cents to $300.85.

BROCK MARKET POSITIONS:

CORN: Cash-only Marketers: 2024 CROP:100% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 6-5-25, 6-20-25).

2025 CROP: 25% sold on hedge-to-arrive contracts (2-5-25, 2-24-2025, 6-9-25).

Hedgers: 2024 CROP: 100% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 4-15-2025, 6-5-25, 6-20-25).

2025 CROP: 20% sold on hedge-to-arrive contracts (2-5-25, 2-24-2025, 6-9-25); long 1 Dec. 2025 $4.70 call option, short 2 Dec. $5.40 put options on 10% (2-24-2025); long 1 July 2026 $4.70 put option, short 2 July 2026 $5.40 call options against 10% (6-6-25); aside futures.

SOYBEANS: Cash-only marketers: 2024 CROP: 100% sold (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25, 6-2-25, 6-23-25).

2025 CROP: 30% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25, 4-15-25, 4-29-25, 6-2-25, 6-23-25), aside futures.

2025 CROP: 10% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25); short July 2026 futures on 10% (6-23-25).

SRW WHEAT: Cash-only Marketers: 2024 CROP: 100% sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 50% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25).

Hedgers: 2024 CROP:100% cash sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24)

2025 CROP: 40% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25); aside futures.

HRW WHEAT: Cash-only Marketers: 2024 CROP: 100% sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 50% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 4-17-24, 5-8-24, 5-14-24, 5-16-24, 5-30-24, 6-4-24, 9-19-24, 10-15-24, 10-18-24).

2025 CROP: 40% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25); aside futures.

LEAN HOGS: Aside futures.

LIVE CATTLE: Short Aug. 2025 live cattle futures against 25% of 3rd qtr. marketings (6-13-25); short Dec. live cattle futures against 25% of 4th qtr. marketings (6-13-25)); Long $195 put options against June 2025 live cattle futures on 100% of 2nd qtr. marketings (1-29-25); long $190 put options against Aug. 2025 live cattle futures on 50% of 3rd qtr. marketings (1-29-25); aside futures.

FEEDER CATTLE: Sellers are aside futures. Feeder buyers remain aside futures.

MILK: Aside futures. 50% of 2nd qtr. production contracted in the cash market (5-9-25); short Aug. 2025 Class III milk futures against 50% of 3rd qtr. sales (5-29-25).

FEED BUYERS: CORN: 100% of 2nd qtr. needs bought in the cash market (5-6-25) 25% of 3rd qtr. needs bought in the cash market (5-6-25). SOYMEAL: 50% of 2nd qtr. needs bought in the cash market, long July soymeal futures on 50% (3-5-25); 25% of 3rd qtr. needs bought in the cash market, long July soymeal futures on 50% (3-5-25).

COTTON: Cash-only Marketers: 2024 CROP:75% sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24, 3-13-25, 3-18-2025, 4-28-25). 2025 CROP: No sales recommended.

Hedgers: 2024 CROP: 65% cash sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 3-13-25, 3-18-25, 4-28-25), aside futures: 2025 CROP: No cash sales recommended. Short Dec. 2025 futures on 20% (4-28,5-8)

RICE: 2024 CROP:90% forward contracted (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25. 4-29-25). 2025 CROP: 10% forward contracted (6-9-25).