Weekly COT Highlights – Week Ended Tuesday, June 22nd

Main Takeaways this Week

- Corn: Not much change. Supportive setup remains in place.

- Beans: Break in selling spree.

- Hogs: buyers beware. Selling spree continues for 5th straight week.

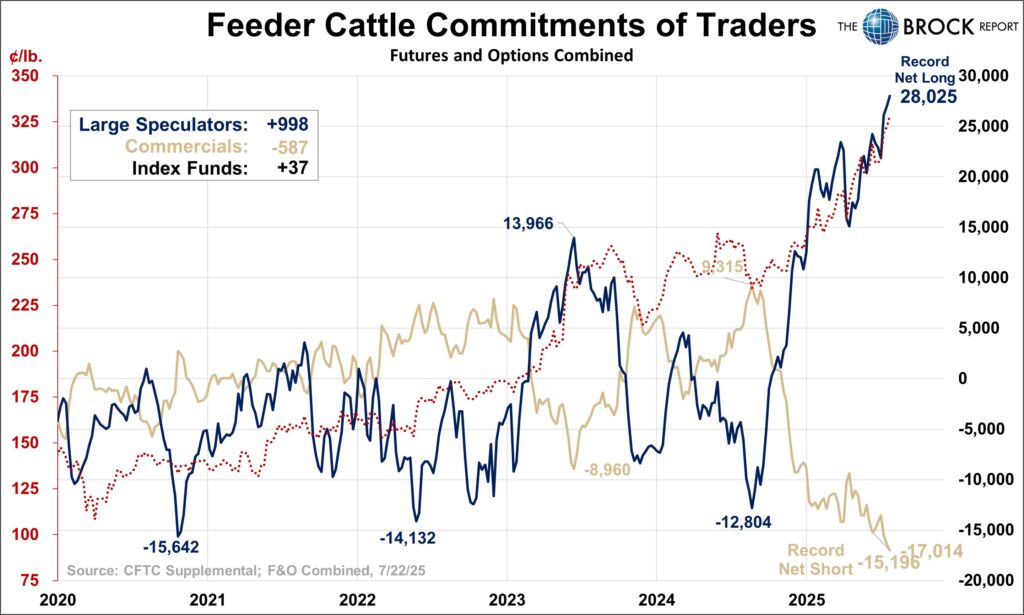

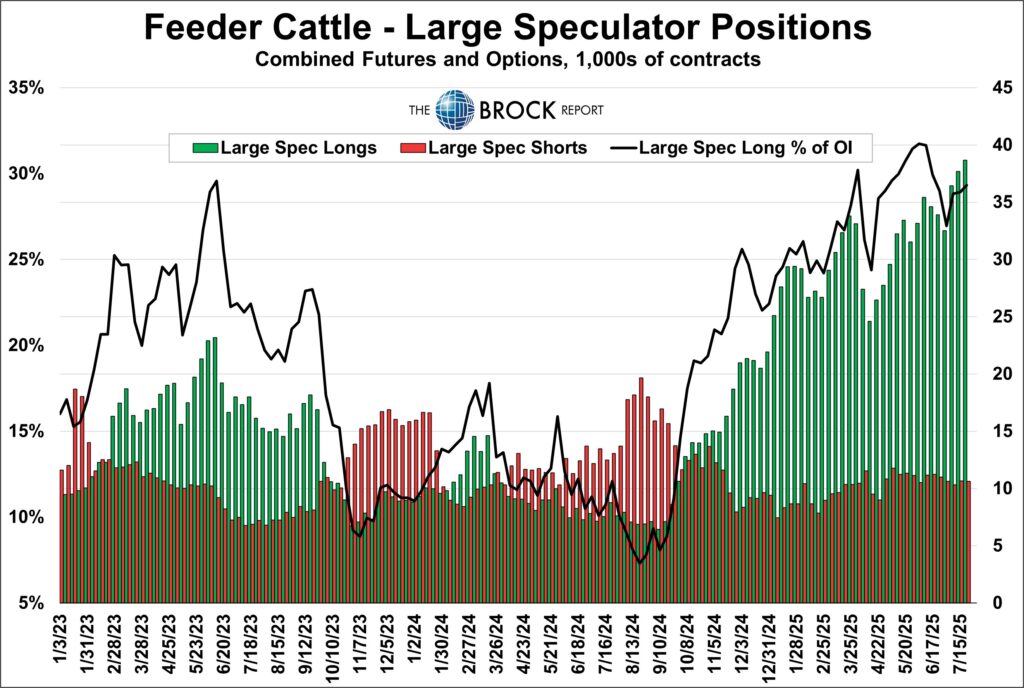

- Feeders: ANOTHER NEW RECORD NET LONG

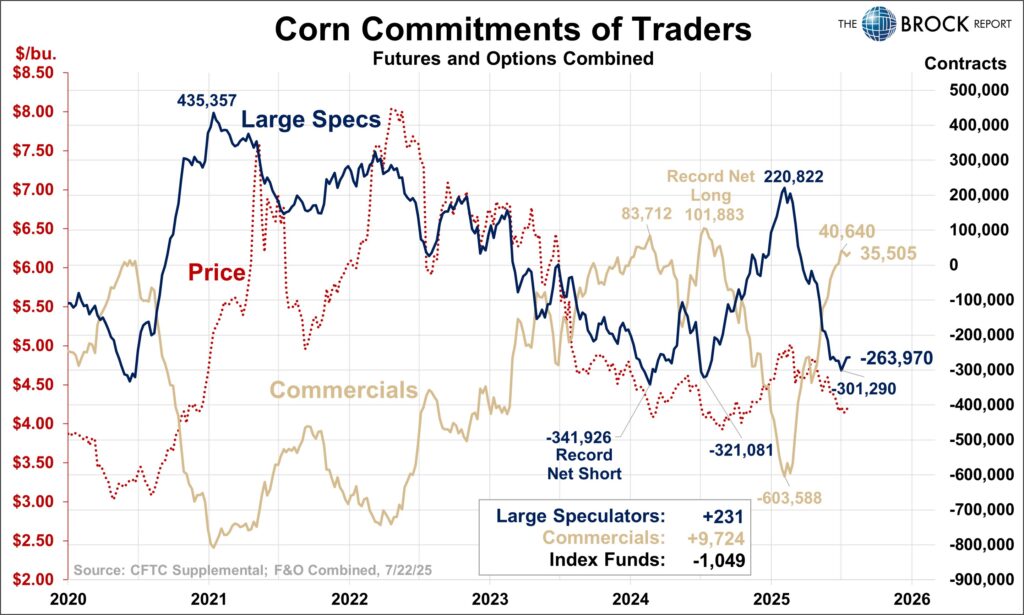

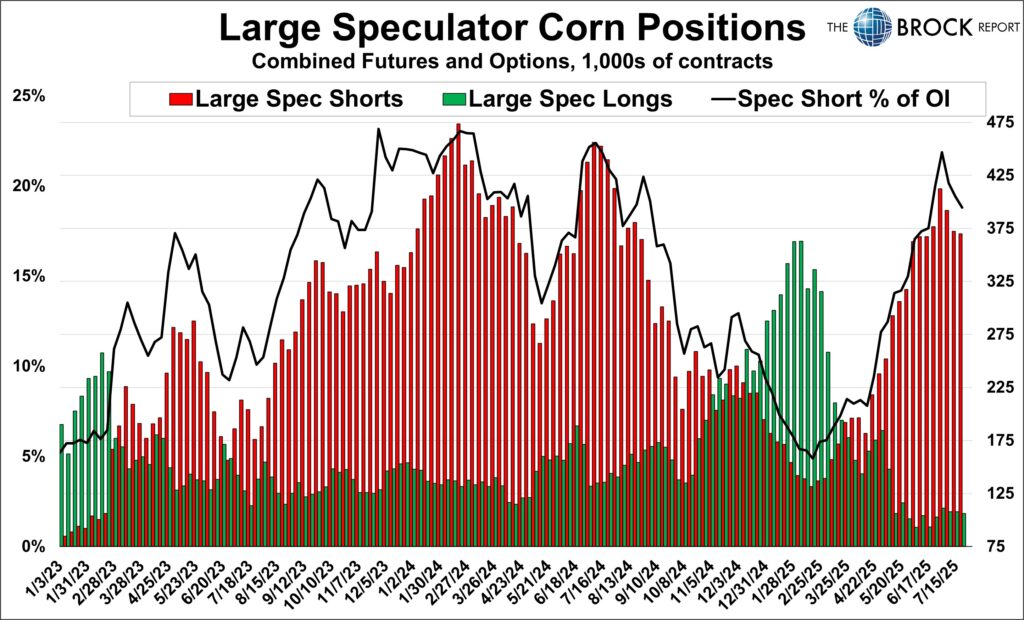

Corn

VERY modest buying this week. This marks the third straight week of buying, following a stretch where large specs sold 17 of 19 weeks.

Big picture: No change really. Setup remains supportive and the potential for a sharp rally is definitely present with specs holding such a massive short position.

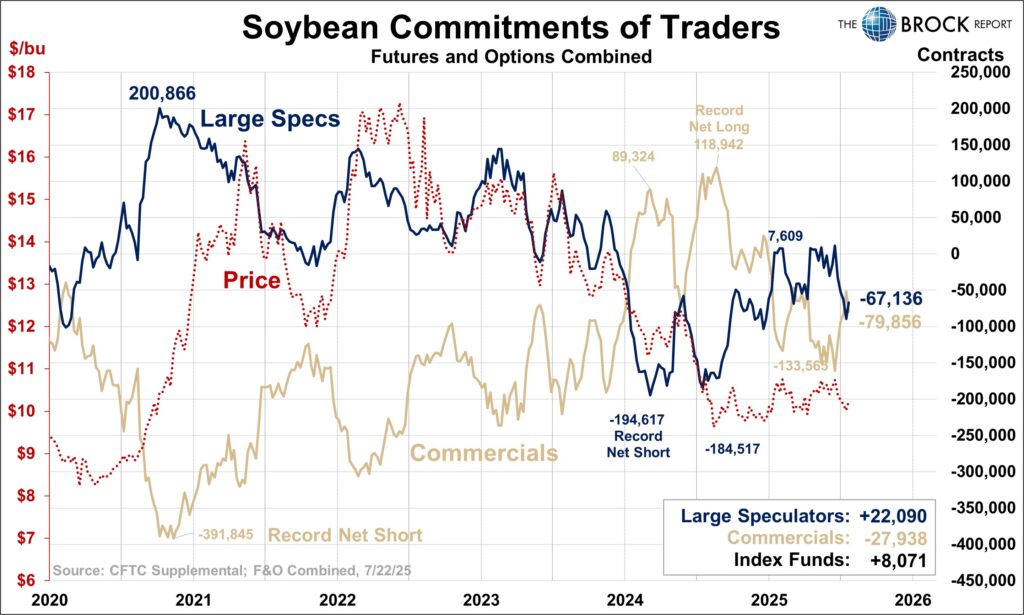

Soybeans

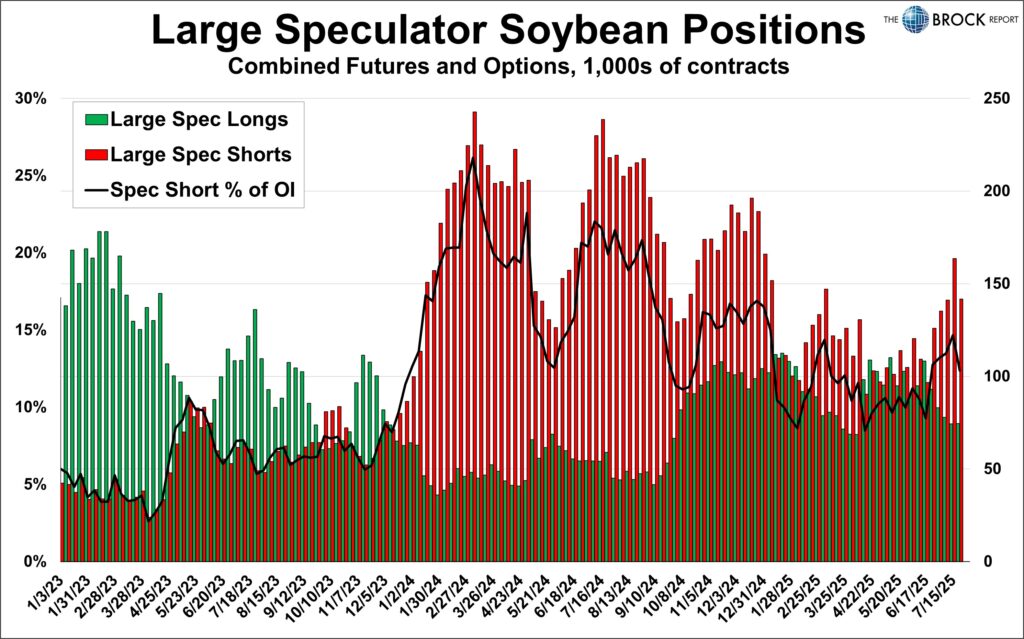

Relief is in sight! Specs were significant buyers this week, decreasing their net short position by over 22,000 contracts following a 4 week stretch in which they sold over 100,000 contracts. For beans to have any chance holding in this area, they will need speculative net buying and ideally speculative new buying, ie new longs. This week was entirely short liquidation, still a positive considering the past 4 weeks.

Big picture is this setup doesn’t tell us much. As we’ve been saying, specs could become big buyers or sellers, and it was our opinion a few weeks ago that the risk of selling was significant. That came to fruition, but this weeks release has us hoping they are done selling. The technical picture is mixed, and what happens next is that’s largely dependent on August weather in the top producing states in our opinion.

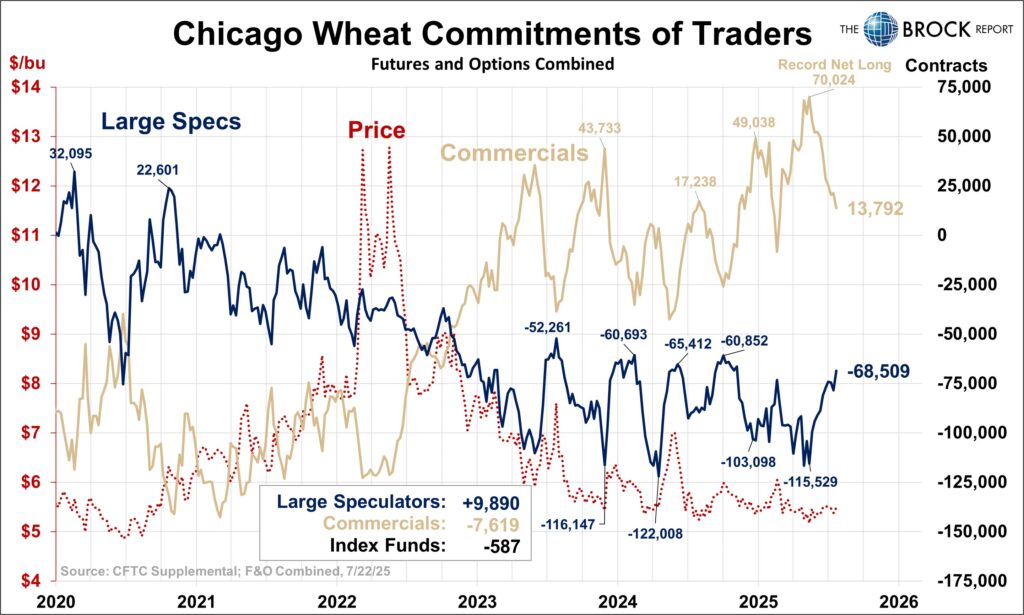

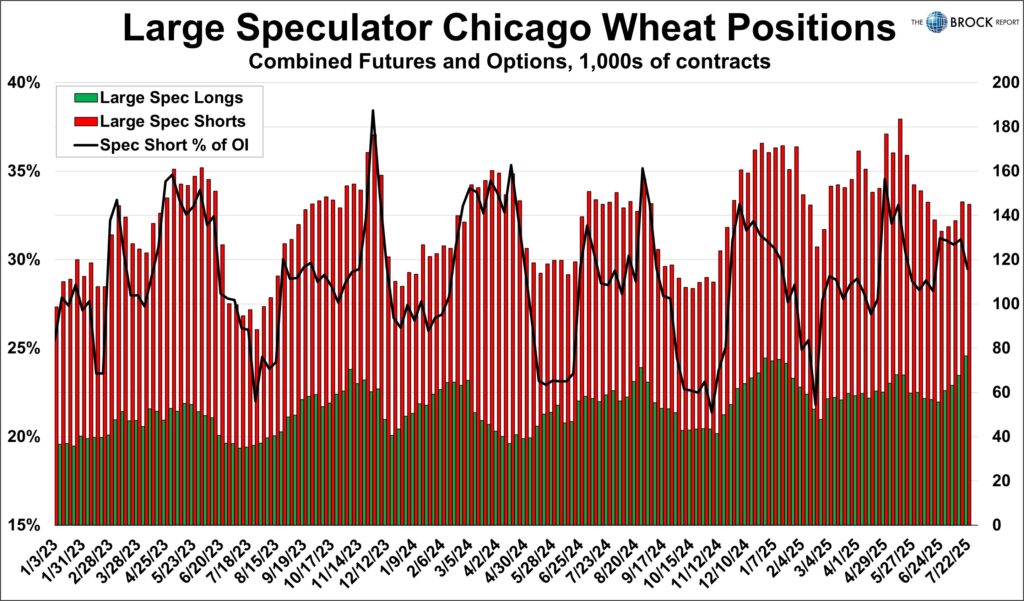

Wheat

The buying spree we asked for is well under way. The price rally we thought would accompany it has yet to commence. Specs were net buyers of nearly 10,000 contracts this week, and sit short 68,500 contracts. As shown below, many of their last buying sprees ended in the -65,000 to -50,000 contract short area.

For reasons outside the context we cover here, we remain optimistic that futures have built a base and are not in a rush to advance sales at this point.

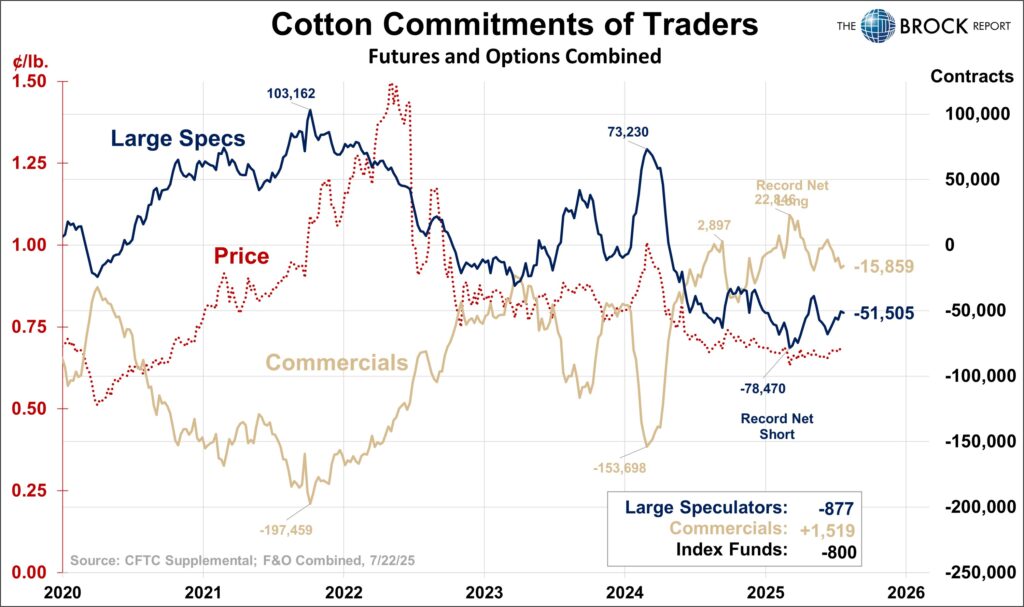

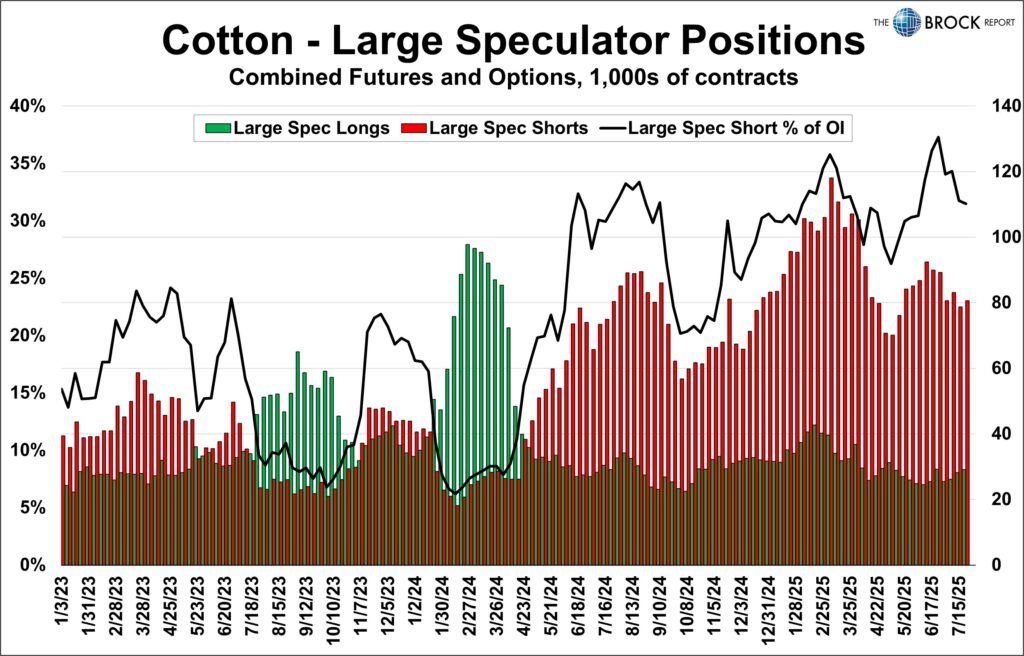

Cotton

Not much activity here. Specs and commercials have pretty much remained in a similar setup for 12 months now, moving at most net 30,000 contracts off of their position from 52 weeks ago, currently sitting just 264 contracts net short of that position. Nothing to take away from the cotton COTs at this time.

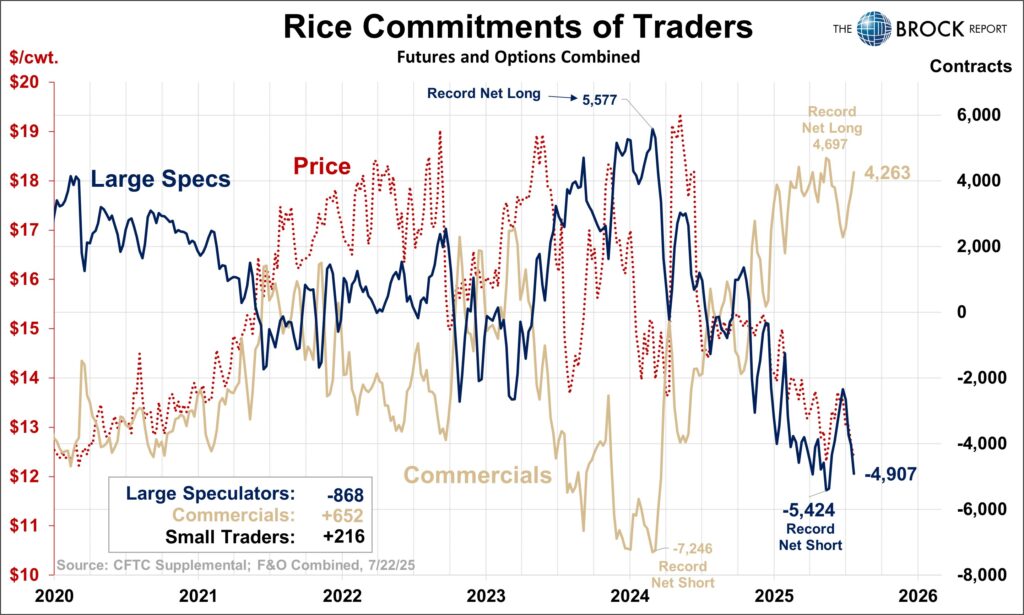

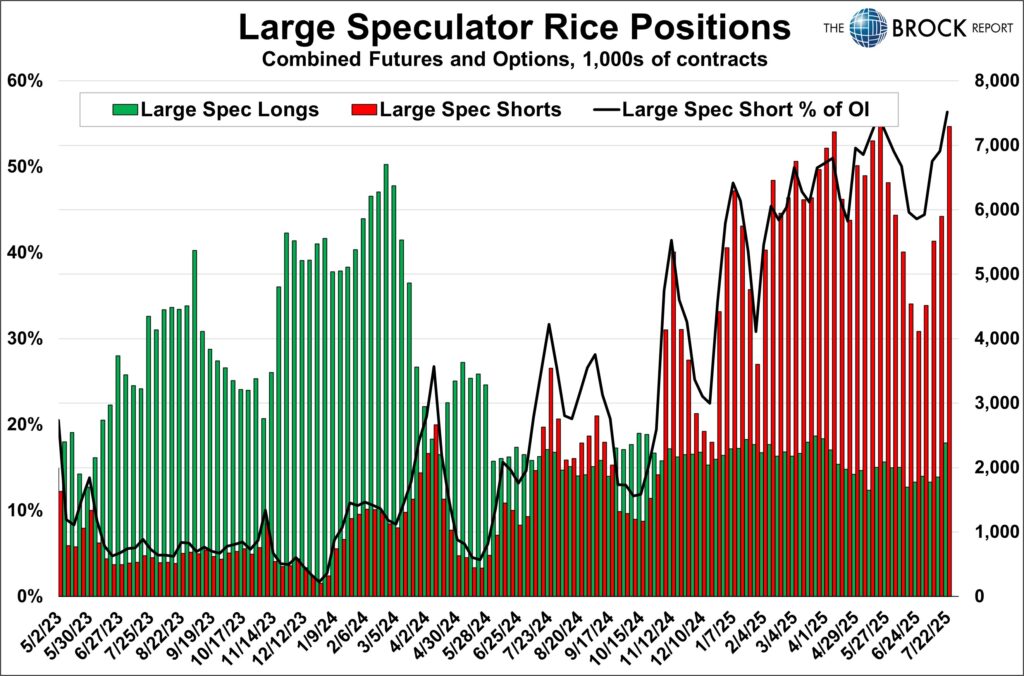

Rice

Five straight weeks of buying ended and specs have now been net sellers for four straight weeks as of Tuesday. Since Tuesday however, positive trade headlines have cause futures for bounce pretty solidly, and technically futures made a 5-wave buy signal Wednesday. With specs near record net short and some potentially supportive trade news, we could very well have just put the bottom in this market.

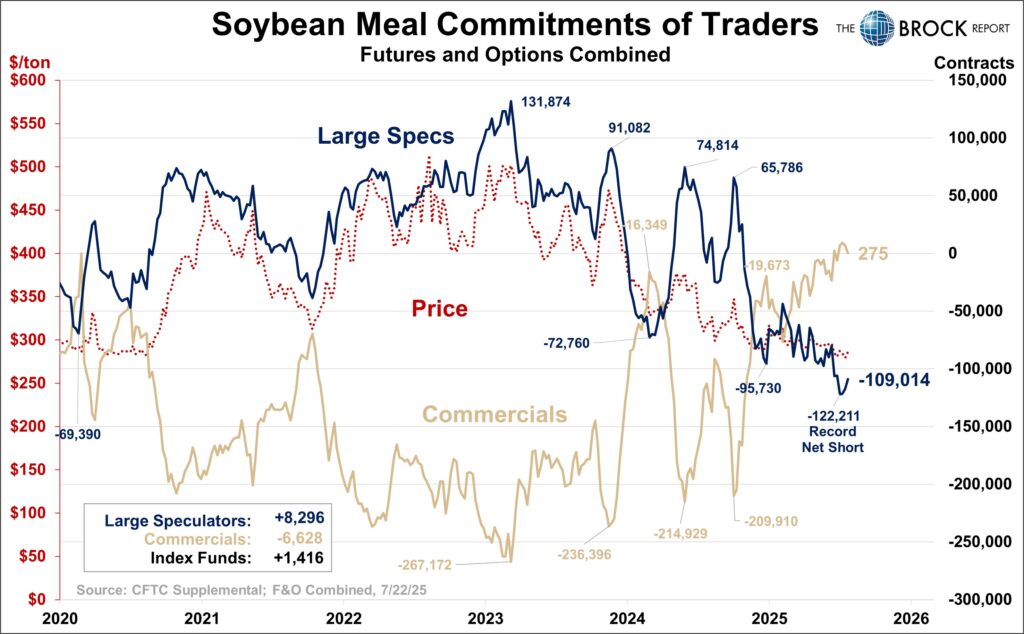

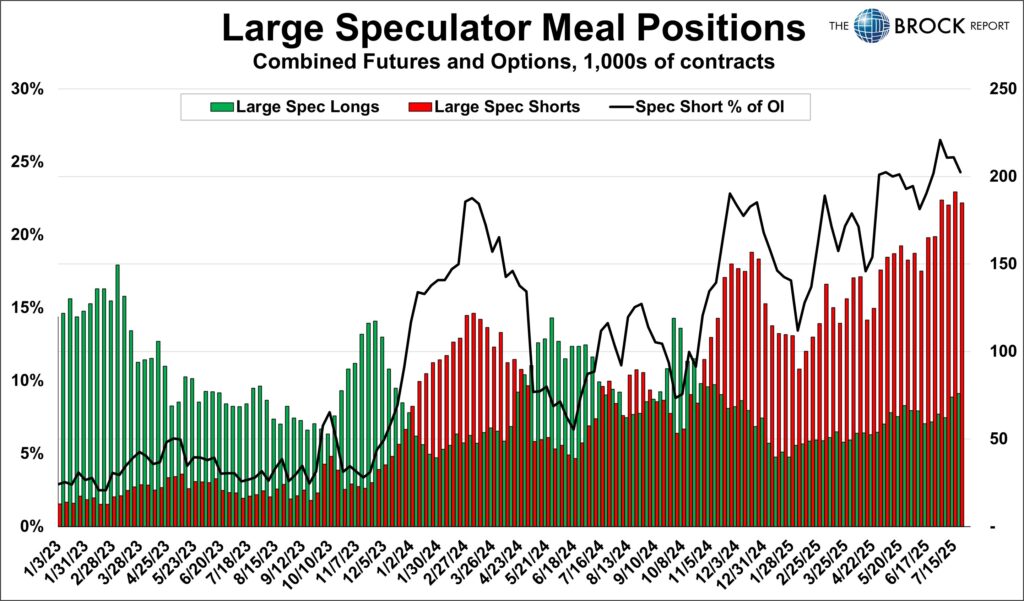

Soybean Meal

Large specs were net buyers of 8,300 contracts this week, now their third consecutive week of buying since setting a new record net short. Futures rallies this last week, peaking Wednesday and trailing off into the weekend. Prices are still very cheap if you zoom out and look at a price chart going back to 2010, and the COT setup remains very supportive. This is certainly a buyers market.

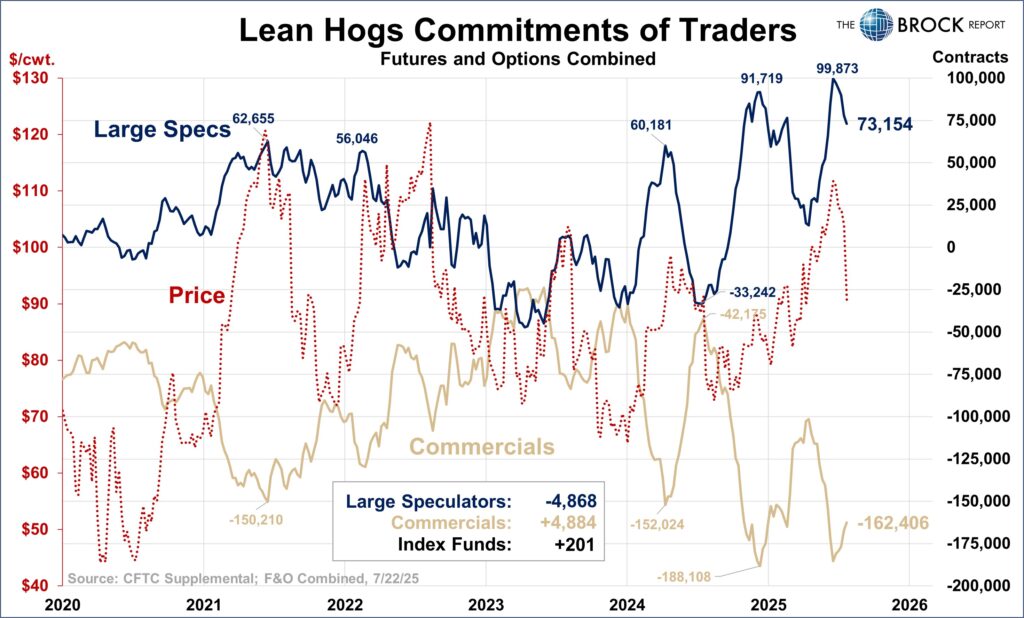

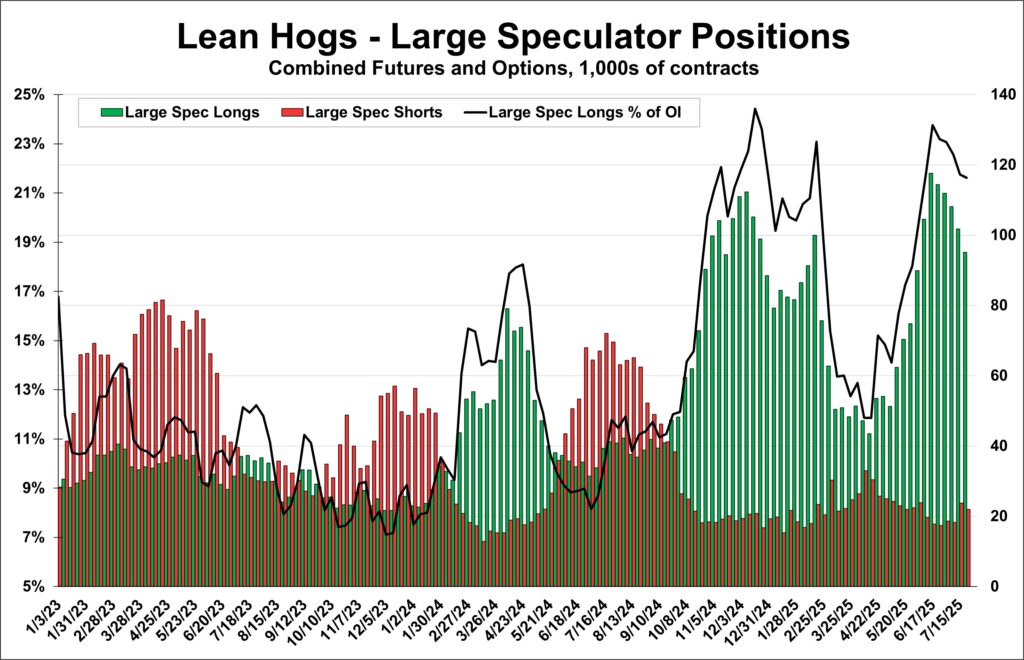

Lean Hogs

We’re a big believer that the lean hog COT is one of the best indicators of future price movement. At the start of our weekly COT coverage, the lean hog COT was a major focus as it helped pick the top and bottom of the market in 2024. As noted in the last two months, we believed it would pick the top in this market again, and after 5 consecutive weeks of selling, and futures drifting lower, our confidence has grown that a top is in this market.

That said, the dramatic drop in the price below is largely due to October becoming the most active contract over the August. We should note that all of our price lines are pulled from weekly most active price data, not the nearby contract.

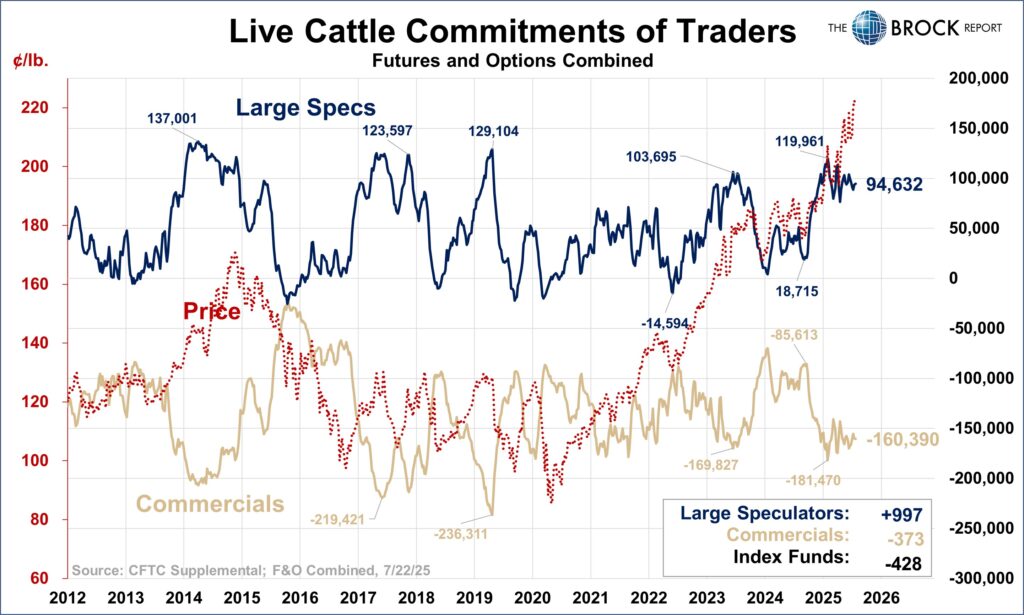

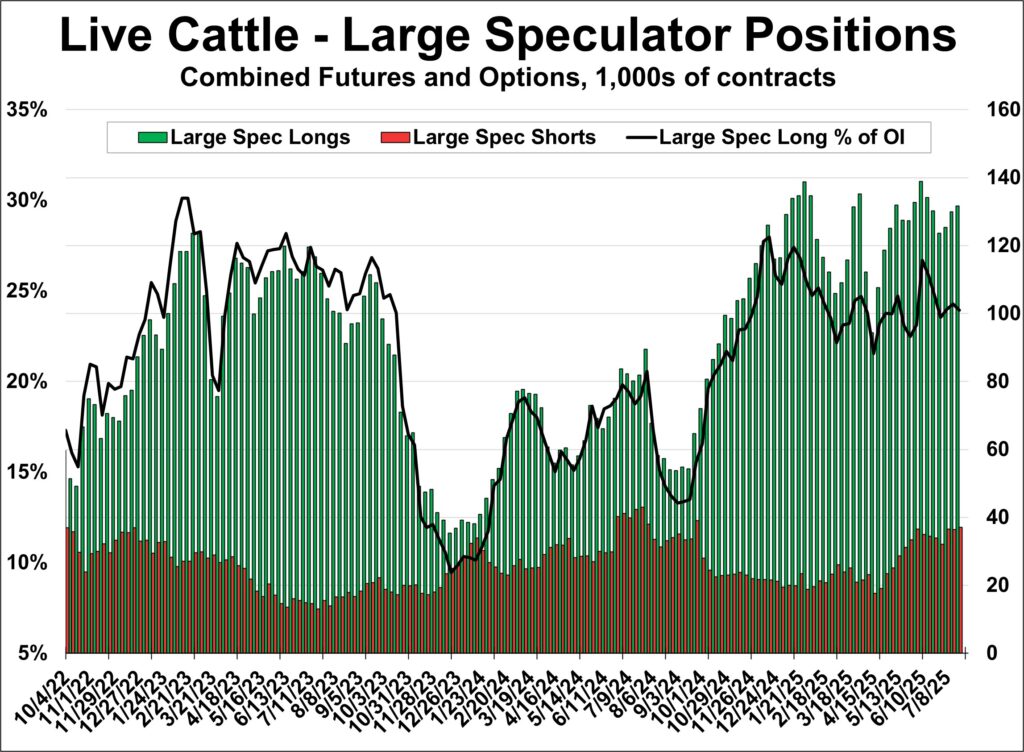

Cattle Complex

New record high futures prices forced us to change the y-axis scale again. In the case of feeders, we had to change the y-axis scale for large speculator net long position, because they AGAIN have set a new record this week. The higher they rise the farther they fall. When that will happen, nobody knows. What else can be said about this market!?