Grain and soybean futures are mostly lower at the end of a cautious early trading session with corn and soybean futures remaining under pressure from favorable growing weather and high yield expectations. Positive U.S. economic data has failed to provide price support amid nervousness over new tariff threats from President Trump. Wheat are under further pressure from rising export market competition amid ample U.S. and world supplies. Cotton futures are under pressure from trade concerns and a strong dollar.

Corn futures were mostly steady to 1/4 cent lower at the end of early trading, with soybean futures 3 1/4 to 4 1/4 cents lower, while wheat futures mostly ranged from 4 1/2 cents lower to 1 cent higher. Cotton futures mostly range from 29 to 32 points lower.

President Trump announced this morning on social media that he will levy a 25% tariff on all U.S. imports from India on Friday, Aug. 1, noting the U.S. has a “MASSIVE” trade deficit with India. In addition, India faces a penalty for continuing to buy military equipment and energy from Russia, he said.

There is positive economic news as the initial estimate shows the U.S. economy grew at a rate of 3.0% in Q2, beating the consensus of trade expectations at 2.3% despite Trump administration tariffs. The news has been supportive for crude oil futures and the dollar.

U.S. crude oil futures range from 25 to 38 cents higher in the wake of the GDP data after shaking off pressure from speculative profit taking in the wake of recent gains. American Petroleum Institute data showing a rise of 1.539 mil. barrels in U.S. crude oil stocks was a negative market factor overnight. President Trump’s threat to impose further sanctions on Russi in 10 days if Moscow does not reach a truce with Ukraine remains supportive for prices.

The dollar index has pushed out to a 2-month high on support from the GDP data as market participants await this afternoon’s Fed interest rate decision. The FOMC is overwhelmingly expected to leave the Fed funds rate target unchanged at 4.25-4.50%, so the focus will be on Fed Chairman Jerome Powell’s post-meeting press conference. Aug. gold futures are $16.50 lower on the dollar’s strength.

The GDP data has done little to move the needle for stock index futures prices, which point to a slightly higher opening for U.S. stock indexes as investors await the Fed interest rate decision and President Trump’s decision on extending the trade truce with China. The deadline for U.S. reciprocal tariffs on a number of countries also looms on Friday along with the monthly U.S. employment report. President Trump said on social media this morning that tariff deadline “STANDS STRONG AND WILL NOT BE EXTENDED”, calling Aug. 1 “A BIG DAY FOR AMERICA”.

Asian stock indexes finished Wednesday trade mixed, while major European indexes are mostly higher in afternoon trade.

The monthly employment survey from private payroll firm ADP showed that the U.S. economy added 104,000 jobs in July compared with trade expectations that averaged 64,000. The data for June was revised to indicate a loss of 23,000 jobs, vs. the 33,000 initially reported.

The Energy Information Administration’s weekly Petroleum Status report due out this morning is expected on avg. to show a further drawdown of 1.6 mil. barrels in U.S. crude oil stocks. The index of pending home sales for June is expected on avg. to come in up 0.2% from May.

Corn and soybean futures price action was very cautious overnight, with prices showing limited movement. Corn futures traded minimal ranges of 2 cents or less and soybean futures held in ranges of 5 3/4 cents or less for most of the early session and as traders awaited this morning’s slew of economic data, the Fed interest rate decision and word on an extension of the U.S.-China trade truce.

Most-active Dec. corn futures held inside of their Tuesday range overnight and have nearby chart support at $4.09 1/4-$4.10, with key support remaining at $4.07 1/2. Most-active Nov. soybean futures also traded inside of their Tuesday range, finishing near their session low after establishing nearby resistance at $10.12 1/4. Nearby chart support for Nov. beans remains at $10.04 1/2 and $9.98 1/4-$10.00.

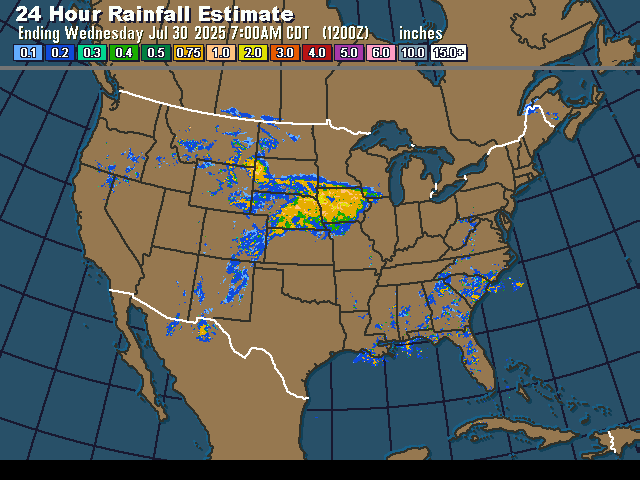

Further significant rains swept through the western Corn Belt overnight from eastern Nebraska through much of Iowa and into southwestern Wisconsin and northwestern Illinois, which will help keep corn and soybean traders anticipating big U.S. corn and soybean yields and crop totals.

Near-term weather forecasts remain mostly favorable for corn and soybean production prospects. The NWS week 3-4 outlook for Aug. 9-22 does favor below-normal rainfall across Iowa and Illinois along with normal/above-normal temperatures, but crops will likely have sufficient soil moisture to draw on during that period, limiting any problems.

Worries about Chinese demand remain high in the soybean market. No significant trade breakthroughs with China are likely ahead of the start of the 2025-26 marketing year on Sept. 1. Chinese demand for U.S. soybeans is expected to remain slow to start the year. President Trump has stated his intention to meet with China’s President Xi Jinping later this year, but a summit meeting between the two leaders has yet to be confirmed.

Bunge Global stock is up slightly in premarket trading after the company reported a smaller-than-expected drop in its Q2 profit. The core agribusiness segment saw an adjusted profit fall of 22% while net sales dropped 5.1% to $9.17 billion in Q2 from a year earlier.

In an earnings conference call, Bunge CFO John Neppl said he expects the expansion of Bunge’s Morristown, Indiana soybean processing plant to come on line in October and be fully running by “early to mid next year”.

Wheat futures traded narrow ranges of 5 1/2 cents or less overnight but ended early trade near their session lows. Sep. SRW wheat futures ended early trade against Tuesday’s 2-1/2 month low of $5.26, with contract low support not far off at $5.21 1/4. HRW wheat futures held inside their Tuesday range overnight, but finished just 2 1/4 cents above their contract low at $5.15.

Wheat futures continue to struggle mightily with large U.S. supplies and prospects for rising export competition from Black Sea and European Union supplies, although U.S. wheat has recently been priced lower. The dollar’s surge against the euro in the wake of the U.S.-EU trade deal has added to concerns about the competitiveness of U.S. wheat.

Moscow-based analyst SovEcon says it has raised its forecast for Russia’s 2025-26 wheat exports to 43.3 MMT from 38.3 MMT. Russian agriculture minister Oksana Lut said on Wednesday that Russian producers have so far harvested about 50 MMT of grain, but there is some slippage in the pace of harvest due to a late start, Russian state news agency RIA Novosti reported.

In positive news, Bangladesh’s government has approved the purchase of 220,000 MT of U.S. wheat as part of efforts to ease trade tensions and reduce steep import tariffs imposed by the Trump Administration. The purchase will be made in a government-to-government deal at $302.75 per MT, a food ministry official told Reuters News Service. Earlier this month, Bangladesh signed a memorandum of understanding to import 700,000 MT of wheat annually from the U.S. over the next five years.

Torrential rains across western, northern and central Ukrainian regions have significantly slowed the wheat, barley and rapeseed harvests, causing a drop in export rates and a potential slide in rapeseed output this year, producers’ union UAC said on Wednesday. More rain is expected this week, resulting in further harvest delays.

Livestock futures may start out mixed this morning, with lean hog futures likely to come under pressure from Tuesday’s weak price action and $2.44 drop in the composite pork cutout value. Live cattle and feeder cattle futures may start out stronger on technical follow-through to Tuesday’s further gains and positive economic data, but both markets may be vulnerable to pressure from speculative profit taking. Feeder cattle futures should also find support from a further $2.27 rise in the CME cash feeder cattle index to $332.20.