Corn and soybean futures came under further pressure overnight from favorable U.S. weather and high crop expectations, with crude oil market weakness also a negative factor. Losses have been limited, though, by a weaker dollar. Wheat futures were narrowly mixed at the end of early trade with spring wheat contracts weaker under harvest pressure. Cotton futures have rebounded so far on apparent hopes for a U.S. interest rate cut and the weaker dollar.

Corn futures were mostly 1 3/4 to 1 1/2 cents lower at the end of early trading, with soybean futures 1/4 to 1 cent lower, while wheat futures mostly ranged from 1 1/2 cents lower to 2 1/4 cents higher. Cotton futures mostly range from 67 to 75 points higher.

Looking at other markets, U.S. crude oil futures range from $1.29 to $1.58 lower under pressure from an OPEC-plus decision to hike production further in September and concerns about the strength of the U.S. economy. However, the OPEC production increase of 547,000 barrels per day was in line with expectations and losses have been limited by U.S. threats to impose secondary tariffs on countries buying Russian crude oil.

The dollar index moderately weaker after charting a huge bearish reversal on Friday in response to the U.S. monthly employment report and a subsequent plunge in Treasury yields that took the yield on the 10-year T-note to a 3-month-plus low. Most-active Dec. gold futures are $28.00 higher at a 6-session high.

U.S. stock indexes are set to open moderately higher on based on index futures trade on apparent support from ideas Friday’s weakness was overdone in light of mostly positive corporate earnings reports. Asian stock indexes were mostly higher in Monday trade, while major European indexes are higher in afternoon trade.

Investors this morning will be watching data on U.S. manufacturing orders for June, with orders on avg. expected to be down 4.9% from May.

Corn futures traded ranges of 4 1/4 cents or less overnight and ended early trade near their session lows. Most-active Dec. futures charted a new low for the current down move at $4.08 1/2, 1 cent above their July 14 reversal low. Technically, a Dec. close below $4.07 1/2 should set up a further drop to at least $3.85-$4.00.

Soybean futures mostly held inside of their Friday trading ranges overnight, trading narrow ranges of 7 1/2 cents or less, and finished near midrange for the session. Most-active Nov. soybeans have nearby chart support at $9.86, with nearby resistance at $9.93 1/2-$9.94 1/2.

Both corn and soybean futures will likely remain under pressure this morning from high crop expectations. This afternoon’s weekly U.S. Crop Progress report may peg U.S. corn crop conditions steady to slightly lower vs. last week’s reading of 73% good/excellent, while pegging soybean conditions steady to slightly stronger than last week’s 70% good/excellent.

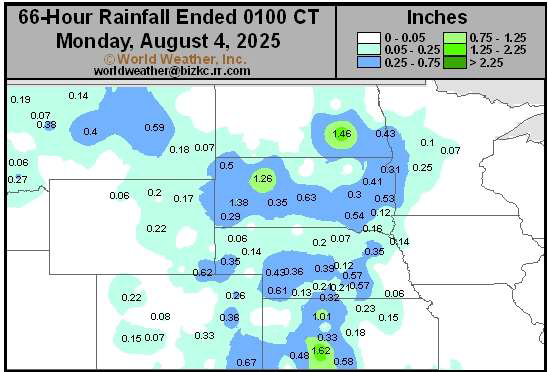

The U.S. Midwest was dry over the weekend, with mild temperatures, while parts of the central and southern Plains saw moderate rainfall.

The central Midwest from eastern Kansas through Missouri and Illinois to Michigan and parts of Ohio will experience net drying during the coming week, World Weather Inc. says. U.S. rainfall in the coming week will be greatest in the Dakotas, Minnesota, western Wisconsin, northwestern Iowa and Nebraska as well as in portions of southern Indiana and Kentucky. Amounts will range from 0.75 to more than 2 inches, with some areas in the Dakotas and western Minnesota getting more than 3 inches.

Temperatures will remain mild across most of the U.S. Corn Belt today and tomorrow, with highs in the 70s and low 80s F., before starting to warm up. By Friday, highs should range from the mid-80s to low 90s across most of the Belt, with lower temps continuing in the northern Plains.

President Trump pushed back the imposition of U.S. reciprocal tariffs to Thursday, Aug. 7 to give other nations a few extra days to work out trade deals. But U.S. Trade Representative Jamieson Greer told CBS over the weekend that the latest round of tariffs “are pretty much set” and unlikely to change.

Greer said that rare earth metals were a key focus of the recent U.S.-China trade talks in Stockholm. He said the U.S. had received supply commitments from China, but indicated the two sides were “about halfway there” in discussions on rare earths.

A bumper second corn crop in Brazil remains a negative factor for corn prices. Brokerage house StoneX this morning raised its forecast for Brazil’s 2024-25 second-crop corn production to 111.7 MMT from a previous estimate of 108.2 MMT. The StoneX estimate is 7.2 MMT above the most recent second-crop estimate from CONAB, the supply dept. of Brazil’s agriculture ministry.

SRW wheat and HRW wheat futures fell to new lows overnight, but then rebounded and wound up posting small gains overnight and finished early trade near their session highs on support from speculative short covering with the U.S. winter wheat harvest now winding down. The firm finish to early trade may spur further speculative short covering this morning.

Sep. SRW wheat futures charted a new contract low of $5.13 before ending early trade at $5.18 3/4. Sep. HRW wheat traded to a new low of $5.12 1/2 before also ending early trade at $5.18 3/4. Sep. spring wheat futures charted a new contract low of $5.69 1/4 overnight.

Large speculators were net sellers of more than 15,000 contracts of SRW wheat futures/options during the week ended last Tuesday, pushing their net short position in the market to nearly 84,000 contracts, while commercial traders increased their net long position by about 10,000 contracts to nearly 24,000. This creates high potential for a significant short covering rally. Large speculators were also net short about 42,000 contracts of HRW wheat futures as of last Tuesday’s close.

Livestock futures may start out mostly higher this morning, with lean hog futures likely to find further support from strong wholesale pork prices after the composite pork cutout value rose $2.94 to $116.94 on Friday. Live cattle futures may find renewed support from their discounts to Plains cash markets after Friday cash trade occurred at mostly $236 in southern Plains markets. Feeder cattle futures should find support from firm cash markets and weak corn prices. The CME cash feeder cattle index rose another 88 cents on Friday to $335.89.

Tyson foods stock is higher in premarket trade after the company reported better-than-expected Q3 earnings and raised its revenue forecast for fiscal 2025 on support from strong profit margins in its chicken and prepared foods segments. The strong profits there offset rising losses in Tyson’s beef business, which is now expected to lose $375 million to $475 million in fiscal 2025, compared with the previous loss estimate of $200 million to $400 million.