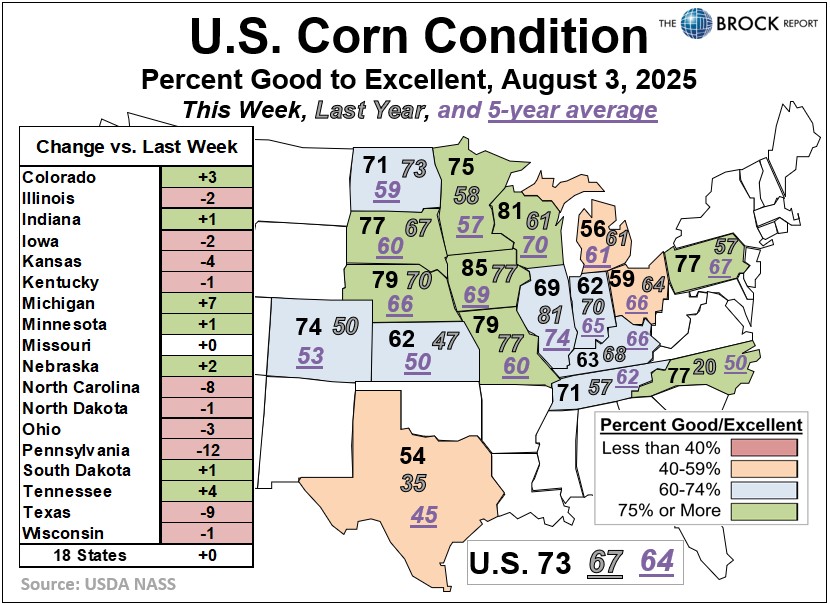

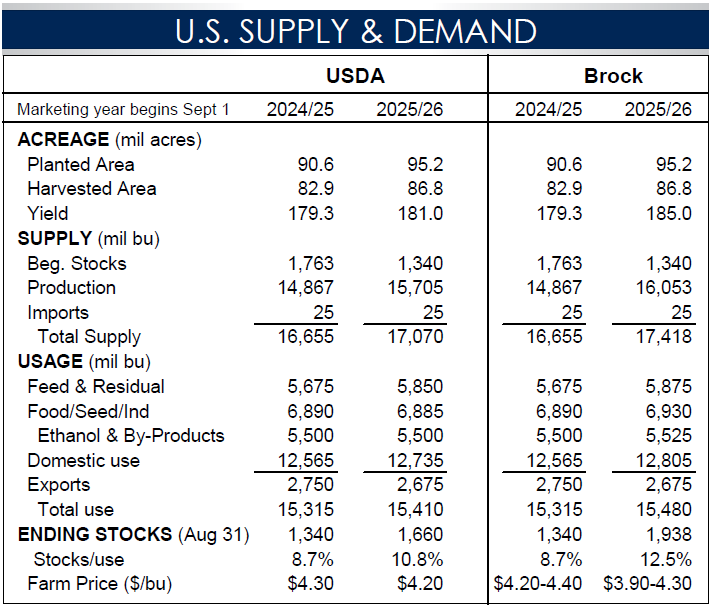

Yield estimates keep ramping up, many believable forecasts as high as 189 bushels per acre. At this stage our assumption is the market is trading on a 185-bushel yield. In either case, this is going to be a big crop. USDA will have its say on the matter on Tuesday, although it will be far from the final word. While the crop is going to be big regardless, reaching the higher end of yield expectations will require favorable conditions straight up to the finish line. Reports of issues, including tassel wrap and tip back, will be monitored, but they are unlikely to cause the sort of widespread problem that would be a drag on the national yield.

Storage space is going to be an issue at harvest time. Large quantities of old-crop are still moving to terminals. Not only will space be tight but so will unit trains to get the corn out. Basis levels will likely drop significantly starting in about another three or four weeks, maybe sooner.

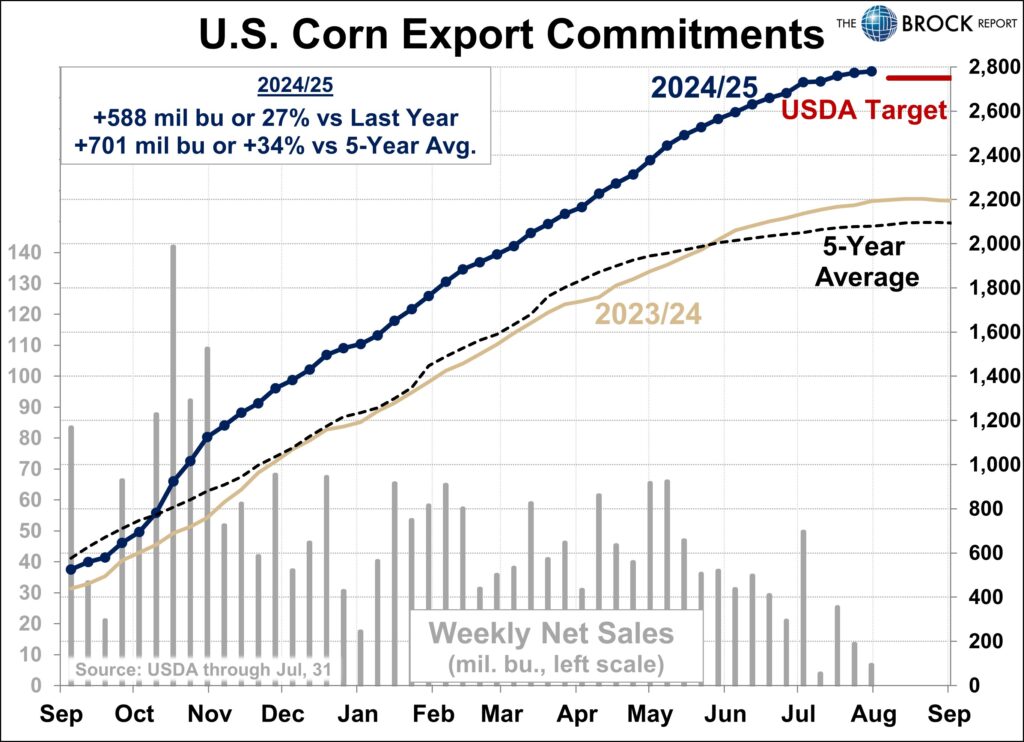

On the positive side, lower prices are stimulating more export demand. Weekly sales reported Thursday were robust, and USDA also announced four “flash” export sales over three days this week.

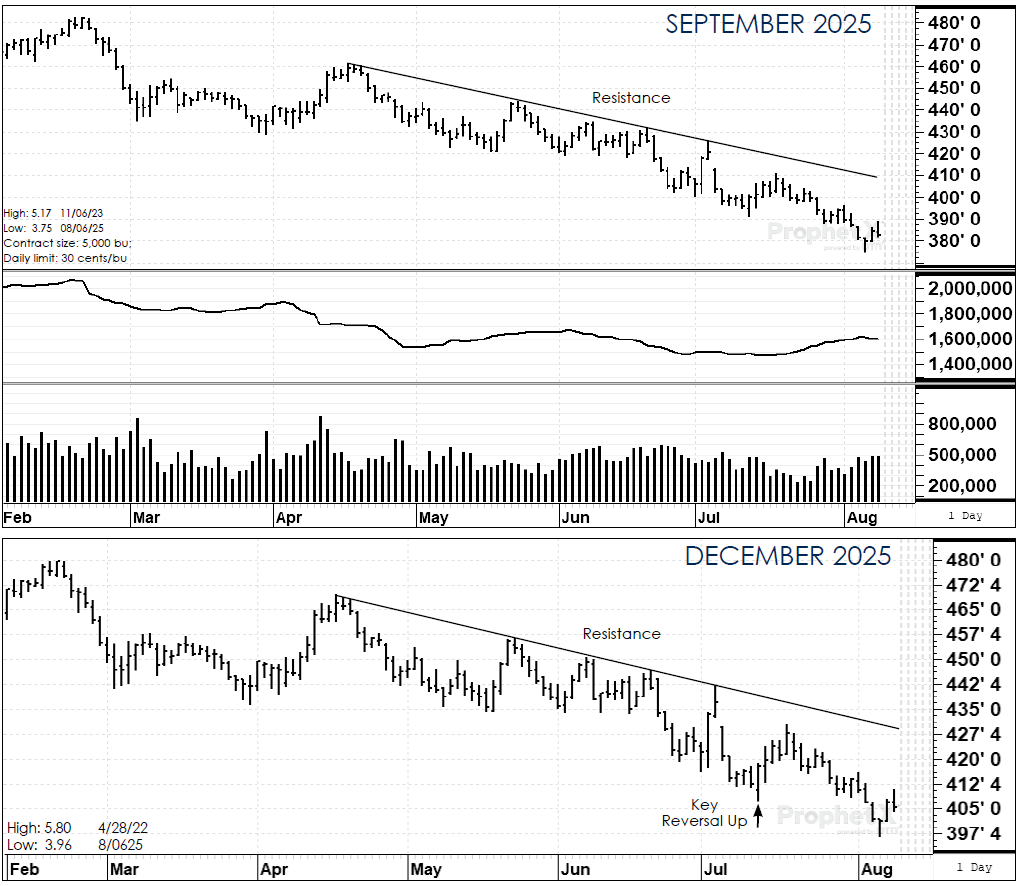

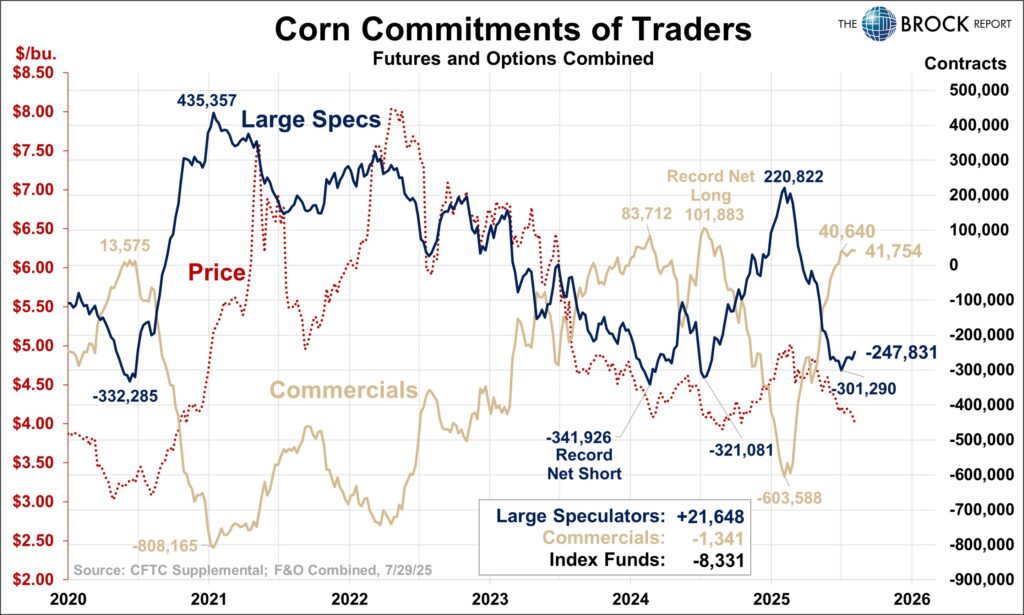

Technically, prices plunged into new lows this week, but March futures were able to find support at approximately $4.15. Resistance is at $4.30. On a weekly continuation chart, support is at $3.60, the low established in July of last year.

Cash-only marketers’ strategy: Fortunately, old-crop was gone long ago. In the new-crop, 35% of the crop has been forward cash contracted. Be patient.

Hedgers’ strategy: Old-crop is long gone. In the new-crop, 30% is covered with cash contracts. An additional 20% is covered with options positions. 10% is covered with long December $4.70 puts/short (2) December $5.40 calls that established a floor of approximately $4.70. The other position is long July 2026 $4.70 puts/short (2) July 2026 $5.40 calls. Also putting in a floor of about $4.70. Another 10% is covered by a Mar. Futures hedge.