For the last few months, soybean oil has been the bull carrying prices higher, but now the spread between oil and meal has done a flip, and oil is now leading the march down.

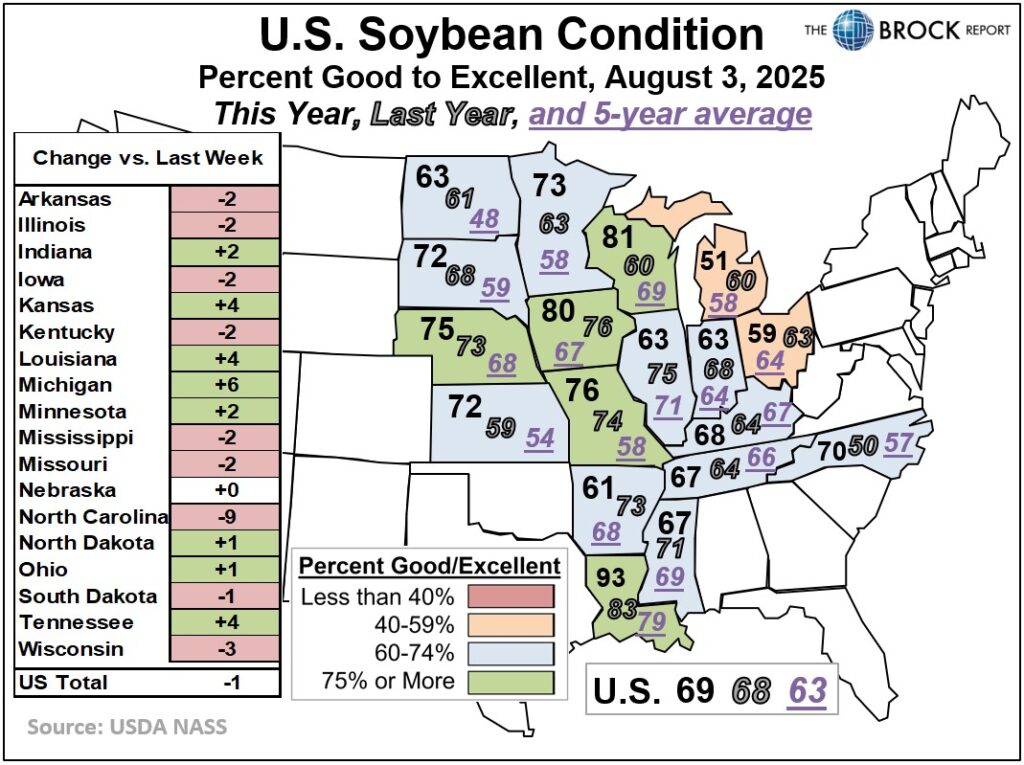

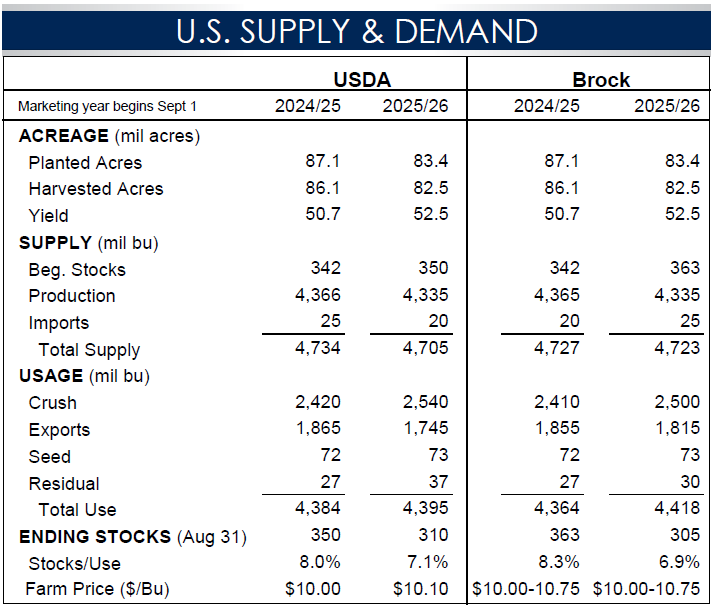

August is the critical growing month for soybeans. Rain and heat will contribute to bolstering yields. Since we’re not even halfway through August, the final outcome is yet to be known but, with the current weather forecast, it would appear as though the soybean crop is going to be large. The good news is that acreage is way down. Harvested acreage this year is expected to be 82.5 million acres versus last year’s 86.1. Nevertheless, with a yield of 52.5 to 53 bushels per acre, the carryover will still exceed 300 million bushels. Last year’s was 363.

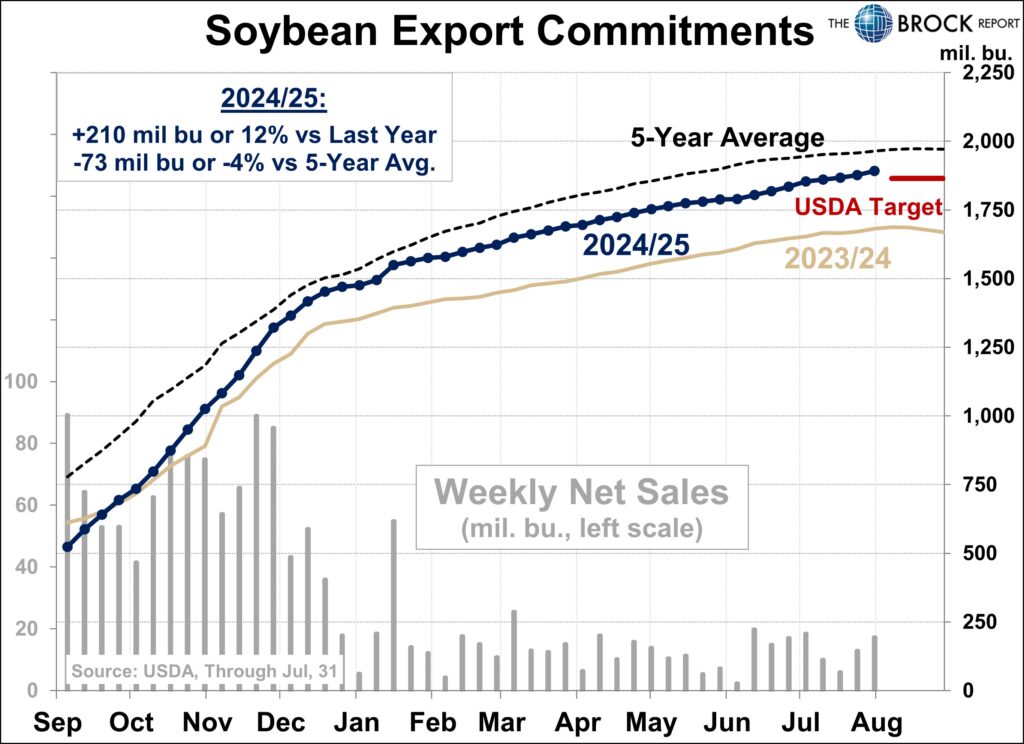

Still no sign of a trade deal with China, which continues to not buy new-crop soybeans.

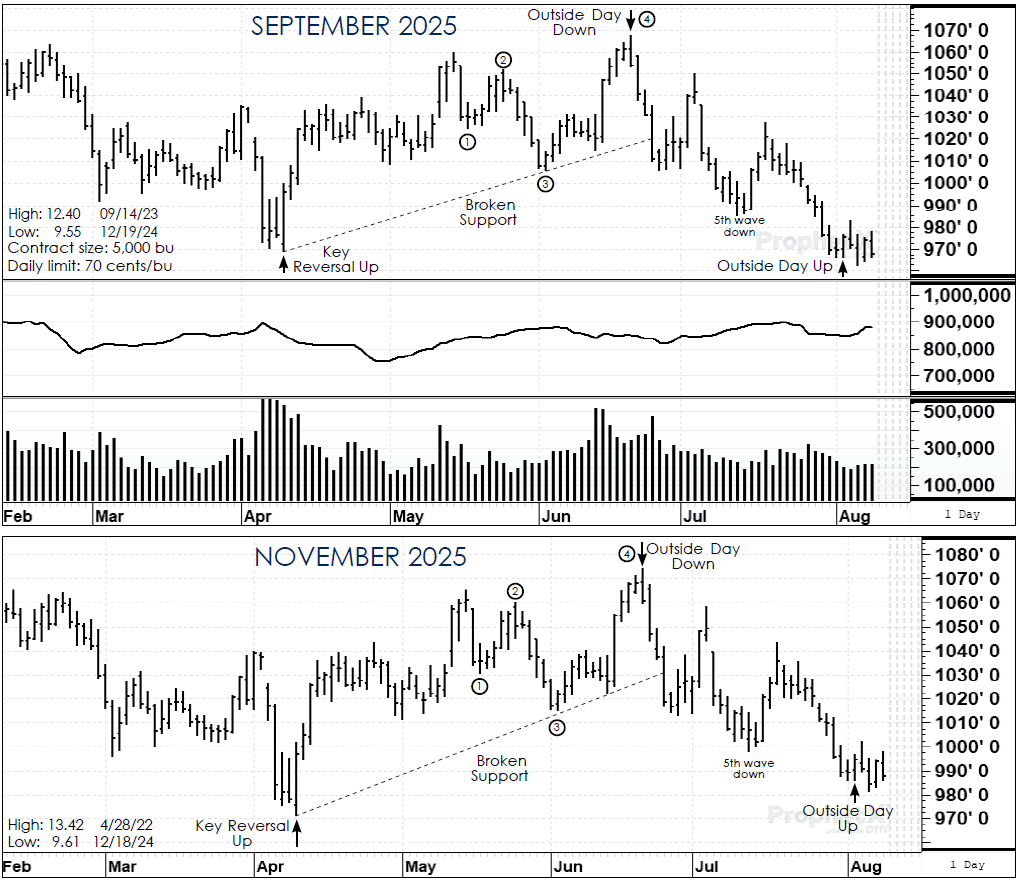

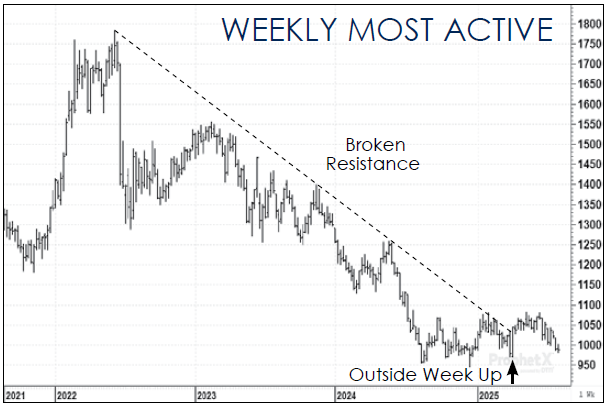

Technically, on weekly continuation charts, the major support is at $9.50. With November futures currently trading above $9.90, there is some significant risk but, at the same time, our estimate is the market is trading in the bottom 30% of this year’s expected price range.

The USDA’s forecasted average price is $10.10. The market is currently well below that. So if one were to believe the USDA estimate, the market is considerably underpriced. That doesn’t mean that it can’t get even more underpriced.

The futures spreads continue to paint a negative price picture. Trading at over 80% of carry is a good indication that commercial buyers are expecting a large crop. This is definitely a year where storage is going to pay big as the deferred futures come down to meet the cash. With the July futures trading at over $10.50 and the nearby November at $9.72, that creates a huge carrying spread to make profits for storage returns.

Cash only marketers’ strategy: Old-crop is long gone and 30% of the new-crop was contracted long ago.

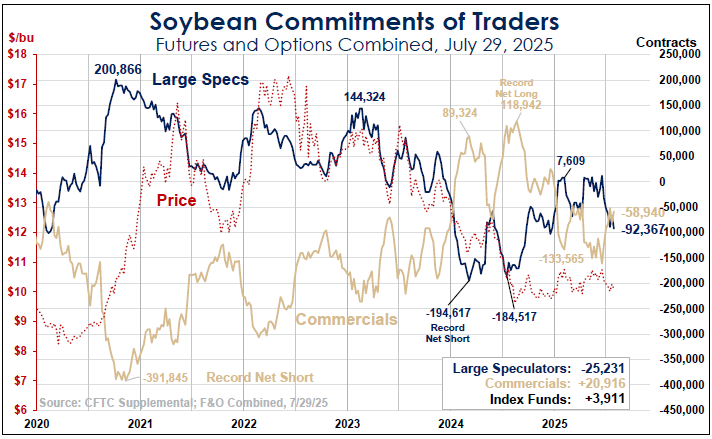

Hedgers’ strategy: One hundred percent of old-crop sold months ago as well as 30% of the new. We also continue to maintain short futures hedges in the July futures at an average of $10.60 on an additional 30%.