Soybean futures fell back in early trading as traders took profits on long positions following 3 days of strong gains amid renewed demand worries and favorable U.S. crop weather. Corn futures also came under renewed pressure from prospects for a record large U.S. crop, with a record high forecast for Brazilian production adding to pressure on prices. Wheat futures also retreated under pressure from the corn market weakness and large U.S. supplies. Cotton futures have turned slightly higher on support from good weekly export sales.

Corn futures were mostly 3 3/4 to 4 3/4 cents lower at the end of early trading, with soybean futures mostly 4 to 7 1/2 cents lower, while wheat futures mostly ranged from 1 to 5 3/4 cents lower. Cotton futures mostly range from 14 to 18 points higher.

This morning’s U.S. Producer Price Index (PPI) report has put a damper on hopes for the Fed to lower interest rates. The PPI for July came in up 0.9% from June, far above the avg. of expectations at 0.2%, while the core PPI (minus food, energy and trade services) rose 0.6% vs. the an avg. trade estimate of 0.3%. For the 12 months ended with July, the PPI was up 3.3%, while the core CPI was up 2.8%.

Despite the PPI data, U.S. crude oil futures are 60 to 72 cents higher on apparent support from speculative position evening ahead of tomorrow’s Trump-Putin summit meeting in Alaska. The dollar index has turned moderately higher in the wake of the PPI report. Most-active Dec. gold futures are $5.90 lower on the dollar’s strength.

Based on index futures trade, U.S. stock indexes are set to open moderately lower amid decreased expectations for Fed rate cuts. Asian stock indexes mostly fell in Thursday trade. Major European stock indexes are mostly higher in afternoon trade.

Weekly U.S. unemployment claims came in at 224,000, compared with trade estimates that averaged 229,000 and the previous week’s revised 227,000.

Soybean futures pushed to 6-week highs overnight, but failed there and ended early trade near their session lows. Most-active Nov. soybeans traded as high as $10.49 1/4 overnight, but ended early trade 12 cents off that high, which may set the stage for further long liquidation/selling this morning.

Corn futures also ended early trading near their session lows after failing to push through nearby chart resistance at their Wednesday highs overnight. Dec. corn futures have traded within a half cent of the contract low at $3.92 they set on Tuesday after establishing nearby resistance at $3.98 1/2.

Soybean futures trading volume remained elevated on Wednesday’s further rally, but futures open interest fell slightly for the third day in a row, indicating that short covering remained the primary driver of the price strength, rather than new buying. Corn trading volume fell off substantially on Wednesday after spiking to 7-month high on Tuesday, while open interest rose slightly on the modest strength.

CONAB, the supply department of Brazil’s agriculture ministry this morning raised its estimate of Brazil’s 2024-25 corn production to 137.0 MMT from 131.97 MMT, raising its forecast for second-crop production by 5.0 MMT to 109.56 MMT. CONAB raised its forecast for Brazil’s 2024-25 corn exports by 4 MMT to 40 MMT. The new CONAB crop forecast is 5 MMT above USDA’s estimate, but USDA forecasts Brazilian exports at 43 MMT.

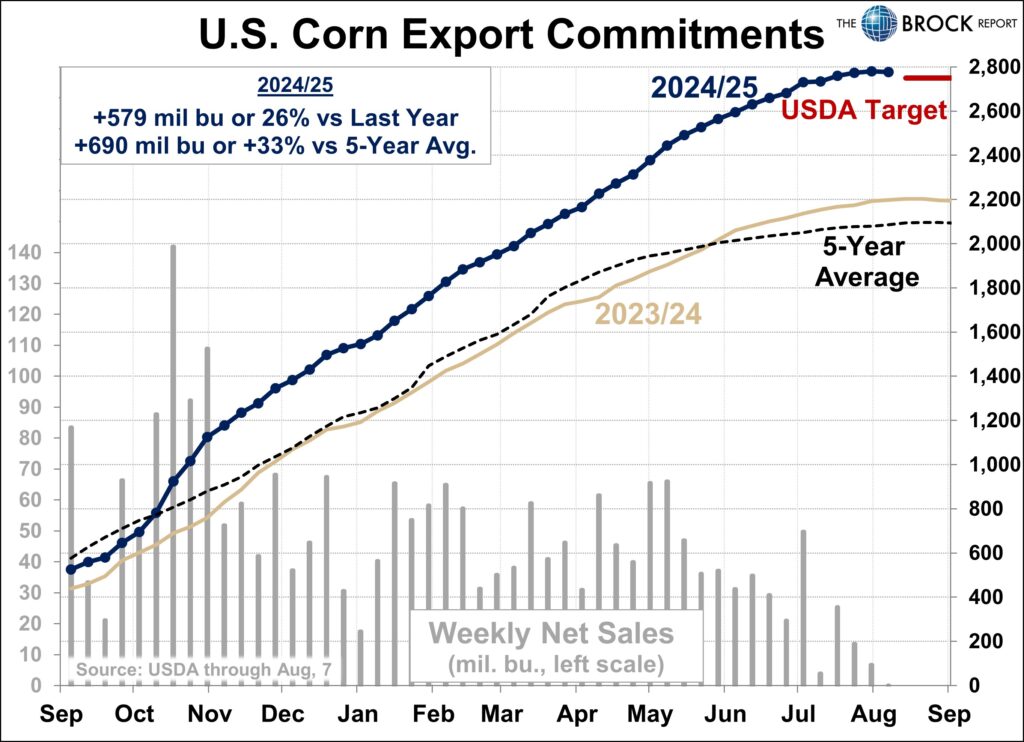

Net U.S. corn export sales for the week ended Aug. 7 came in at 77.1 mil. bu. compared with trade expectations that ran 45.5-110 mil. bu. and the previous week’s sales of 131.2 million. The sales total included net cancellations of 3.5 mil. bu. for 2024-25 delivery. The sales data looks neutral to negative for corn prices. Weekly corn export shipments came in at 59.9 mil. bu. vs. the previous week’s 48.4 million.

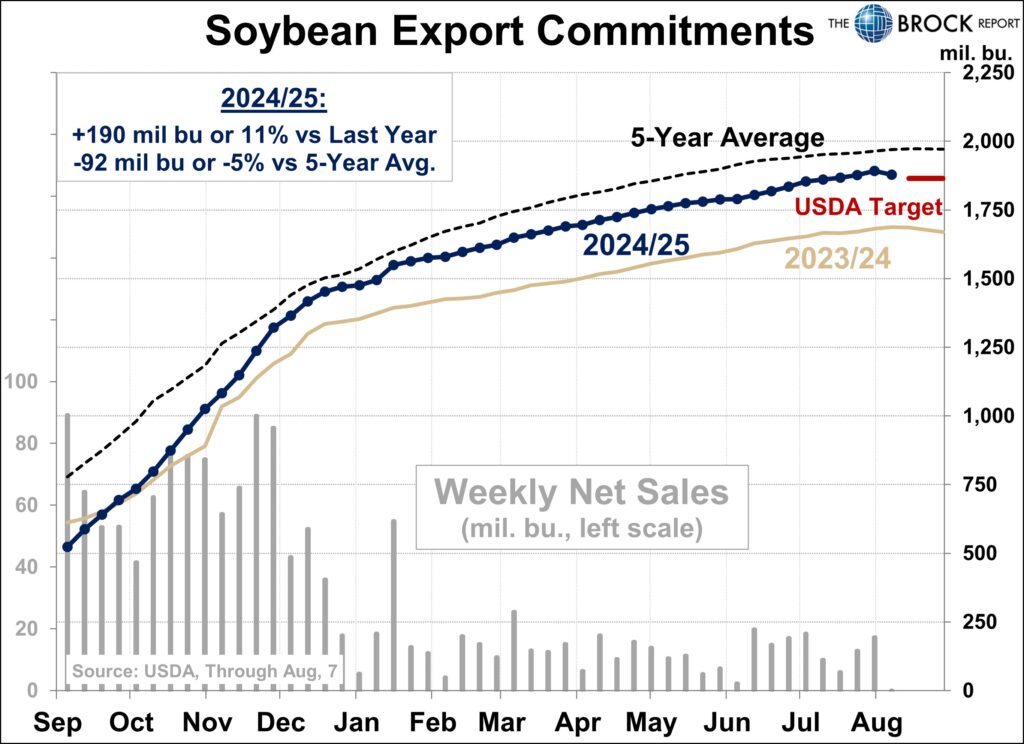

Net weekly soybean export sales came in at 27.7 mil. bu. compared with trade expectations that ran 16.5-59.0 mil. bu. and the previous week’s sales of 37.2 million. The sales total included net cancellations of 13.9 mil. bu. in previous sales for 2024-25 delivery. The sales data looks negative for soybean prices. Weekly soybean export shipments came in at 19.6 mil. bu. vs. the previous week’s 25.8 million.

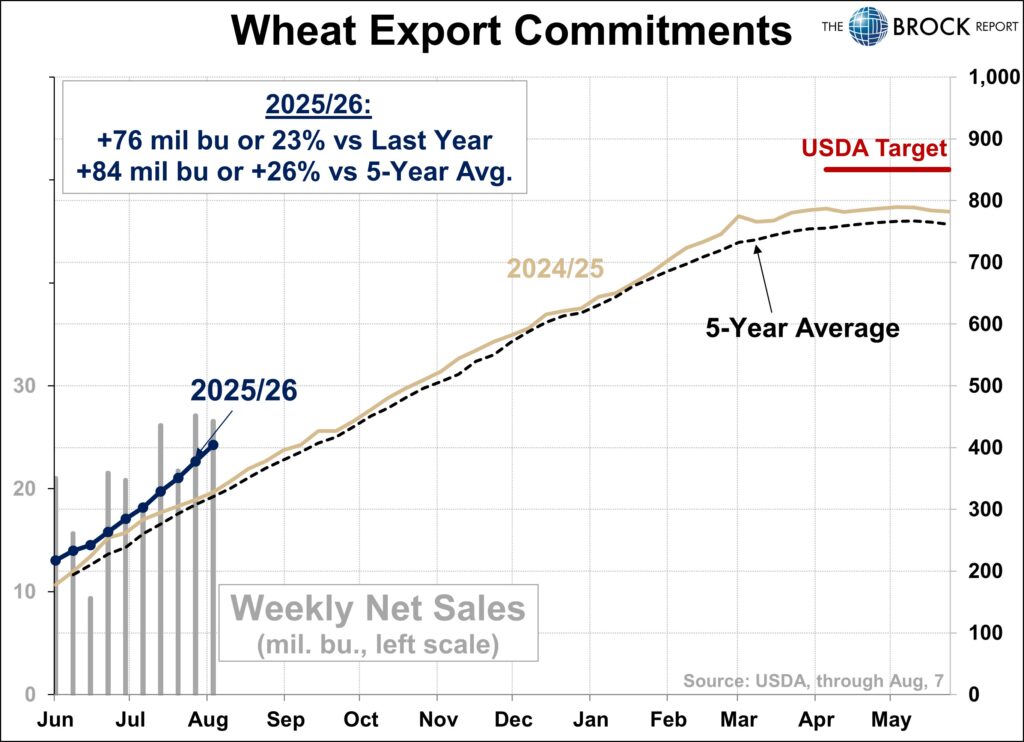

Net weekly U.S. wheat export sales came in at 26.6 mil. bu. compared with trade expectations that ran 14.5-31.0 mil. bu. and the previous week’s sales of 27.1 mil. bushels. The sales data looks supportive for wheat prices. Weekly wheat export shipments came in at 12.5 mil. bu. vs. the previous week’s 24.5 million.

The Midwest will see another two weeks of favorable conditions for crop development and very high production potentials with drier weather advertised for Aug. 21-28 beneficial for early maturing corn, World Weather Inc. says. Regular rounds of showers and thunderstorms will occur through next Wednesday and many areas that have recently dried down will see a bolstering of soil moisture with nearly all of the region left with enough subsoil moisture to support crop development through the end of the month.

SRW wheat futures fell back against their contract lows overnight, while HRW wheat futures broke out to new lows. Sep. SRW wheat matched the low of $5.02 1/4 it set on Tuesday, while Sep. HRW wheat traded as low as $5.01, within 3/4 of a cent of key support from the May low on the most-active HRW wheat continuation chart.

There is little fresh fundamental news to drive wheat price direction other than the weekly export sales. U.S. spring wheat harvest pressure will remain a negative market factor along with the absence of significant crop issues in key world growing areas and the massive U.S. corn crop.

Germany’s association of farm cooperatives has forecast the country’s 2025 wheat crop at 22.42 MMT, up from a July forecast of 21.56 MMT and up 21.1% from last year despite crop damaging rains late in the growing season. There are indications of crop quality damage due to the July and early August rains.

The wheat export market looks quiet this morning, with major buyers staying out for now.

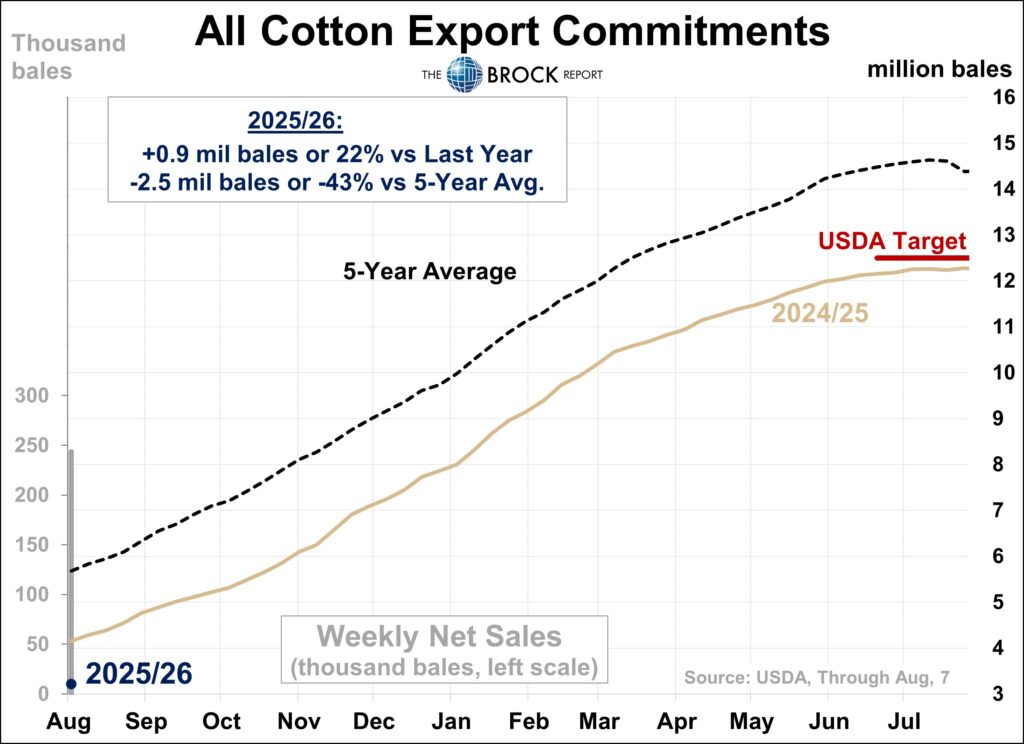

Net U.S cotton export sales for the week ended Aug. 7 were much improved, totaling 242,000 running bales for 2025-26 delivery and 1,000 bales for 2026-27 delivery. Sales rose despite China’s continued absence as a buyer. Vietnam was the leading buyer on the week, taking 119,200 running bales.

Livestock futures may start out mixed this morning following Wednesday’s choppy trading session. Lean hog futures may find support from Wednesday’s renewed strength in cash hog and wholesale pork prices and their discounts to cash, but lackluster weekly U.S. pork export sales of 21,200 MT will be a negative market factor. Live cattle and feeder cattle futures should continue to find support from firm cash markets, while renewed speculative profit taking on long positions could weigh on prices. The CME cash feeder cattle index rose another $1.40 on Wednesday to $344.09.