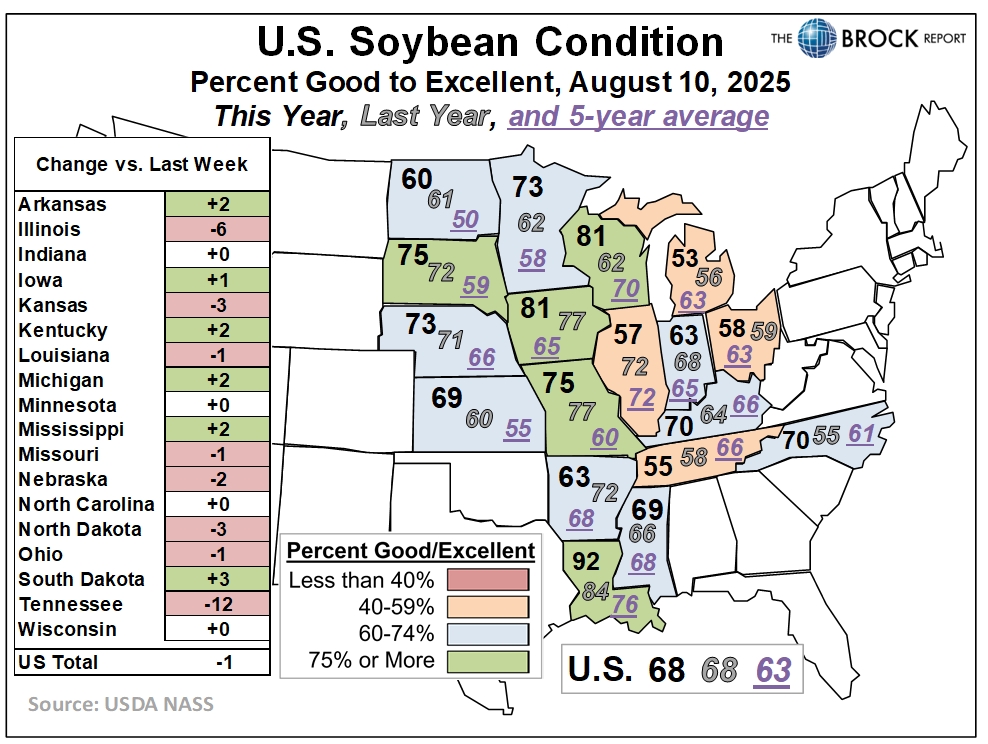

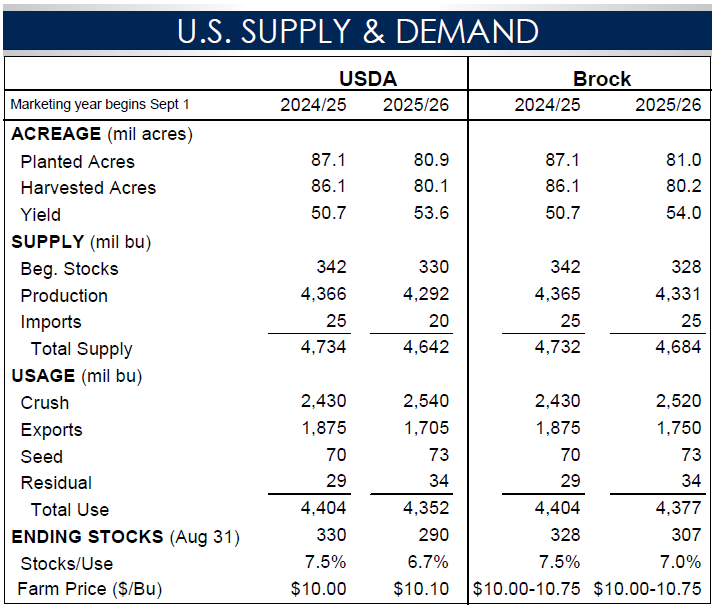

Tuesday’s report was quite bullish. Lowering expected planted acreage from 83.4 to 80.9 million acres was a big surprise. Increasing the yield estimate from 52.5 to 53.6 was also a surprise but was not negative enough to offset the sharp drop in planted acreage. The bottom line is carryover was reduced from 310 to 290 million bushels by the USDA. We see the carryout at 307 million, but that is just splitting hairs. USDA left the expected average price the same at $10.10 and we have left ours the same in a range of $10.00 to $10.75. With November futures currently trading at about $10.35 after deducting a basis of 30 to 50 cents, beans are still cheap based on these balance sheet changes.

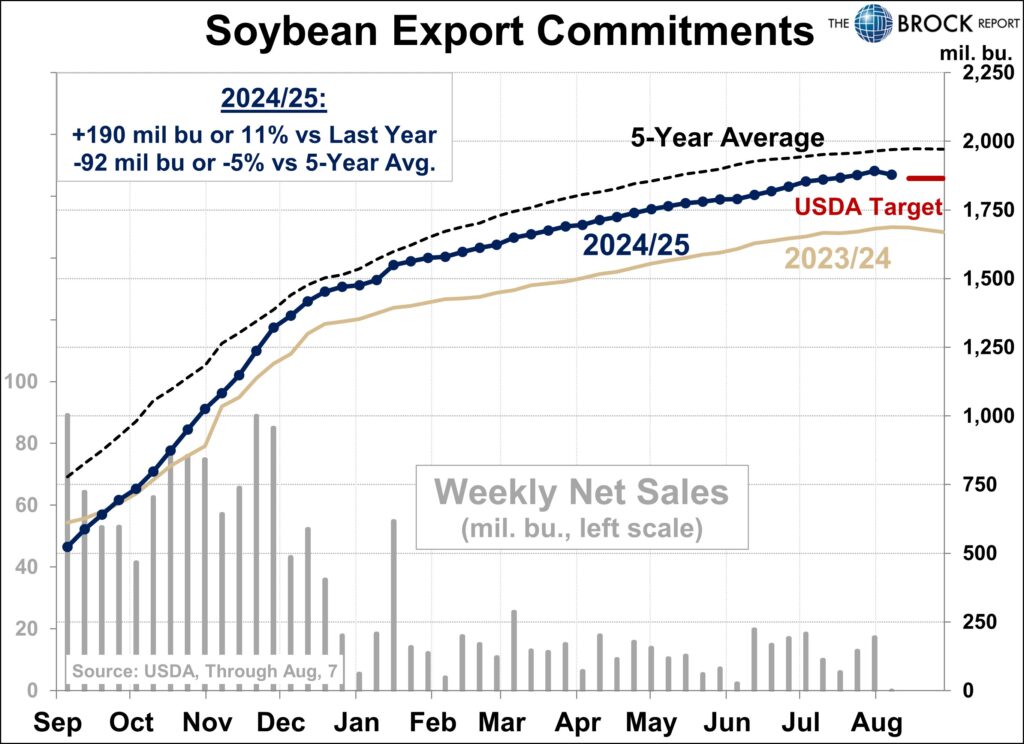

The main fundamental pressure on the market is export demand, which remains very weak for the next marketing year starting Sept. 1. China is not buying anything and there’s no sign they are about to in the near-term (see pages 4 and 5). If there’s no trade deal with China to revive purchases, the onus will largely be on renewable diesel to drive demand.

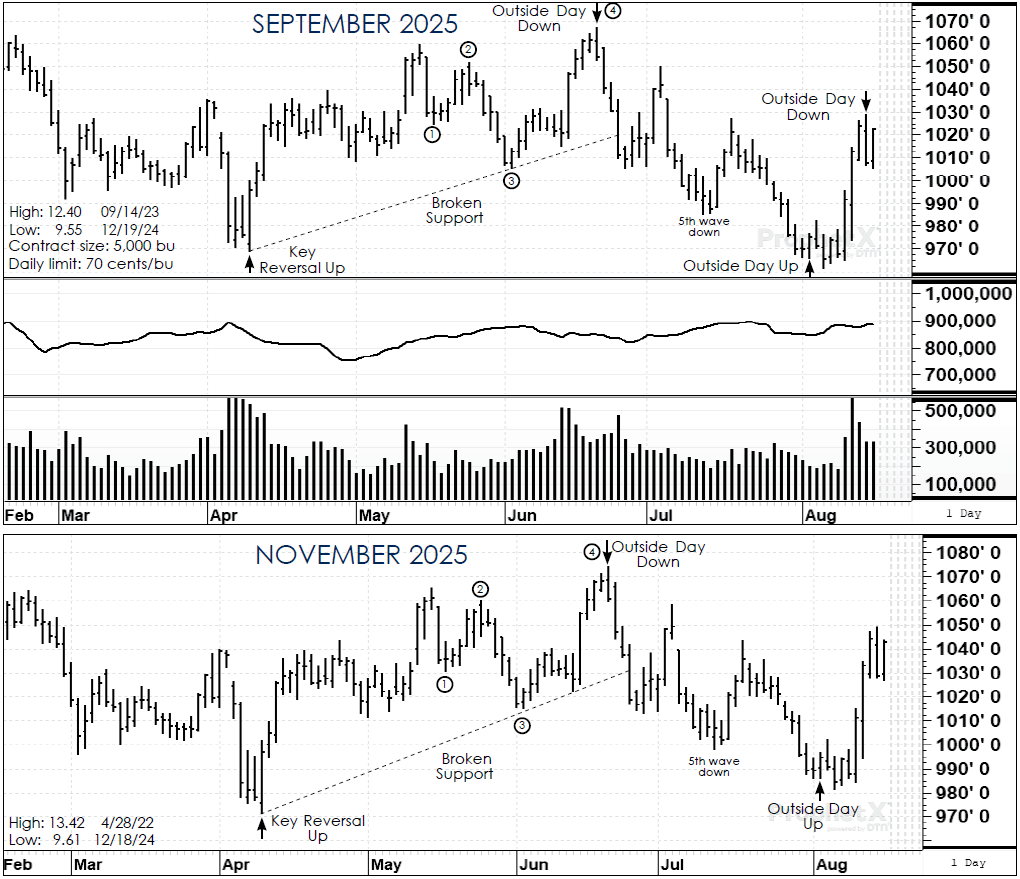

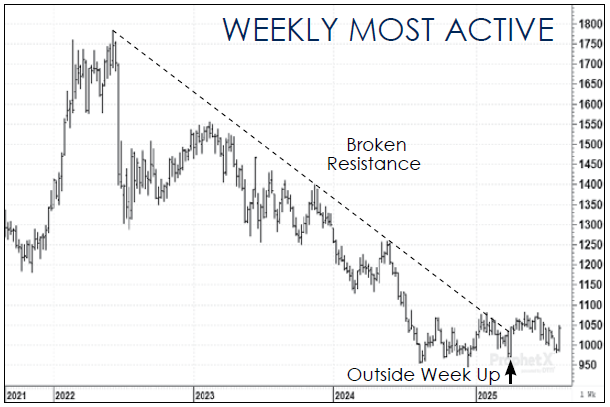

Technically, this market now has a confirmed bottom. On the long-term monthly continuation charts, the support level at $9.45 has held. It is unlikely that the market will now challenge the lows of last week. Difficult at this time to obtain any upside objective. The first resistance area is $10.80, which was the high in June on nearby futures. If the market can get through that level, which we think it will, then the objective is in the $11.00 to $12.00 range. Doesn’t sound likely right now but, with strength in soybean meal and soybean oil, anything is now possible.

Cash only marketers’ strategy: Old-crop was sold months ago as well as 30% of the new-crop contracted. Do not do anything else at this point.

Hedgers’ strategy: Old-crop has been gone for a long time as well as 30% of the new-crop contracted. We lifted all short hedges the day of the crop report. Stand on the sidelines.