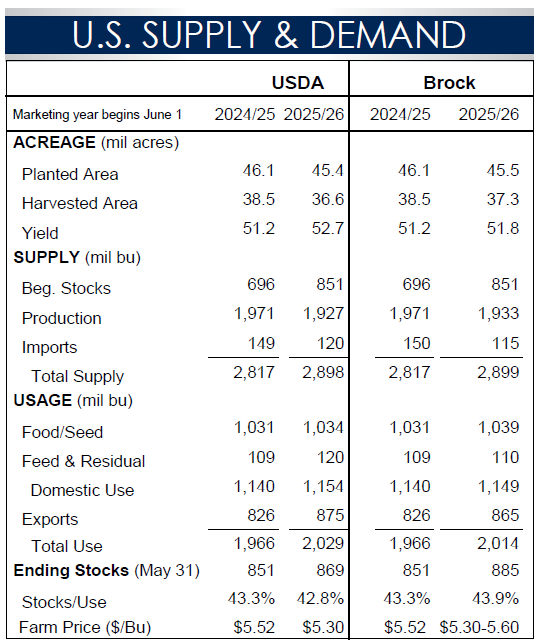

This week’s price action tested the nerves of the bulls. On Thursday, the market dropped below the $5.40 support area in March Chicago futures but then rallied to turn higher. The key reversal low on August 20 at $5.36 ½ continues to hold. At this stage, March needs a close above $5.52 ½ to confirm a breakout to the upside.

Note that open interest has dropped off sharply in the last week. That infers that the downward selling pressure has come from longs giving up on their position and exiting the market.

While it is difficult from a fundamental point of view to justify significantly higher prices, at this level, the market has discounted the bearish news. This is not a market at this time to be selling in. This is a buying opportunity.

In the Kansas City market, price pressure has been more substantial. The market moved into new contract lows this week but then rallied to turn higher on Thursday. Thursday’s low desperately needs to hold at this level. Healthy rains in the southern Plains have set the stage for good hard red winter planting conditions. As in the Chicago market, however, this is a buyer’s market, and not a seller’s.

Cash only marketers’ strategy: Seventy percent has already been sold. Sit tight.

Hedgers’ strategy: Sixty percent has been sold in the cash market. No futures or options positions are on.