CORN COMMENTS

NO NEW RECOMMENDATIONS

Corn futures rallied ahead of the three-day weekend, with bull spreading a notable feature. September corn futures rose 12½ cents to $3.98, after trading in a range of $3.87 to $3.98½. December corn settled up 10¼ cents to $4.20 ¼, and March corn settled up 10¼ cents to $4.37¾. As a reminder, markets are closed on Monday for Labor Day.

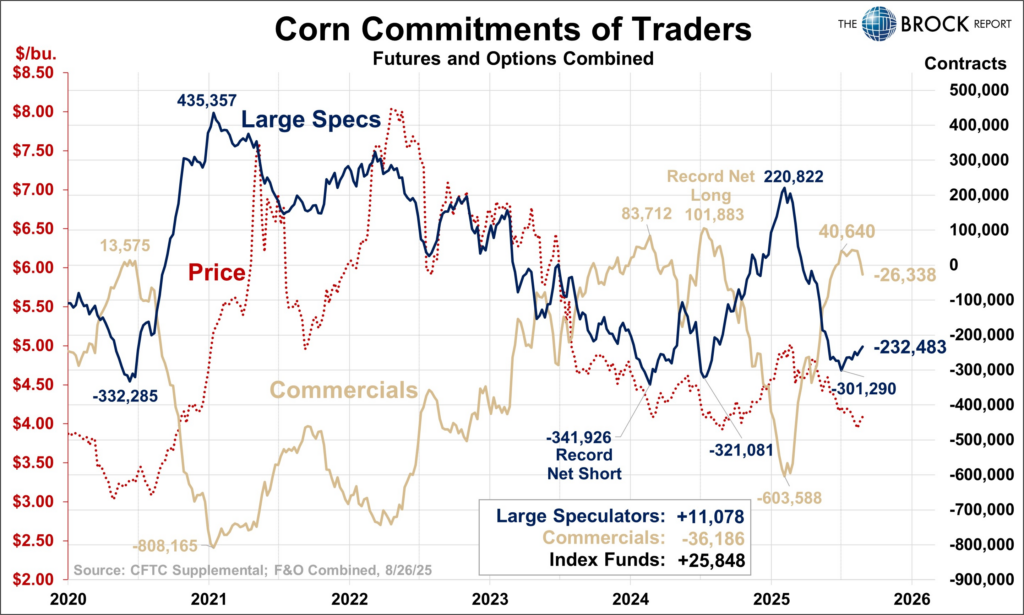

It was a good week for corn, with December settling up 9 cents on the week and seeing good follow-through after yesterday’s bullish outside day up. The market made a five-week high today, and bulls in the December contract will target the July 18 high of $4.30 ¼. Large speculators were net short by 232,483 contracts as of Tuesday, a reduction of 11,078 from the prior week, CFTC said in its weekly Commitments of Traders report, leaving plenty of potential for a short-covering rally.

There were no deliveries today against the September contract on first notice day. Rising chatter about disease pressure, including in Iowa, Minnesota and Illinois, is helping to sup-port the market, feeding a broader sense that USDA’s lofty crop estimate on Aug. 12, including the whopping yield of 188.8, is bound to be reduced. Strong export demand, including weekly export sales on Thursday, are also a supportive factor.

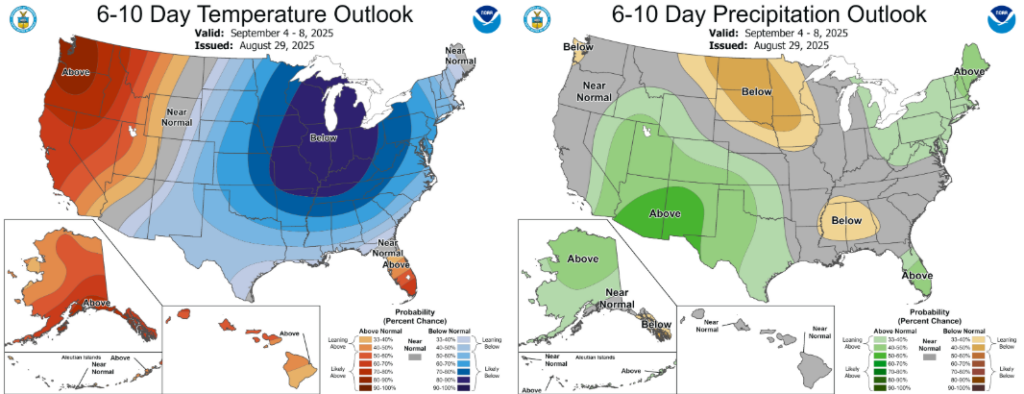

The weather outlook for corn is mostly benign, both in the U.S. and globally. Here in the U.S. generally cool and dry conditions are expected over the next 10 days. When traders return next week they’ll be taking a look at the weather forecast for late next week into the weekend, as World Weather Inc. says that frost is a possibility in the Upper Midwest. The likelihood of this being a market-moving event is slim, but we’ll see what the forecast looks like on Monday night. Elsewhere, western Europe is expected to see some much-welcome rains, particularly in France, over the next week, but it comes too late to be of help to the corn crop, which has already taken a yield hit. Conditions in China are mostly favorable, World Weather Inc. says.

SOYBEAN COMMENTS

NO NEW RECOMMENDATIONS

Soybean futures rallied into the weekend, settling near the day’s highs. September soybeans settled up 8½ cents to $10.36¾, while November rose 6½ cents to $10.54½, and January settled up 5¾ cents to $10.72½.

Soybean meal futures were mostly higher. Nearby September settled down $2.70 to $283.60, but all other contracts posted gains. October settled up $0.50 to $283.40, while December soybean meal settled up $1.70 to $289.00. Soybean oil futures settled slightly lower. Septem-ber soybean oil settled down 28 points to $51.47, while the most active December contract settled down 29 points to $52.14.

Any “up” days in soybeans recently are being attributed by some to optimism about China buying, but that seems more like traders searching for an answer rather than acting on any actual developments with China. There’s no sign of a deal. Although U.S. export sales for next marketing year have been decent considering the complete absence of China, that is a pretty big qualifier. Lack of Chinese buying looks to be a headwind for the foreseeable future.

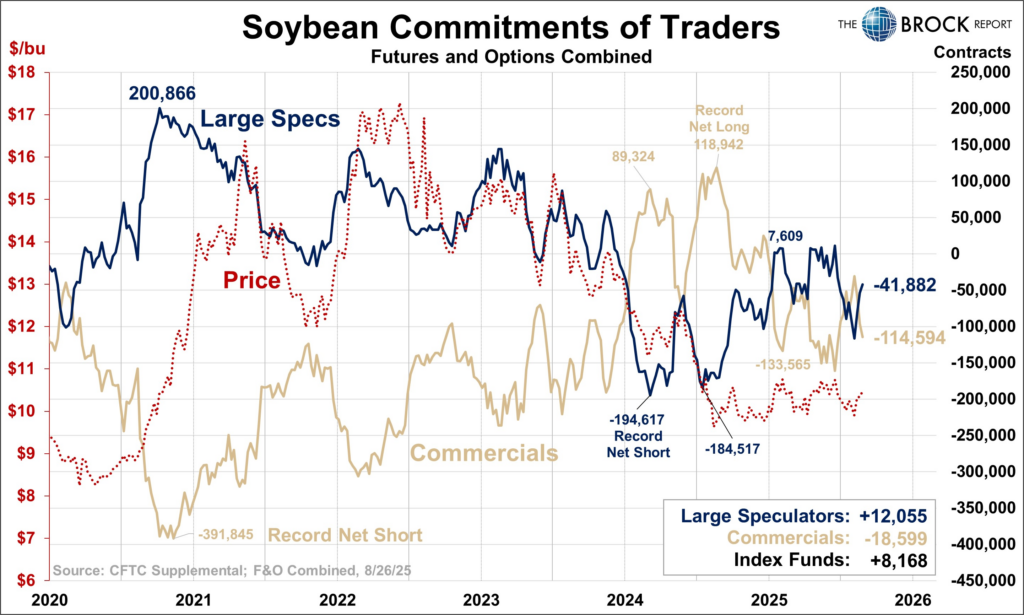

For the week, November soybeans lost 6 cents. The next upside target is the recent high at $10.62 ¾. On the downside, support is at $10.40, and the area between $10.25 and $10.30 also looks like support. November soybeans had rallied by more than 70 cents, and this week’s lackluster performance could just be a case of a market needing a breather. Large speculators were net short 41,882 contracts in the week ended Tuesday, a reduction of 12,055 from the prior week. There were only three deliveries against the September soybean contract on first notice day.

There’s still some unease about soybean crop yield potential due to dryness, particularly in the lower Midwest. All of southern Missouri, along with southern Illinois, western Kentucky and western Tennessee, is in or on the brink of drought, with limited relief expected in the near-term. There is expected to be some widespread rains next week in the Midwest, which could halt any further yield deterioration.

WHEAT COMMENTS

NO NEW RECOMMENDATIONS

Wheat futures ended higher, boosted by short covering heading into the weekend, with sup-port from strength in corn and soybeans. Chicago wheat settled up 5 to 7¾ cents, with bull spreading a feature. September settled at $5.18, December at $5.34¼, and March at $5.52. Kansas City wheat also ended higher, gaining 4 to 6 cents in most contracts and rebounding from contract lows. September Kansas City wheat settled at $4.92¾, December at $5.19¾, and March at $5.40¾. Minneapolis spring wheat was slightly higher. September spring wheat settled up 4 cents to $5.59¼, December settled up 2¾ cents to $5.80, and March settled up 1 cent to $5.99¾.

While we continue to think there’s more upside than downside in the wheat market at this point, all three classes look a bit different technically. In the December contract, Chicago wheat gained 7 cents for the week. Unlike K.C. and Minneapolis, it did not make a new con-tract low this week. Kansas City wheat made new lows Wednesday and again Thursday, but settled up 1 ½ cents for the week, and 13 cents off the Thursday low. Minneapolis wheat meanwhile fell out of bed on Wednesday and made another contract low today before re-bounding to end higher. Still, Dec. spring wheat was down 10 cents on the week.

The weakness in Kansas City was due in part to recent rains and a wet forecast for the central and southern Plains, which is boosting the winter wheat planting outlook. Harvest pres-sure is a factor in spring wheat.

Elsewhere conditions are mostly favorable, including in China, India and Australia. Dryness is a concern in parts of Ukraine into southern Russia. In western Europe, France is expected to see ample rains in the week ahead, which will be much-welcome for a region that has been mired in drought, and as with the U.S. Plains, it should boost winter wheat planting.

Large speculators were net short 95,036 contracts of Chicago wheat as of Tuesday, a reduction of 12,395 from the prior week, the CFTC said today.

COTTON AND RICE COMMENTS

NO NEW RECOMMENDATIONS

Cotton futures did not join in the rally today, settling lower amid pressure from a soft crude oil market and lackluster demand. Thinly traded October settled down 83 points to $65.21, while December settled down 76 points to $66.54 after trading in a range of $66.51 to $67.50. March cotton settled down 64 points to $68.44.

Except for gains on Thursday, which were wiped out today, cotton spent most of the week on the defensive. Most-active December cotton ran into trend line resistance early in the week and today made a three-week low, with cotton bears targeting the August low of 65.88. But our bias for prices from here is to the upside, with support from the cool weather in the southern Plains, which is expected to continue over the next two weeks. That is likely to hurt cotton yields. That said, the cool weather is also being accompanied by some badly needed rains in Texas dryland areas, complicating the outlook.

Large speculators were net short 60,493 contracts of cotton as of Tuesday, an increase of 2,305 from the prior week, the CFTC said.

Rice futures rallied. September rice settled up 27 cents to $11.79, while the most active No-vember contract settled up 26 cents to $12.17 after trading in a range of $11.93½ to $12.25. After plunging last week, the rice market might be stabilizing. Although September rice did take out the prior week’s contract low, which was also a five-year low, by one tick on Thurs-day, with today’s gains it settled up 27 cents for the week. The November contract settled up 34 cents on the week.

LIVESTOCK COMMENTS

NO NEW RECOMMENDATIONS

Live cattle futures ended higher. August futures went off the board at $241.90, up $4.90. Oc-tober settled up $2.73 to $239.65, while December settled up $2.18 to $240.78. Wholesale beef prices surged this week and continued to rise on Friday, with the afternoon Boxed Beef report showing Choice up $1.00 and Select up $4.16.

There’s no sign yet that the bull market in cattle has reached an end. This was the 10th straight week higher for October live cattle. Higher beef prices are providing some stability to packer margins, which were at an estimated $75.60 per head according to HedgersEdge on Friday, up from $57.45 a week earlier.

USDA this afternoon reported active cash trade in Nebraska at $245 on a live basis, steady with most of last week’s trade. Texas saw light trade at $242. Kansas trade was quiet today, but trade earlier in the week was at $242, up $2 from the prior week.

Feeder cattle futures also rallied. September settled up $2.98 to $364.78, while October settled up $2.95 to $364.48, and November settled up $3.58 to $363.60. The trend in feeder cattle futures was similar to live cattle, with new contract and all-time highs on Wednesday and a solid weekly gain, the ninth in the past 10 weeks for September futures. The CME Feeder Cattle Index rocketed higher, from $347.44 on Aug. 20 to $365.23 as of Aug. 27, leaving it aligned with nearby futures contracts.

Lean hog futures settled higher. October settled up $0.75 to $95.03, while December settled up $0.43 to $87.40, and February settled up $0.33 to $89.63. The afternoon pork carcass cut-out value was up $2.83.

The cash hog index has now been down 10 days in a row at the lowest level since June 19. Weekly hog slaughter is in line with the June hogs and pigs report. The national negotiated cash carcass value this afternoon was down $3.28 to $104.91, USDA said.

BROCK MARKET POSITIONS

CORN: Cash-only Marketers: 2024 CROP:100% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 6-5-25, 6-20-25).

2025 CROP: 35% sold on hedge-to-arrive contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25).

Hedgers: 2024 CROP: 100% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 4-15-2025, 6-5-25, 6-20-25).

2025 CROP: 30% sold on hedge-to-arrive contracts and regular forward contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25); long 1 Dec. 2025 $4.70 put option, short 2 Dec. $5.40 call options on 10% (2-24-2025); long 1 July 2026 $4.70 put option, short 2 July 2026 $5.40 call options against 10% (6-6-25); aside futures.

SOYBEANS: Cash-only marketers: 2024 CROP: 100% sold (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25, 6-2-25, 6-23-25).

2025 CROP: 30% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25, 4-15-25, 4-29-25, 6-2-25, 6-23-25)

2025 CROP: 30% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25); aside futures.

SRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25), aside futures. 2026 CROP: No sales advised.

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); Short May 2026 futures on 10% (8-5-25). 2026 CROP: No sales advised.

HRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25).

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); aside futures. 2026 CROP: No sales advised.

LEAN HOGS: Short Feb. 2026 lean hog futures against 25% of 1st qtr. marketings (8-14-25)’; short June 2026 lean hog futures against 25% of 2nd qtr. marketings (8-14-125).

LIVE CATTLE: Aside futures; long $225 put options against Oct. 2025 live cattle futures on 50% of 4th qtr. marketings (8-8-25); long $190 put options against Aug. 2025 live cattle futures on 50% of 3rd qtr. marketings (1-29-25).

FEEDER CATTLE: Sellers are aside futures. Feeder buyers also remain aside futures.

MILK: No forward cash sales advised; aside futures.

FEED BUYERS: CORN: 25% of 3rd qtr. needs bought in the cash market (5-6-25). SOYMEAL: long July soymeal futures on 50% (3-5-25); 50% of 3rd qtr. needs bought in the cash market (3-5-25, 7-3-25); 25% of 4th qtr. needs bought in the cash market (7-3-2025)

COTTON: Cash-only Marketers: 2024 CROP: 100% sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24, 3-13-25, 3-18-2025, 4-28-25, 6-24-25, 7-16-25). 2025 CROP: No sales recommended.

Hedgers: 2024 CROP: 100% cash sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 3-13-25, 3-18-25, 4-28-25, 6-24-25, -16-25), aside futures: 2025 CROP: No cash sales recommended. Aside futures.

RICE: 2024 CROP: 100% sold (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25. 4-29-25, 7-18-25). 2025 CROP: 10% forward contracted (6-9-25).

NOTE: Along with the potential for profit, there is always a risk of losing money when trading futures and options contracts.

Copyright 2025 by Richard A. Brock & Associates, Inc.

Any unauthorized redistribution or reproduction of this commentary is strictly forbidden.