CORN COMMENTS

NO NEW RECOMMENDATIONS

Corn futures crept another 1/4 to 3/4 of a cent higher in cautious, rangebound trading as support from soybean market strength, slow farmer selling and increased hopes for a U.S-China trade deal outweighed pressure from the large U.S. harvest and a stronger dollar. Dec. corn futures rose 3/4 of a cent to $4.22 1/2, while Mar. futures rose 1/2 cent to $4.36 3/4 and May futures rose 1/4 cents to $4.45 1/4.

Corn futures treaded water today, charting ranges of 4 1/2 cents or less amid a shortage of fresh fundamental news. However, the close was firm with futures settling at midrange or higher for the day. Nearby Dec. futures bounced off their 40-day moving avg. and posted their highest close in 3 1/2 weeks. Nearby resistance for Dec. futures remains at $4.24-$4.24 3/4 and now has nearby chart support at $4.19 1/2. Dec. will still need to close above the gap on its daily price chart at $4.31 1/4-$4.32 3/4 to open the door for a test of $4.50.

After jumping on Thursday, corn futures open interest fell off on Friday by more than 200,000 contracts to about 336,000. Futures open interest declined slightly suggesting short covering supported prices more than fresh buying.

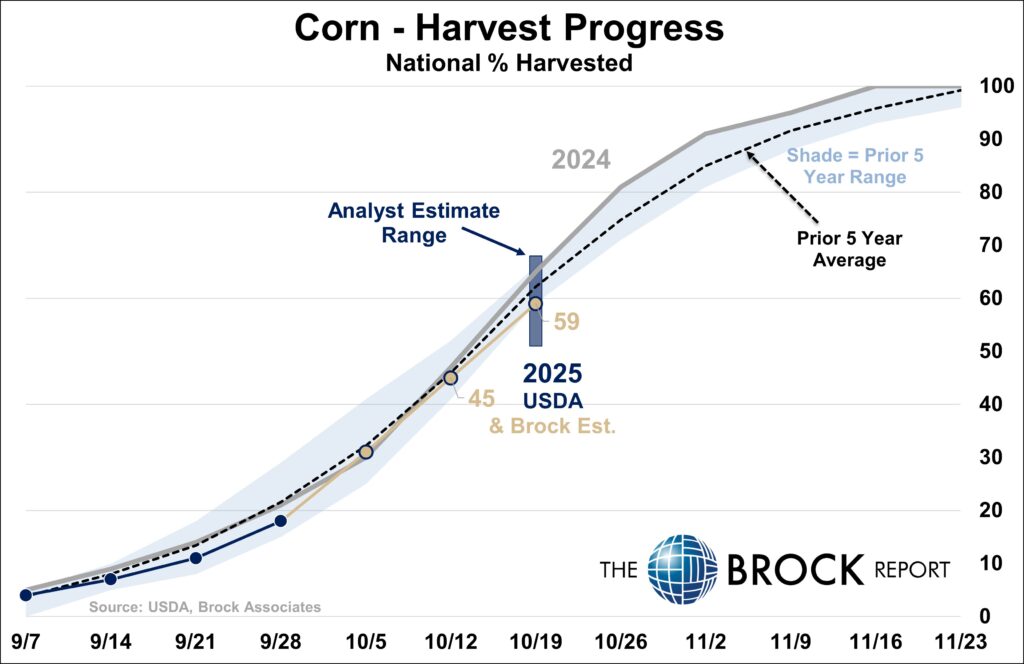

As we noted earlier, we estimate the U.S. corn harvest was 59-62% complete as of Sunday. The avg. estimate of harvest progress in a Bloomberg survey of 14 analysts was 59%, with estimates ranging anywhere from 51% to 68%.

Weather was clear across most of the Midwest today, except for eastern N. Dakota and parts of southwest Minnesota and northwest Iowa. Most of the Corn Belt is expected to be largely dry through Saturday morning. The NWS 6- to 10-day outlook for Oct. 25-29 dos call for above-norma rainfall across the heart of the Corn Belt from western Iowa through eastern Ohio.

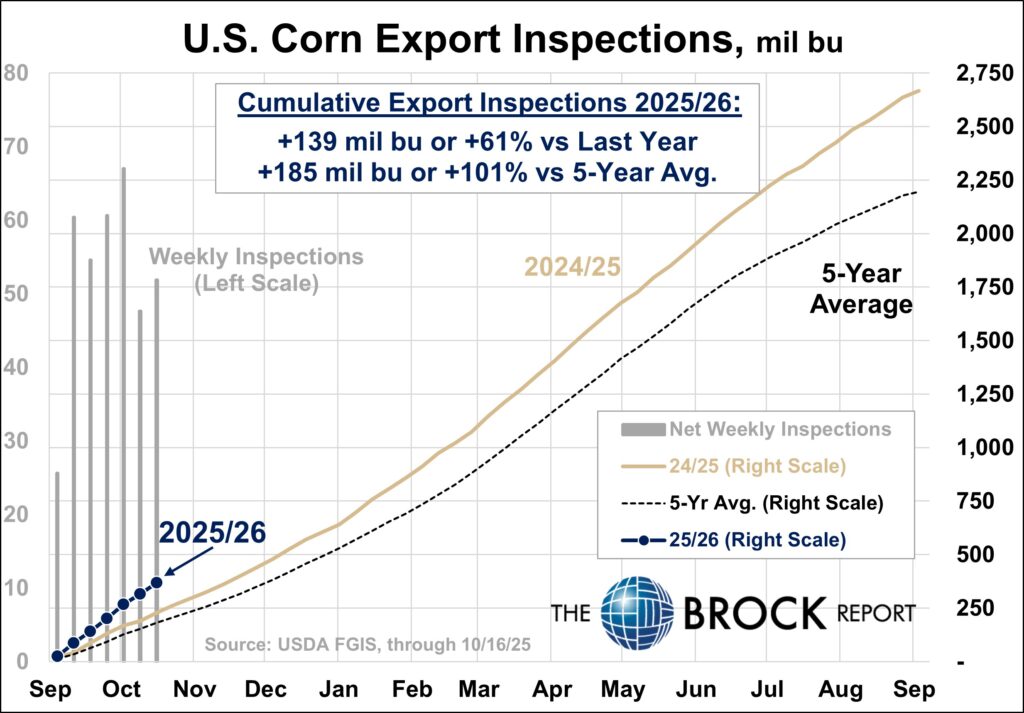

USDA reported export inspections for the week ended Oct. 16 totaled 51.9 mil. bu., up slightly from 47.6 mil. bu. a week earlier and up from 39.4 mil. bu. a year earlier. Export inspections were in line with trade expectations that ran from 39.5 to 63.5 mil. bushels. Export inspections for the marketing year to date totaled 367.6 mil. bu., up 60.6% vs. a year earlier.

Central Illinois spot processor basis bids are steady, ranging from 25 cents under to 10 under Dec. futures, according to USDA. CIF basis bids for delivery of corn to the U.S. Gulf are steady to slightly stronger vs. Friday afternoon. The CIF bid for October delivery is steady at 80 over Dec. futures, while the bid for November delivery is also steady at 80 over and the bid for December delivery is 1 cent stronger at 79 over.

SOYBEAN COMMENTS

NO NEW RECOMMENDATIONS

Soybean futures jumped 10 to 13 1/4 cents on support from hopes for China to return to the U.S. market after President Trump said purchases of U.S. soybeans were a condition for a U.S.-China trade deal and he believed China would agree to make fresh purchases. Technically-driven short covering and slow producer selling in the cash market were also supportive for prices along with soymeal futures strength. Nov. soybeans rose 12 1/4 cents to $10.31 3/4, while Jan. futures rose 13 1/4 cents to $10.50 and Mar. rose 13 1/4 cents to $10.64. Dec. soyoil futures rose 18 points to 51.31 cents, while Dec. soymeal futures rose $4.00 to $285.00.

The short-term soybean futures chart picture is now looking very constructive, with futures posting their highest closes in more than a month. Nov. soybeans’ close above $10.30 should set up a test of the next level of chart resistance at $10.47 3/4-$10.52 3/4. A close above the market’s September high at $10.52 3/4 would open further upside to $10.62 3/4-$10.75 3/4.

With only 9 sessions left until first notice day for deliveries against Nov. futures, open interest in Jan. futures is now higher than in Nov. futures. The next levels of resistance on the Jan. chart are at $10.66 1/2-$10.72 and $10.81-$10.87. Once Jan becomes the most-active contract, a weekly close above $10.80 by Jan. would be a major breakout on the weekly most-active soybean futures continuation chart.

Dec. soymeal futures posted their highest close in a month after charting a weekly reversal up last week. A Dec. close above roughly $288.00 would break the downtrend line off the market’s 2025 high and open potential for a further rally back to at least $300.00.

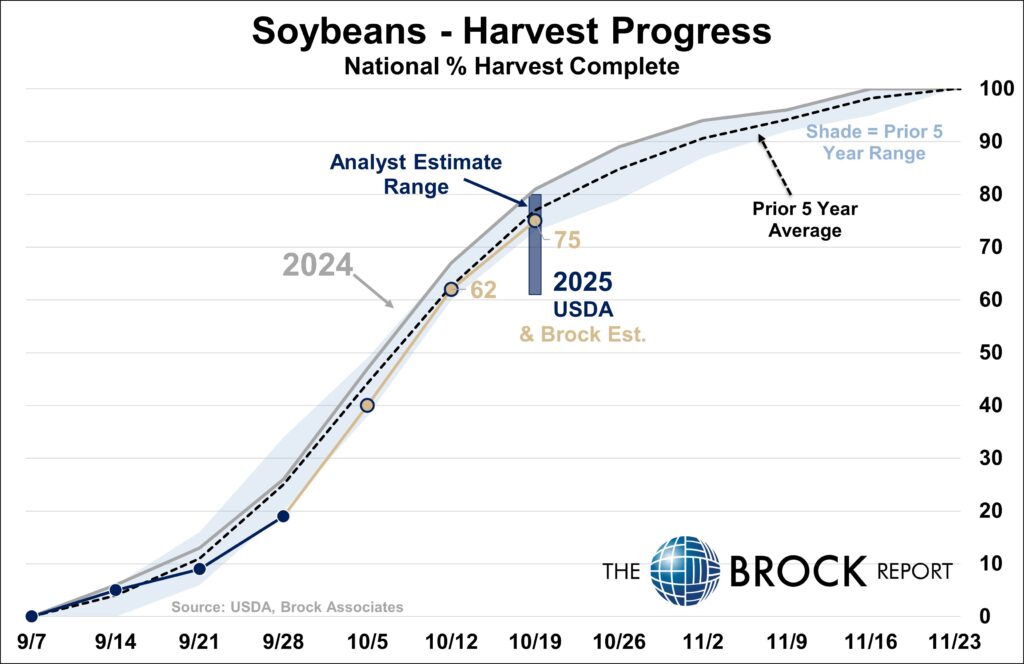

As we noted at midsession, we estimate U.S. soybean harvest progress at 75-78% as of Sunday. Trade estimates of harvest progress avg. 74% in a wide range from 61% to 80%, according to the Bloomberg survey.

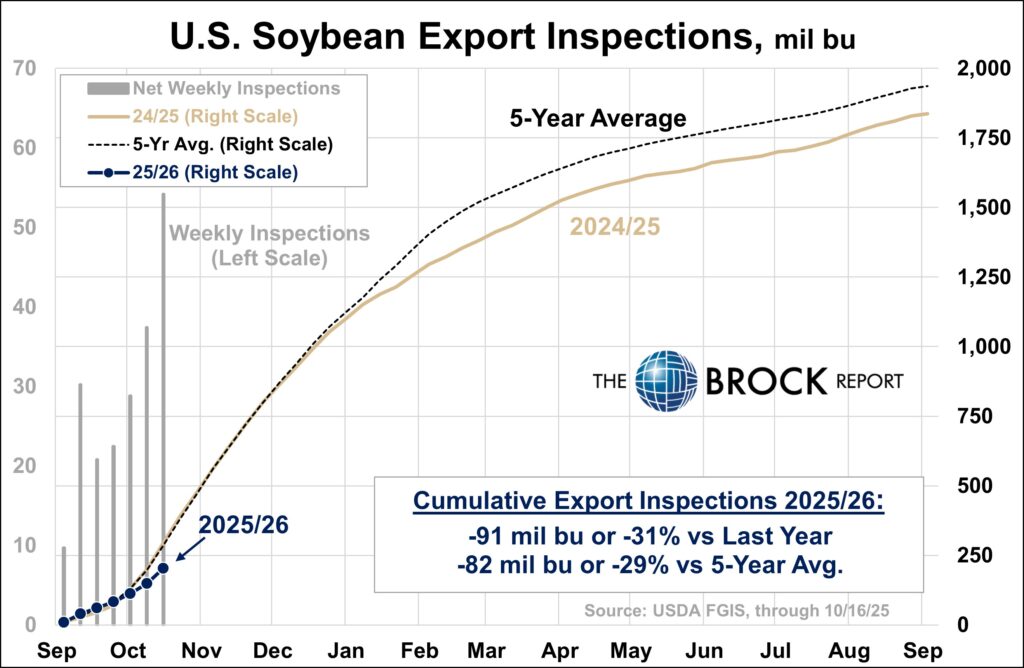

USDA reported U.S. soybean export inspections for the week ended Oct. 16 totaled 54.2 mil. bu., up from 37.4 mil. a week earlier, but well below the year-earlier total of 93.7 mil. bushels. Weekly inspections were in line with trade expectations that ran 18.5-50 mil. bushels. Soybean export inspections for the marketing year to date totaled 203.5 mil. bu., down 30.9% from a year earlier.

Weather models have trended drier over the next two weeks for about 80% of Brazil’s growing area – there there will still be rainfall – but only about 50% of normal, says Eric Snodgrass, Nutrien Ag Solutions Senior Science Fellow.

Central Illinois processor spot soybean basis bids are 3 to 5 cents stronger, ranging from 12 cents under to 10 over Nov. futures, according to USDA. CIF basis bids for delivery of soybeans to the U.S. Gulf are slightly stronger vs. Friday afternoon. The CIF basis bid for October delivery is 1 cent stronger at 76 over Nov. futures, while the bid for November delivery is 1 cent stronger at 78 over and the bid for December delivery is 1 cent stronger at 68 over Jan. futures.

WHEAT COMMENTS

NO NEW RECOMMENDATIONS

Wheat futures started the week with mixed trade. Chicago settled up 1 to 2 ¾ cents, settling at $5.04 ¾ in the December, $5.21 ½ in the March, and $5.33 in the May. Kansas City wheat was down 1 to 2 cents, settling at $4.90 in the December, $5.09 ½ in the March and $5.23 in the May. Minneapolis wheat settled flat in nearby months, at $5.48 ½ in the December, $5.68 ½ in the March, and $5.82 ¼ in the May.

Although there weren’t many fireworks, technically it appears to have been a constructive day, with Chicago and Kansas City both seeing some follow-through buying as the markets continued to rebound off the contract lows set last week. Some contracts had posted a bull-ish daily reversal off those lows last week, and today’s action reinforces the hope that wheat has finally made a bottom. Minneapolis wheat, which unlike K.C. and Chicago continued to make new contract lows last week through Friday, found support at those contract lows to-day.

A lack of fresh fundamental news has limited market activity. Ample U.S. and world supplies remain a negative market factor along with favorable U.S. winter wheat planting conditions. A fresh export tender from Algeria and excessive rains in China’s winter wheat belt are sup-portive market factors.

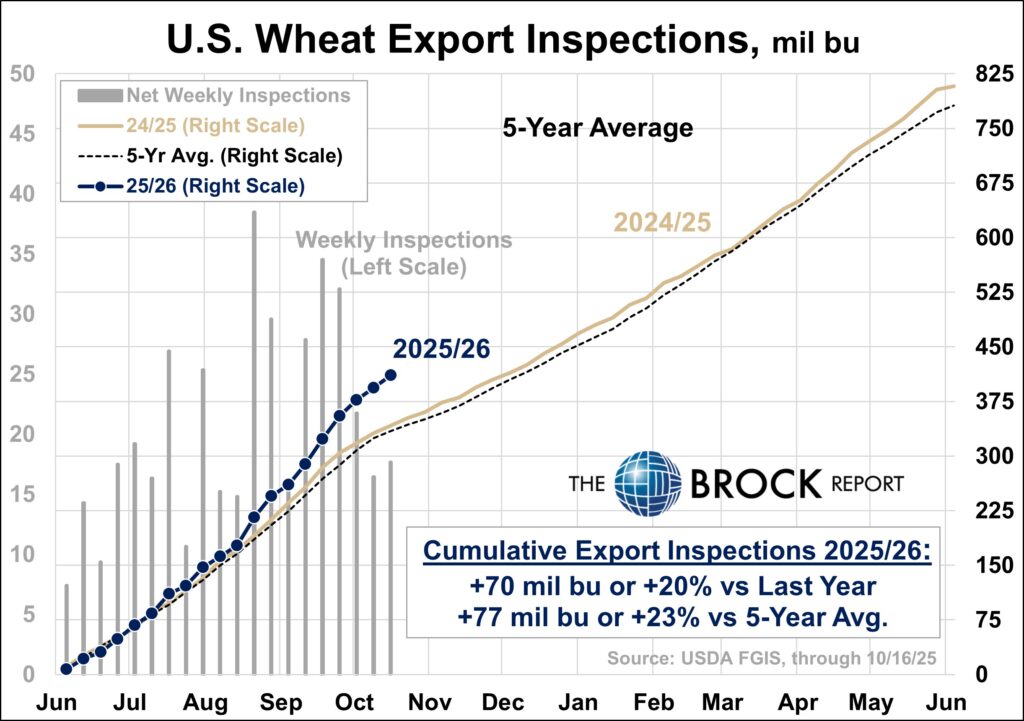

USDA reports U.S. wheat export inspections for the week ended Oct. 16 totaled 17.7 million bushels, up from 16.4 million a week earlier and 9.9 million a year earlier. Inspections were in line with trade expectations that ran 13-20 million bushels. Wheat export inspections for the marketing year to date totaled 411.3 million bushels, up 20.4% from a year earlier.

Still no Crop Progress data due to the federal government shutdown, but trade estimates of U.S. winter wheat seeding progress as of Sunday averaged 76% in a range from 73%-80% compared with the year-earlier progress of 73%. Much of the HRW crop in the Plains has been planted in favorable conditions, and while some soft red winter areas in the Mid-South and eastern Corn Belt have been too dry, recent rains have alleviated some of those concerns.

China has launched a 60-day campaign to secure wheat planting in the main North China Plain winter wheat belt, the government said on Monday, after heavy rains left fields wet and threatened to delay planting and disrupt next year’s grain supply. The Ministry of Agriculture will adopt targeted measures to strengthen planting in wet conditions, take action to handle late sowing, and improve field management before winter, it said in a statement.

News that Algeria’s state grains agency OAIC has launched a new tender for a nominal 50,000 MT of milling wheat is a supportive factor for prices. The deadline for the tender is Wednes-day. The market will be expecting a significantly larger purchase from OAIC. In its last tender for milling wheat, which closed on Sept. 23, OAIC is believed to have bought at least 600,000 MT, paying $259-$261 per MT cost and freight included. OAIC also is estimated to have bought about 400,000 MT of durum wheat in a tender that closed last week.

COTTON AND RICE COMMENTS

NO NEW RECOMMENDATIONS

Cotton futures ended mostly lower. December cotton settled down 12 points to 64.16, after trading a range of 64.05 to 64.78. March cotton was down 1 point to 65.77, and May was up 4 points to 67.01. Harvest pressure and lackluster demand continue to hang over the market.

Technically the outlook for cotton is starting to improve, and the market made higher highs and higher lows again today. But cotton bulls still have a lot of work to do. We had men-tioned the 18-day moving average last week as a first potential test, and cotton failed that test today, running smack into it in the December contract and then retreating. After an initial retreat the market still hovered in positive territory for much of the session before sinking late.

If cotton tests the 18-day moving average again and passes it, the next upside target would be 65.28, which is an Oct. 9 high and also a 50% retracement of the market’s plunge from Sept. 17 to a contract low on Oct. 14. If there is follow-through from today’s weakness, bears will be targeting that contract low and below that the continuation low just above 62.00.

While cotton and wheat are both at least making an attempt to establish a bottom, rice just keeps on making new lows. Rice futures were down again today, with pressure from abun-dant global supplies and light demand. November rice settled down 14 cents to $10.48, after trading a range of $10.45 to $10.69. January rice settled down 10 ½ cents to $10.75. Both Nov. and Jan. made new contract lows. For the Nov., that is also a six-year low on a front-month basis, with no clear potential support until the $10 area.

LIVESTOCK COMMENTS

NO NEW RECOMMENDATIONS

Live cattle futures ended higher, as Friday’s strong Plains cash trade and stronger wholesale beef prices today helped the market rebound from Friday’s poor showing. President Trump on Friday told reporters that the U.S. was planning to import beef from Argentina to bring down beef prices for consumers, but that news appeared to have been priced in with Friday’s plunge. Futures settled up $1.25 to $1.83, at $241.85 in the October, $243.65 in the December and $244.525 in the February. The afternoon Boxed Beed report showed Choice up $2.41 and Select up $3.19.

It is a typical quiet Monday morning in Plains direct cash markets with buyers and sellers tak-ing inventory after Friday trade. No packer bids or feedlot asking prices have been estab-lished. We would expect steady to slightly higher cash trade this week after feedlots were successful pushing prices higher last week to $240 on a live basis, up $5 to $6 from the prior week. The average packer operating margin is estimated by HedgersEdge at minus $180.15 per head, down from minus $175.35 on Thursday.

Feeder cattle futures settled mixed, with strength in nearby months. October feeders were up $1.00 to $372.95, November feeders gained 98 cents to $372.675, and January feeders were down 13 cents to $369.175. The market did not trigger our morning hedge recommendation in the January contract. Other contracts were lower. The CME Feeder Cattle Index for Thurs-day was up $1.41 to $376.51.

Lean hog futures were also mixed, with weakness in nearby months. December hogs lost 30 cents to $82.075, and February was down 5 cents to $84.725. But April was up 30 cents to $88.95. The afternoon pork carcass cutout value was down 62 cents.

The national average negotiated cash carcass price this afternoon was 40 cents lower at $89.74. The lagging CME cash lean hog index is 47 cents lower at $96.12 and is expected to fall another 54 cents on Tuesday. Today’s hog slaughter is expected to run 486,000 head, down 5,000 from last week, but up 5,000 from last year.

BROCK MARKET POSITIONS

CORN: Cash-only Marketers: 2024 CROP:100% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 6-5-25, 6-20-25).

2025 CROP: 35% sold on hedge-to-arrive contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25).

Hedgers: 2024 CROP: 100% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 4-15-2025, 6-5-25, 6-20-25).

2025 CROP: 30% sold on hedge-to-arrive contracts and regular forward contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25); aside futures; short July 2026 $5.40 call options against 10% (6-6-25).

SOYBEANS: Cash-only marketers: 2024 CROP: 100% sold (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25, 6-2-25, 6-23-25).

2025 CROP: 40% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25, 9-2-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25, 4-15-25, 4-29-25, 6-2-25, 6-23-25)

2025 CROP: 40% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25, 9-2-2025); aside futures.

SRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25), aside futures. 2026 CROP: No sales advised.

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); Short May 2026 futures on 10% (8-5-25). 2026 CROP: No sales advised.

HRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25).

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); aside futures. 2026 CROP: No sales advised.

LEAN HOGS: Short Feb. 2026 lean hog futures against 25% of 1st qtr. marketings (10-9-25); Short June 2026 lean hog futures against 25% of 2nd qtr. marketings (10-9-25)

LIVE CATTLE: Aside futures; long $240 Nov. put options on Dec. 2025 futures on 25% of 4th qtr. marketings (10-17-25); long $230 put options on Dec. 2025 futures against 25% of 4th qtr. marketing (10-9-25).

FEEDER CATTLE: Sellers are aside futures. Feeder buyers remain aside futures.

MILK: No forward cash sales advised; aside futures.

FEED BUYERS: CORN: 100% of 3rd qtr. and 4th qtr. needs bought in the cash market (5-6-25, 9-17-25). SOYMEAL: 100% of 3rd qtr. needs bought in the cash market (3-5-25, 7-3-25, 9-17-25); 100% of 4th qtr. needs bought in the cash market (7-3-2025, 9-17-25)

COTTON: Cash-only Marketers: 2024 CROP: 100% sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24, 3-13-25, 3-18-2025, 4-28-25, 6-24-25, 7-16-25). 2025 CROP: No sales recommended.

Hedgers: 2024 CROP: 100% cash sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 3-13-25, 3-18-25, 4-28-25, 6-24-25, -16-25), aside futures: 2025 CROP: No cash sales recommended. Aside futures.

RICE: 2024 CROP: 100% sold (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25. 4-29-25, 7-18-25). 2025 CROP: 10% forward contracted (6-9-25).