Weekly COT Highlights – Week Ended Tuesday, January 27th, 2026

Main Takeaways this Week

Another somewhat brief one this week.

- Corn: Neutral positioning with room for short-covering

- Soybeans: First buying after a long unwind.

- Wheat: Positioning continues to favor short-covering.

- Rice: Buying trend remains intact.

- Hogs: Crowded longs, rising risk! Proceed with caution.

Be sure to check out this week’s Brock report! Page 10 includes an educational feature on short-dated put options by our Consultant/Broker Cody Brunes! Click here to see the print edition.

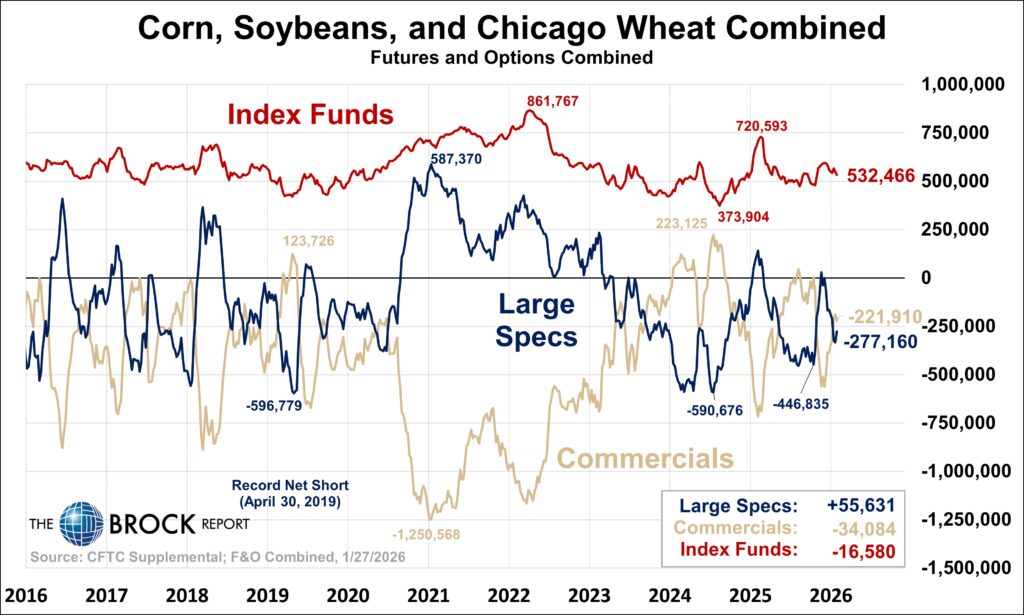

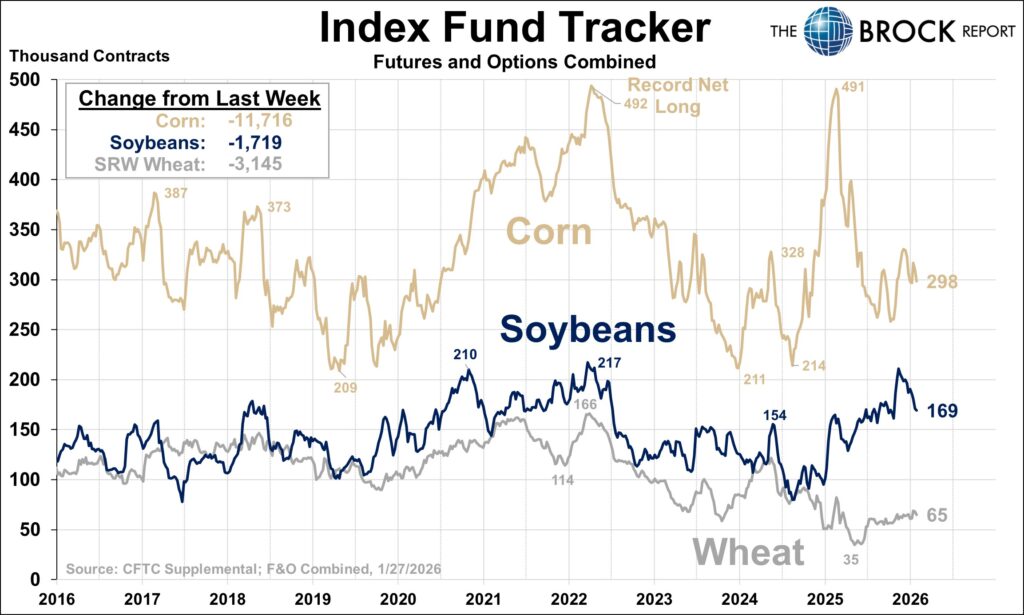

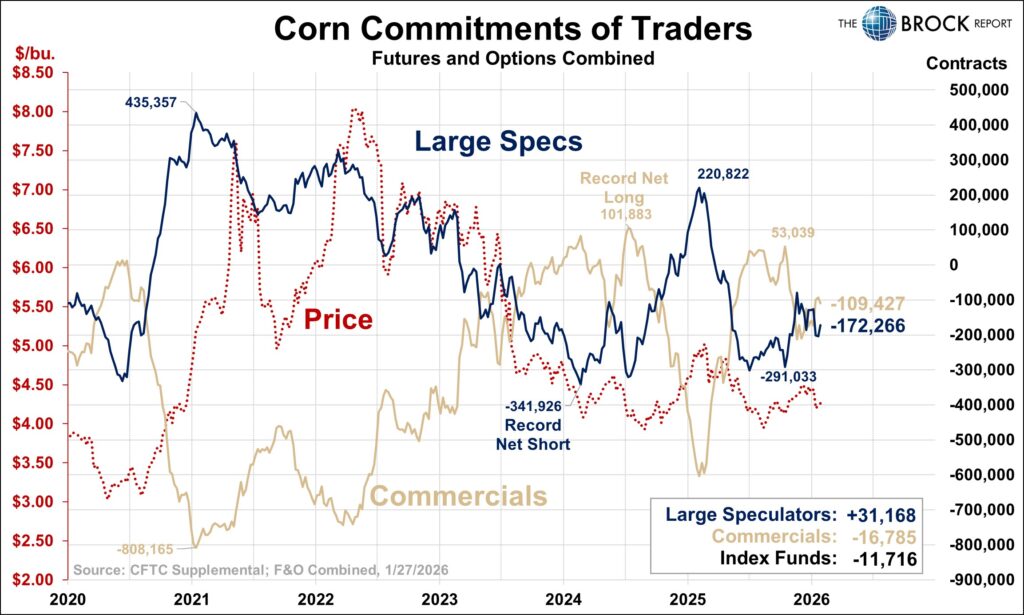

Corn

Once again, not much here. Pretty good amount of buying this week from large speculators this week. Through the month of January Specs sold 43,405 contracts. Not a massive short position for them, but there still remains the opportunity for some buying. Overall a pretty neutral setup.

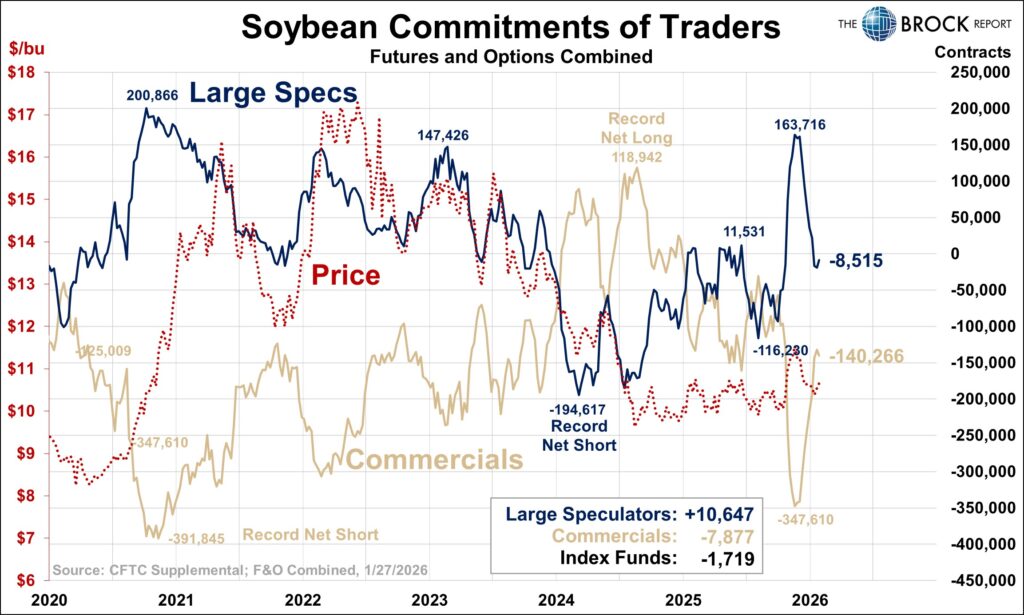

Soybeans

Over the past two months Specs have been sellers of 167,754 contracts. This week marks the first time that large specs have bought since the December 2nd COT report. Just a small amount of buying, but any amount of buying at this point should be seen as a positive. The massive 163,716 contract long position they held in December took them about 2 months to build, and about the same exact amount of time to break down. As we have mentioned, positions just like the one shown on this graphic are a major reason why we closely follow this report.

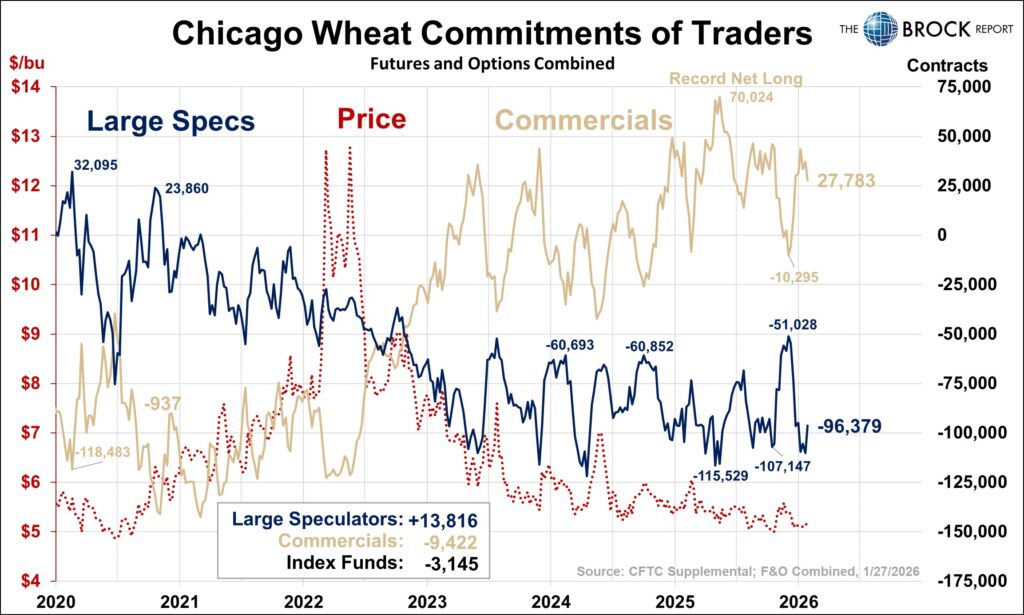

Wheat

Large speculators were buyers of 13,816 contracts this week, and with their position still sitting fairly close to record short levels, the market appears set up for additional short-covering in the weeks ahead. In this week’s Brock report, we raised our wheat export estimate by 50 million bushels, putting our number 50 million bushels above USDA’s forecast. While that change alone is not especially significant, the current trader positioning suggests that even a small amount of bullish news could prompt an outsized buying response in this market.

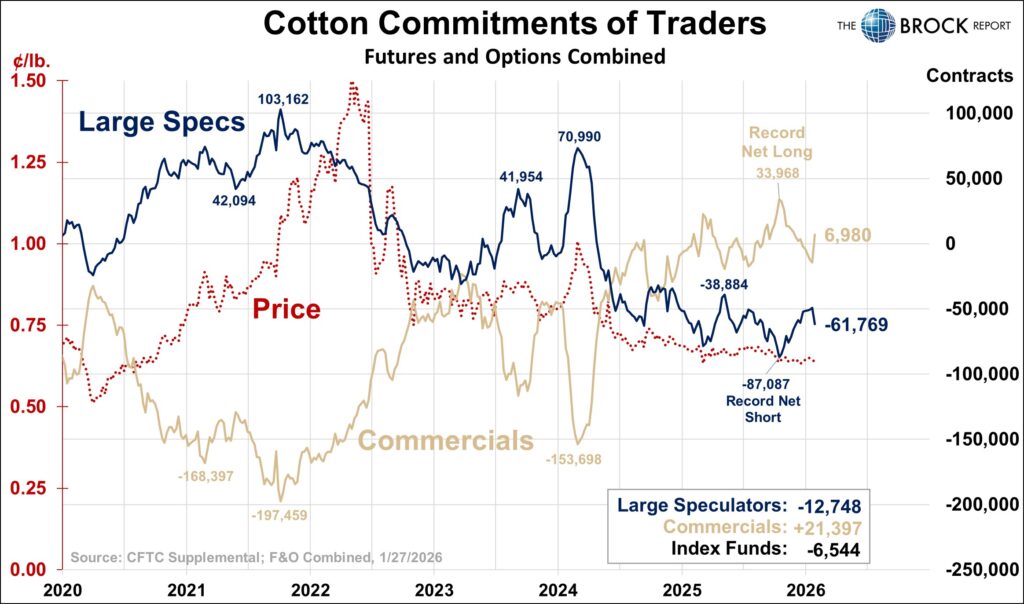

Cotton

Largest amount of selling by large specs in a week since November of 2024. Specs were able to wipe out the last five weeks of buying with this one week of selling. In past years specs have rarely been short this market (4-times since 2012). This recent run has easily topped all of those for the longevity of the short position. If specs are still short come April, that will effectively make it two years of holding a net short position. If you take a look at the price line on our graphic this short position has obviously held a bit of weight over any rally in this market for some time now.

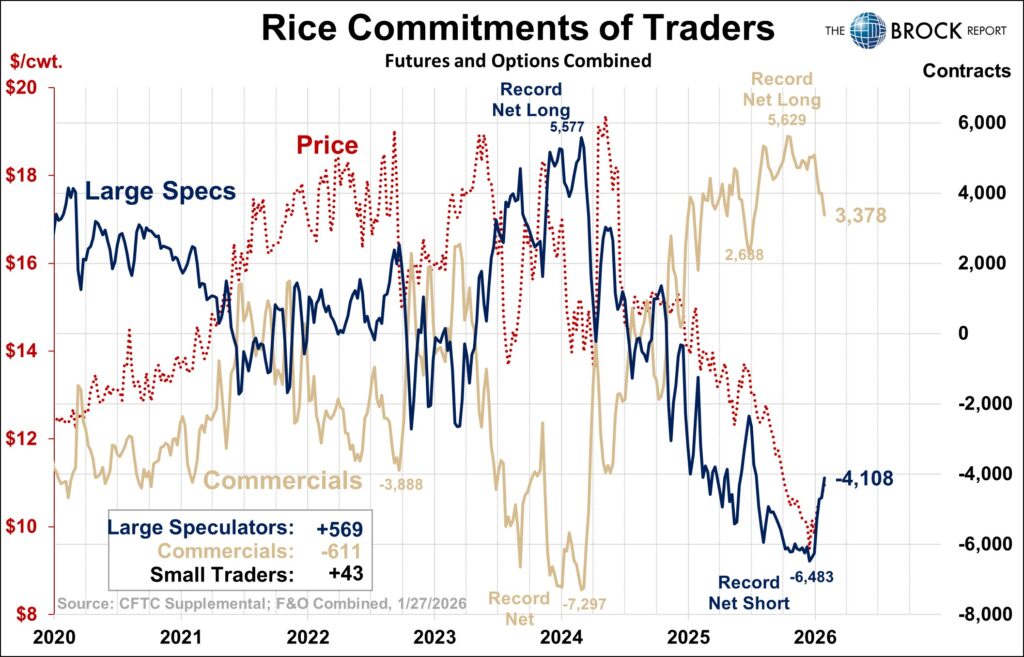

Rice

Large specs back to heavy buying this week. This being the sixth week in a row of large spec buying. This market certainly seems to have found a bottom, up about $1.50 since the change in sentiment. Plenty more room for Specs to keep on buying too.

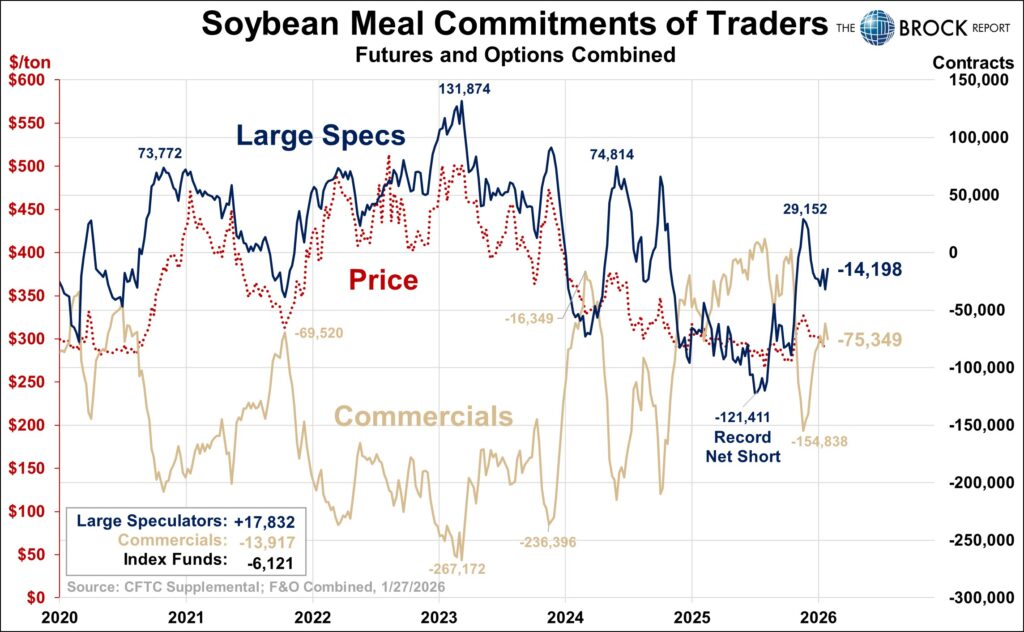

Soybean Meal

Large specs wipe out their selling from last week with an almost identical amount of purchasing this week. Large specs are buyers for the month of January, buying about 9,000 contracts. Not much to see here once again.

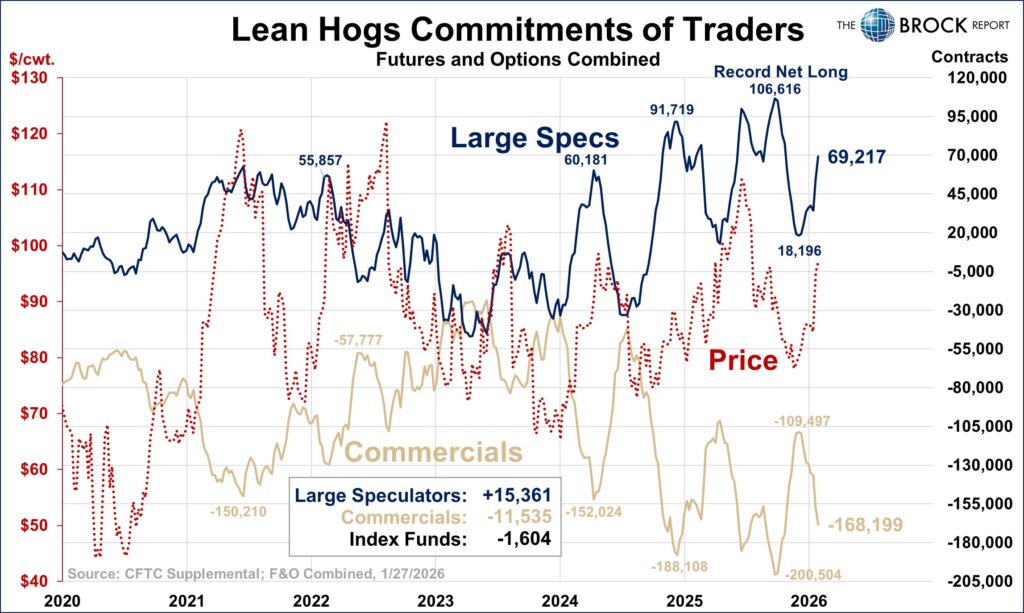

Lean Hogs

This graphic is likely the highlight of this week’s report. Large speculators have built another sizable long position, pushing back into what we would call extreme long territory. Over the last two months, they have purchased 50,226 contracts. As a reminder, these reports only reflect positioning through Tuesday. That said, we recorded a five-wave buy signal on Wednesday, making it especially important to watch how they adjust their position in next week’s report. For those not already short this market, it may be time to consider doing so, and for those who are already short, it may be appropriate to evaluate adding to that position.

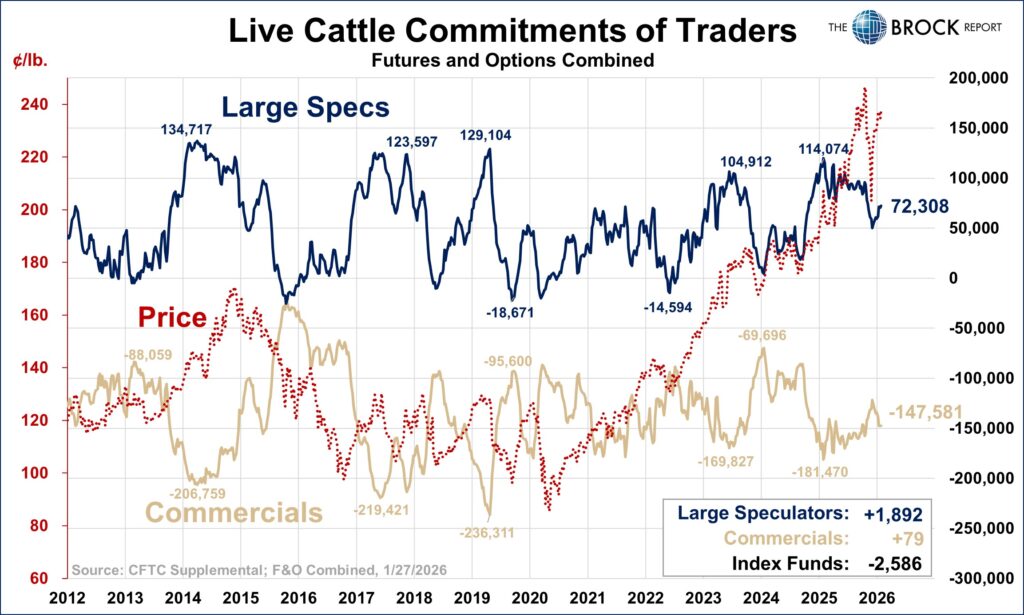

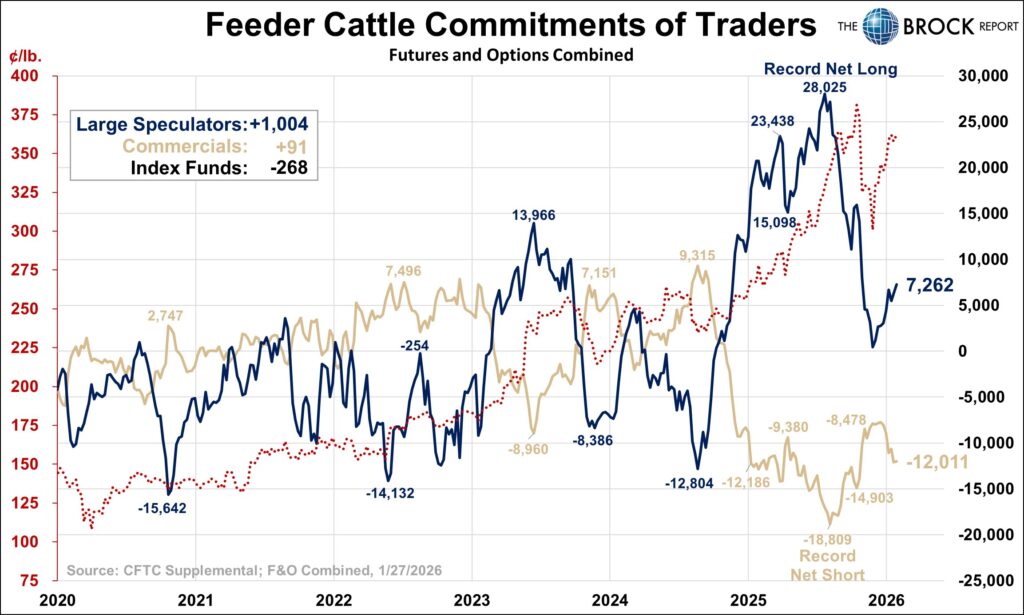

Cattle Complex

Nothing to see here!