Weekly COT Highlights – Week Ended Tuesday, February 3rd, 2026

Main Takeaways this Week

- Corn: “Neutral positioning with room for short-covering.” Copy and paste from last week.

- Soybeans: Specs reset. Rebuild next?

- Wheat: Specs continue to buy.

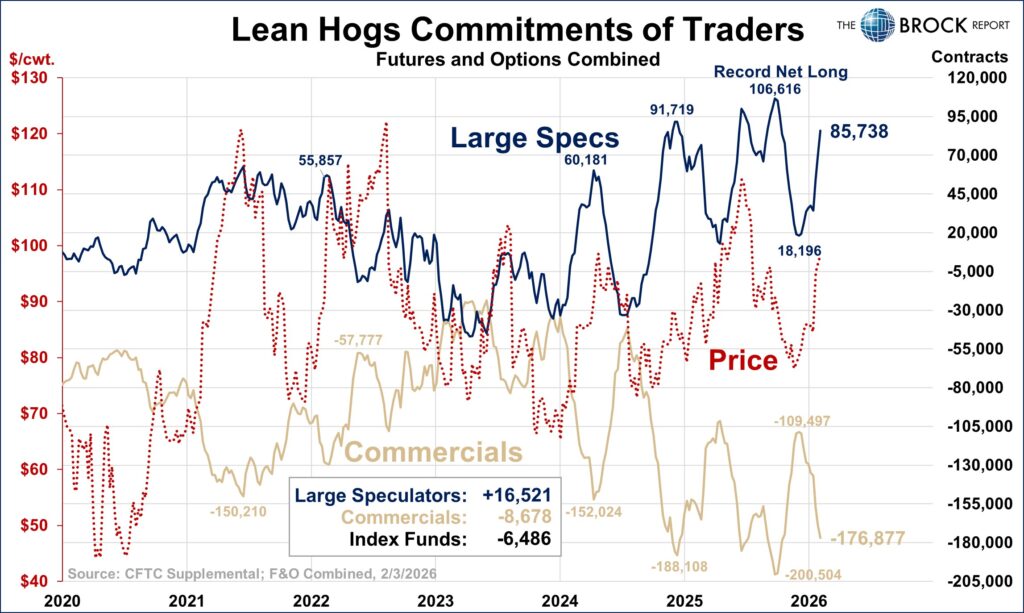

- Hogs: Cycle repeating. Caution.

- Cotton: Large Specs hold record total shorts.

Be sure to check out this week’s Brock report! Page 3 has some great insight into the recent cattle inventory report! Click here to see the print edition.

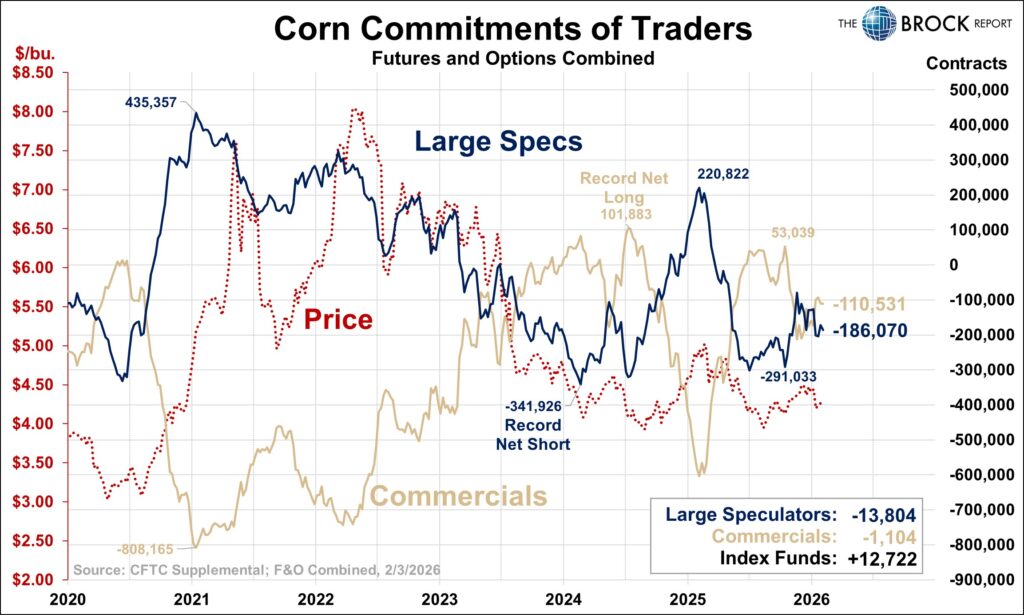

Corn

We can’t seem to get any sustained large spec buying in the corn market. After a pretty sizable amount of buying last week, speculators are sellers in this week’s report. To be completely honest, since mid-November this report has been pretty boring for the corn market. Since that time, large specs have only changed their position by 106,592 contracts. Before the big selloff after the January report, the change was just 46,636 contracts over a span of almost two months. To put that into perspective, in last week’s report large specs were buyers of about 31,000 contracts, meaning they were nearly buyers in one week, the same amount they had changed their position in almost two months. Yet, as we’ve mentioned the last couple of weeks, there’s still plenty of room for buying as they continue to hang onto their short position.

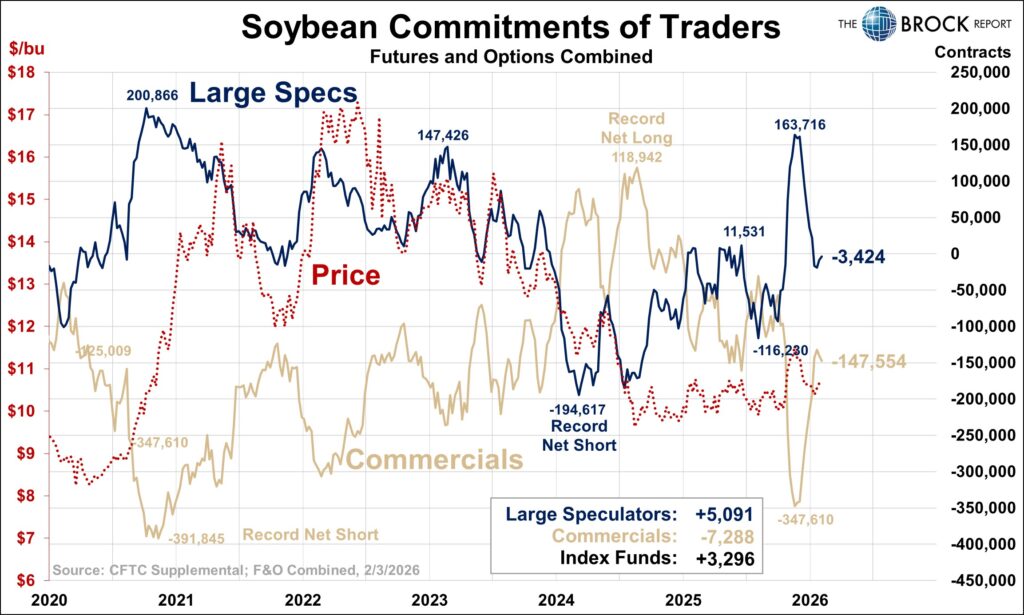

Soybeans

Minimal buying from speculators in what was a wild week in terms of price action. This was definitely one of those weeks where we wish the data ran through Thursday rather than Tuesday. It has been almost exactly two months since large specs hit their peak long position, and this weeks buying spree was largely driven by the same news. Because of the recent selloff, the reset button has essentially been pushed, putting large specs in a position to react quickly to any new market developments. Last time, we were unable to watch this report closely because of the shutdown. This time around we will have up-to-date data, and the soybean COT will be at the top of the watch list over the next few weeks.

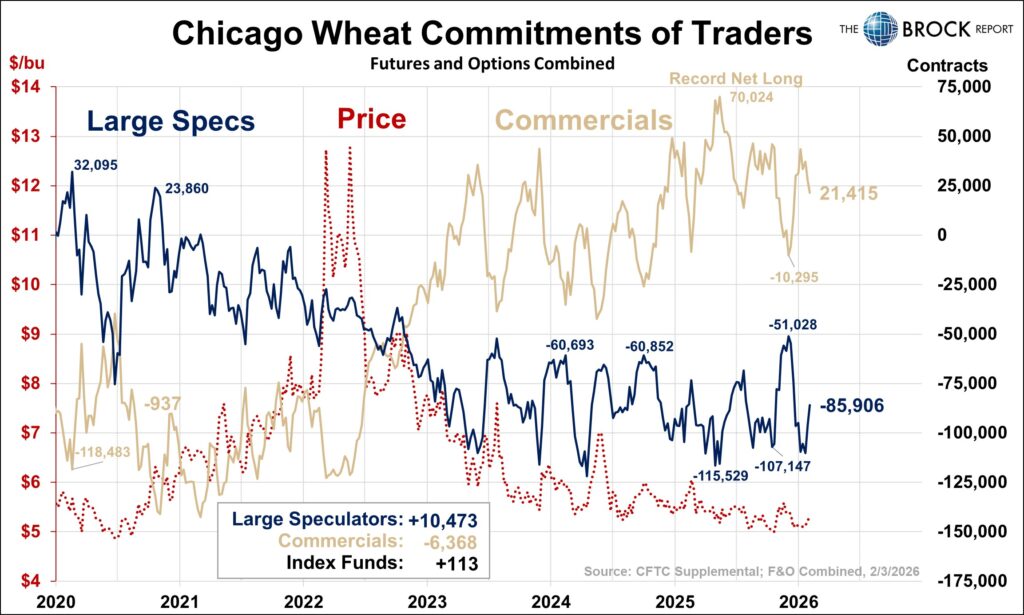

Wheat

A lot of the same story as last week for wheat. Specs make it two weeks in a row as buyers of more than 10,000 contracts, pulling their net short position back to its smallest level since late December. Another week of fairly strong export data has helped support the move, and the short-term trend certainly appears to be turning higher.

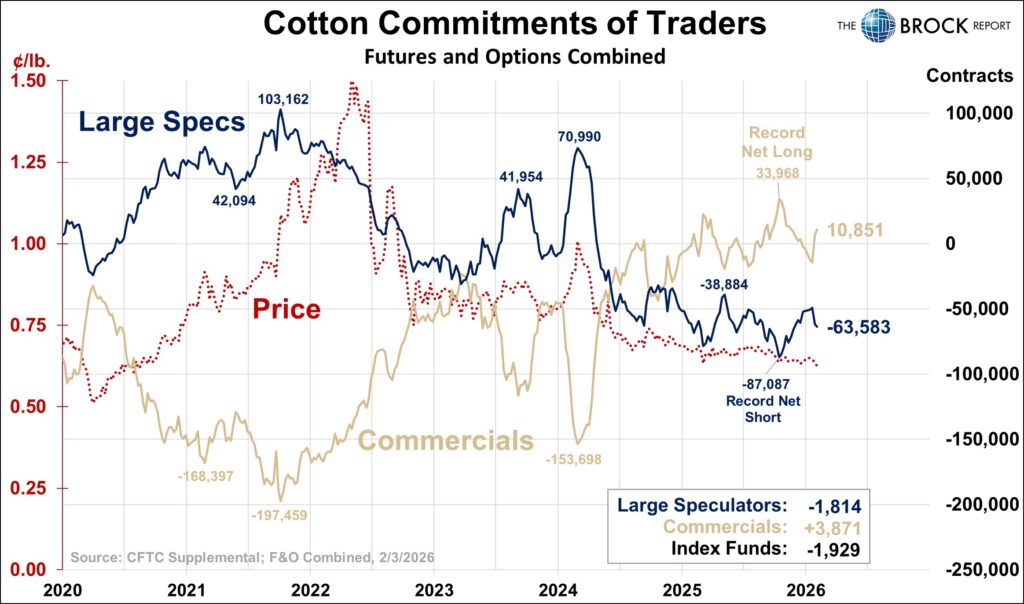

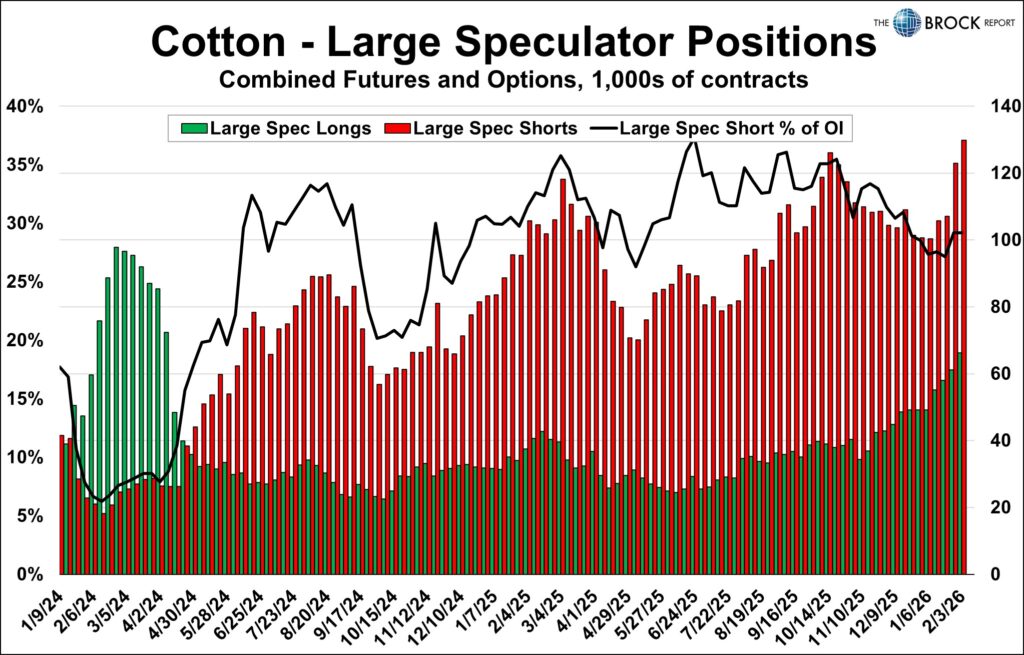

Cotton

For cotton, we are using two charts this week, so we’ll start by explaining how they work and how they relate to each other. Each week, the CFTC reports the number of long and short contracts held by large speculators, commercials, index funds, and other trader categories. We calculate the net position by subtracting short contracts from long contracts, which is what is depicted in the blue and gold line charts. The second cotton chart breaks that net position down further, showing the individual long and short positions that make up the total. We highlight this because this week marked a record number of short contracts held by large speculators (Red Bar on second chart).

Since June of 2025, large spec open interest has surged.. When open interest expands alongside a large short position, it suggests conviction behind the bearish narrative, but it also increases the market’s vulnerability to sharp short-covering rallies if sentiment shifts.

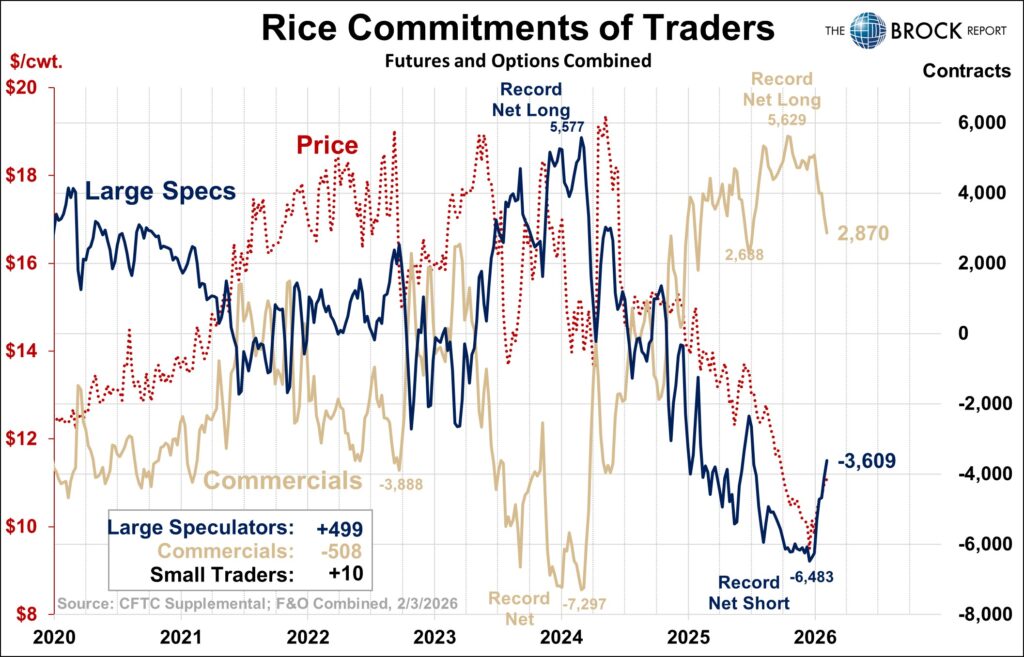

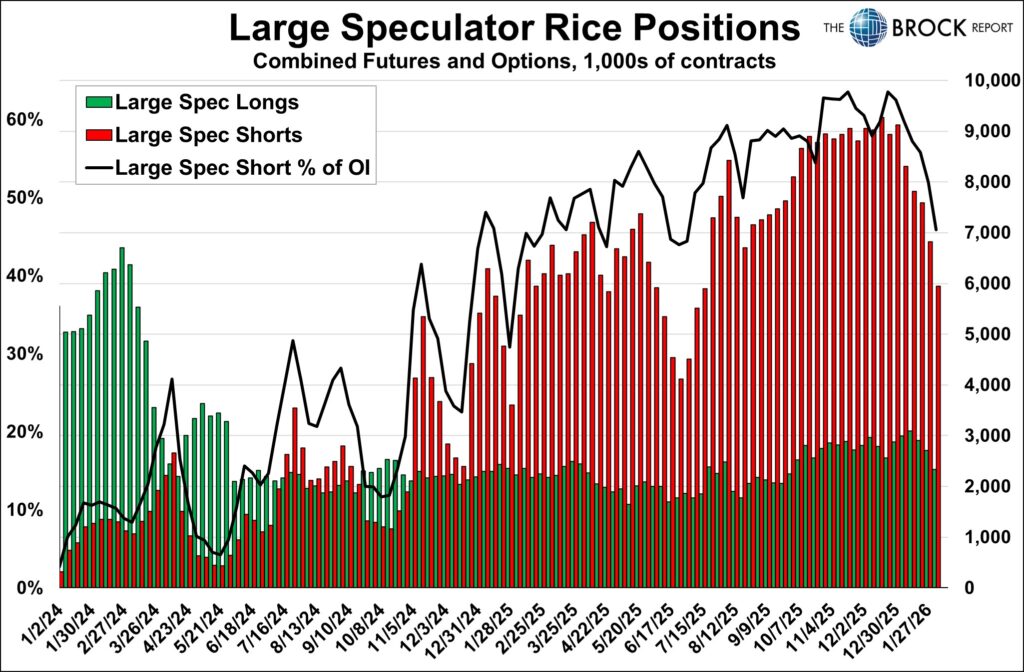

Rice

Buy, buy, and buy some more is what large speculators have been doing in the rice market since the start of the year, liquidating nearly half of their record net short position. We’re also including the Large Spec Position chart in this week’s COT to highlight the sharp drop in the percentage of large spec short open interest. It’s been fun to watch this chart as it has been a textbook example of price following positioning, as the rally has closely tracked the aggressive short covering in this market.

Lean Hogs

Large specs continue to follow the same pattern in lean hogs, steadily rebuilding their net long position. At 85,738 contracts, positioning is once again approaching record territory, and another push to new highs would mark the fifth time since the start of 2024 that specs have reached extreme net long levels. Each cycle over the past two years has shown a similar build in length followed by an eventual round of liquidation. With positioning once again elevated, caution is warranted.

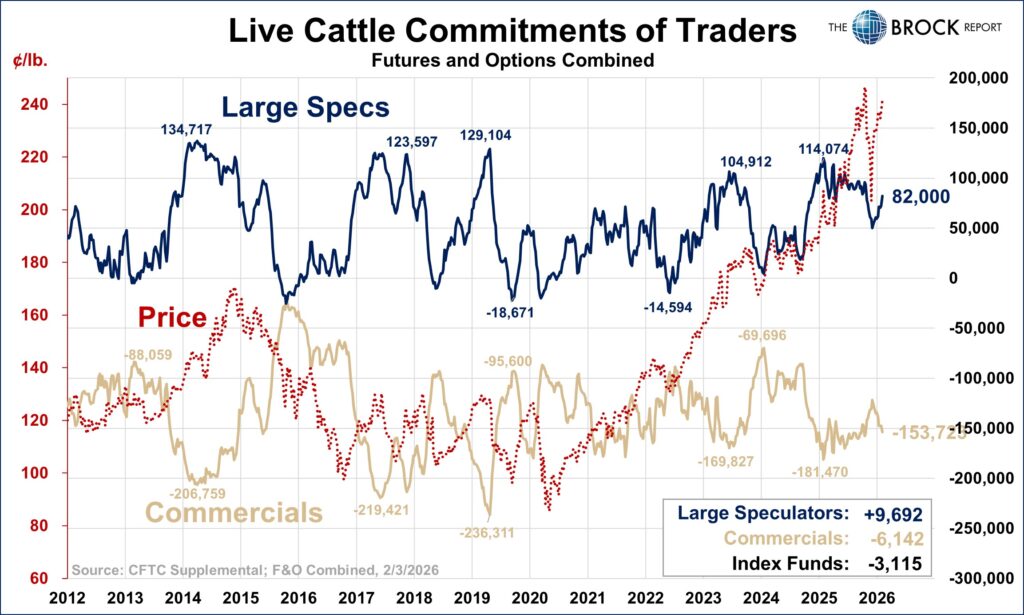

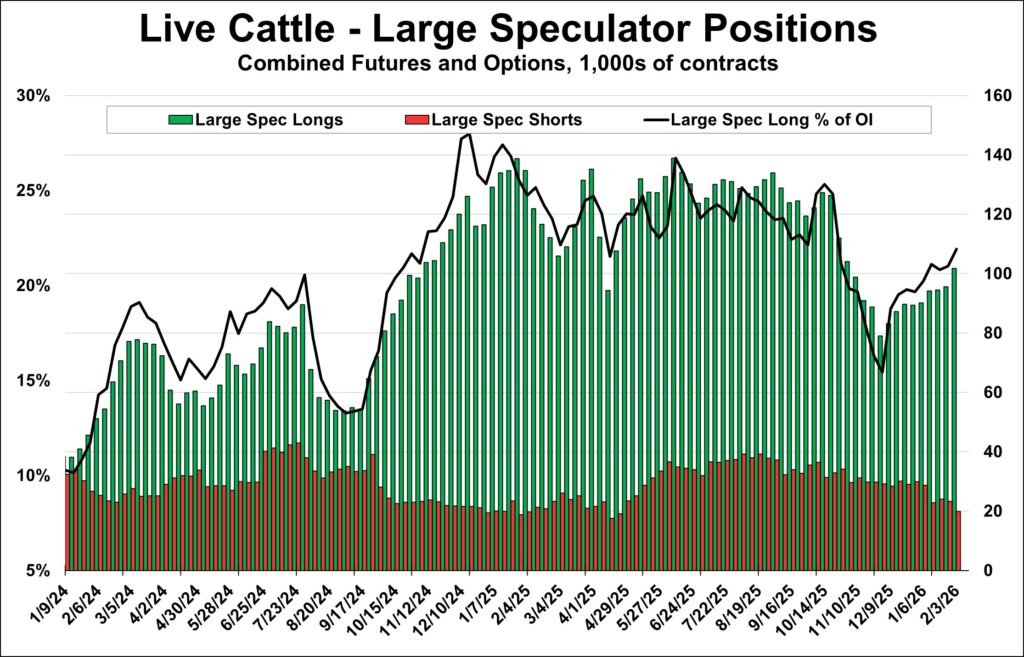

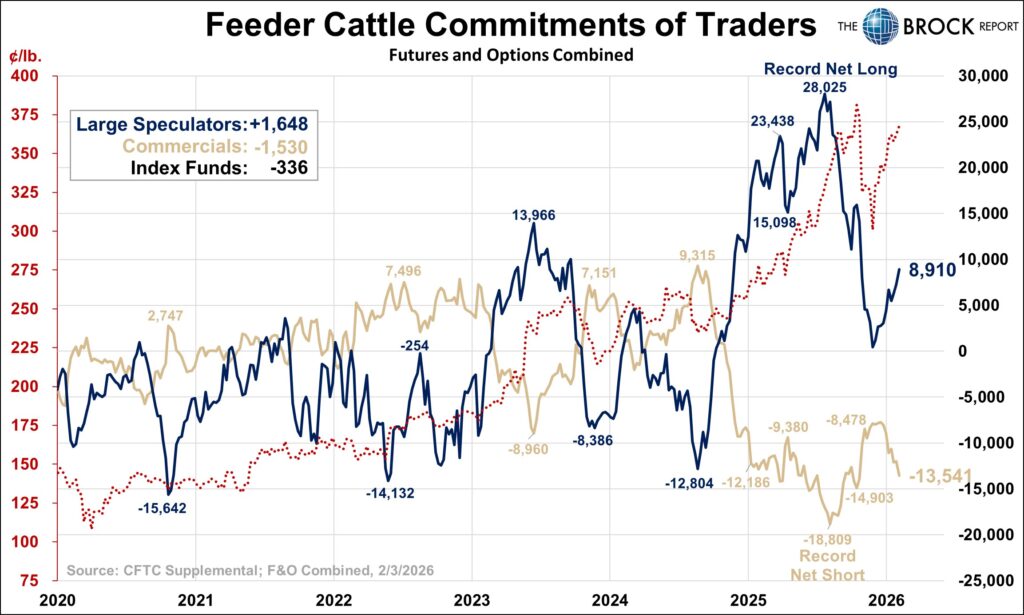

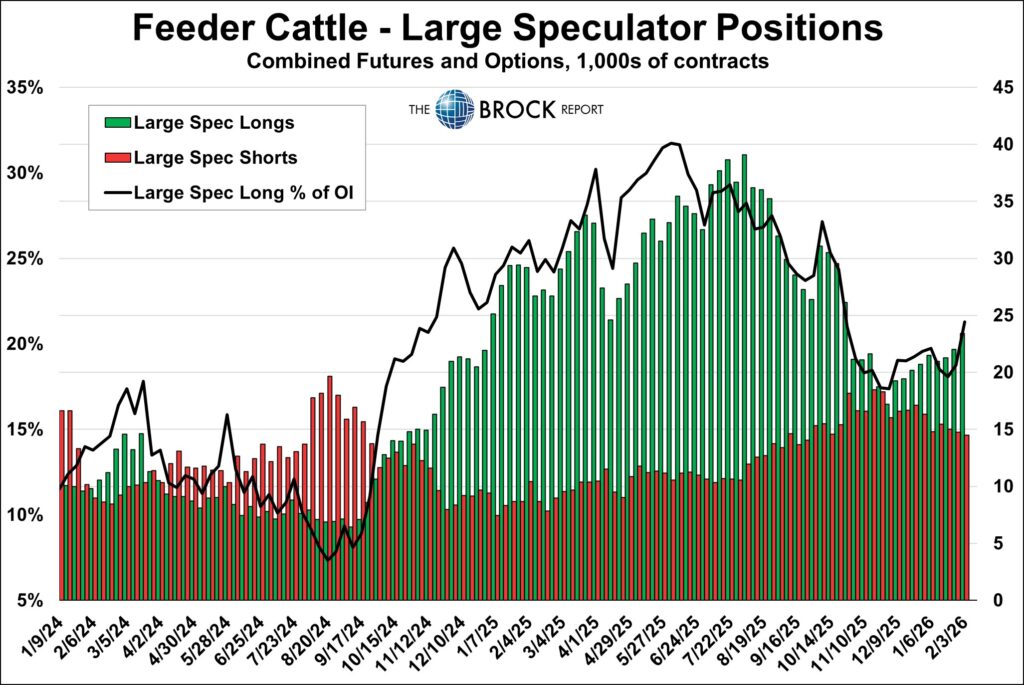

Cattle Complex

A bit of buying this week across the cattle complex. In both live and feeder cattle, large speculators have increased exposure, and since the start of the year the percentage of long open interest held by large specs has surged. Positioning in live cattle is already back near prior highs, while feeders still have more ground to recover after the recent liquidation cycle. With prices once again approaching new highs, speculative participation continues to rebuild alongside the rally.