The January Crop Report invoked “fear” amongst many traders and producers. The sharp increase in corn and bean supplies was a surprise to everyone. That’s the bad news. The good news is that the negative supply news is now known and built into the market. The main market drivers are always the fundamental changes that we don’t see coming.

With this news known, and the supply situation essentially locked in, the odds are reasonably high the seasonal bottom in both corn and soybeans is in. There were many panic sales made following the report. It is not easy to try to stay calm in that type of market, with that kind of news.

The emotional concern that most people go through after a report, such as the January one, is the fear of “having missed the market.” In most cases, a good rule of thumb is to take some deep breaths and let the market take a couple days to settle down. Some other observations:

1. Two days following the release of that Jan. 12 report, corn and soybean prices both made bottoms, as well as wheat. Another strong indication that the news is now built into those price levels.

2. On Friday of the week the report was released, March corn futures charted a five-wave buy signal. A very bullish technical signal. (see charts page 6)

3. Since the release of the report, open interest in corn has been rising sharply, as has the open interest in soybean futures. We believe this is the result of commercial buyers building long positions, and we will get a look at that data from the CFTC on 1/30 just after this is printed. (See Saturday email.)

4. Look at the prices. The balance sheet on corn even with these large numbers would indicate an expected average price between $4.10 and $4.30. That’s where the market was trading after the release of the report. Once again, the bearish fundamentals are built in.

Key Fundamentals Are Changing

There are some key fundamentals that are changing in a very subtle way. Consider the following:

1. Crude oil prices since the first week in January have risen by 12%. Similar increases have occurred in diesel fuel and gasoline. Some of this can be attributed to what is occurring in Iran—maybe most of it. It’s not relevant why it has happened, it is more relevant that it has happened. Gold prices have increased by nearly 20% since the first week of January. These moves are inflationary.

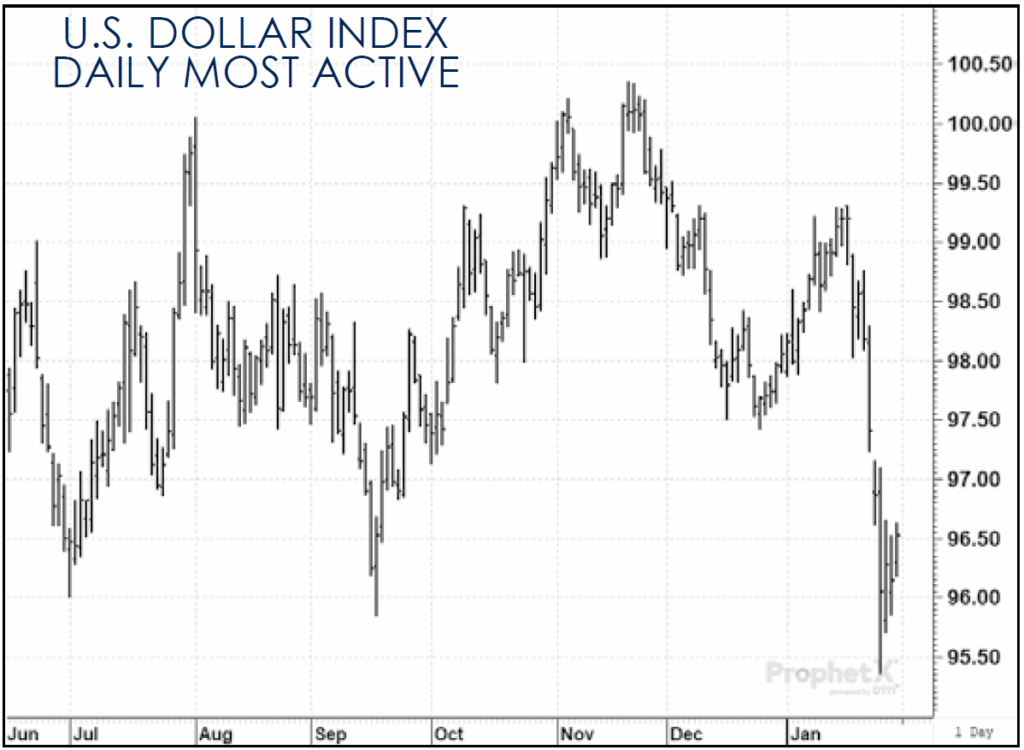

2. The U.S. dollar has dropped sharply (effectively also adding to inflation pressures) making agricultural commodities shipped from the U.S. much less expensive.

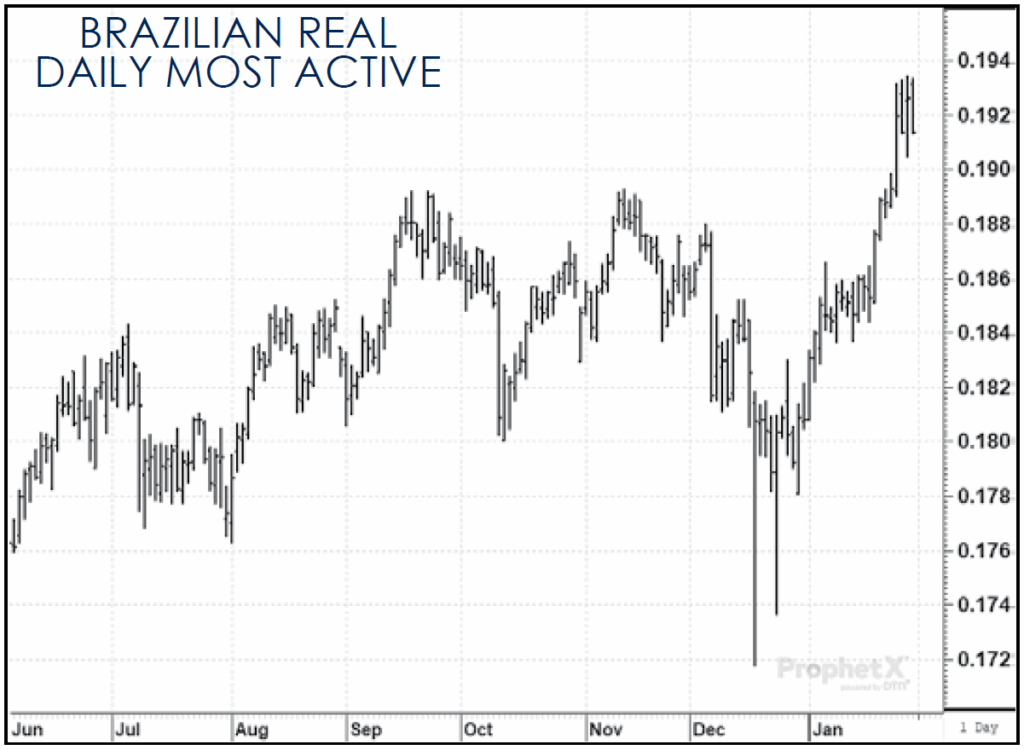

3. The Brazilian real has rallied sharply making their soybeans more expensive.

4. Corn exports are insanely strong. Well above last year’s record pace. Last week’s export sales were the largest since March 2021. Exports are up everywhere but China; this is not a localized demand spike, it’s global demand growth.

5. Despite the recent rug pull on efforts to allow year-round 15% ethanol blend, Trump promised farmers this week in Iowa to get it passed. It is likely going to happen, which will be bullish for corn demand, not immediately but long term.

6. Ethanol export demand has been very strong. Trump is pushing hard for more ethanol exports to Japan, and Japan’s yen has been strengthening versus the dollar. Also, bullish corn.

The bottom line: Almost everyone in the business is underestimating the potential for increases in demand for both soybeans and corn. Almost everyone is also focused on the bearish fundamentals and overlooking the fact that these fundamentals are known and built into today’s price.

In two months, odds favor the balance sheets looking different. They are constantly changing. We are currently publishing an estimated carryover of 2.027 billion bushels in corn. We raised our Feed and Residual to match USDA this week. Our export number is currently 200 million bushels higher than the USDA’s, and frankly it is likely still too low based on shipment and sales data. The USDA will almost certainly raise corn exports again, and more than once, like last year. If we end up being too low at 3.4 billion bushels, and all of a sudden, the ending stocks situation starts to look supportive, if not bullish.

In the case of soybeans, while the export pace was abysmal until 3 weeks ago, the last few weeks really increased the odds of getting to 1.6 billion bushels. This includes last week’s sales that were the highest for any week since November 2023. If exports hit 1.6 billion and crush reaches our forecast of 2.6 billion verses USDA is 2.570 billion that takes the carryover to 295 million bushels. That may be wishful thinking, but we believe the odds are better than 50/50 that could occur with continued counter seasonal demand from China.

The important piece of information to remember in all of this is that the bearish supply numbers are obvious, well known and almost certainly built into the current price structure. Old news is no news. It’s the news that we don’t know that’s going to drive prices.

Potential Bearish News

Yes, there is some. The bearish fundamentals to watch out for in corn are acres and feed and residual. With current price ratios, odds favor the same or actually more corn acres this coming year. With the government payments favorably impacting the financial picture of many farmers, and current price ratios favoring corn, the odds of lower corn acres are further reduced. We’re likely to see a slight increase in corn acres and a slight decrease in soybean acres. This is another fundamental that, however, will help drive soybean prices higher. Regarding feed and residual, a 746 million bushel increase year over year seems dubious at best, but Q1 usage supports that increase so we’re matching USDA for now.

The potential bearish news for soybeans is that exports fall farther. We’ve been saying for months that the USDA was too high, and, in the latest USDA report, they did lower exports by 60 million bushels. Since then, as mentioned above, the picture has improved. Just too early to call the ball game on this one. A lot can change here.

Putting it All Together

Market volatility is going to be high, and decisions are going to be emotional. Is this the kind of news that is going to drive corn to $5.50 or higher? No. Not quickly, anyway. If prices can get back into the high $4.00 range, we will be fortunate. We will almost certainly recommend advancing sales if nearby futures reach $4.50 and the bottom line is we are not concerned corn futures are going to fall out of bed and start with a $3 handle.

In the case of soybeans, this doesn’t mean $12.00 soybeans, but it could mean $11.50 soybeans. As is always the case in soybeans, a few strong export sales reports and we’re looking at significantly higher prices, or a couple cancellations and we’re looking at significantly lower prices.

Sidebar: Outside Influences

As laid out on page 19 this week, it was a wild week in a number of markets. Gold and silver rocketed to new all-time highs, only to plunge on Friday in what looked to be the worst one-day performance for silver ever. The dollar index fell to a four-year low, and crude oil surged to a six-month high.

The grains markets were relatively unaffected by all of this, although the weakness in the dollar was likely supportive, particularly for wheat. The extreme moves in those other markets do inject some unpredictability into the grains, however. A weaker dollar, particularly versus some currencies such as the Brazilian real and the Japanese yen, is a potentially supportive factor for grain prices and boosts our export prospects. Further gains in crude oil could support markets such as corn and cotton. On the flip side, a reversal in those trends could put renewed pressure on the grains.

Beyond any direct impact, these moves are also a reminder of how shifting money flows from investors can affect the grains markets for good and for ill. Have a plan but be prepared for the unexpected. The balance sheet fundamentals for grain and oilseeds may point in one direction; currencies, other commodities and financial markets can send our markets in unexpected directions.