Weekly COT Highlights – Week Ended Tuesday, March 11

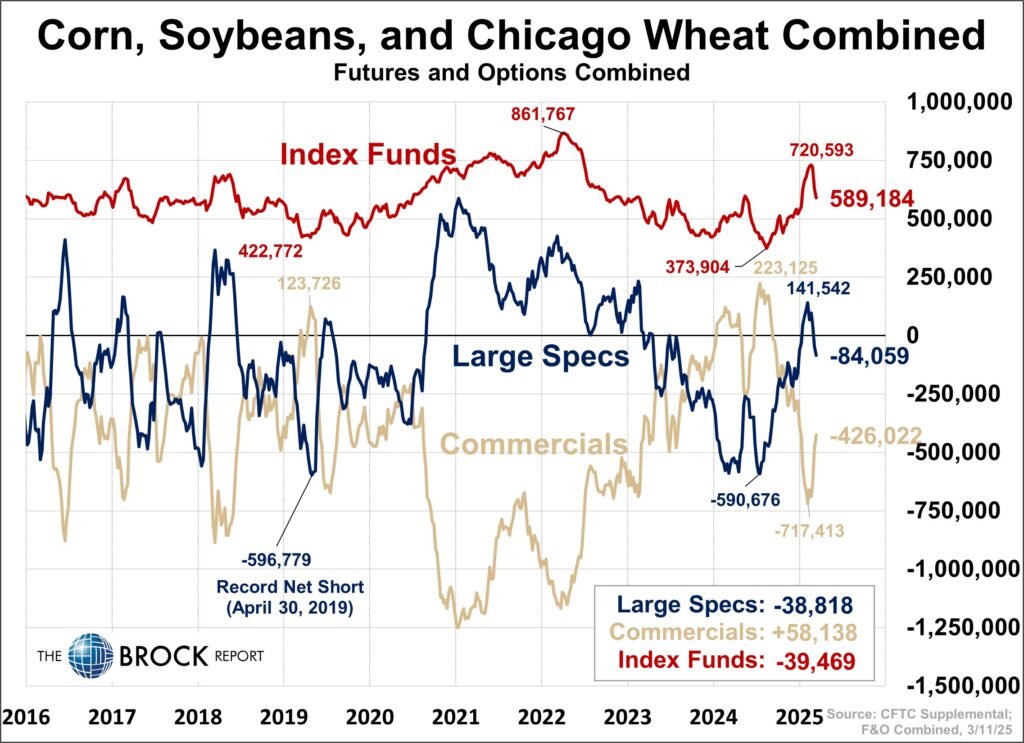

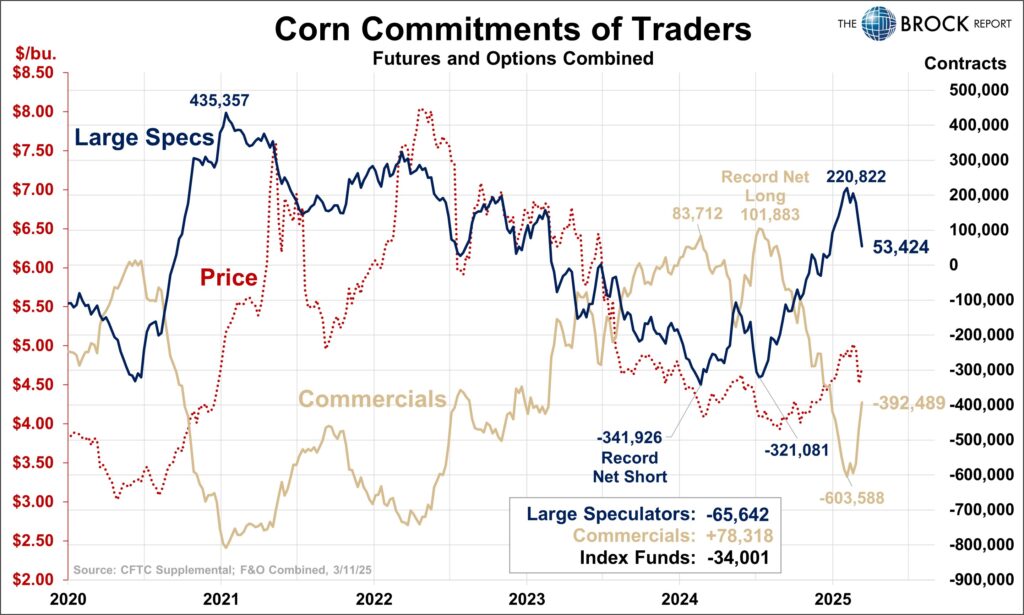

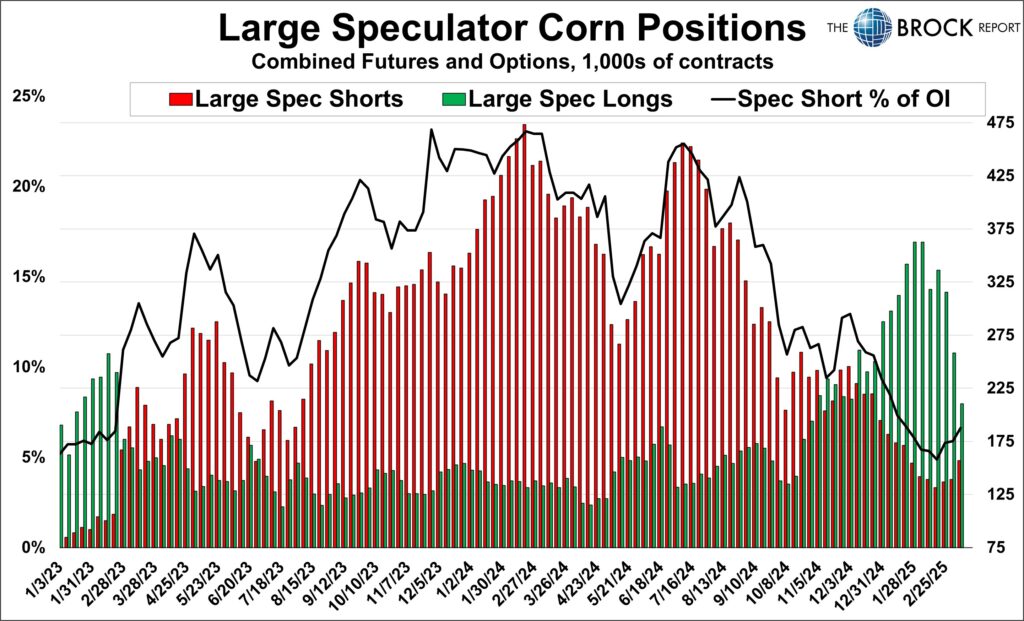

When we say “the rubber band is about to snap”, this is how extreme it can be: Large specs and index funds again were massive sellers this week in corn, capping a two week period that saw a combined net selling of 221,741 contracts of corn between the two groups. That’s more than 1.1 billion bushels of corn.

Click Here to watch a video explanation of the COT reports.

Click Here to see last week’s COT Analysis

Main Takeaways this Week

- Massive selling in Corn continues

- Soybean COT in no-mans-land

- Cotton poised for a massive rally

- Fat and Feeder cattle COT’s show significant divergence

Corn

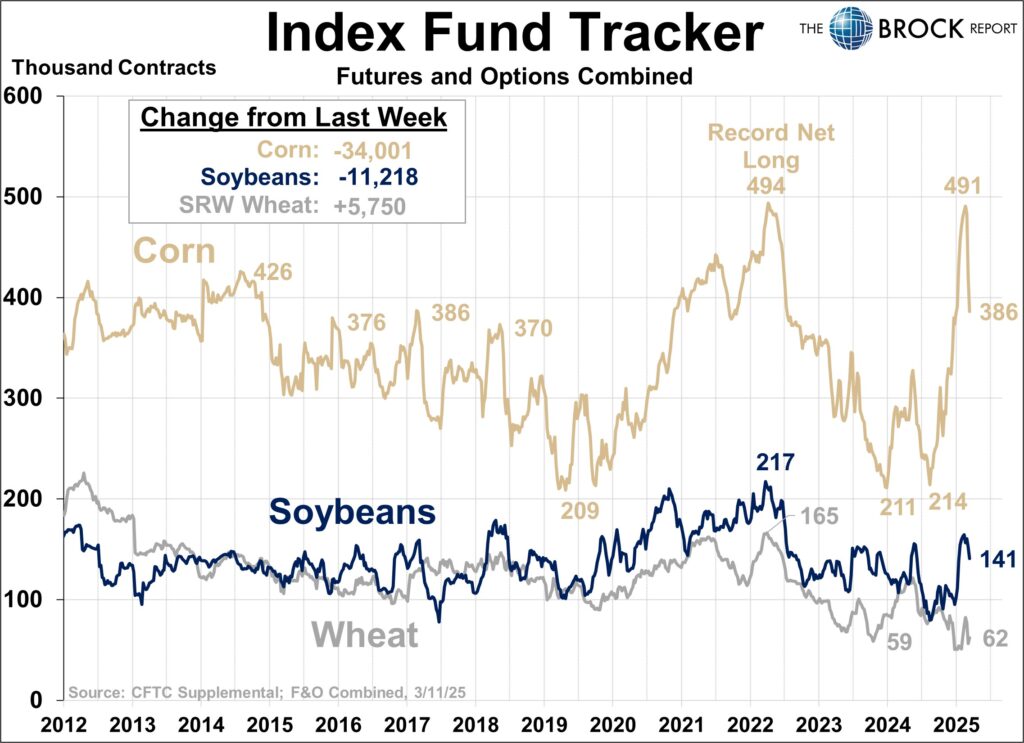

As mentioned above, index funds and large speculators could not get out of their long positions fast enough as the tariff rhetoric picked up. They combined to sell over 95,000 contracts this week, and over the last two weeks they’ve sold over a billion bushels of corn futures and options.

As discussed in this weeks Brock Report, both groups still hold sizable long positions, so we expect to see continued selling pressure from this group. With the planting intentions report looming, and numbers like 94-95 million acres circling, a price trend that is decidedly lower and uncertain political environment…why wouldn’t they liquidate? Perhaps more concerning is that large speculators increased their short exposure this week as well. All things said.

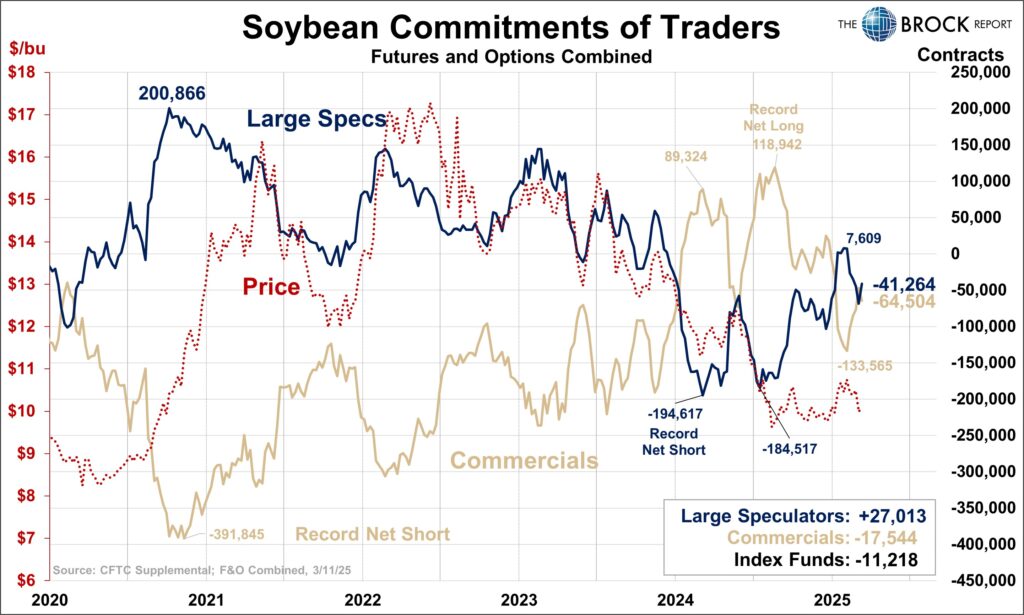

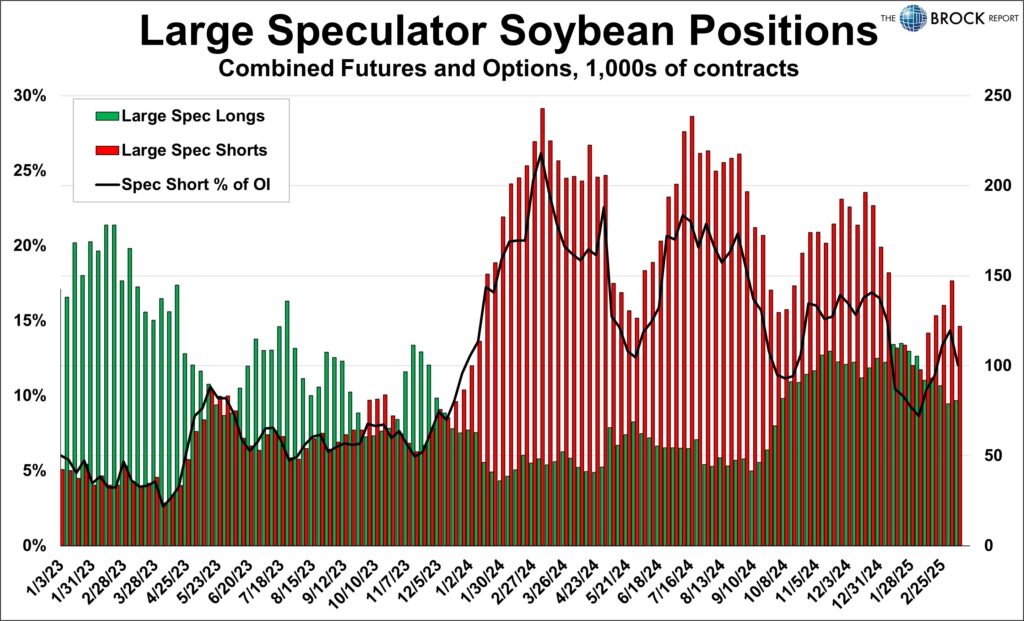

Soybeans

Large specs were actually net BUYERS in the week ended Tuesday, almost entirely through short liquidation. We would put this report in the “tells us nothing” category at the moment.

The good news is technically the $10 level has held in the old and new crop contracts, and it’s an important level for both. If you are familiar with head and shoulder formations, beans charted an inverse H&S, where the shoulder level is right at $10. If we break that level I think we can expect funds and specs to aggressively sell and push prices lower.

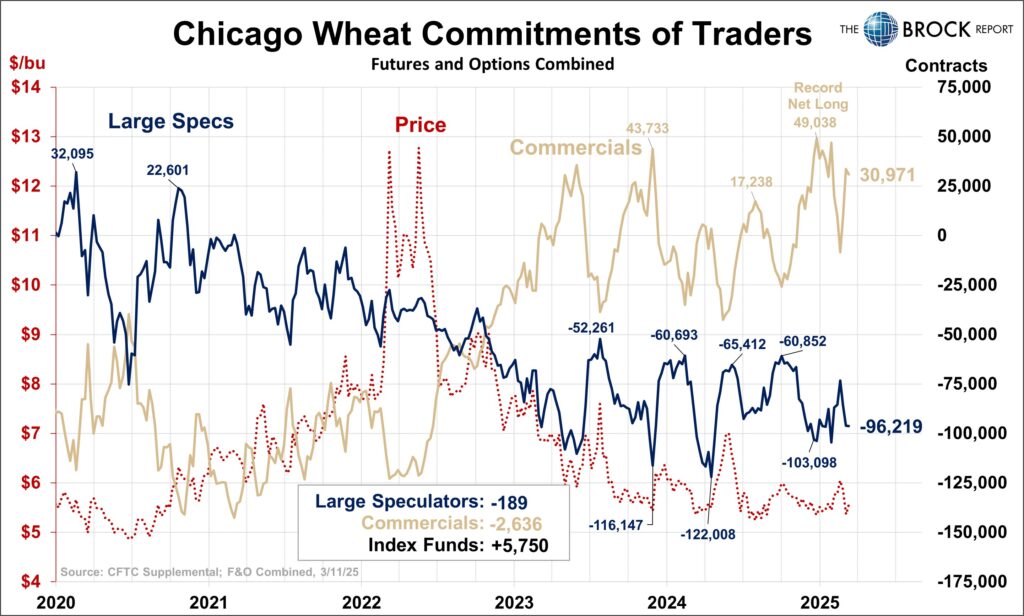

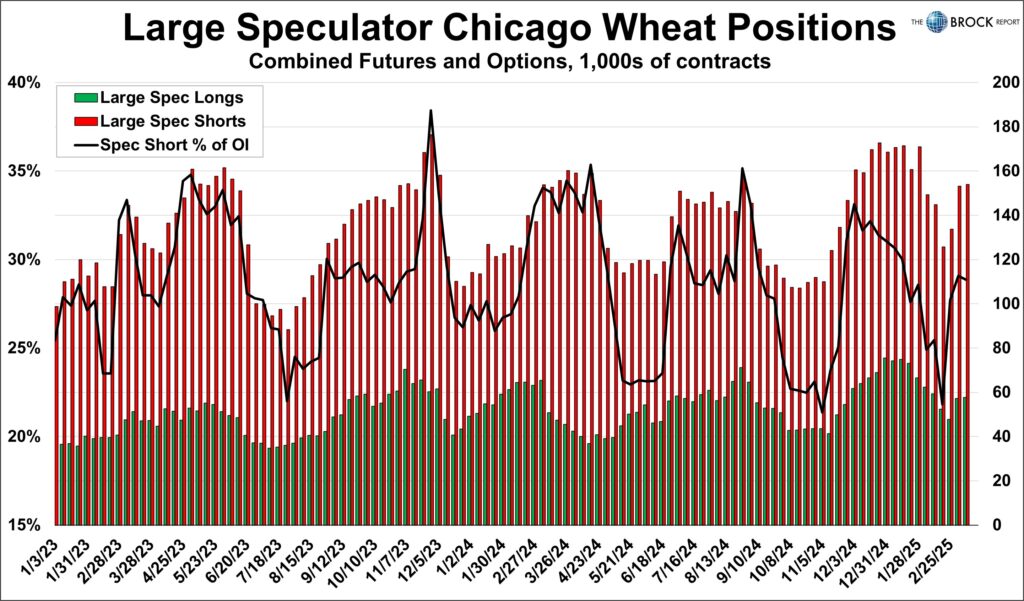

Wheat

A ho-hum week for wheat. Specs did essentially nothing to the size of their long or short position sizes. Index funds were modest buyers, and currently hold a historically small net long. This COT setup is quite bullish with the funds holding a ton of dry powder, specs sitting sizably short, and commercials sizably long. The technical picture looks good as well, and fundamentals are somewhere between moderate to supportive at current price levels. Looking for higher prices ahead.

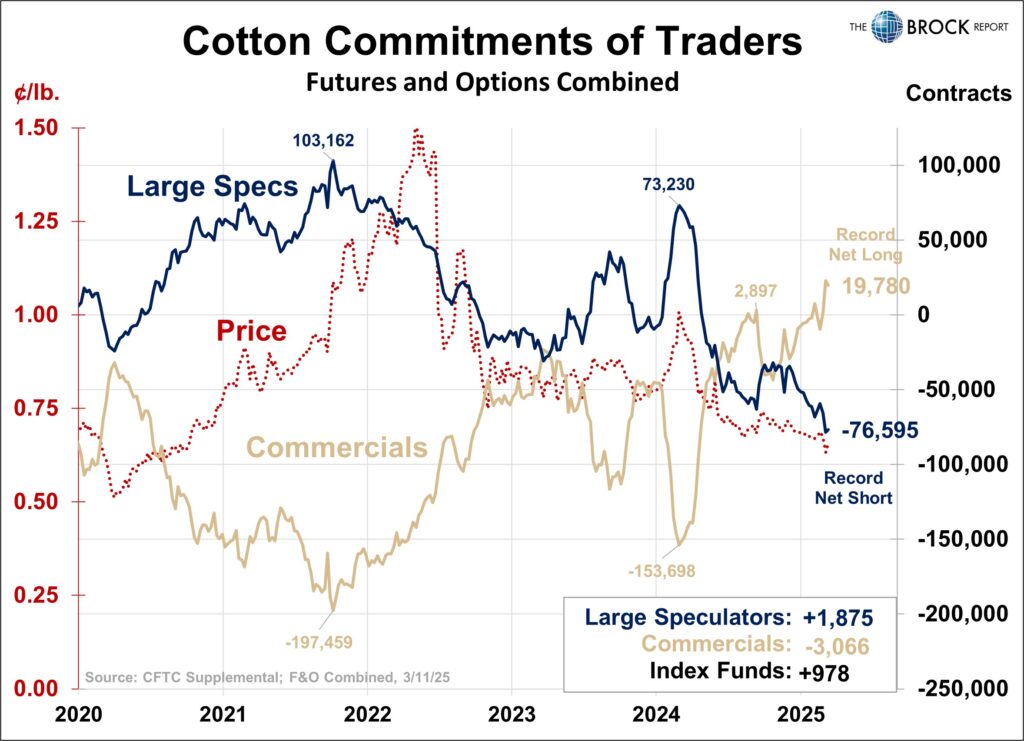

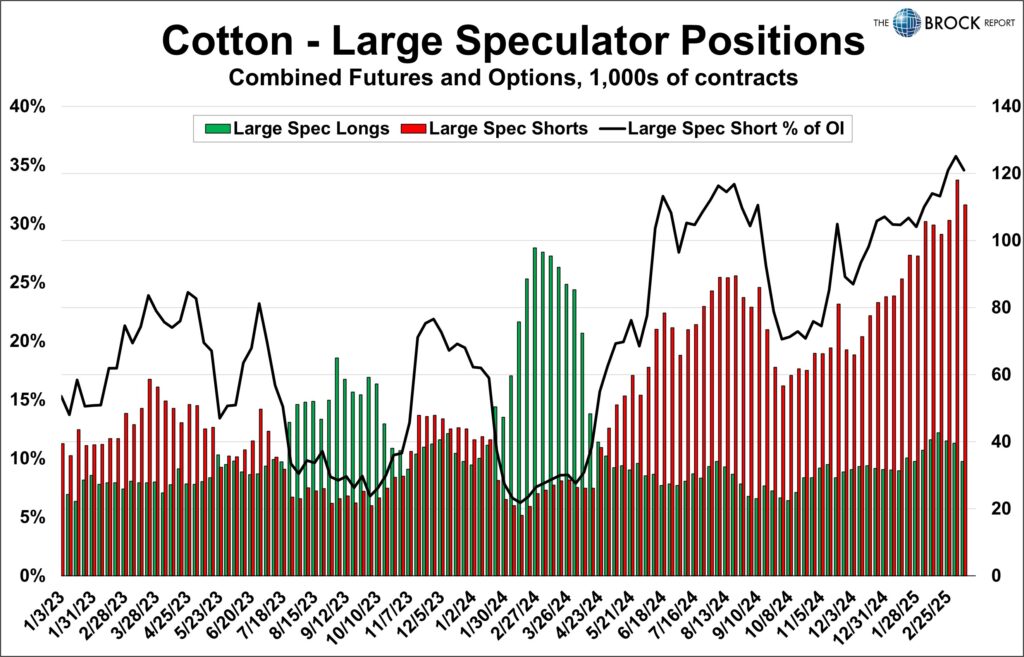

Cotton

Lets not get lost in the weekly changes here. After charging to new all time record short last week, specs were modest buyers int he week ended Tuesday. Price action continued higher through the week, breaking trendline resistance and the 40DMA which most active futures have not been able to do in months.

THIS LOOKS GOOD. We’d classify this COT as very bullish. It will take a July close over 70 to really light this market on fire. Hard to say if this could happen prior to March planting intentions, but as discussed in this weeks Brock Report, we believe acres will be below the current cotton council estimate. If the stars align futures could mount a massive rally.

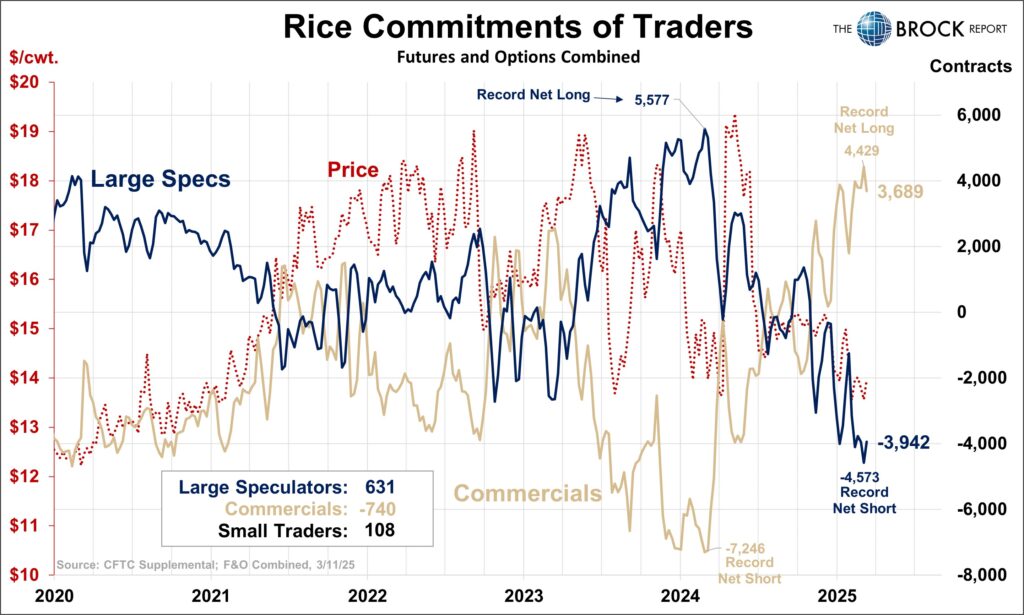

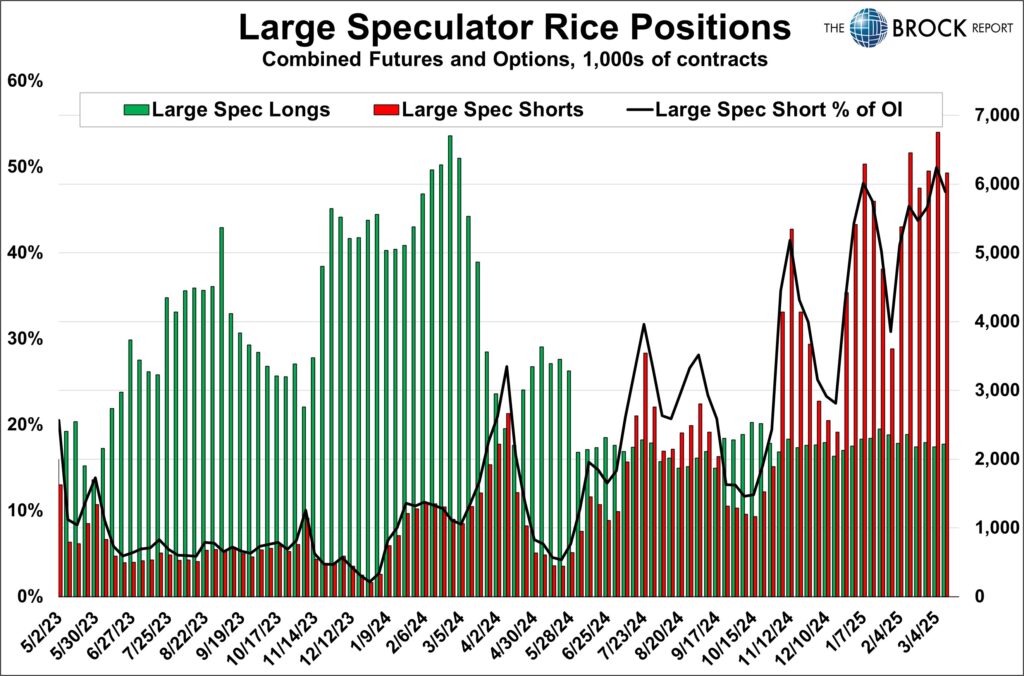

Rice

Specs have established new record net shorts more times than we care to count over the past few months, but this week were modest net buyers. Prices surged 7.8% from Friday’s low to Monday’s high, but drifted lower from Tuesday on. Spec shorts alone are 44% of total open interest, massive but not unheard of in rice. This is a classic ‘bullish rubber band’, but we aren’t as confident that rice specs drive price action as we are in other markets like corn, beans and wheat.

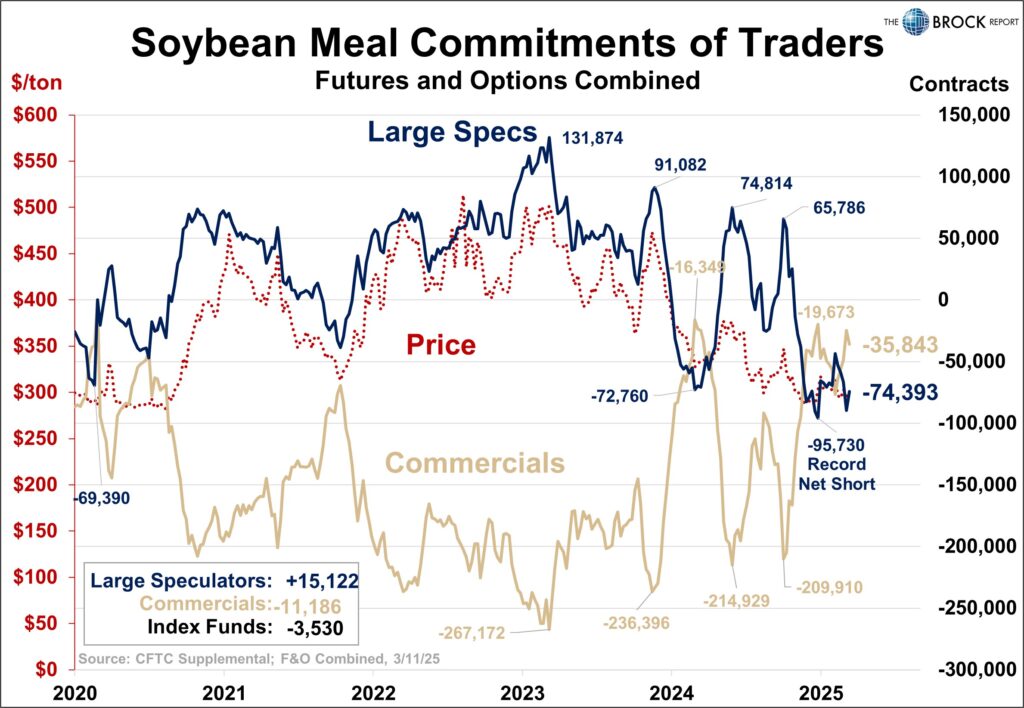

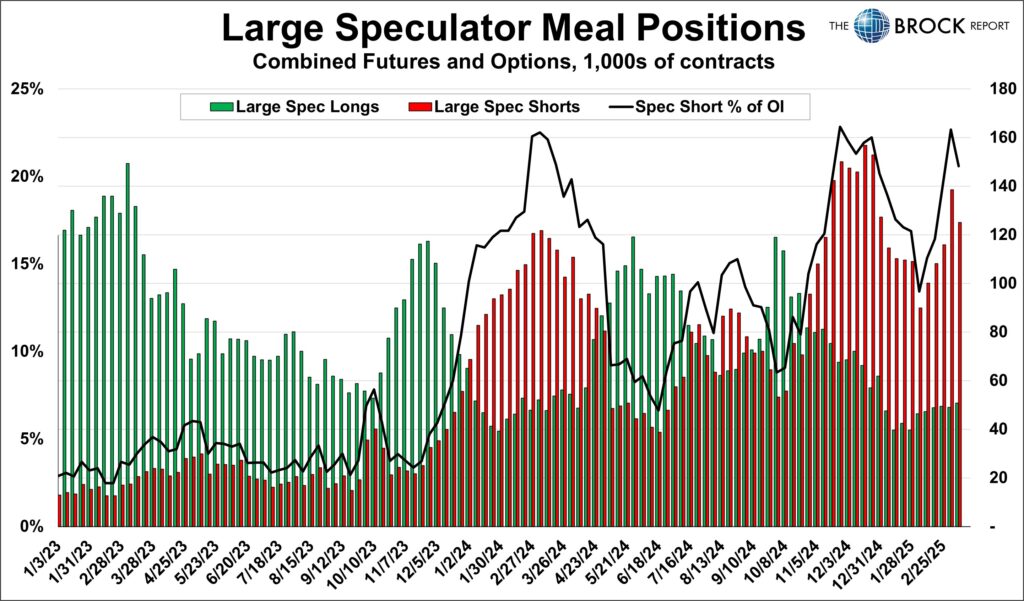

Soybean Meal

This is a very supportive COT and a big part of why we advised meal buyers to establish coverage earlier this week. Large specs were buyers of over 15,000 contracts after a 4-week stretch of selling 45,941 contracts total. We are not fundamentally bullish meal, but futures repeatedly have found support at $300 and this setup should limit downside. If July trades near 305 look to get on board if you need to buy meal.

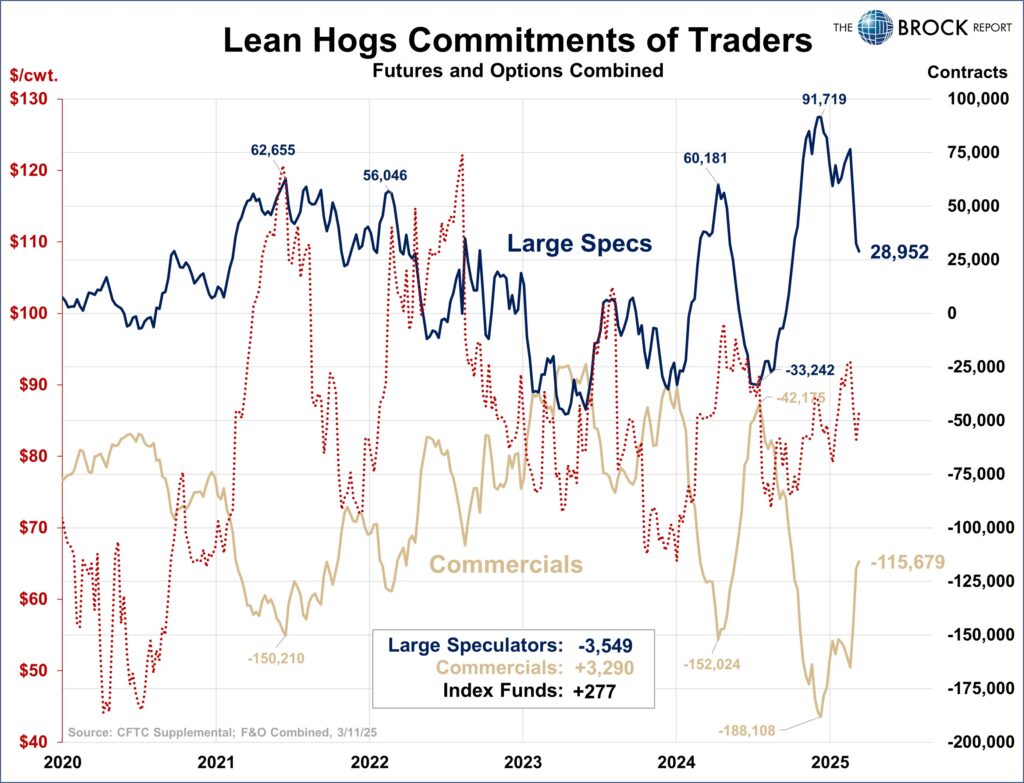

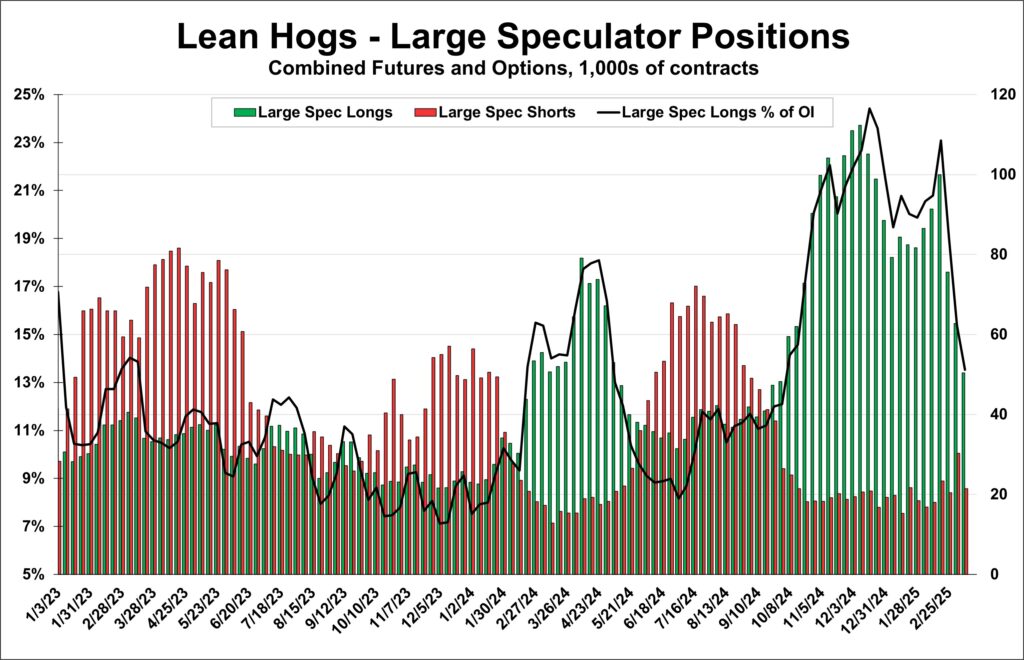

Lean Hogs

After the last two weeks spec selling of 3,549 contracts feels like a win. We’ve already seen spec selling pressure prices to the tune of ~$12, and while this remains a bearish setup, the good news is that this net selling has been almost entirely long liquidation and the size of the spec long is getting back to a more normal size. Last week specs added to their short positions in a big way which caused us a lot of concern, but they reversed that this week. All in all, feels like this unwind may be coming to a close in the next week or two.

Cattle Complex

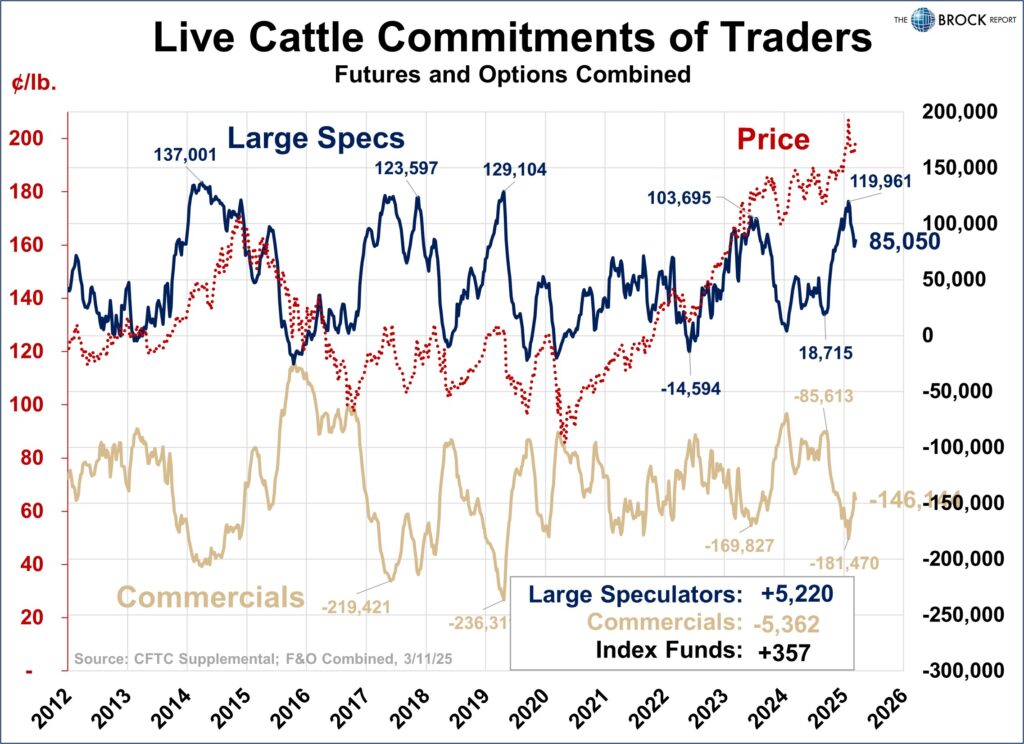

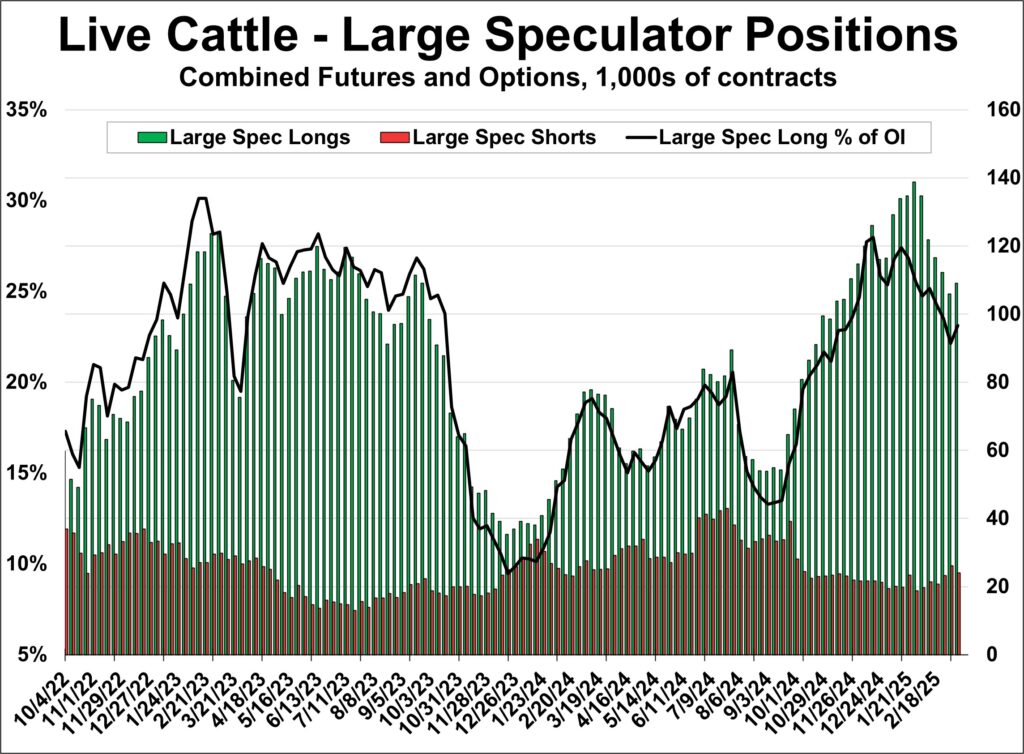

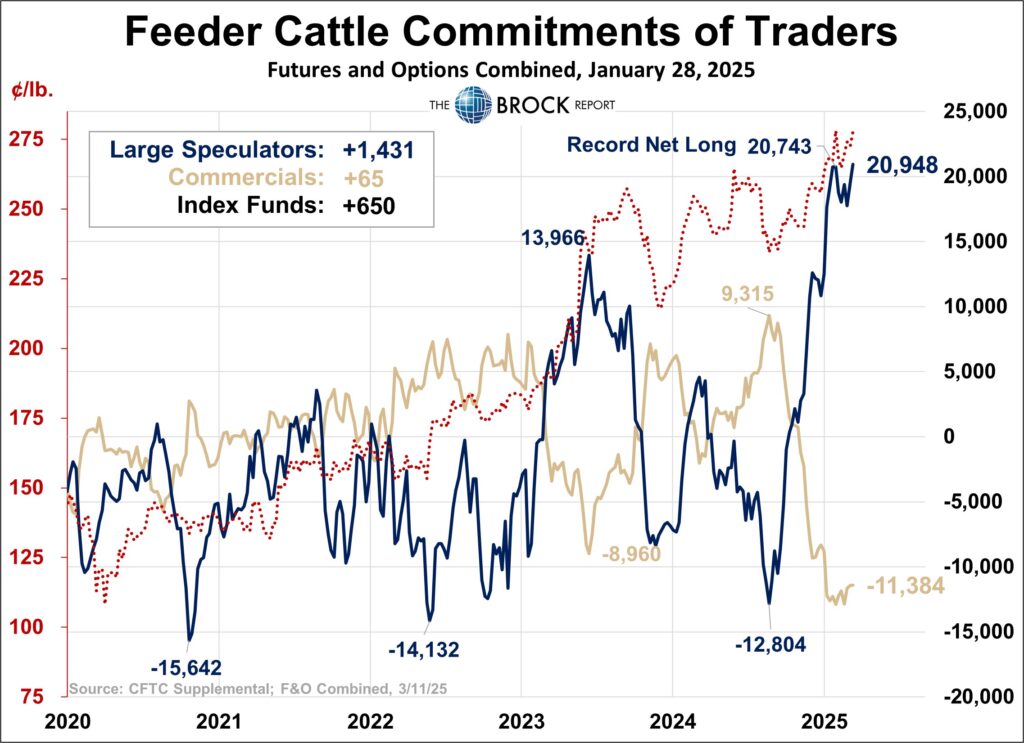

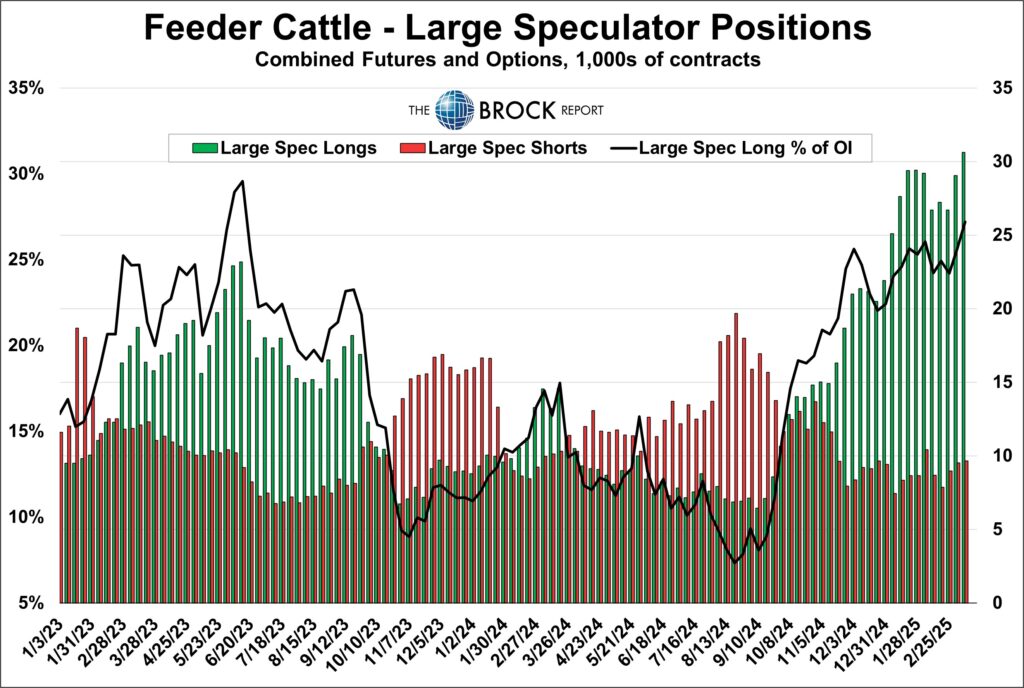

These are two different markets and this report is a good example of that. Large specs have been liquidating their long positions in live cattle, though took a break this week, and in feeder cattle they have continued to add to their longs, establishing a new record net long this week.

Both of these markets are, to overuse the phrase, a rubber band ready to snap. However, they are also a train that nobody wants to step in front of. This bull market turns 5 years old this April, picking tops in a market like that is tough.

We continue to hold put option protection in Live Cattle, smartly lifting short calls that were established at the same time after making most of the profits on those. In feeders we still hold the puts and calls.