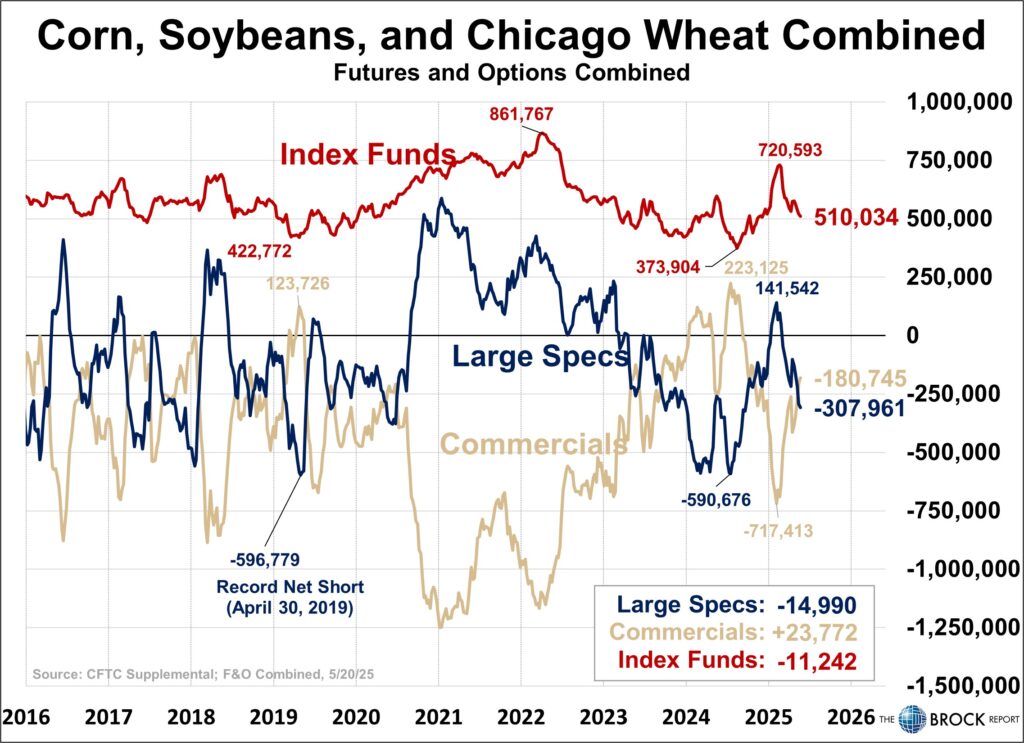

Weekly COT Highlights – Week Ended Tuesday, May 20

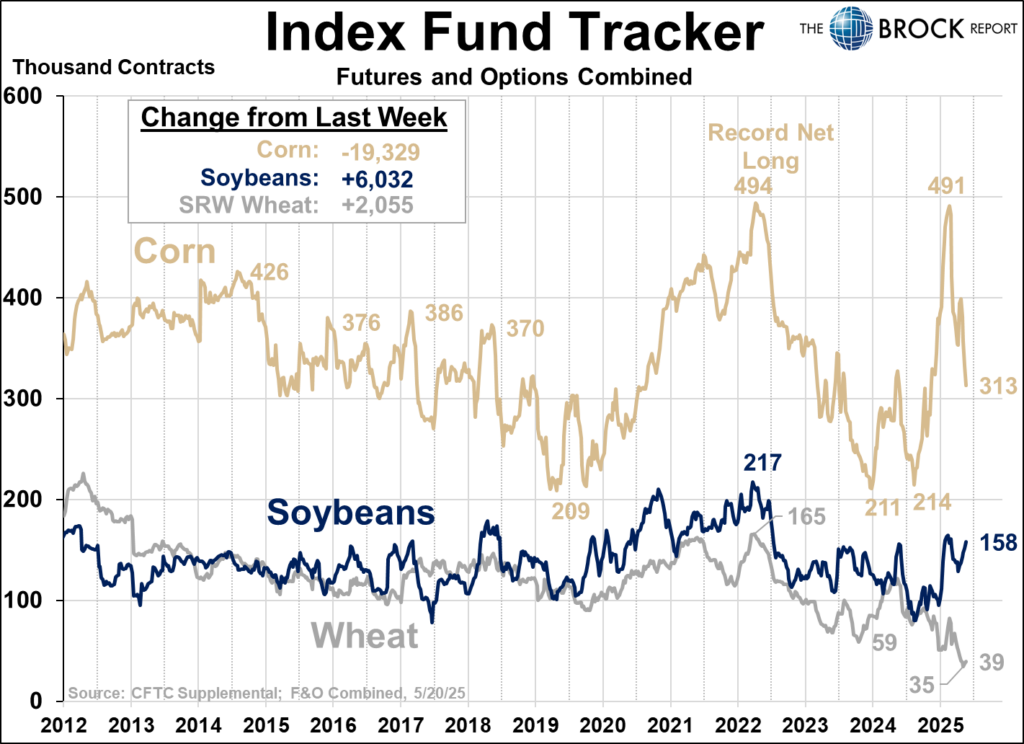

Index funds continue to sell corn for the 4th straight week, and buy soybeans for the 6th straight week. They have now been net buyers of week for the 2nd consecutive week, which hopefully marked a lasting low in their ownership level.

- Signs show that specs may be turning a corner on corn and are ready to start buying.

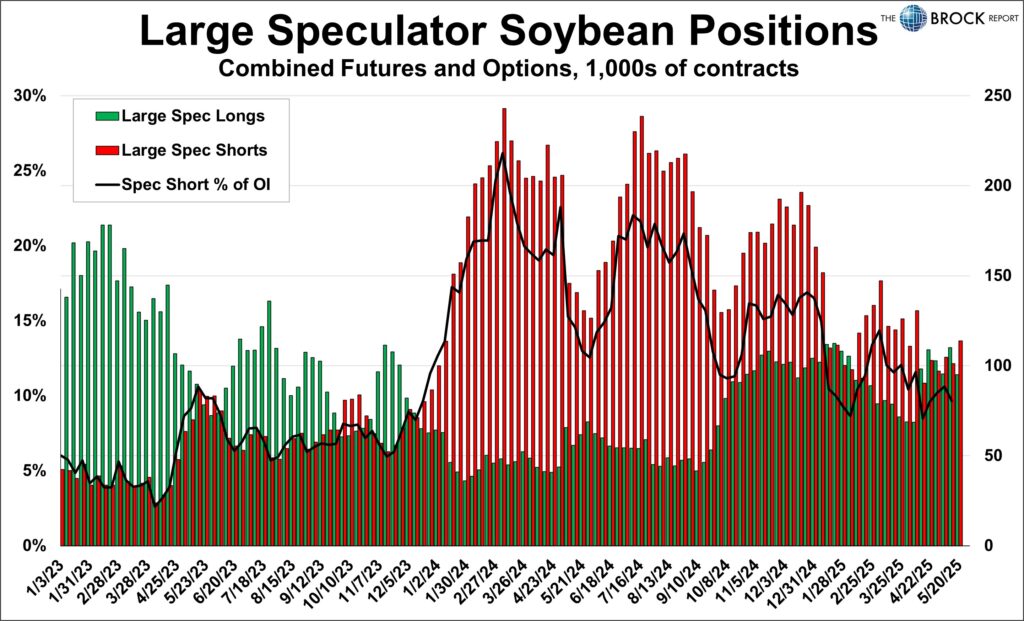

- Large Specs continue to flip-flop on beans, aggressive sellers this week.

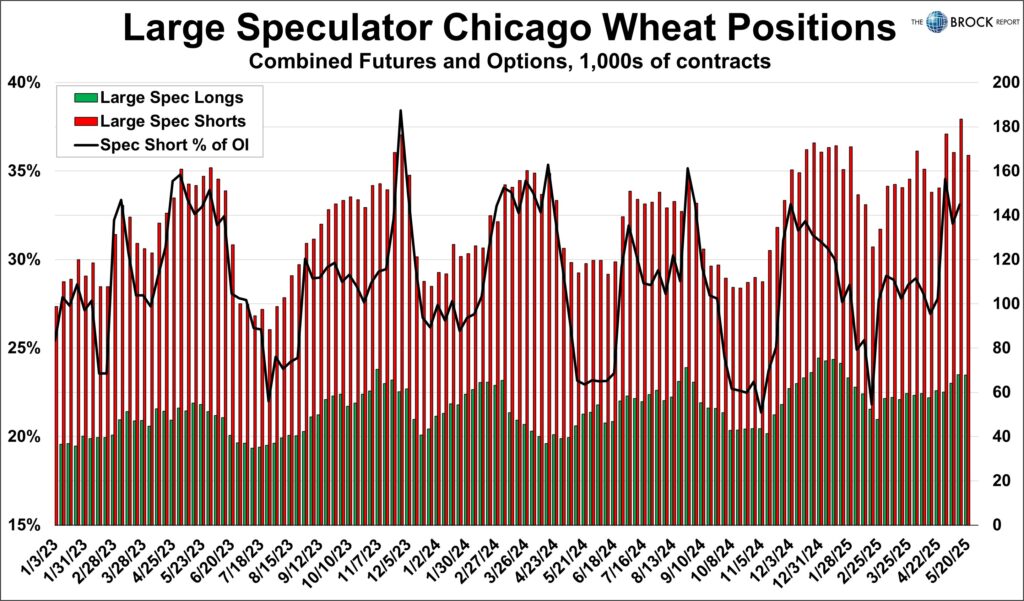

- Significant spec short liquidation in wheat may have begun and will move prices higher.

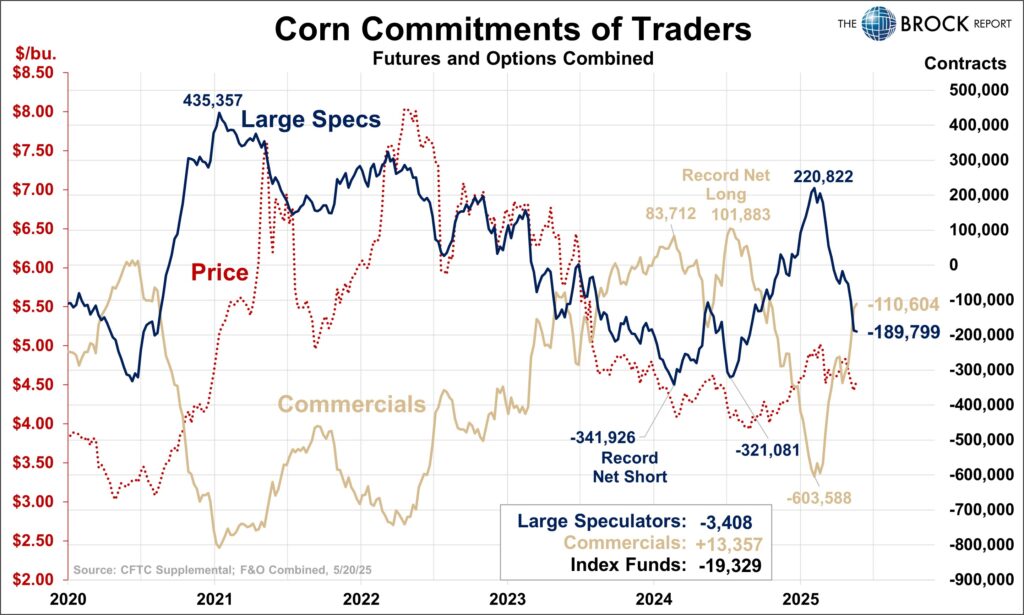

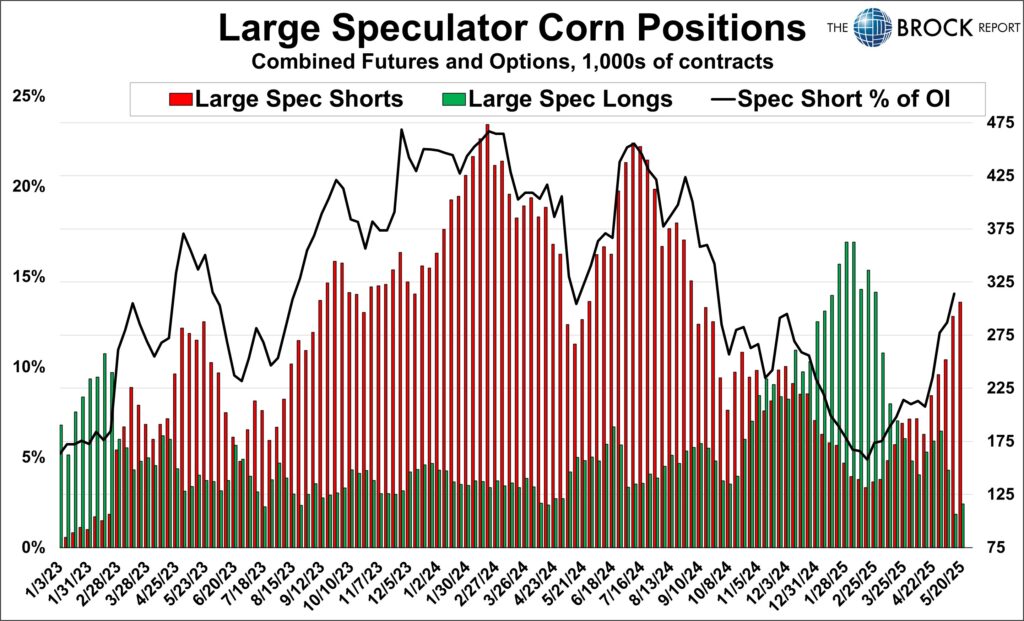

Corn

Large specs were modest net sellers but we are happy to see growth in the number of outright longs, coming off of a record few last week. This latest selling spree that started in Feb. was first hinted at when we saw not long liquidation, but new short building. Our hope is that moving forward this growth in outright longs is the signal that large specs are ready to start buying this market more aggressively.

Index funds left no doubt however, that they are not interested in long exposure, again aggressively selling corn. They’ve been sellers 11 of the last 13 weeks, combined net sellers of a total of 177,756 contracts of futures and options over this time frame.

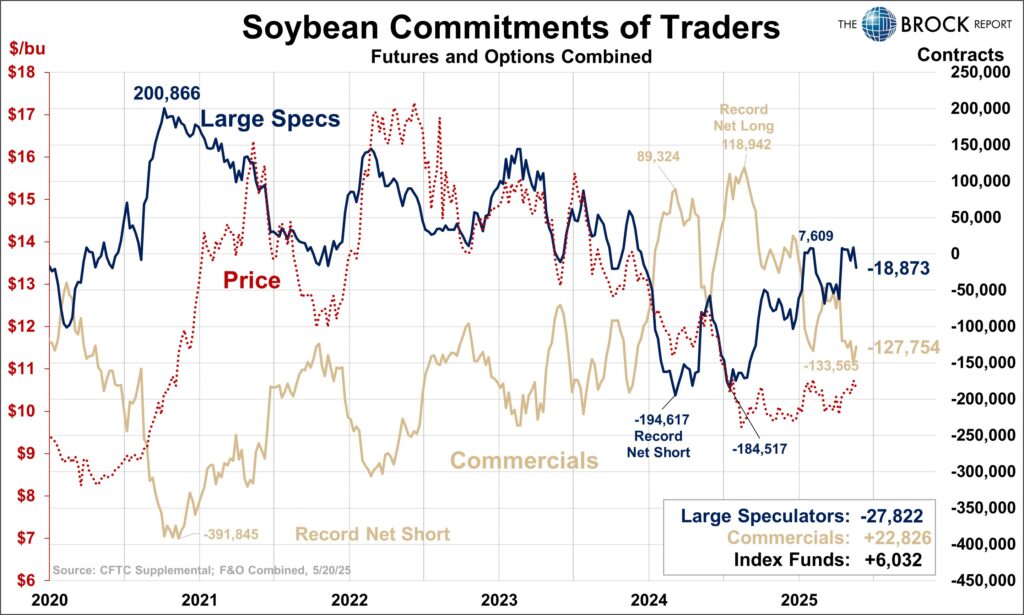

Soybeans

Large specs were aggressive sellers to the tune of a net 27,822 contracts, taking them from net long to net short soybeans. They have not shown any consistency week to week, their net position essentially remaining the same for the past few months. Unfortunately this week they increased the number of shorts and decreased the number of longs, not a good combination but one week is nothing to get into a tizzy about.

Index funds continue to show favor to soybeans, now net buyers for 6 consecutive weeks.

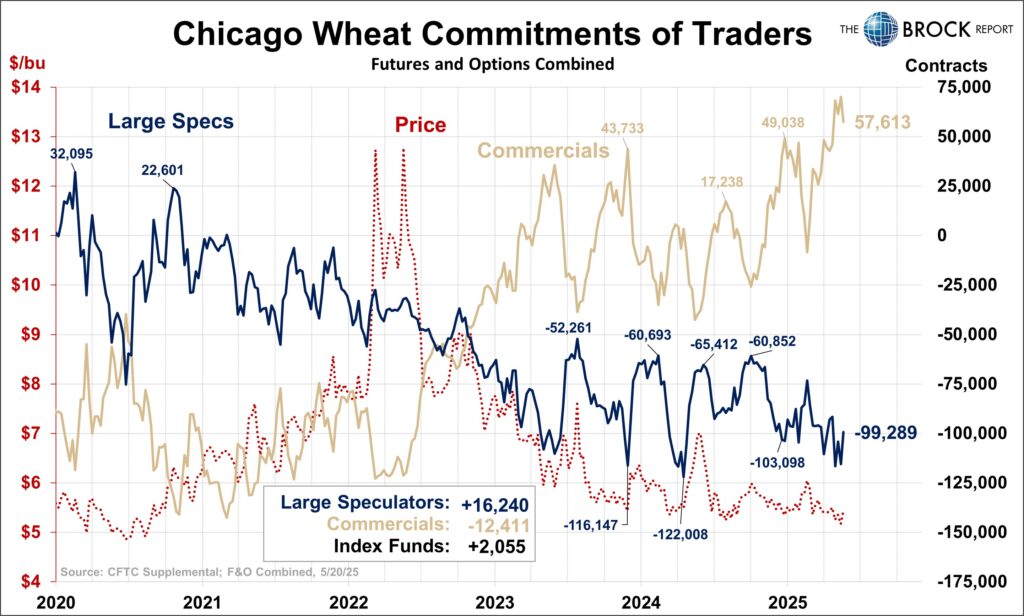

Wheat

Has the rubber band snapped?? By the looks of it, yes. We’ve been anticipating this move and the rebound in prices it should cause for some time now. Not so much predicting that it will happen now, but raising the warning flag that it WILL happen, at some point. This weeks net buying from specs was entirely short liquidation. If this unwinding continues we would anticipate nearby futures in the $6.00-$6.25 area sooner than later.

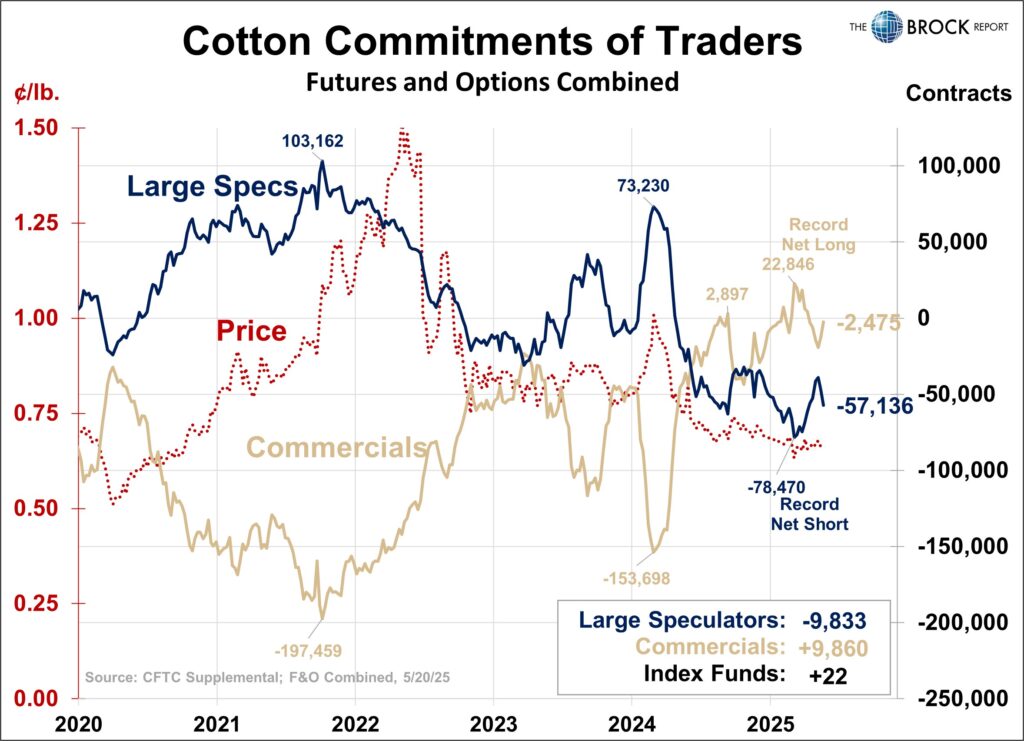

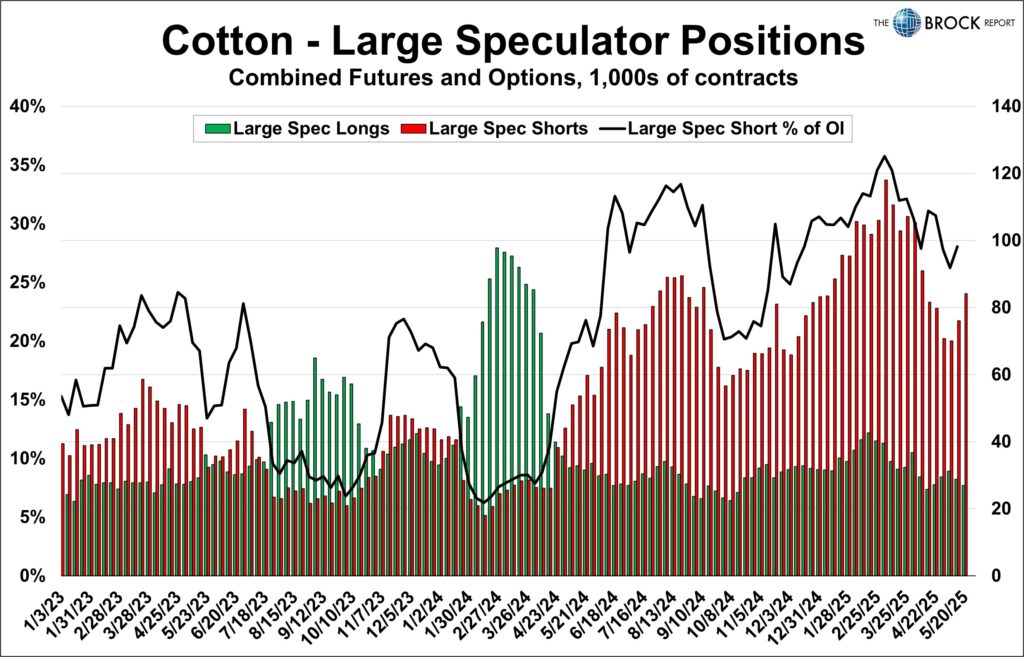

Cotton

Unfortunately our anticipation of large spec short covering/commercial long unwinding driving cotton prices higher has not unfolded. We got the unwinding of the spec/commercial spread, but we did not get the pop in prices that we had hoped it would drive. Large specs have turned an about face and have now been net sellers for two consecutive weeks. Futures are trading near contract lows and we anticipate that those will hold.

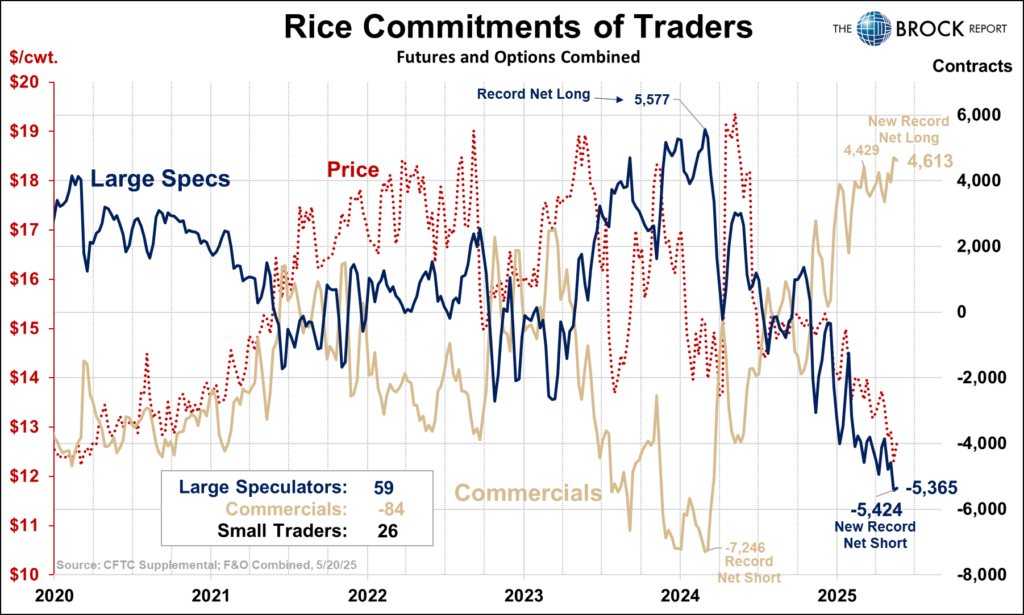

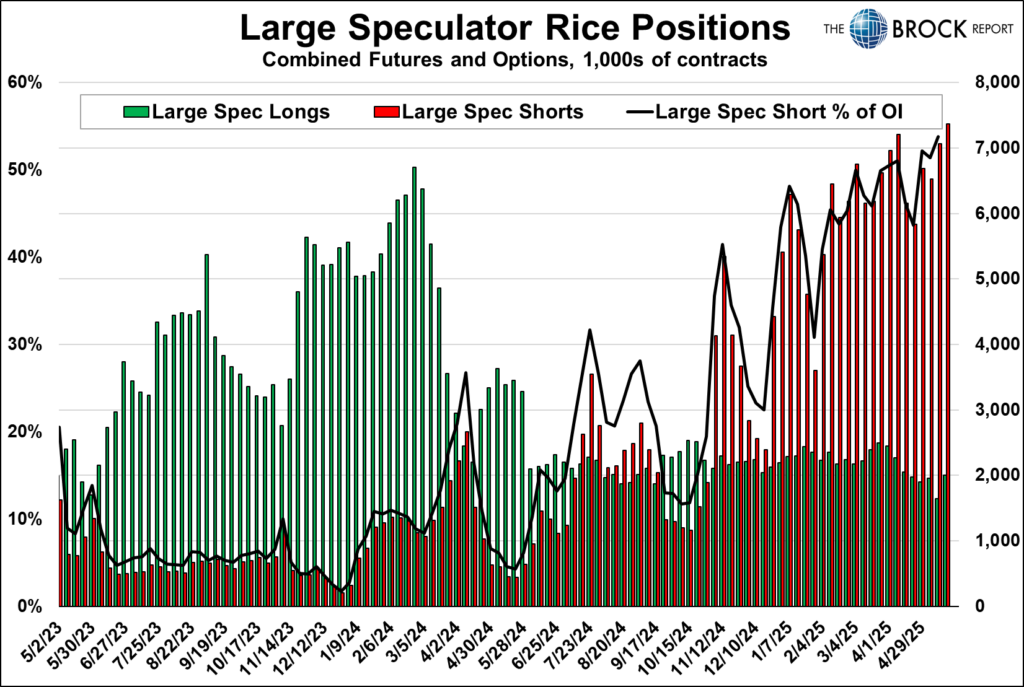

Rice

The future looks relatively bright for rice, as futures have rebounded this week and there are signs that large specs are bargain hunting. While the did increase the number of short positions, growth in longs outpaced that and as a result they were modest net buyers. We’d rather see new longs than short liquidation. Spec shorts as a % of total open interest is at a record high 55.94%!!! Short liquidation is a given, just a question of when that starts and how much will it pressure prices higher. At the very least we feel confident at this point that the low is in.

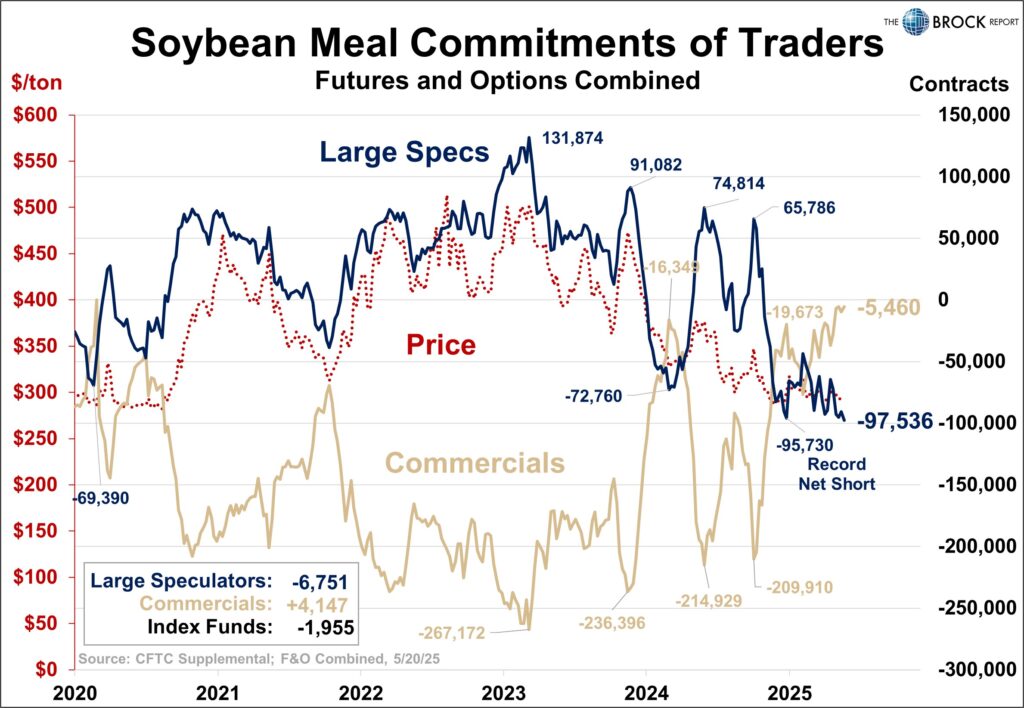

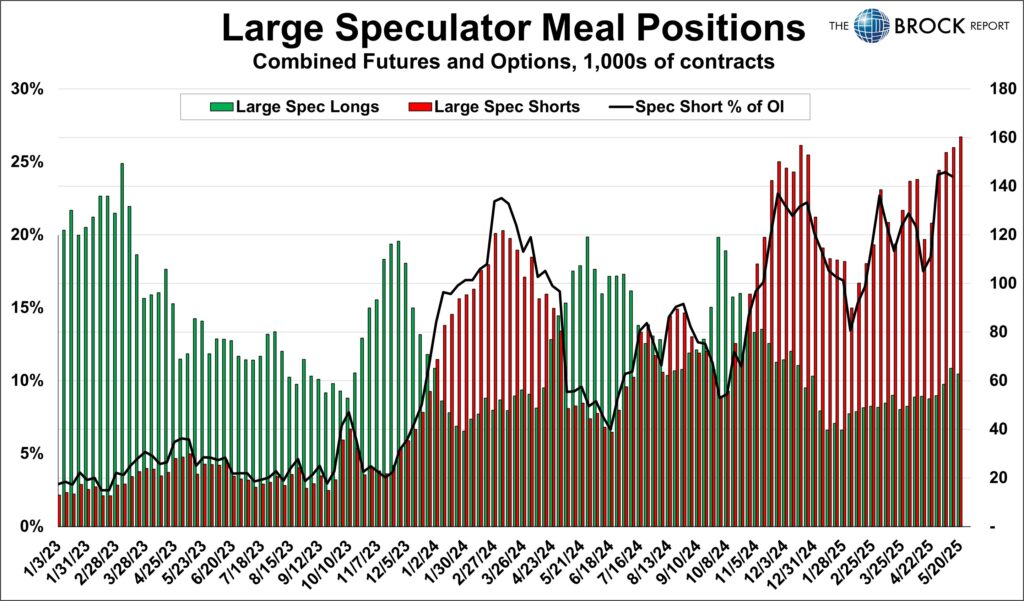

Soybean Meal

Nearly a new record net short as large specs were net sellers of 6,751 contracts in the week ended Tuesday. Futures rebounded nicely later this week and we remain very confident that the lows are in for soybean meal, due to this trader setup and the long-term price history. 280-290 has been a support area for nearby futures since 2010 aside from a few months in 2015 and 2016. Buyers should be aggressive here.

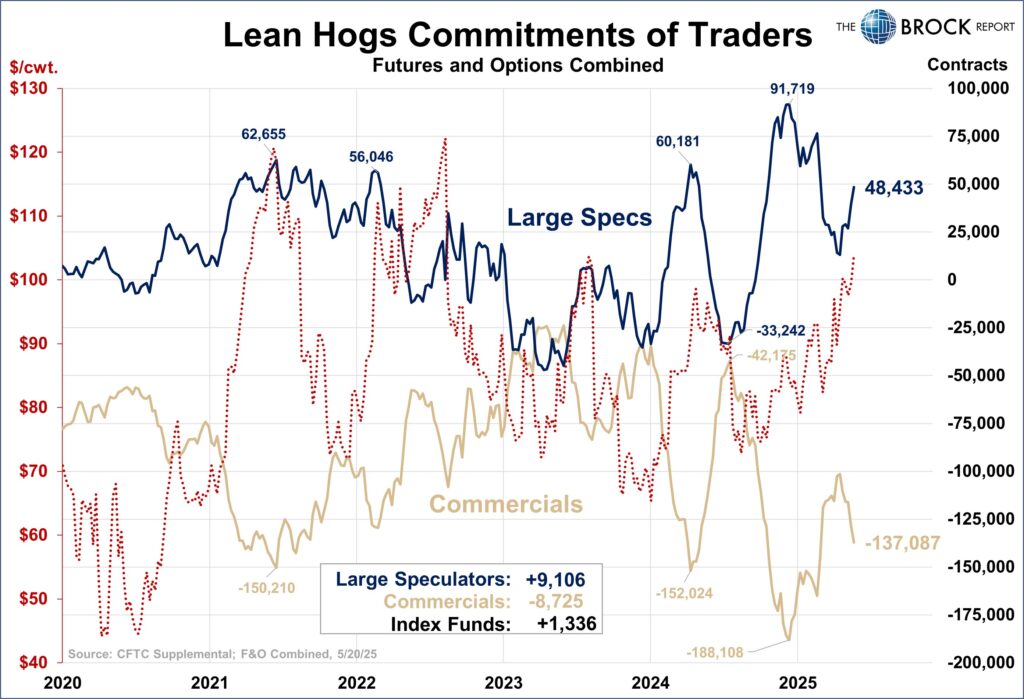

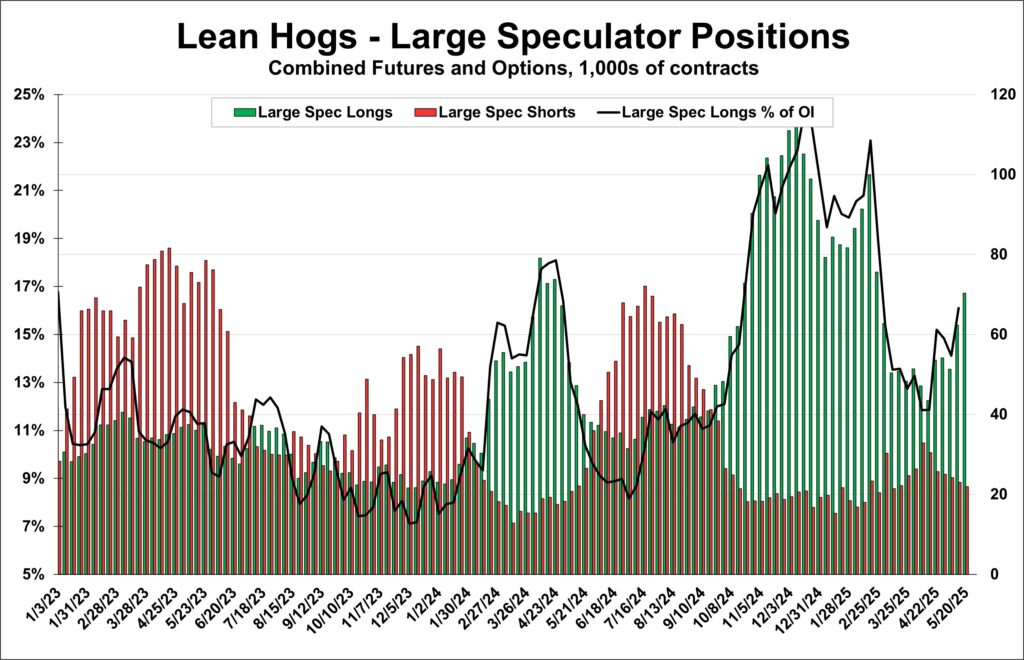

Lean Hogs

Large specs were again aggressive buyers this week through sizable new buying and modest short liquidation. While this would suggest a continued move higher in prices, we need to zoom out and just consider the outright position. Extremely long specs and extremely short commercials, particularly following a massive price rally, is the perfect storm for a massive sell off. We may be early, but we did establish protection on third and fourth quarter production this week. Consider doing the same.

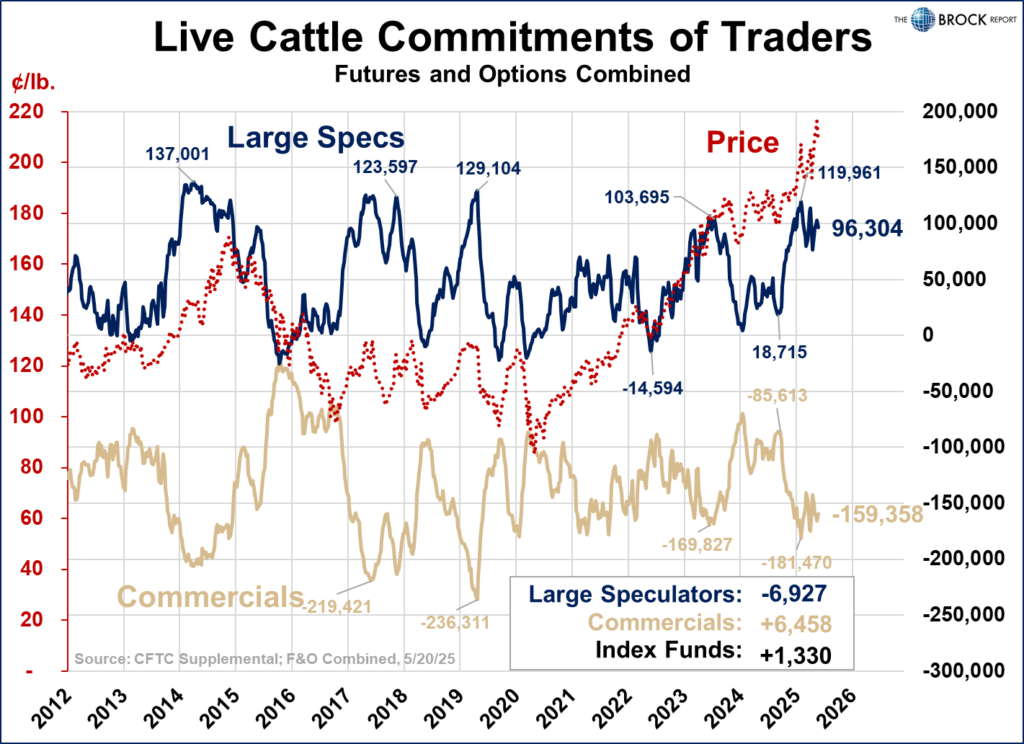

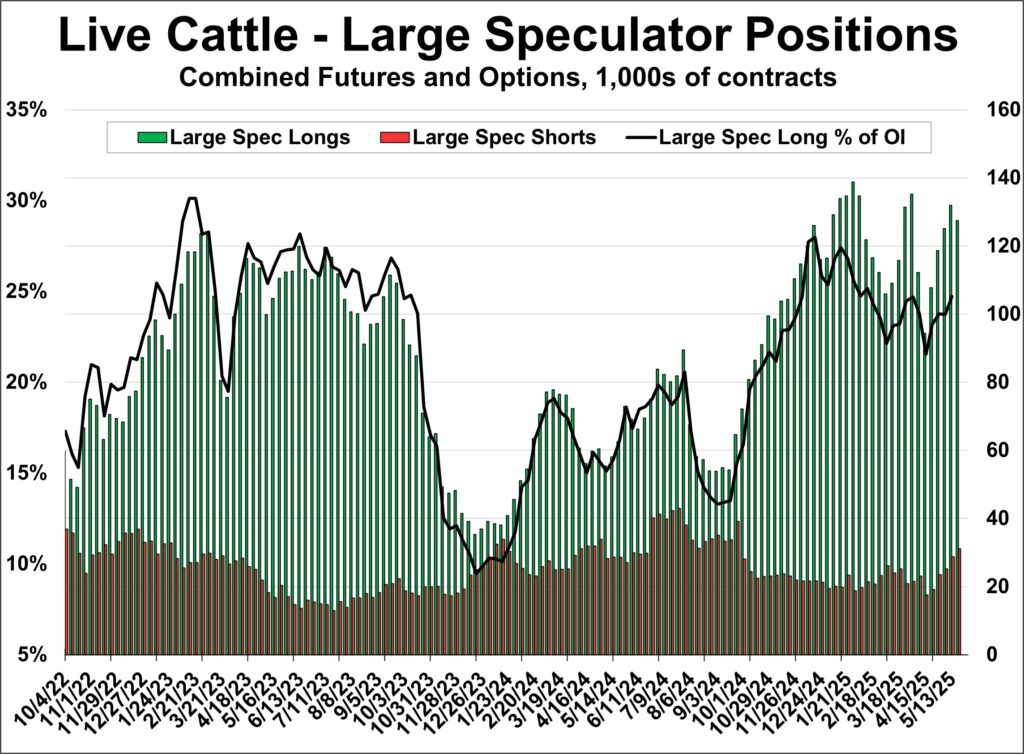

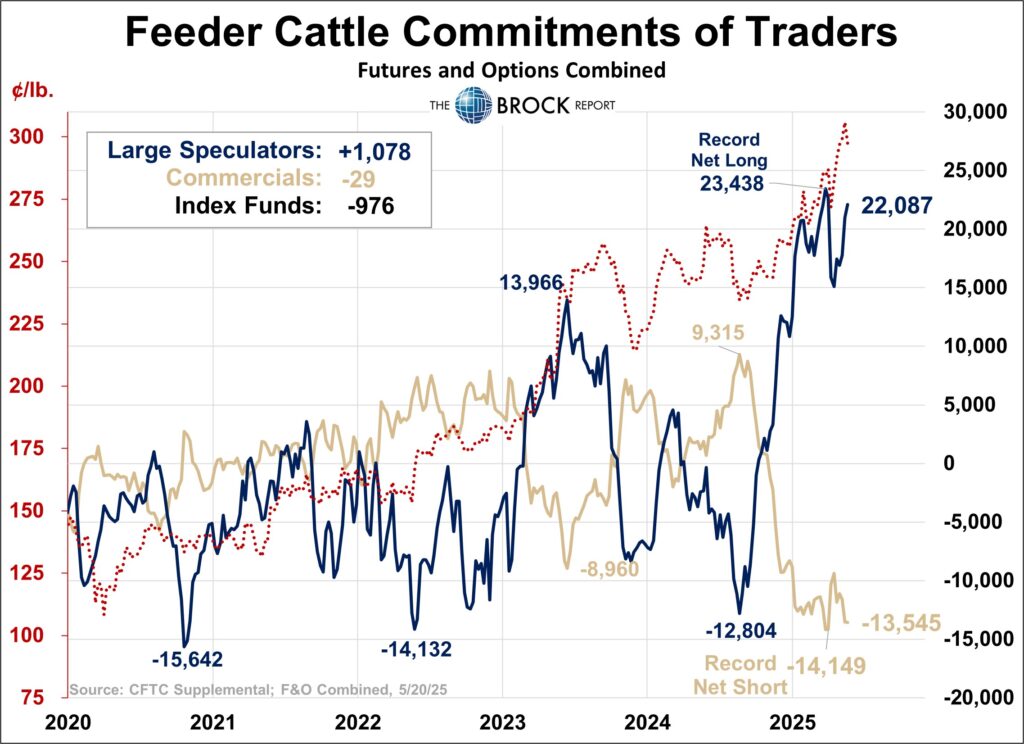

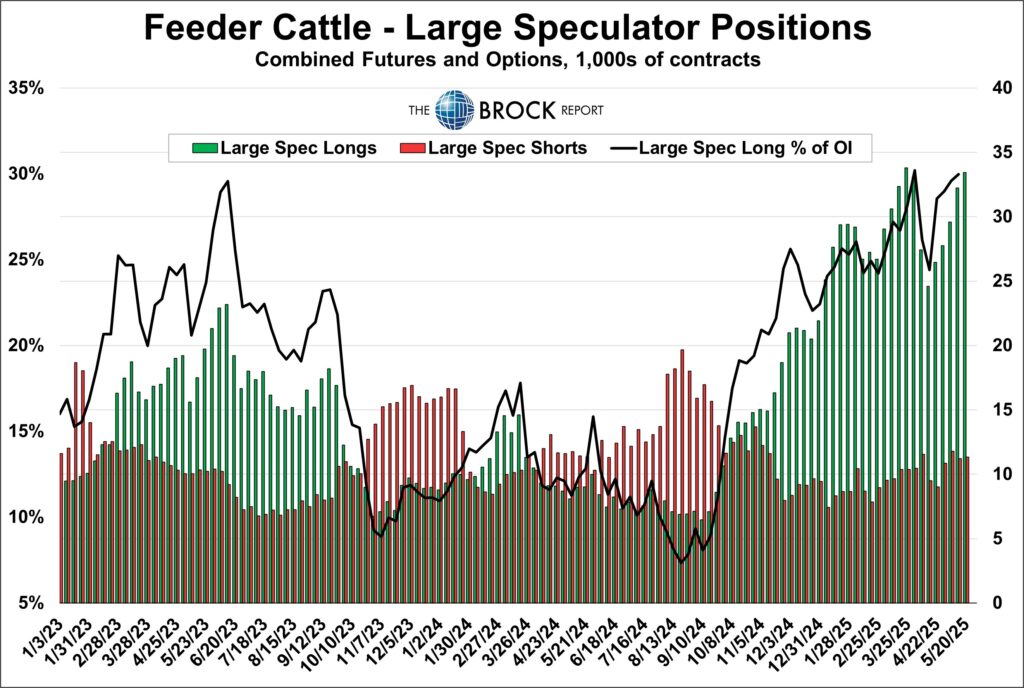

Cattle Complex

We will take most of our cues for this complex from the live cattle complex, and large specs have been increasing the number of shorts they hold for 6 consecutive weeks. Now, most of those weeks were outweighed by growth in longs, but as discussed in the corn, this ‘against the grain’ trend can be an early warning specs are about to change things up. Picking tops in 5+ year bull markets is a fools errand, but there are enough warning sings, including a massive bearish key reversal last week, to warrant price protection.