Weekly COT Highlights – Week Ended Tuesday, June 10

Main Takeaways this Week

- Corn: The end is in sight regarding spec selling. Very bullish setup and specs finally buyers this week.

- Beans: Nobody knows what to do with beans, still.

- Wheat: Bullish setup continues to play out in orderly fashion

- Meal: Supportive setup, procure needs.

- Anything that walks: Specs want to own it. Must see charts at bottom.

Corn

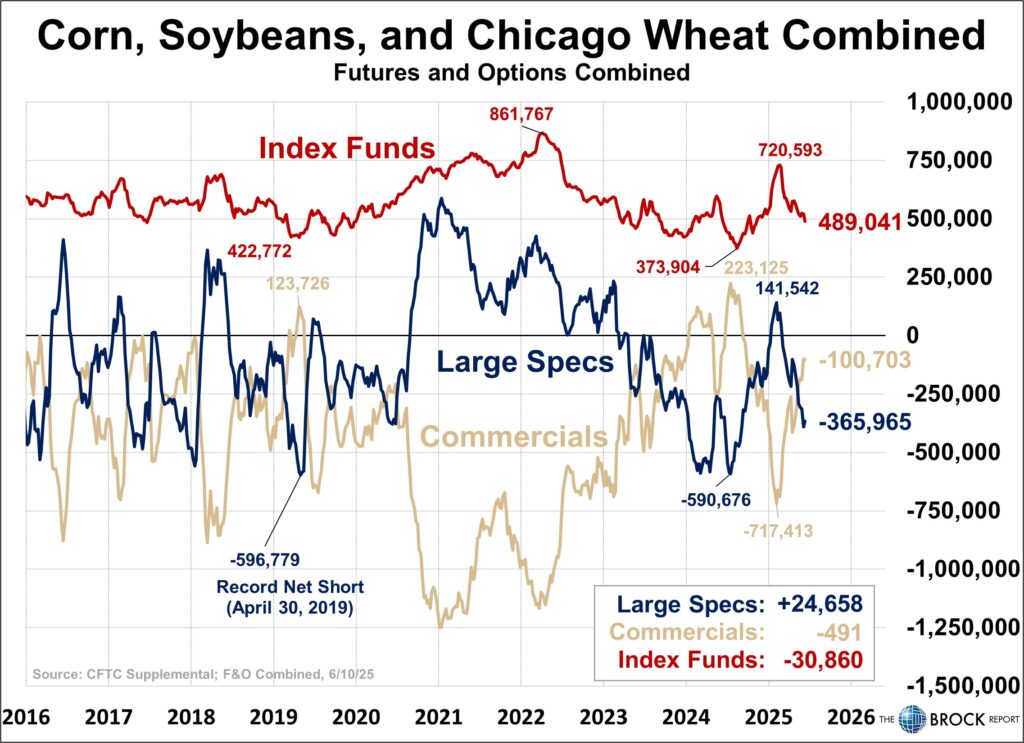

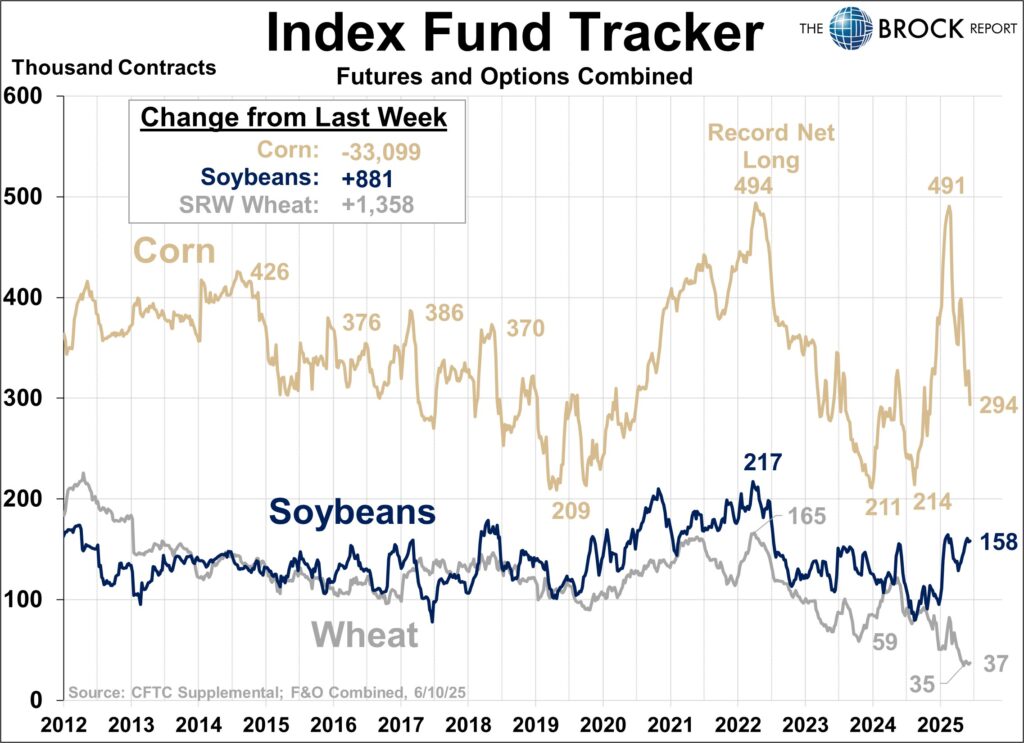

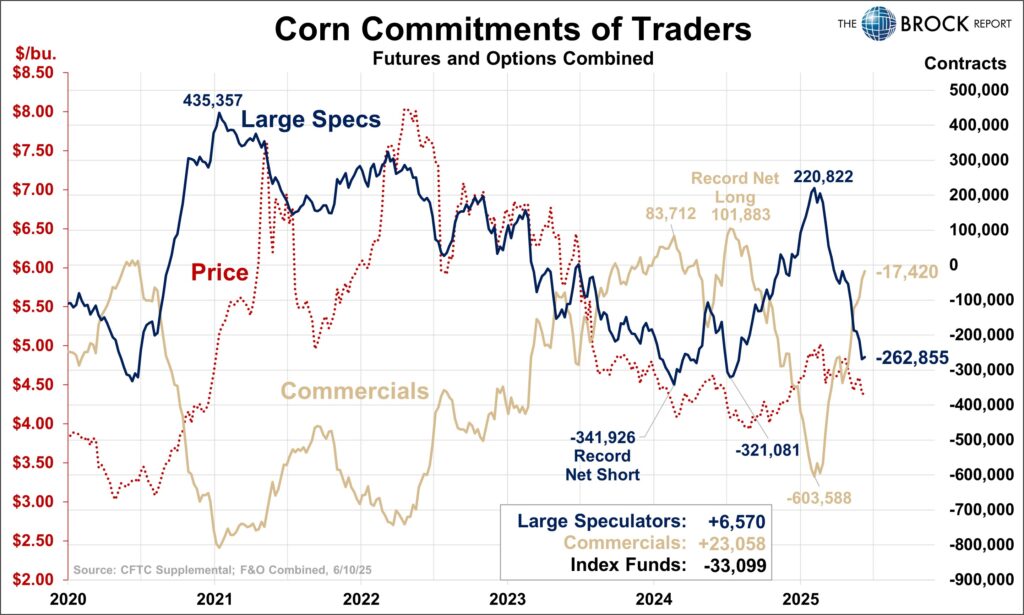

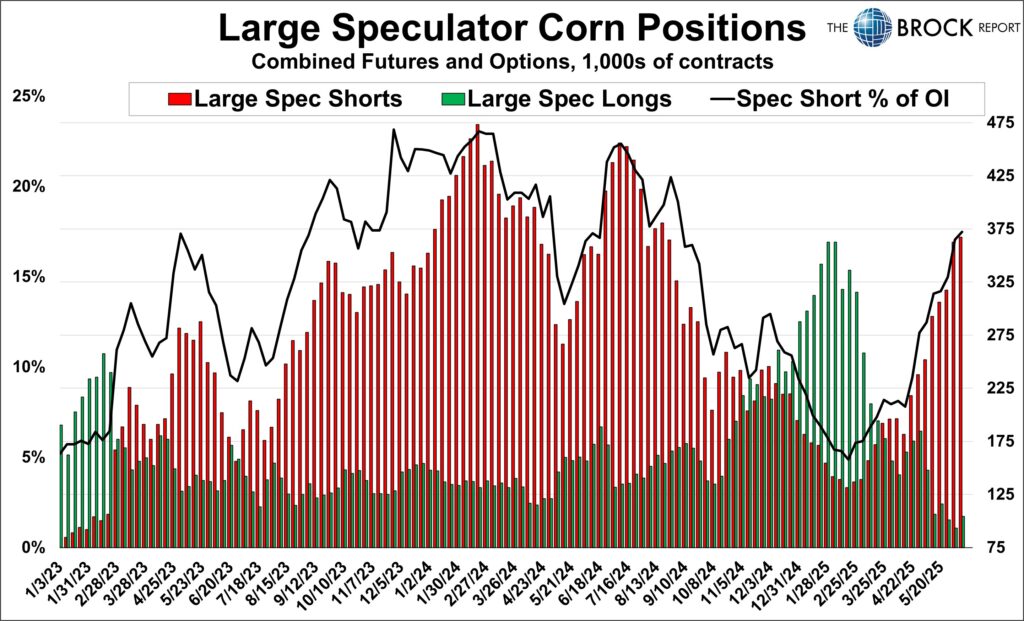

Back in February, we warned of the risk of large spec long liquidation and the pressure that could put on prices. They proceeded to sell corn for 14 of the 15 following weeks pushing July 25 futures 80¢ lower.

Are they done? Well last week we said they should be done soon, and while there is not confirmation of that, they were small net buyers this week, with new longs outpacing new shorts. It’s important to note that coming into this week, specs held the fewest number of long positions since April of 2009…16 years ago!

We’re spending the time rehashing this move and this history to impress upon you two things:

- This report does provide useful and actionable insights.

- Specs are now in the OPPOSITE position from February

This is the classic ‘rubber band’ ready to snap. While we do not see a ton of upside from a fundamental perspective, we are now in the boat that contract lows are very likely to hold, and if this market does move higher, it will start that move before we know the fundamental reasons for it. With specs this close to their all time largest net short and commercials sitting quite long, we do not want to hold significant short positions on the board.

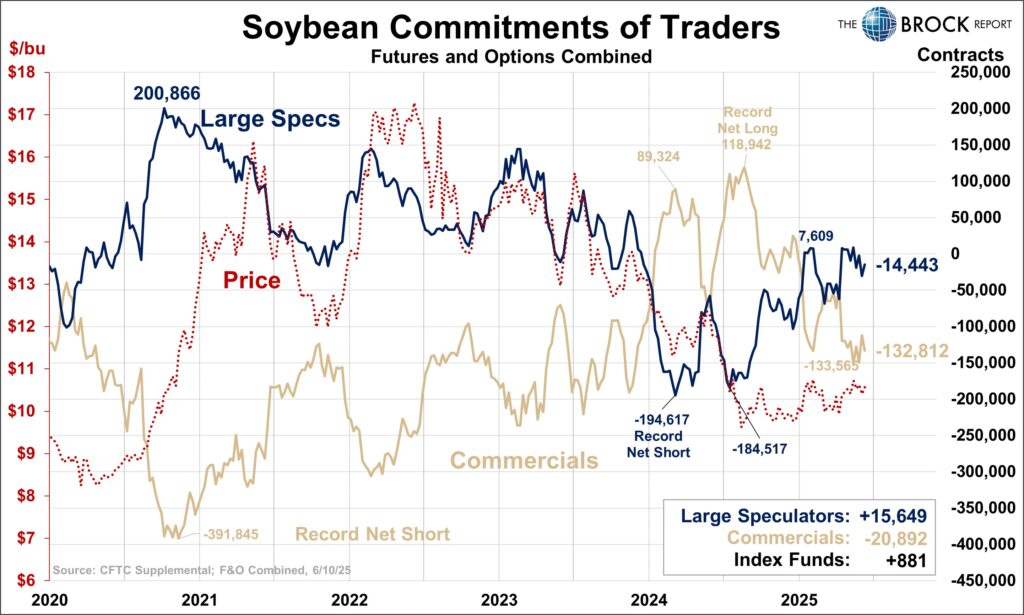

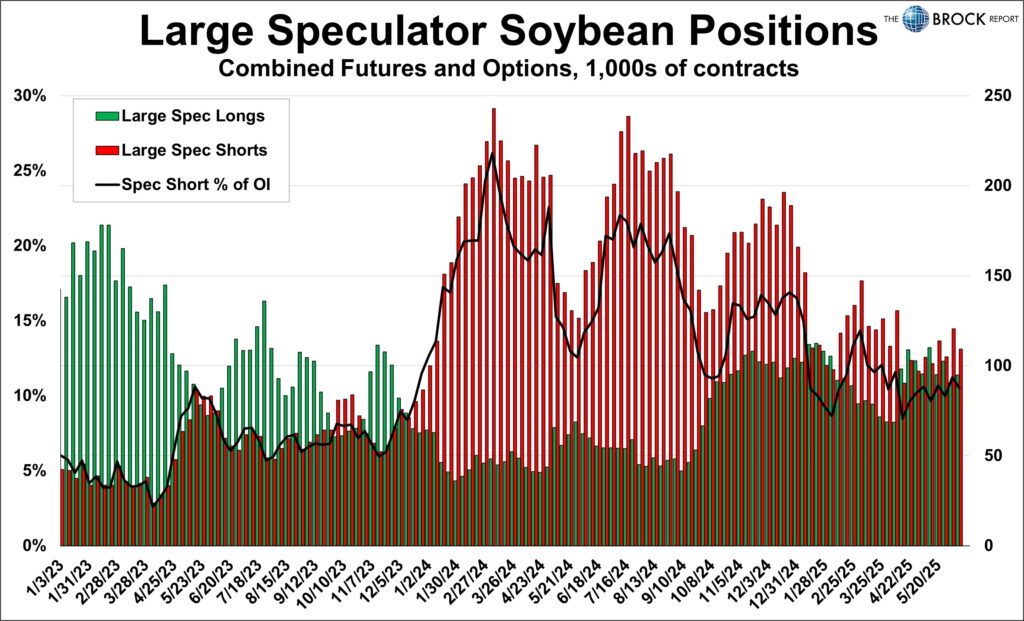

Soybeans

Not much to say here. If you missed the last few weeks of analysis, the bottom line is specs have no clue what to do with this market, and likely won’t until acreage is confirmed, and possibly until we get farther into the growing season and production volume becomes more clear.

Were on 15 weeks of specs buying one week and selling the next, barring a couple of very small position moves in consecutive weeks. This may be a different story next week as the RVO news shot soybean oil and soybeans sharply higher Friday, but this kind of new can be fickle until it is written in stone.

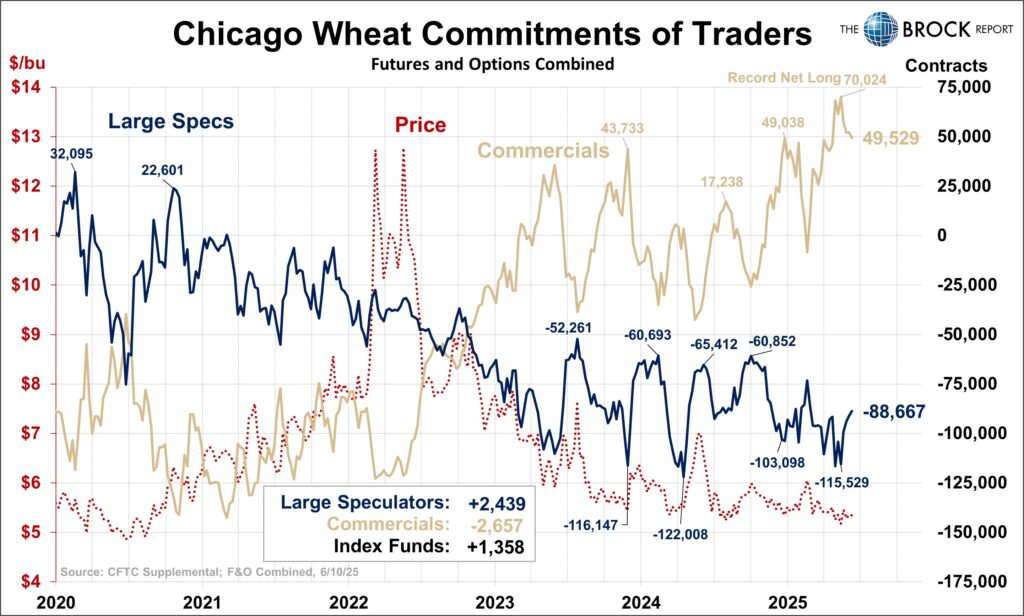

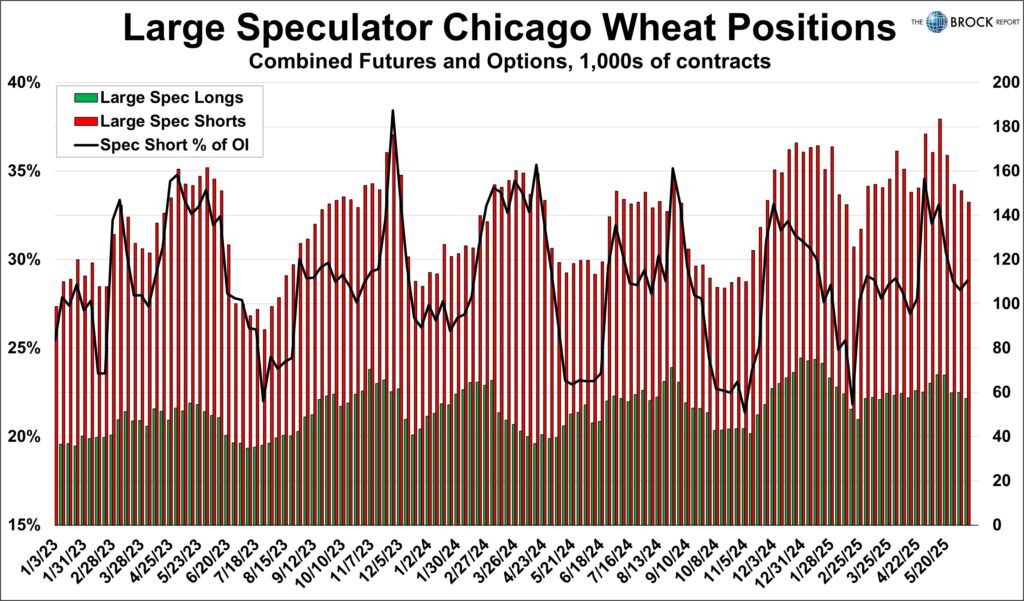

Wheat

As noted in The Brock Report this week, this COT setup is a large part of why we are friendly wheat futures moving forward. Far from record levels, specs still hold a sizable short and the process of unwinding that has been underway and document here at length the past few weeks.

Strategically, for farm management purposes and out of respect for the recent rally amid a longer-term downtrend, we advanced cash sales early in the week. For hedgers we bought back those sales on the board with Friday’s daily reversal higher. There is certainly more upside than downside in this market.

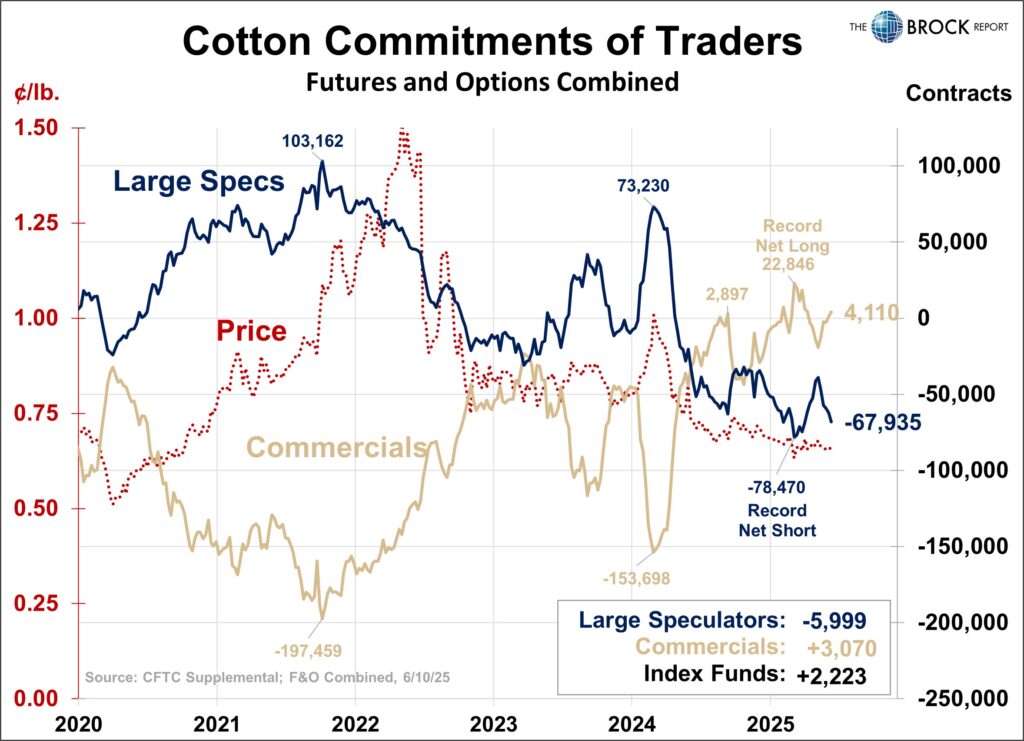

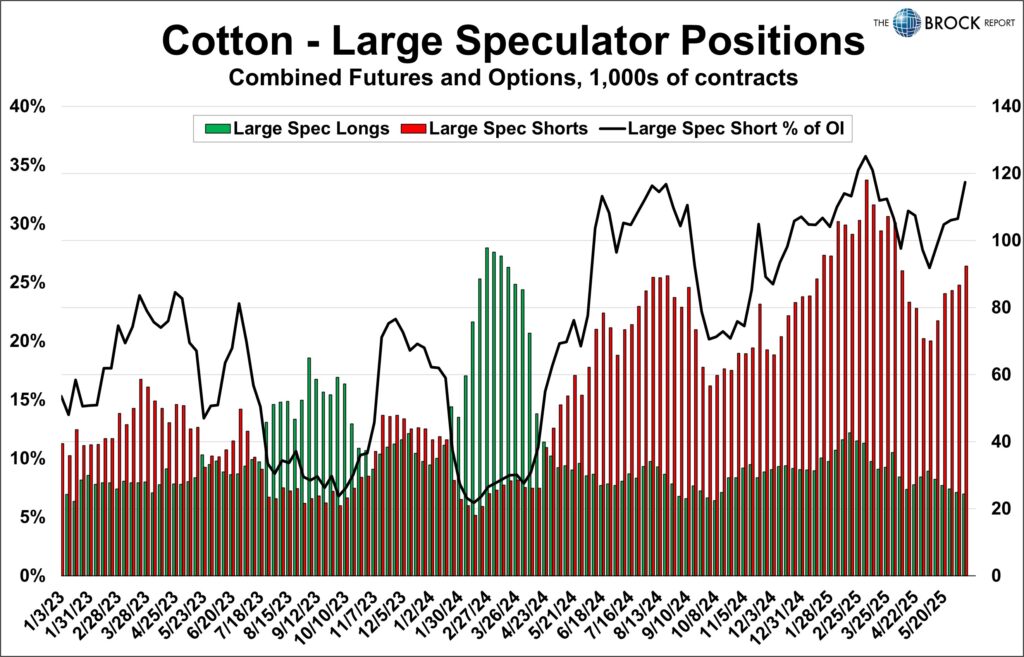

Cotton

Five straight weeks of selling from large specs has continued to pressure prices, though futures have simply drifted sideways to slightly lower and remain above the key levels of 65¢ in July and 67¢ in Dec. This setup is very similar to wheat. Depressed prices after a long and slow drift lower, with specs sitting very short and commercials very long: recipe for a sharp rally. Hard to say when that might happen, what might cause it, or if it will even happen, but this is enough to have us sitting on our hands (while also holding a short 20% Dec. futures position for several weeks now).

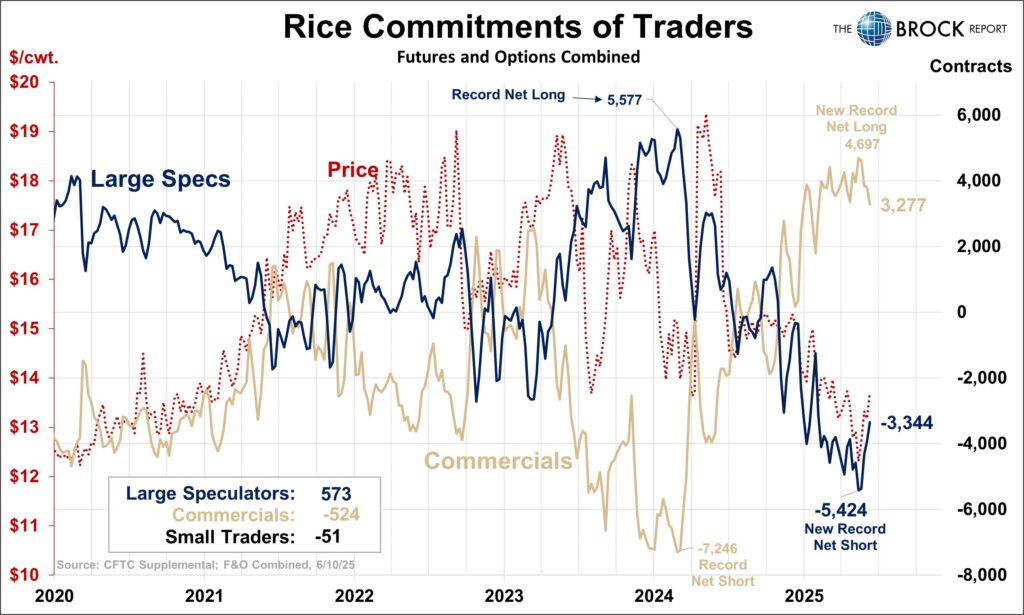

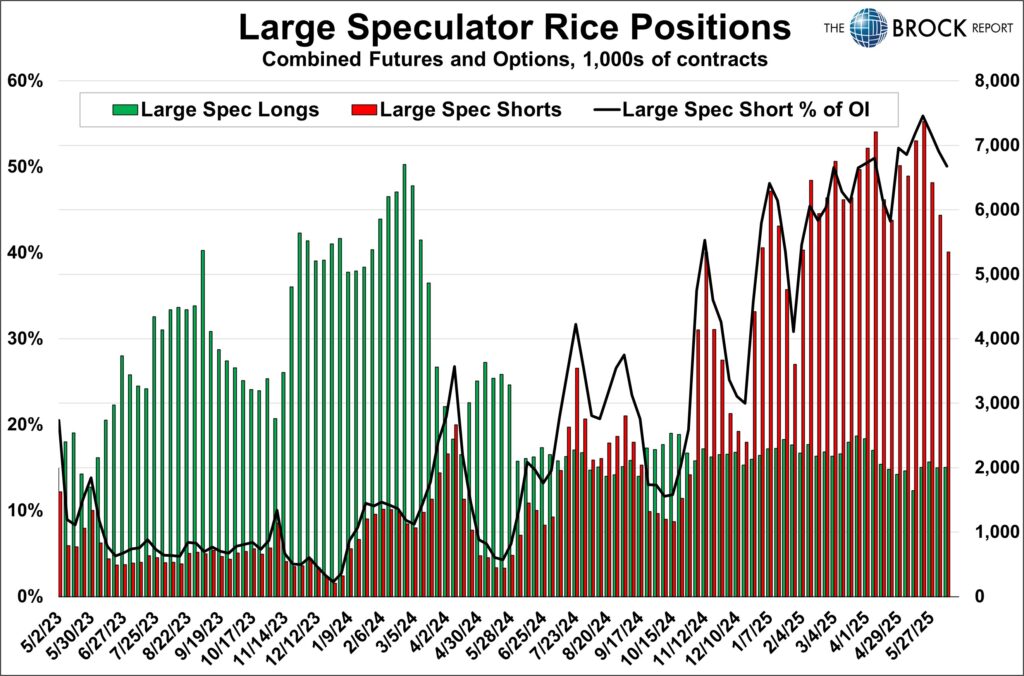

Rice

The spec short/commercial long unwinding in Rice has move rice futures higher the past few weeks, it’s nice when thing work the way they should! Spec shorts as a % of total open interest has dropped from 54% to 50%, so still a very large chunk of the trades, which has us thinking there is a good amount of potential left in this rally.

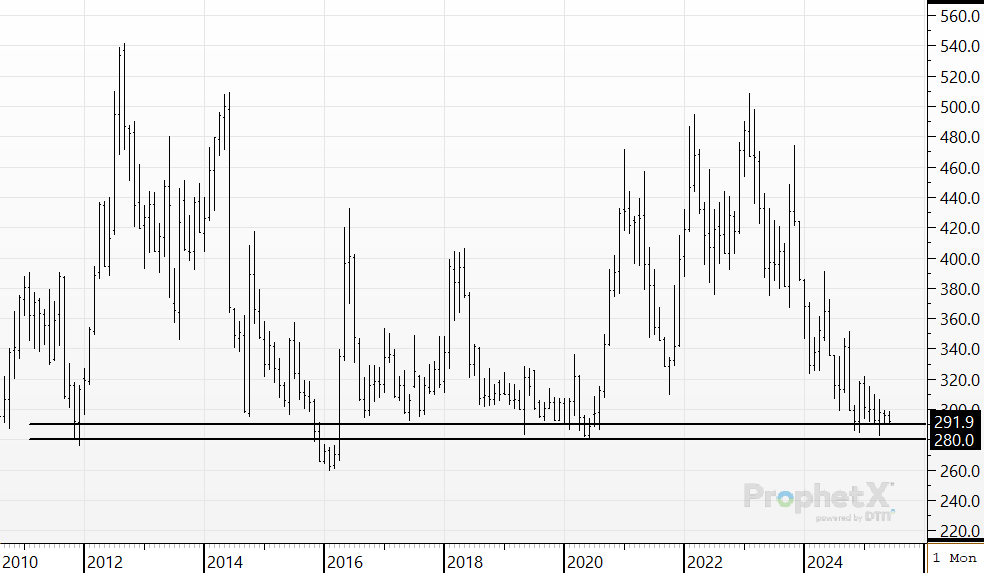

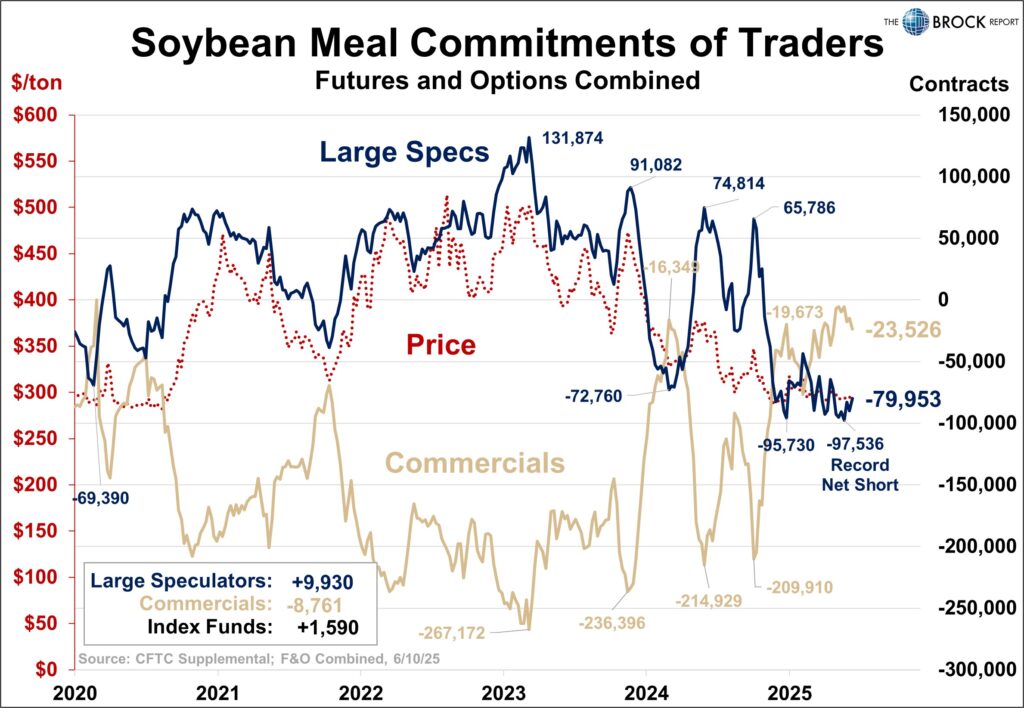

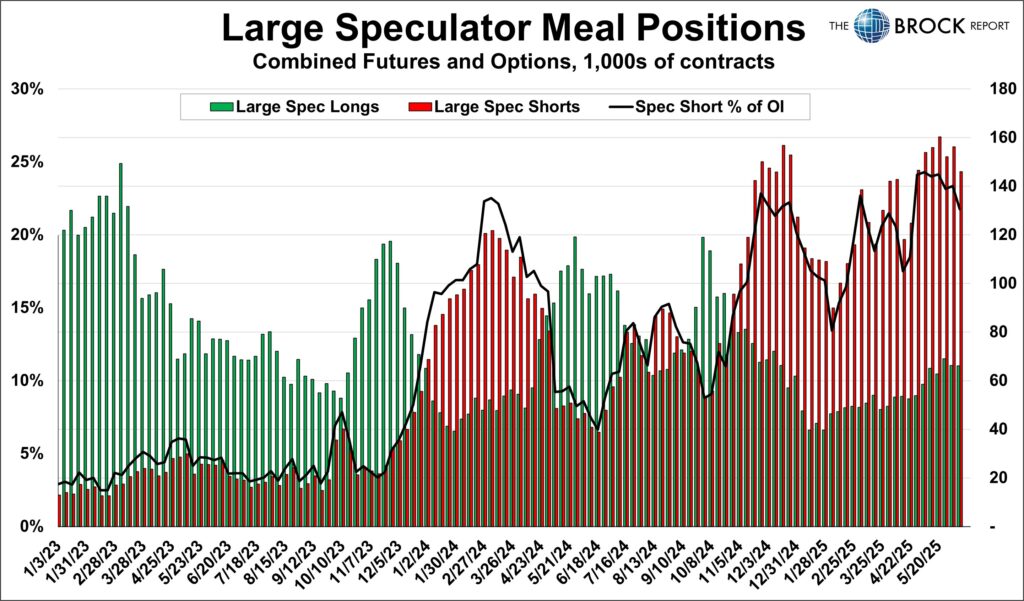

Soybean Meal

Specs have been slowly and unsteadily coming out of their record net short position. Not the rubber band snapping we wanted to see. However, futures are sitting right on MAJOR horizontal support, with July futures staying above 290. Take a longer term view and you’ll see that 280-290 for nearby futures has essentially been the main support level going back to 2010 barring a few months in late 2015 and early 2016.

This is a time to be very aggressive in procuring soybean meal needs. If not because we think prices are going up, because we think they are done going down.

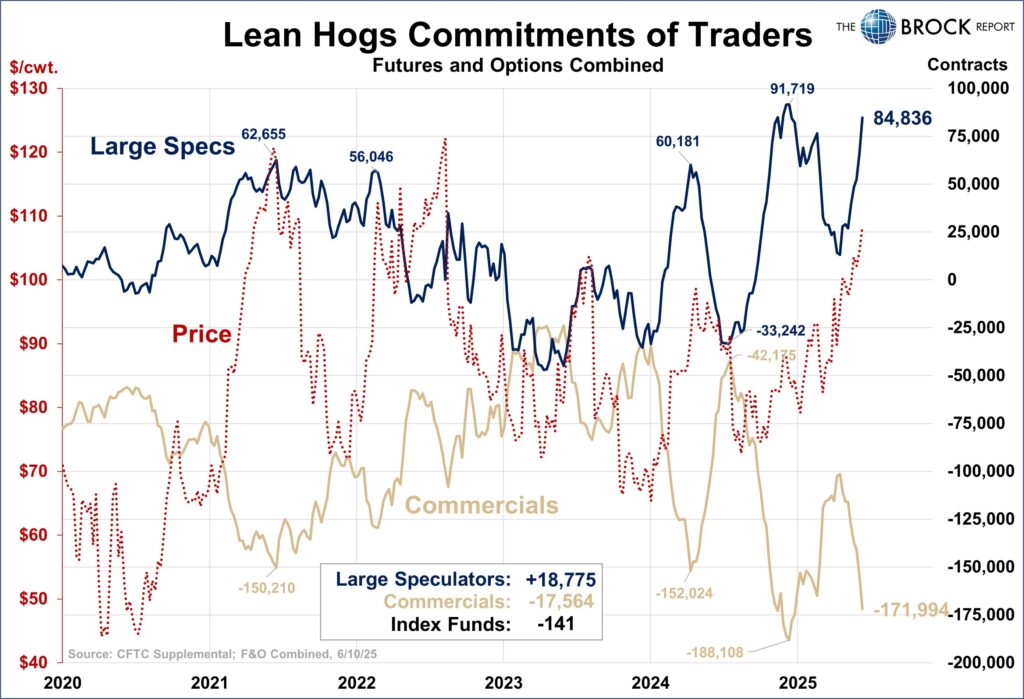

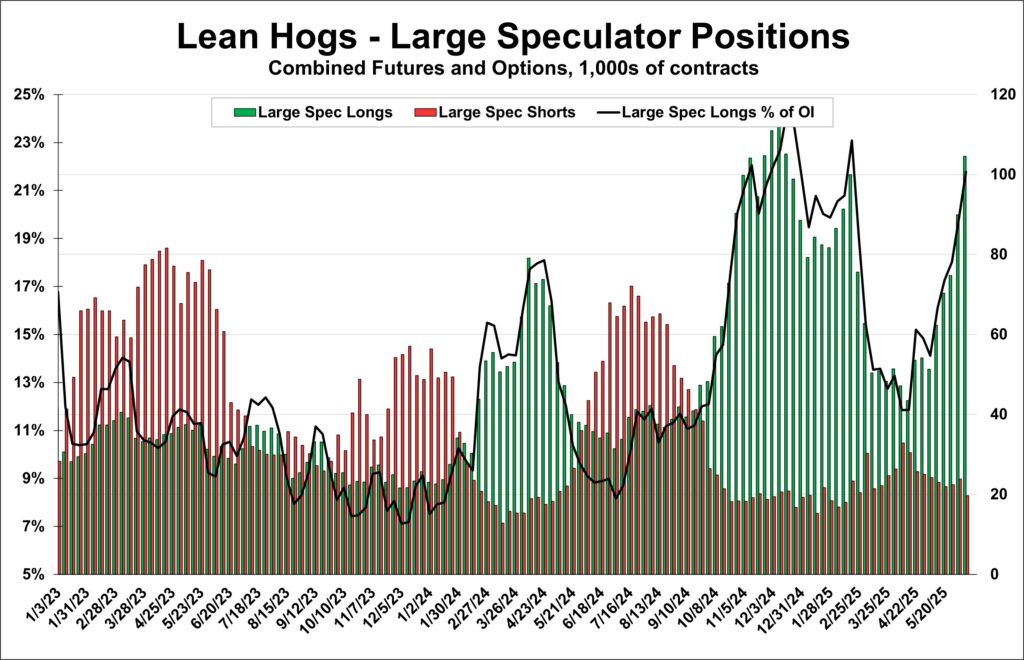

Lean Hogs

This one has been fun to watch. Specs want to own anything that walks these days. They’ve been net buyers of lean hog futures for 7 of the last 8 weeks, with longs now accounting for nearly 23% of total open interest. They are approaching ‘overbought’ territory for lack of a better term. Basically, while there is no sign they are done with their buying spree, they are so extended and prices have shot up so fast, that this is not a market to sleep on. This could turn at any moment, and it will likely fall hard and fast.

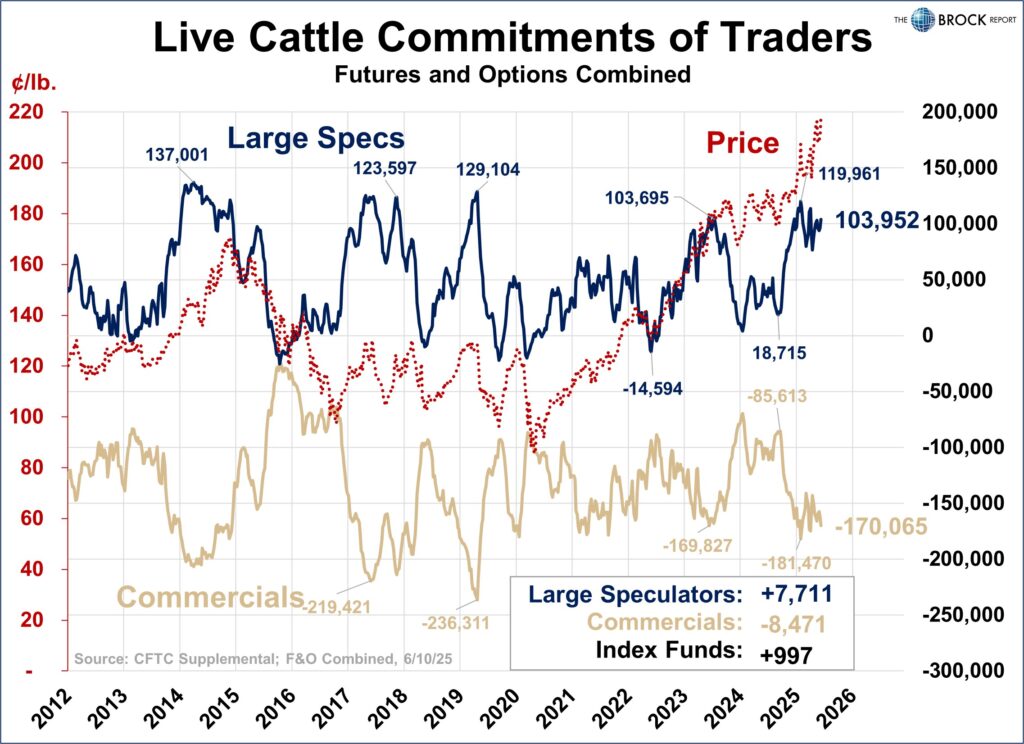

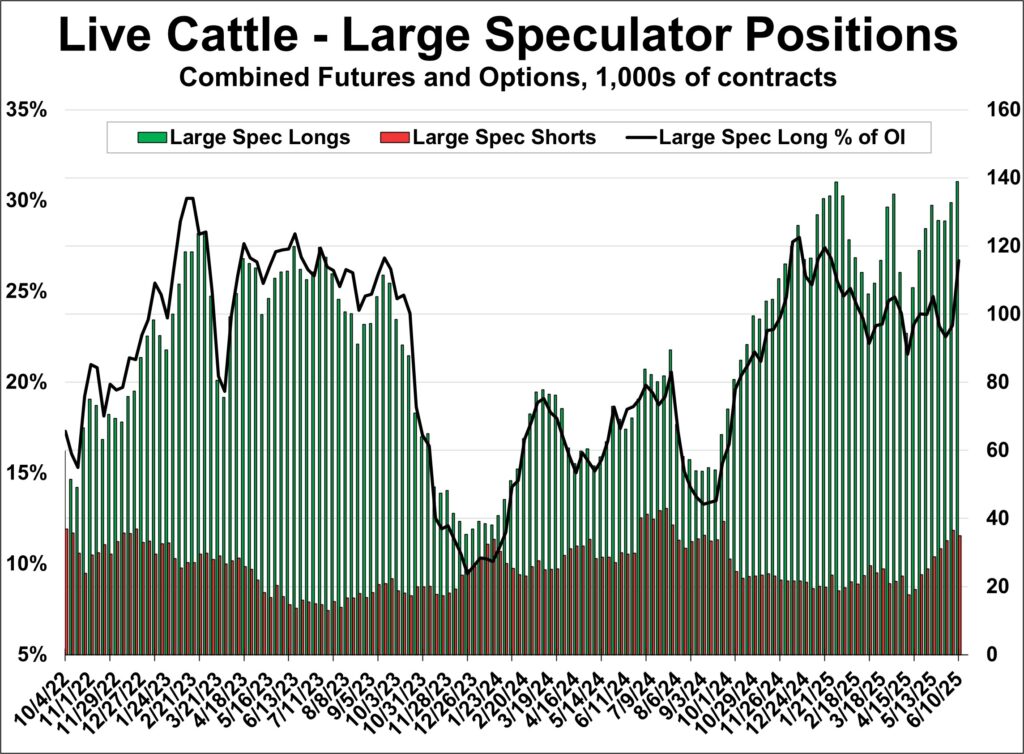

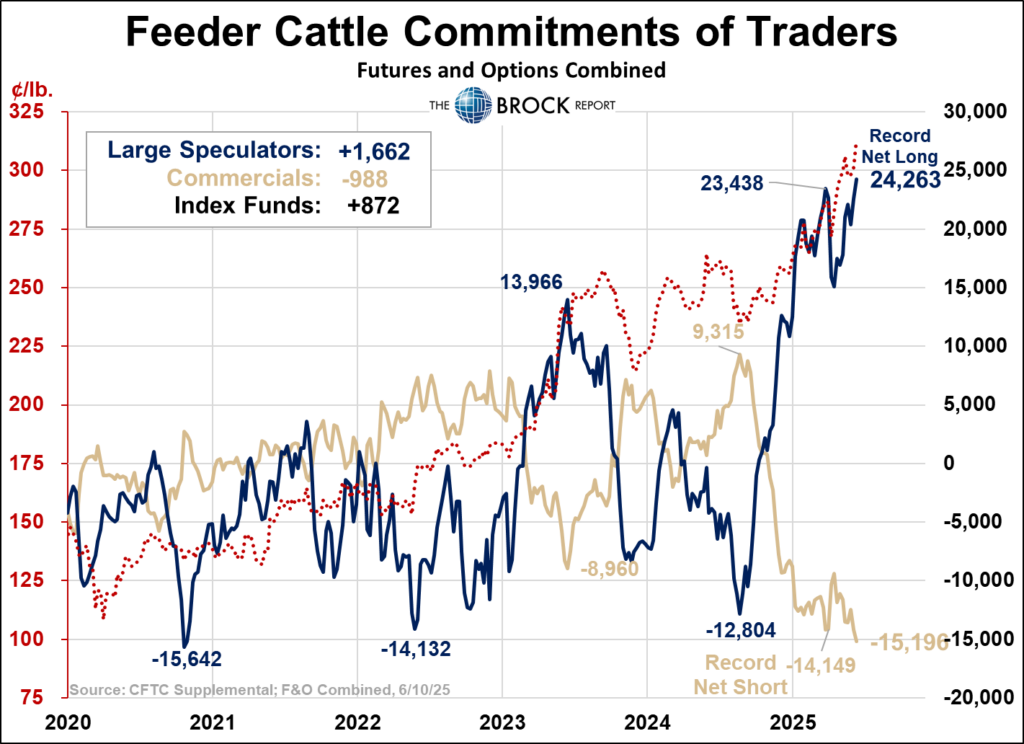

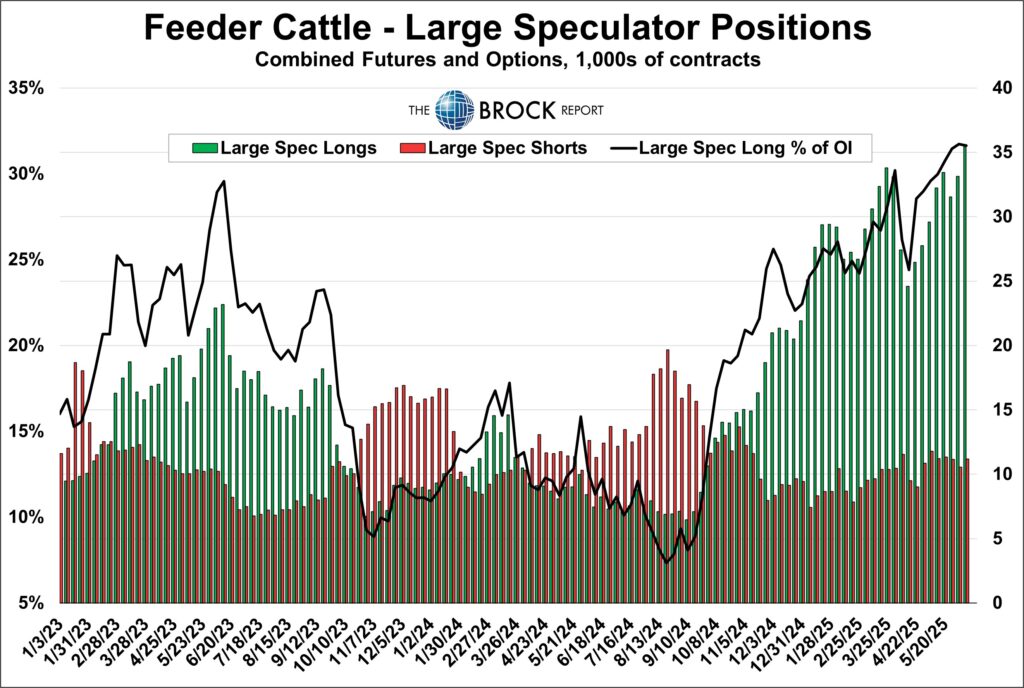

Cattle Complex

Behold the 5+ year bull market. We have yet again had to adjust the Y scale to accommodate new all time high prices, specs set a new record net long in feeders, and continue to be happy to be long anything that walks. This is an incredibly tough market to trade. There is no telling when it will top but it will at some point and it will do so sharply. It may have done so Friday but there have been several fake outs over the last 6 months. We re-established short live cattle positions Friday, but our order to get short feeders did not hit. Caution is warranted and a risk management plan is a must. With specs this over extended on the long side a run for the exit will likely be swift and severe.