Click Here to see last week’s COT Analysis

Weekly COT Highlights – Week Ended Tuesday, July 1

- Specs continue to sell corn and soybeans, buy wheat

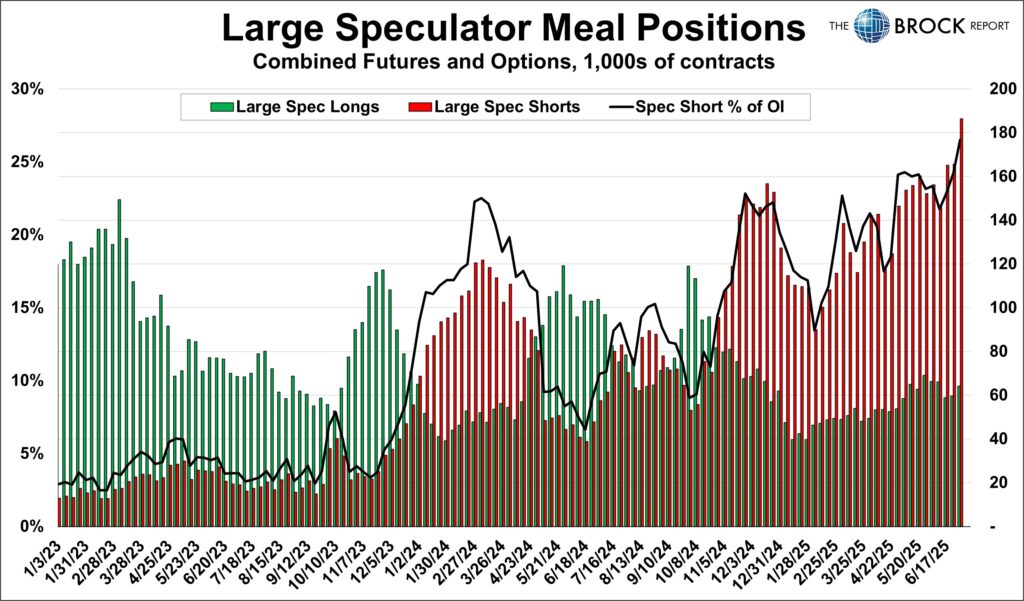

- Specs establish new record net short in meal complex

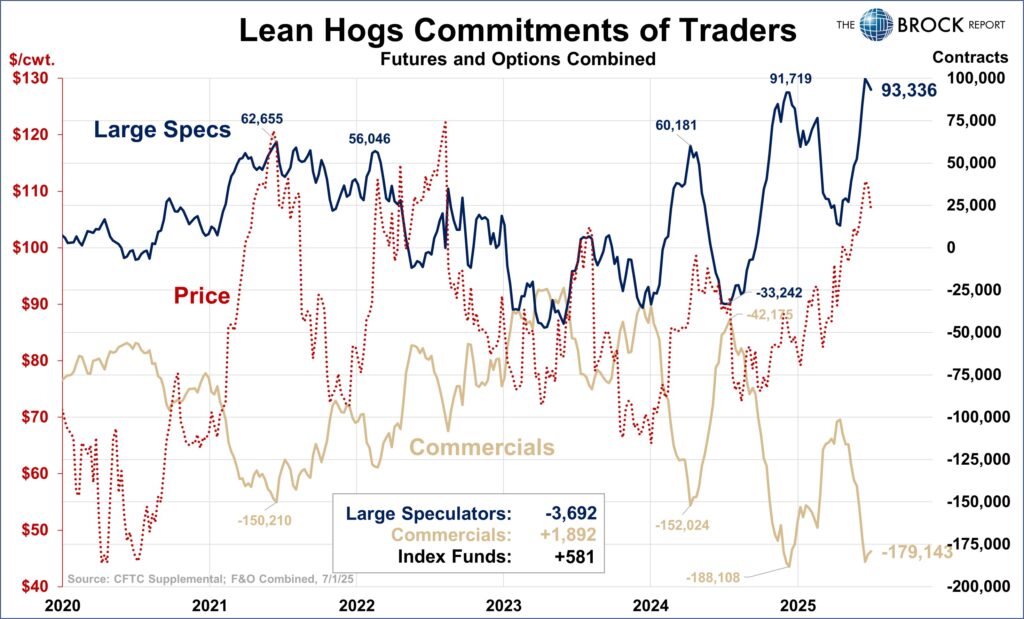

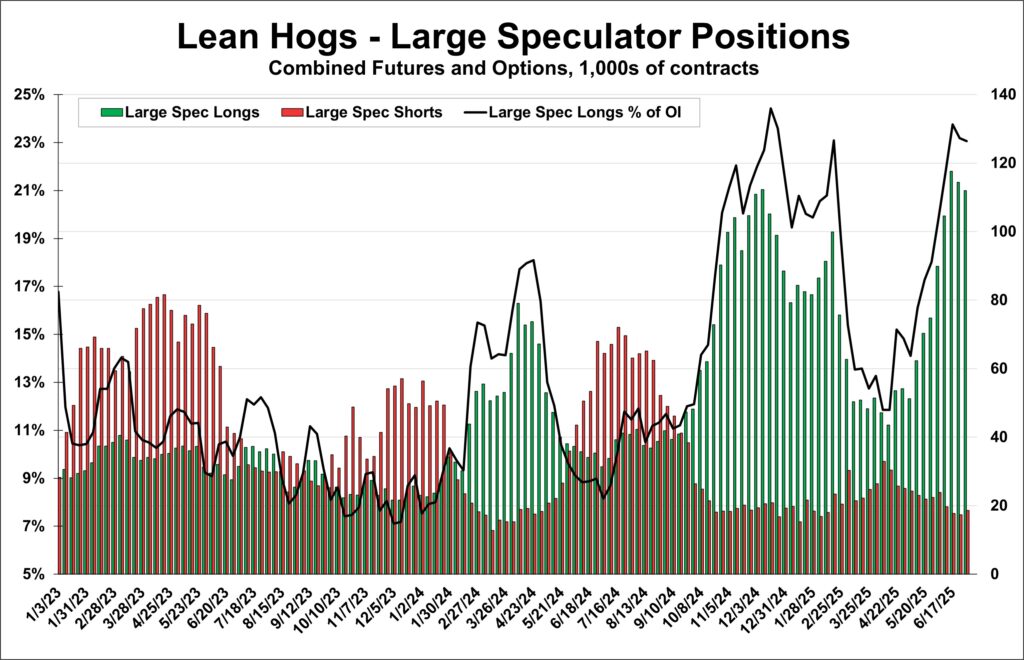

- Spec selloff in hog complex looks imminent

Corn

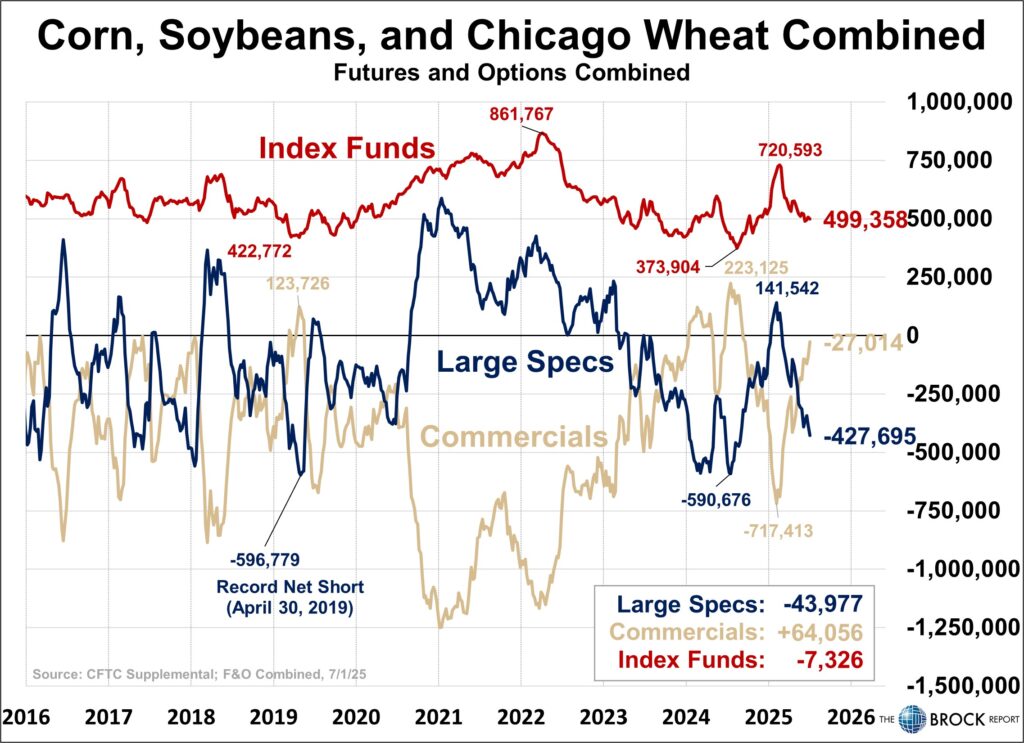

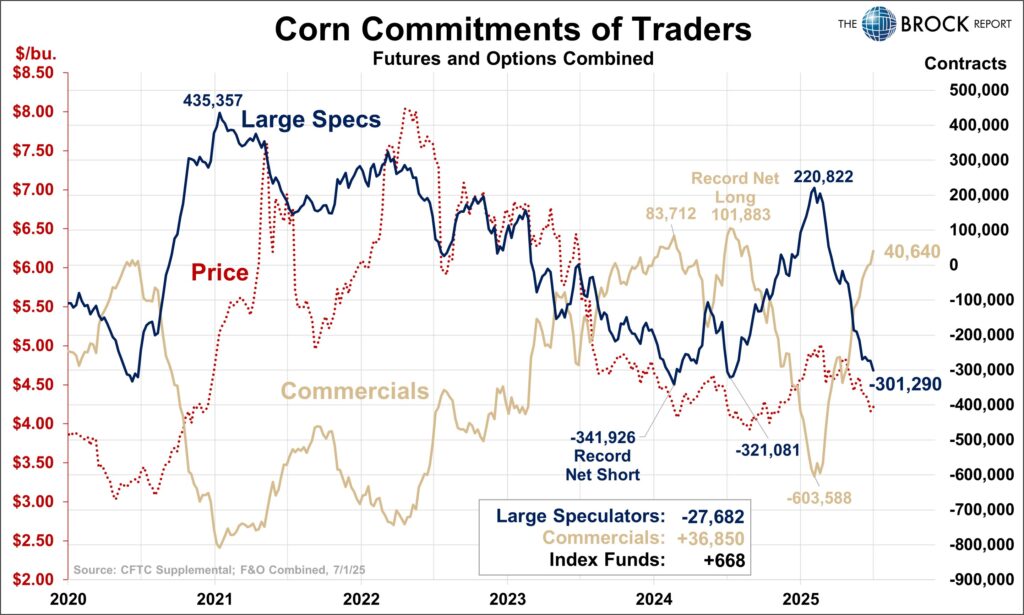

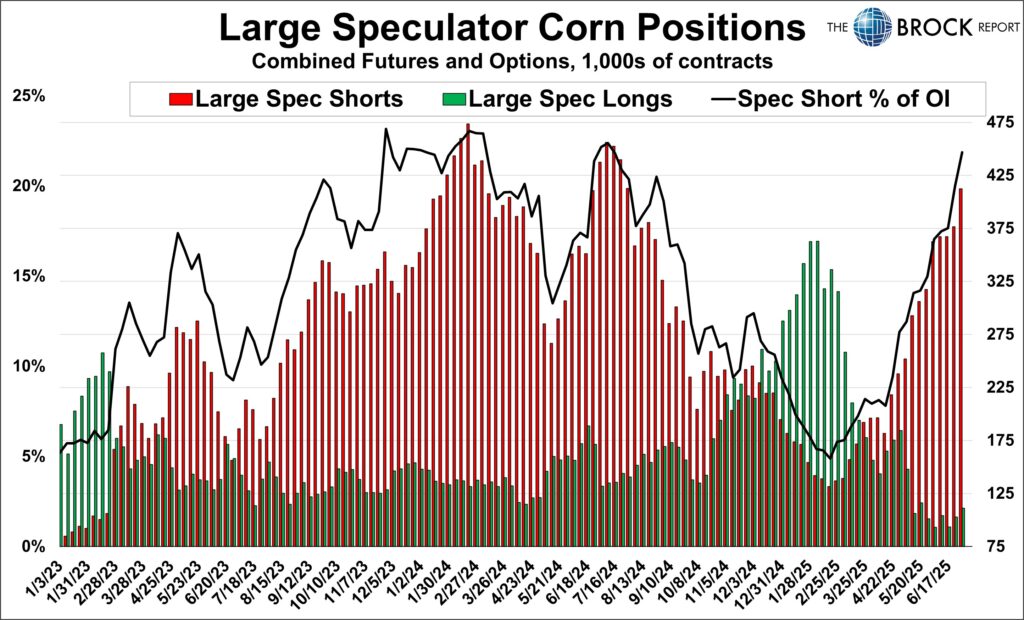

Large speculators continue to hammer the corn market, now just ~40,000 contracts from their largest all time net short position. They’ve been net sellers 17 of the last 19 weeks, which takes us back to February when we warned that specs long liquidation could be a major issue for this market. Just two weeks ago specs set a record for the fewest number of long positions since 2009.

While all of this sounds bearish, it’s not. At some point the 400,000+ short positions large specs hold will need to be covered, and if there is a significant shift in fundamentals they may run for the exit…just the opposite of what has happened since late February. There is little sign that is about to happen though, and we are not yet in the “bottom is in” camp. This report is thorugh July 1, a day that made new contract lows, followed by two days of likely short covering to pop the market. As you well know, price action today, the first post holiday trading day, was extremely negative and may indicate that the last two days was simply short covering ahead of the weekend.

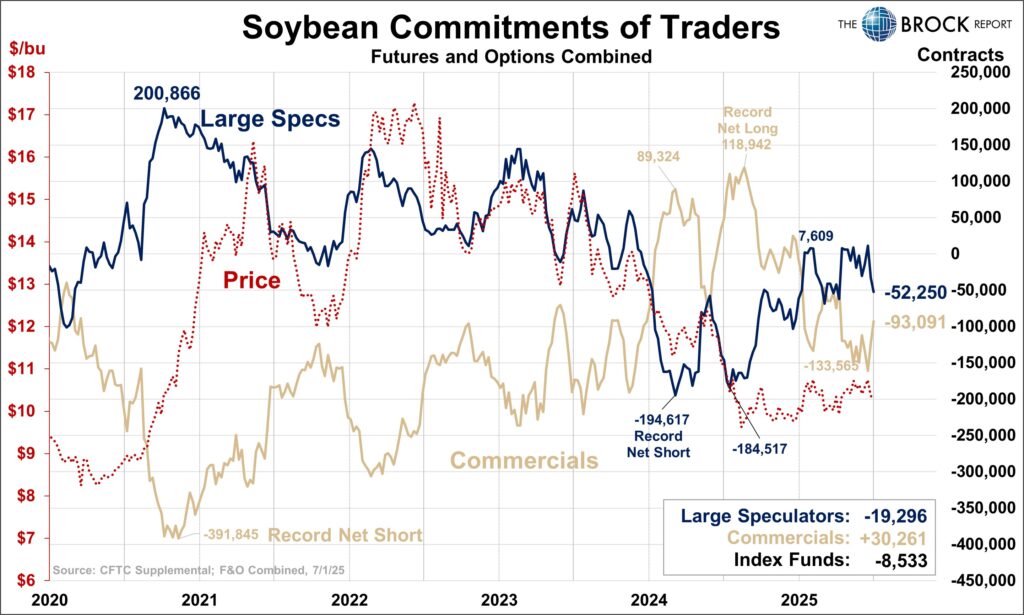

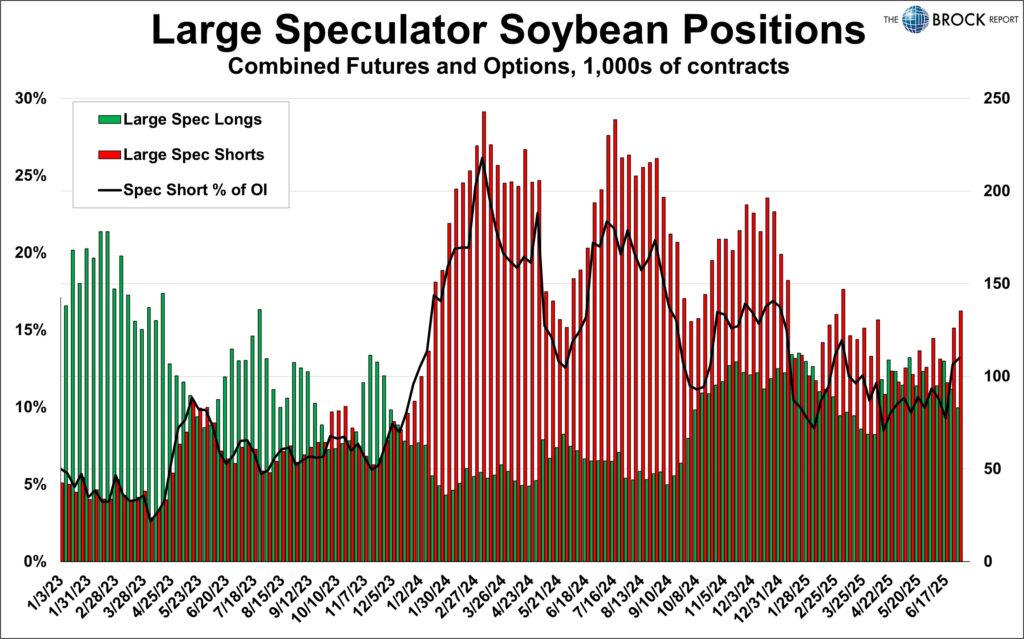

Soybeans

Large specs in soybeans are setup similarly to how corn specs were back in February. While they are not net long this market, they are well above their recent net short position from mid 2024, and have plenty of room to continue selling while staying well within their typical exposure range. Our readers will know that specs went for months without buying/selling two weeks in a row, but they have now been sellers for two consecutive weeks. This is not a positive trend, but also not as large a red flag as it was for corn in Feb. It is cause for concern but not the most important factor to the bean complex at the moment.

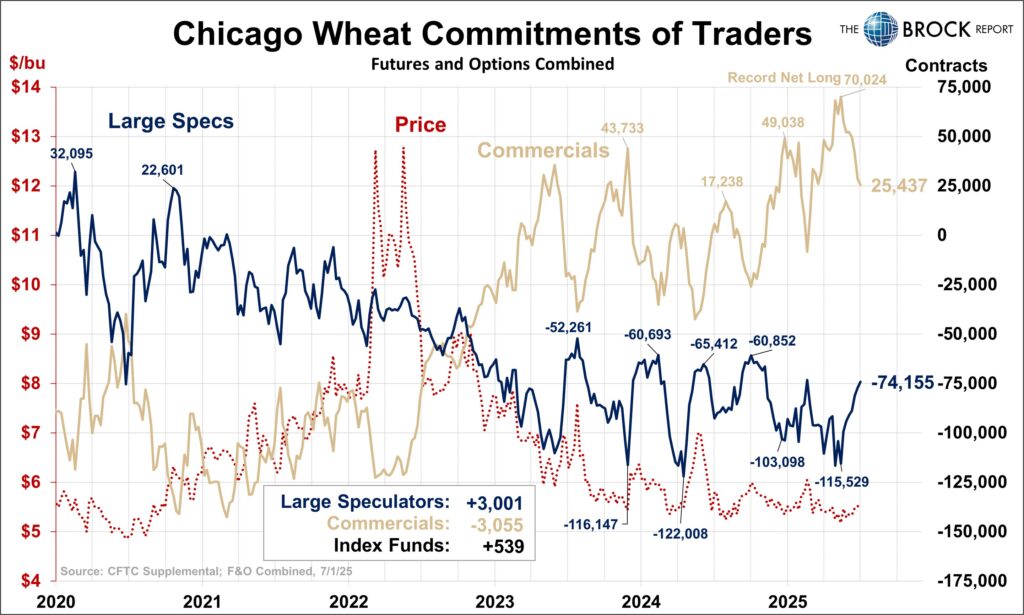

Wheat

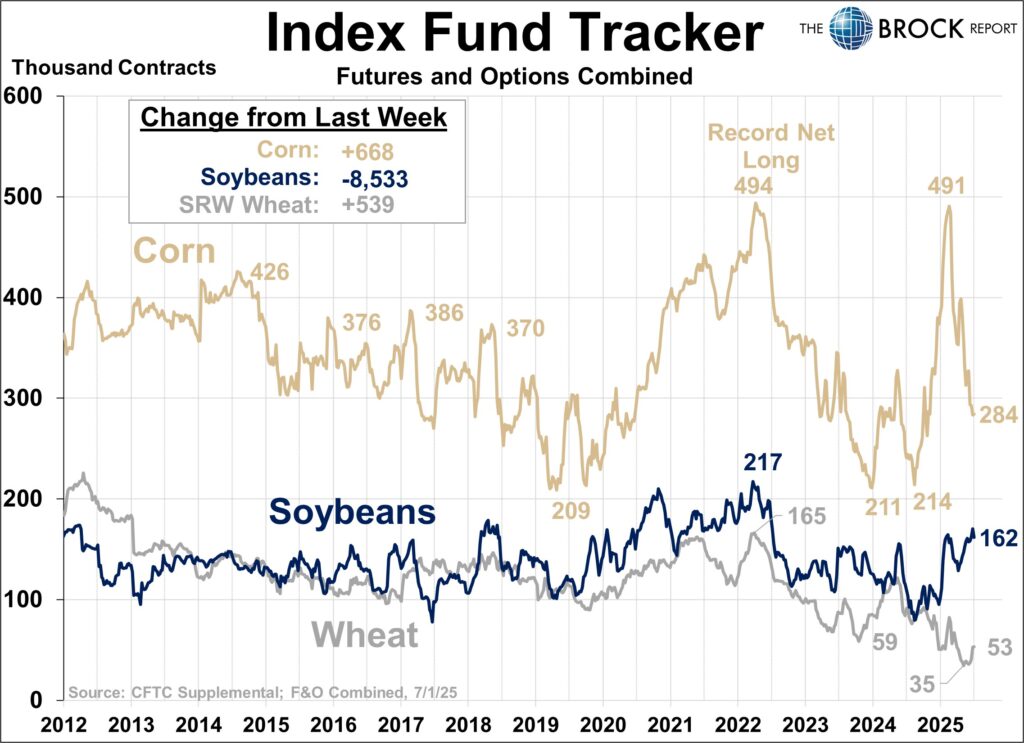

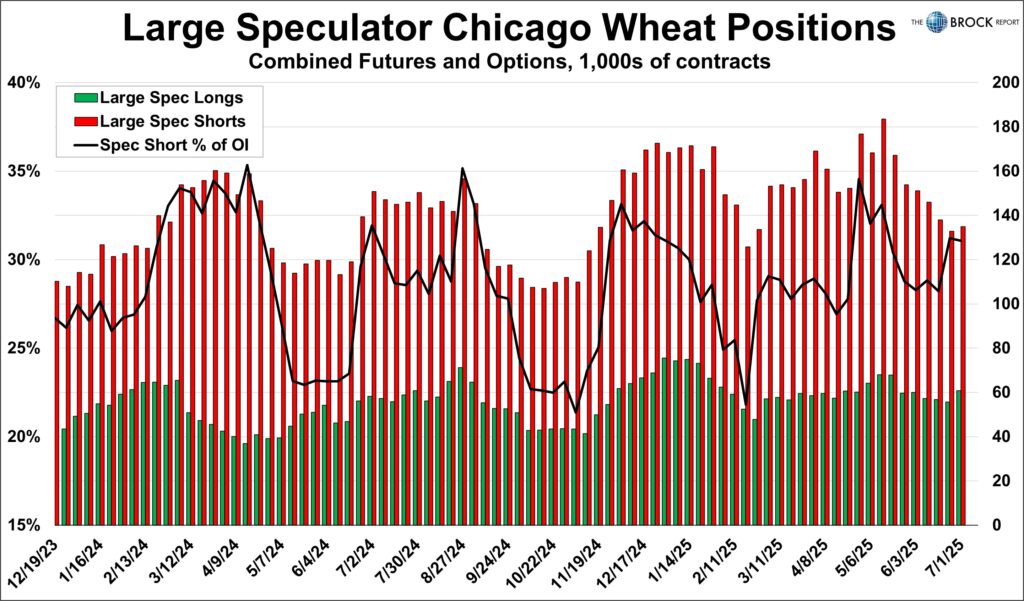

Our consistent readers will also already know that for wheat the COT has been one of the few bright spots in all of the grain markets. With specs having held a massive net short, and commercials a record net long as of mid May, we suggested that spec short covering should be a supportive force for this market.

As shown two charts below, large spec short liquidation has been a steady feature. They’ve been net buyers for 7 consecutive weeks and 11 of the last 13. It is worth pointing out for educational purposes that specs hardly ever change the number of long positions, it’s the shorts that vary. In fact, specs have not been net long the SRW market since March of 2021. Despite this continued short covering SRW futures prices have failed to mount a continued rally, they have however showed signs of strength, rallying ~55¢ in the 5 day period ending 6/20.

Bottom line is large specs and index funds are buying and both are still far from their long term average holding level, which should continue to be supportive.

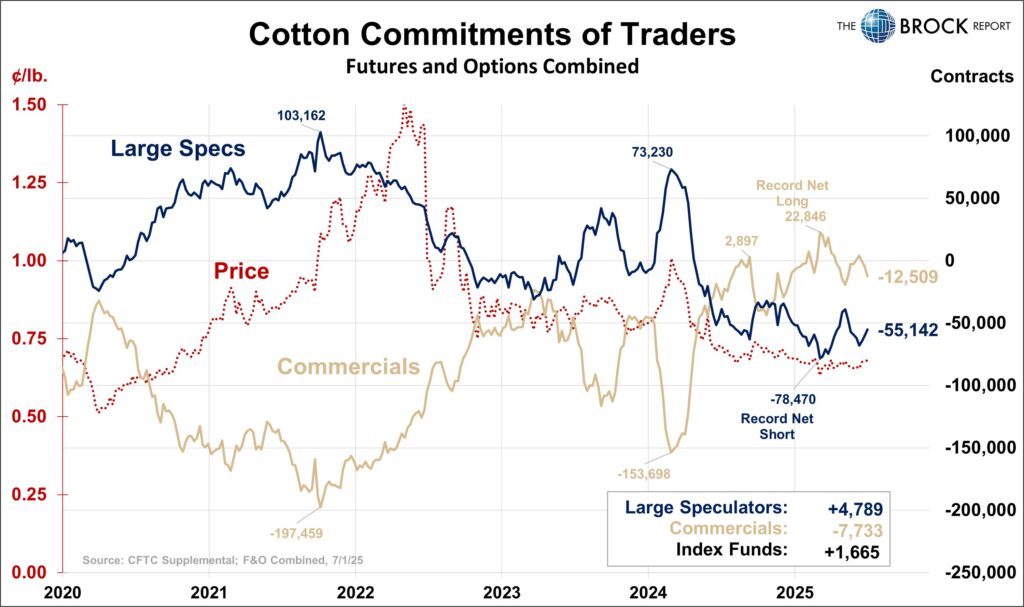

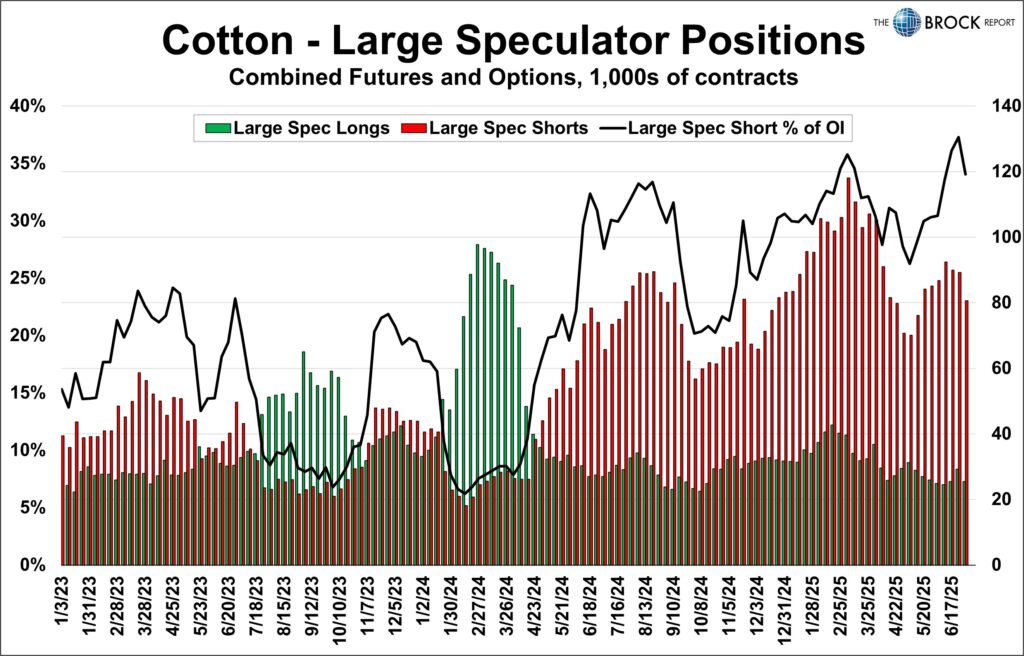

Cotton

Specs have been streaky. Since establishing a new record net short in March, specs have been on a 6 consecutive week buying spree, 5 week selling spree, and now a 3 week buying spree. This setup remains a supportive factors with specs still significantly short and commercials near the top of their range. All this support has done thought is to cause futures to drift sideways the last several months. The opportunity for a sharp rally remains present, but the market is still waiting for a fundamental shift to spark some fireworks.

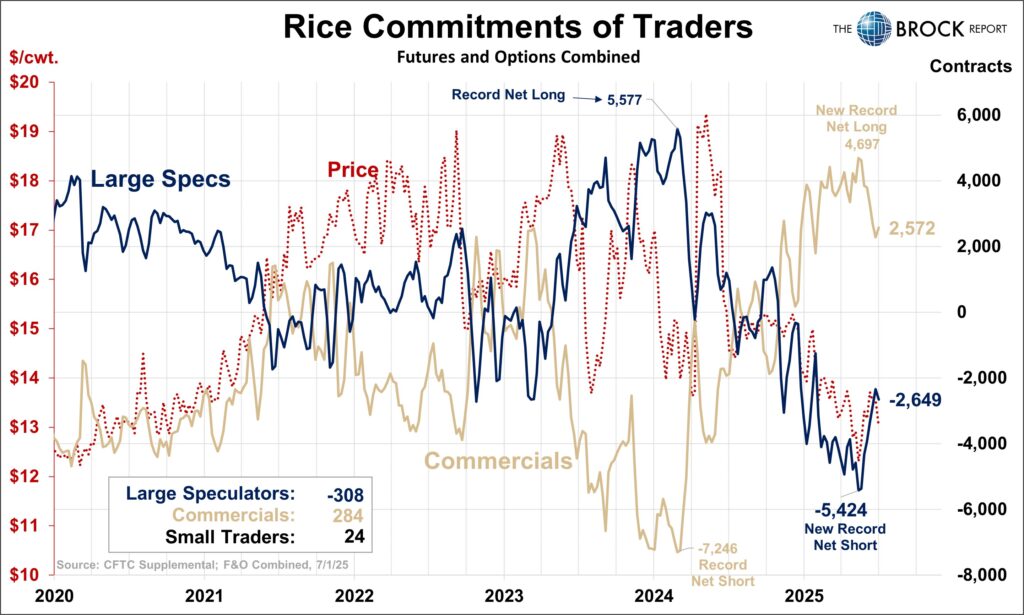

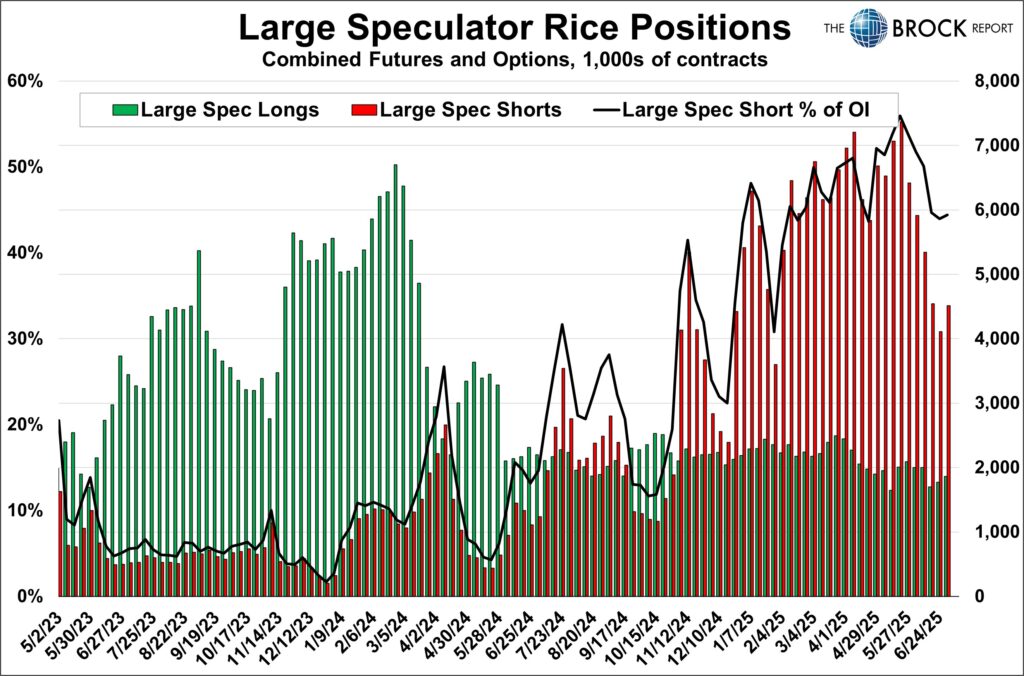

Rice

Specs were modest sellers this week after being net buyers 10 of the last 11 weeks. This short covering caused futures to rally ~9.5% off their contract low in May, but has not helped price action the last two weeks. The correlation between spec activity and the futures market is not nearly as strong in rice as it is in corn or soybeans, but we still believe this setup will be supportive and creates the potential for sharp rallies like we saw from mid May to mid June.

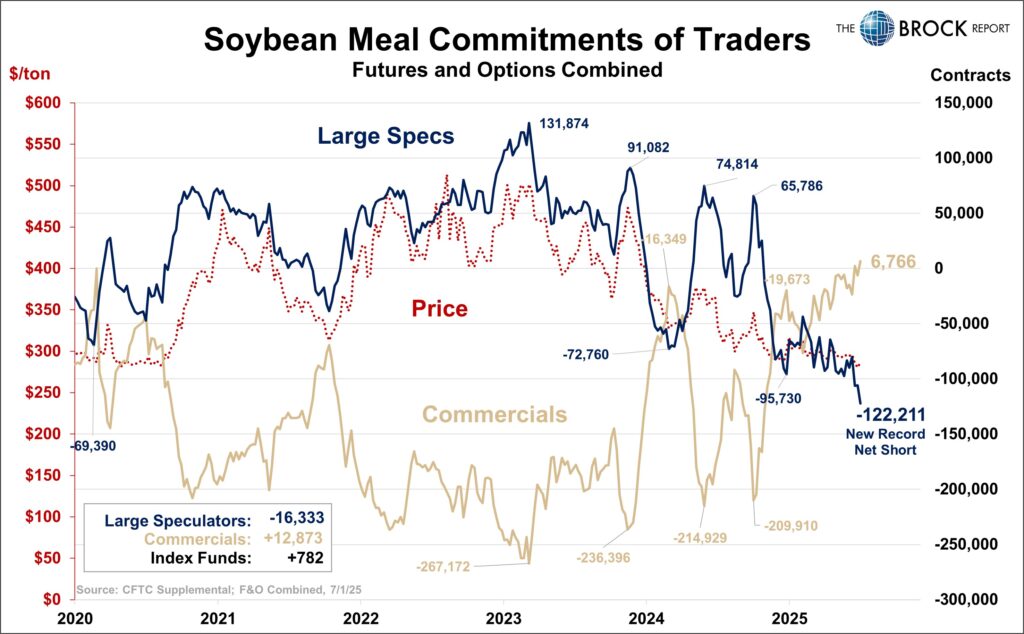

Soybean Meal

A new record net short for large speculators here, who have been relentless sellers in this market. This is likely to come to an end soon, and frankly there’s no need to over complicate this market. On a monthly most active continuation chart, $275 is major support, having been breached only a few months in 2015/2016, since June of 2010. This is a buyers market and we have advised buyers to do just that. It might be early and that advice may look foolish next week, but we doubt it will look foolish over the next few months.

Lean Hogs

We raised the red flag on lean hogs last week, just as we did in Feb. for corn. Specs have now been net sellers two consecutive weeks primarily through long liquidation. This week they also increased their short exposure. We are very concerned this market will sell off sharply and advice extreme caution to producers.

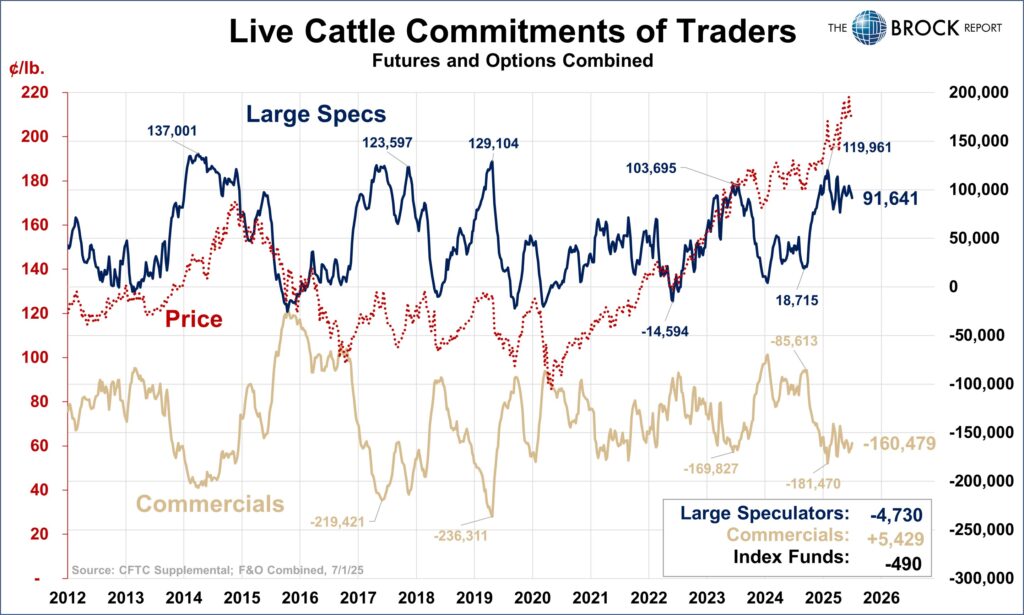

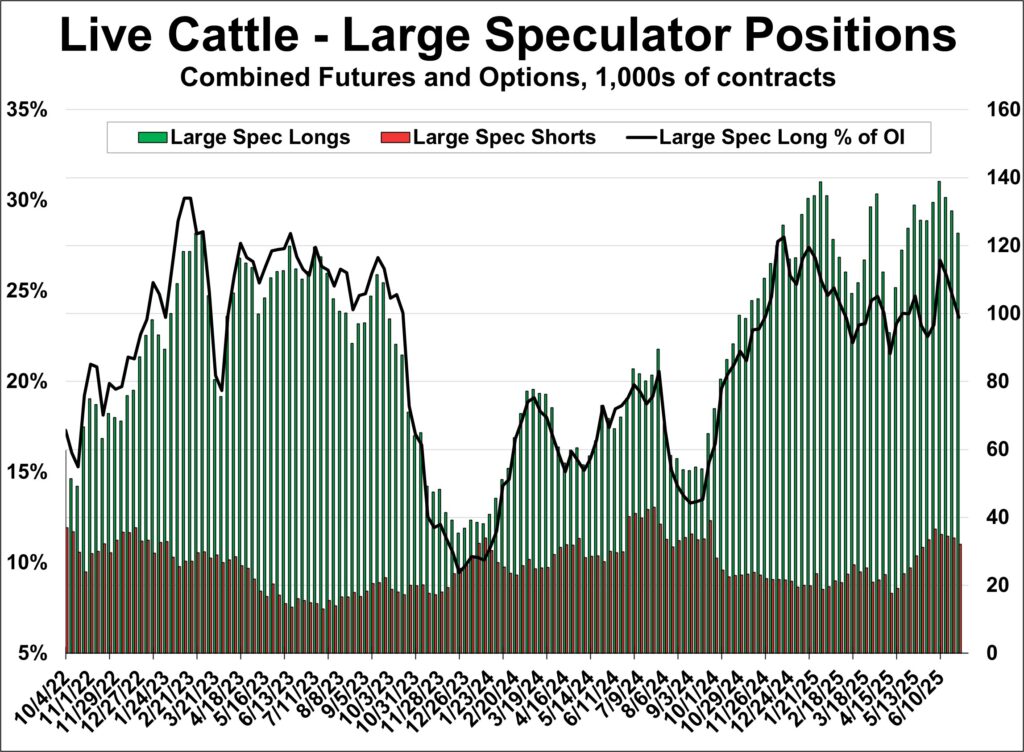

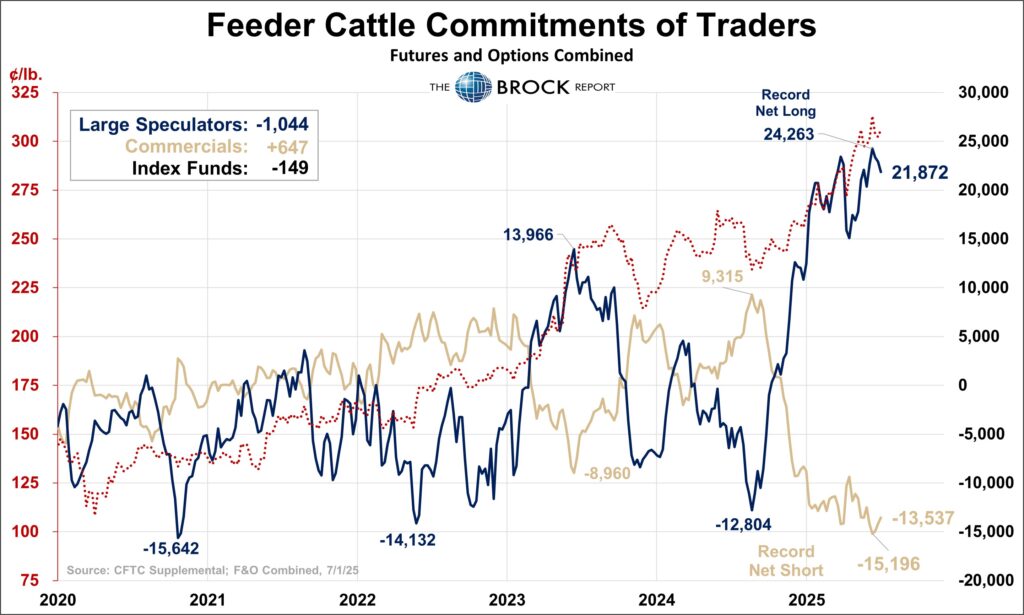

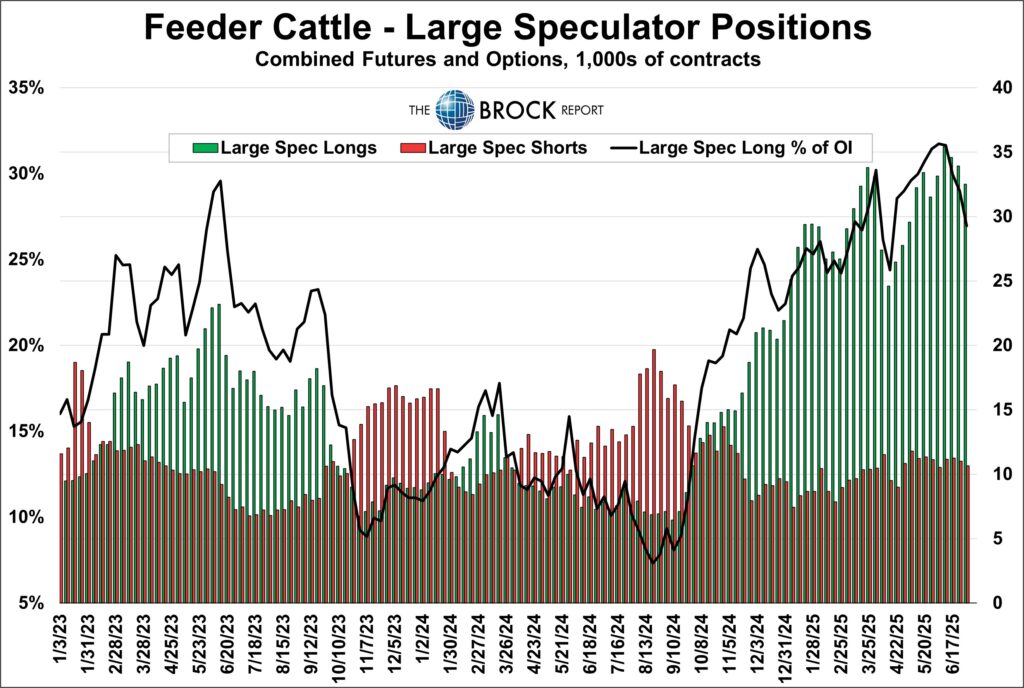

Cattle Complex

This 5 year bull market has made a lot of people look really smart, and a lot of people look really dumb. We suppose that how all markets work, but this has been relentless! That said, the COT setups for both fats and feeders is very concerning, with spec longs accounting for well over 25% of total open interest in both markets. Specs are particularly extended in the feeder complex. That said the fundamentals still seem to support higher prices. We will continue to watch these markets and continue to establish modest protection when we feel a sell off may be coming. This is a market that will tank when least expected and after it weeds everyone out. We definitely advise caution for cattle sellers, but picking the top is going to be tough.