Weekly COT Highlights – Week Ended Tuesday, October 7

Main Takeaways this Week

We’re BACK! Sort of. If you look at the date above, it is not a typo, Friday’s CFTC COT report is data through October 7. Rather that just complain about the government and their inability to process historical data with something like, oh I don’t know, a computer, we’ll see if any nuggets pop out that might have helped.

In a way this can be more educational, because we have the price history following this data. So, did the data give us a clue? Let’s have some fun with this!

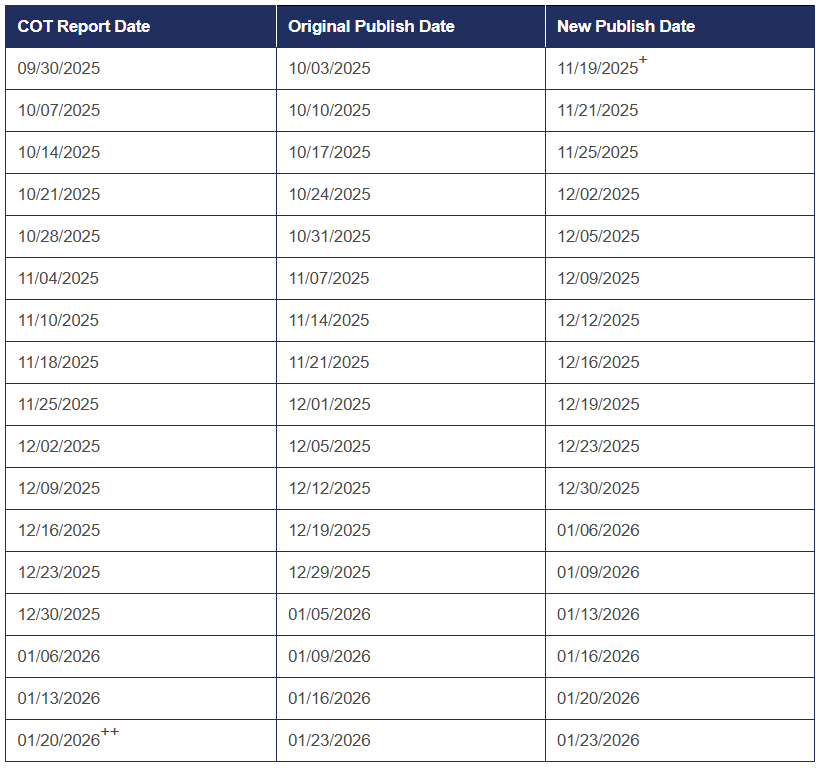

Before we get into the report, immediately below is the release schedule. We will continually update the chart on Infographics, and on Saturday we will at the very least be sending out select charts in this space.

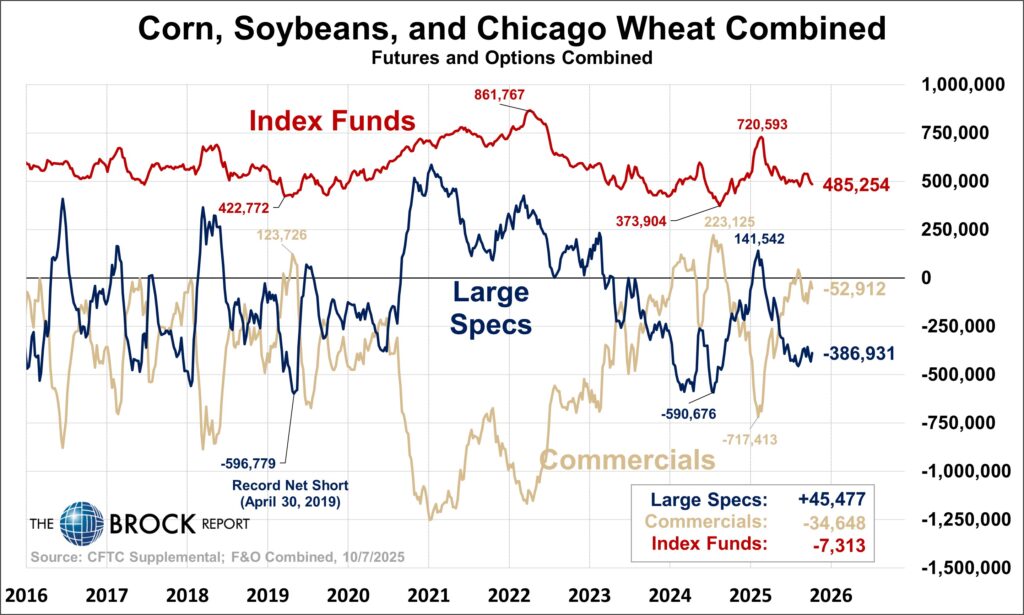

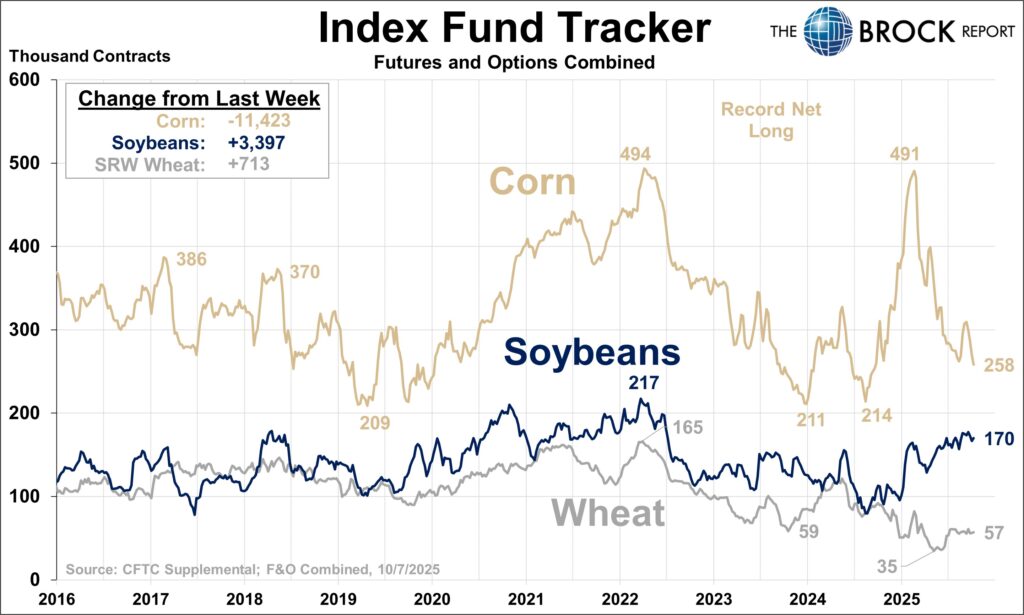

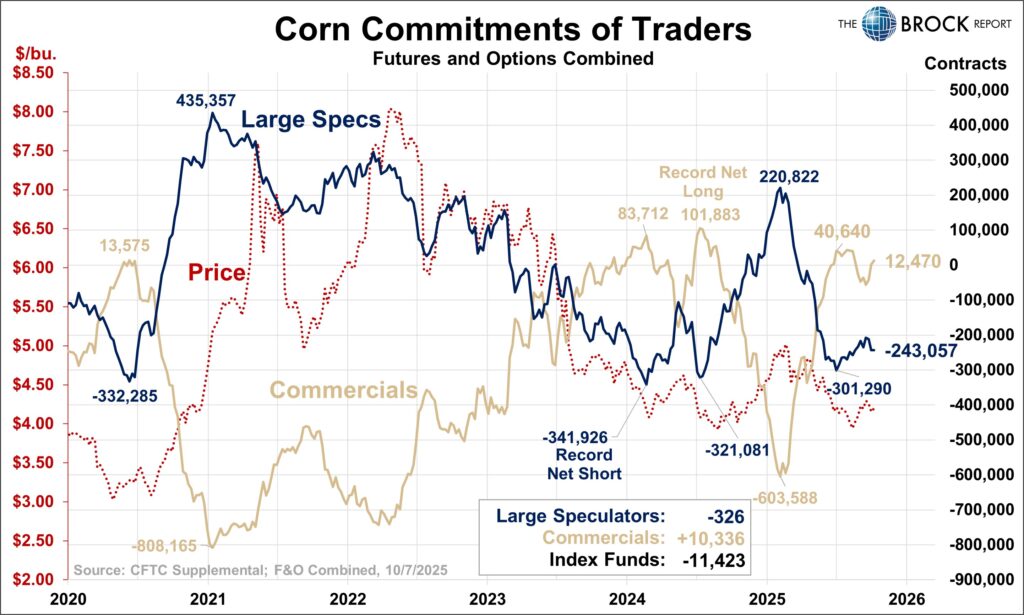

Corn

Corn prices since early October really have not done much. They dropped about 10¢, then rallied about 25¢, and then sold off about 20¢. With inconsistent price action, we would not expect to see any extreme movement in the large spec position. Nothing in this report, we’ll check back in next week.

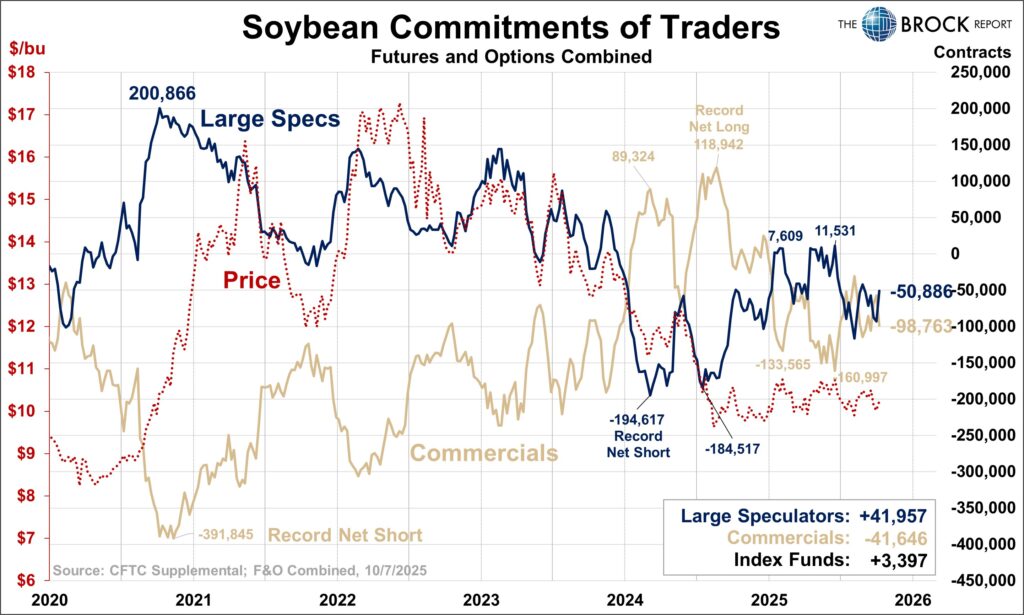

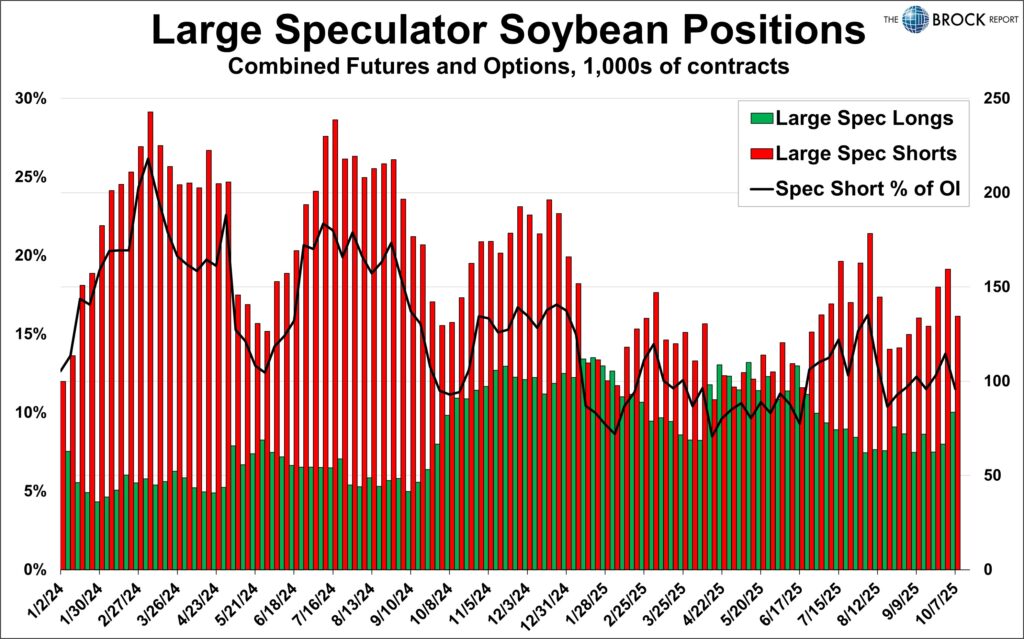

Soybeans

Soybean prices on the other hand shot STRAIGHT up in the weeks after October 7. As we always say, large speculator buying pressures futures prices higher. So, one sign that a sharp rally might be coming would be significant large speculator buying. We also preach that for a sustained rally, you need not only large spec short liquidation, but you want to see them adding long positions. Low and behold, in the COT report before the rally starts, we see significant net buying from large specs, through both short liquidation and new long position building. WOULD HAVE BEEN NICE TO KNOW THAT IN OCTOBER! 🙂

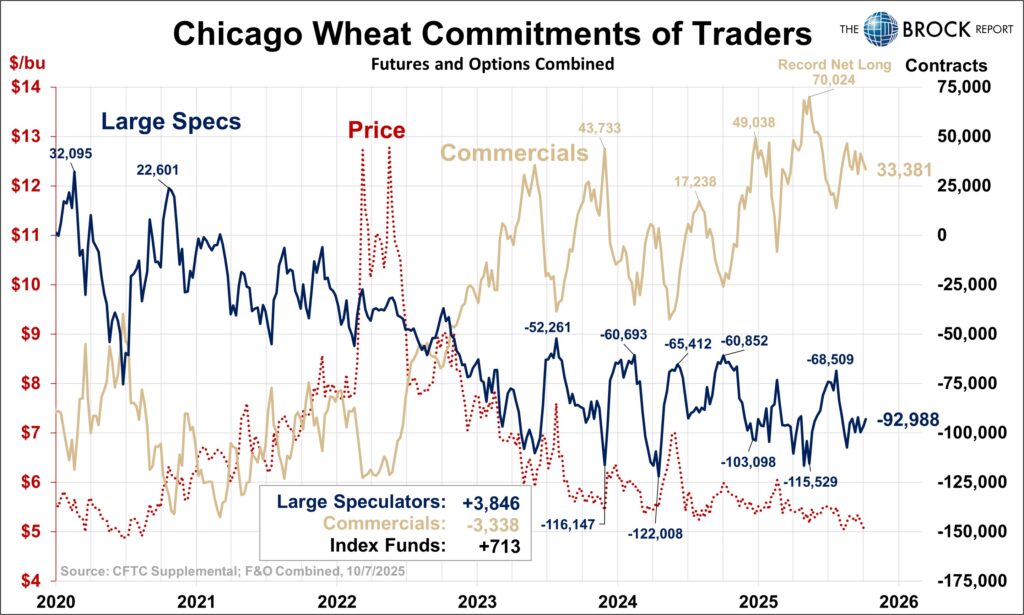

Wheat

Nothing to see here.

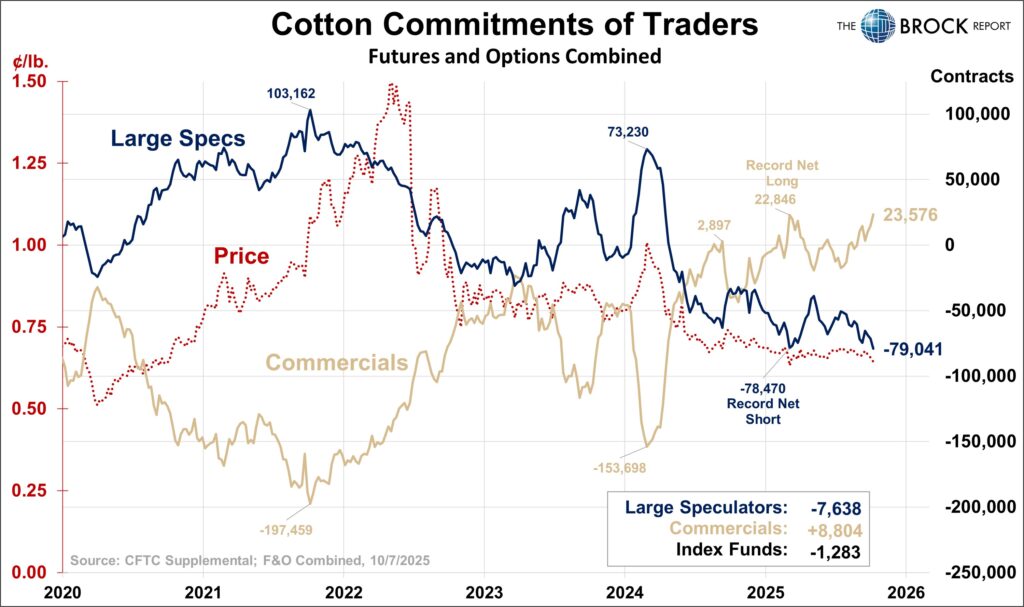

Cotton

Specs continued selling, establishing a new record net short (never mind the chart annotations, not redoing the file just for this). That would be an indication that additions price pressure is on the way, and that hedge protection would be warranted. Would have been nice to know.

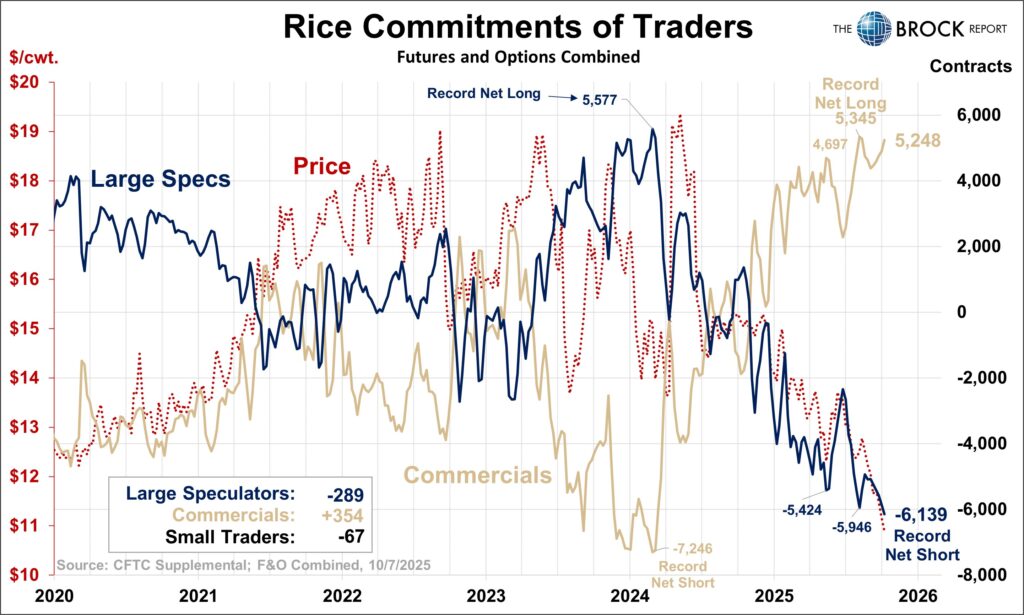

Rice

Additionally for rice, a new record net short set by large speculators = additional downward pressure on prices. Would have been nice to know.

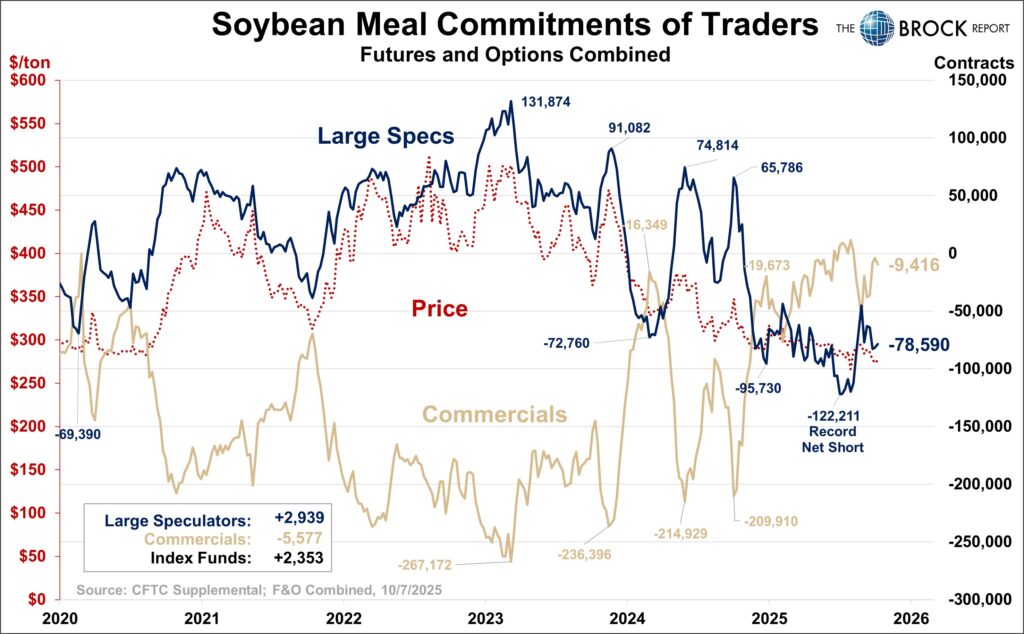

Soybean Meal

Modest buying in the meal, overshadowed by the prior few weeks of massive buying, would combined be a moderate indication that we could see a sharp rally in futures. This one we were on before the government shutdown took away our data. We warned many many times that the combination of low prices, and I mean roughly matching the lows going back to 2008, as well as the record net short by large speculators, was a recipe for a sharp rally in prices. We advised feed buyers to procure needs, and those that followed the recs are today very thankful.

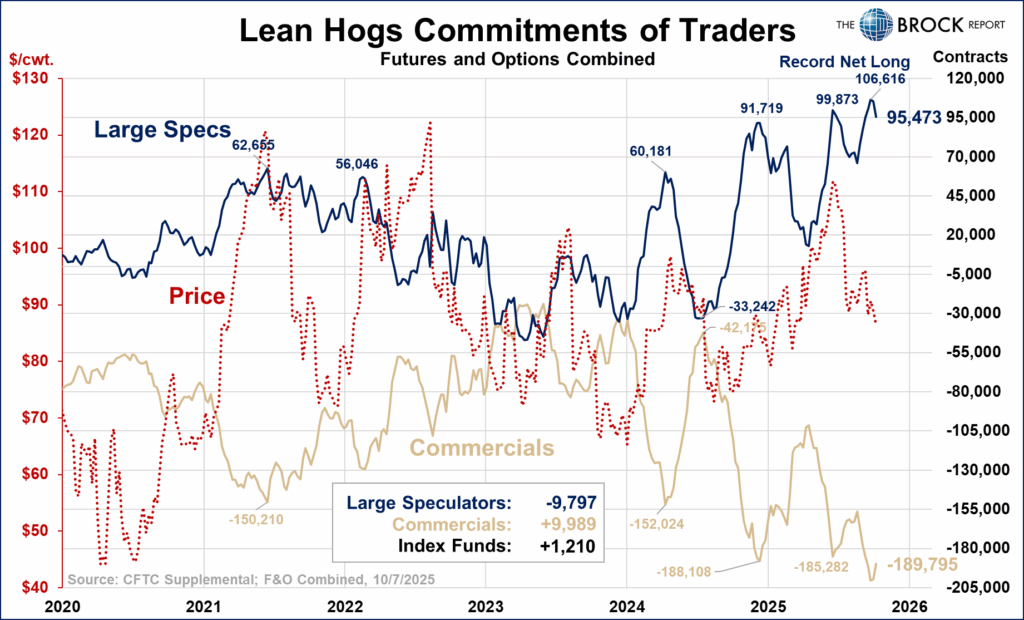

Lean Hogs

This setup is LITERALLY why we use these reports. Large specs at a record net long, commercials at a record net short, prices at elevated levels all add up to the potential for a massive selloff. While the data through Sep 30 (released earlier this week) showed some modest selling, in fact the first week of large spec net selling after 5 straight weeks of buying, it would have been enough to get our attention but not really convince us a selloff was imminent. This report however showed pretty significant net selling and would have absolutely set off some alarm bells. Thankfully, the technical action was enough to trigger us to advise some hedge protection, but this data may have made us more aggressive.

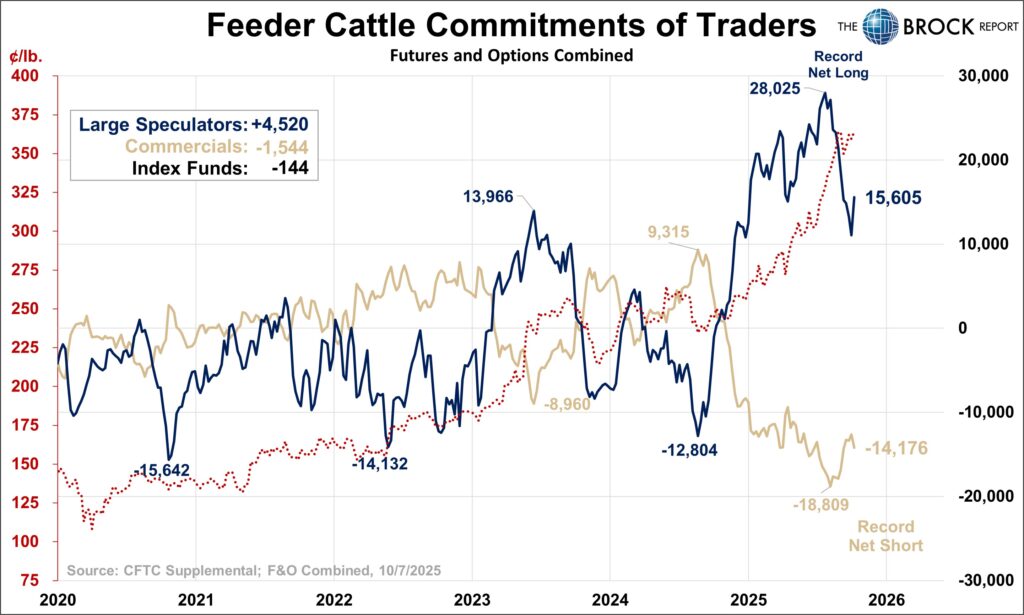

Cattle Complex

The Cattle COTs are a mixed bag as far as this 20-20 hindsight / educational review goes. Feeders gave their warning signal LOUD AND CLEAR several weeks before the selloff started, not to say that this information made trading them any easier, in fact possibly more difficult. This release showed significant buying, and as you can see below futures followed suit. The previous selling failed to produce a drop in prices, though again, this was a warning signal and not a ‘trade timing indicator’. It will be interesting to see this COT data as it comes out.

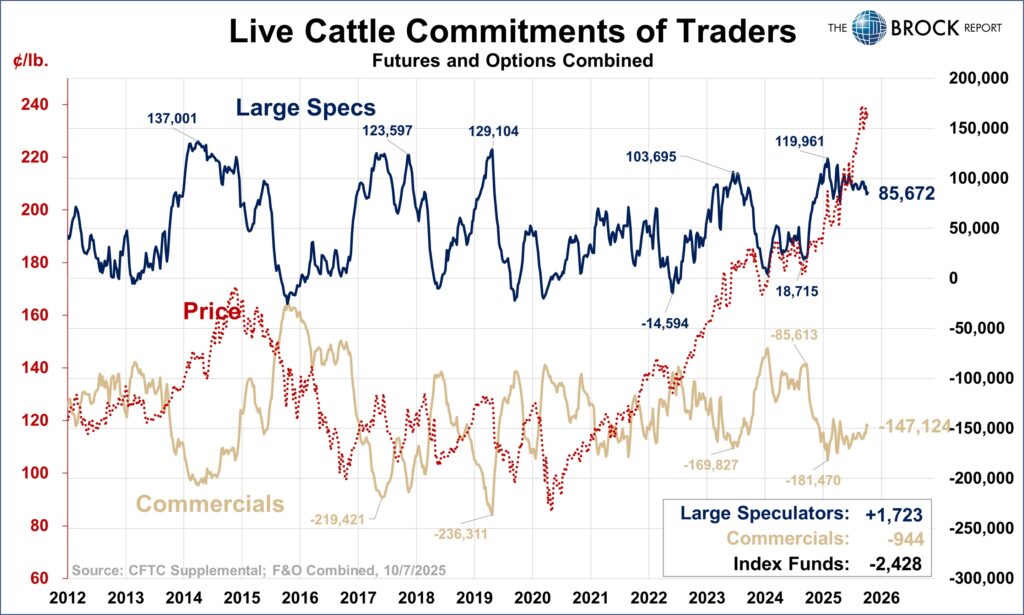

Not much to discuss in the live cattle COT.