Weekly COT Highlights – Week Ended January 6th

Main Takeaways this Week

We are finally back up to date!!! While I don’t know how you feel about the lack of COT data over the past several month, but personally it was a big deal to not have this data. And given the price move we saw in soybeans, and then watching the COT data come out after the fact, this served as a stark reminder of how important and useful this data is.

We won’t pontificate too much for fear of losing your attention, but we do hope you will get back into the swing of thing with us this week as we review the lastest and finally current CFTC COT data released this Friday afternoon.

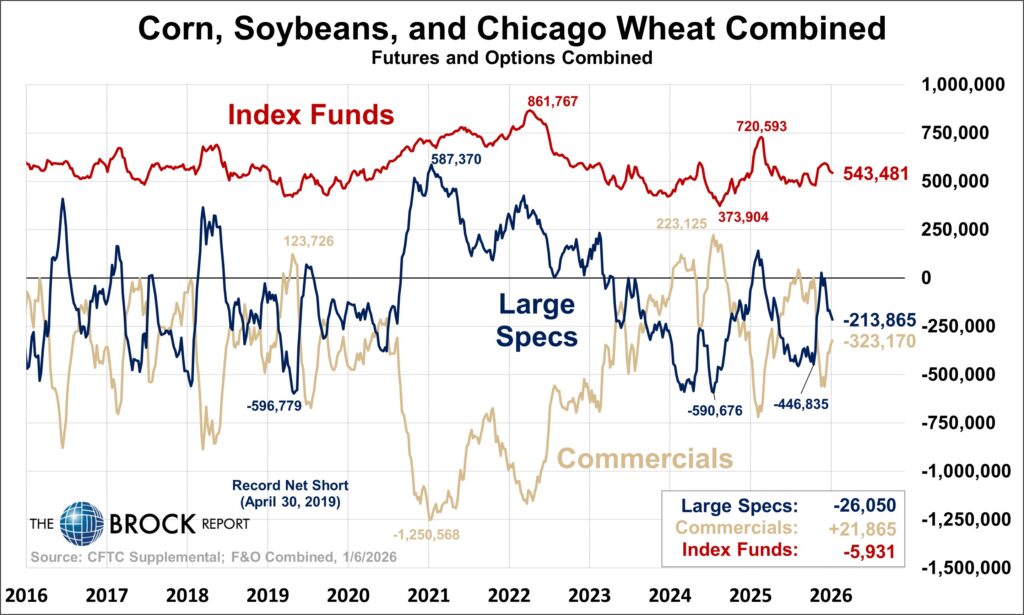

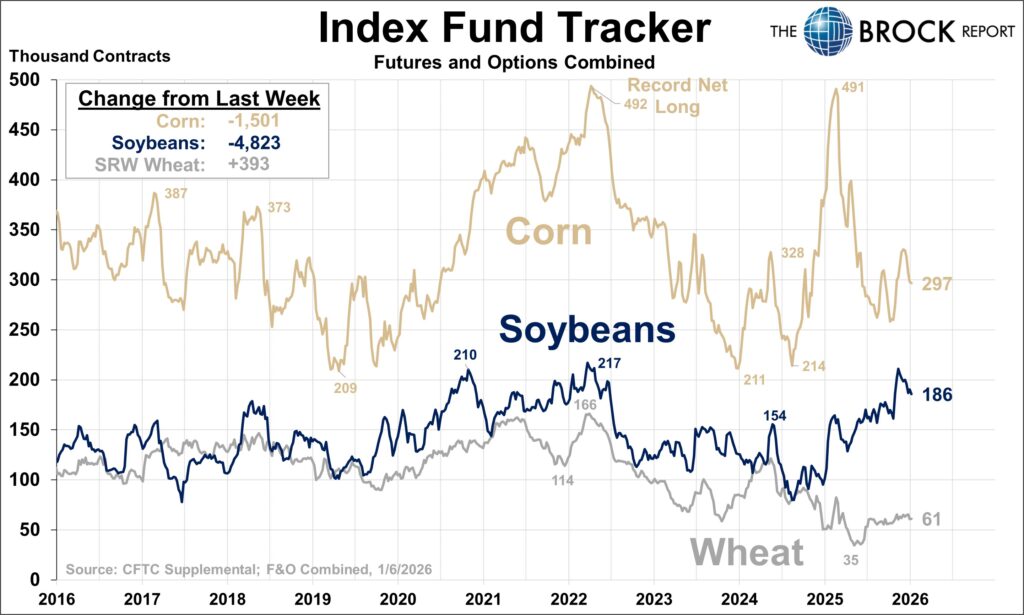

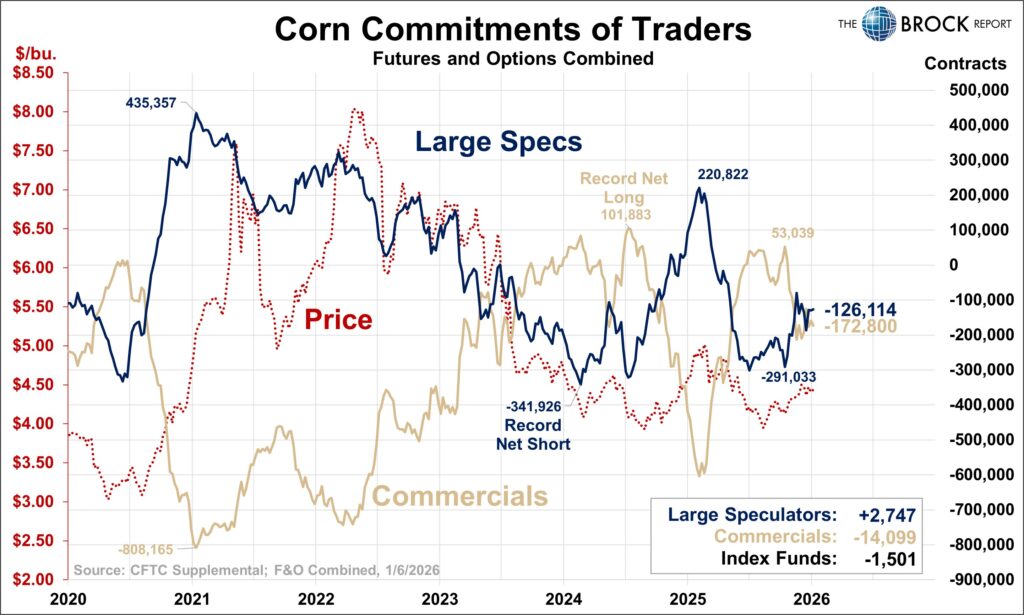

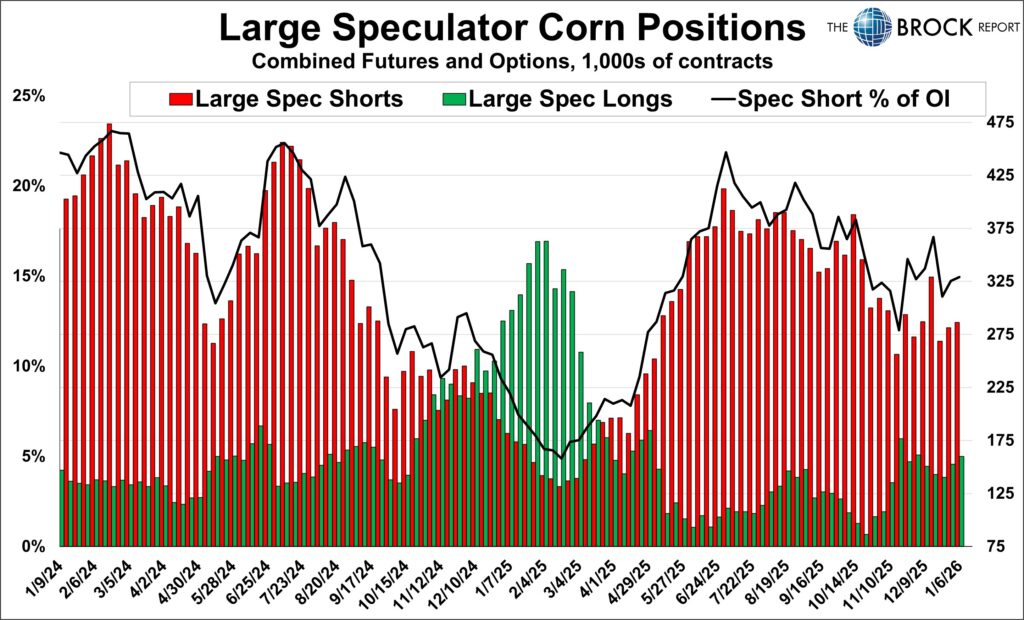

Corn

Very modest buying this week as large specs still sit short ~125,000 contracts, and commercials short 173,000 contracts. This is about as “no man’s land” as you can get, and provides little clue as to what direction corn is likely to move next. Similarly, technically the charts don’t say much and corn has been moving sideways for the last two months. Gun to our head you ask if corn is in an uptrend or downtrend, we firmly believe the lows are in and we are in a broad uptrend, but that required you to zoom out a bit. Since October little has happened.

Monday’s USDA report will likely not change that much. Supply is enormous, demand is extremely strong, those two combined means choppy markets.

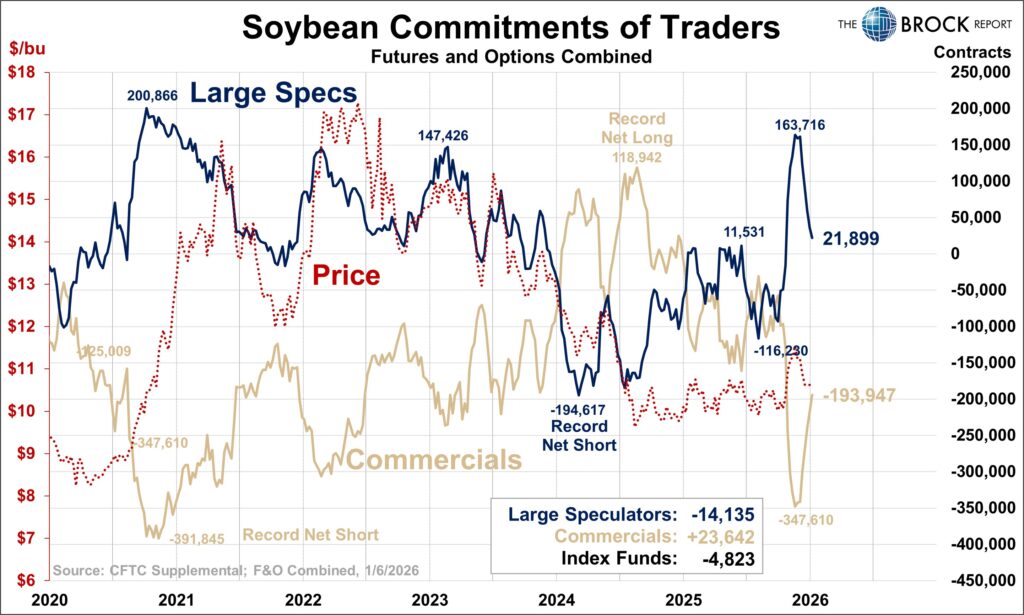

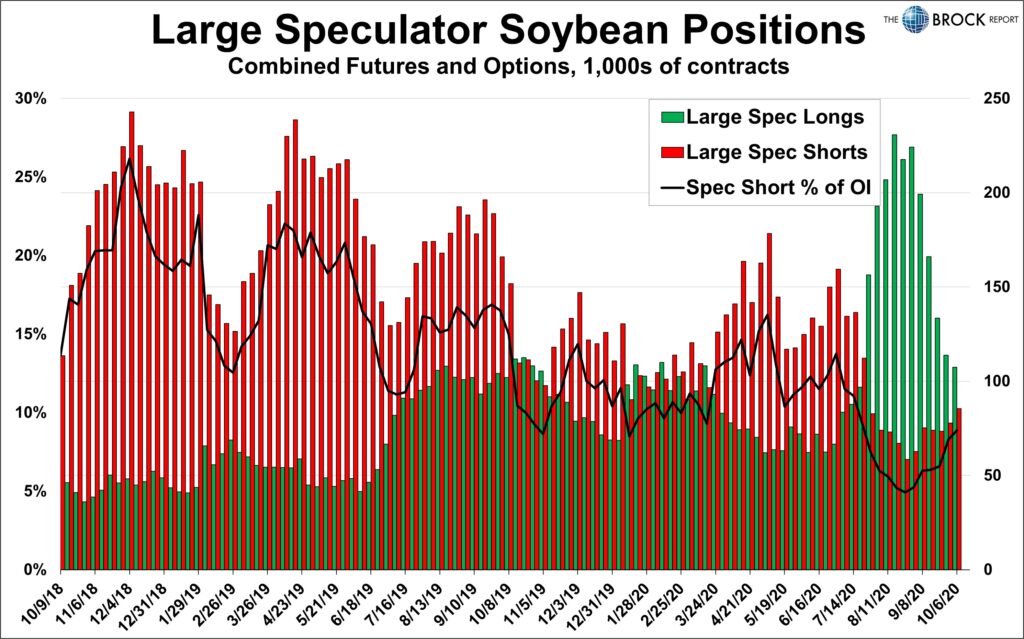

Soybeans

This is far less ambiguous than the corn COT, and the chart immediately below should make EVERYONE a believer of the importance of COT data. Specs bough the daylights out of the soybean complex as rumors of a trade deal with China emerged and developed, and then sold the dickens out of it as the seasonal export window to China closed with nothing having been shipped there. This COT data would have made us much more aggressive, though we did make sales, in November and early December. Water under the bridge.

Bottom line is large speculators are still selling this market, but keep in mind the data is only current through Tuesday. Futures mounted a strong rally on Monday, but if that was driven by spec buying, that buying was overshadowed by the previous week’s selling in this data. We expect to see a neutral to modest net buying in the next report. Until we see that, there is reason to be concerned as large specs still have about 100,000 longs that they could liquidate, and they hold just ~60,000 shorts, a position they could increase. Monday’s USDA reports will likely drive their activity for the next several weeks so pay attention to the report, and Premium Subscribers should be sure to tune into our Market Edge presentation in the afternoon.

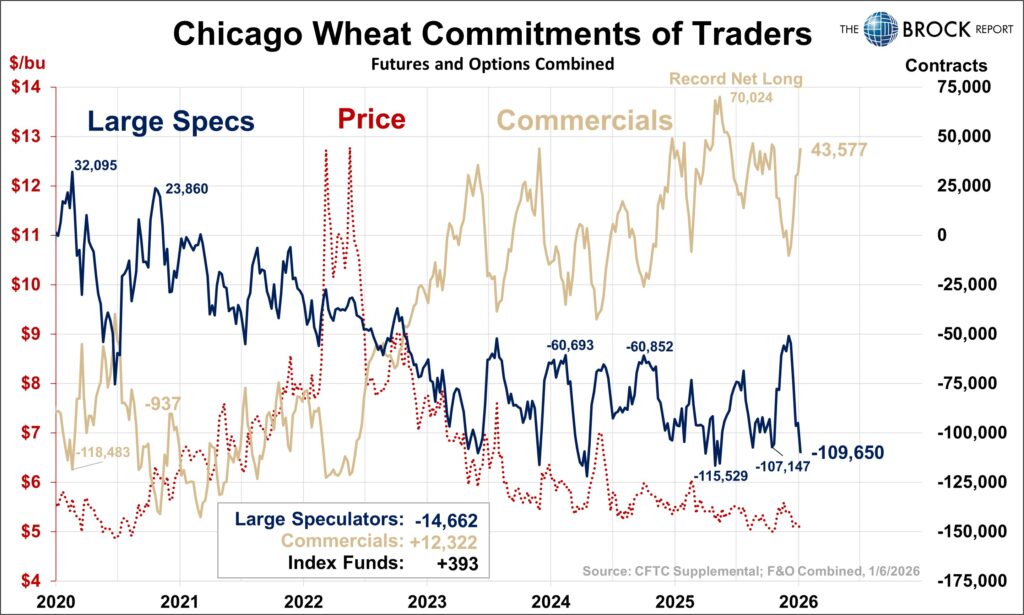

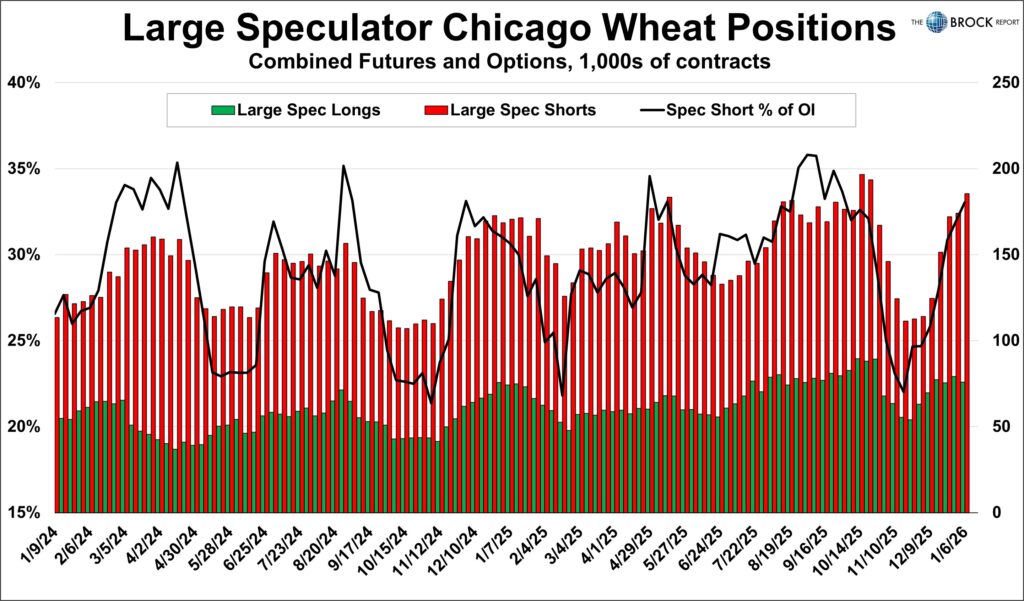

Wheat

Pretty bullish setup here. Prices have held up relatively well considering the massive selloff from laarge specs over the past several weeks as they went from short 50,000 contracts to 110,000. Now large specs are sitting near historically large net short sizing, while commercials are approaching their record net long established in the first half of 2025. Be patient in the market, there is real potential for a rally here, like in cotton, if something fundamental can get the market moving.

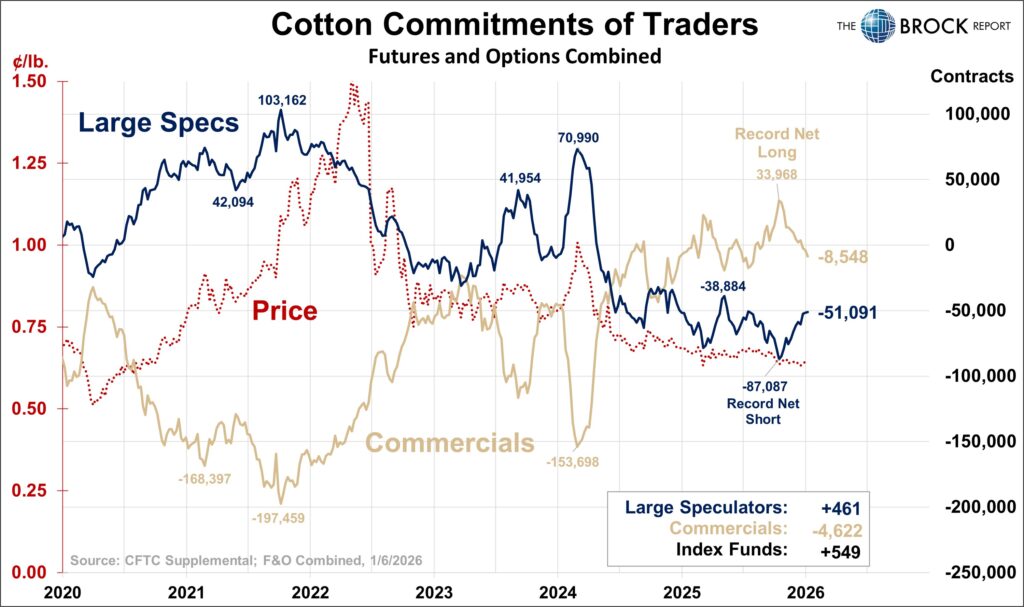

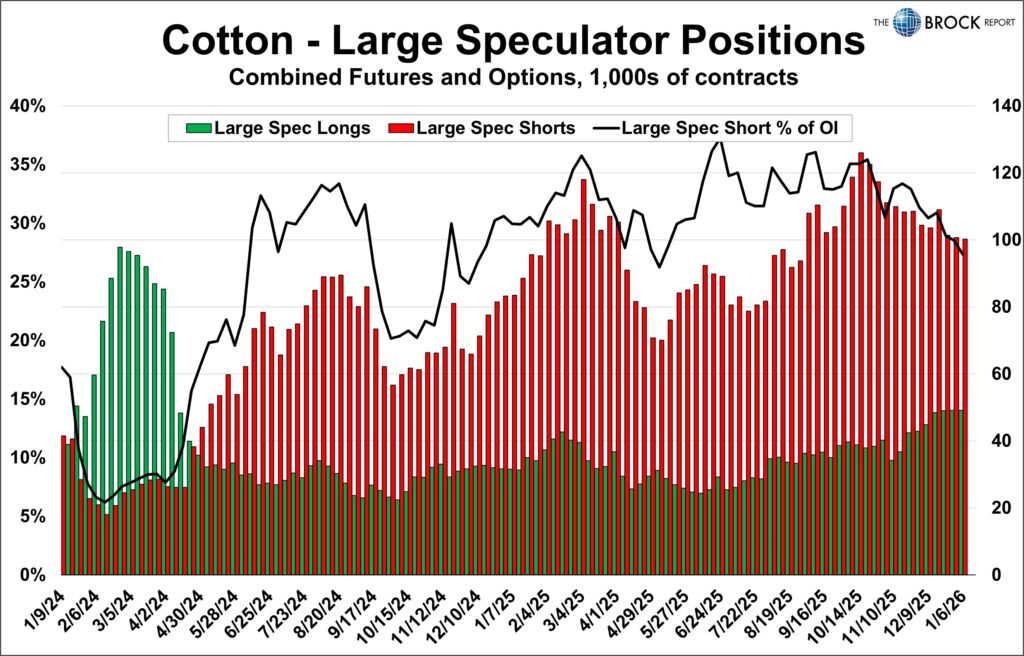

Cotton

Cotton producers really cannot get a break. Even with pretty solid large spec buying cotton futures just aren’t moving higher. The overall setup here doesn’t tell us much, other than the fact that cotton needs a fundamentally bullish story to get prices off the floor. The first crack at that will come Monday at 11am with several USDA reports. Hang in there.

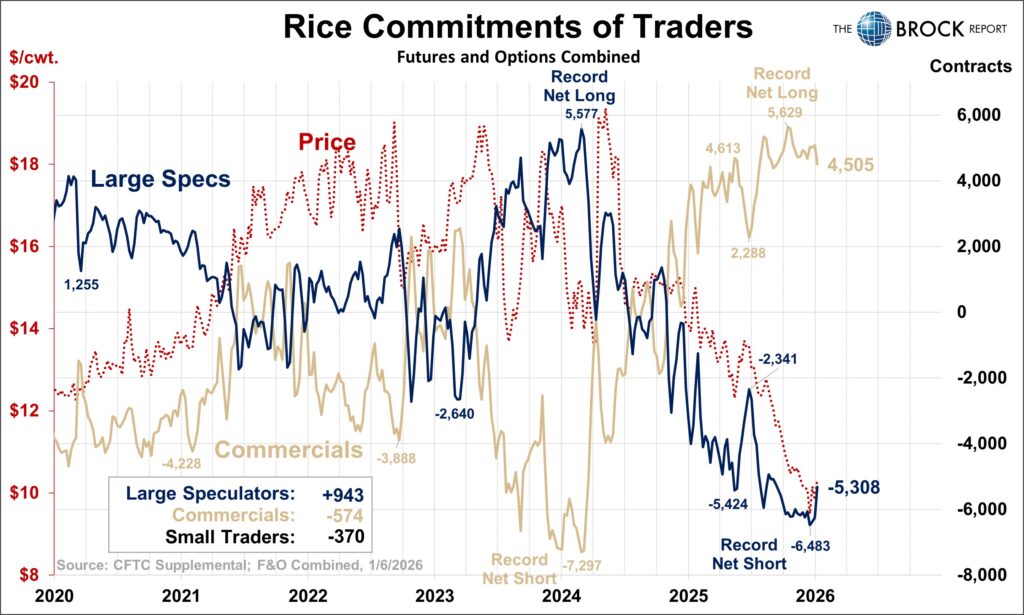

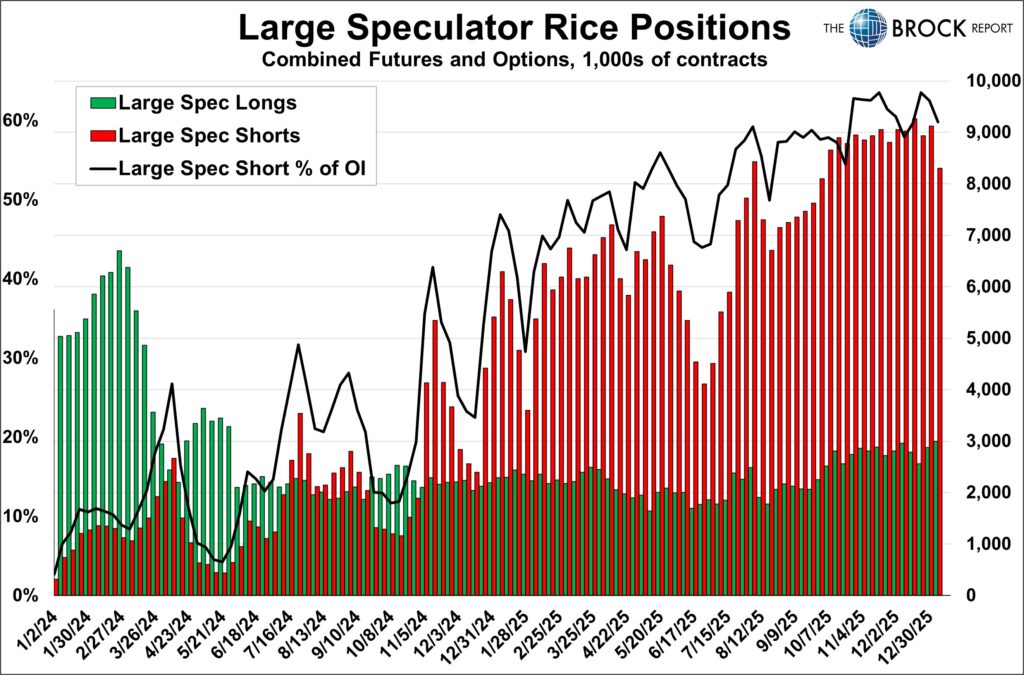

Rice

This is as bullish of a setup as you will ever see. Specs coming off a record short, commercials coming off a record long, and prices, well lets not talk about the prices. There is a LOT of room to the upside and a lot of dry powder for specs to spend. You can see two charts below that this latest net buying came from very aggressive short covering, and you can also see they still have a TON of shorts to liquidate. This looks very good for rice producers, and it has been a long time since anything about this market looked good to them. Do not be advancing rice marketings.

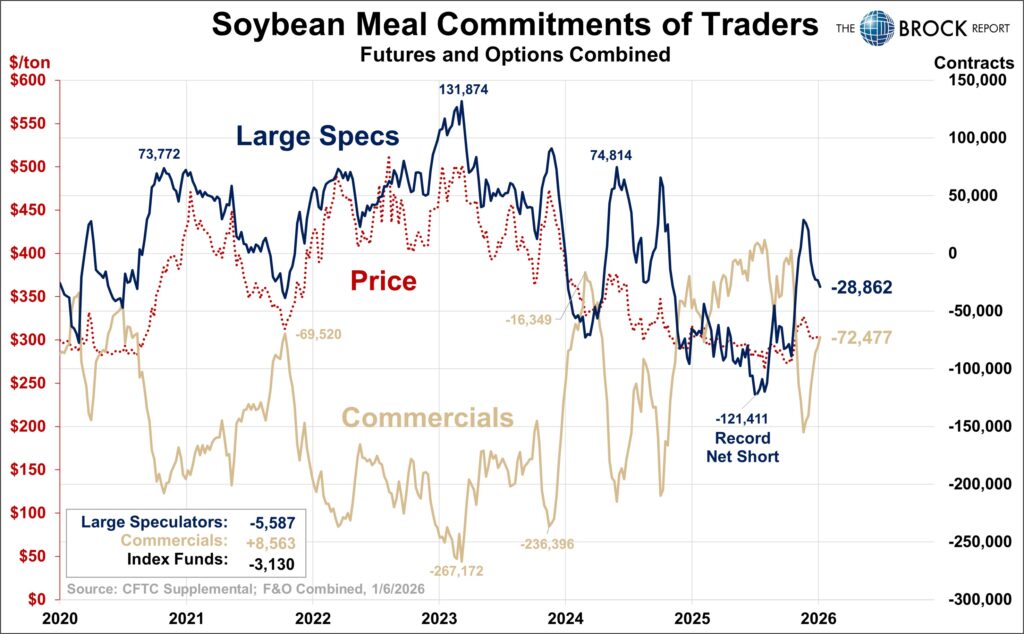

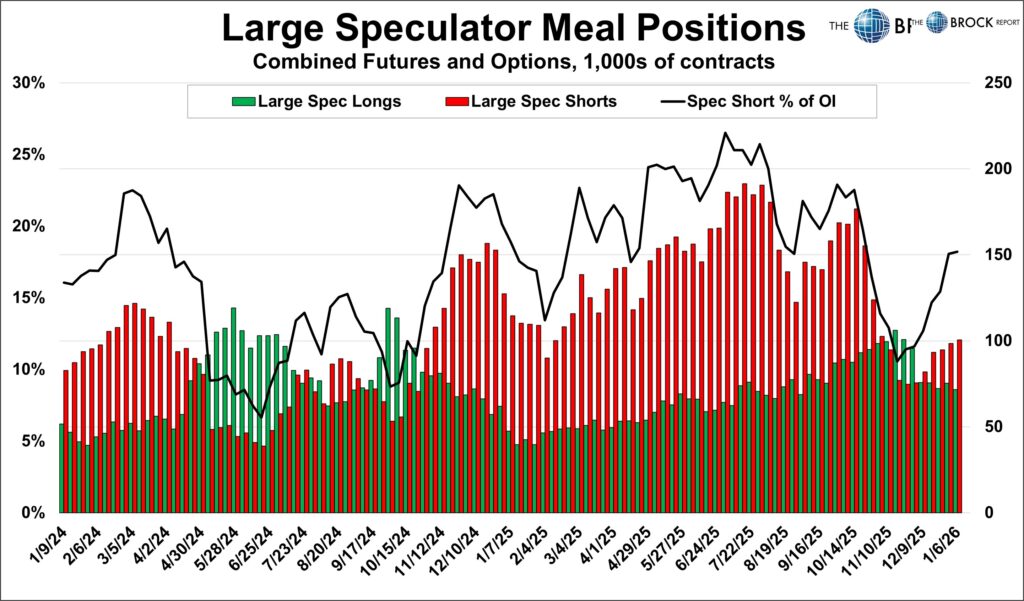

Soybean Meal

Pretty neutral setup but there’s no denying that large spec selling has driven this market lower. Recently this has been additional new selling which is typically quite concerning, but given the price levels we did decide to advance feed purchases this week and would still recommend doing so. We bought just 50% of the second quarter, and are now looking for an opportunity to buy more. This COT says perhaps we should be patient. Time will tell.

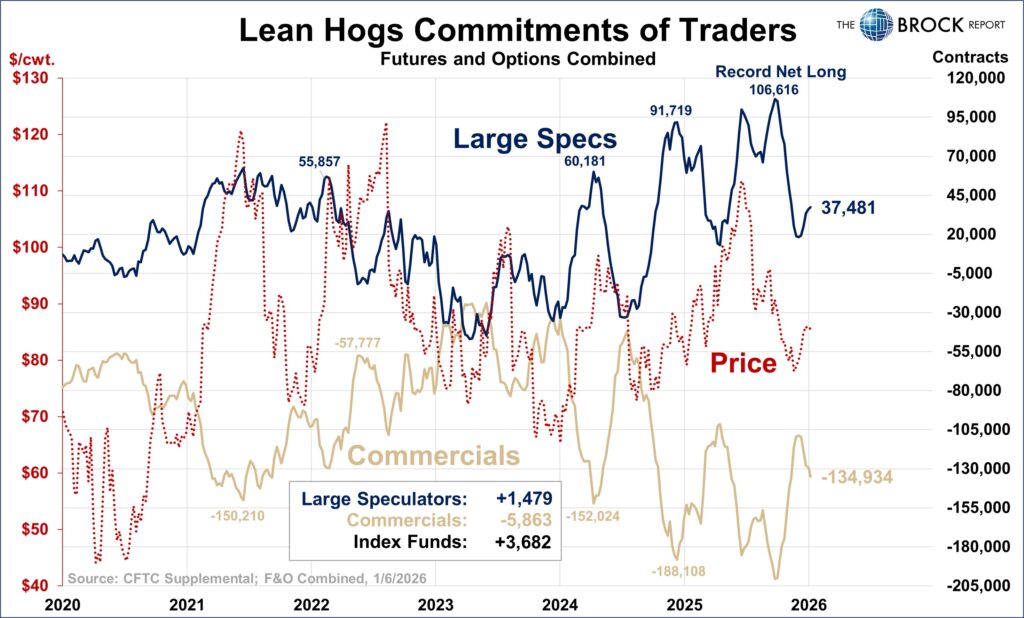

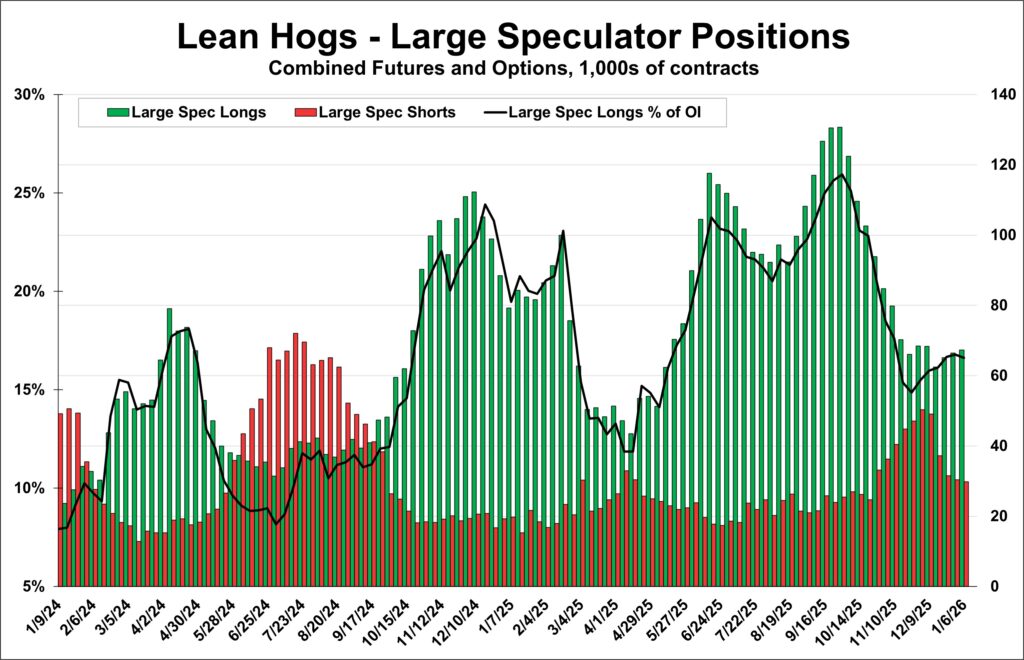

Lean Hogs

Pretty good look here as large specs have returned to buying and brought the futures market along for the ride with contracts all about $10 higher than their November lows. We established a very small position selling calls against 25% of a quarter, and worked an order to sell more Friday that went unable. We are watching this market closely to add more significant hedge protection, but much like meal, with specs being consistent buyers there is some reason for caution. All in all, this setup is relatively neutral and won’t sway out decision making much, so be alert for recommendations.

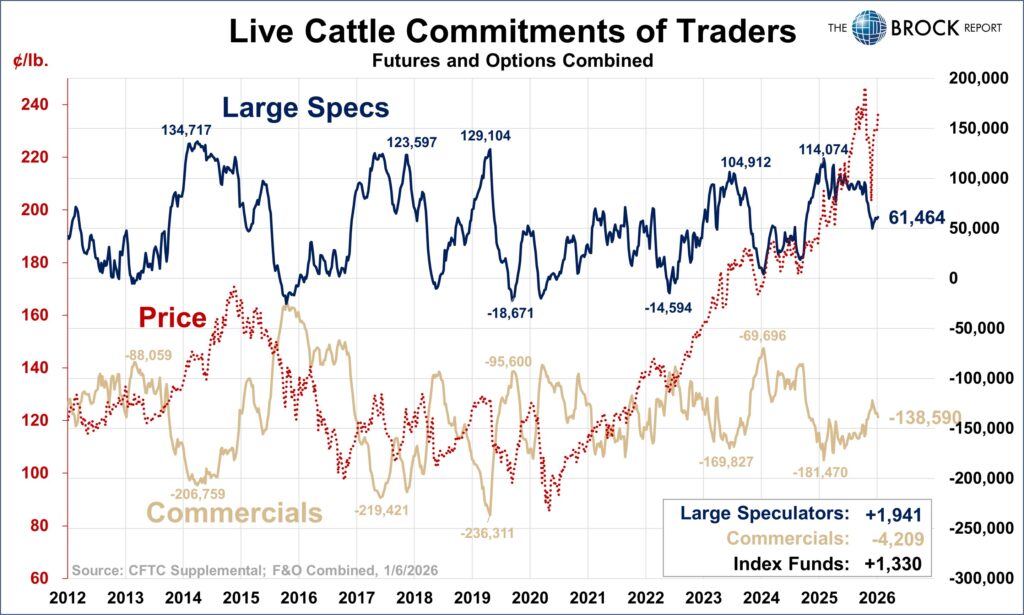

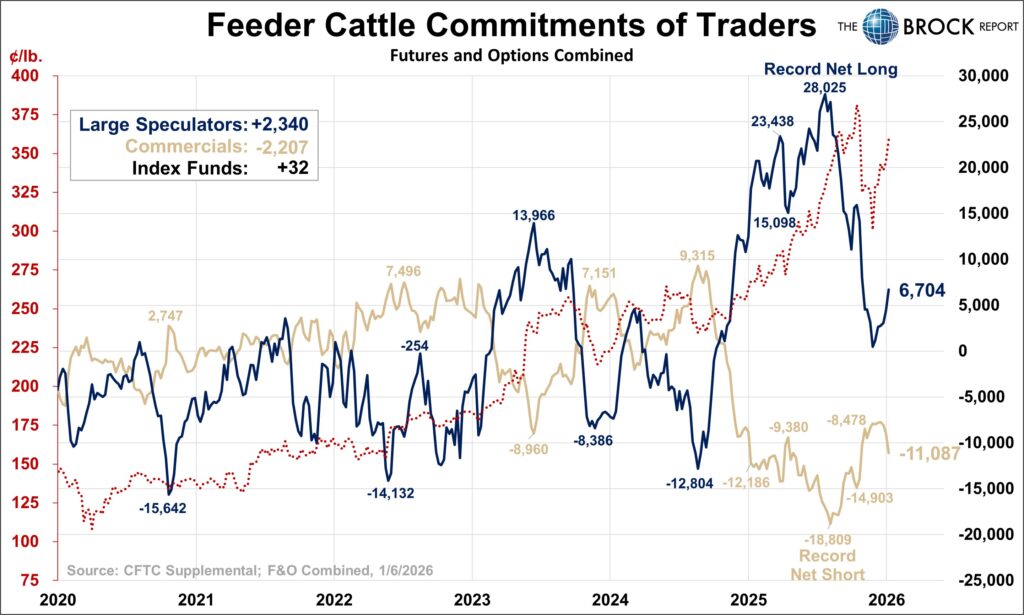

Cattle Complex

Both fats and feeders have enjoyed a massive rally since mid November, and as suspected large spec buying was a key feature driving that price surge. In both cases specs have a lot of room to build larger long position and still be well under their record positions, so we are going to be looking for significant sell signals before we recommend hedges in either of these markets. Price action late in the week did not look good, so be alert for recommendations.