Weekly COT Highlights – Week Ended Tuesday, January 20th, 2026

Main Takeaways this Week

As we are having (or had depending on when you’re reading this) our annual office party this Friday afternoon, this week’s COT report will be primarily graphics with brief callouts where we see something significant, in place of our typical thorough breakdown. Frankly at times I think that less may be more, so if you are a big fan of this weeks writeup, email dbrock@brockreport.com and let me know!

This was a great week for the grains, so as always, be sure to checkout this week’s Brock Report for a full breakdown of the markets. Click here to see the print edition.

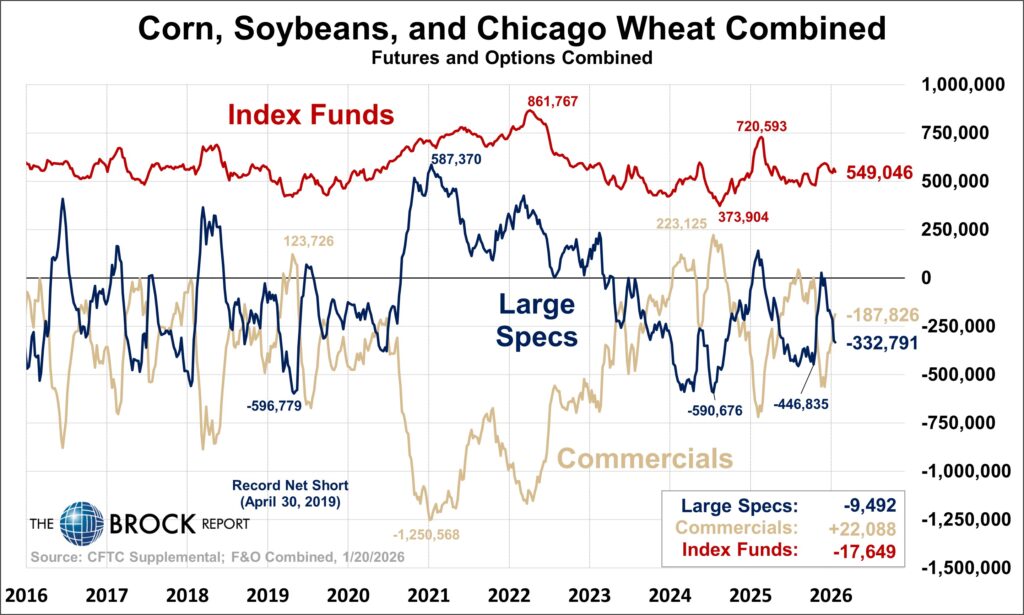

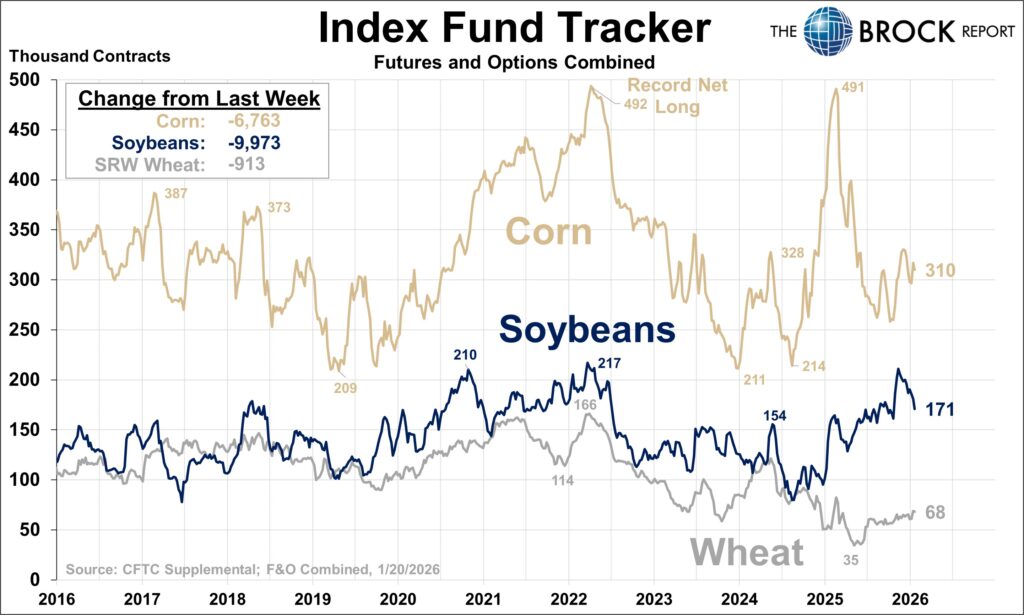

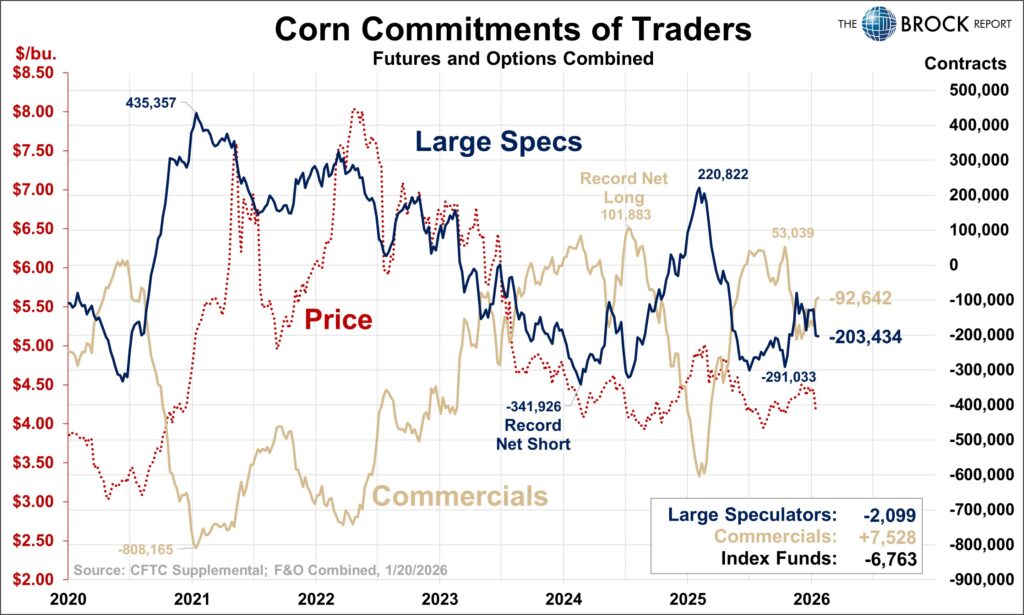

Corn

Nothing much here. Modest large spec selling this week. Pretty neutral positions as a whole, but leaning supportive for futures prices. Large specs are far closer to their largest all time net short than they are even recent large net longs. So, while this is not at an absolute extreme, it is a setup that would enable and perhaps encourage a good rally higher.

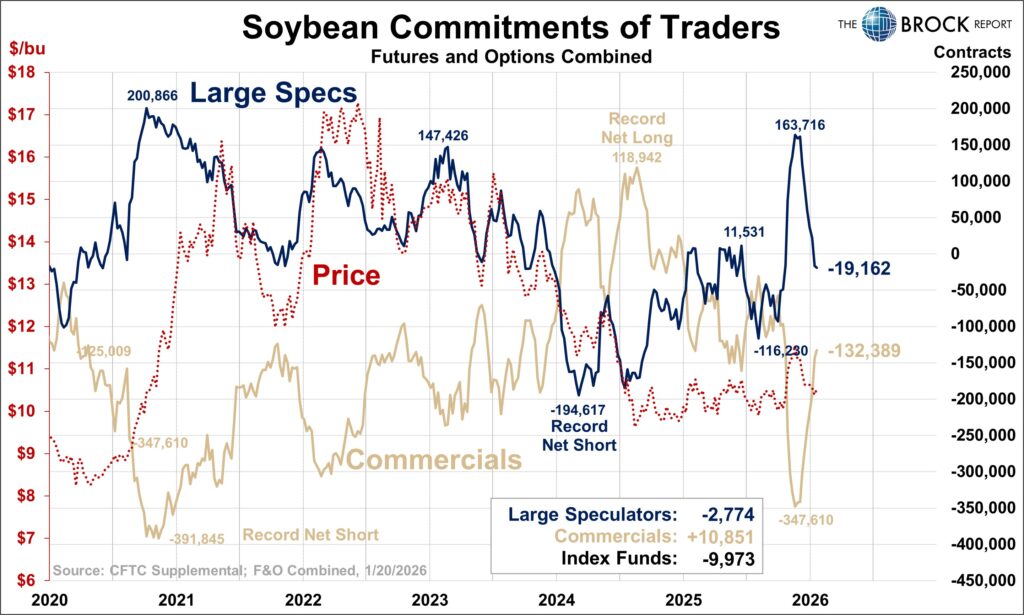

Soybeans

Nice to see large specs take a break from selling this market. We need to see a little more here and on the price charts before we are convinced a move higher is coming. Right now, there’s a lot of mixed signals so be patient on advancing sales, but also alert for recommendations on and weakness in the futures market.

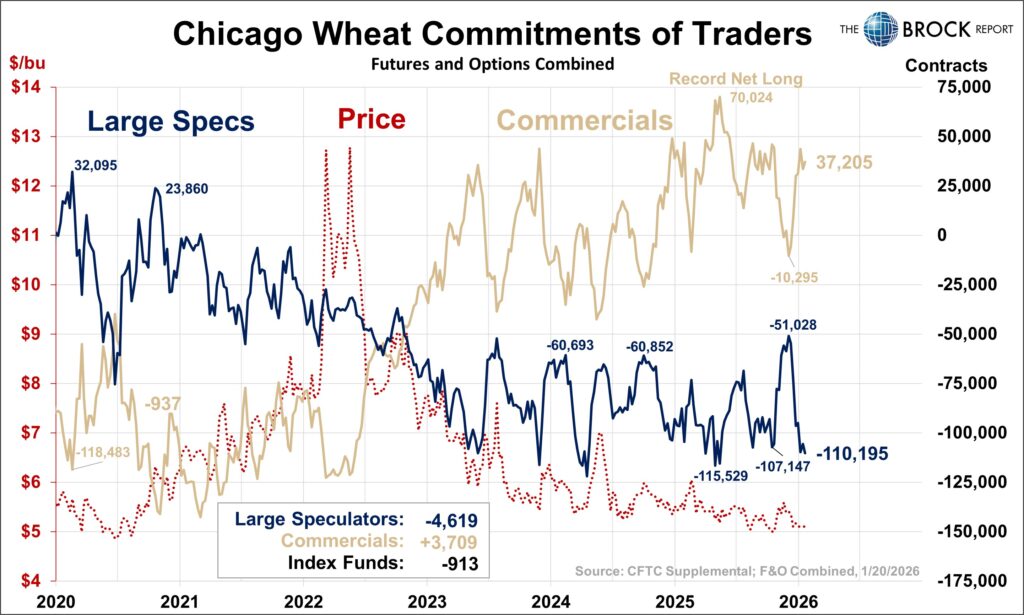

Wheat

Large specs are massively short and commercials massively long. This sets the market up for a sharp rally, which may have commenced on Friday. All signs point to higher prices.

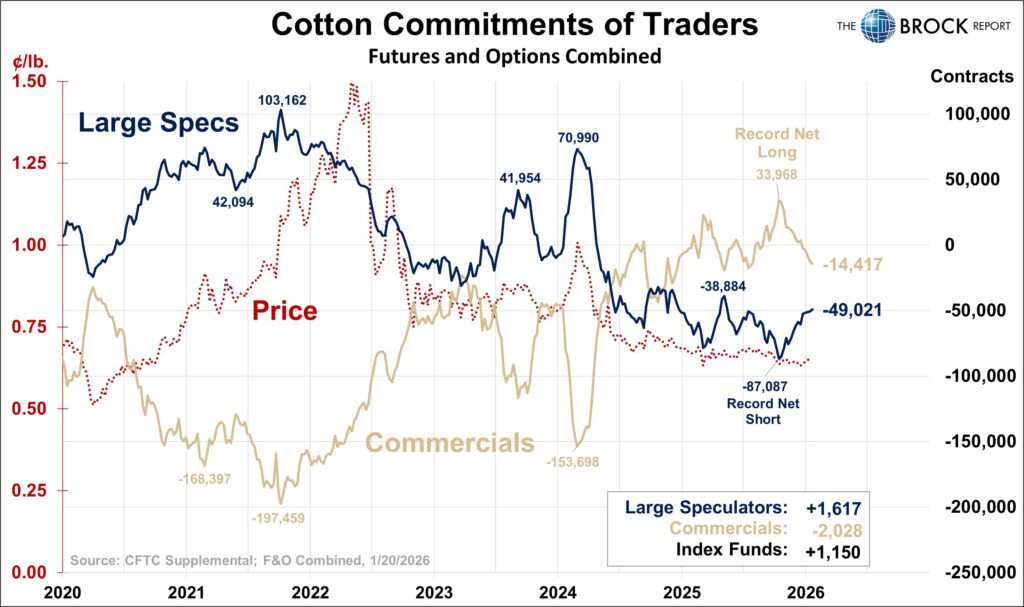

Cotton

Large specs continue buying, futures remain flat. This is one case that makes us question the COT, but a quick glance at 2023-2025 in particular, and the 2020-2021 rally below, shows there is real value. Timing is not always perfect, we continue to believe this market is making a major bottom.

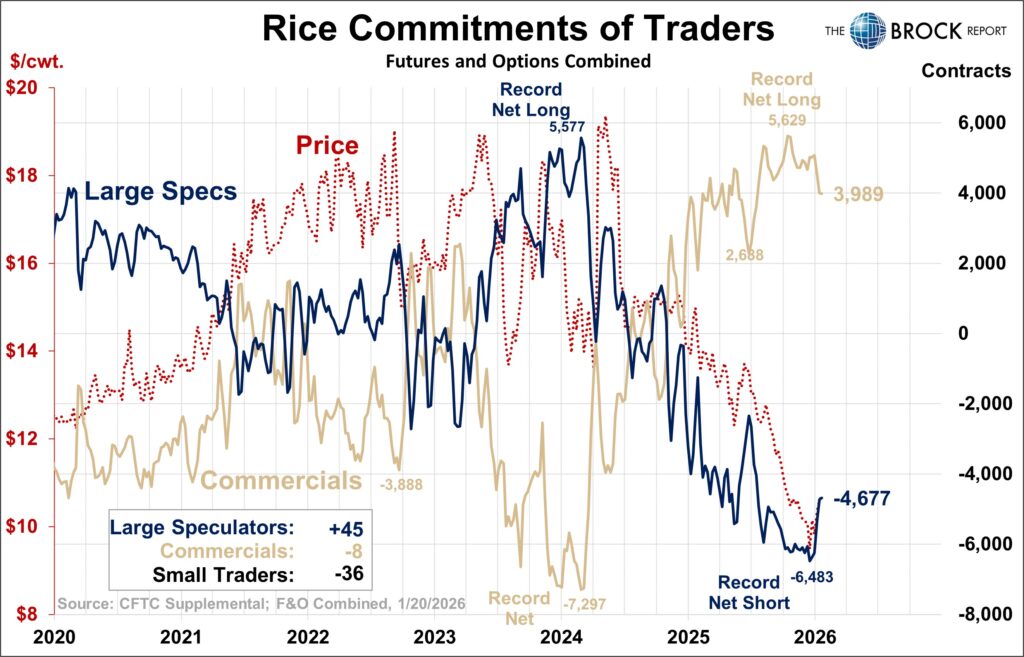

Rice

Large spec buyers cooled off this week, net buyers of only 45 contracts. This setup remains very bullish.

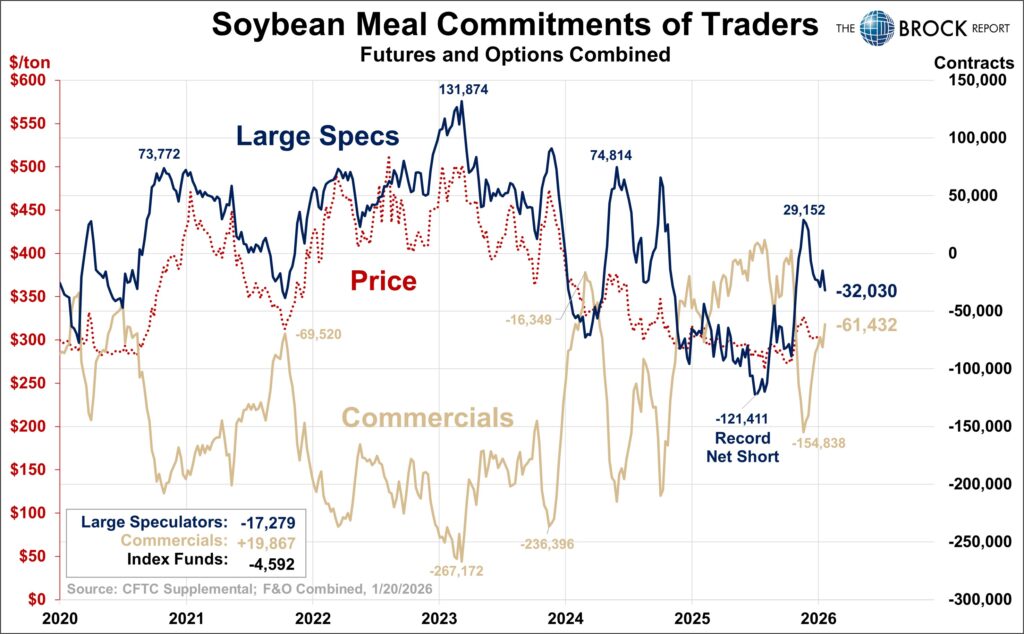

Soybean Meal

Nothing much here.

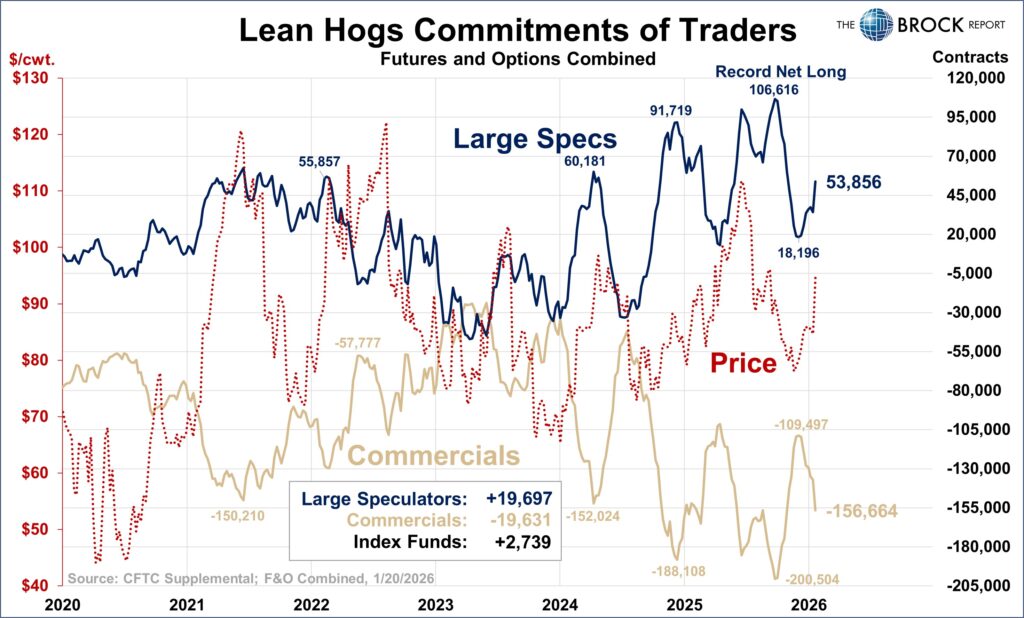

Lean Hogs

Large specs were massive buyers. As stated last week, stay out of the way of this move until a solid sell signal is given. When that happens we will take decisive action, but continue to watch closely. Could be some time until that happens.

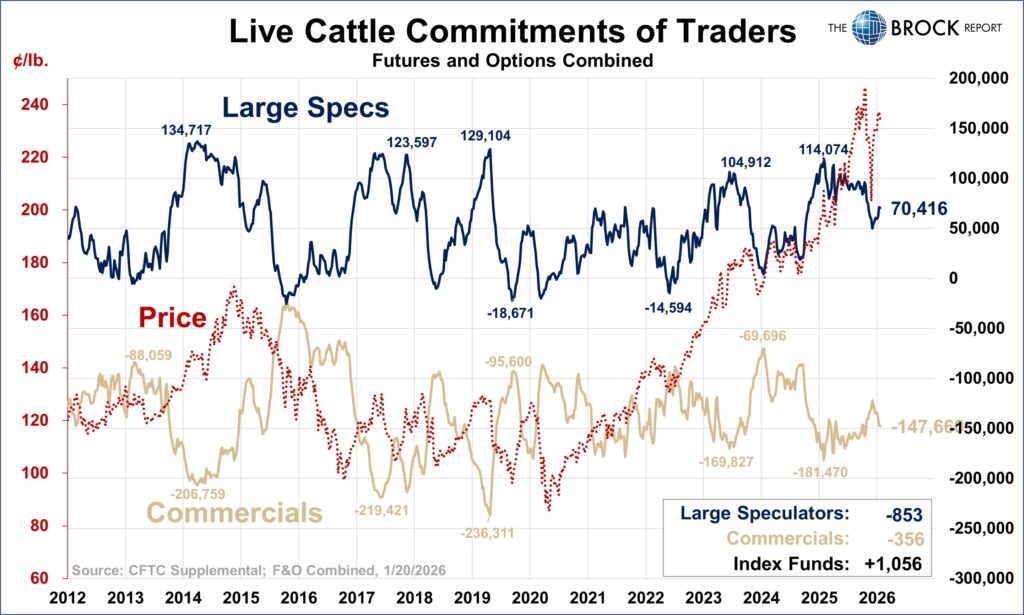

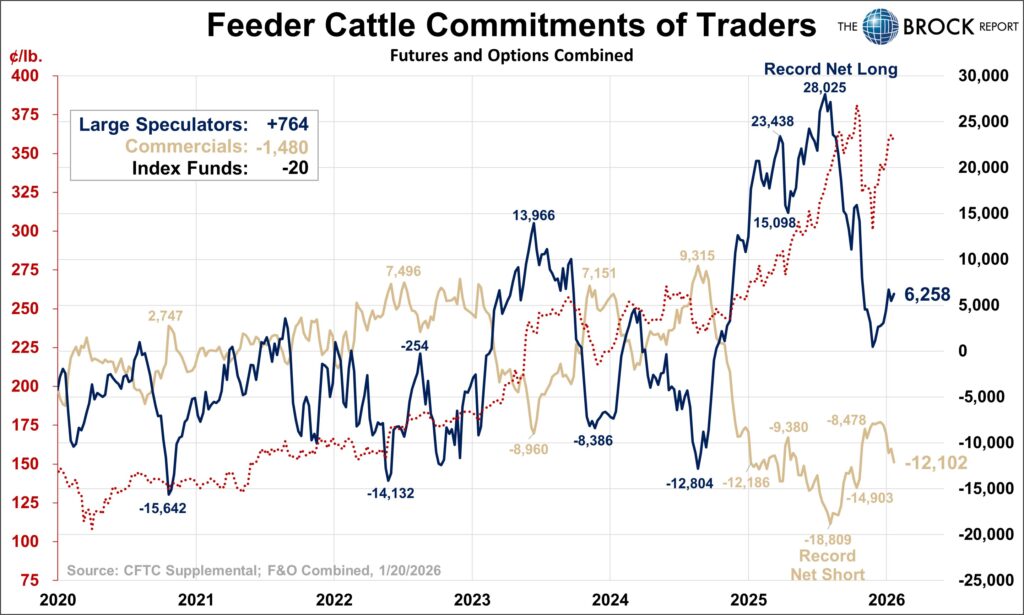

Cattle Complex

Nothing to see here!