Weekly COT Highlights – Week Ended Tuesday, February 10.

Main Takeaways this Week

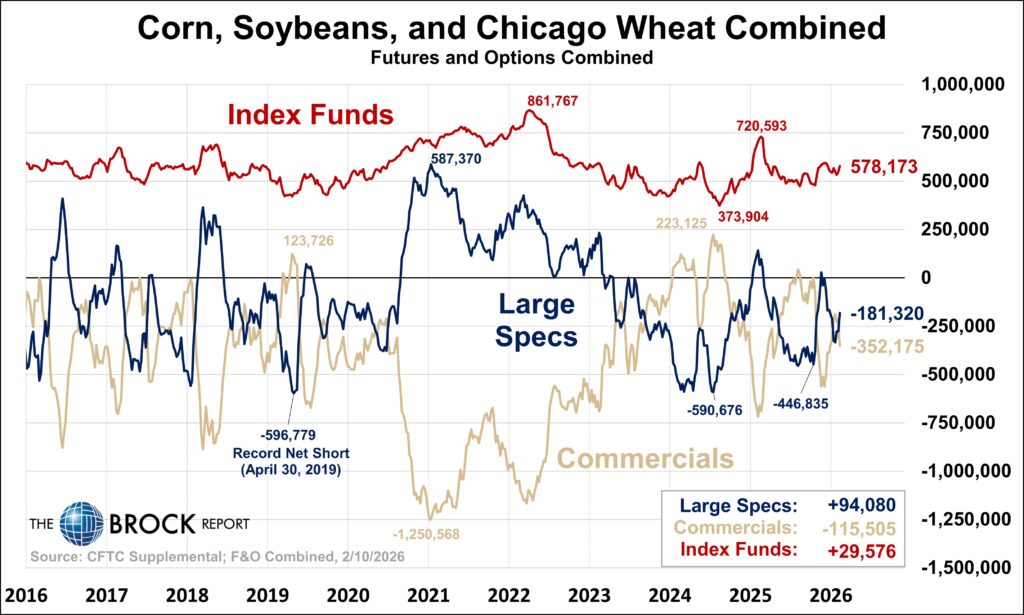

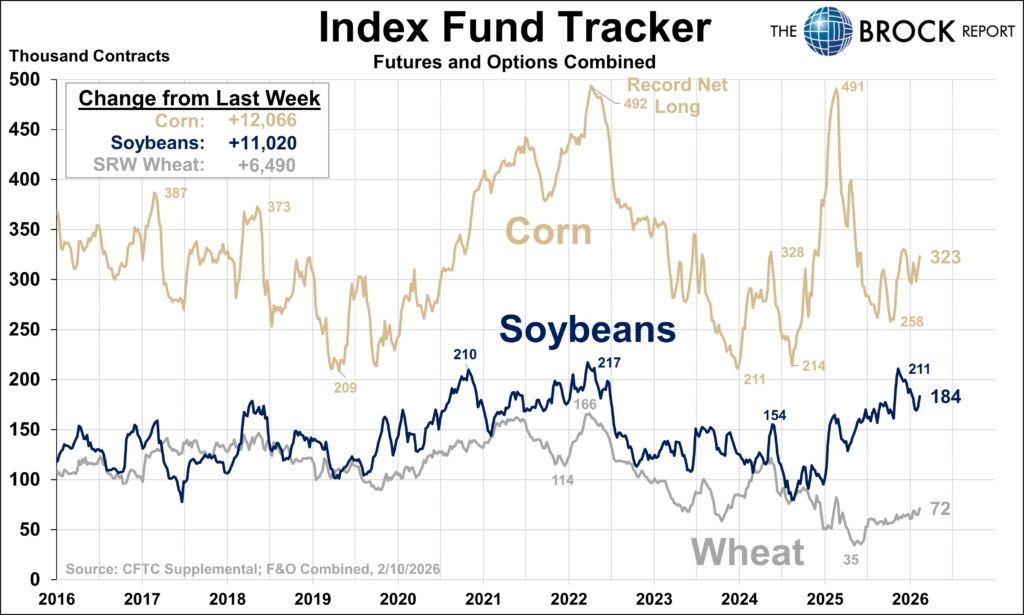

“Money Flow” was a discussion point this week, as on Thursday wheat and corn rallied sharply for no known reason. Soybeans rallied also, but that reason is known. Whether there’s any truth the “money flow”, or that’s just what analysts say when they don’t know what’s going on, COTs this week support that it may be real.

Large specs were net buyers of the C/B/W complex as a whole, though modest sellers of wheat. Index funds were buyers of all three.

There has also been broader talk of a return to the commodity complex by money managers, though largely driven by metals and energy, grains could be dragged along as part of that bucket.

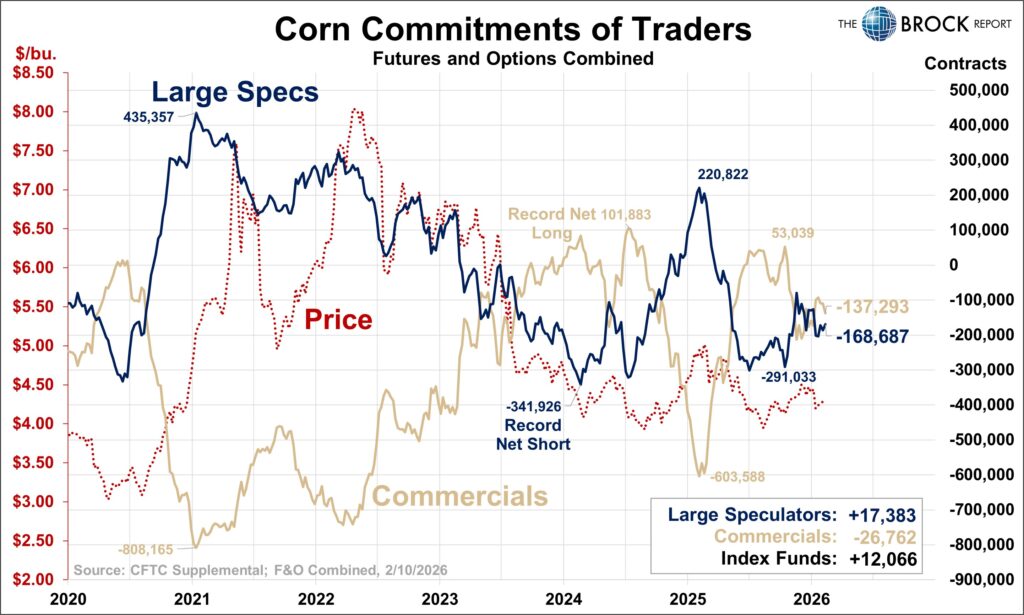

Corn

Corn remains in a somewhat supportive setup, not extreme. Happy to see decent sized net buying from specs and index funds. The struggle here is going to be continued expectation of large planted acres this spring, and several areas of technical resistance from 440-455 in march futures.

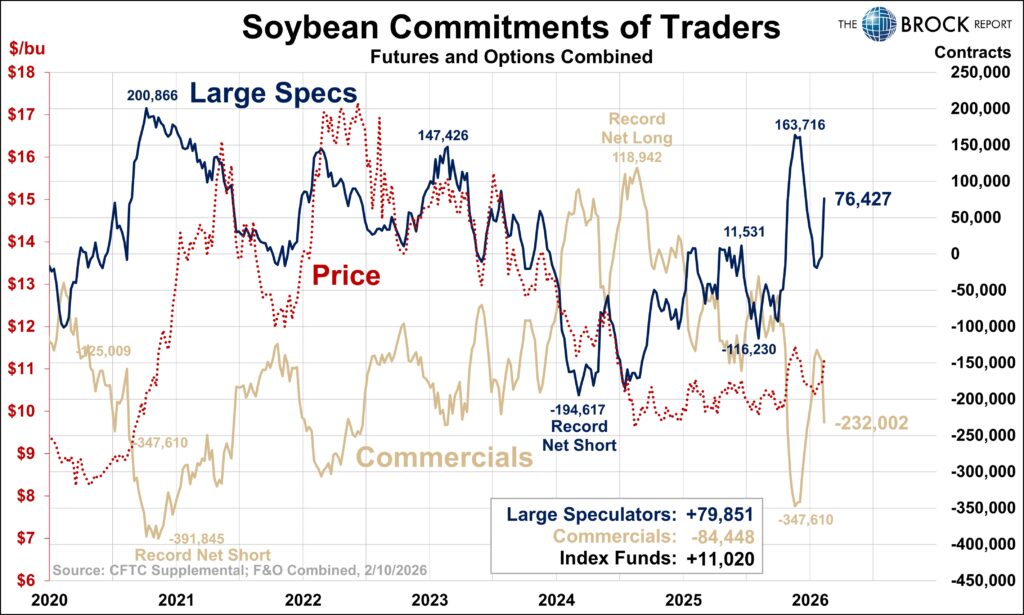

Soybeans

Boy do specs LOVE buying beans on Trump tweets. They were net buyers of nearly 80,000 contracts in the week ended Tuesday, the third consecutive week (totaling 95k contracts) and the most since 10/28. We discuss the news and surrounding skepticism from market analysts including us, and also the optimism that traders seem to have as they rush to buy.

This is a very positive trend as long as it lasts, but considering the delay in reporting data, futures are likely to reverse before we get a COT report warning. Because that is the case we have to look at how much room we think specs have to keep buying. At net long 76,424 contracts, compared to the recent high of +163,716 contracts, looks like they have some room to go. Another week of buying like this and they’ll be right back to their recent large long exposure, which was the largest long position they’ve held since late 2020. And remember, this data is through Tuesdays, so if they have maintained this pace they will be there by Tuesday of this week.

Bottom line: large specs could ALREADY be at an extremely long position, setting the stage for another rapid long liquidation event like we saw in December. They could also continue buying for a couple of weeks. Proceed accordingly. We opted to advance cash sales another 10% as a “scale up sale”, read Cash Marketing page for an explainer of that sale.

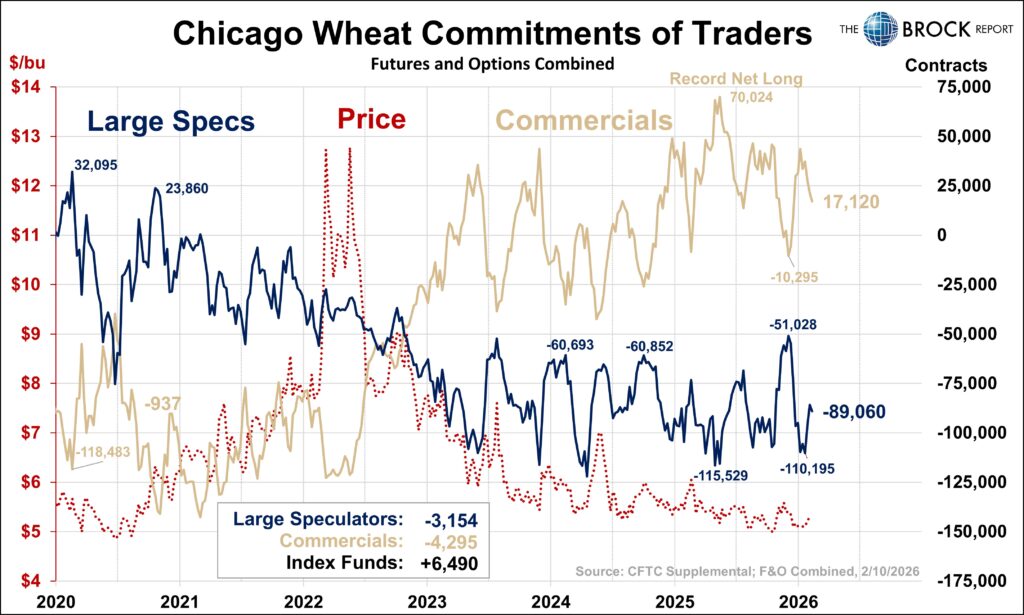

Wheat

Specs were modest net sellers in the week ended Tuesday which we don’t love to see, but nothing has changed. This remains a supportive setup and we continue to see higher prices ahead.

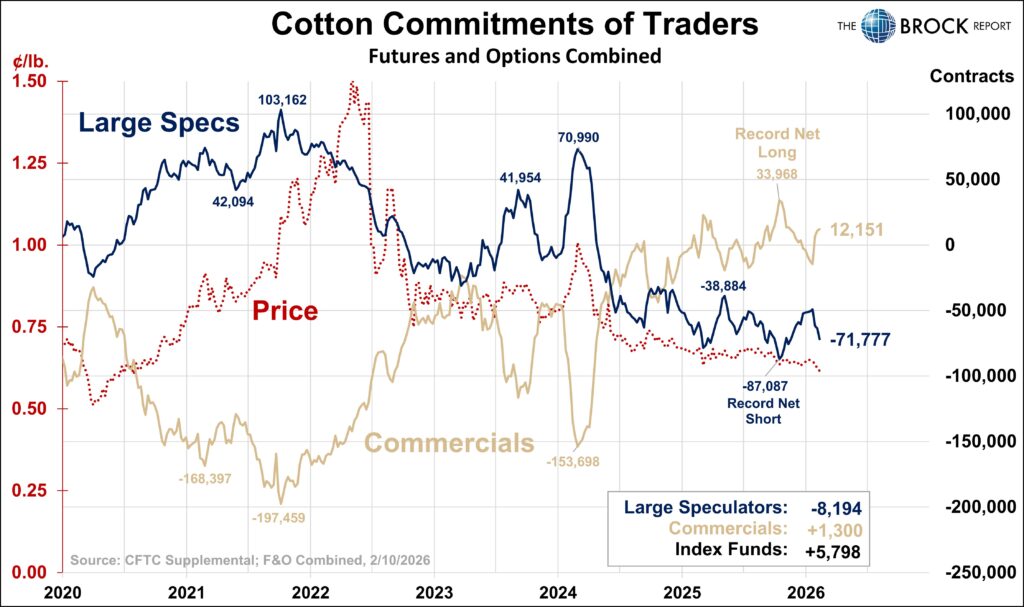

Cotton

Turn off the machines!!! Large specs will not stop selling cotton. They’ve done so for 3 consecutive weeks following 5 consecutive weeks of buying. Futures fared well after Tuesday however, so perhaps the tide is turning. Whether it has turned yet or not, longer term this remains supportive.

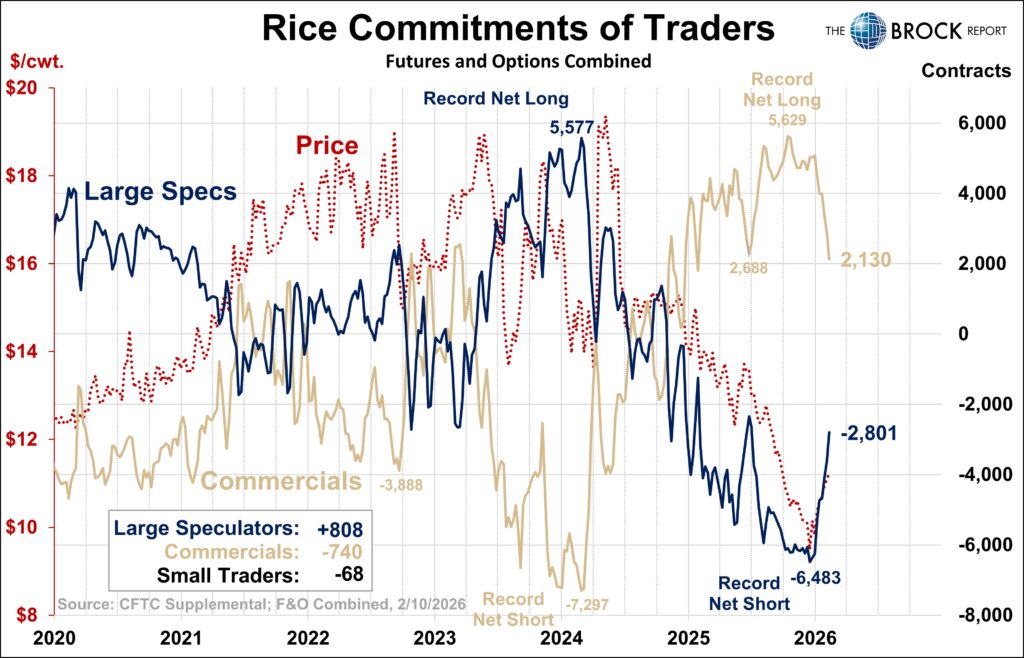

Rice

We, and rice producers, hope that this move higher is not yet over. This week’s COT suggests it is not, and the recent weeks have renewed our confidence in the COT as a tool to predict price moves in the rice market. Late week price action was poor but for now, steady as she goes.

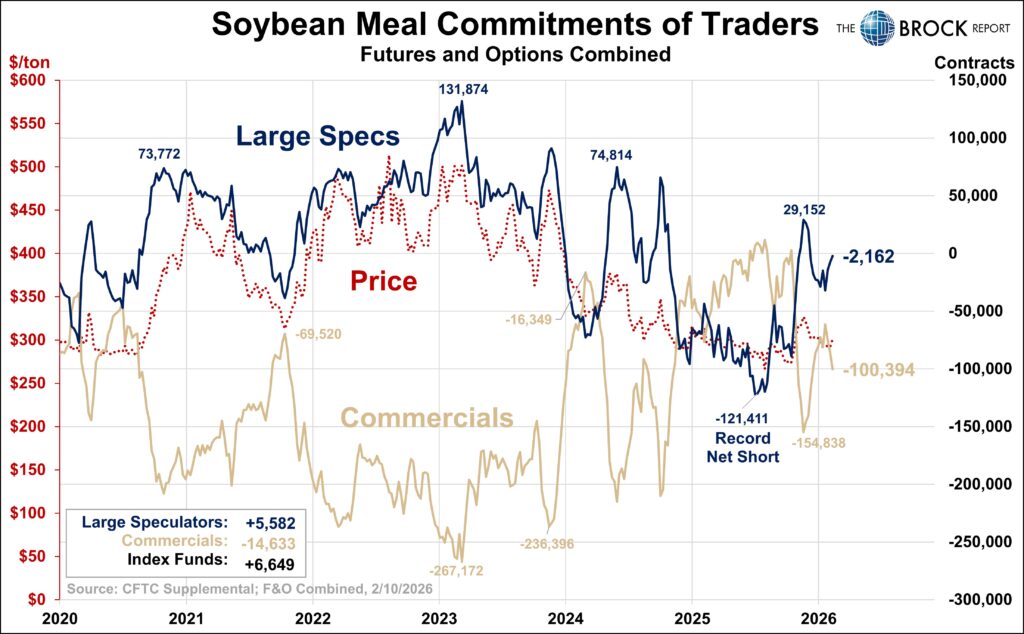

Soybean Meal

Very neutral activity and overall position. General trend is spec buying which should be supportive for prices, but nothing overwhelming here.

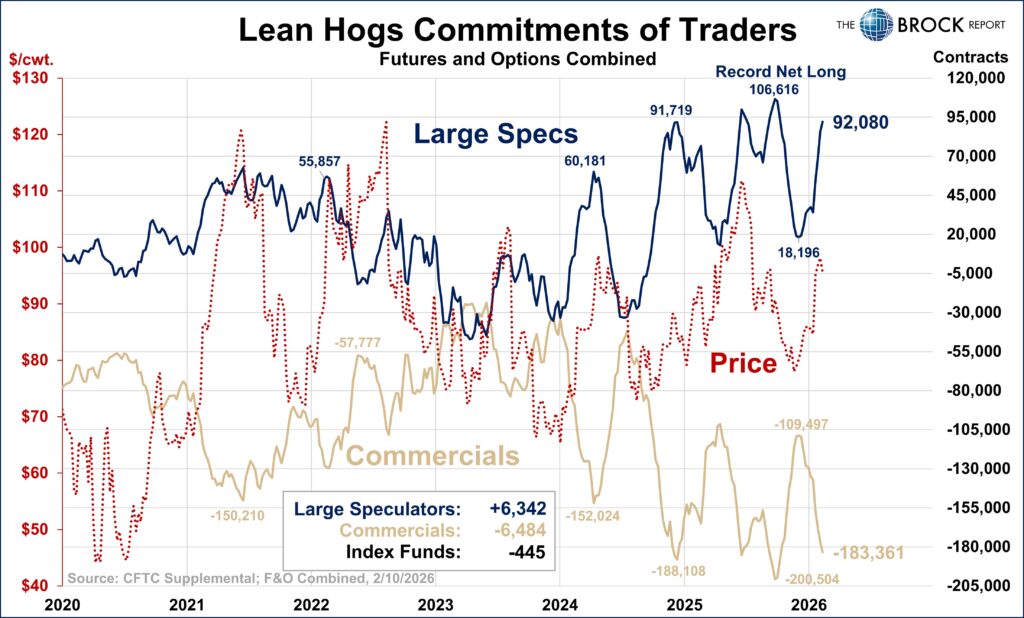

Lean Hogs

CAUTION. Three weeks ago we said don’t get in the way of this move. Two weeks ago we said it is time to start taking some caution. Last week we said WATCH OUT. This week we saw why.

In the week ended Tuesday specs were small net buyers, as they turned from big buyers coming into this reporting period, into large sellers on thew way out. For perspective, the three previous weeks of net buying was +19.6k, +15.3k, +16.5. So the +6,342 net buying this week tells us they have reversed course mid reporting period, as does the price action.

This is a perfect example of why you use this report to prepare yourself to make decisions, and do not wait for the report to act on those decisions.

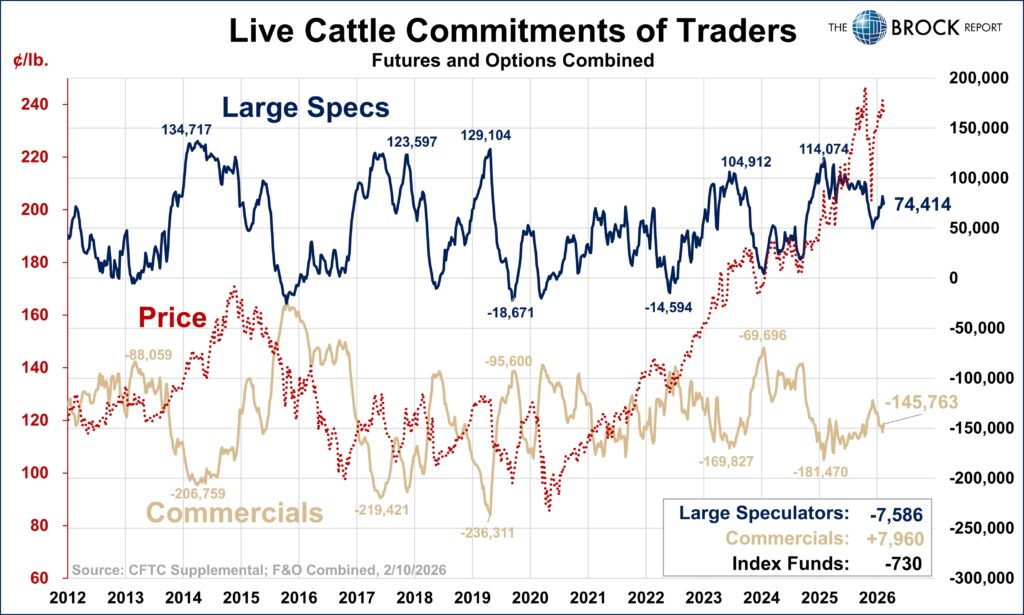

Cattle Complex

After being pretty aggressive buyers the 7 of the last 9 weeks, large specs were net sellers of 7,586 contracts of live cattle, the most since 10/28. Some caution warranted but nothing extreme here.

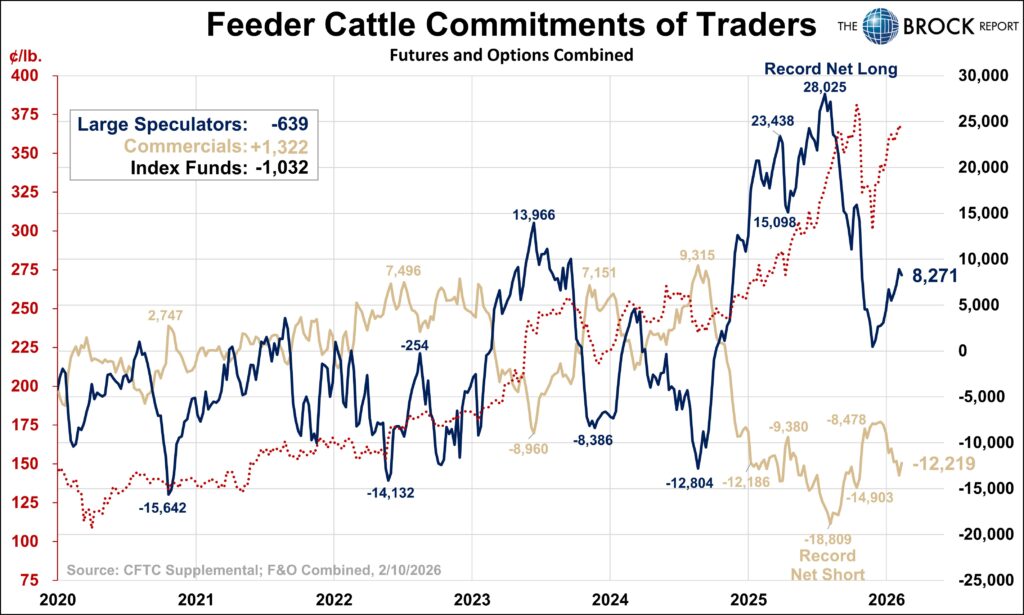

Nothing to see in the feeders.