Weekly COT Highlights – Week Ended Tuesday, February 17.

Main Takeaways this Week

- Corn: Speculative buying continues at a gradual pace, but positioning remains far from extreme.

- Soybeans: MASSIVE buying once again.

- Wheat: Still heavily short, room for more short covering.

- Rice: 11 straight weeks of speculative buying has left the market vulnerable.

- Lean Hogs: Heavy selling, but data too late?

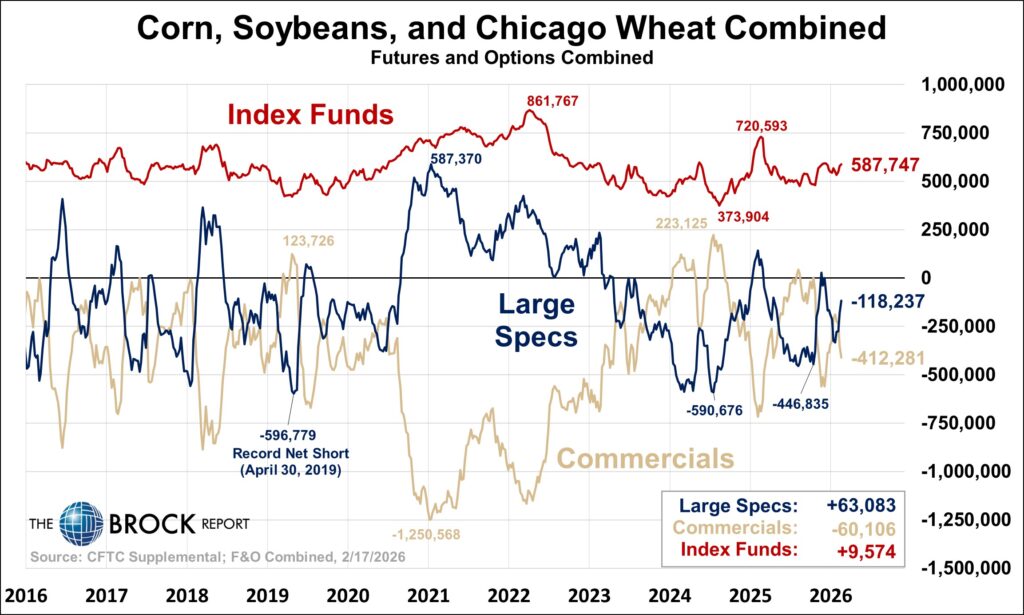

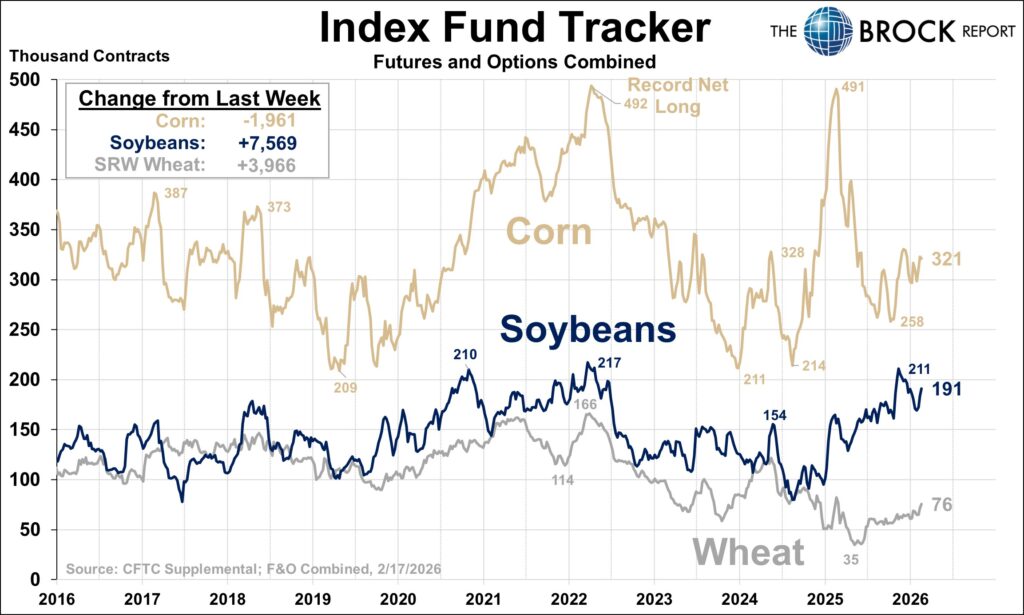

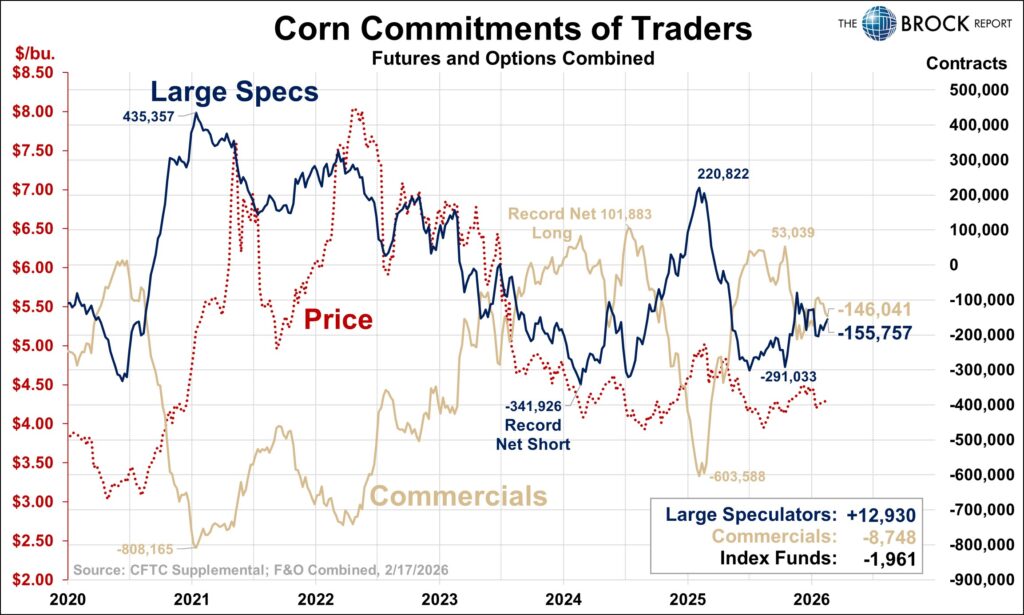

Corn

Corn speculators were small buyers for the week ended Tuesday. Not a large amount of buying, but we’ll take it as the setup continues to leave room for speculators to go on a buying streak, as we have been mentioning. Including this week, specs one month position change is +47,677 contracts, not much happening in this market since the start of February. In fact, going back to the 1/13/26 report the average weekly position change has only been a little over 15,000 contracts.

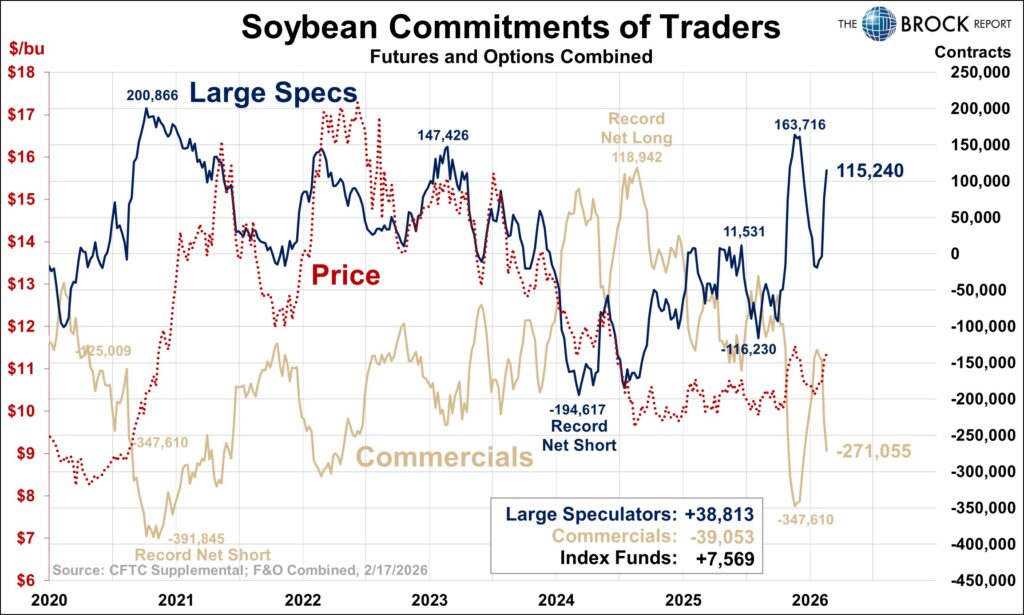

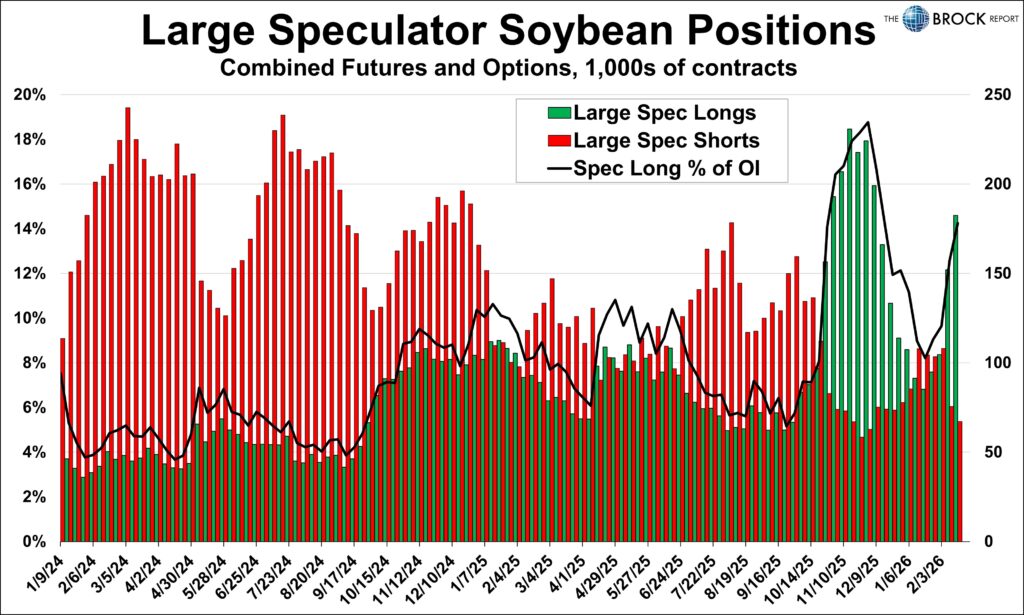

Soybeans

Yet another week of MASSIVE buying for large specs this week. If not for last week’s buying of nearly 80,000 contracts, this would have been the largest weekly buying since the October 7th report. Taking a look at our Large Speculator Position Chart, large specs now currently hold roughly 14% of Soybean open interest. Given the continued expansion in speculative length, we made additional soybean sales this week. With continued buying at this pace, the market is becoming increasingly vulnerable to a round of long liquidation if momentum stalls. After futures showed weakness this morning, we chose to act rather than risk giving back a pricing opportunity.

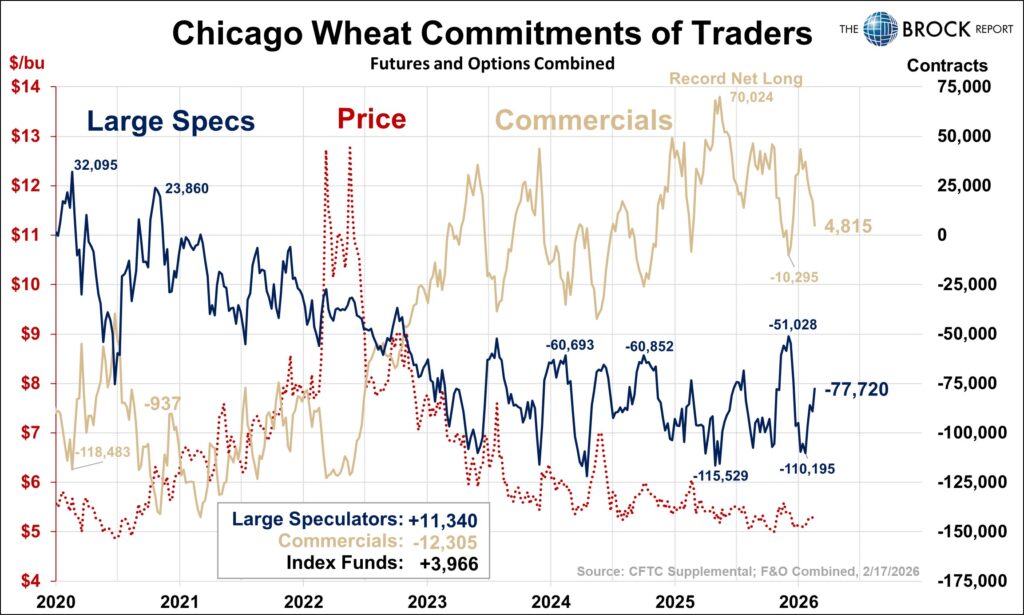

Wheat

What a week for wheat. After showing weakness Tuesday, futures quickly reversed course, with May ending the week up 32 cents. Large specs were modest buyers once again, adding just over 11,000 contracts after a small amount of selling last week. While not aggressive, the buying suggests more short covering as prices began to find support late last week. Even with this increase, large specs remain heavily net short. That leaves the door open for additional short covering if momentum continues to build.

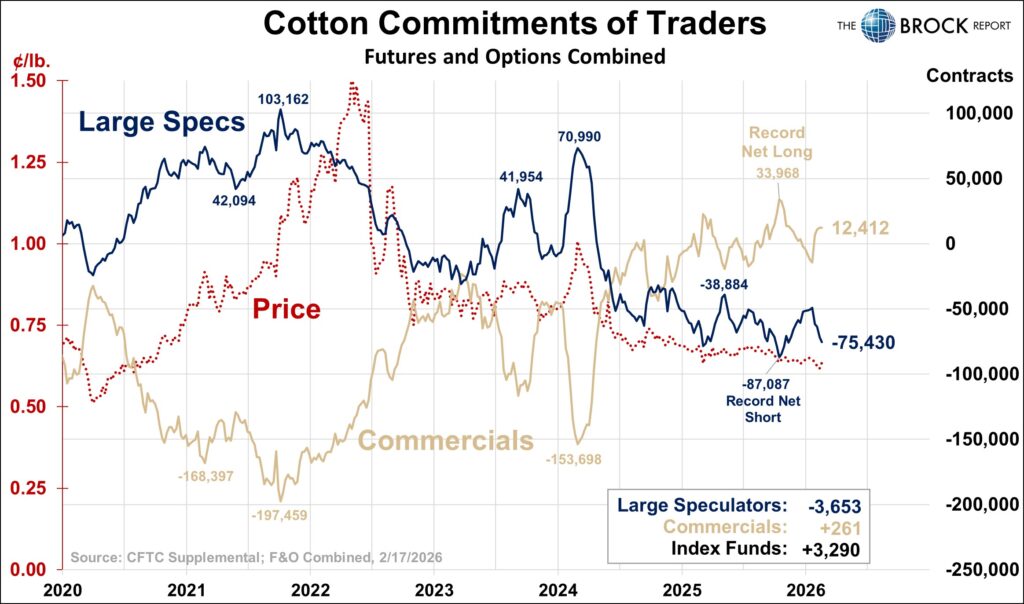

Cotton

Large specs have now been sellers for four consecutive weeks. After charting a five-wave move higher last week, we expect sentiment to begin shifting in this market. That view is reinforced by the strong move futures made to close out the week.

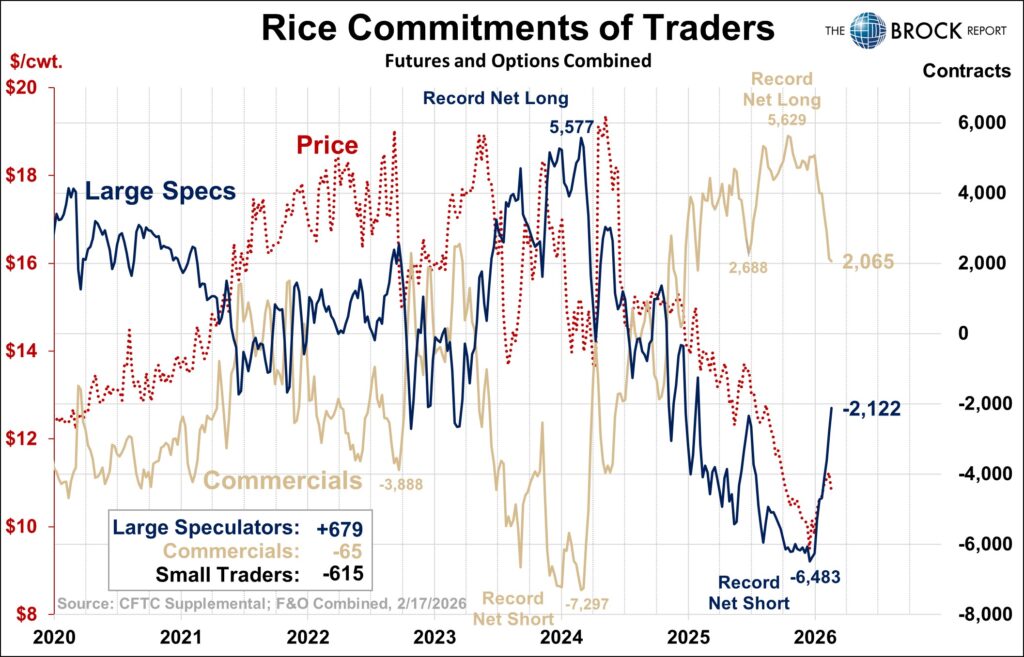

Rice

Large specs have now been buyers for 11 straight weeks. That steady shift in positioning has been notable, especially considering the lack of a major fundamental change during that stretch. When specs build length this consistently without a clear shift in the fundamentals, it can leave the market vulnerable. Even though large specs are not holding a meaningful net long position yet, the pace of recent buying increases the risk of liquidation if momentum stalls. In other words, it doesn’t require a record net long for a setback to occur it only takes buying to slow down, and it seems that’s exactly what has happened in this market this week.

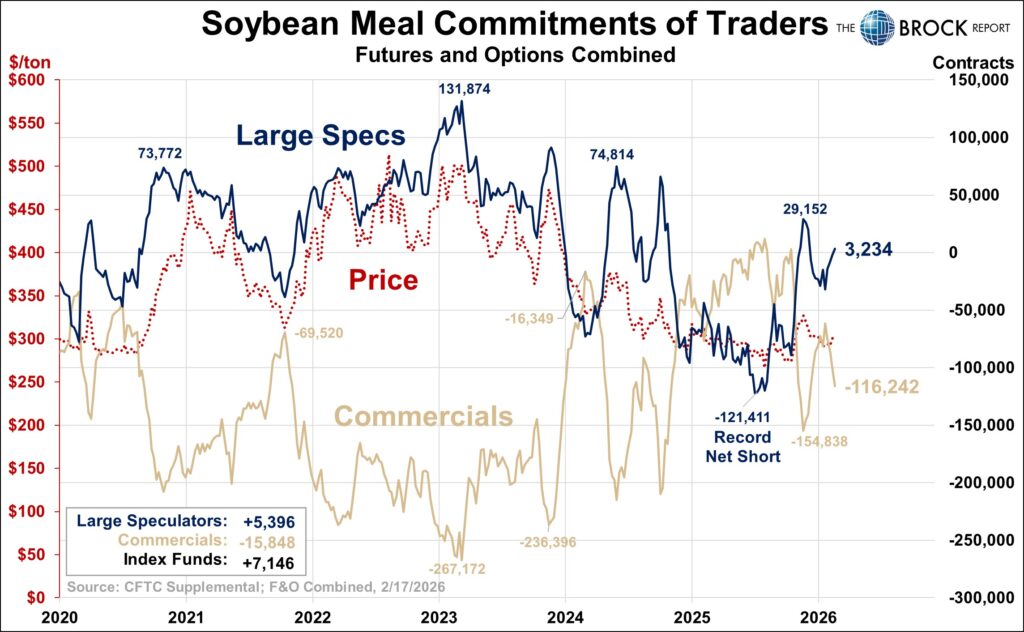

Soybean Meal

Last week we noted there was nothing overly convincing in the positioning, and that largely remains the case. However, while the week-to-week buying has been modest, large specs have now been buyers for four straight weeks. For now, the buying has been controlled rather than aggressive, and the market has yet to see a sharp shift in speculative exposure.

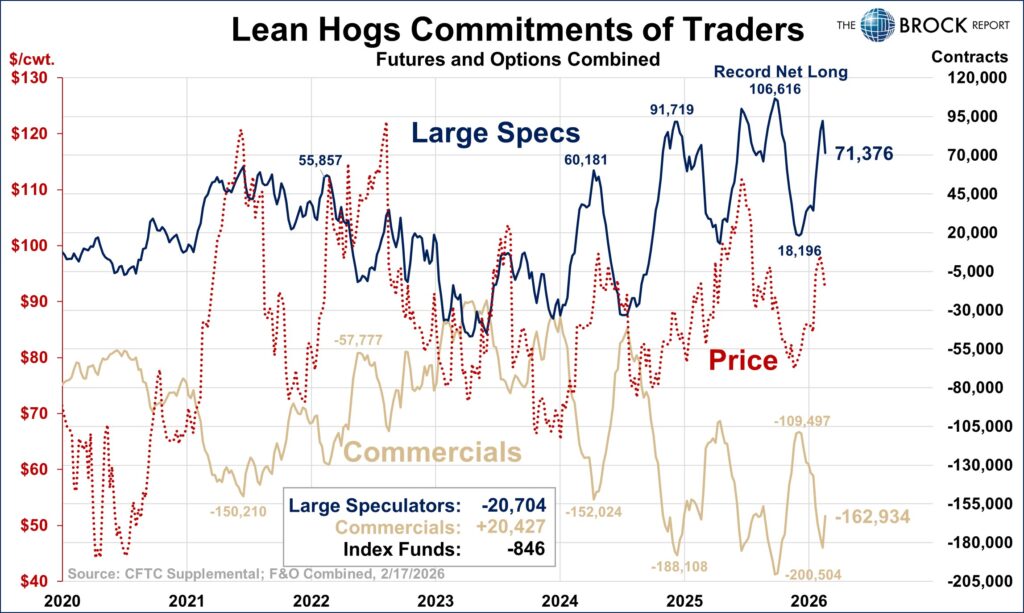

Lean Hogs

Selloff beginning? Large specs were sellers of just over 20,000 contracts this week, the largest weekly selling since March of last year. However, the timing of the report highlights an important point. The April Lean Hog contract has already closed roughly $5 off its recent high. By the time speculative selling shows up clearly in the COT data, the market may have already made a significant move. This is why the COT report should be used as a confirmation tool, not a trigger by itself. Price action often turns first, and positioning data follows. The key is reading the chart and recognizing positioning, rather than waiting for the report to make the decision for you.

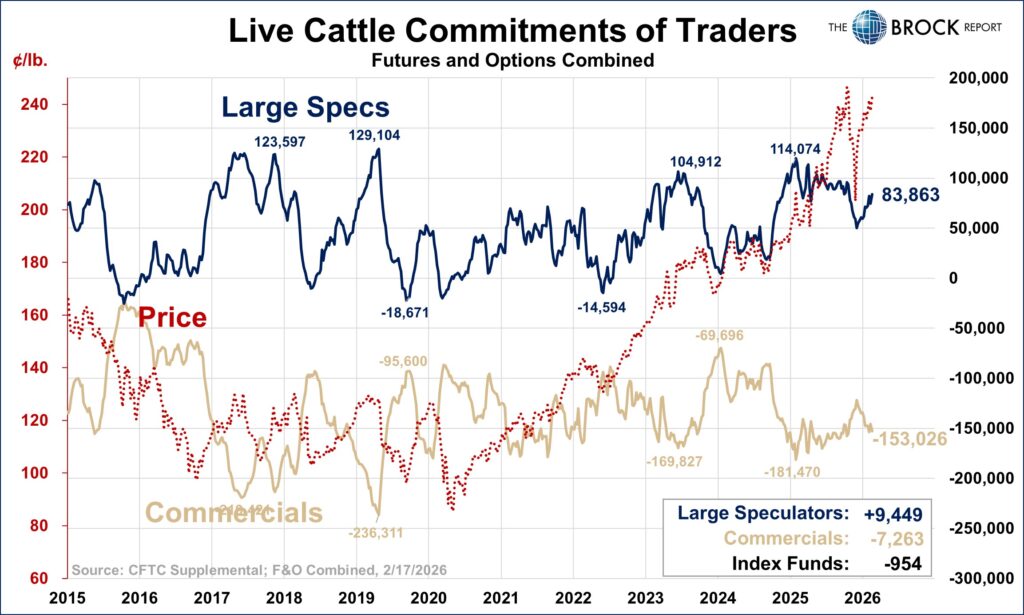

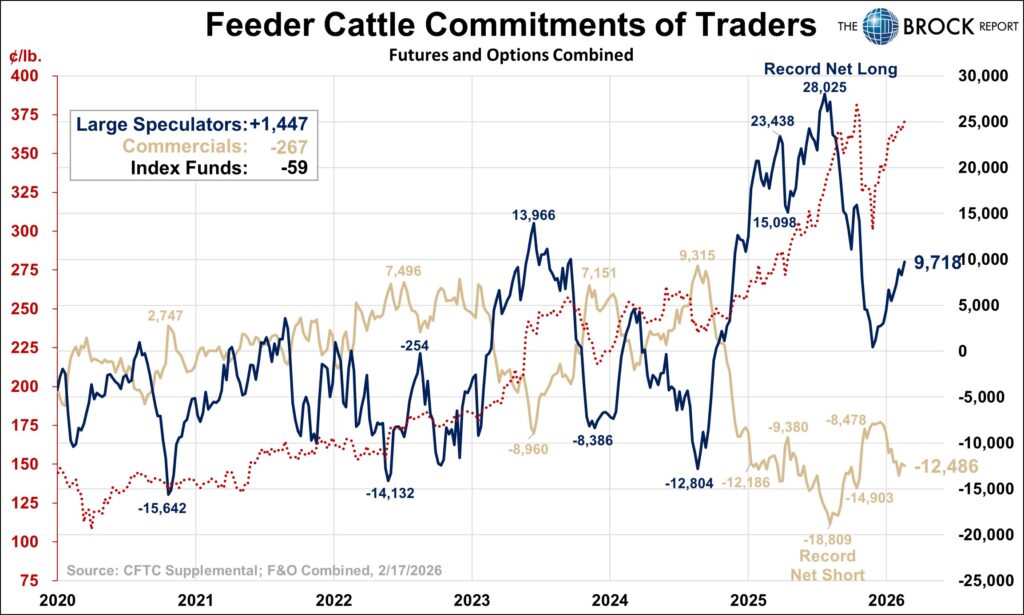

Cattle Complex

Not much to see in either of the two markets. Modest buying by large specs in both.