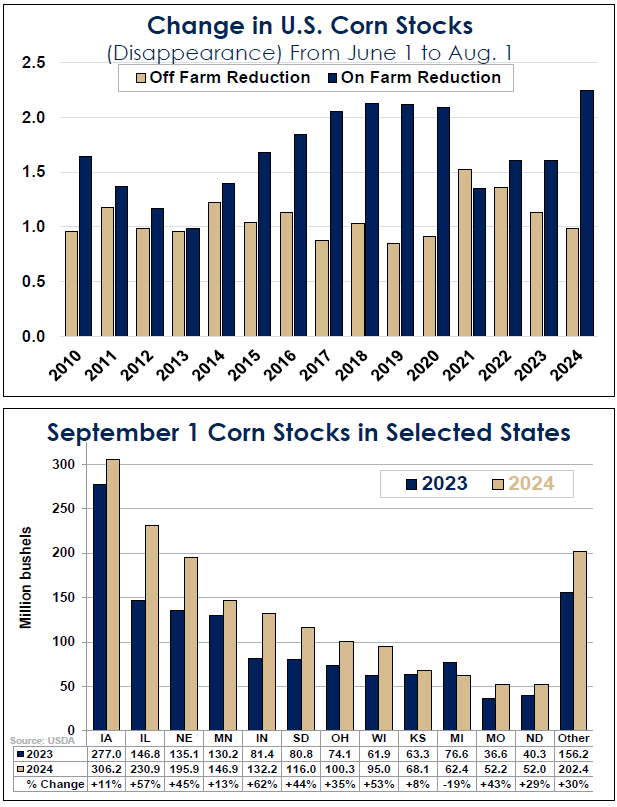

Sometimes surprises come in a pleasant package. That was the case Monday when the USDA released the stocks report as of September 1. Supplies of corn came in much lower than expected. As of September 1, corn supplies are estimated to be 1.76 billion bushels to start this marketing year out. As recently as Aug. 12, USDA was estimating the 2023/24 ending stocks at 1.867 billion bushels. That’s a sizeable difference. Most importantly, it takes the stocks-to-usage ratio from a previous estimate of 14.5% down to our estimate now of 13.8%, and we believe will result in an expected average price of corn 20 to 30 cents higher than previously estimated.

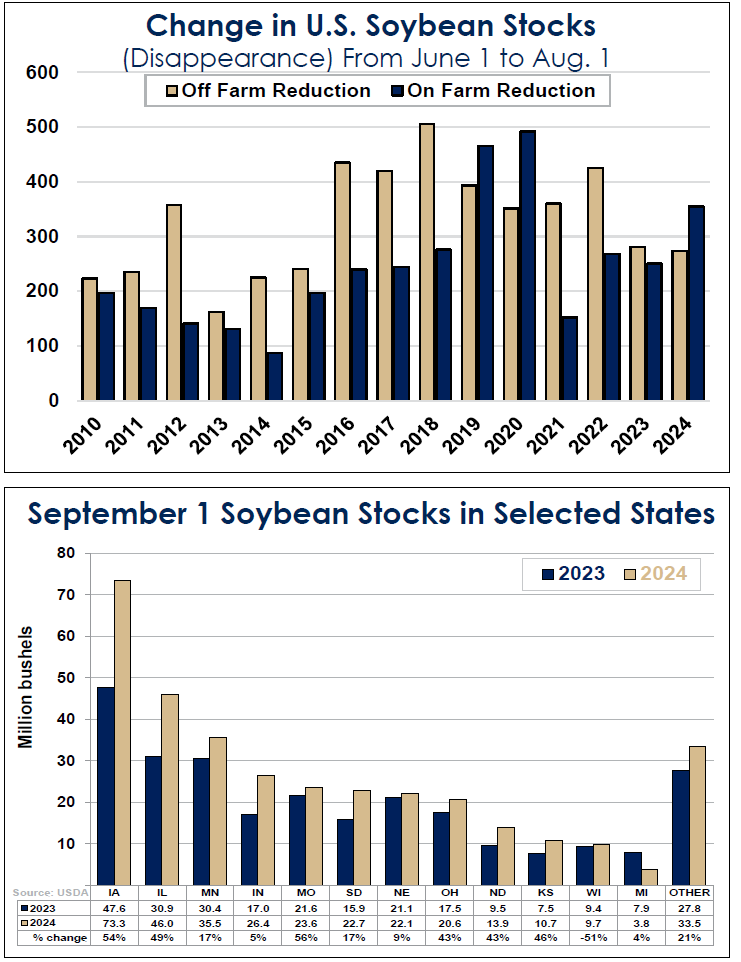

How did this happen? The table below shows where the cuts came from. Iowa supplies of corn from September 1 of 2023 to September 1, 2024, were up only 10% versus Illinois up 58%. Minnesota was up 44% but Nebraska was down 12%. Indiana was up 43%. Kansas was actually down by 18%. Doesn’t really make a lot of difference how corn supplies in those states were so different, but they are factual. Most of the differences came from previous overestimates from the USDA of supplies or increased usage or most likely both. Cutting the supplies by that significant an amount does make a difference.

Where to From Here?

We’ve emailed all subscribers our Grain Marketing Guidebook that contains corn and soybean seasonality charts like the ones published in the September 6 issue. If you can’t find your copy email breport@brockreport.com. The last time the cash market bottomed in August was the 2022/23 marketing year. The following year the high came in October, only the second time that has happened since 1970. Twice after making a bottom in August the market peaked in September, once in March and April, seven times between May and July, and just twice the following August.

In the case of soybeans odds also favor a mid-summer peak. Only two times after making a marketing year low in August have soybeans peaked between October and April. Three times they peaked in September, which may have just happened this year as well. Nine times soybeans peaked the following May to July, 5 of those years being a July peak. So, looking at this alone we will have to ask ourselves the question: Did we just peak for the year, or will we peak later this summer?

The bottom line: It is common for both corn and soybeans to bottom in August, and they both seem to have higher odds of peaking in early to mid-summer. But either commodity peaking in September or October is far from out of the question. Price action in the next week or two will likely indicate whether we just saw the high for the marketing year, or if it will come this summer. This is also a tough time of the year for producers to have strong prices. Many have just made a lot of sales to make room for new crop and are ready to sit pat for a while. Many are also soon to be making their decisions on what to plant next year. So high prices now may mean more acres, increasing the likelihood we just saw the highs.

Another factor that favors a late season high in corn is that so many bushels were moved off the farm June through August. Producers have space in the bin to store and carry in the market to motivate them to do so. Moving forward we expect producers to be tight holder of grain.

Grain Spreads Are Bullish

Frequently spreads tell the whole story before the fundamentals are known. Note that the December 2024 – July 2025 corn spread made a major bottom in mid-September. This is showing that there is more demand for corn nearby. It indicates that even though we are in the midst of harvest, cash corn is not moving all that fast to the market.

The other chart that is even more significant is the December 2024 soybean meal — July 2025 soybean meal. Not only has it just broken its downward resistance line but it has absolutely exploded to the upside showing that there is a strong demand for meal near-term. These two charts are included in the website edition.

The other chart that is of significance is the weekly corn futures continuation chart that can be found here. Note that the market has broken through its intermediate downtrend line. Next resistance area on the weekly chart is around $4.70, the highs in June.

Farmers Tight Holders No More

We said earlier that it didn’t really matter why the corn stocks were down, but there is one aspect of the reductions that we want to highlight. As the chart below shows, the reduction in on-farm storage was dramatic.

Why does it matter than stocks were down on the farm specifically? For much of the early part of the year, the assumption was that farmers were tight holders of their corn. There was some basis to that assumption. But that dynamic did not hold up this summer. Farmers clearly sold more corn than expected. And that is good news. There have been fears of a wave of farmer selling in corn as producers “throw in the towel” and made room for the harvest of a large crop. But with farmers having already moved a lot of grain off the farm, any such wave now will not be so pronounced. This farmer selling is what caused the washout that ended late August. Also, that corn is now in the “stronger hands” of commercials.

Reality Check

As we have already said in the September 6 issue, we think that the corn and soybean markets have found a bottom. And we think that with Monday’s Grain Stocks report there is more reason to be optimistic about prices, particularly corn. But as of now, supplies still look ample for the 2024/25 marketing year. Corn yields continue to look very good in the Midwest, and there have been very few harvest disruptions.

Add to that the prospect of large crops again in South America. Weather forecasters have for weeks been predicting a more normal rainfall pattern in October in key Brazilian areas following an extended dry period, and the outlook for the next week shows increased rains. That will ease concerns about the soybean crop and first-crop corn. And on the demand side, there isn’t a strong bullish story right now either. As these markets have shown recently, they don’t need a strong bullish story to go higher. But at some point, the bull will “need to be fed.”