BROCK MID-SESSION COMMENTS

CORN HEDGE REMINDER: Sell March 2026 corn futures at $4.20 stop on 10% of expected production. If filled this will take us to 30% hedged on expected 25/26 production.

SOYBEAN HEDGE REMINDER: Sell July 2026 soybean futures at $10.50 stop on 15% of expected production. If filled this will take us to 30% hedged on expected 25/26 production.

WHEAT HEDGE REMINDER: Sell May 2026 SRW wheat futures at the market on 10% of expected production. if filled this will take us to 10% hedged on expected 25/26 production.

Grain and oilseed futures are mixed at mid-day: Corn is up 3 to 5 cents, and soybeans are down 1 to 2. The wheat market continues to look ugly, down 8 to 9 cents and making new lows for the move. Cotton is up 50 to 90 points, and rice futures are mixed.

In outside markets, the dollar index is flat. The Dow is down 50 points, and crude oil is down 90 cents.

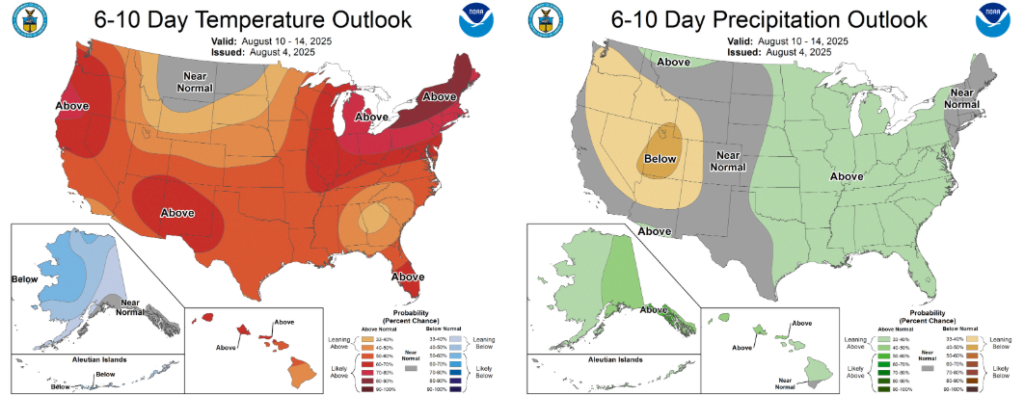

The U.S. Midwest remained largely dry on Monday. Conditions will continue to be mostly favorable for crop regions east of the Rocky Mountains through the next 10 days. The lower eastern Midwest, northern Delta and western parts of the Tennessee River Basin may be drier than usual for a while and the ground is likely to firm up especially during the second week of the forecast period. StoneX’s corn yield estimate of 188.1 bushels per acre issued yesterday hangs over the market, and if realized would keep a thumb on the market for some time to come. But there is skepticism that yields will rise that high, even as the trade expects USDA to raise its yield estimate next week.

In export news, S. Korean buyers are back in the corn market, with MFG reportedly tendering for up to 140,000 MT of corn for November delivery from S. America or S. Africa only.

As noted this morning, ADM reported Q2 earnings of 45 cents per share, down from 98 cents a year earlier, but adjusted earnings came out to 93 cents per share, beating the avg. of analysts’ expectations at 82 cents per share. Second-quarter earnings were the lowest in five years, and ADM trimmed its full-year adjusted earnings outlook to $4.00 per share, also the lowest in five years. CEO Juan Luciano said a better policy environment for biofuels should help the company in the second half of the year. He also completely dismissed the idea that the company’s high fructose corn syrup sales would be hurt by a switch to cane sugar, an issue that emerged unexpectedly in July when President Trump announced Coca-Cola would be making that switch. Coke subsequently said it would be introducing a new product including cane sugar, but there’s no sign of a wholesale switch. Luciano said HFCS orders and projected sales have been unaffected.

Wheat futures extended losses upon reopening this morning as large U.S. supplies and demand worries continued to weigh on prices along with corn market weakness. The absence of major buyers from the export market right now and the continued absence of any major crop problems in key world growing areas are helping to keep pressure on prices.

Sep. SRW wheat futures have now traded as low as $5.07, less than 1 cent off the May low on the weekly most-active wheat futures chart. Sep. HRW wheat futures have traded as low as $5.05, with support on the most-active HRW wheat futures continuation chart at $5.00 1/4. We are reestablishing light hedge protection in the May futures because they are at a carry of more than 50 cents over nearby Sep. futures.

Census Bureau export data released this morning and compiled by USDA’s Foreign Agricultural Service shows that U.S. June wheat exports totaled 63 mil. bu., down from 79 mil. in May, but up 12.5% from 56 mil. in June 2024.

LIVESTOCK COMMENTS

ADVICE REMINDER: LEAN HOG HEDGERS were earlier advised to buy Oct. 2025 lean hog futures at the market against 50% of 4th qtr. marketings to exit the previously advised long position and were also advised to buy Feb. 2026 against 25% of 1st qtr. marketings to exit the remaining short position.

Livestock futures were higher across the board at 11:15 a.m. CT, with lean hog futures 5 cents to $1.85 higher, while live cattle futures were $2.80 to $3.63 higher and feeder cattle futures were $5.05 to $5.45 higher. Lean hog futures continue to find support from lower-than-expected hog slaughter and firm cash hog/wholesale pork prices. Live cattle futures are again finding support from their discounts to Plains cash markets and technically-driven buying. Feeder cattle futures continue to draw added support from corn market weakness.

Most-active Oct. lean hog futures have surged to a 3-week plus high of $92.95 and are holding near that high, with nearby support at the old resistance level of $91.98 that was broken this morning. Oct. hogs have pushed past their 40-day moving avg. and next have chart resistance up at $94.40. Feb. futures have also pushed to a 3-week-plus high of $86.68 and have further chart resistance at $87.38, with nearby support at $85.70.

USDA has not yet reported the midmorning composite pork cutout value due to packer submission issues. The national avg. negotiated cash carcass value at midmorning was $110.98. The lagging CME cash lean hog index is 27 cents lower at $109.99 and is projected to fall another 43 cents on Wednesday. Today’s hog slaughter is expected to run 465,000 head, down 3,000 head from last week and down 15,000 from last year.

Most-active Oct. live cattle futures have traded as high as $227.85 with chart resistance at last week’s highs of $229.85-$230.43 and nearby support now at $224.10 and $221.90. Feb. live cattle have traded as high as $229.30, with resistance at $229.83-$229.93 and nearby support now at $225.75 and key support at last week’s low of $223.15. Most-active Sep. feeder cattle futures have traded as high as $340.53 and are only about 50 cents below last week’s reversal high of $341.05, with nearby support down at $334.15 and last week’s low down at $329.75.

Plains direct cash cattle markets remain quiet this morning with no packer bids reported, but some feedlot asking prices have emerged in the southern Plains at $238-$240, up from last week’s mostly $235-$236 trade. No asking prices have been established in northern dressed carcass markets. USDA reported last week’s Kansas negotiated sales totaled 7,932 head. Last week’s Nebraska negotiated sales totaled 24,002 head, with live sales $2-$3 higher at $245-$247, while dressed carcass prices were $3-$5 higher at $383-$385, mostly $383.

Midmorning Beef cutout values are delayed due to packer submission issues. The avg. beef packer operating margin is estimated by HedgersEdge at minus $296.80 per head, down slightly from minus $293.30 on Monday.

BROCK MARKET POSITIONS

CORN: Cash-only Marketers: 2024 CROP:100% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 6-5-25, 6-20-25).

2025 CROP: 35% sold on hedge-to-arrive contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25).

Hedgers: 2024 CROP: 100% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 4-15-2025, 6-5-25, 6-20-25).

2025 CROP: 30% sold on hedge-to-arrive contracts and regular forward contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25); long 1 Dec. 2025 $4.70 put option, short 2 Dec. $5.40 call options on 10% (2-24-2025); long 1 July 2026 $4.70 put option, short 2 July 2026 $5.40 call options against 10% (6-6-25); aside futures.

SOYBEANS: Cash-only marketers: 2024 CROP: 100% sold (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25, 6-2-25, 6-23-25).

2025 CROP: 30% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25, 4-15-25, 4-29-25, 6-2-25, 6-23-25), aside futures.

2025 CROP: 30% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25); short July 2026 futures on 15% (7-25-25).

SRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25). 2026 CROP: No sales advised.

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); aside futures. 2026 CROP: No sales advised.

HRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25).

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); aside futures. 2026 CROP: No sales advised.

LEAN HOGS: Short Oct. 2025 lean hog futures on 50% of 4th qtr. marketings (6-27-25); short Feb. lean hog futures on 25% of 1st qtr. (7-23-25).

LIVE CATTLE: Aside futures; long $190 put options against Aug. 2025 live cattle futures on 50% of 3rd qtr. marketings (1-29-25).

FEEDER CATTLE: Sellers are aside futures. Feeder buyers also remain aside futures.

MILK: No forward cash sales advised; aside futures.

FEED BUYERS: CORN: 25% of 3rd qtr. needs bought in the cash market (5-6-25). SOYMEAL: long July soymeal futures on 50% (3-5-25); 50% of 3rd qtr. needs bought in the cash market (3-5-25, 7-3-25); 25% of 4th qtr. needs bought in the cash market (7-3-2025)

COTTON: Cash-only Marketers: 2024 CROP: 100% sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24, 3-13-25, 3-18-2025, 4-28-25, 6-24-25, 7-16-25). 2025 CROP: No sales recommended.

Hedgers: 2024 CROP: 100% cash sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 3-13-25, 3-18-25, 4-28-25, 6-24-25, -16-25), aside futures: 2025 CROP: No cash sales recommended. Aside futures.

RICE: 2024 CROP: 100% sold (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25. 4-29-25, 7-18-25). 2025 CROP: 10% forward contracted (6-9-25).

NOTE: Along with the potential for profit, there is always a risk of losing money when trading futures and options contracts.

Copyright 2025 by Richard A. Brock & Associates, Inc.

Any unauthorized redistribution or reproduction of this commentary is strictly forbidden.