After a three-year selloff and months of a “can this get any worse?” news cycle, U.S. grain producers may finally be seeing the first real signs that the tide has officially turned in their favor. The summer and early fall of 2025 have been marked by record acreage, near perfect growing conditions, and a steady drumbeat of negative headlines — yet as harvest wraps up, the market’s mood is shifting from panic to patience.

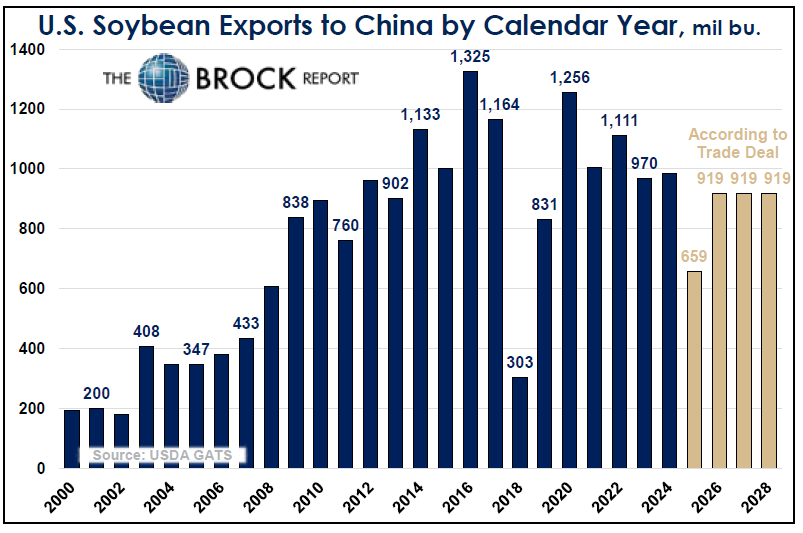

The last several weeks have been marked with deteriorating yields due to poor finishing conditions, extremely strong corn export inspections, and in the case of beans, increased confidence in a trade deal with China to salvage a portion of what typically accounts for about 25% of U.S. soybean demand.

If you’re an astute reader than you know we started calling the bottom of this market in The Brock Report lead story way back in the Aug. 22 issue, and our confidence in that call grew the following weeks. Even still, as recently as Oct. 14, nearby corn was trading at $4.10 and soybeans at $10.01. But the markets came to life, with all corn contracts filling their 4th of July gaps and soybeans trading at 12-month highs this week.

The question everyone is asking themselves now: is this our get out of jail marketing opportunity, or a time to be patient and wait for higher prices? It is certainly a better marketing opportunity than many thought we would get after the Aug. 12 WASDE and a great spot for catch-up sales, but we won’t definitively know the answer to that question for weeks or months. When asking questions like this, it is important to step back and look at the bigger picture. If you’re asking about what to expect over the next several months, you need to look at the past several months.

Bearish Exhaustion, Technical Bottoms

For much of the year, the story was all about oversupply. Corn acreage reached levels not seen since the 1930s, and early USDA yield estimates were sky-high. But as the season progressed, disease pressure (especially rust in Iowa) and less-than-ideal finishing weather, including a rapidly developing drought in the lower Midwest, have trimmed yield expectations. We are not getting USDA reports, which probably makes 90% of growers happy and it certainly adds importance to the work we do to keep producers informed, but everyone is flying somewhat in the dark.

While it is anecdotal, yield reports from our consultants, brokers and clients are pretty consistent across the board: Yields are consistently inconsistent, good but not as good as we thought back in August. At the end of the day, it appears we have a strong corn crop, likely a record yield, but far below what the USDA printed in their August WASDE. Soybean yield reports are similar — probably record high, but not out of this world. The difference here between soybeans and corn is the USDA did not print a national yield that is a record by 3.5%, and an acreage not seen since the 1930s.

Meanwhile, technical signals across the grain complex — key reversals up, narrowing spreads, and improved basis — suggest that the worst of the price collapse may be behind us. Again, old news for our steady readers.

Corn and wheat appear to have entered a base-building phase. The seasonal pattern is reminiscent of last year: a bottom in August, a setback in October, and the potential for a rally into winter. Commercial buyers are starting to bid up for grain as farmer selling slows, and storage is paying off for those able to hold out for better basis.

Strong Signals in Corn

As producers debate whether to make sales on this rally, rather than making emotional decisions, take a minute to consider the bigger picture.

1. This market made a classic “bottom on bearish news” on August 12. USDA added 7.8 bu/acre to the yield, a 4.31% increase, and added 1.9 million harvested acres. Futures have done nothing but trade higher since.

2. The 5-week Friday close rule went long in mid-September. This is one of the more boring, but consistently accurate technical signals for “long-term” traders, a category in which producers squarely sit.

3. All contracts have rallied back and filled their Fourth of July gaps. They have failed to show any follow-through since then, but it is too early to say they won’t.

4. It has been more than a month since CFTC Commitments of Traders data was updated but, at that time, large speculators held a significant short position, posing a threat to cover shorts and shoot this market higher. Some of this has likely taken place already.

5. The futures price pattern this year closely resembles last year: August low, rally through September, set back into October, and then last year rallied into late February. We’ve done everything but the rally into February part this year.

Mixed Signals in Soybeans

Soybeans remain the wild card. USDA’s export targets have looked increasingly optimistic over the past several weeks. However, as of early Thursday, it appeared the Trump administration was close to reaching an agreement that would bring China back to the U.S. soybean market in quantities best described as “status quo,” as shown below. That said, it’s a heck of a lot better than zero. South American competition is fierce, with Brazil’s record crop and Argentina’s recent tax holiday allowing China to source beans elsewhere. Domestic crush for renewable diesel is a bright spot, but not enough to offset export losses in the short term. This market has been building a base for 12 months and came to life this week, trading to a new 12-month high.

What’s Next?

Is this the start of a new uptrend, or just a pause before the next storm? Our view right now is this is the early stages of a broader move higher. Much depends on the export outlook for soybeans, i.e., the scale and timing and execution of a trade deal with China, and the final yield and production for both corn and soybeans. For now, the market has absorbed the worst of the bearish news, and producers who have managed risk and storage may be positioned to benefit from any upside surprises.

As always, patience and flexibility will be key. The worst may be behind us, but uncertainty still rules the day.