Grain and soybean futures extended their recovery overnight on support from further weakness in the value of the dollar, technically-driven buying/short covering and hopes the White House will offer further tariff relief in addition to the 1-month exemption granted to U.S. automakers. However, gains faded late in early trade with corn and wheat futures ending mixed and soybean contracts only slightly higher. Cotton futures are rallying on technically-driven short covering, the dollar’s weakness and improved export sales.

Corn futures were 2 1/4 cents lower to 1/4 cent higher at the end of early trading, with soybean futures mostly 2 to 5 3/4 cents higher, while wheat futures were mostly 1 4/4 cents lower to 2 cents higher. Cotton futures range from 126 to 179 points higher,

Looking at other markets, U.S. crude oil futures are 19 to 38 cents higher after bouncing off nearly 6-month lows on Tuesday, but gains have been limited by OPEC-plus plans to boost production and rising U.S. crude oil stocks.

The dollar index is moderately weaker and has fallen to a 4-month low, wiping out all of its gains since President Trump’s reelection under pressure from trade concerns and worries the U.S. economy is headed into recession. April gold futures are $7.40 lower despite the dollar’s weakness.

Based in stock index futures trade, U.S. stock markets are set to open sharply lower on renewed tariff anxiety and recession fears along with weak earnings reports from retailers. Asian stock indexes ended Thursday trade mixed. European stock indexes are mostly lower in afternoon trade.

Weekly U.S. unemployment claims came in at 221,000 compared with trade estimates that averaged 235,000 and the previous week’s 242,000. The January U.S. trade deficit came in at 131.38 bil., vs. trade estimates that averaged $128.70 bil. and the revised December deficit of $98.06 billion.

Corn futures pushed to 3-session highs overnight, but ended early trade near their session lows. May corn traded as high as $4.61 1/2 but ended early trade at $4.56, with nearby support at $4.53 1/2.

Soybean futures posted modest gains overnight, but also finished closer to their session lows after falling back from 3-session highs. May soybean futures traded as high as $10.22 3/4 before ending early trade at $10.17 1/2 with nearby support at $10.13 3/4.

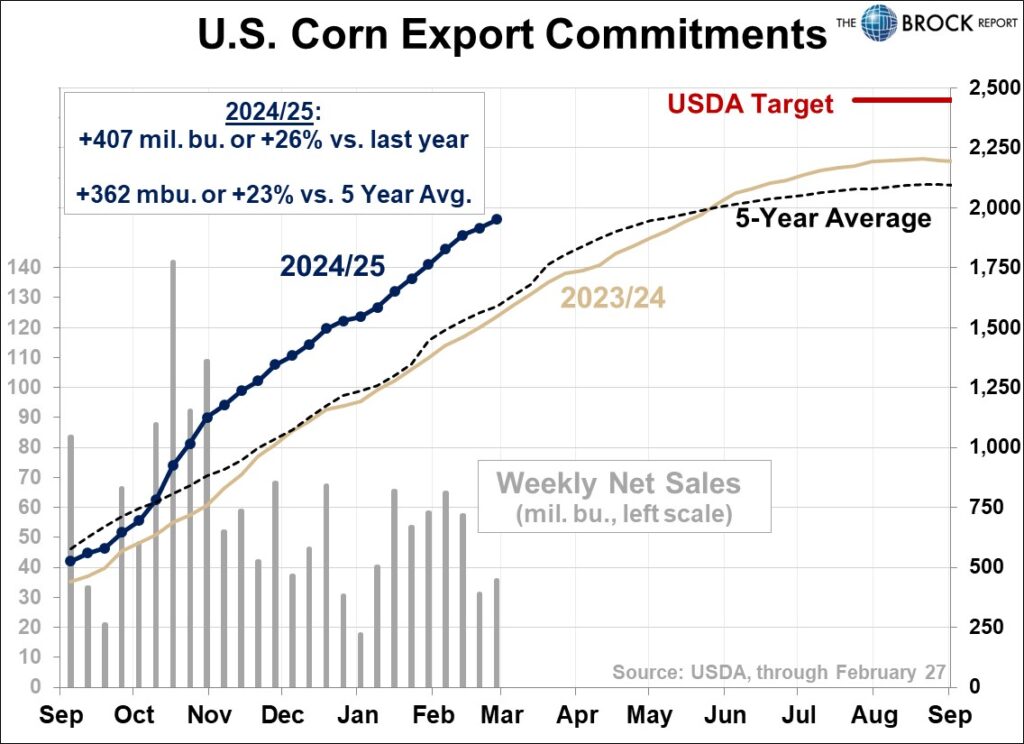

Net U.S. corn export shipments for the week ended Feb. 27 came in at 37.8 mil. bu. toward the high end of trade expectations that ran 27.5-43.5 mil. bu. and up slightly from the previous week’s sales of 36.3 mil. bushels. The sales data looks neutral for corn prices. Weekly U.S. corn export shipments totaled 49.9 mil. bu. down slightly from previous week’s 52.0 million.

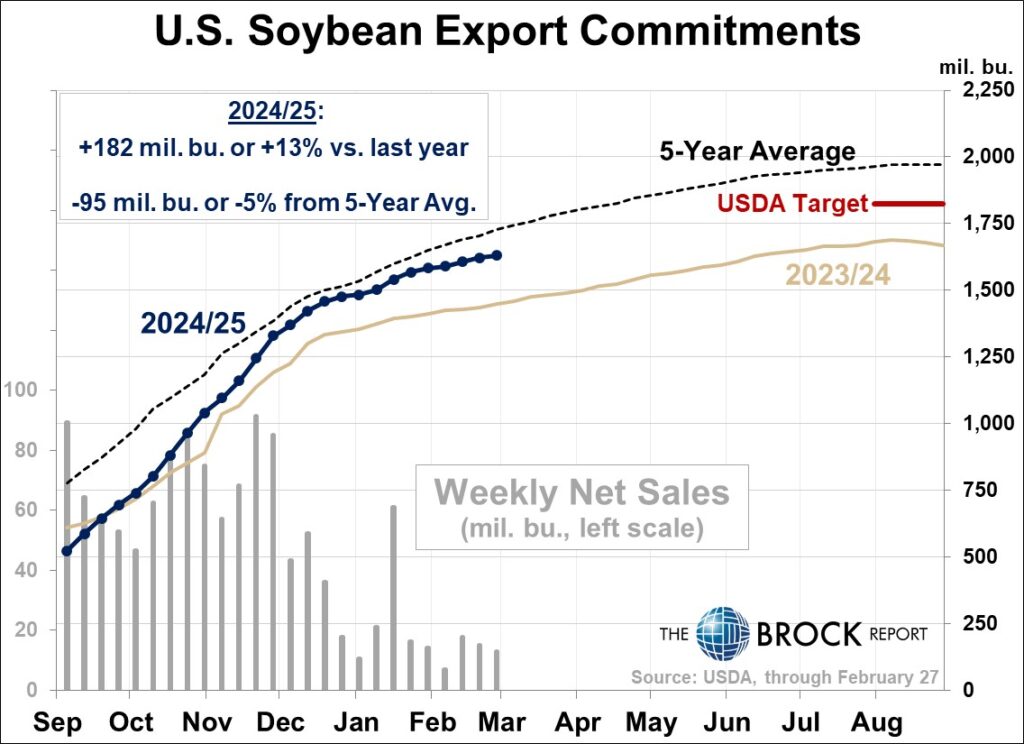

Net weekly U.S. soybean export sales totaled 15 mil. bu. (13 mil. for 2024-25 delivery) compared with trade expectations that ran 11.0-20.0 mil. bu., compared with the previous week’s sales of 15.2 mil. bushels. The export sales look to be neutral for soybean sales. Weekly soybean export shipments totaled 29.1 mil. bu., down from the previous week’s 35.7 million.

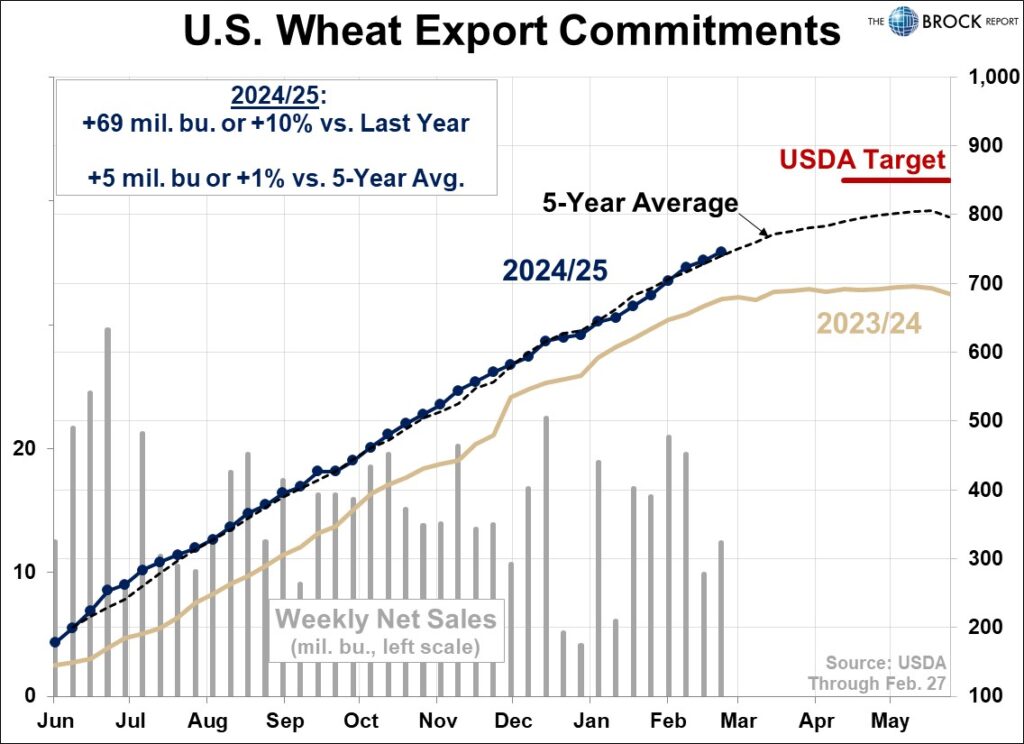

Net weekly U.S. wheat export sales totaled 15.2 mil. bu. (12.4 mil. for 2024-25 delivery) in line with trade expectations that ran 8.0-19.5 mil. bu. and up slightly from the previous week’s sales of 10.1 mil. bushels. The export sales total looks neutral to slightly negative for wheat prices. Weekly wheat export shipments of 14.0 mil. bu. were up marginally from 13.9 mil. a week earlier.

Ahead of Tuesday’s USDA Supply/Demand report, trade expectations for USDA’s U.S. corn ending stocks projection avg. 1.516 bil. bu. in a range from 1.415-1.630 bil. compared with USDA’s February estimate of 1.540 billion.

Little change in the U.S. soybean carryout forecast is expected. Trade expectations for USDA’s U.S. soybean stocks projection avg. 379 mil. bu. in a range from 365-395 mil. bu. compared with USDA’s February estimate of 380 mil. bu.

S. Korea’s MFG is reportedly tendering for up to 140,000 MT of U.S., S. American or S. African corn. The tender closes on Friday.

USDA announced this morning that exporters have sold 20,000 MT of U.S. soyoil to unknown destinations for 2024-25 delivery.

Wheat futures also traded to 3-session lows overnight, before fading to finish early trade near their session lows. May SRW wheat futures traded as high as $5.54 1/2 but ended early trade at $4.48 1/2. July SRW wheat traded as high as $5.68, but ended early trade at $5.62.

USDA’s projection for 2024-25 U.S. wheat ending stocks is not expected to change much in Tuesday’s USDA Supply/Demand report. Trade expectations for the carryout projection avg. 797 mil. bu. in a range from 779-835 mil. bu. compared with USDA’s February projection of 794 mil. bushels.

A couple areas of low pressure will move across the U.S. southern Plains in the next seven days, mainly today through Saturday. These two systems will provide some rain and snow. The moisture will be beneficial; however, central production areas are likely to be dry. Greater precipitation will be needed later this month to help ensure favorable conditions for winter wheat development in spring.

The portion of U.S. winter wheat areas under moderate or more severe drought remains relatively low at 24% as of Tuesday, up from 22% a week earlier and 15% a year earlier. In Kansas 23% of winter wheat area is under moderate drought.

The wheat export market remains relatively quiet. South Korean flour millers reportedly bought 98,200 MT of U.S. and Canadian milling wheat in a tender that closed overnight. A group of feed importers in Thailand reportedly bought 67,000 MT of optional-origin feed wheat in a tender that closed Wednesday. Jordan has issued a new tender for up to 120,000 MT of milling wheat.

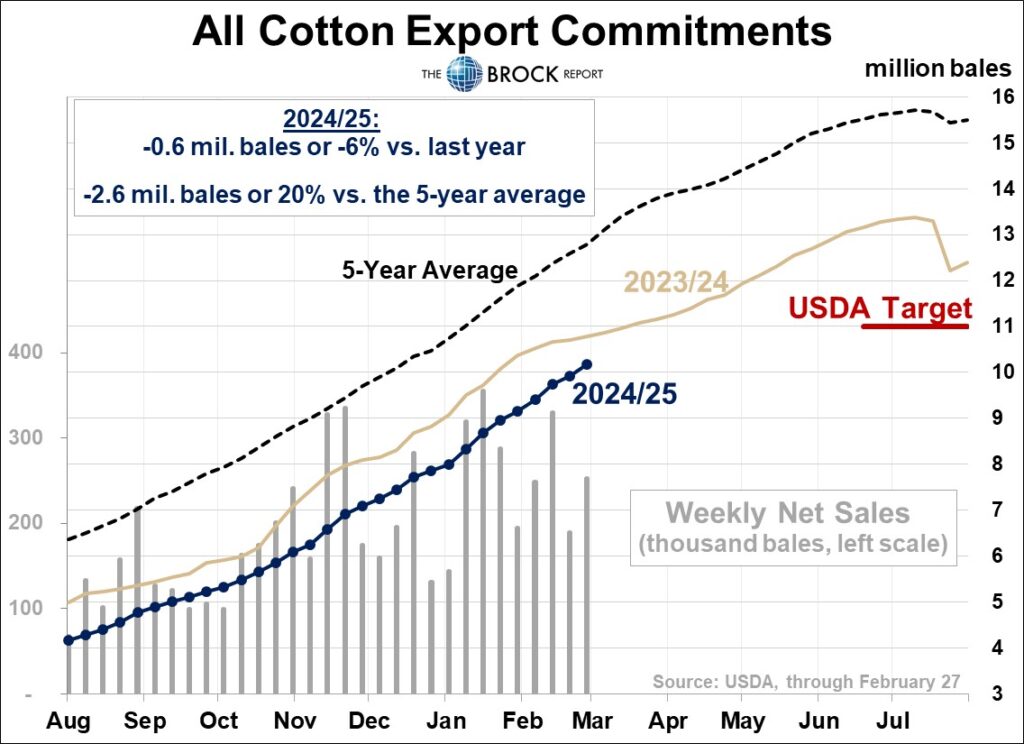

Net U.S. cotton export sales for the week ended Feb. 27 totaled 241,500 running bales for 2024-25 delivery and 105,600 bales for 2025-26 delivery. Sales for 2024/25 were up 45% from a week earlier and 6% from the prior 4-week average.

Livestock futures may open mostly higher again this morning on support from technical follow-through to Wednesday’s strength. Lean hog futures gains are likely to be limited by tariff concerns and Wednesday’s $1.29 crop in the composite pork cutout value. Weekly U.S. pork export sales of 42,400 MT should be a supportive market factor. Declines of $1.33-$1.49 in beef cutout values will be a negative cattle market factor. Weekly U.S. beef export sales of 13,400 MT should be a neutral to negative market factor.

this morning, with lean hog futures possibly finding support from speculative profit taking in the wake of Tuesday’s further losses. Live cattle futures may find support from follow-through to Tuesday’s rally. Feeder cattle futures may be pressured by firmer corn prices and Tuesday’s $1.83 drop in the CME cash feeder index.