GRAIN COMMENTS

NO NEW RECOMMENDATIONS

Grain and oilseed future are mostly lower in a broad selloff, with added pressure this morning coming from President Trump and statements about China. Harvest pressure, favorable weather and a lack of fresh demand news are also weighing on the market. Corn is down 4 cents, while soybeans are down 15 to 16 cents, adding to losses after Trump’s statements. Wheat is down 5 to 8 cents, and cotton is down 40 to 70 points. Rice is down 13 to 14 cents.

Wheat and cotton have both made new contract lows today. Rice is hovering a penny above its contract low set earlier in the week, which was also a six-year low.

In outside markets, the Dow is down 500 points. Crude oil is down $2.50, with added pressure from confirmation that Israel is moving troops out of Gaza as part of a ceasefire agreement. The dollar index is down 0.2%.

The main news this morning was President Trump threatening a “massive increase” of tariffs on goods from China, citing recent “hostile” export controls on rare-earth minerals, and saying he saw “no reason” to meet with Chinese President Xi Jinping in two weeks in South Korea as planned. The president added that one countermeasure the US is considering “is a massive increase of Tariffs on Chinese products coming into the United States of America,” adding that “there are many other countermeasures that are, likewise, under serious consideration.” Bloomberg notes this is the latest in a series of moves adding to tensions between the two countries, including moves by China to restrict rare earth minerals exports and slapping new port fees on U.S. ships. All of this makes the prospect of a deal for China to buy U.S. soybeans seem more remote.

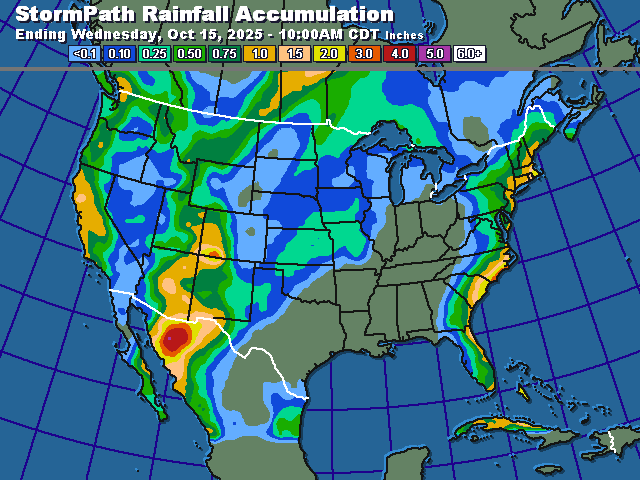

U.S. harvest weather continues to look largely favorable, with good progress likely over the weekend. Virtually all of the Midwest will see at least some rain over the next two weeks according to World Weather. That rain will generally be welcome, as most areas could use some, while rains won’t be heavy enough to cause prolonged harvest delays. The lower Midwest and the Delta region will be drier. Winter wheat planting conditions in the central and southern Plains will remain favorable.

Elsewhere around the world crop threats due to weather are also limited. Most notably, Argentina and southern Brazil continue to see good planting conditions with ample soil moisture. Center-south and center-west Brazil have been more of a concern due to dryness, but World Weather Inc. sees rains ramping up in those regions over the next two weeks.

Wheat futures have extended losses this morning after making new contract lows overnight, with prices pressured by technically-driven selling, heightened U.S.-China trade tensions and the sell-off in corn and soybean futures. Higher forecasts for Russia’s 2025 wheat production are also a negative market factor, although there is market skepticism about estimates out of that country.

President Trump’s comment on social media that China is “becoming very hostile” coupled with his threat to raise import tariffs on Chinese goods has shot a hole in market hopes for major trade progress at an expected Trump-Xi meeting at the end of this month.

Dec. SRW wheat futures have now traded as low as $4.97, which is a new 5-year-plus low for a most-active wheat contract, and now have nearby chart resistance at $5.00 and $5.09 1/2. Dec. HRW wheat futures have already traded as low as $4.80 3/4 and now have nearby resistance at $4.93 1/2.

Moscow-based SovEcon has raised its estimate of Russia’s 2025 wheat crop to by 600,000 MT to 87.8 MMT, citing larger-than-expected production in Siberia. However, with Siberia being far from Russia’s major export ports, the impact of the larger production on the world export market will be delayed.

LIVESTOCK COMMENTS

ADVICE REMINDER: LIVE CATTLE MARKETERS were earlier advised to sell Feb. 2026 live cattle futures at $241.25 stop against 25% of 1st qtr. marketings. That stop has since been hit.

Livestock futures are mostly lower at midsession, with live cattle and feeder cattle futures under heavy pressure from speculative profit taking in the wake of recent strong gains. Lean hog futures are under further pressure from technically-driven long liquidation despite firmer cash hog/wholesale pork prices. The apparent deterioration in U.S.-China trade relations has likely weighed on both cattle and hog futures as well. Lean hog futures are steady to 45 cents lower at 11:20 a.m. CT, while live cattle futures range from 3 cents higher to $2.03 lower and feeder cattle futures are $2.88 to $4.10 lower.

Most-active Dec. lean hog futures have hit a new low for the current down move of $83.73 and now have nearby chart resistance at $84.58. Feb. lean hogs have traded to a 7-week low of $85.95, and now have nearby resistance at $86.85. June lean hogs have charted a 6-session low of $100.40, but are now above midrange for the day after holding above key support at $100.33 from their Oct. 2 low.

The composite pork cutout value was 85 cents higher at midmorning at $103.49, with the midmorning negotiated cash carcass price at $96.91, up from Thursday’s final value of $94.42. The lagging CME cash lean hog index is 62 cents lower at $100.08 and is expected to fall another 65 cents on Monday. Today’s hog slaughter is expected to run 484,000 and Saturday slaughter is expected to hit 178,000 head, up from 146,000 last week and 174,000 last year.

Most-active Dec. live cattle earlier traded as low as $237.28, but have bounced back up near $240.00 on support from firm cash markets. Dec. has nearby chart resistance from $240.20 up to $241.35. Feb. futures have traded as low as $240.75, but have bounced back up near $242.50 and have nearby chart resistance at $243.63-$243.95. Most-active Nov. feeder cattle futures earlier sold off back to $368.60, but are now near mid-range for the day with chart resistance at $374.45-$375.08.

Plains direct cash cattle markets remain largely quiet this morning, with the only packer bids reported at $362 on a dressed carcass basis in Nebraska. Feedlots in the southern Plains are now asking mostly $237 for live cattle, vs. last week’s mostly $233 trade. Sales in the Plains have been minimal so far week, with only a few hundred head moving, according to USDA, so packers should become more aggressive this afternoon. Meanwhile, sales in Iowa/Minnesota thru Thursday totaled 2,194 head at mostly $230-$231 on a live basis.

The wholesale beef market appears to have stabilized for now. Beef cutout values ranged from $1.05 to $2.67 higher at midmorning with the choice cutout value at $366.27. The avg. beef packer operating margin is estimated by HedgersEdge at minus $183.25, down slightly from minus $176.60 per head, on Thursday.

BROCK MARKET POSITIONS

CORN: Cash-only Marketers: 2024 CROP:100% sold on hedge-to-arrive contracts and regular forward contracts (7-19-23, 8-15-23, 1-2-24, 5-8-24, 5-15-24, 5-16-24, 5-30-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 6-5-25, 6-20-25).

2025 CROP: 35% sold on hedge-to-arrive contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25).

Hedgers: 2024 CROP: 100% sold on hedge-to-arrive and regular forward contracts (7-19-23, 8-15-23, 5-8-24, 5-16-24, 11-12-24, 12-12-24, 2-5-25, 2-21-25, 4-15-2025, 6-5-25, 6-20-25).

2025 CROP: 30% sold on hedge-to-arrive contracts and regular forward contracts (2-5-25, 2-24-25, 6-9-25, 7-9-25); long Dec. 2025 $4.70 put options on 10% (2-24-2025); long 1 July 2026 $4.70 put option, short 2 July 2026 $5.40 call options against 10% (6-6-25); aside futures.

SOYBEANS: Cash-only marketers: 2024 CROP: 100% sold (7-19-23, 8-22-23, 11-16-23, 5-16-24, 10-8-24, 12-18-24, 2-5-25, 2-12-25, 2-26-25, 6-2-25, 6-23-25).

2025 CROP: 40% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25, 9-2-25).

Hedgers: 2024 CROP: 100% cash sold (7-19-23, 8-22-23, 11-16-23, 5-9-24, 12-18-24, 2-5-25, 2-26-25, 4-15-25, 4-29-25, 6-2-25, 6-23-25)

2025 CROP: 40% sold on hedge-to-arrive contracts or regular forward contracts (2-12-25, 6-23-25, 7-9-25, 9-2-2025); aside futures.

SRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25), aside futures. 2026 CROP: No sales advised.

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); Short May 2026 futures on 10% (8-5-25). 2026 CROP: No sales advised.

HRW WHEAT: Cash-only Marketers: 2025 CROP: 70% sold on hedge-to-arrive and regular forward contracts (5-30-24, 6-4-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25).

Hedgers: 2025 CROP: 60% sold on hedge-to-arrive and regular forward contracts (5-30-24, 10-15-24, 2-24-25, 6-9-25, 6-10-25, 6-24-25); aside futures. 2026 CROP: No sales advised.

LEAN HOGS: Short Feb. 2026 lean hog futures against 25% of 1st qtr. marketings (10-9-25); Short June 2026 lean hog futures against 25% of 2nd qtr. marketings (10-9-25)

LIVE CATTLE: Aside futures; long $230 put options on Dec. 2025 futures against 25% of 4th qtr. marketing (10-9-25).

FEEDER CATTLE: Sellers are aside futures. Feeder buyers remain aside futures.

MILK: No forward cash sales advised; aside futures.

FEED BUYERS: CORN: 100% of 3rd qtr. and 4th qtr. needs bought in the cash market (5-6-25, 9-17-25). SOYMEAL: 100% of 3rd qtr. needs bought in the cash market (3-5-25, 7-3-25, 9-17-25); 100% of 4th qtr. needs bought in the cash market (7-3-2025, 9-17-25)

COTTON: Cash-only Marketers: 2024 CROP: 100% sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 6-28-24, 3-13-25, 3-18-2025, 4-28-25, 6-24-25, 7-16-25). 2025 CROP: No sales recommended.

Hedgers: 2024 CROP: 100% cash sold (2-12-24, 2-27-24, 4-3-24, 6-27-24, 3-13-25, 3-18-25, 4-28-25, 6-24-25, -16-25), aside futures: 2025 CROP: No cash sales recommended. Aside futures.

RICE: 2024 CROP: 100% sold (5-3-24, 5-8-24, 5-28-24, 5-29-24, 7-15-2024, 7-30-24, 9-24-24, 2-21-25. 4-29-25, 7-18-25). 2025 CROP: 10% forward contracted (6-9-25).