Soybean futures managed modest gains in early trade on support from technically-driven short covering and speculative bargain hunting likely spurred by news that Argentina’s export tax holiday has already ended. Gains have been limited by harvest pressure and China’s continued absence from the U.S. soybean market. Corn and wheat futures also rose in early trade on speculative bargain hunting and technically-driven short covering. Cotton futures are marginally higher in quiet early trade.

Corn futures were mostly 2 1/4 to 3 1/4 cents higher at the end of early trading, with soybean futures mostly 3 to 6 cents higher, while wheat futures were mostly 3 3/4 to 5 3/4 cents higher. Cotton futures mostly range from 6 to 10 points lower.

Looking at other markets, U.S. crude oil futures are 44 to 54 cents lower under pressure from technically-driven speculative profit taking after hitting 7-week highs on Wednesday. Renewed demand concerns have been a negative market factor.

The dollar index is moderately higher after rising to a 14-session high on support from stronger-than-expected GDP growth and higher Treasury yields. Most-active Dec. gold futures are $5.00 higher but trading inside their Wednesday range.

Based on index futures trade, U.S. stock indexes are set to open lower with a higher-than-expected GDP growth number dampening expectations for further interest rate cuts. Rising potential for a U.S. govt. shutdown on Oct. 1 is also spurring investor profit taking in the wake of Monday’s move to record highs. Asian stock indexes were narrowly mixed in Thursday trade, while major European indexes are lower in afternoon trade.

The third estimated of U.S. Q2 GDP growth this morning came in at 3.8% compared with trade estimates that averaged 3.3% and the previous estimate of 3.3%. U.S. durable goods orders for August came in up 2.9% from July easily topping the avg. trade estimate of -0.4%. Weekly U.S. unemployment claims came in at 218,000 compared with trade estimates that averaged 235,000 and the previous week’s revised 232,000.

Investors this morning will be watching data on U.S. existing home sales for August, with sales expected on avg. to be down 1.2% from July.

Soybean futures rebounded overnight after again holding nearby chart support and ended early trading near their session highs. Futures have spent the past 3 sessions consolidating after falling sharply last Friday and on Monday. However, it remains unclear if they are building a base or consolidating for a new downward move. Nov. soybeans have nearby support at $10.05-$10.06 1/2 with nearby resistance at $10.17-$10.20 1/4.

Corn futures are working on potential bullish outside trading days as they have rallied to 4-session highs after falling through their Wednesday lows briefly overnight. Strong weekly export sales gave futures a further boost late in early trade. Nearby Dec. corn has traded as high as $4.28 1/4. Key resistance for Dec. remains at $4.31 1/4-$4.32 3/4 from the downward gap left on its daily chart in early July.

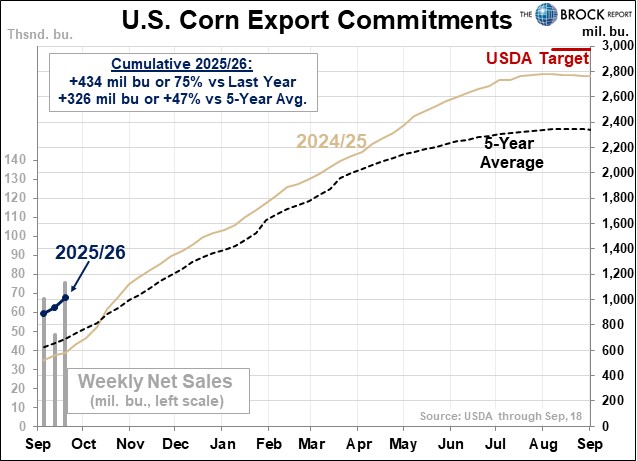

Net U.S. corn export sales for the week ended Sept. 18 came in at 75.7 mil. bu. topping trade expectations that ran 39.5 to 71 mil. bu. and the previous week’s sales of 48.5 million. The sales data is clearly supportive for corn prices.

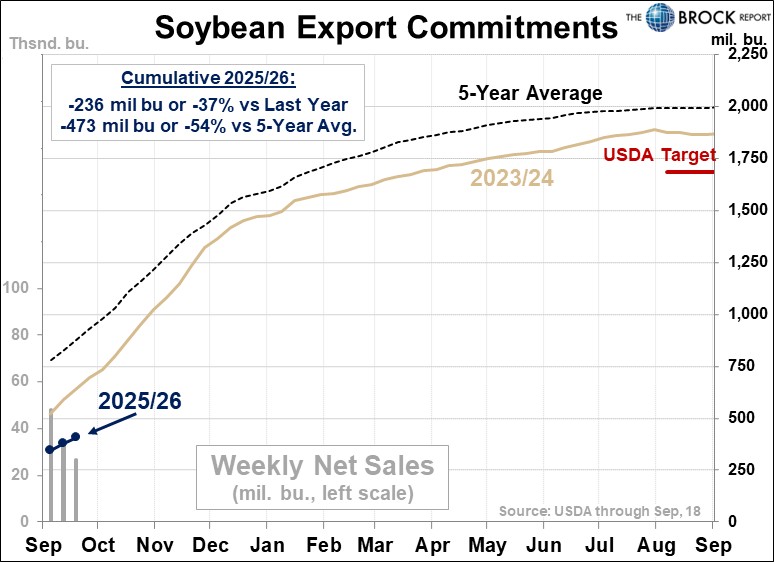

Net weekly U.S. soybean sales came in at 26.6 mil. bu., compared with trade expectations that ran 18.5 to 59.0 mil. bu. and the previous week’s sales of 34.0 mil. bushels. The lower export total looks negative for soybean prices. To no one’s surprise, China remained absent from the weekly sales report.

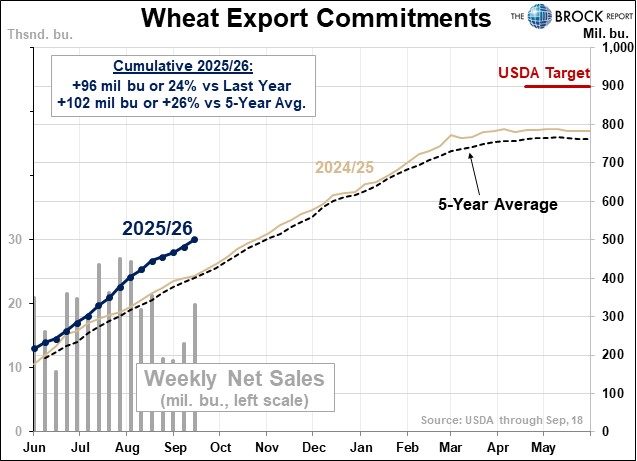

Net weekly U.S. wheat export sales totaled 19.8 mil. bu. compared with trade estimates that ran 11.0-22.0 mil. bu. and the previous week’s sales of only 13.9 mil. bushels. The improved sales should be supportive for wheat prices.

Argentina’s move to waive export taxes on grain, soybeans, soy products, beef and poultry has come to a very quick end with Buenos Aires re-applying the tax after a cap of $7 bil. in registered export sales was reached. It took just two days for sales to hit that cap.

The U.S. should cancel “unreasonable” tariffs on China in order to create conditions to expand bilateral trade, a Chinese commerce ministry spokesman said on Thursday when asking if China would purchase U.S. soybeans.

Chinese negotiators are in Washington for technical level talks. Senior Chinese trade negotiator Li Chenggang on Monday met with political and business leaders from the U.S. Midwest, signaling that China could purchase some American soybeans ahead of more wide-ranging trade talks.

S. Korea’s Nonghyup Feed Inc. reportedly bought about 60,000 MT of soymeal in a private deal on Wednesday that is to be sourced from S. America, the U.S. or China. S. Korea’s MFG is tendering for up to 140,000 MT of corn for January arrival.

SRW wheat futures, like corn futures, are working on potential bullish outside trading days as they have rallied to 4-session highs after earlier falling through their Wednesday lows overnight. Dec. SRW wheat has traded as high as $5.26 after establishing nearby chart support at $5.18 1/4. The market’s 40-day moving avg. is now nearby resistance at $5.26 3/4, with resistance from last week’s high up at $5.35 3/4. Dec. HRW wheat futures ended early trade near their session highs, but have not yet pushed past their Wednesday highs.

Wheat futures may be finding some support from an escalation in the Russia-Ukraine war, with Russia’s top port city being struck by a drone attack on Wednesday and Ukrainian drone attacks crippling Russia’s crude oil and gasoline production.

Large supplies in competing exporting countries will likely continue to limit wheat futures strength. Australia is on track to produce its third largest wheat crop ever, according to a Reuters survey of analysts in that country. The median estimate in that survey was 35.3 MMT, with estimates ranging from 33-34 MMT up to 36.9 MMT.

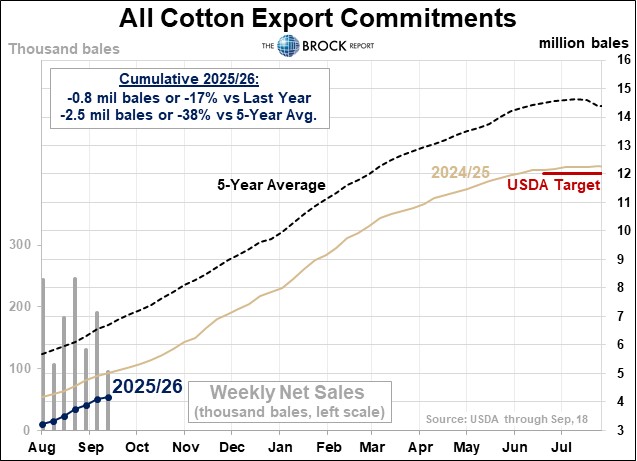

Cotton futures may feel pressure from poor weekly export sales. Net U.S. cotton export sales for the week ended Sept. 18 fell to just 86,100 running bales for 2025-26 delivery

Livestock futures may open mostly lower with lean hog futures likely to come under pressure from technically-driven speculative long liquidation and position evening ahead of this afternoon’s Hogs and Pigs report. Wednesday’s $1.05 drop in the composite pork cutout value will be a negative market factor. Live cattle and feeder cattle futures may also be pressured by technically-driven long liquidation following Wednesday’s price weakness. Negative packer operating margins and Wednesday’s further declines of $3.41-$3.48 in beef cutout values will be negative market factors.