Grain and soybean futures weakened overnight amid a lack of fresh supportive news, with favorable U.S. crop weather putting renewed pressure on corn and soybean futures along with U.S.-China trade tensions ahead of the annual Midwest crop tour, which gets underway today. Wheat futures remained under pressure from large U.S. supplies, and expectations for rising export competition and corn market weakness, despite favorable U.S. export sales. Cotton futures have edged higher in quiet, choppy early trade.

Corn futures were mostly 2 to 3 1/4 cents lower at the end of early trading, with soybean futures mostly 2 3/4 to 4 1/2 cents lower, while wheat futures mostly ranged from 3 1/4 cents lower to 3/4 of a cent higher. Cotton futures mostly range from 10 to 14 points higher.

Looking at other markets, U.S. crude oil futures are 1 to 9 cents lower in cautious early trade after finding light overnight support from the absence of any new sanctions that could reduce Russian exports in the wake of Friday’s Trump-Putin meeting. However, fears of a supply glut continue to weigh on prices as OPEC-plus boosts production.

The dollar index is slightly stronger on apparent support from recent strength in Treasury yields, with the yield on the 10-yr. T-note rising 0.9 points between Wednesday and Friday to its highest level since late July. Most-active Dec. gold futures are $6.50 higher despite the dollar’s strength.

Based on index futures trade, U.S. stock indexes are set to open marginally lower as traders cautiously await today’s meeting between President Trump and Ukraine’s President Volodymyr Zelenskiy and other European leaders on the Russia-Ukraine war. Asian stock indexes were mixed in Thursday trade. Major European stock indexes are lower in afternoon trade.

There are no significant U.S economic reports due out today. Overall, this will be a quiet week for economic data. Data on new home sales for July are due out on Tuesday, with data on July existing home sales due out on Thursday.

Corn futures traded narrow ranges of 4 cents or less overnight inside of their Friday and finished early trade near their session lows. Most-active Dec. futures traded as low as $4.01 1/4 after establishing nearby chart resistance at $4.04 1/2-$4.05 3/4. The market’s 18-day moving avg. is at about $4.07.

Soybean futures traded ranges of 8 cents or less inside of their Friday ranges but finished above midrange for the early session. Most-active Nov. soybeans fell as low as $10.34 1/2 overnight before finishing early trade at $10.39 with nearby chart resistance at $10.43 1/2-$10.43 3/4 and $10.49 1/4.

Corn and soybean traders this morning will be watching the first results from the annual Pro Farmer crop tour, which gets underway this morning. Traders will be looking for verification of USDA’s huge U.S. yield forecast of 188.8 bu. per acre, which was based on farmer surveys and satellite data. This will represent the first widespread in-field scouting of the crop since USDA does not do actual surveying of fields until September.

This afternoon’s USDA Crop Progress report is likely to peg U.S. corn conditions steady to slightly lower than last week’s rating of 72% good/excellent as the crop continues to move toward maturity. Soybean conditions may hold steady at 68% good/excellent.

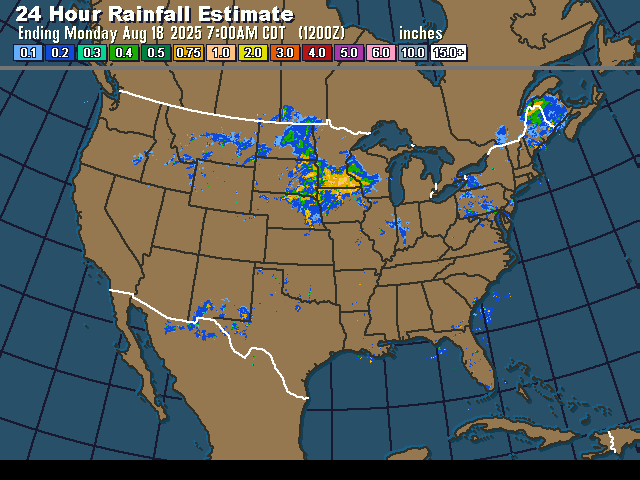

Further rains swept across parts of the western Corn Belt from eastern Nebraska through Iowa and southern Minnesota into Wisconsin overnight, keeping that are well supplied with moisture.

Below-normal rainfall is expected in the U.S. Midwest, Delta and a part of the Great Plains during the next 10 days to two weeks, although totally dry weather is unlikely, World Weather Inc. notes. This is August and it is always hard to get enough rain to counter evaporation at this time of year. Sufficient subsoil moisture should carry most crops through the drying period relatively well, but some moisture stress will be increasing later this month into early September for unirrigated areas.

Cooler temperatures should also be favorable for crops. High temperatures are expected to be in the upper 70s to low 80s across a large portion of the Midwest from Wednesday into early next week.

Strong export demand should remain supportive for corn prices. USDA this morning announced that exporters sold 124,000 MT of U.S. corn to unknown destinations for 2025-26 delivery.

China has reportedly purchased its first cargo of Australian canola since 2020, with state-run trading firm COFCO booking a shipment of about 50,000 MT. The purchase comes after China last week announced a stiff preliminary anti-dumping duty on imports of canola from Canada. COFCO is reportedly seeking more cargos of Australian canola.

Wheat futures continued to struggle overnight, holding in narrow ranges of 6 1/2 cents or less overnight just above the new contract lows they charted last week. Futures did pull off their session lows late in early trading, finishing near midrange for the session. Sep. SRW wheat futures have nearby chart support at $5.00 3/4-$5.01 1/2, with nearby resistance at $5.07 3/4-$5.08 3/4. Sep. HRW wheat futures have nearby support at $5.01, with nearby resistance at $5.06 3/4-$5.08 3/4.

U.S. wheat futures may find some support from European wheat prices, which have turned slightly higher. Dec. milling wheat futures on the Euronext Exchange in Paris fell to a new contract low earlier, but have since rallied after failing to find significant fresh selling interest there.

Traders will be watching to see if today’s talks with Ukraine and its western European allies bring any movement toward an and to the Russia-Ukraine war, which could provide a boost to Black Sea region wheat production.

A larger estimate of Russia’s 2025 production is a negative market factor. Moscow-based IKAR has raised its forecast for Russia’s 2025 crop (excluding occupied areas of Ukraine) to 85.5 MMT from 84.5 MMT and raised its wheat export forecast to 42.5 MMT from 41.5 MMT. USDA last week pegged Russia’s crop at only 43.5 MMT, but forecast 2025-26 exports at 46.0 MMT.

U.S. spring wheat harvest pressure will remain a negative market factor. USDA may peg harvest progress at 30-31% as of Sunday, up from 16% a week earlier. Strong Plains cash cattle prices should continue to provide support for futures along with Friday’s further jump of $3.88 to $6.76 in beef cutout values. Lean hog futures should find support from Friday’s $1.22 rise in the composite pork cutout value and their discounts to cash hog markets.