BROCK MORNING COMMENTS

Grain and oilseed futures were mixed in relatively quiet trade overnight. Entering this morning’s break, corn was up 1 to 2 cents, and soybeans were up 1 to 4 cents, led by nearby months. Wheat futures were steady in Chicago, while K.C. and Minneapolis wheat were down 1 to 3 cents. Cotton futures were down slightly, while rice futures were mixed. New skepticism about improved trade relations between the U.S. and China hang over the complex, while traders watch U.S. planting weather forecasts.

After rallying the past couple of days in large part on optimism on trade, specifically with China, the U.S. stock market is pointed lower today as China slashed cold water on prospects of an imminent deal. President Xi’s spokesman overnight denied that there has been any progress or even talks, saying “any reports on development in talks are groundless,” and saying that if the U.S. wants talks, it first needs to undo all “unilateral” tariffs. Some analysts say the U.S. is in a weak position, given rising concern about the economy here and weakening poll numbers for President Trump, although China certainly has much to lose itself if the trade war continues on its present course.

Dow, S&P 500, and Nasdaq futures were all lower overnight. Crude oil is up slightly after falling yesterday and the dollar index is down slightly after rallying yesterday, but both so far have remained well within yesterday’s trade ranges.

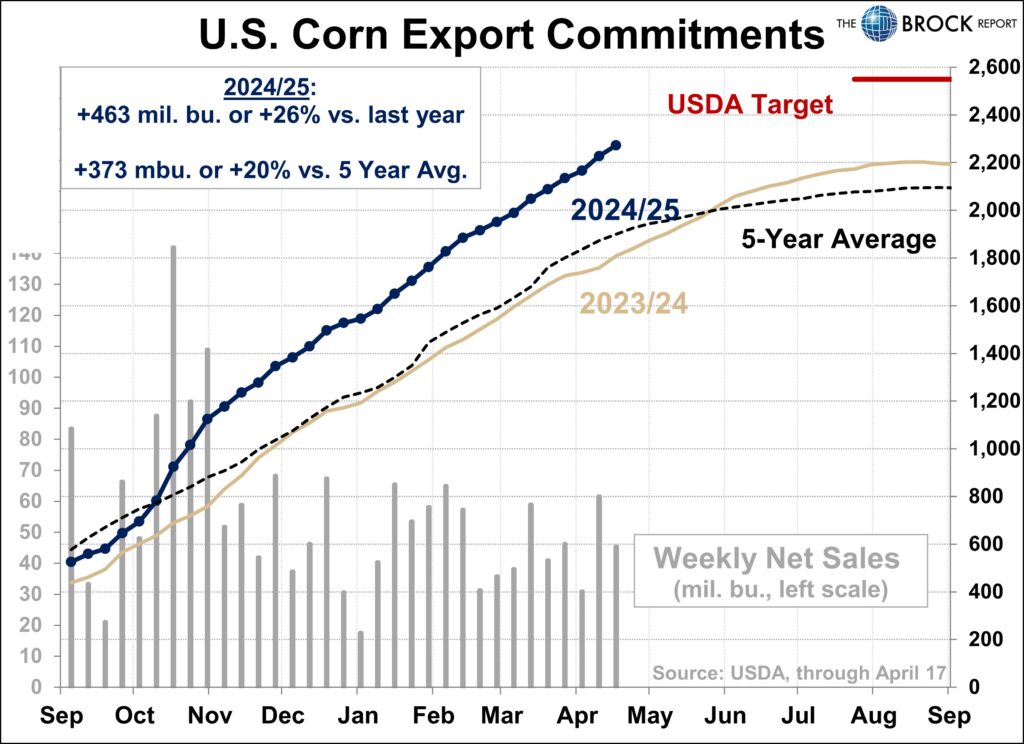

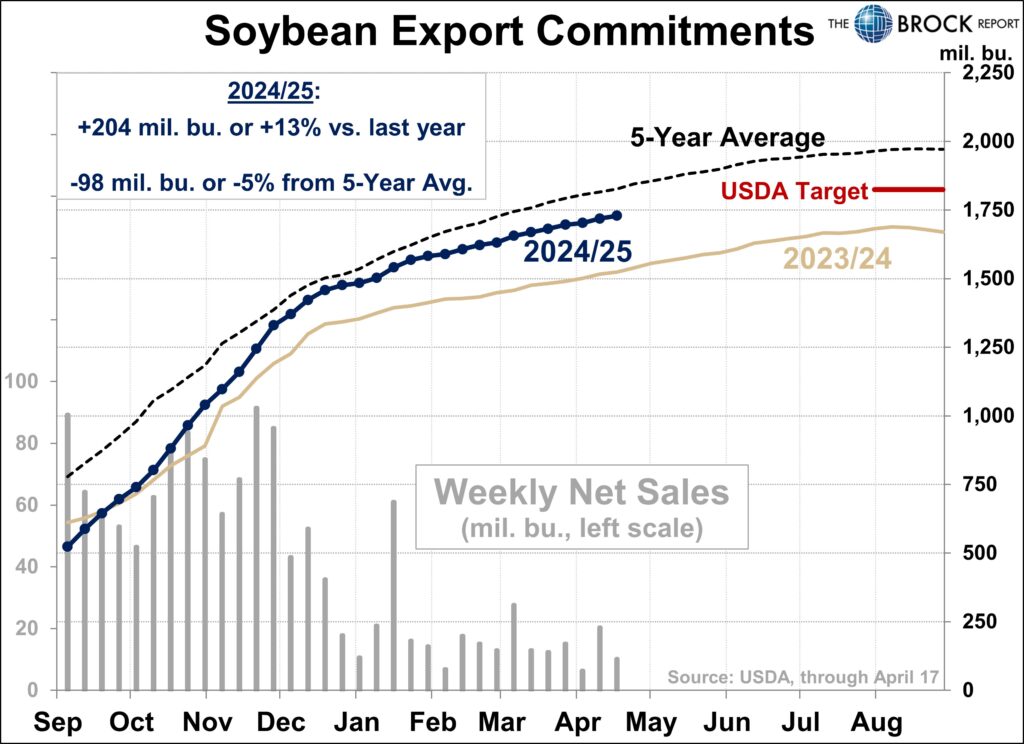

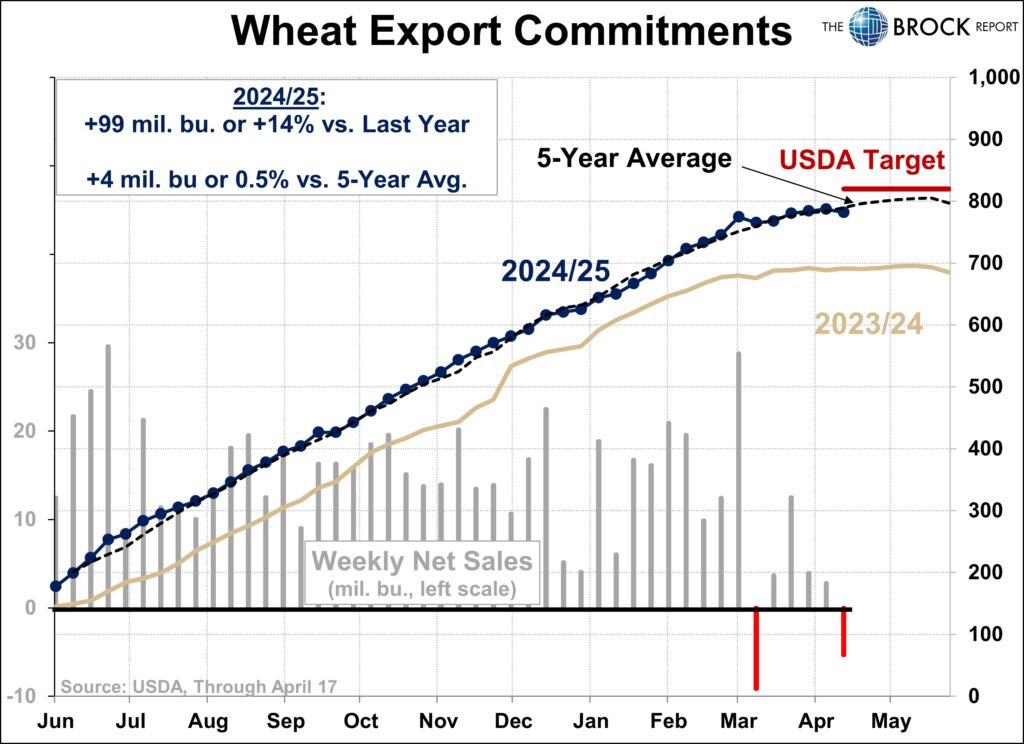

Weekly export sales were solid for corn but lackluster overall. USDA reported corn net sales of 1.153 MMT, up 1% from the four-week average and within trade guesses of 800,000 to 1.3 MMT. Soybean export sales of 277,000 were down 25% from the four-week average and at the lower end of trade guesses that ran 200,000 to 600,000. For wheat, USDA reported net reductions of 145,000 metric tons for old crop, at the low end of trade guesses, and 372,000 metric tons for new crop, topping trade guesses of 100,000 to 300,000.

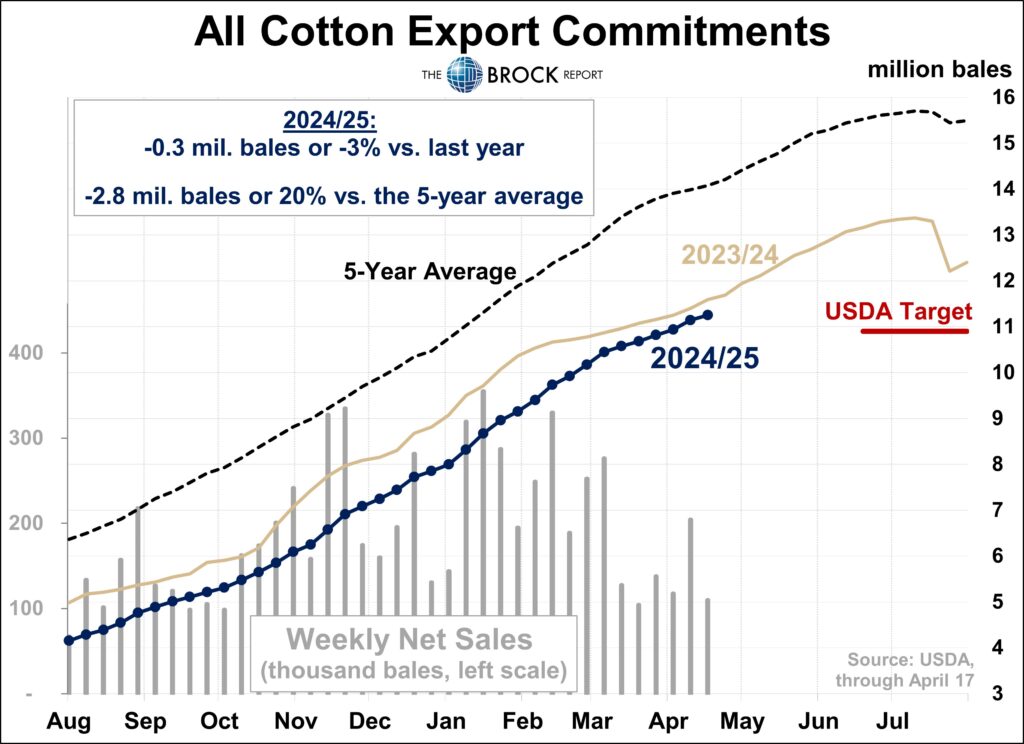

Cotton net export sales of 104,000 bales for 2024-25 were down 22% from the four-week average. China was not a buyer and in fact had small net cancellations. New crop cotton sales were a net 38,000 bales. Rice net export sales of 49,000 metric tons were up slightly from the four-week average.

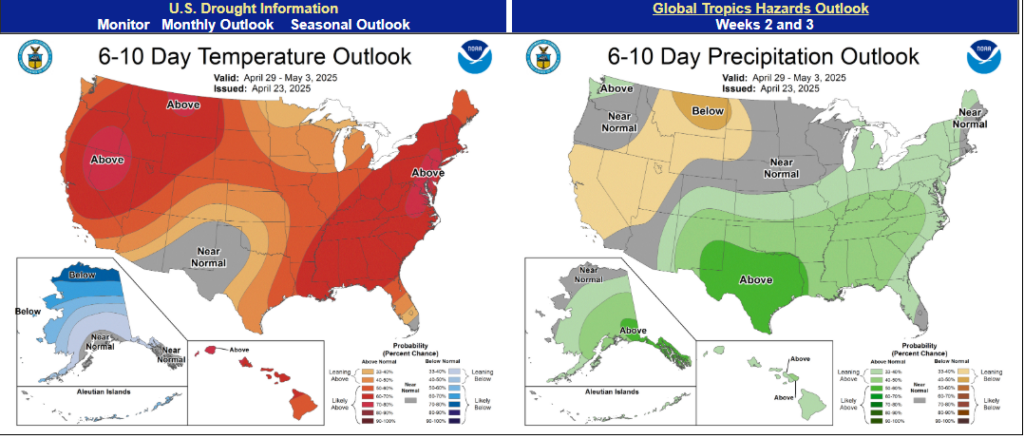

The weather pattern over the next seven days east of the Rockies will be “active,” World Weather Inc. says. That will be beneficial in some areas, particularly those dealing with drought, while in other areas it could slow planting. Hard red winter wheat in West Texas and western production areas of the Plains will see needed and beneficial rain, although “some flooding” is a possibility in central Oklahoma. The rains may also be a nuisance in the Delta region into the Tennessee and Ohio River valleys, which had already seen excessive rains and flooding earlier in the month. But the rains will be accompanied by “unusual” warmth, World Weather says, which will speed drying.

Crop concerns elsewhere in the world are limited right now, with the biggest feature for the grains complex being the ample moisture in Safrinha corn areas of Brazil. World Weather says that soil moisture levels will be good as the monsoon season gives way to dryness in May. The fate of late-planted Safrinha corn had been a main concern throughout the season, but at this point it looks like worst-case scenarios will not materialize. Most of Argentina will see dry conditions over the next 10 days, facilitating harvest.

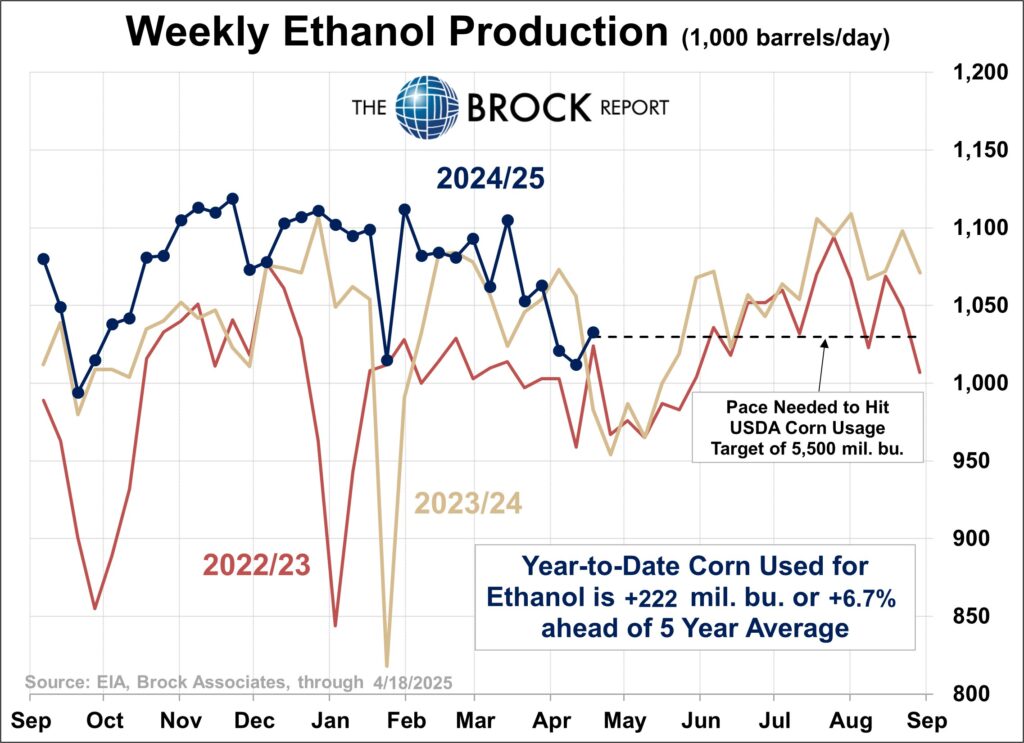

Weekly ethanol production in the week ended Friday edged higher to 1.033 million barrels per day, up from 1.012 million the prior week, EIA said yesterday. The four-week average is 4.0% above year-ago levels. Ethanol stocks meanwhile declined to 25.5 million barrels, down 1.3 million barrels or 5.0% from the prior week. Stocks are down 1.0% from a year ago. Gasoline demand rose sharply to 9.414 million barrels per day, up from 8.462 million the prior week. The four-week average for gasoline demand is down 0.4% from a year ago.

In the livestock complex, Plains cash cattle trade remains mostly quiet for the week. There was for the second straight day very light trade in Kansas on Wednesday. The trade yesterday was at $213, up from $210 a week earlier. Tuesday’s trade had been at $208. Futures surged again on Wednesday, propelled to new contract highs on technical momentum and a rallying stock market. Lean hog futures were narrowly mixed, easing after nearby months had settled higher each of the prior nine sessions.

Pork weekly export sales this morning came in at a marketing-year low of just 5,800 metric tons, down 82% from the four-week average, in large part because of net cancellations of 12,000 metric tons by China. Weekly beef net export sales of 10,300 metric tons were down 11% from the four-week average.

NOTE: Along with the potential for profit, there is always a risk of losing money when trading futures and options contracts.

Copyright 2025 by Richard A. Brock & Associates, Inc.

Any unauthorized redistribution or reproduction of this commentary is strictly forbidden.