As we near the end of the 2024/25 marketing year, old-crop U.S. corn and soybean exports are on pace to come in very close to USDA’s current forecasts, even though they have tailed off seasonally. Meanwhile, advance U.S. corn export sales for next marketing year are off to a solid start, but advance soybean sales have started to lag a bit amid China’s continued absence from the U.S. market.

Old-crop corn export sales as of July 17 totaled 2.760 billion bushels, up 27.4% over last year, with USDA forecasting a 20% rise in actual exports to 2.750 billion bushels. USDA-reported export shipments as of July 17 were still 381 million bushels short of that forecast, but actual export data from the Census Bureau showed total corn exports were 7.7% larger than USDA-reported shipments at the end of May, which suggests exports may have already reached about 2.550 billion bushels. If that is the case, exports need to average only about 31 million bushels per week over the final 6-plus weeks of the marketing year to reach USDA’s forecast.

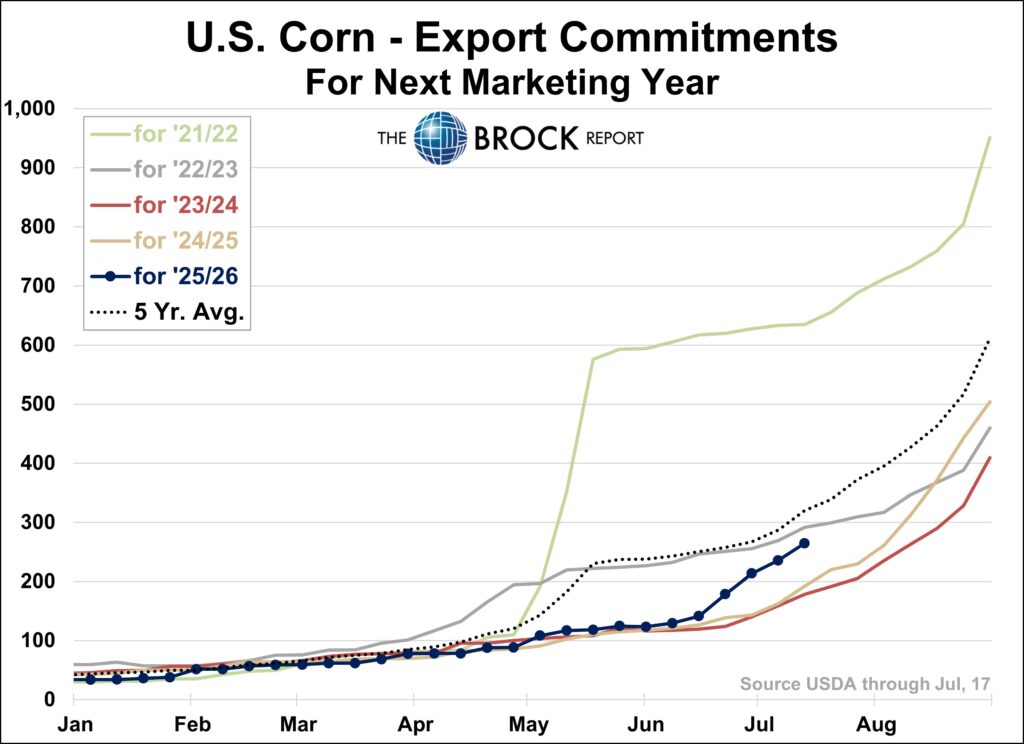

Corn export sales commitments for next marketing year were nearly 265 million bushels as of July 17, up about 38% from advance sales at the same point a year earlier but still below the five-year average, as can be seen in the second chart at right. More than two-thirds of the advance sales so far have been to top U.S. corn buyers Mexico and Japan, with most other buyers staying on the sidelines for now, although it would appear South Korean buyers entered the market this week.

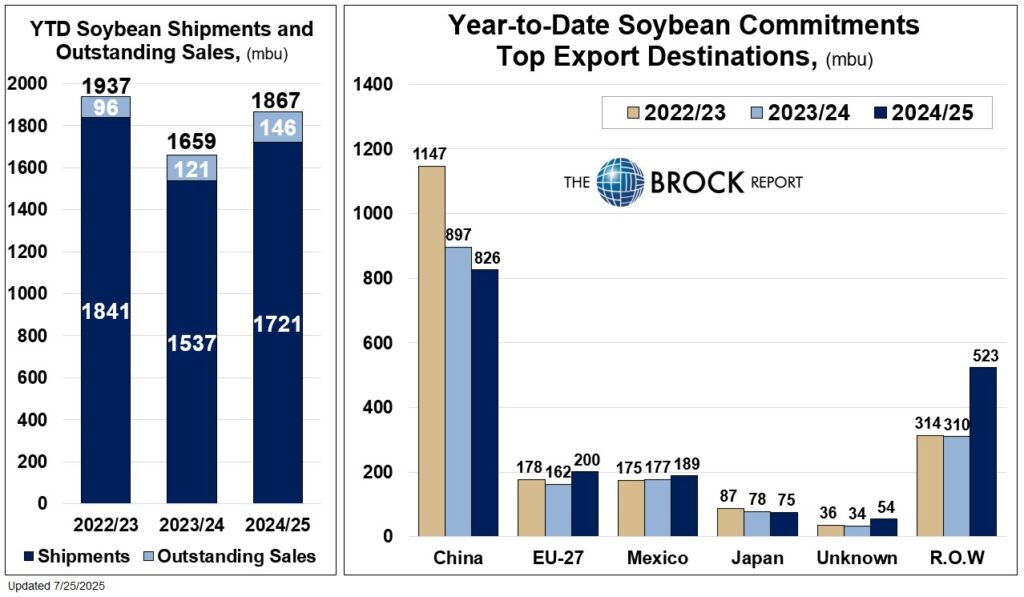

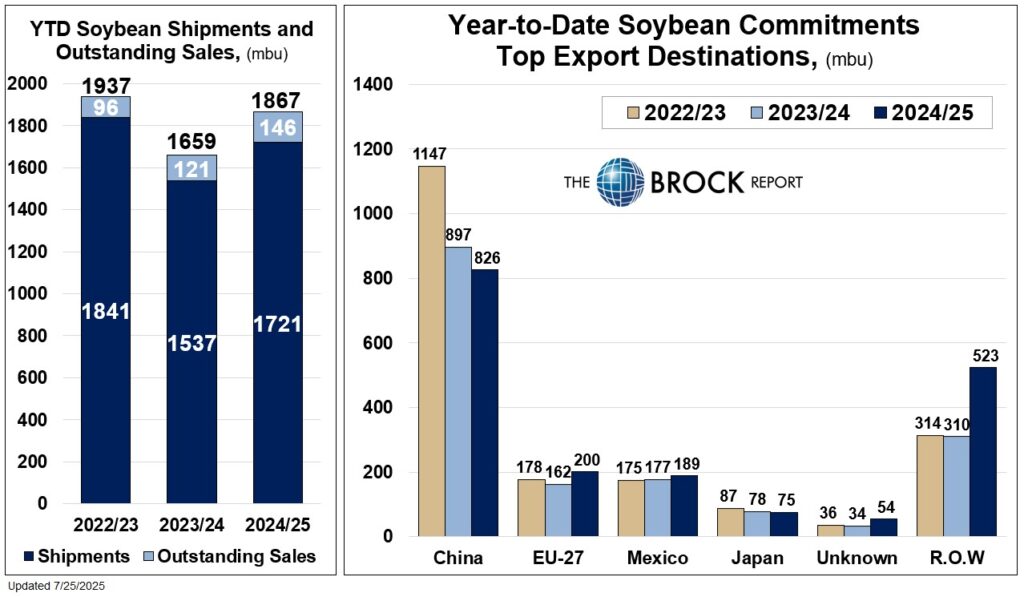

Looking at old-crop soybean exports, USDA forecasts exports at 1.865 billion bushels, up 10% from last year. Through July 17, U.S. export sales commitments totaled 1.867 billion, 12.5% above a year earlier, while USDA-reported export shipments were 12% above last year, and 144 million short of USDA’s forecast. Census Bureau total soybean exports through the end of May were 2.5% larger, suggesting exports may now total about 1.764 billion bushels. If that is the case, export shipments need to average about 15.7 million per week for the rest of 2024/25 to reach USDA’s forecast. Weekly export shipments haven’t been that high since April, though, so exports may fall a bit short of USDA’s target.

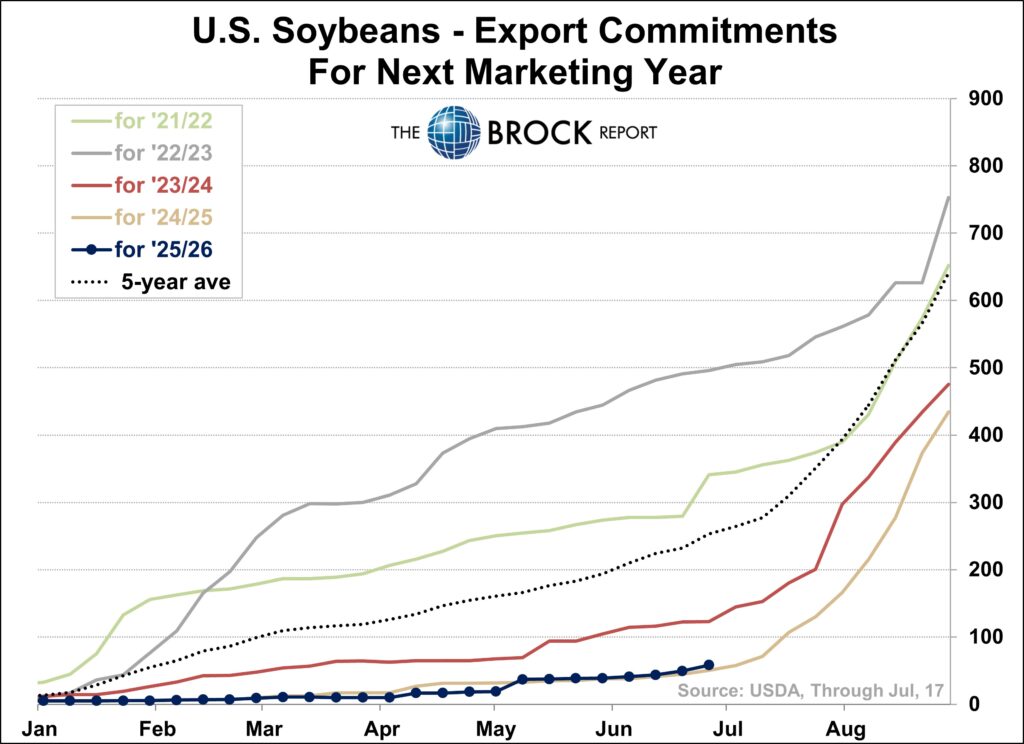

Advance soybean export sales for next marketing year were less than 96 million bushels as of July 17, down 10.3% from a year earlier. That’s a small deficit at this early point, which could vanish in an instant, especially if China returns to the U.S. market. China has yet to book any U.S. soybeans for 2025/26. A year ago, China had just begun booking new-crop soybeans, having bought just 5.8 million bushels. The difference this year is that China has a much larger Brazilian crop to draw from and U.S.-China trade tensions are higher. It is unclear when China may resume significant purchases of U.S. soybeans.