Grain and soybean futures are narrowly mixed at the end of early trading with soybean contracts getting a further boost from technically-driven short covering and Monday’s lower-than-expected U.S. crop rating. Corn futures have come under further pressure from big crop expectations and ample U.S. supplies continue to weigh on wheat futures. Cotton futures are holding small gains in quiet early price action. Outside influences have been negative with the dollar slightly stronger and crude oil futures weaker.

Corn futures were mostly 1 1/4 to 1 1/2 cents lower at the end of early trading, with soybean futures mostly 3 3/4 to 5 cents higher while wheat futures mostly ranged from 3 cents lower to 1/2 cent higher. Cotton futures mostly range from 26 to 28 points higher.

Looking at other markets, U.S. crude oil futures range from 83 cents to $1.02 lower under pressure further pressure from demand worries and the latest OPEC-plus supply increase. Losses have again been limited by President Trump’s threats to impose secondary tariffs on countries buying Russian crude oil.

The dollar index is moderately stronger despite growing expectations for the Fed to lower interest rates at its next meeting in the wake of recent weak U.S. employment data. The greenback has firmed after President Trump again denied he plans to fire Fed Chairman Jerome Powell. Most-active Dec. gold futures are $4.60 lower.

Based on index futures trade, U.S. stock indexes are set to open narrowly mixed after rebounding strongly from Friday’s sell-off on Monday amid support from positive corporate earnings reports and expectations for falling interest rates. Asian stock indexes rose in Tuesday trade, while major European indexes are higher in afternoon trade.

The U.S. trade deficit for June came in at $60.18 bil. vs. trade expectations that averaged 60.9 bil. and the revised May deficit of $71.66 billion. Investors this morning will be watching the release of the Institute for Supply Management’s July purchasing managers index (PMI) for the U.S. service sector, which on avg. is expected to come in at 51.2 up from 50.8 in June, indicating increased expansion in the sector.

Corn futures again fell to new contract lows overnight under pressure from high U.S. crop expectations, but rebounded off those lows to finish early near their session highs. Most-active Dec. futures traded as low as $4.03 1/4 before finishing early trade at $4.05 3/4.

Soybean futures pushed to 3-session highs overnight, with most-active Nov. futures trading as high as $10.00. A Nov. close above $9.94 1/2 would technically be a 5-wave buy signal. Nearby technical resistance for Nov. beans is at $10.00 3/4 and at $10.05 3/4 from the market’s 10-day moving average.

The steady U.S. corn crop rating of 73% good/excellent, which was the highest for early August in 9 years, further supports expectations for a big crop. Our regression analysis of the correlation between crop ratings and final yield points to a potential massive avg. U.S. yield of 192.51 bu. per acre. We certainly are not predicting anything that high, but there are some big numbers floating around in the market, with brokerage house StoneX on Monday forecasting an avg. yield of 188.1 bushels. We suspect the futures market is trading a yield number at least 4-5 bu. above USDA’s trendline estimate of 181.

While the soybean market has seemingly found some light support from Monday’s U.S. crop rating of 69% good/ex., which was down 1 percentage point from a week earlier, it is difficult to read much into that modest drop. Soybean yield expectations are also high, with StoneX projecting a national avg. yield of 53.6 bu., 1.1 bu. above USDA’s trendline estimate and very close to our own estimate.

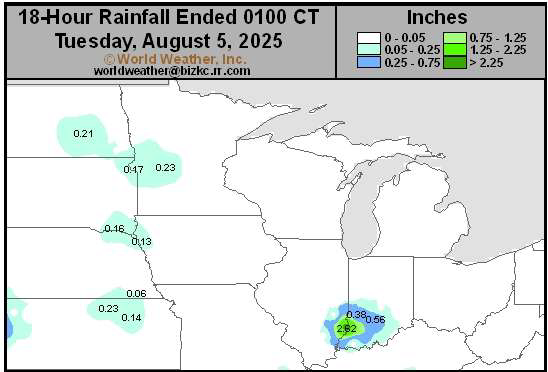

The U.S. Midwest remained largely dry on Monday. Conditions will continue to be mostly favorable for crop regions east of the Rocky Mountains through the next 10 days. The lower eastern Midwest, northern Delta and western parts of the Tennessee River Basin may be drier than usual for a while and the ground is likely to firm up especially during the second week of the forecast period.

In export news, S. Korean buyers are back in the corn market, with MFG reportedly tendering for up to 140,000 MT of corn for November delivery from S. America or S. Africa only.

ADM reported Q2 earnings of 45 cents per share, down from 98 cents a year earlier, but adjusted earnings came out to 93 cents per share, beating the avg. of analysts’ expectations at 82 cents per share. ADM’s Q2 revenues slipped roughly 5% vs a year earlier and came up short of expectations. For the year, ADM now expects adjusted earnings to come in near the low end of its previously issued outlook, at approximately $4 a share.

Brazil’s second-crop corn harvest advanced to 75.2% complete as of Aug. 2, up from 66.1% a week earlier, but still behind last year’s rapid pace of 91.3% complete, according to CONAB, the supply dept. of Brazil’s agriculture ministry. Harvest is nearly over in the top growing state of Mato Grosso at 96.9% complete.

Wheat futures continue to struggle, even with the U.S. winter wheat harvest nearing the finish line at an estimated 86% complete as of Sunday. SRW wheat and HRW wheat futures traded narrow price ranges of 6 1/2 cents overnight, but slid to new long-term lows again before rebounding somewhat. Sep. SRW wheat traded as low as $5.11 1/2 before ending early trade at $5.14 3/4. Support on the weekly most-active SRW wheat futures continuation chart is at the 5-yr. plus low of $5.06 1/4 that was charted in May. Sep. HRW wheat traded as low as $5.10 1/2 before ending early trade at $5.14 1/4. Support is at $5.00 1/4, the 5-yr-plus low charted in May on the weekly most-active HRW wheat futures chart.

Spring wheat futures held above their Monday lows overnight, finding light support from the drop in the U.S. crop rating to 48% good/excellent from 49% last week and a slow start to harvest. The U.S. spring wheat harvest was estimated to be 5% complete as of Sunday vs. a 5-yr. avg. of 9% and the avg. of trade expectations at 7%.

There is no major news from the world wheat export market. Jordan is believed to have passed on its latest tender for up to 120,000 MT of milling wheat. A group of buyers in Thailand is reportedly tendering for about 60,000 MT of feed wheat.

Livestock futures may start out mostly higher this morning, with lean hog futures likely to find further support technically-driven buying, their discounts to cash and lower-than-expected hog slaughter. Monday’s estimates slaughter was only 425,000 head, well short of expectations for 464,000 head slaughter. Live cattle and feeder cattle futures may find support from a firm Monday close. Live cattle futures should also continue to find support from their discounts to cash.