Grain and soybean futures ended early trade mixed with soybean contracts firming after holding nearby chart support at their Friday lows. Easing trade worries underpinned prices after President Trump struck a more moderate tone in Sunday comments about the U.S. trade war with China than he had on Friday and Treasury Sec. Scott Bessent said this morning that he still expected Trump to meet with Chinese President Xi Jinping later this month.

Corn futures were narrowly mixed in early trade with ongoing harvest pressure offset by indications of lower-than-expected yields and strong demand. Wheat futures, though, sank to new lows under further pressure from ample supplies and a strong dollar. Cotton futures are little changed after giving back earlier gains.

Corn futures mostly range from steady to 3/4 of a cent lower to 1/2 cent higher at the end of early trade, with soybean futures mostly 2 1/2 to 3 1/2 cents higher and wheat futures 1/2 cent to 3 1/2 cents lower. Cotton futures are steady to 3 points higher.

Looking at other markets, U.S. crude oil futures are 69 to 71 cents higher amid reduced concerns about U.S.-China trade relations after hitting a 5-month low on Friday.

The dollar index is moderately stronger on support from President Trump’s softer tone towards China. Gold futures, though, are $106.00 higher after hitting another all-time new high of $4,109.70 on support from safe-haven buying spurred by increased U.S.-China tensions.

Based on index futures trade, U.S. stock indexes appear set to open strongly higher on President Trump’s latest trade comments and indications a Trump-Xi meeting is still likely, recovering some of their steep Friday losses. However, index futures have pared gains after Treasury Sec. Bessent warned of a tough U.S. response to China’s new curbs on rare earth exports and said the U.S. govt. shutdown is hurting the economy. Asian stock indexes mostly fell in Monday trade, while major European indexes are mostly higher in afternoon trade.

There are no significant U.S. economic reports due out today and there are no signs the govt. shutdown will end any time soon. Republicans and Democrats appear to be farther away than ever from ending the stalemate over govt. spending.

Soybean futures ended early trade near their session highs after testing, but holding their Friday lows Sunday evening. Nov. soybeans traded as high as $10.11 1/2 overnight and have nearby chart support at $10.02 1/2-$10.03. We expect to see futures consolidate today as traders watch for more news on U.S.-China trade relations.

Corn futures again traded tiny ranges of 2 1/4 cents or less overnight. Futures ended near their session lows as pressure from the record large U.S. harvest outweighed support from reduced trade worries and reports of lower-than-expected yields. Dec. corn finished against nearby support at $4.12 1/4, with further support still at $4.10 1/2 and nearby resistance now at $4.15 and $4.19 1/4.

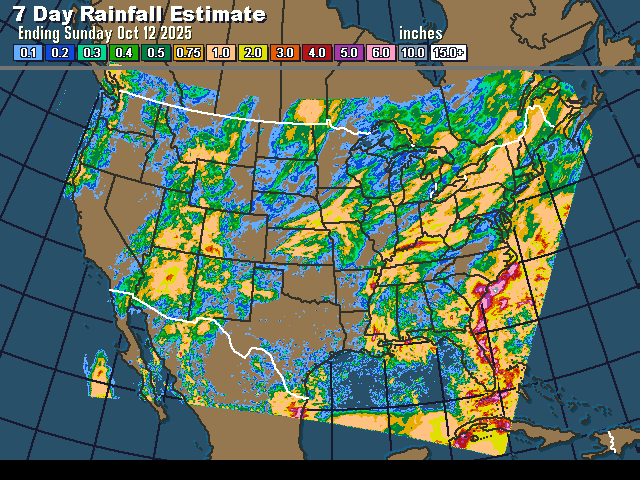

The market will go without USDA crop progress data for a second straight week due to the govt. shutdown. Producers likely made strong progress on corn and soybean harvest last week, although rains caused delays in some areas. Our own estimate right now is that the U.S. corn harvest likely reached about 45% complete as of Sunday, up from 31% a week earlier, while soybean harvest may have reached 62%, up from 40% a week earlier.

Warm, dry, and favorable conditions for fieldwork occurred in most of the Midwest during the weekend with areas of rain occurring from in and near central Missouri to west-central Illinois as well as from eastern North Dakota to east-central South Dakota and the northwestern corner of Iowa to most of Minnesota and parts of northwestern Wisconsin. Rain during the next two weeks should not be great enough to prevent good harvest progress from being made in much of the Midwest while the rain that does fall will be important to winter crops, World Weather Inc. says.

China’s September soybean imports were the second-largest on record at 12.87 MMT, according to China’s General Administration of Customs. Imports were up 13.2% from a year earlier and were up 4.8% from August. “China’s soybean supply outlook has become increasingly secure, supported by strong imports from January to September, a surge in purchases from Argentina during its temporary tax holiday, and continued heavy buying from Brazil,” Rosa Wang, an analyst at Shanghai-based agro-consultancy JCI told Reuters News Service.

Planting of the 2025-26 soybean crop continued to move swiftly in Brazil last week, reaching 14% complete as of last Thursday, up from 9% a week earlier and 8% a year earlier, according to Brazilian analyst AgRural. Planting of first-crop corn reached 45% of the projected area in the key center-south growing region, versus 41% a year earlier, AgRural said.

China’s vice premier on Monday said that recent continuous rainfall in the key grain-producing Huang-Huai-Hai region has disrupted the autumn harvest, urging swift action to ensure the country meets its annual grain output target of around 700 MMT. The Huang-Huai-Hai region – China’s largest summer corn and winter wheat belt, spanning provinces such as Shandong, Henan, Hebei, and Jiangsu – is now racing against time to salvage crops during the critical harvest window.

Wheat futures sank to new contract lows overnight amid ample supplies and a lack of demand news. Nearby Dec. SRW wheat futures traded as low as $4.94 1/2 and finished early trade just above that low, with nearby resistance at $5.01 3/4. The next significant support on the weekly most-active SRW wheat futures continuation chart appears to be at about $4.75. Dec. HRW wheat futures fell as low as $4.79 1/2 after establishing nearby chart resistance at $4.86 1/4.

Steady to lower Russian wheat export prices are a negative market factor. The price for 12.5% protein Russian wheat for free-on-board (FOB) shipment from the Black Sea at the end of November was $229 per MT at the end of last week, down $3 from a week earlier, according to IKAR consultancy. SovEcon consultancy put to price at $230-$232 per MT FOB, unchanged from a week earlier.

France is heading for its largest wheat ending stocks in two decades as a collapse in demand from Algeria and China narrows export options, despite merchants profiting from slow Russian shipments to grab sales to Egypt and Asia.

Livestock futures may open mixed again this morning with live cattle and feeder cattle futures likely to find further early support from technically-driven buying after another strong close on Friday. The rebound in U.S. stock markets after Friday’s collapse should also help both markets. Lean hog futures may remain under pressure from seasonal weakness in cash hog and wholesale pork prices, as well as technically-driven long liquidation.