Soybean futures moved sharply higher in early trade on support from hopes China will buy more U.S. soybeans after President Trump said on social media overnight he hoped China would “quadruple” its purchases of U.S. beans. Futures did back off their highs amid doubts about any Chinese purchases. Corn futures are slightly higher on support from the soybean rally and speculative position evening, while wheat futures ended early trade narrowly mixed. Cotton futures are slightly higher in relatively quiet early trading.

Corn futures were mostly 1 to 1 3/4 cents higher at the end of early trading, with soybean futures mostly 14 1/4 to 17 1/4 cents higher, while wheat futures mostly ranged from 2 3/4 cents lower to 3 1/4 cents higher. Cotton futures mostly range from 37 to 45 points higher.

Soybean futures were trading slightly lower until Trump’s social media post at 10:21 p.m. CT on Sunday night, which said: “China is worried about its shortage of soybeans. Our great farmers produce the most robust soybeans. I hope China will quickly quadruple its soybean orders. This is also a way of substantially reducing China’s Trade Deficit with the USA. Rapid service will be provided. Thank you President XI.”

Looking at other markets, U.S. crude oil futures range from 36 to 37 cents higher in cautious early action as traders await a planned Friday meeting between President Trump and Russian President Vladimir Putin in Alaska that could set the stage for a Russia-Ukraine peace deal.

The dollar index is moderately higher as traders await the release of the latest U.S. inflation data on Tuesday morning. Most-active Dec. gold futures are $79.10 lower after the White House said it would clarify what it termed as “misinformation” about import tariffs for gold bars.

Based on index futures trade, U.S. stock indexes are set to open slightly higher as investors wait to see whether President Trump will extend the U.S. tariff truce with China, which is set to expire on Tuesday. Asian stock indexes mostly rose in Monday trade. Major European stock indexes are mostly lower in afternoon trade.

There are no significant U.S. economic reports due out today. Investors are awaiting the U.S. Consumer Price Index data for July, which is due out Tuesday morning. On avg., analysts expect a 0.2% monthly increase in the headline CPI and a 0.3% increase in the core CPI (minus food and energy).

Soybean futures surged shortly after President Trump’s social media post and have backed only slightly off of their overnight highs. Most-active Nov. soybean futures are working on a potential outside day up and have charted a 10-session high of $10.15, while July soybeans have hit an 8-session high of $10.70 3/4 and are also working on a possible outside day up.

Corn futures have been pulled higher by soybean prices, but expectations for a record large U.S. crop continue to limit price strength. Most-active Dec. corn futures have traded as high as $4.08 3/4 after establishing nearby chart support at $4.03. Nearby resistance for Dec. is at Friday’s high of $4.11.

We certainly do not know what President Trump may know, but his social media post looks like an attempt to strong arm China into making purchases of U.S. soybeans in order to assure an extension of the tariff truce. Unless this is followed up shortly by actual Chinese purchases of U.S. soybeans, the price spike will likely disappear as quickly as it occurred. China does not have any critical need for large imports of U.S. soybeans since it has imported record amounts of Brazilian beans over the past 3 months.

It would be virtually impossible for China to quadruple its purchases of U.S. soybeans on an annual basis. It has bought about 826 mil. bu. of U.S. soybeans this year, which quadrupled would amount to 3.304 bil. bu., or about 76% of USDA’s current forecast for 2025 U.S. production. That would leave a huge supply shortage for U.S. processors, who are expected to crush 2.540 bil. bu. of soybeans in 2025-26.

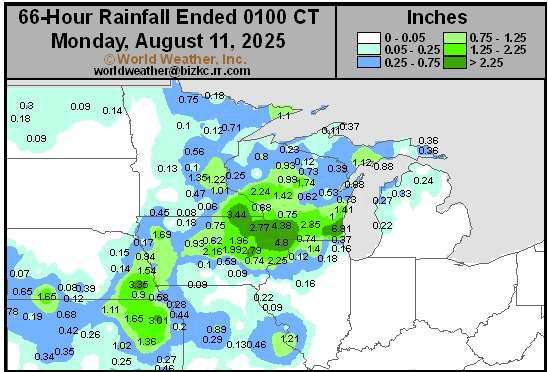

Heavy rains caused flooding in parts of eastern Iowa Sunday, likely negatively impacting some corn and soybean fields. Those rains were nothing like what fell on southeastern Wisconsin Saturday night into Sunday, though, with widespread rainfall totals in excess of 6 inches and totals up of 14.5 inches record within Milwaukee metropolitan area.

We do not expect this afternoon’s USDA Crop Progress report to indicate any major changes in U.S. corn or soybean crop ratings. The corn crop rating might slip slightly again with crop development becoming more advanced.

Brazil’s second-crop corn harvest was 88% complete as of last Thursday in the country’s center-south region, up 7 percentage points from a week earlier, but behind last year’s pace of 97% complete, according to Brazilian analyst AgRural.

In export news, S. Korea’s MFG is tendering for up to 70,000 MT of corn from the U.S., S. America or S. Africa for December arrival.

Ukraine’s economy ministry has revised its 2025 grain crop forecast to 56 MMT from 54 MMT previously, Deputy Economy Minister Taras Vysotskiy told Reuters on Monday. He said a larger-than-expected corn harvest of around 28 MMT was the main reason for the higher estimate of overall grain production this year. However, that estimate is still below USDA’s forecast for a 2025 Ukrainian corn crop of 30.5 MMT.

Wheat futures traded ranges of 9 cents or less overnight and mostly managed small gains after shaking off overnight weakness. Sep. SRW wheat futures traded as high as $5.20 3/4 overnight after establishing nearby support at $5.13 1/4. Sep. ended early trade near midrange for the session. Sep. HRW wheat traded as high as $5.20 1/2 overnight after establishing nearby support at $5.11 1/2.

This afternoon’s USDA Crop Progress report should show winter wheat harvest more than 90% complete and may peg spring wheat harvest progress 14%-16% up from last week’s 5%.

The wheat export market remains largely quiet, although we continue to expect that major buyer Algeria may be back in the market soon after making its last purchase in mid-July. Buyers in the Philippines are said to have bought around 50,000 MT of feed wheat from Australia.

USDA Sec. Brooke Rollins on Saturday at the Iowa State Fair said she will have a major announcement on Aug. 15 on the battle against New World screwworm, which has forced suspension of U.S. livestock imports from Mexico. Rollins said she has “been getting an unbelievable amount of pressure” to reopen ports along the U.S-Mexico border to cattle imports.

Livestock futures may open mostly lower this morning with live cattle and feeder cattle futures likely to be pressured by further technically-driven long liquidation after collapsing on Friday. Feeder cattle futures finished locked limit down on Friday, leaving pent up selling interest. However, strong Friday cash trade in Plains direct markets at $235-$237, mostly $235 on a live bases, may limit further weakness in futures. This week’s trade may be mostly steady. Lean hog futures may be pressured by weaker Friday cash trade, but should find support from Friday’s $1.08 rise in the composite pork cutout value.