Grain and soybean futures are mixed at the end of early trading with soybean contracts suffering double-digit losses overnight under pressure from a sharp drop in soyoil prices. Reports the U.S. EPA has proposed a much lower target for 2026 renewable diesel/biodiesel blending than an industry group recommended have sent nearby July soyoil futures down their 3-cent daily limit. Corn and wheat futures have rallied, though, on support from strong weekly export sales. Cotton futures are marginally higher in choppy trading.

Corn futures are mostly 1/2 cent to 3 1/4 cents higher at the end of early trading, with soybean futures mostly 12 1/2 to 15 1/4 cents lower, while wheat futures mostly range from 3 to 5 3/4 cents higher. Cotton futures mostly range from 3 to 8 points higher.

Looking at other markets, U.S. crude oil futures are $1.48 to $1.53 lower at 4-session lows after President Trump said the U.S. is close to a nuclear deal with Iran that would lift U.S. economic sanctions against that country. Crude prices have also been pressured by a surprise jump in U.S. crude stocks reported by EIA on Wednesday. Losses have been limited by positive U.S. economic data.

The dollar index is moderately weaker under pressure from easing inflation concerns and June gold futures are $12.70 higher on the dollar’s weakness and well off of a 5-week low they hit overnight.

Based on index futures trade, U.S. stock indexes are set to open slightly lower amid investor profit taking despite easing inflation concerns. Asian stock indexes mostly fell in Thursday trade, Major European stock indexes are mixed in afternoon trade.

Investors have lots of economic news to digest. U.S. retail sales for April came in up 0.1% from March, matching the average trade of trade expectations and March sales were revised upward to +1.7% indicating a strong economy.

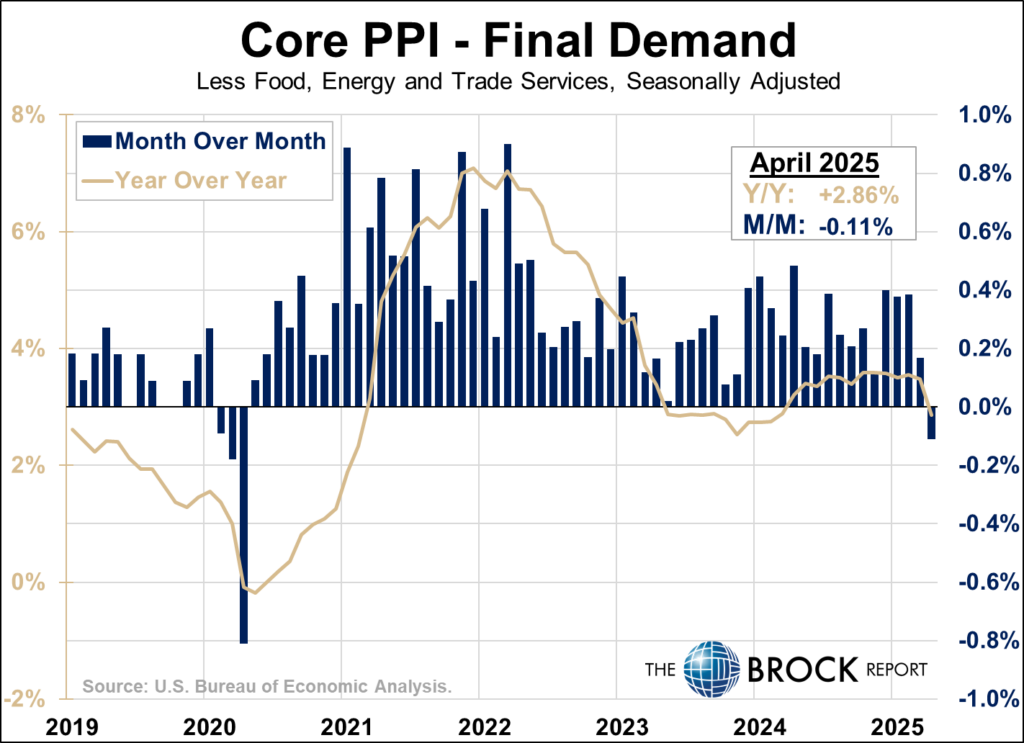

The U.S. Producer Price Index for April fell by 0.5% compared with trade expectations that averaged +0.3%, while the core PPI (minus food, energy and trade services) was down 0.1% vs. trade expectations that also averaged +0.3%. On an annualized basis, the PPI was up 2.4% and the core PPI was up 2.9%. The PPI data should further ease inflation concerns.

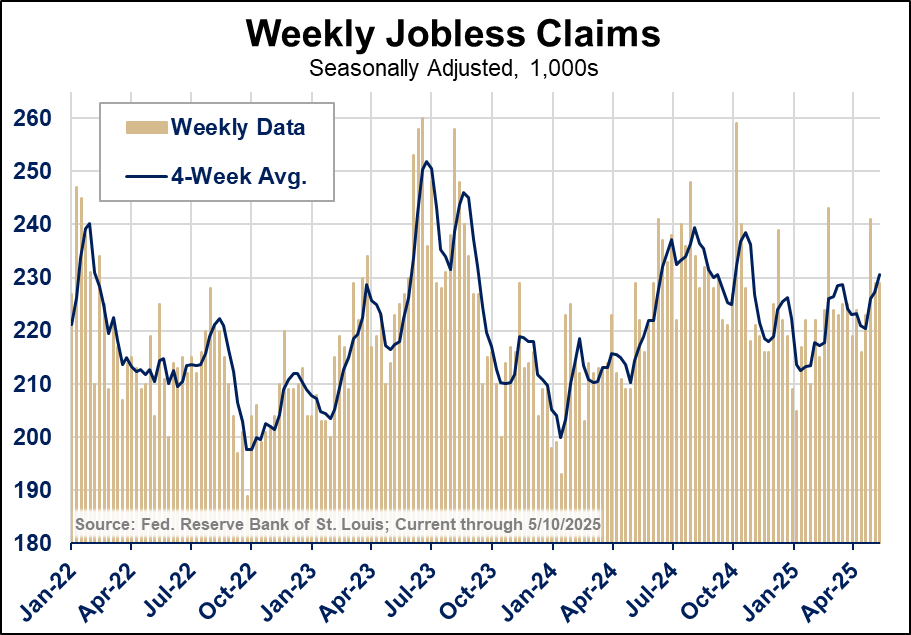

Weekly U.S. unemployment claims came in at 229,000 compared with the average of trade estimates at 226,000 and the previous week’s revised 229,000. The New York Fed’s latest Empire State Manufacturing Index reading came in at -9.2 compared with an average trade estimate of -9.0 and the previous reading of -8.1.

Later this morning, data on U.S. industrial production for April is due out, with analysts on avg. expecting production to be up 0.1% from March.

Soybean futures ended early trade below mid-range for the session. Nearby July soybeans fell as low as $10.60 1/2 before finding some support. Further chart support should be at $10.52 1/2-$10.56 1/2 and July now has nearby resistance at $10.73 1/4 and $10.82. Nov. soybeans have nearby support at $10.46 1/2 and nearby resistance at $10.57 3/4 and $10.65 1/2.

Corn futures rallied late in overnight trade on support from strong weekly export sales, with nearby July futures strongest. July corn finished early trade near its session high of $4.49 after earlier establishing nearby support at $4.43 1/2. Dec. corn finished near its session high and has $4.41 1/2-$4.43, with nearby support at $4.37 1/2-$4.38 1/4 and at $4.35 3/4.

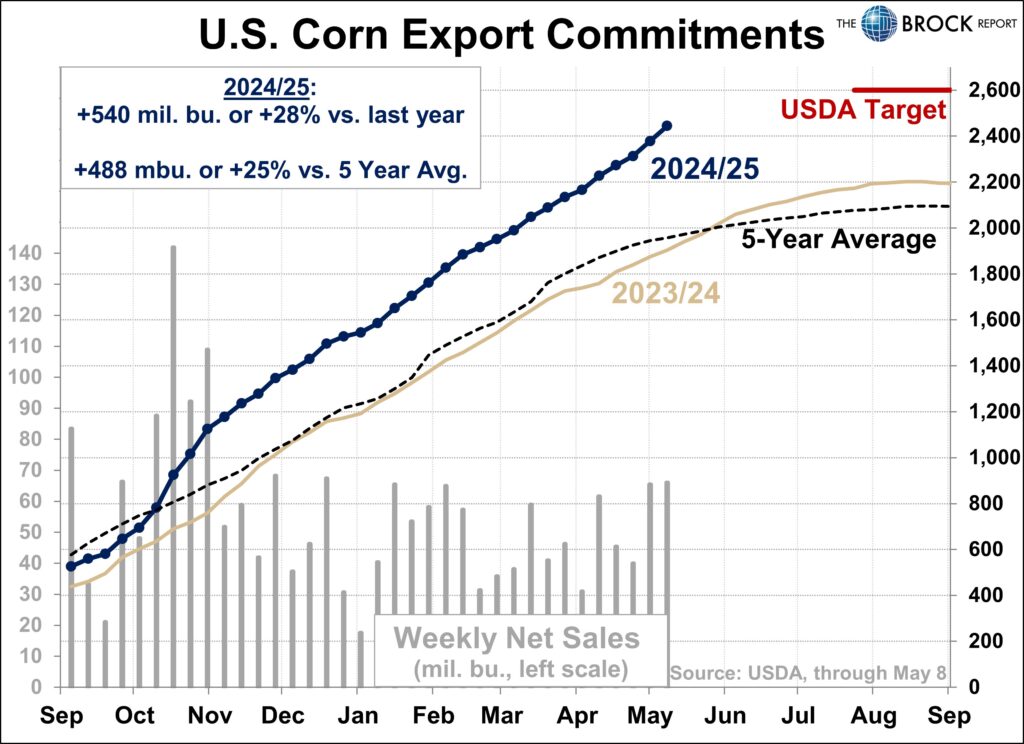

Net U.S. corn export sales for the week ended May 8 came in at 86 mil. bu., including 66.0 mil. for 2024-25 delivery compared with trade expectations that ranged from 47.0-87.5 mil. bu. and the previous week’s sales of 66.1 mil. bushels. The sales data should be supportive for corn prices. Weekly corn export shipments fell to 55.6 mil. bu. from 71.6 mil. the previous week.

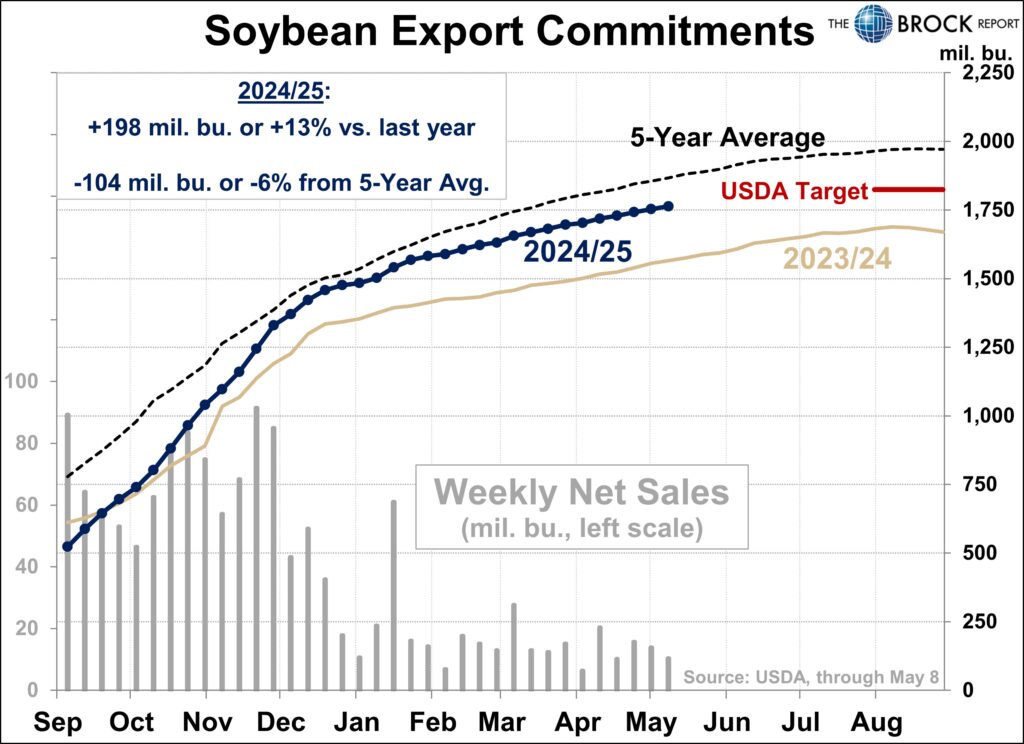

Net weekly U.S. soybean sales came in at 28.4 mil. bu. including 10.4 mil. for 2024-25 delivery, compared with trade expectations that ran 11.0-33.0 mil. bu. and the previous week’s sales of 14.2 million. The sales data looks largely neutral for soybean prices. Weekly soybean export shipments of 15.8 mil. bu. were up from 9.5 mil. the previous week.

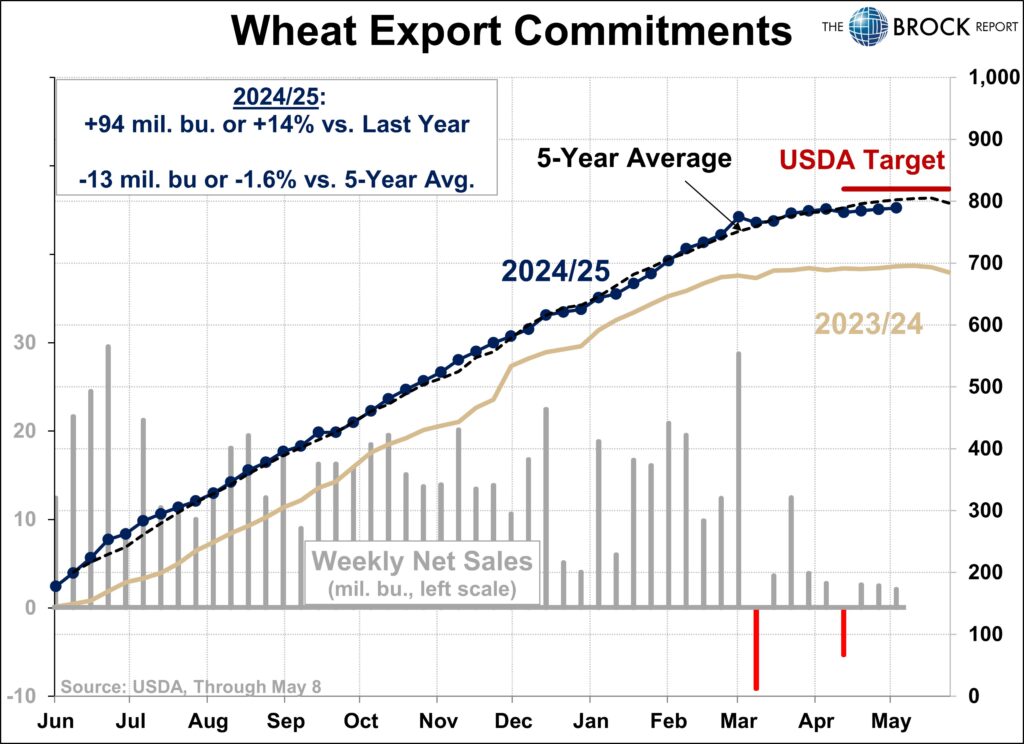

Net U.S. wheat export sales came in at 29.6 mil. bu., including 27.4 mil. bu. for 2025-26 delivery, easily topping trade expectations that ran 1.5-22.0 mil. bu. and the previous week’s sales of 20.7 mil. bushels. The sales total provides evidence wheat prices have fallen low enough to spark increased demand and should be supportive for futures prices.

As we expected, Brazil’s CONAB this morning raised its forecast for that country’s 2024-25 corn production again, pegging it at 126.87 MMT, up from a previous estimate of 124.74 MMT on stronger expected second-crop output. However, USDA raised its Brazil corn forecast by 4 MMT to 130 MMT on Monday. CONAB also raised its 2024-25 soybean production forecast to 168.34 MMT from the April estimate of 127.87 MMT.

Rain is underway today in the southeastern half of Saskatchewan, Canada, far southwestern Manitoba and the western Dakotas where significant rainfall of 0.75 to 2.50 inches is anticipated, with a few amounts of 2.50 to more than 3.00 inches likely in the western Dakotas and far southeastern Saskatchewan. The rain will bolster soil moisture and ease some long term dryness

Most other U.S. crop areas east of the Rocky Mountains will receive rain at one time or another during the next two weeks, although rain from the central Plains to the heart of the Midwest will hold off until next week

Wheat futures finished early trade strongly, rallying to session highs late in response to the strong weekly export sales. Nearby July SRW wheat futures traded to a 4-session high of $5.31 after establishing nearby chart support at $5.21 3/4 overnight. July HRW wheat futures traded to a 5-session high of $5.29 after establishing nearby support at $5.20 1/4.

Wheat futures certainly appear to have bottomed out for now, but ample U.S. wheat supplies should limit the upside for prices along with a lack of major crop threats in other major exporting nations. A rebound in European Union wheat production and exports is likely to keep export competition stiff.

French analyst Strategie Grains has raised its forecast for 2025 EU soft wheat production to 129.8 MMT from a previous estimate of 128.1 MMT. The new crop estimate represents an increase of 14.7% over last year’s weather-reduced crop.

Ukraine’s farm ministry is keeping its 2025 grain harvest forecast at 56 MMT despite unfavorable weather in April and early May, the first deputy agriculture minister said on Thursday. State weather forecasters said on Tuesday that weather conditions in early May were mostly satisfactory for grain fields, but frost and drought in southern regions have damaged or killed some winter wheat, peas, rapeseed and barley crops.

Weather models continue to advertise Black Sea region precipitation with Ukraine wettest and Russia’s Southern region and western Kazakhstan driest, but not completely dry.

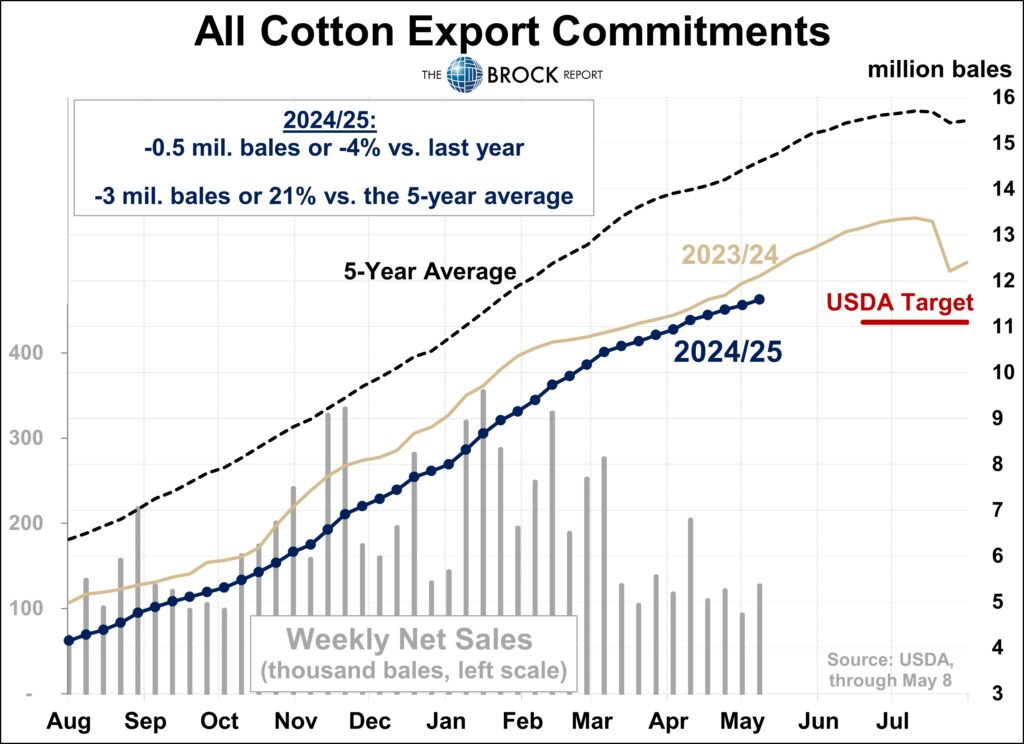

Net weekly U.S. cotton export sales for the week ended May 8 totaled 122,200 running bales for 2024-25 delivery and 34,200 bales for 2025-26 delivery. The sales were an improvement over the previous week, but remained poor overall.

Livestock futures may open mixed this morning with live cattle and feeder cattle futures likely to come under significant pressure from speculative long liquidation after posting massive bearish key reversals on Wednesday. Live cattle weakness may be limited, though, by futures discount to cash. Hedgers should be alert this morning for possible fresh recommendations. Lean hog futures may feel pressure from technically-driven selling, cattle futures weakness and lackluster weekly U.S. pork export sales of 24,600 MT.