Soybean futures came under further pressure in early trading from concerns about a disappointing EPA biofuels proposal, China’s continued absence from the U.S. market and rising harvest activity. Corn futures ended largely unchanged despite rising harvest pressure, while wheat futures turned higher on renewed support from speculative short covering despite a stronger dollar. Cotton futures are under pressure from technically-driven selling after failing at key chart resistance on Wednesday.

Corn futures were mostly 1/4 cent to 3/4 of a cent lower at the end of early trading, with soybean futures mostly 2 1/4 to 3 1/4 cents lower, while wheat futures mostly ranged from 3/4 of a cent lower to 2 cents higher. Cotton futures mostly range from 52 to 56 points lower

Looking at other markets, U.S. crude oil futures are little changed after coming under light pressure overnight from economic concerns. Support has come from the sharp drop of 9.3 mil. barrels in U.S. crude stocks reported by the EIA on Wednesday.

The dollar index is moderately higher and near its session high despite Wednesday’s Fed interest rate cut, and prospects for further rate cuts this year. Most-active Dec. gold futures are $29.90 lower on the dollar’s strength.

Based on index futures trade, U.S. stock indexes appear set to open moderately higher on support from Wednesday’s rate cut and the Fed’s signal that it plans further rate cuts this year. Asian stock indexes were mixed in Thursday trade. Major European stock indexes are higher in afternoon trade.

Weekly U.S. unemployment claims came in at 231,000 compared with trade expectations that averaged 241,000 and the previous week’s revised 264,000.

Corn futures again showed little movement overnight, trading ranges of just 2 1/2 cents or less and finished early trade near their session lows, which could encourage further selling this morning. Nearby Dec. corn established nearby chart resistance at $4.28 and traded as low as $4.25 1/2. A Dec. close below $4.20 would be concerning technically.

Soybean futures traded narrow ranges of 6 cents or less and fell to 4-session lows overnight, but finished near midrange for the early session. Nearby Nov. futures established nearby chart resistance at $10.44 1/2 and nearby support at $10.38. The market’s 40-day moving avg. may be key technical support down at $10.27 1/2.

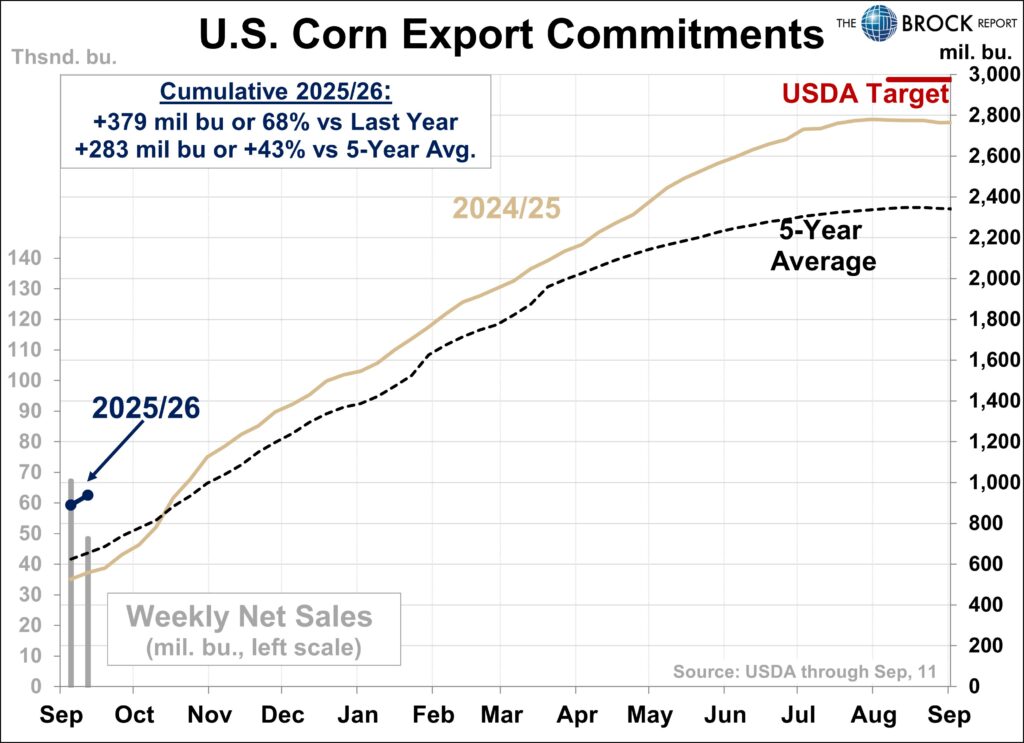

Net U.S. corn export sales for the week ended Sept. 11 came in at 48.5 mil. bu. compared with trade expectations that ran from 23.6 mil. bu. to 74.8 mil. and the previous week’s new sales of only 21.3 mil. bushels. The export sales data looks neutral for corn prices.

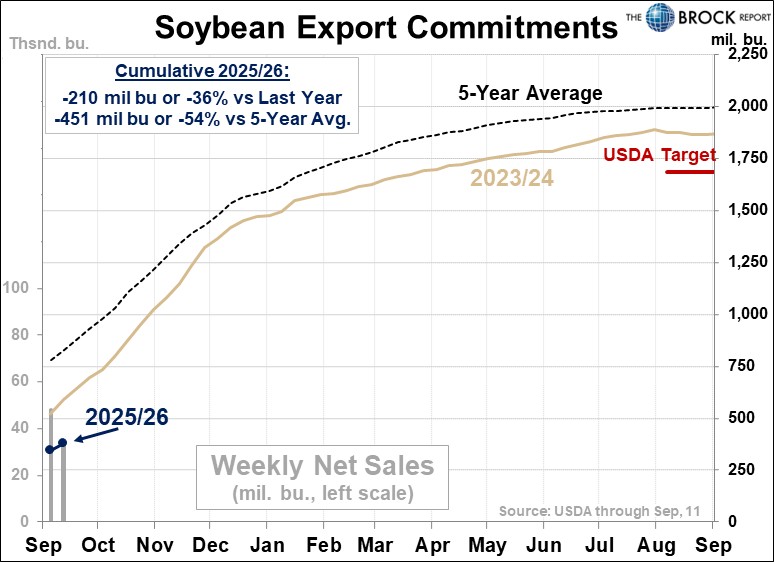

Net weekly U.S. soybean export sales totaled 34.0 mil. bu. compared with trade expectations that ran from 14.5 mil. to 55.0 mil. bu. and the previous week’s new sales of 19.9 mil. bushels. The sales total looks neutral for soybean prices, but China remained absent from the list of buyers, which may put some further pressure on prices.

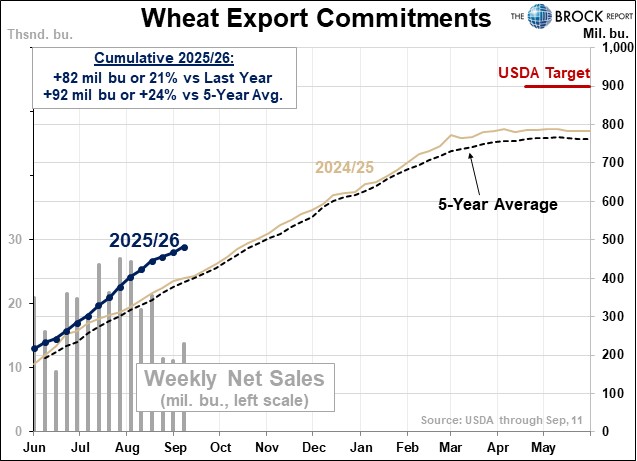

Net weekly U.S. wheat export sales totaled 13.9 mil. bu. compared with trade estimates that ran from 11.0-24.0 mil. bu. and the previous week’s sales of 11.2 mil. bushels. The sales data looks slightly negative for wheat prices.

USDA also announced this morning that exporters have sold 110,000 MT of corn to Mexico for 2025-26 delivery.

Relief from dryness in the lower and eastern U.S. Midwest will evolve next week while the next several days will continue dry and warm. Rain in the western U.S. Corn Belt into the weekend will disrupt fieldwork. Some follow-up rain is expected next week to possibly further delay crop maturation and harvest progress.

The EPA proposal on reallocation of biofuels blending obligations lost to Small Refinery Exemptions (SREs)has not been well-received by the soyoil market, as it left the issue unresolved for now. EPA co-proposed two options: Reallocate all of the exempted volume and add it to 2026 and 2027 RFS requirements, or reallocate half of the exempted volume. However, the Renewable Fuels has said it is cautiously optimistic about the proposal.

Brazil’s CONAB has forecast that country’s 2025-26 soybean production at 177.67 MMT, vs. 2024-25 output of 171.47 MMT and has projected a 2025-26 corn crop of 138.28 MMT vs. a 2024-25 crop of 139.7 MMT.

Wheat futures faded late in early trading under apparent pressure from lackluster weekly U.S. export sales. SRW wheat contracts traded well inside of their Wednesday ranges and finished early trade near midrange for the session. Dec. SRW wheat has nearby chart resistance at $5.32 1/4 and $5.35 3/4, with nearby support at $5.24-$5.27. HRW wheat futures finished early trade below midrange. Dec. HRW wheat has nearby chart resistance at $5.19 and $5.24, with nearby support at $5.13 1/4-$5.14 1/2.

Parts of the U.S. HRW wheat belt received more rainfall overnight, with the heaviest amounts concentrated in the Texas Panhandle.

Russia has harvested 84 MMT of wheat so far in 2025, RIA news agency reported on Thursday, citing Russian Agriculture minister Oksana Lut.

The International Grains Council has raised its estimate of 2025-26 world wheat production by 8.0 MMT to 819 MMT. The IGC estimate is above USDA’s latest estimate of 816.2 MMT.

The world export market remains mostly quiet. Syria is reportedly still considering offers and has not made any purchases in an import tender for 200,000 MT of milling wheat that closed this week.

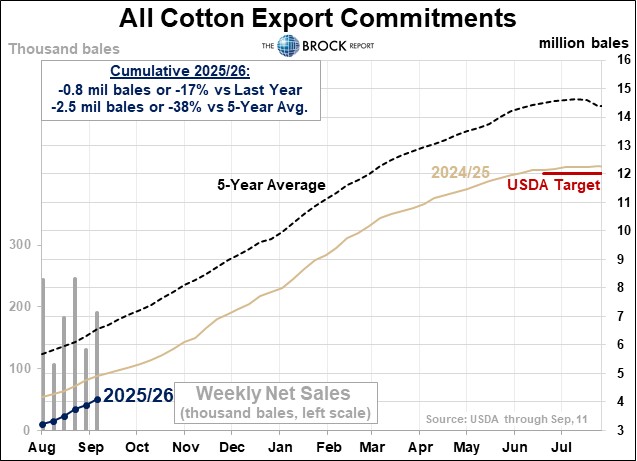

Net U.S. cotton export sales for the week ended Sept. 11 totaled 186,100 running bales for 2025-26 delivery and 19,000 for 2026-27 delivery. Sales were up from 129,600 running bales a week earlier and should be supportive for cotton prices.

Livestock futures are likely to start out mostly lower this morning with live cattle and feeder cattle futures likely to be hit by technical follow-through to Wednesday’s sharp losses. But cattle futures trade will likely remain highly volatile with futures finding support from their discounts to cash and the Fed’s signal it plans further interest rate cuts. Falling wholesale beef prices will be a negative market factor. Lean hog futures may feel pressure from another soft weekly pork export sales total of 22,000 MT.