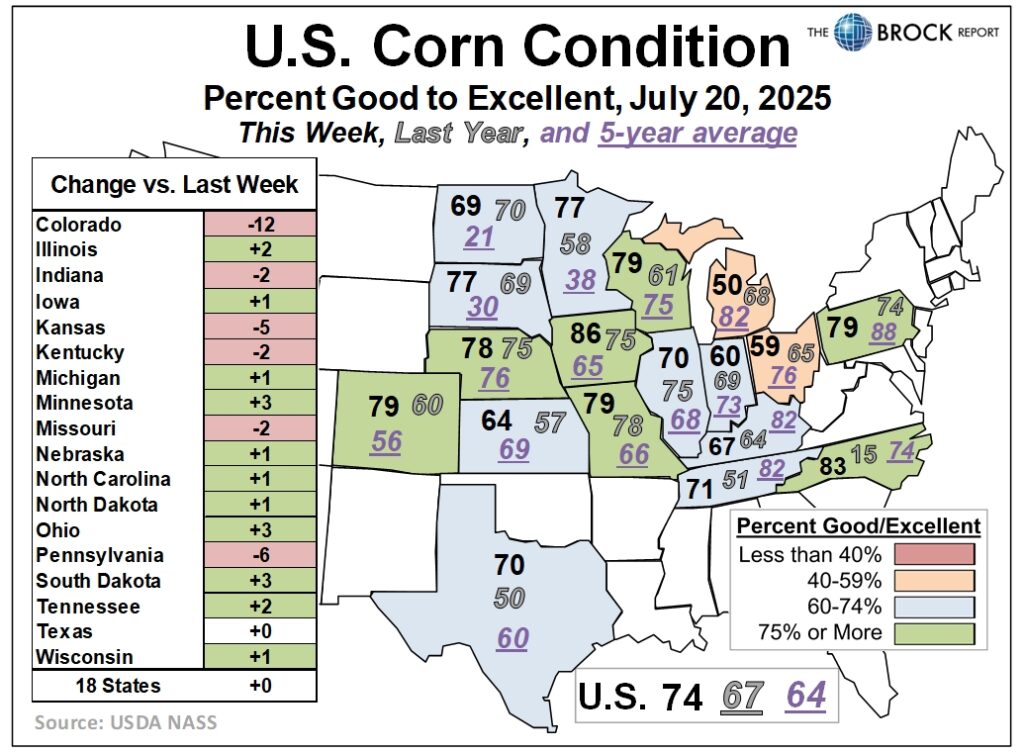

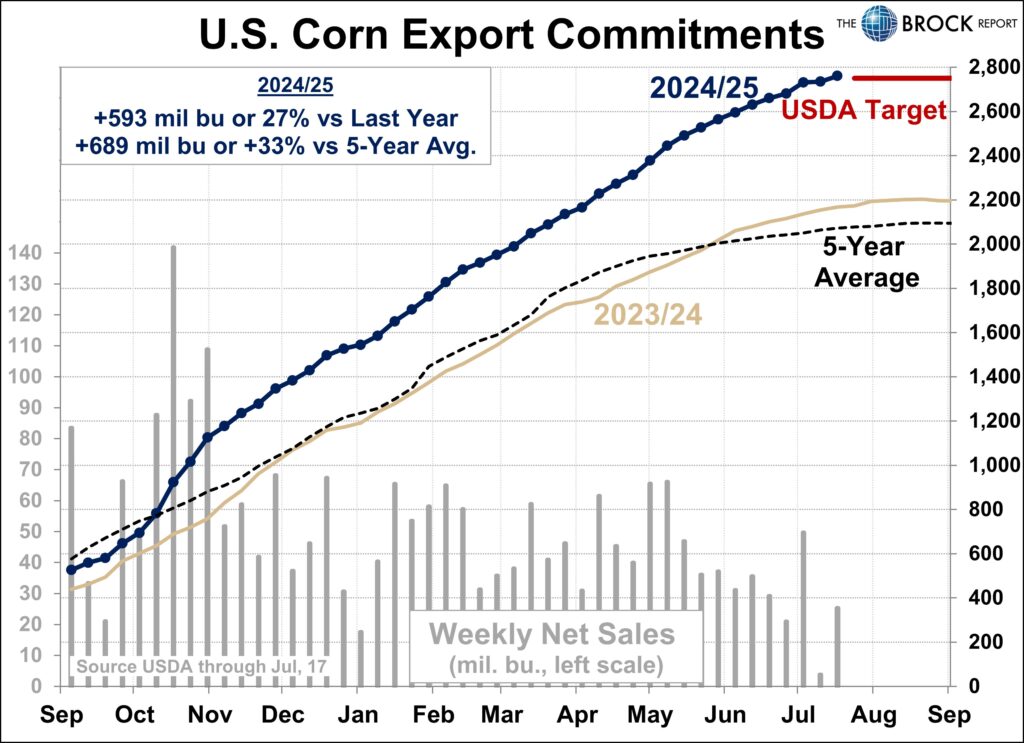

The bulls continue to hope for some positive trade news. On Thursday, prices got a bump after USDA incorrectly reported a large export sale to China–it turned out to be to South Korea instead. Bulls are also latching on to pollination issues (see page 5). Also in the news was extreme heat throughout the central part of the Corn Belt. None of it helped rally the corn market at all. Going into Friday’s close, corn prices were down nine cents for the week.

Truck lines are long throughout terminals in the Midwest. Hopefully, the corn was forward priced and not being dumped at today’s level or being put on a deferred price contract. No way of knowing. Most likely some of each.

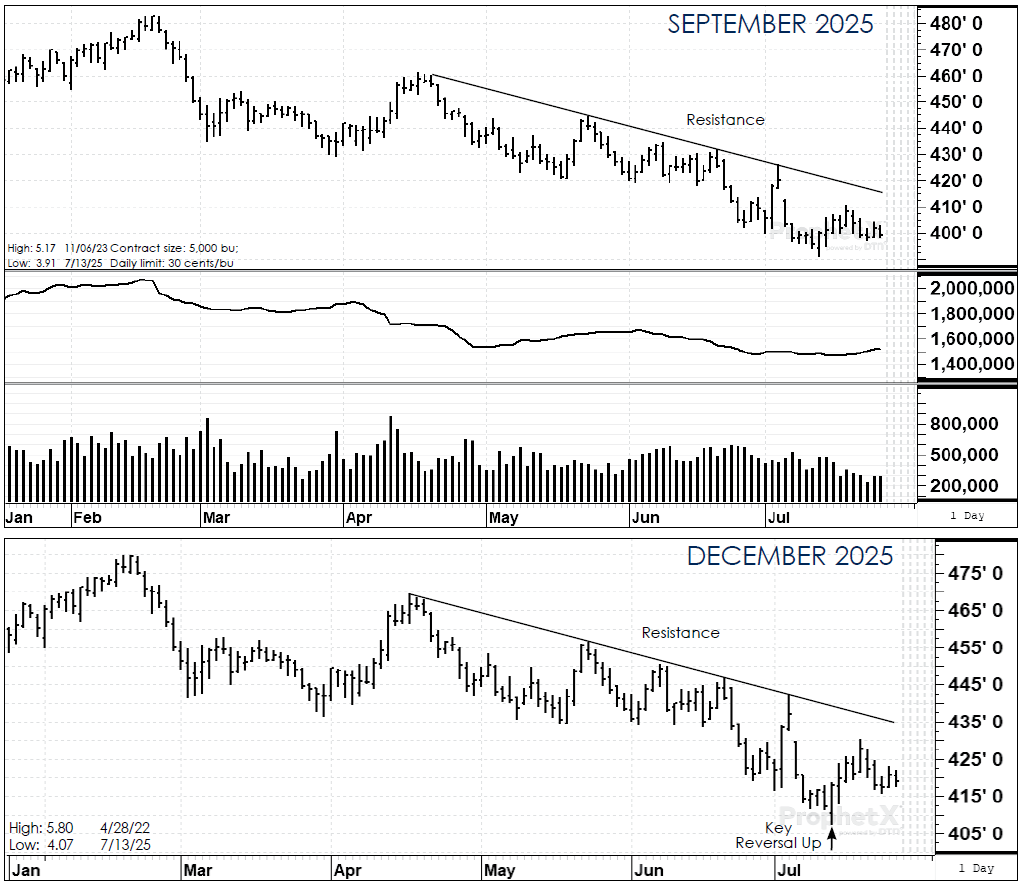

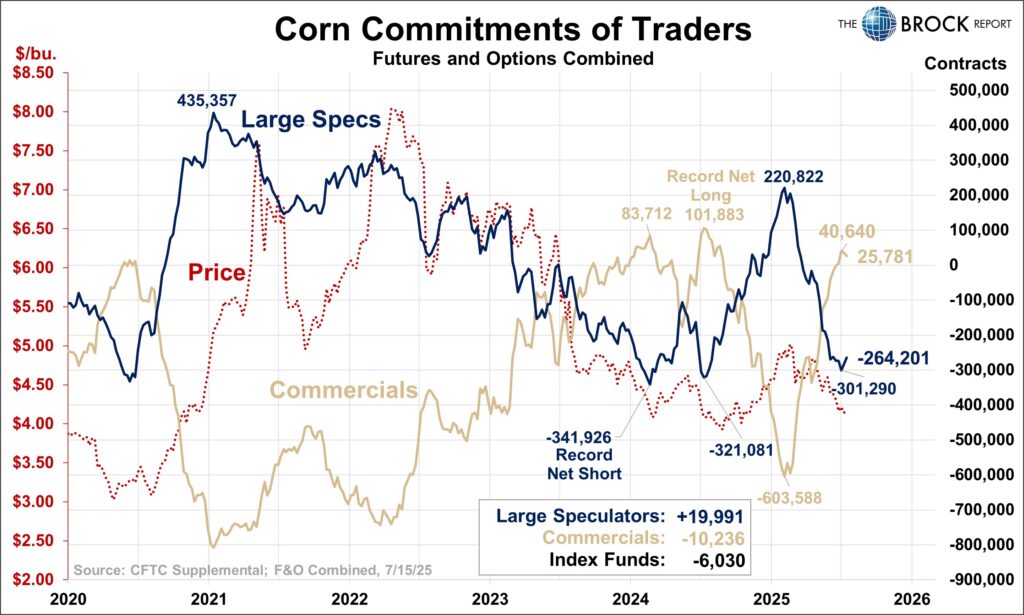

Technically, the gap on weekly nearby charts just below $4.00 is technically filled. Like many others, we had hoped that this gap would stop the decline. It does not appear as though that is going to be the case now. A close in nearby corn futures below $3.95 would set the stage for a move to test the lows on August 26, of last year, at $3.60. We do believe this is the final phase of the bear market, but that doesn’t mean that the final phase may not include an exhaustion leg down. With only one month to go in the marketing season, it is disappointing that corn prices are not responding at all to even the slightest bullish news.

Cash-only marketers’ strategy: Old-crop was gone long ago and new-crop sales still sit at 35%. As long as you have storage, sit tight. As we have mentioned many times over the last few months, if you do not have storage, then you must be more aggressive on the sales side.

Hedgers’ strategy: Old-crop is gone. New-crop is 30% contracted. An additional 20% is covered with options positions. Ten percent is covered with long December $4.70 puts/short (2) December $5.40 calls. That established a floor of approximately $4.70 and with December futures now under $4.19, the strategy has worked well. The other position is long July 2026 $4.70 puts/short (2) July 2026 $5.40 calls. Also working well.