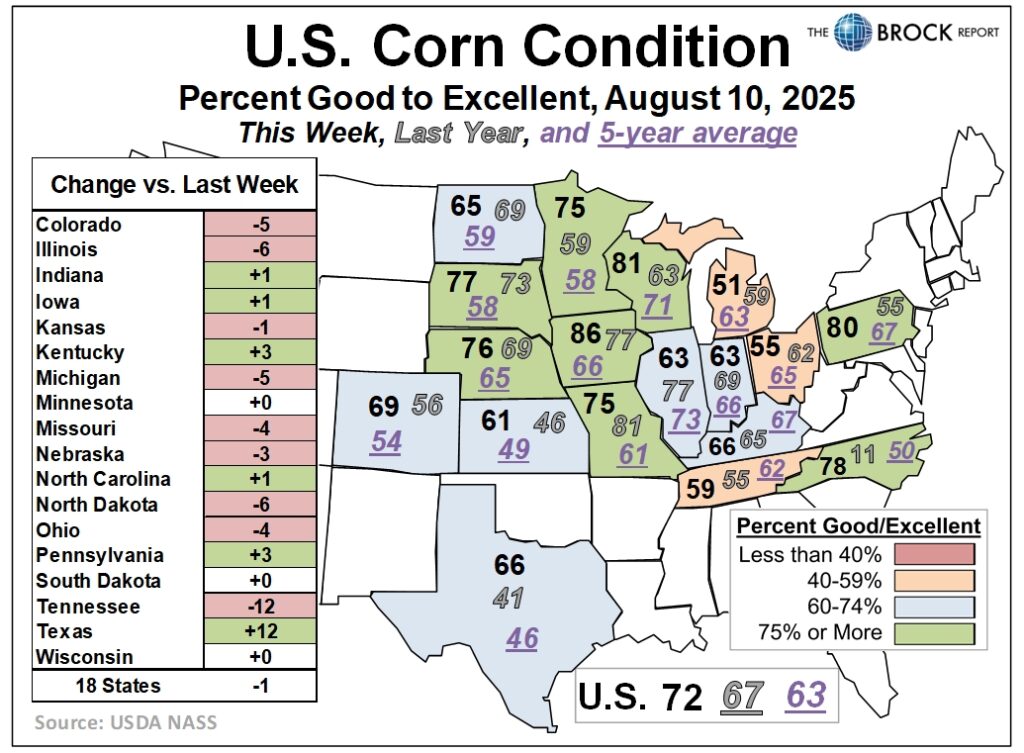

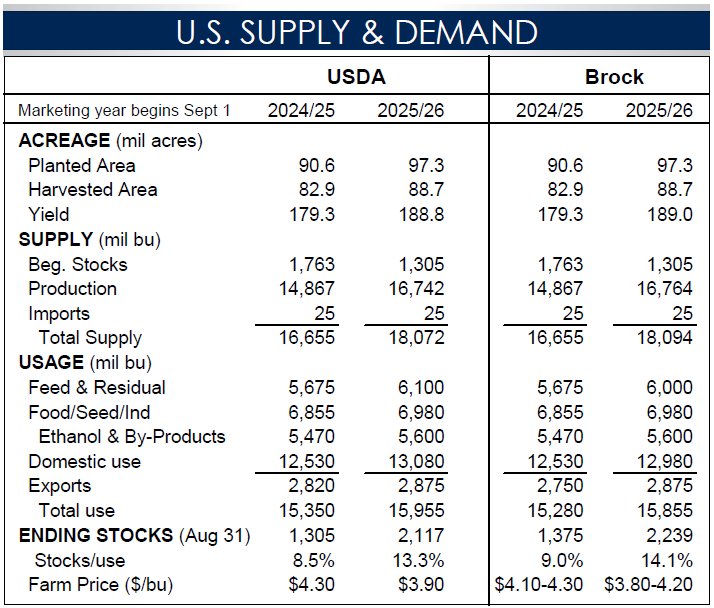

Tuesday’s USDA crop report was clearly a big surprise. A sharp increase in planted acreage from 95.2 to 97.3 million acres, versus last year at 90.6, was more than the trade expected. Most everyone also did not expect to see the yield estimate increase from 181 bushels per acre to 188.8.

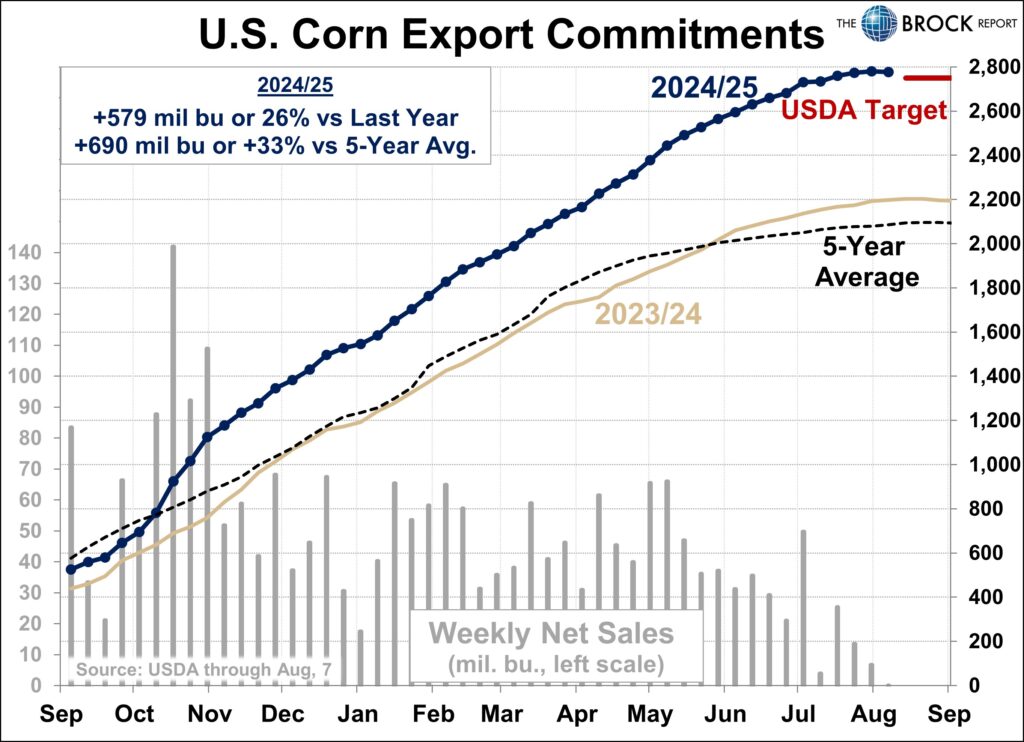

The good news is that cheaper prices are stimulating demand. Feed usage is up, ethanol usage is up, and so are exports. That trend could continue for quite some time.

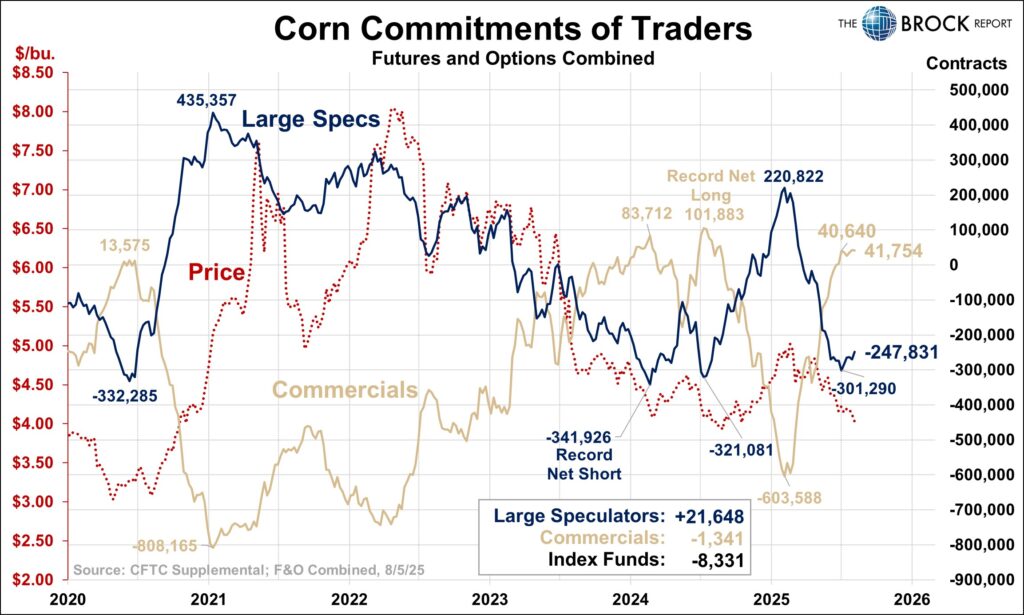

Most importantly, after going down in price the day of the report, the market worked sideways to higher Wednesday, Thursday and Friday. This is a very positive sign. The bearish news is discounted; it’s time to quit being excessively bearish on prices. Most of the adjustments in prices will now come in basis changes as harvest has already begun in the south.

Once the movement of old-crop corn is over (yes there is still some out there), producers will become very tight holders of the new-crop at this price level. Even though the crop will be large, if it goes into storage, the market is going to have difficulty pulling it out. Basis levels are going to stay strong longer than most people expect.

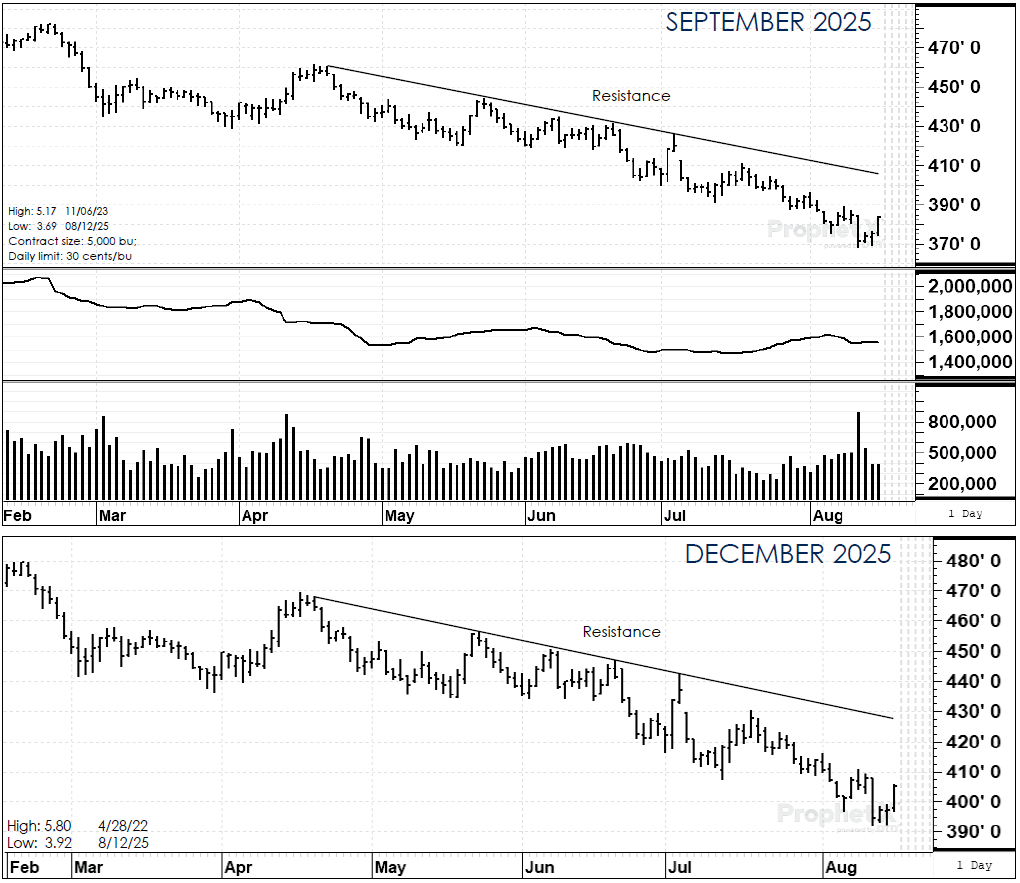

Price action will be very choppy over the next couple of weeks. While it appears corn futures are attempting to find a bottom, nothing is yet confirmed. But as stated above, it is time to quit being so bearish. Once harvest is complete, we will go back to our prediction of the last several months in that the deferred futures will come down to meet the cash. Storage will pay good dividends this year.

Cash-only marketers’ strategy: We have not made any changes. Past advice has everyone 35% contracted on the new-crop and we will wait for additional strength to sell any more.

Hedgers’ strategy: Thirty percent has been contracted and an additional 30% covered with options and futures strategies. Ten percent is covered with long December $4.70 puts/short (2) December $5.40 calls establishing a floor of approximately $4.70. The other option position is long July 2026 $4.70 puts/short (2) July 2026 $5.40 calls. That also established a floor of about $4.70. An additional 10% is covered with March futures that we will be guarding with tight stops over the coming week.