As indicated in the lead story, the corn market this year has behaved alot like it did last year. Coincidence? Probably not. There are several similarities between this year’s crop and last year’s crop.

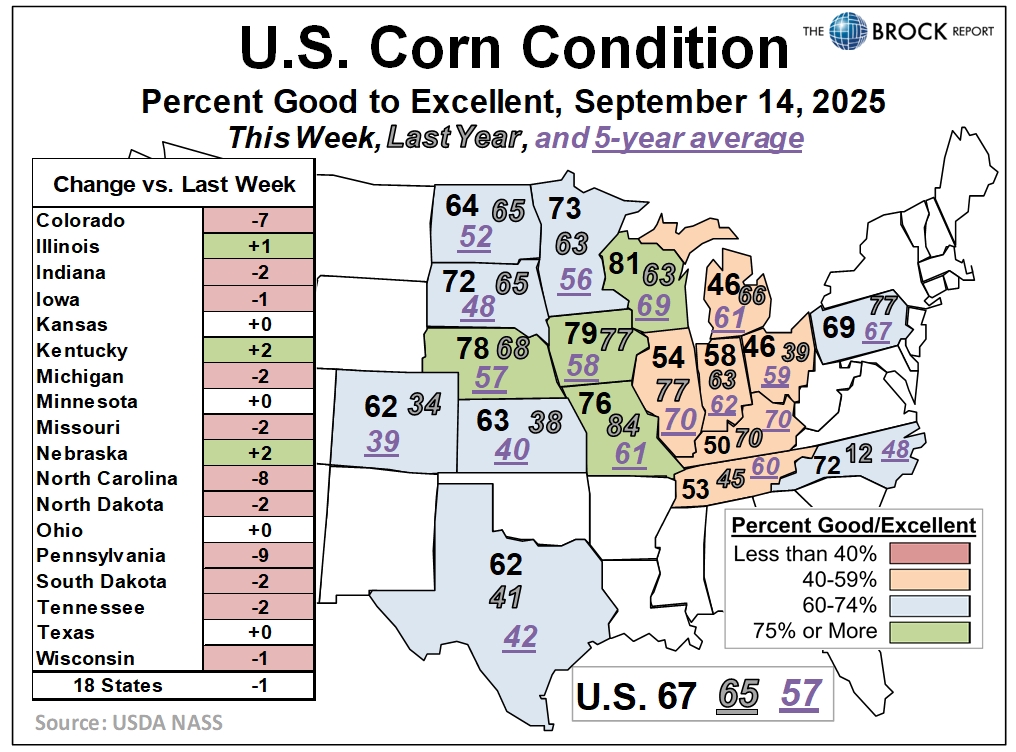

Yields on early corn continue to be favorable but not much higher than expected. Rumors of disease problems in the western Corn Belt continue to surface. Basis levels throughout most of the Midwest this week were flat.

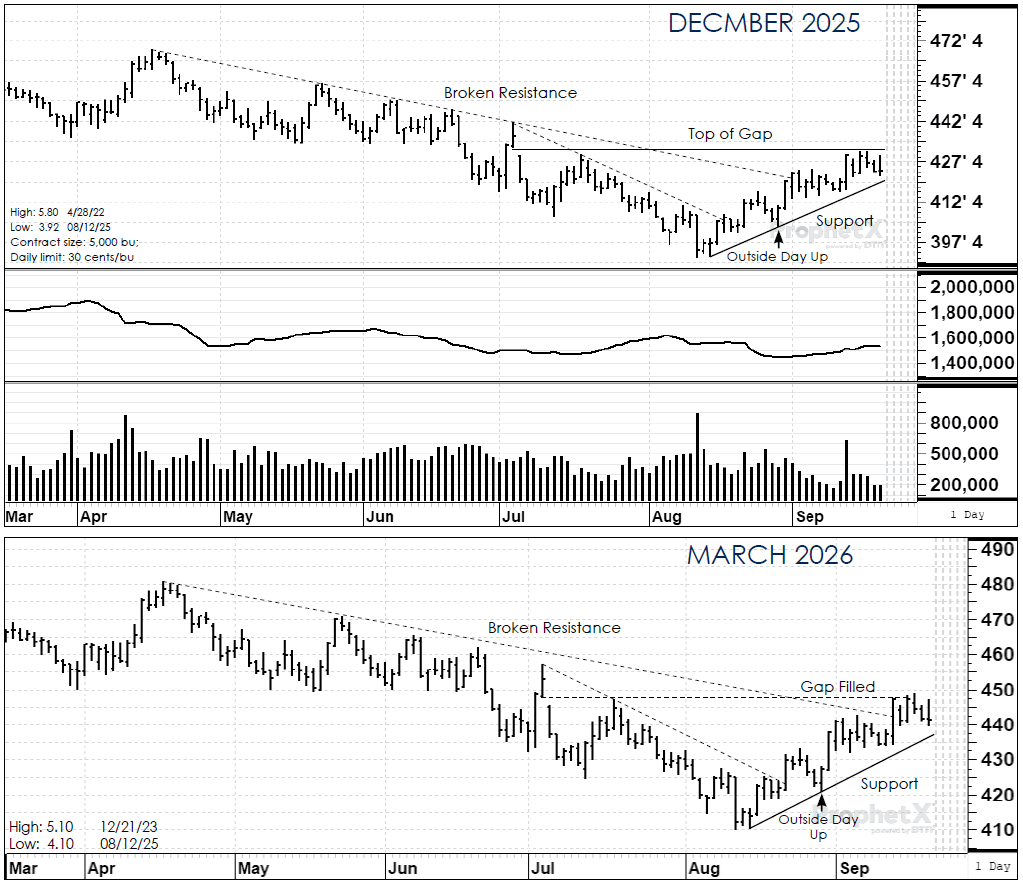

Technically, resistance in the March corn futures is at this week’s high at $4.49 and support is at $4.42. The market has rallied to fill the gap that was left on the charts on July 7. It also has moved up to the resistance area at $4.50 which was the support established April through June. On weekly continuation charts, with the shift from the September contract to the December contract, huge gaps were left on the upside. Some will say that that means nothing because of the contract change. Three months from now, however, everyone will look back at the gap and forget the reason. This will likely be a breakaway gap.

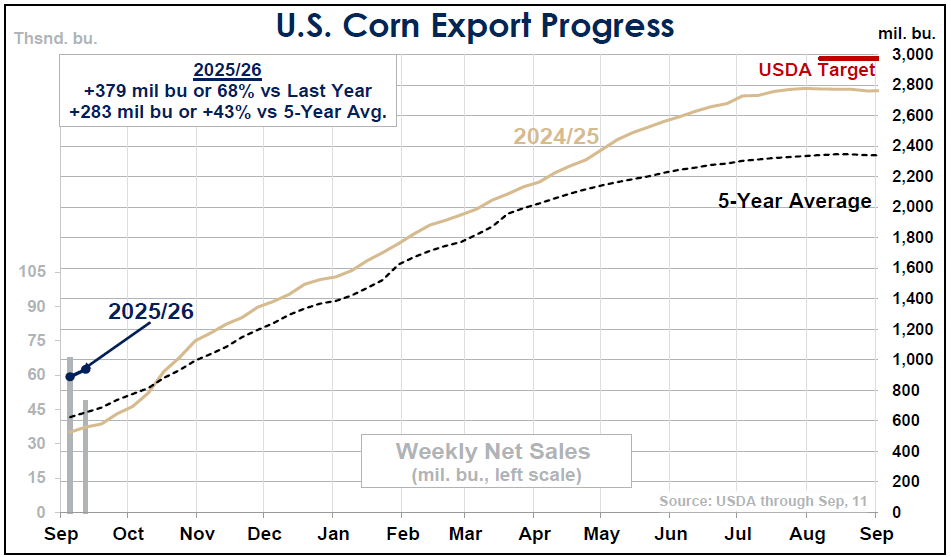

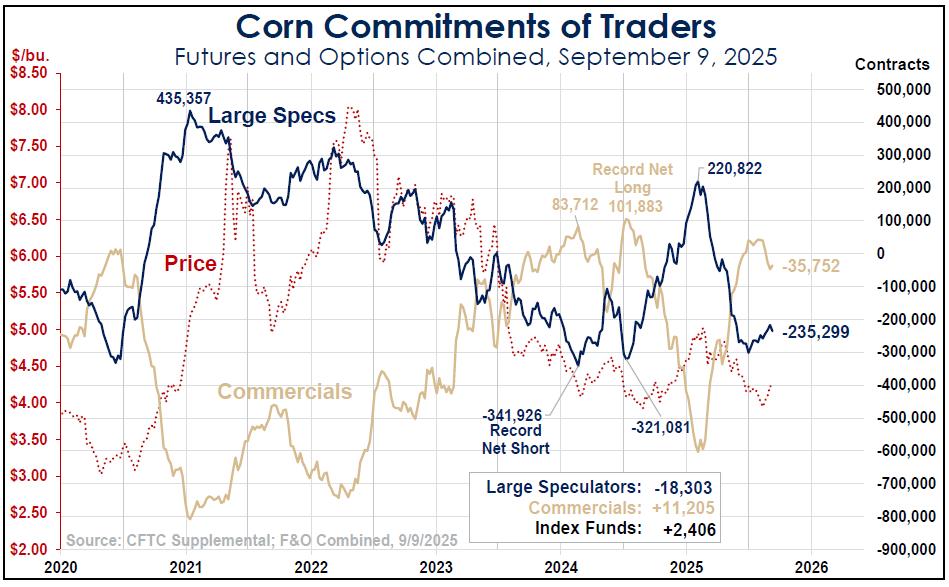

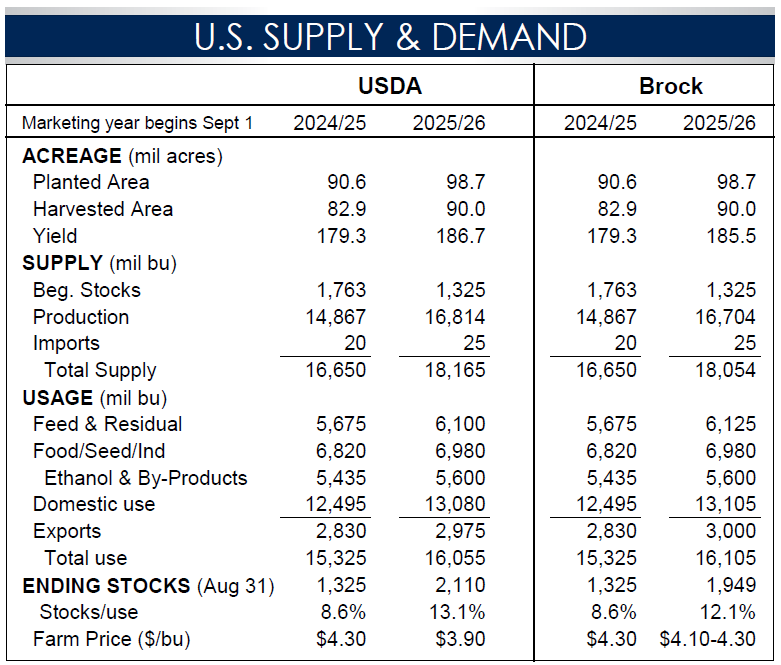

As pointed out in the lead, the fundamentals in the corn market we believe will continue to get more friendly. Exports are strong. The U.S. crop will be big but is very unlikely to get bigger from current USDA estimates in our view. We’re not saying this is going into a major bull market but it is a market that has established a substantial bottom.

Cash-only marketers’ strategy: We’ve been 35% sold in this market for quite some time. Be patient for now.

Hedgers’ strategy: Thirty percent is sold in the cash market. Twenty percent has been covered with both December and July option strategies. This week we took profits on the short December calls, and we are working a GTC stop to buy Dec. futures at $4.33 to offset the puts.